Stocks Soar To Record Highs As Hawkish Fed, Dovish Trump Spark Bond Bloodbath

February Auto Sales Mixed As Incentive Spending And Inventory Days Both Surge

PwC Accountants Behind Oscars Fiasco Barred From Future Academy Awards

Second To None: A Look At Valuations Vs. Fundamentals

Dramatic Aerial Footage Shows What The Oroville Dam Looks Like Now

Snap IPO To Price At $17, Above Range, Valuing Company At $24 Billion

The Fed Has Now Set The Stage For An 'Ides Of March' Moment

Can 'Soft' Become 'Hard'? - RBC Explains The Market's "Longer-Term Battle"

Arora Report: "Three-Quarters Of Today's Market Surge Is From A Massive Short Squeeze"

White House Prepares For Trade War, Warns US "Will Not Be Bound By WTO Decisions"

Only A Trade-A-Saurus Bets On Recoupling

Fed's Beige Book Notes Decline In Optimism About The Outlook, Sharp Drop In Broadway Attendance

JPMorgan's Trading Desk Lost Money On Just Two Days In The Past 4 Years

by Martin Armstrong, Armstrong Economics:

COMMENT:

Marty; Some people are trying to claim that China in bypassing the

Swift System, they are undermining the dollar. The latest absurd

statement is that Japan will bypass the dollar and SWIFT System to

transact using China’s CIPS system in inter-bank settlement. I really

had to laugh at how ignorant this statement is for it would mean Japan

will no longer sell anything in the USA. It seems that these people so

desperate to kill the dollar clutch at anything and we just laugh in the

trading rooms. I think you should address this statement for the naive

people out there who are clueless as to real international trade.

COMMENT:

Marty; Some people are trying to claim that China in bypassing the

Swift System, they are undermining the dollar. The latest absurd

statement is that Japan will bypass the dollar and SWIFT System to

transact using China’s CIPS system in inter-bank settlement. I really

had to laugh at how ignorant this statement is for it would mean Japan

will no longer sell anything in the USA. It seems that these people so

desperate to kill the dollar clutch at anything and we just laugh in the

trading rooms. I think you should address this statement for the naive

people out there who are clueless as to real international trade.

RPD

Read More

Are you Ignorant enough to vote for this piece of trash...Of course you are...Just look at the voting record...

COMMENT:

Marty; Some people are trying to claim that China in bypassing the

Swift System, they are undermining the dollar. The latest absurd

statement is that Japan will bypass the dollar and SWIFT System to

transact using China’s CIPS system in inter-bank settlement. I really

had to laugh at how ignorant this statement is for it would mean Japan

will no longer sell anything in the USA. It seems that these people so

desperate to kill the dollar clutch at anything and we just laugh in the

trading rooms. I think you should address this statement for the naive

people out there who are clueless as to real international trade.

COMMENT:

Marty; Some people are trying to claim that China in bypassing the

Swift System, they are undermining the dollar. The latest absurd

statement is that Japan will bypass the dollar and SWIFT System to

transact using China’s CIPS system in inter-bank settlement. I really

had to laugh at how ignorant this statement is for it would mean Japan

will no longer sell anything in the USA. It seems that these people so

desperate to kill the dollar clutch at anything and we just laugh in the

trading rooms. I think you should address this statement for the naive

people out there who are clueless as to real international trade.RPD

Read More

Are you Ignorant enough to vote for this piece of trash...Of course you are...Just look at the voting record...

Yes She May: Oprah Hints At Presidential Run

French Protester "Attacks" Presidential Frontrunner Macron's With An Egg

Euro Breakup Contagion Risk Is Exploding

America's In A Drugged Stupor

Q1 GDP Estimates Tumble: Goldman, Atlanta Fed Cut To 1.8%, JPM At 1.5%, Bank Of America Sees Only 1.3%

Mexican Peso Surges On Chatter Fed Will Rescue Currency From Trump's Damage

by Kenneth Schortgen, The Daily Economist:

First they ignore you, then they laugh at you, then they fight you,

then you win. These were the words of a famous revolutionary who used

non-violent protest as the means to overthrow the British Empire from

its hold over India.

First they ignore you, then they laugh at you, then they fight you,

then you win. These were the words of a famous revolutionary who used

non-violent protest as the means to overthrow the British Empire from

its hold over India.

Now in 2017 there is another revolution going on that is for the future of the world’s money. And where even as recently as three years ago the mainstream establishment media was both scoffing at and vilifying the advent of crypto-currencies and those who embraced them, on Feb. 27 that same mainstream media is now hailing Bitcoin as the potential savior for the monetary system of the world’s second largest economy.

Read More

First they ignore you, then they laugh at you, then they fight you,

then you win. These were the words of a famous revolutionary who used

non-violent protest as the means to overthrow the British Empire from

its hold over India.

First they ignore you, then they laugh at you, then they fight you,

then you win. These were the words of a famous revolutionary who used

non-violent protest as the means to overthrow the British Empire from

its hold over India.Now in 2017 there is another revolution going on that is for the future of the world’s money. And where even as recently as three years ago the mainstream establishment media was both scoffing at and vilifying the advent of crypto-currencies and those who embraced them, on Feb. 27 that same mainstream media is now hailing Bitcoin as the potential savior for the monetary system of the world’s second largest economy.

Read More

by Andy Hoffman, Miles Franklin:

If anyone claims

Precious Metals are not relentlessly suppressed – whilst the “Dow Jones

Propaganda Average” is persistently supported, in an increasingly

desperate attempt to delay “Economic Mother Nature’s” inevitable arrival

– consider gold and silver “trading” since the election. Let alone, since I published the “12:00 PM EST cap of last resort” six weeks ago, after watching this hideous “algo” for more than a decade.

If anyone claims

Precious Metals are not relentlessly suppressed – whilst the “Dow Jones

Propaganda Average” is persistently supported, in an increasingly

desperate attempt to delay “Economic Mother Nature’s” inevitable arrival

– consider gold and silver “trading” since the election. Let alone, since I published the “12:00 PM EST cap of last resort” six weeks ago, after watching this hideous “algo” for more than a decade.

Here’s the last three days’ “trading” – with yesterday’s suppression being particularly egregious, given that no other market budged when the Cartel did its daily dirty work. Moreover, per this week’s “why the Cartel is (rightfully) terrified,” its “incentive” to attack PMs is particularly strong now, as gold and silver are on the verge of re-capturing their 200 WEEK moving averages of $1,260/oz and $18.60/oz, respectively.

Read More

If anyone claims

Precious Metals are not relentlessly suppressed – whilst the “Dow Jones

Propaganda Average” is persistently supported, in an increasingly

desperate attempt to delay “Economic Mother Nature’s” inevitable arrival

– consider gold and silver “trading” since the election. Let alone, since I published the “12:00 PM EST cap of last resort” six weeks ago, after watching this hideous “algo” for more than a decade.

If anyone claims

Precious Metals are not relentlessly suppressed – whilst the “Dow Jones

Propaganda Average” is persistently supported, in an increasingly

desperate attempt to delay “Economic Mother Nature’s” inevitable arrival

– consider gold and silver “trading” since the election. Let alone, since I published the “12:00 PM EST cap of last resort” six weeks ago, after watching this hideous “algo” for more than a decade.Here’s the last three days’ “trading” – with yesterday’s suppression being particularly egregious, given that no other market budged when the Cartel did its daily dirty work. Moreover, per this week’s “why the Cartel is (rightfully) terrified,” its “incentive” to attack PMs is particularly strong now, as gold and silver are on the verge of re-capturing their 200 WEEK moving averages of $1,260/oz and $18.60/oz, respectively.

Read More

by Kristinn Taylor, The Gateway Pundit:

In yet another example of why the Trump administration has such heartburn in dealing with the media, President Donald Trump met with a about sixty presidents of Historically Black Colleges and Universities in the Oval Office on Monday, yet the media focused on Trump senior advisor Kellyanne Conway taking pictures of the meeting while positioned on an Oval Office couch.

AFP posted only one photo from the meeting, focused on Conway, with the caption, “Kellyanne Conway checks her phone after taking a photo of President Donald Trump and leaders of black universities, colleges in Oval Office”

Read More

In yet another example of why the Trump administration has such heartburn in dealing with the media, President Donald Trump met with a about sixty presidents of Historically Black Colleges and Universities in the Oval Office on Monday, yet the media focused on Trump senior advisor Kellyanne Conway taking pictures of the meeting while positioned on an Oval Office couch.

AFP posted only one photo from the meeting, focused on Conway, with the caption, “Kellyanne Conway checks her phone after taking a photo of President Donald Trump and leaders of black universities, colleges in Oval Office”

Read More

by Jeff Poor, Breitbart:

Tuesday in an interview that aired on Fox News Channel’s “Fox & Friends,” President Donald Trump reacted to comments from House Minority Leader Nancy Pelosi over the weekend saying his administration has “done nothing.”

Tuesday in an interview that aired on Fox News Channel’s “Fox & Friends,” President Donald Trump reacted to comments from House Minority Leader Nancy Pelosi over the weekend saying his administration has “done nothing.”

Trump called Pelosi “incompetent” and pointed to the current state of the Democratic Party as evidence.

“Well, I’ve been watching Nancy’s statements, and I think she’s incompetent, actually,” Trump said. “You know if you look at what’s going on with the Democrats and the party, it’s getting smaller and smaller. You know, in a certain way I hate to see it because I like a two-party system. And we’re soon going to have a one-party system. I actually think a two-party system is healthy and good. But she’s done a terrible job.”

Read More

Tuesday in an interview that aired on Fox News Channel’s “Fox & Friends,” President Donald Trump reacted to comments from House Minority Leader Nancy Pelosi over the weekend saying his administration has “done nothing.”

Tuesday in an interview that aired on Fox News Channel’s “Fox & Friends,” President Donald Trump reacted to comments from House Minority Leader Nancy Pelosi over the weekend saying his administration has “done nothing.”Trump called Pelosi “incompetent” and pointed to the current state of the Democratic Party as evidence.

“Well, I’ve been watching Nancy’s statements, and I think she’s incompetent, actually,” Trump said. “You know if you look at what’s going on with the Democrats and the party, it’s getting smaller and smaller. You know, in a certain way I hate to see it because I like a two-party system. And we’re soon going to have a one-party system. I actually think a two-party system is healthy and good. But she’s done a terrible job.”

Read More

by Steve St. Angelo, SRSRocco Report:

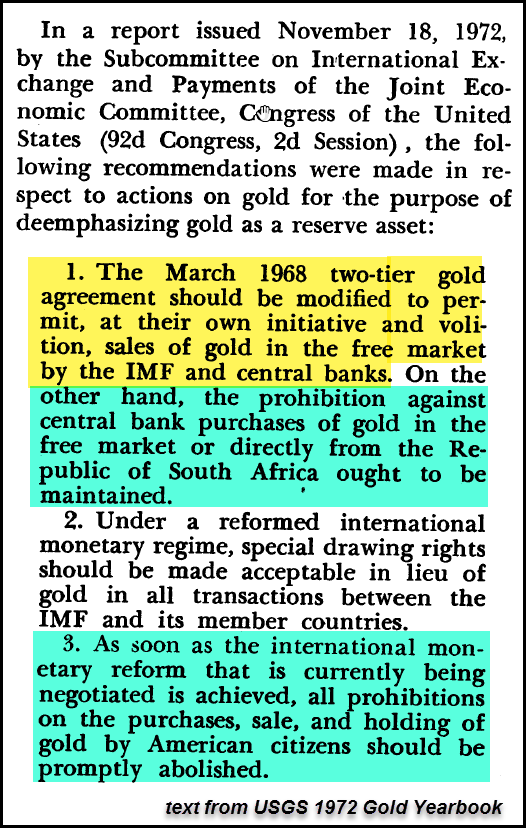

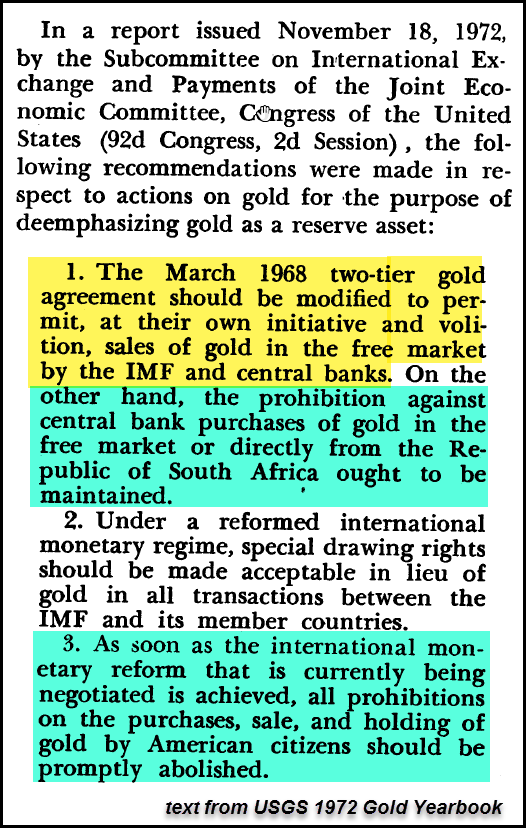

According to newly uncovered information in the gold market, it

provides additional evidence of why the Fed, Central Banks and the IMF

were forced to RIG the gold market. Actually, looking at this new

information, I had no idea of the amount of Fed, Central Bank and IMF

gold market intervention until I put all the pieces together.

According to newly uncovered information in the gold market, it

provides additional evidence of why the Fed, Central Banks and the IMF

were forced to RIG the gold market. Actually, looking at this new

information, I had no idea of the amount of Fed, Central Bank and IMF

gold market intervention until I put all the pieces together.

Now, when I say “new information”, it pertains to new information and data that I dug up from older official documents. While most of the folks in the precious metals community realize that the Fed and Central Banks have sold gold into the market to depress the price, this new evidence puts the gold market it in an entirely DIFFERENT LIGHT.

Read More

According to newly uncovered information in the gold market, it

provides additional evidence of why the Fed, Central Banks and the IMF

were forced to RIG the gold market. Actually, looking at this new

information, I had no idea of the amount of Fed, Central Bank and IMF

gold market intervention until I put all the pieces together.

According to newly uncovered information in the gold market, it

provides additional evidence of why the Fed, Central Banks and the IMF

were forced to RIG the gold market. Actually, looking at this new

information, I had no idea of the amount of Fed, Central Bank and IMF

gold market intervention until I put all the pieces together.Now, when I say “new information”, it pertains to new information and data that I dug up from older official documents. While most of the folks in the precious metals community realize that the Fed and Central Banks have sold gold into the market to depress the price, this new evidence puts the gold market it in an entirely DIFFERENT LIGHT.

Read More

NO

MOVEMENT OF GOLD FROM THE FRBNY/TROUBLE AT GREEK BANKS AS CITIZENS

THERE REMOVE THEIR DEPOSITS AND PLACE IN SAME HAVENS OTHER THAN GREECE

from Harvey Organ:

HUGE USA TRADE DEFICIT OF 68 BILLIONS DOLLARS WHICH WILL BE A NEGATIVE

IN FIRST QUARTER GDP/TARGET PLUNGES DEEPLY INTO THE RED WITH POOR

OUTLOOK/MANY BRICKS AND MORTAR COMPANIES HAVE THE SAME PROBLEMS AS

TARGET/LIKELIHOOD FOR A RATE HIKE RISES TO 72% IN THE USA

HUGE USA TRADE DEFICIT OF 68 BILLIONS DOLLARS WHICH WILL BE A NEGATIVE

IN FIRST QUARTER GDP/TARGET PLUNGES DEEPLY INTO THE RED WITH POOR

OUTLOOK/MANY BRICKS AND MORTAR COMPANIES HAVE THE SAME PROBLEMS AS

TARGET/LIKELIHOOD FOR A RATE HIKE RISES TO 72% IN THE USA

In silver, the total open interest FELL by 9,731 contracts DOWN to 199,568 with respect to YESTERDAY’S TRADING. In ounces, the OI is still represented by just less THAN 1 BILLION oz i.e. 0.997 BILLION TO BE EXACT or 142% of annual global silver production (ex Russia & ex China).

FOR THE NEW FRONT MARCH MONTH: THEY FILED: 349 NOTICE(S) FOR 1,745,000 OZ OF SILVER

In gold, the total comex gold FELL BY ONLY 2 contracts WITH THE FALL IN THE PRICE GOLD ($0.20 with YESTERDAY’S trading ).The total gold OI stands at 452,363 contracts.

Read More @ Harveyorganblog.com

from Harvey Organ:

In silver, the total open interest FELL by 9,731 contracts DOWN to 199,568 with respect to YESTERDAY’S TRADING. In ounces, the OI is still represented by just less THAN 1 BILLION oz i.e. 0.997 BILLION TO BE EXACT or 142% of annual global silver production (ex Russia & ex China).

FOR THE NEW FRONT MARCH MONTH: THEY FILED: 349 NOTICE(S) FOR 1,745,000 OZ OF SILVER

In gold, the total comex gold FELL BY ONLY 2 contracts WITH THE FALL IN THE PRICE GOLD ($0.20 with YESTERDAY’S trading ).The total gold OI stands at 452,363 contracts.

Read More @ Harveyorganblog.com

by Claire Bernish, The Free Thought Project:

Because police “cannot cope” with the “huge” influx of reports on child

abuse, they now say pedophiles whose ‘only’ crime is viewing child

pornography should undergo rehabilitation — instead of going to prison.

Because police “cannot cope” with the “huge” influx of reports on child

abuse, they now say pedophiles whose ‘only’ crime is viewing child

pornography should undergo rehabilitation — instead of going to prison.

In a mere three years, child abuse reports have skyrocketed in volume by 80 percent; and, as Chief Constable Simon Bailey of the National Police Chiefs’ Council and head of Operation Hydrant, “which is investigating multiple allegations of historic sexual abuse across the UK,” the BBC reports, “knew his view would cause nervousness and draw headlines.

“But he said the numbers of reports of abuse were at ‘huge proportions’ — an NSPCC study in late 2016 used figures which suggested the number of individuals looking at such images could exceed half a million.”

Read More

In a mere three years, child abuse reports have skyrocketed in volume by 80 percent; and, as Chief Constable Simon Bailey of the National Police Chiefs’ Council and head of Operation Hydrant, “which is investigating multiple allegations of historic sexual abuse across the UK,” the BBC reports, “knew his view would cause nervousness and draw headlines.

“But he said the numbers of reports of abuse were at ‘huge proportions’ — an NSPCC study in late 2016 used figures which suggested the number of individuals looking at such images could exceed half a million.”

Read More

by Jeremiah Johnson, Ready Nutrition:

Who’s itching to get outside and start gardening? This article has to

do with some things you can start preparing in your herbal gardens for

the spring…but prepare now. Yes, now, while the snow and ice and the

Yeti are all around… well, probably not (and hopefully not) the Yeti.

But just because that snow and ice are still on the ground does not mean

you cannot start taking the steps to give you an advantage and a “step

ahead” of the pack come springtime.

Who’s itching to get outside and start gardening? This article has to

do with some things you can start preparing in your herbal gardens for

the spring…but prepare now. Yes, now, while the snow and ice and the

Yeti are all around… well, probably not (and hopefully not) the Yeti.

But just because that snow and ice are still on the ground does not mean

you cannot start taking the steps to give you an advantage and a “step

ahead” of the pack come springtime.

Having a successful garden is all about timing. Make sure you prep your starter soil, pots and the area where you plan to grow. If you don’t live in an area where there is heavy snow, begin cleaning and preparing your growing area. Here are some tips to get started.

Read More

Having a successful garden is all about timing. Make sure you prep your starter soil, pots and the area where you plan to grow. If you don’t live in an area where there is heavy snow, begin cleaning and preparing your growing area. Here are some tips to get started.

Read More

/

Let’s frame the situation in simple terms. You work for a company that

has a very lucrative partnership with a big-time money man. That money

man gives you a piece of information and tells you it’s important.

Let’s frame the situation in simple terms. You work for a company that

has a very lucrative partnership with a big-time money man. That money

man gives you a piece of information and tells you it’s important.

No comments:

Post a Comment