And We The Sheeplez Sleep...Welcome to Nazi America...Now under control of both Republican AND Democrate Nazi's...

“I think the American people should be extremely concerned about their personal rights and privacy. As I was being searched at the airport, there was a Latino couple to my left, and an Asian couple to my right also being aggressively searched. I briefly had to remind myself that this was not North Korea or Nazi Germany. This is the land of the Free."

Commodity Trading Giants Unleash Liquidity Scramble, Issue Record Amounts Of Secured Debt

Submitted by Tyler Durden on 10/06/2015 - 21:54 In a furious race to shore up as much liquidity as possible, Glencore - which a month ago announced a dramatic deleveraging plan - and its peers have been quietly scrambling to raise billions in secured funding. Case in point none other than Glencore's biggest competitor and the largest independent oil trader in the world, Swiss-based, Dutch-owned Vitol Group, whose Swiss unit Vitol SA earlier today raised a record $8 billion in loans.The Two Major Factors That Will Drive Markets In Q4 According To SocGen (Spoiler: Not The Fed)

Submitted by Tyler Durden on 10/06/2015 - 21:29 For SocGen, as a result of a rather unfortunate credibility-losing accident, the Fed will not be one of the two major factor that will drive markets in the fourth quarter. So what will? According to the French bank, it is all up to China and Earnings now.Fortress Backs Hundred Million Dollar Subprime, Payday Lender Scheme: "He Has Peacock Feathers Tattooed Down His Left Arm"

Submitted by Tyler Durden on 10/06/2015 - 21:01 "I don’t hide tattoos, I don’t take earrings out. I just don’t do that, because ultimately if you don’t like who I am, you’re not going to like what I do."Is Russia Plotting To Bring Down OPEC?

Submitted by Tyler Durden on 10/06/2015 - 20:29 Russia can be seen as maneuvering to split OPEC into two blocs, with Russia, although not a member, persuading the “Russian bloc” to isolate Saudi Arabia and the Gulf Arab OPEC members within OPEC. This might persuade the Saudis to seek a compromise with the have nots.A "Heroic" Ben Bernank... Blames Congress For Poor Economic Recovery

Submitted by Tyler Durden on 10/06/2015 - 20:06 "That’s why I often said that monetary policy was not a panacea — we needed Congress to do its part. After the crisis calmed, that help was not forthcoming. When the recovery predictably failed to lift all boats, the Fed often, I believe unfairly, took the criticism."NYSE Short Interest Surges To Record, Pre-Lehman Level

Submitted by Tyler Durden on 10/06/2015 - 19:28 There are two ways of looking at the NYSE short interest, which as of September 15 surged by 1.4 billion to 18.4 billion shares or just shy of the level hit on July 31, 2008: one is that a massive short squeeze is about to be unleashed, sending the S&P500 to new all time highs; the other is that just as the record short interest in July 2008 correctly predicted the biggest financial crisis in history and all those shorts covered at huge profits, so another historic market collapse is just around the corner.How Developed Markets Become Banana Republics: "Debt Is A Much Easier Way To Gather Consensus"

Submitted by Tyler Durden on 10/06/2015 - 19:00 "A smart politician can see that if somehow the consumption of middle-class householders keeps rising, if they can afford a new car every few years and the occasional exotic holiday, and best of all, a new house, they might pay less attention to their stagnant monthly paychecks. And one way to expand consumption, even while incomes stagnate, is to enhance access to credit."The Trans-Pacific Partnership: Permanently Locking In The Obama Agenda For 40% Of The Global Economy

Submitted by Tyler Durden on 10/06/2015 - 18:29 We have just witnessed one of the most significant steps toward a one world economic system that we have ever seen. Negotiations for the Trans-Pacific Partnership have been completed, and if approved it will create the largest trading bloc on the planet. In this treaty, Barack Obama has thrown in all sorts of things that he never would have been able to get through Congress otherwise. And once this treaty is approved, it will be exceedingly difficult to ever make changes to it. So essentially what is happening is that the Obama agenda is being permanently locked in for 40 percent of the global economy.Russian Embassy Trolls Saudi Arabia On Twitter

Submitted by Tyler Durden on 10/06/2015 - 18:01 The Kremlin has thus far observed some semblance (and we do emphasize the word “some”) of decorum in criticizing the West’s approach to Syria. The nicetites just went out the window...The Phrase That Launches Recessions

Submitted by Tyler Durden on 10/06/2015 - 17:35 “It feels like someone just flipped the switch to ‘off’ without any concrete reasoning,” one of the executives commented.Barry Diller: "If Trump Wins I'll Move Out Of The Country"

Submitted by Tyler Durden on 10/06/2015 - 17:32 "If Donald Trump doesn’t fall, I'll either move out of the country or join the resistance. I just think it's a phenomenon of reality television as politics and I think that that is how it started. Reality television, as you all know, is based on conflict. All he is is about conflict and it's all about the negative conflict. He's a self-promoting huckster who found a vein, a vein of meanness and nastiness."SocGen Models A Chinese Hard-Landing; Sees The S&P Crashing 60%

Submitted by Tyler Durden on 10/06/2015 - 17:00 "Our model indicates the US equity market could potentially drop by 30% in the event of an ‘EM lost decade’ and by 60% in the event of a China hard landing (i.e. S&P 500 back to its lows)."Silver Coin Premiums Soar Above 50%

Submitted by Tyler Durden on 10/06/2015 - 16:38 Courtesy of Sharelynx' Nick Laird who tracks precious metal premium by vendor, we continue our recent series showing the discrepancy between paper and physical metals, in this case silver. As Nick notes, APMEX price premiums are a lot higher than the Monex. And as can be seen in the charts below, premiums rose above 50% for 1-19 coins & above 40% for 500 plus coins.Silver Coin Premiums Soar Above 50%

Submitted by Tyler Durden on 10/06/2015 - 16:38 Courtesy of Sharelynx' Nick Laird who tracks precious metal premium by vendor, we continue our recent series showing the discrepancy between paper and physical metals, in this case silver. As Nick notes, APMEX price premiums are a lot higher than the Monex. And as can be seen in the charts below, premiums rose above 50% for 1-19 coins & above 40% for 500 plus coins.Biotechs Butchered As Oil Orgasms In Otherwise Uneventful Day

Submitted by Tyler Durden on 10/06/2015 - 16:08Prominent Permabull Says Correction Not Over Yet, Expect "Final Capitulation"

Submitted by Tyler Durden on 10/06/2015 - 15:52 "The strong stock market rally during the last few days has pushed the S&P 500 near its highest closing level since the correction began in late August. This has boosted optimism that the recent selloff may be ending. While this could certainly prove to be the case, we remain less sanguine that the vulnerabilities, which initially produced this correction, have yet to be resolved. Ultimately, we expect a more fearful investment culture suggesting a final capitulation and more importantly, a lower stock market valuation level able to withstand a less hospitable recovery as the economy nears full employment."Glencore Explains What Would Happen If It Is Downgraded To Junk

Submitted by Tyler Durden on 10/06/2015 - 15:43 "In the event of a downgrade by Standard & Poor’s and/or Moody’s from current ratings to the level(s) immediately below... there are $4.5 billion of bonds outstanding, where a 125bps margin step-up would apply, in the event that the bonds were rated sub-investment grade by either major ratings agency."The United States and 11 other Pacific Rim nations reached an agreement Monday on the Trans-Pacific Partnership, the largest regional trade accord in history. The agreement has been negotiated for eight years in secret and will encompass 40 percent of the global economy. The secret 30-chapter text has still not been made public, although sections of draft text have been leaked by WikiLeaks during the negotiations. Congress will have at least 90 days to review the TPP before President Obama can sign it.

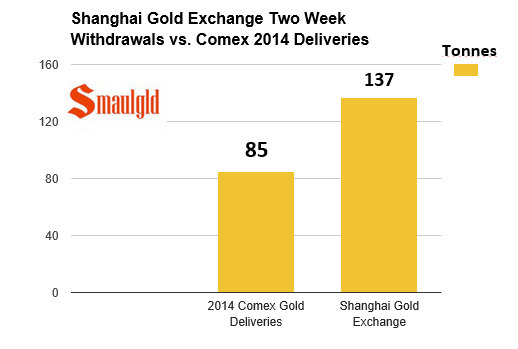

from Smaulgld:

Despite the predictions of many smart analysts of an imminent collapse

or default of Comex, it hasn’t yet and probably won’t. Comex analysts

have noted the seeming unsustainble gold and silver trading on Comex and

have long predicted “imminent” collapses or defaults of that exchange.

Despite the predictions of many smart analysts of an imminent collapse

or default of Comex, it hasn’t yet and probably won’t. Comex analysts

have noted the seeming unsustainble gold and silver trading on Comex and

have long predicted “imminent” collapses or defaults of that exchange.

“The COMEX will default in the next week or several weeks and people will be “settled” with Dollars, no more metal will be delivered! So, knowing that “game over” has arrived–Famed precious metals analyst Bill Holter, April 2013”

Currently, Comex analysts cite blatant anomalies like:

Read More

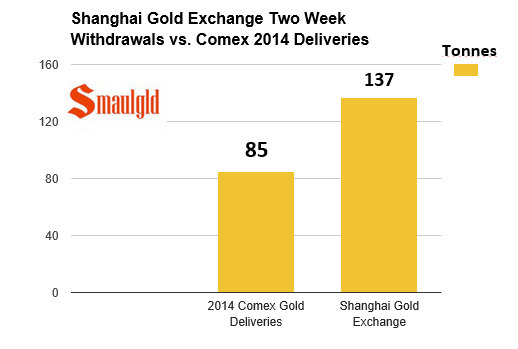

Despite the predictions of many smart analysts of an imminent collapse

or default of Comex, it hasn’t yet and probably won’t. Comex analysts

have noted the seeming unsustainble gold and silver trading on Comex and

have long predicted “imminent” collapses or defaults of that exchange.

Despite the predictions of many smart analysts of an imminent collapse

or default of Comex, it hasn’t yet and probably won’t. Comex analysts

have noted the seeming unsustainble gold and silver trading on Comex and

have long predicted “imminent” collapses or defaults of that exchange.“The COMEX will default in the next week or several weeks and people will be “settled” with Dollars, no more metal will be delivered! So, knowing that “game over” has arrived–Famed precious metals analyst Bill Holter, April 2013”

Currently, Comex analysts cite blatant anomalies like:

Read More

by Jeff Nielson, Bullion Bulls:

Let me take a moment to remind any newer readers here of the

“fundamentals” of any debt market. The more insolvent a nation is, the

higher the rate of interest it must pay on its debt — in order to

compensate lenders for their increased risk.

Let me take a moment to remind any newer readers here of the

“fundamentals” of any debt market. The more insolvent a nation is, the

higher the rate of interest it must pay on its debt — in order to

compensate lenders for their increased risk.

Then we have the Fraudulent States of America. The FSA (formerly USA) is obviously bankrupt, based on merely its “official” debt of well over $17 trillion. Then there is the additional $200 TRILLION in what the U.S. government calls “unfunded liabilities” the language of a Deadbeat.

Every day, the U.S. government (obviously) gets more bankrupt, but every day it pays lower and lower interest on its debts. How? Again (for the benefit of newer readers) there is only one way that this fraud market could be pumped up in such an extreme manner. The Federal Reserve is COUNTERFEITING U.S. dollars, and using that counterfeit fiat currency to buy-up all U.S. Treasuries.

Read More

Then we have the Fraudulent States of America. The FSA (formerly USA) is obviously bankrupt, based on merely its “official” debt of well over $17 trillion. Then there is the additional $200 TRILLION in what the U.S. government calls “unfunded liabilities” the language of a Deadbeat.

Every day, the U.S. government (obviously) gets more bankrupt, but every day it pays lower and lower interest on its debts. How? Again (for the benefit of newer readers) there is only one way that this fraud market could be pumped up in such an extreme manner. The Federal Reserve is COUNTERFEITING U.S. dollars, and using that counterfeit fiat currency to buy-up all U.S. Treasuries.

Read More

from BackToConstitution:

The Federal Reserve, aka, ‘The Fed’, is NOT a government agency! Most people don’t know that fact and so they don’t understand how this fake government agency is at the core of problems in the USA! They don’t understand why the IRS Mafia hounds us and steals from us! Get rid of The Fed and the IRS Mafia and you will be much more prosperous! If you need 100 reasons to end the fed, forever, here they are. Article Link: 100 Reason to Shut Down The Fed, FOREVER

The Federal Reserve, aka, ‘The Fed’, is NOT a government agency! Most people don’t know that fact and so they don’t understand how this fake government agency is at the core of problems in the USA! They don’t understand why the IRS Mafia hounds us and steals from us! Get rid of The Fed and the IRS Mafia and you will be much more prosperous! If you need 100 reasons to end the fed, forever, here they are. Article Link: 100 Reason to Shut Down The Fed, FOREVER

by Marshall Swing, Silver Doctors:

This appears to be the date when The Elite plan to crash the world’s

economies and quickly institute their one world government and one world

currency in the ensuing chaos:

This appears to be the date when The Elite plan to crash the world’s

economies and quickly institute their one world government and one world

currency in the ensuing chaos:

The cover of the year for The Economist magazine has generated speculation about The Elite of the world for many years and what they do in the world economies and how they do it. The Economist magazine is well known to have its roots in Rothschild ownership and control. This, of course brings to mind the other Elite of the world and their minions, those who attend Bilderberg conferences. The Elite, of the world, who are said to control the world economic scene, are sometimes listed as:

Read More

This appears to be the date when The Elite plan to crash the world’s

economies and quickly institute their one world government and one world

currency in the ensuing chaos:

This appears to be the date when The Elite plan to crash the world’s

economies and quickly institute their one world government and one world

currency in the ensuing chaos:The cover of the year for The Economist magazine has generated speculation about The Elite of the world for many years and what they do in the world economies and how they do it. The Economist magazine is well known to have its roots in Rothschild ownership and control. This, of course brings to mind the other Elite of the world and their minions, those who attend Bilderberg conferences. The Elite, of the world, who are said to control the world economic scene, are sometimes listed as:

Read More

from Western Journalism:

by Dave Kranzler, Investment Research Dynamics:

I love how these ex-Fed Chairmen admit the truth several years after the fact. Recall that Greenspan gave a famous speech about the not being able to see financial bubbles until after they occur just before the internet/tech stock bubble popped.

And Bernanke stated in the 2005-2006 timeframe that there was not a housing bubble and that the economy was fine. Of course, that was just before the housing market crashed hard and the economy dropped into the worst economic contraction since the Great Depression.

Now all of a sudden Benanke seems to have found “religion” about the criminality of bankers. I wonder if this is part of his Yom Kippur “soul cleansing.” In an interview this past weekend Bernanke stated that financial executives should have been investigated and prosecuted for perpetrating the great financial collapse: More Wall Streeters Should Be In Jail.

Read More

I love how these ex-Fed Chairmen admit the truth several years after the fact. Recall that Greenspan gave a famous speech about the not being able to see financial bubbles until after they occur just before the internet/tech stock bubble popped.

And Bernanke stated in the 2005-2006 timeframe that there was not a housing bubble and that the economy was fine. Of course, that was just before the housing market crashed hard and the economy dropped into the worst economic contraction since the Great Depression.

Now all of a sudden Benanke seems to have found “religion” about the criminality of bankers. I wonder if this is part of his Yom Kippur “soul cleansing.” In an interview this past weekend Bernanke stated that financial executives should have been investigated and prosecuted for perpetrating the great financial collapse: More Wall Streeters Should Be In Jail.

Read More

/

No comments:

Post a Comment