Another sad chapter in the CIA's book of failed government overthrows comes to a close, leaving the Syria "rebels" that the CIA had supported for years, to fend for themselves, and handing over Syria to Putin, who has once again "won" or as the administration would prefer to spin it, "has hung himself."

from RT America:

Russian defense ministers have reported that at least two high ranking members of the Islamic State (formerly known as ISIS/ISIL) and around 300 insurgents were killed in Russia’s ongoing bombing of targets in Syria. Lizzie Phelan reports live from the ground.

Russian defense ministers have reported that at least two high ranking members of the Islamic State (formerly known as ISIS/ISIL) and around 300 insurgents were killed in Russia’s ongoing bombing of targets in Syria. Lizzie Phelan reports live from the ground.

from NextNewsNetwork:

from TruthTube451 (AKA MrGlasgowTruther):

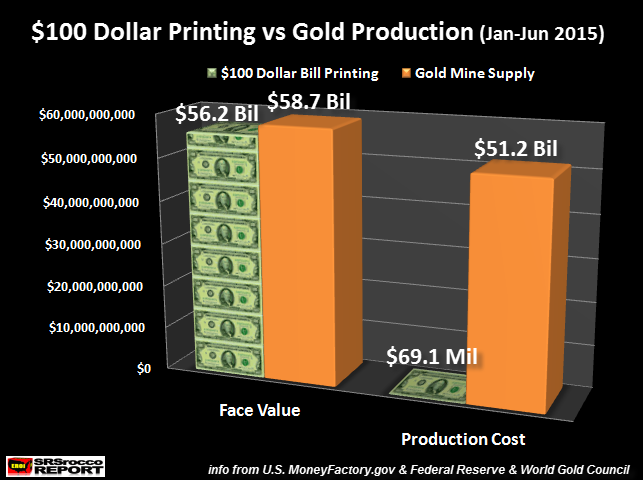

The biggest scam in history continues as the U.S. Department of Treasury Bureau of Printing and Engraving floods the world with worthless fiat currency. Of course, all countries now have fiat currencies, however the U.S. Federal Reserve Note is still the world’s reserve currency.

The growth of U.S. currency in circulation has been considerable over the past twenty years. According to the Federal Reserve Statistical Release, the total value of Federal Reserve Notes in circulation jumped from $423 billion in 1996 to $1.38 trillion as of October 8th, 2015. This was a staggering 228% increase even though the population of the United States only increased 21% during the same time period.

The huge increase of U.S. currency in circulation over this twenty-year period was due to two reasons:

Read More

from KingWorldNews:

Global investors are now getting squeezed out of their long equities

and long junk bonds, and so a lot of these hedge funds are down big on

the year. They (hedge funds) are desperate for gains and as gold and

gold stocks start to rise, I believe that gold stocks will turn into the

new ‘momentum class.’

Global investors are now getting squeezed out of their long equities

and long junk bonds, and so a lot of these hedge funds are down big on

the year. They (hedge funds) are desperate for gains and as gold and

gold stocks start to rise, I believe that gold stocks will turn into the

new ‘momentum class.’

It sounds almost hilarious to say that now because gold stocks are so depressed and they are so far from being momentum names, except for the one I recommended that is up 1,000%. But when nothings else is working for institutional investors, they will begin to flock into the thing that is working, and I think that will be gold and gold stocks.

Michael Belkin Audio Interview @ KingWorldNews.com

It sounds almost hilarious to say that now because gold stocks are so depressed and they are so far from being momentum names, except for the one I recommended that is up 1,000%. But when nothings else is working for institutional investors, they will begin to flock into the thing that is working, and I think that will be gold and gold stocks.

Michael Belkin Audio Interview @ KingWorldNews.com

China's President Tops Obama In "Most Influential" Ranking

Submitted by Tyler Durden on 10/10/2015 - 13:45Fairy Tales & The Gun Control "Middle Ground"

Submitted by Tyler Durden on 10/10/2015 - 12:15 Presented with no comment...Gun Control: Fashionable Prohibition For Modern Lawmakers

Submitted by Tyler Durden on 10/09/2015 - 21:15 With the latest school shooting, all humane people are expected to jump up and do something to stop the next shooting. The most popular response among media pundits and national policymakers right now is an expansion of the various prohibitions now in place against guns. For anyone familiar with the history of prohibitions on inanimate objects, however, these appeals to prohibition as a “common sense” solution are rather less convincing.US Recession Watch: The Inventory Liquidation Looms

Submitted by Tyler Durden on 10/10/2015 - 11:35 There can be little doubt that the massive, unprecedented surge in inventory accumulation (which counts positively to GDP) will eventually be liquidated. When it does the US enter recession, global dollar liquidity crashes, the value of dollar surges even higher, pulling EM further down and a world recession will be upon us again. In this scenario central banks panic...And WeTheSheeplez SLEEP...

"The Biggest Protest This Country Has Seen In Years" - Quarter Million Germans Protest Obama "Free Trade" Deal

Submitted by Tyler Durden on 10/10/2015 - 10:56 250,000 Germans marched in Berlin today in protest against the planned "free trade" deal between Europe and the United States which they say is anti-democratic and will lower food safety, labor and environmental standards. "This is the biggest protest that this country has seen for many, many years," Christoph Bautz, director of citizens' movement Campact told protesters in a speech.Caught On Video: Bomb Attacks At Turkey Peace Rally Leave 86 Dead, 186 Injured

Submitted by Tyler Durden on 10/10/2015 - 08:56 Earlier today, around 10am local time, Turkey’s capital Ankara, was rocked by two blasts which according to NBC killed over 52 demonstrators, who had gathered for a peace march, as the country grapples with mounting security threats just three weeks before snap elections. The explosions also wounded more than 120 people, the Turkish Interior Ministry said. The cause of the blasts was unclear, the ministry said, adding that it had launched an investigation."It's Over For Me" Matt Drudge Warns Public "You're A Pawn In The 'Ghetto-isation'" Of The Web

Submitted by Tyler Durden on 10/09/2015 - 22:50 The very foundation of the free Internet is under severe threat from copyright laws that could ban independent media outlets, according to Matt Drudge. "I had a Supreme Court Justice tell me it’s over for me,” said Drudge, warning web users that they were being pushed "pawn-like" into the cyber "ghettos" of Twitter, Facebook and Instagram.filed under Lying Bitch...

"We Should Have Known Something Was Wrong"

Submitted by Tyler Durden on 10/09/2015 - 22:40 "If only it was that easy to print our way out of a global crisis."The Deep State: Source Of All Negativity

Submitted by Tyler Durden on 10/09/2015 - 22:25 The Deep State is destructive, but it’s great for the people in it. And, like any living organism, its prime directive is: Survive! It survives by indoctrinating the fiction that it’s both good and necessary. However, it’s a parasite that promotes the ridiculous notion that everyone can live at the expense of society. The American Deep State rotates around the Washington Beltway. It imports America’s wealth as tax revenue. A lot of that wealth is consumed there by useless mouths. And then, it exports things that reinforce the Deep State, including wars, fiat currency, and destructive policies. This is unsustainable simply because nothing of value comes out of the city.Another Petro-State Throws In The Towel: The Last Nail In The Petrodollar Coffin

Submitted by Tyler Durden on 10/09/2015 - 22:14 While record mainland deficits covered by the petroleum sector is nothing new in Norwegian budget history, on the contrary it is closer to the norm, the 2016 budget did raise some eyebrows. The other side of the ledger, the net inflow to the SWF from activities in the North Sea will, again according to budget, be lower than the required amount to cover the deficit. This has never happened before and is testimony of the sea change occurring in the world of petrodollar recycling.The Belgium Bottom...TM..

The Real Reason Belgium Sold 1,098 Tonnes Of Gold

As part of a global investigation into how much physical gold central banks have stored at what location and how much is leased out, we submitted the local equivalent of a Freedom Of Information Act (FOIA) request at the central bank of Belgium (NBB) to obtain information about the amount of Belgian official gold reserves, the exact location of all gold bars, the type of gold accounts NBB holds at the Bank Of England (BOE) and how much is leased out and to whom. The outcome of this research was not what we had expected...Only days after both Israeli Prime Minister Netanyahu and Palestinian President Abbas spoke at the UN claiming they were committed to deescalate tensions, violence suddenly surged with Palestinian youth calling for another uprising, or so-called Intifada, against the Israeli occupation.

The violence is spiraling, with Friday funeral services for one of the Palestinian victims deteriorating into some of the most intense cashes in this latest round of escalated unrest. Lena Odgaard reports from the West Bank.

Read More

from Outsider Club:

On Monday, the U.S. Treasury issued $21 billion of three-month bills for absolutely zero interest.

In fact, had it wanted to, the Treasury could have sold its bonds at a negative yield. Meaning, investors were willing to pay a premium to hold U.S. debt.

This is a far cry from February 2007, when three-month Treasuries yielded 5.2%. But it tells you something about today’s investing climate.

Investors right now are more concerned with preserving their money than putting it to work.

Read More

On Monday, the U.S. Treasury issued $21 billion of three-month bills for absolutely zero interest.

In fact, had it wanted to, the Treasury could have sold its bonds at a negative yield. Meaning, investors were willing to pay a premium to hold U.S. debt.

This is a far cry from February 2007, when three-month Treasuries yielded 5.2%. But it tells you something about today’s investing climate.

Investors right now are more concerned with preserving their money than putting it to work.

Read More

from CrushtheStreet:

by Michael Noonan, Edge Trader Plus:

Syria: An example why gold and silver have not rallied, and an example of why gold and silver ultimately will rally.

As a side note, never in the history of the world has a fiat paper currency ever survived. Never before in history has there been so much fiat-created paper currency nor has there ever been as much debt in the world. Never before has the demand for gold and silver been greater, nor the supply of same less, relative to the demand. Obviously, as we have stated in the past, the natural factors of supply and demand are of no consequence for the pricing of gold and silver.

Read More

Syria: An example why gold and silver have not rallied, and an example of why gold and silver ultimately will rally.

As a side note, never in the history of the world has a fiat paper currency ever survived. Never before in history has there been so much fiat-created paper currency nor has there ever been as much debt in the world. Never before has the demand for gold and silver been greater, nor the supply of same less, relative to the demand. Obviously, as we have stated in the past, the natural factors of supply and demand are of no consequence for the pricing of gold and silver.

Read More

from RT:

China’s Central Bank has started a global payment system which provides

cross-border transactions in yuan. The China International Payment

System (CIPS) intends to internationalize the yuan and challenge the US

dollar’s dominance.

China’s Central Bank has started a global payment system which provides

cross-border transactions in yuan. The China International Payment

System (CIPS) intends to internationalize the yuan and challenge the US

dollar’s dominance.

China’s Central Bank has started a global payment system which provides

cross-border transactions in yuan. The China International Payment

System (CIPS) intends to internationalize the yuan and challenge the US

dollar’s dominance.

China’s Central Bank has started a global payment system which provides

cross-border transactions in yuan. The China International Payment

System (CIPS) intends to internationalize the yuan and challenge the US

dollar’s dominance.

“The establishment of CIPS is an important milestone in yuan

internationalization, providing the infrastructure that will connect

global yuan users through one single system,” Helen Wong, greater China chief executive at HSBC, was cited as saying by the Financial Times.

Read More

Read More

from Wolf Street:

“I would be open to the possibility” of reducing the fed funds rate “even further” and go negative, explained Minneapolis Fed President Narayana Kocherlakota on Thursday. Some folks just don’t get it.

Here are the results of seven years of global QE and zero-interest-rate policies:

Global demand is going from sluggish to even more sluggish. Emerging market countries are leading the way, it is said, and China is sneezing. Brazil and Russia have caught pneumonia. Japan is feeling the hangover from Abenomics. Even if there is some growth in Europe, it’s small. And the US, “cleanest dirty shirt” as it’s now called, is getting bogged down.

Read More

“I would be open to the possibility” of reducing the fed funds rate “even further” and go negative, explained Minneapolis Fed President Narayana Kocherlakota on Thursday. Some folks just don’t get it.

Here are the results of seven years of global QE and zero-interest-rate policies:

Global demand is going from sluggish to even more sluggish. Emerging market countries are leading the way, it is said, and China is sneezing. Brazil and Russia have caught pneumonia. Japan is feeling the hangover from Abenomics. Even if there is some growth in Europe, it’s small. And the US, “cleanest dirty shirt” as it’s now called, is getting bogged down.

Read More

/

No comments:

Post a Comment