by Dr Ron Paul, Market Oracle:

In the spirit of New Year’s, here are four resolutions for

president-elect Trump and Congress that will enable them to really make

America great again:

In the spirit of New Year’s, here are four resolutions for

president-elect Trump and Congress that will enable them to really make

America great again:

1) Audit the Fed….and then end it: The Federal Reserve Bank’s easy money polices have eroded the American people’s standard of living and facilitated the growth of the welfare-warfare state. The Fed is also responsible for the growth in income inequality. Yet Congress still refuses to pass Audit the Fed, much less end it.

Read More

1) Audit the Fed….and then end it: The Federal Reserve Bank’s easy money polices have eroded the American people’s standard of living and facilitated the growth of the welfare-warfare state. The Fed is also responsible for the growth in income inequality. Yet Congress still refuses to pass Audit the Fed, much less end it.

Read More

Is 100% Of "US Warming" Due To NOAA Data Tampering?

It's The Dollar, Stupid!

Trump Announces Sprint Bringing 5,000 Jobs Back To US, Says UN Might Be "Waste Of Time & Money"

White House Issues Statement On Phone Call Between Obama And Trump

Will Investors Get 'Hustled' By The Pros In 2017?

George Soros Conjures Hitler In Attack On 'Ascendant Populists', Warns "Democracy Is Now In Crisis"

Federal Appeals Court Revives Hillary Email Case Leaving Key Decision To Trump's Attorney General

More Bad News For NYC Real Estate As Luxury Co-Op Contracts Collapse 25%

Obama To Announce "Retaliation" Measures Against Russia As Early As Tomorrow

How Government Regulation Makes Us Poorer

House Flipping Makes A Comeback As 2016 Volume Soars To Highest Since 2007

The Obama administration is close to announcing a series of measures to

punish Russia for its interference in the 2016 presidential election,

including economic sanctions and diplomatic censure, according to U.S.

officials.

The Obama administration is close to announcing a series of measures to

punish Russia for its interference in the 2016 presidential election,

including economic sanctions and diplomatic censure, according to U.S.

officials.The administration is finalizing the details, which also are expected to include covert action that will probably involve cyber-operations, the officials said. An announcement on the public elements of the response could come as early as this week.

The sanctions portion of the package culminates weeks of debate in the White House on how to revise a 2015 executive order that was meant to give the president authority to respond to cyberattacks from overseas but that did not cover efforts to influence the electoral system.

Read More

by Pam Key, InfoWars:

Tuesday on MSNBC, former Vermont governor and DNC Chair Howard Dean

said going forward the biggest help to the Democratic Party regaining

power will be President Donald Trump, who he said “was going to be

unbelievably erratic and scare the hell out of a lot of people who voted

for him.”

Tuesday on MSNBC, former Vermont governor and DNC Chair Howard Dean

said going forward the biggest help to the Democratic Party regaining

power will be President Donald Trump, who he said “was going to be

unbelievably erratic and scare the hell out of a lot of people who voted

for him.”

Dean said, “I hate to say this but I think the biggest help to the Democrats going forward is Trump is going to be unbelievably erratic and scare the hell out of a lot of people who voted for him. And they already are. If a lot of those folks in Kentucky and West Virginia lose their health insurance, which is absolutely going to happen, because those are the two states that are most dependent on Obamacare, there’s going to be hell to pay for the Republican Party.”

Read More @ InfoWars.com

Dean said, “I hate to say this but I think the biggest help to the Democrats going forward is Trump is going to be unbelievably erratic and scare the hell out of a lot of people who voted for him. And they already are. If a lot of those folks in Kentucky and West Virginia lose their health insurance, which is absolutely going to happen, because those are the two states that are most dependent on Obamacare, there’s going to be hell to pay for the Republican Party.”

Read More @ InfoWars.com

from The Daily Bell:

This is a bad season for banking around the world and especially in Italy where major banks are under water.

This is a bad season for banking around the world and especially in Italy where major banks are under water.

Central banks are supposed to protect banks but who really believes that? In the modern era especially central bank protection has often involved government refinancing.

From the point of view of central banking, the health of the whole system is more important than the health of an individual component. That’s one reason why Italy’s oldest bank was just bailed out.

Read More

Central banks are supposed to protect banks but who really believes that? In the modern era especially central bank protection has often involved government refinancing.

From the point of view of central banking, the health of the whole system is more important than the health of an individual component. That’s one reason why Italy’s oldest bank was just bailed out.

Read More

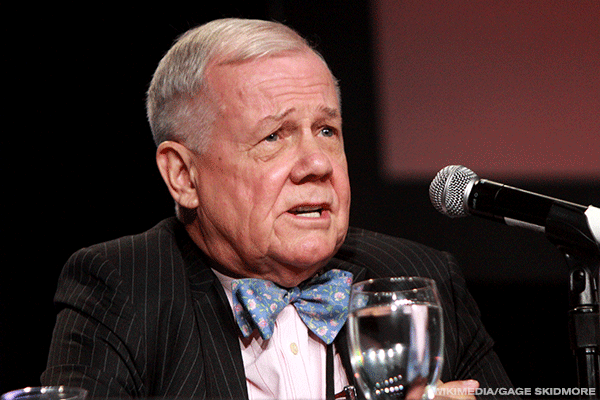

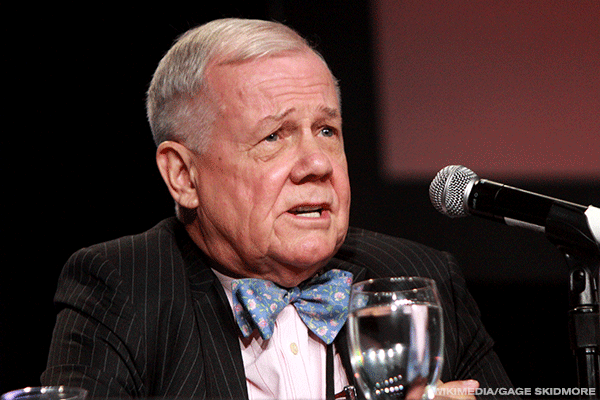

by Kim Iskyan, The Street:

Legendary investor Jim Rogers isn’t afraid of the unknown.

Legendary investor Jim Rogers isn’t afraid of the unknown.

In fact, he made his fortune by investing where others feared to tread.

Rogers made a name for himself in the 1970s after founding the Quantum Fund with George Soros. The fund had gains of 4,200% in 10 years.

Rogers has traveled widely and is known for pioneering the boots-on-the-ground approach to investing in emerging and frontier markets around the world.

From his world travels and decades of investment experience, he has penned a range of best-selling books that blend investment insight, political commentary and travelogue. There are many lessons to be learned from these books.

Read More

Legendary investor Jim Rogers isn’t afraid of the unknown.

Legendary investor Jim Rogers isn’t afraid of the unknown.In fact, he made his fortune by investing where others feared to tread.

Rogers made a name for himself in the 1970s after founding the Quantum Fund with George Soros. The fund had gains of 4,200% in 10 years.

Rogers has traveled widely and is known for pioneering the boots-on-the-ground approach to investing in emerging and frontier markets around the world.

From his world travels and decades of investment experience, he has penned a range of best-selling books that blend investment insight, political commentary and travelogue. There are many lessons to be learned from these books.

Read More

by Jake Anderson, The Anti Media:

The impending evisceration of the global job market by artificial

intelligence and robotic automation is well-trodden territory. Various

estimates suggest the American employment mill could shrink by 30% by

the year 2025. The United Nations’ assessment is even grimmer. They

project two-thirds of the human workforce will be replaced in the next

decade. Usually, the major sectors included in these loss reports are

manufacturing, retail, and blue collar jobs. However, a new analysis

suggests white collar jobs are not immune, and now the world’s largest

hedge fund is replacing its managers with artificial intelligence.

The impending evisceration of the global job market by artificial

intelligence and robotic automation is well-trodden territory. Various

estimates suggest the American employment mill could shrink by 30% by

the year 2025. The United Nations’ assessment is even grimmer. They

project two-thirds of the human workforce will be replaced in the next

decade. Usually, the major sectors included in these loss reports are

manufacturing, retail, and blue collar jobs. However, a new analysis

suggests white collar jobs are not immune, and now the world’s largest

hedge fund is replacing its managers with artificial intelligence.

The firm Bridgewater Associates, which manages $160 billion worth of assets, tasked a team of its engineers with creating AI software that can automate decision-making and eliminate emotion from financial analysis. Leading the effort is the same man, David Ferrucci, who helmed IBM’s supercomputer Watson, which became famous in 2011 for beating humans at Jeopardy!

Read More

The firm Bridgewater Associates, which manages $160 billion worth of assets, tasked a team of its engineers with creating AI software that can automate decision-making and eliminate emotion from financial analysis. Leading the effort is the same man, David Ferrucci, who helmed IBM’s supercomputer Watson, which became famous in 2011 for beating humans at Jeopardy!

Read More

by Ken Jorgustin, Modern Survival Blog:

Self rising flour does not require yeast. Dry yeast has an approximate

shelf life of about 4 months after it’s opened (and if kept refrigerated

– although your own results may vary), while the shelf life of the key

ingredient in self rising flour is about 2 years and does not require

refrigeration.

Self rising flour does not require yeast. Dry yeast has an approximate

shelf life of about 4 months after it’s opened (and if kept refrigerated

– although your own results may vary), while the shelf life of the key

ingredient in self rising flour is about 2 years and does not require

refrigeration.

So lets make some biscuits…

(Re-posted for your interest)

The key ingredient to self rising flour is baking powder. Baking powder is a leavening agent that releases carbon dioxide when moistened. This produces air bubbles in baked goods which cause them to expand and become lighter while baking.

Read More

So lets make some biscuits…

(Re-posted for your interest)

The key ingredient to self rising flour is baking powder. Baking powder is a leavening agent that releases carbon dioxide when moistened. This produces air bubbles in baked goods which cause them to expand and become lighter while baking.

Read More

by Michael Krieger, Liberty Blitzkrieg:

Today’s piece should be seen as a bit of a followup to yesterday’s post, India’s Demonetization Debacle Highlights the Dangers of Monetary Monopoly.

While yesterday’s piece was more philosophical/strategic in nature,

today’s zeroes in on some of the devastating real world impacts of

Narendra Modi’s insane and inhumane cash ban. It’s hard to overstate the

damage this policy has done to India’s economy. Modi is quickly solidifying his place as one of monetary history’s biggest idiots.

Today’s piece should be seen as a bit of a followup to yesterday’s post, India’s Demonetization Debacle Highlights the Dangers of Monetary Monopoly.

While yesterday’s piece was more philosophical/strategic in nature,

today’s zeroes in on some of the devastating real world impacts of

Narendra Modi’s insane and inhumane cash ban. It’s hard to overstate the

damage this policy has done to India’s economy. Modi is quickly solidifying his place as one of monetary history’s biggest idiots.

First, let’s take a look at the destructive impact the move has had on India’s massive small businesses community. The Washington Post reports:

Read More

Today’s piece should be seen as a bit of a followup to yesterday’s post, India’s Demonetization Debacle Highlights the Dangers of Monetary Monopoly.

While yesterday’s piece was more philosophical/strategic in nature,

today’s zeroes in on some of the devastating real world impacts of

Narendra Modi’s insane and inhumane cash ban. It’s hard to overstate the

damage this policy has done to India’s economy. Modi is quickly solidifying his place as one of monetary history’s biggest idiots.

Today’s piece should be seen as a bit of a followup to yesterday’s post, India’s Demonetization Debacle Highlights the Dangers of Monetary Monopoly.

While yesterday’s piece was more philosophical/strategic in nature,

today’s zeroes in on some of the devastating real world impacts of

Narendra Modi’s insane and inhumane cash ban. It’s hard to overstate the

damage this policy has done to India’s economy. Modi is quickly solidifying his place as one of monetary history’s biggest idiots.First, let’s take a look at the destructive impact the move has had on India’s massive small businesses community. The Washington Post reports:

Read More

by Doug Casey, Casey Research:

Justin Spittler, editor of Casey Daily Dispatch: Nick, your advisory is called Crisis Investing. Could you explain what “crisis investing” is?

Justin Spittler, editor of Casey Daily Dispatch: Nick, your advisory is called Crisis Investing. Could you explain what “crisis investing” is?

Nick Giambruno: Crisis investing is basically buying elite companies in beaten-up countries or industries. When there’s a crisis, most people only see danger. But it’s actually an opportunity. A crisis often allows you to buy a dollar’s worth of assets for a dime…or less.

Many of the world’s greatest investors have made their fortunes this way…but anyone can do it. You don’t need to be rich or well connected. You don’t even need to travel to do it.

In fact, if you have a regular brokerage account—and the courage to buy when others are fearful—you’re all set.

Read More

Nick Giambruno: Crisis investing is basically buying elite companies in beaten-up countries or industries. When there’s a crisis, most people only see danger. But it’s actually an opportunity. A crisis often allows you to buy a dollar’s worth of assets for a dime…or less.

Many of the world’s greatest investors have made their fortunes this way…but anyone can do it. You don’t need to be rich or well connected. You don’t even need to travel to do it.

In fact, if you have a regular brokerage account—and the courage to buy when others are fearful—you’re all set.

Read More

/

No comments:

Post a Comment