Rogers: "Volume Is Not Going To Come Back. We've Had A Great 30 Years. That's Finished!"

And the Sheeplez Sleep...

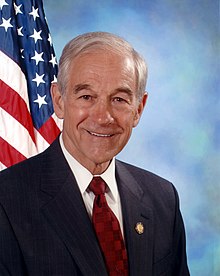

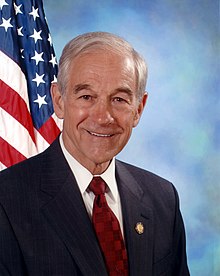

If you think the media is fair...watch this video...Ron Paul 2012

from The American Dream:

There

is nothing wrong with being optimistic, but there is something wrong

with having blind faith that things are going to get better when all of

the evidence is screaming at you that things are going to get worse.

According to a brand new USA TODAY/Gallup Poll,

71 percent of all Americans consider economic conditions in the United

States to be poor right now, but an astounding 58 percent of them

believe that economic conditions in the United States will be good a

year from now. So what can account for this? Are they insane? Are

they hopelessly optimistic? Do they not want to believe the facts that

are staring them right in the face? Well, a lot of it probably has to

do with the upcoming election. Most Republicans are convinced that

things will be “better” somehow if Romney wins in November. Most

Democrats are convinced that things will “continue to improve” if Obama

wins in November. But the truth is that the economy has been declining

steadily in recent years no matter which party has been in power.

There

is nothing wrong with being optimistic, but there is something wrong

with having blind faith that things are going to get better when all of

the evidence is screaming at you that things are going to get worse.

According to a brand new USA TODAY/Gallup Poll,

71 percent of all Americans consider economic conditions in the United

States to be poor right now, but an astounding 58 percent of them

believe that economic conditions in the United States will be good a

year from now. So what can account for this? Are they insane? Are

they hopelessly optimistic? Do they not want to believe the facts that

are staring them right in the face? Well, a lot of it probably has to

do with the upcoming election. Most Republicans are convinced that

things will be “better” somehow if Romney wins in November. Most

Democrats are convinced that things will “continue to improve” if Obama

wins in November. But the truth is that the economy has been declining

steadily in recent years no matter which party has been in power.

Read More @ EndOfTheAmericanDream.com

Read More @ EndOfTheAmericanDream.com

Irony 101 Or How The Fed Blew Up JPMorgan's 'Hedge' In 22 Tweets

HUI Fails to Confirm the Upside Reversal Day of Last Week

Trader Dan at Trader Dan's Market Views - 6 hours ago

Today's selling downdraft in the broader US equity markets, when combined

with more of the risk off trades, derailed the tentative Upside Reversal

Day posted last week in the HUI. You might recall that I mentioned it might

be prudent to get some additional upside price action before becoming too

convinced that we had a sure bottom in the mining sector shares.

The reason for this is that far too many of both these upside reversal

patterns and downside reversal patterns are being generated by the nature

of computer algorithmic trading. In times past we would see these patterns

form ON... more »

Still no word on whether Greece buys out Norwegian funds/Spanish 10 yr yields at 6.23%/Italian bonds at 5.75% Red ink in all bourses throughout the globe

Harvey Organ at Harvey Organ's - The Daily Gold and Silver Report - 7 hours ago

Good evening Ladies and Gentlemen: Gold closed down 23.00 to $1560. 60. Silver fell by 53 cents to $28.52. The markets have digested the news from JPMorgan and now conclude that the 2 billion dollar loss is just a tip of the iceberg. Most of the good guys have now concluded that JPMorgan has underwritten massive quantities of corporate debt via credit default swaps. They then stated that

Total Donations this year...$10.00 Thank You James

Please support our efforts to keep you informed...

Thank You

I'm PayPal Verified

Many have called for very high levels of inflation possibly leading to hyperinflation. Their reasoning is that over printing of the US dollar will cause the dollar to weaken and inflation to set in – more money chasing the same amount, or less, of goods causes prices to rise. A rise in gold and silver (and commodities prices), would be the result.

But the called for massive inflation hasn’t yet happened.

This brings up two questions:

Read More @ MineWeb.com

from RTAmerica:

There are approximately three months left until the Republican National Convention and on Monday, presidential hopeful Ron Paul announced that he will suspend his campaign efforts. The Texas congressman plans on focusing his efforts on winning the delegate vote.

There are approximately three months left until the Republican National Convention and on Monday, presidential hopeful Ron Paul announced that he will suspend his campaign efforts. The Texas congressman plans on focusing his efforts on winning the delegate vote.

By Dr. Ron Paul, GATA:

Last

week I held a hearing to examine the various proposals that have been

put forth both to mend and to end the Fed. The purpose was to spur a

vigorous and long-lasting discussion about the Fed’s problems, hopefully

leading to concrete actions to rein in the Fed.

Last

week I held a hearing to examine the various proposals that have been

put forth both to mend and to end the Fed. The purpose was to spur a

vigorous and long-lasting discussion about the Fed’s problems, hopefully

leading to concrete actions to rein in the Fed.

First, it is important to understand the Federal Reserve System. Some people claim it is a secret cabal of elite bankers, while others claim it is part of the federal government. In reality it is a bit of both. The Federal Reserve System is the collusion of big government and big business to profit at the expense of taxpayers. The Fed’s bailout of large banks during the financial crisis propped up poorly-run corporations that should have gone under, giving them a market-distorting advantage that no business in the United States should receive.

The recent news about JP Morgan is a case in point. JP Morgan, a recipient of $25 billion in bailout money, recently announced it lost another $2 billion. If a corporation shows itself to be a bottomless money pit of “errors, sloppiness and bad judgment,” the Fed shouldn’t have expected $25 billion in free money to change that or teach anyone a lesson in fiscal discipline. But it determined that this form of deliberate capital destruction was preferable to one business suffering bankruptcy. Clearly, some changes need to be made.

Read More @ gata.org

Last

week I held a hearing to examine the various proposals that have been

put forth both to mend and to end the Fed. The purpose was to spur a

vigorous and long-lasting discussion about the Fed’s problems, hopefully

leading to concrete actions to rein in the Fed.

Last

week I held a hearing to examine the various proposals that have been

put forth both to mend and to end the Fed. The purpose was to spur a

vigorous and long-lasting discussion about the Fed’s problems, hopefully

leading to concrete actions to rein in the Fed.First, it is important to understand the Federal Reserve System. Some people claim it is a secret cabal of elite bankers, while others claim it is part of the federal government. In reality it is a bit of both. The Federal Reserve System is the collusion of big government and big business to profit at the expense of taxpayers. The Fed’s bailout of large banks during the financial crisis propped up poorly-run corporations that should have gone under, giving them a market-distorting advantage that no business in the United States should receive.

The recent news about JP Morgan is a case in point. JP Morgan, a recipient of $25 billion in bailout money, recently announced it lost another $2 billion. If a corporation shows itself to be a bottomless money pit of “errors, sloppiness and bad judgment,” the Fed shouldn’t have expected $25 billion in free money to change that or teach anyone a lesson in fiscal discipline. But it determined that this form of deliberate capital destruction was preferable to one business suffering bankruptcy. Clearly, some changes need to be made.

Read More @ gata.org

from Liberty Blitzkrieg

Yesterday I had the pleasure to record another fun and informative radio interview with Dr. Dave Janda out of Michigan. In it we discuss various topics of social, political and economic importance including JPM’s huge loss, Blythe Masters’ sociopathic personality and the derivatives time bomb waiting to explode.

Listen Now @ Liberty Blitzkrieg

Yesterday I had the pleasure to record another fun and informative radio interview with Dr. Dave Janda out of Michigan. In it we discuss various topics of social, political and economic importance including JPM’s huge loss, Blythe Masters’ sociopathic personality and the derivatives time bomb waiting to explode.

Listen Now @ Liberty Blitzkrieg

by Mary Bruce, news.yahoo.com:

Just hours after a top JPMorgan Chase

executive retired in the wake of a stunning $2 billion trading loss,

President Obama told the hosts of ABC’s “The View” that the bank’s risky

bets exemplified the need for Wall Street reform.

Just hours after a top JPMorgan Chase

executive retired in the wake of a stunning $2 billion trading loss,

President Obama told the hosts of ABC’s “The View” that the bank’s risky

bets exemplified the need for Wall Street reform.

Read More & Watch Video @ news.yahoo.com

“JPMorgan is one of the best managed banks there is. Jamie Dimon, the head of it, is one of the smartest bankers we got

and they still lost $2 billion and counting,” the president said. “We

don’t know all the details. It’s going to be investigated, but this is

why we passed Wall Street reform.”

While a powerhouse like JP Morgan might be able to weather an error that the bank’s own CEO called “egregious,” the president questioned what might happen to smaller institutions in similar situations.

“This is one of the best managed banks. You could have a bank that

isn’t as strong, isn’t as profitable managing those same bets and we

might have had to step in,” he said. “That’s why Wall Street reform is

so important.”While a powerhouse like JP Morgan might be able to weather an error that the bank’s own CEO called “egregious,” the president questioned what might happen to smaller institutions in similar situations.

Read More & Watch Video @ news.yahoo.com

In

1976 there was a nationwide panic over a suspicious strain of flu. It

prompted a mass vaccination within the US. It was the swine flu

outbreak.

In

1976 there was a nationwide panic over a suspicious strain of flu. It

prompted a mass vaccination within the US. It was the swine flu

outbreak.A curious strain of H5N1 appeared out of nowhere. During January 19th to February 9th was the only time period when infections were detected. Only one death and 13 were hospitalized from the new strain in H5N1.

Read More @ Activist Post

America as a shining drone upon a hill

by Tom Engelhardt, Antiwar.com:

Here’s the essence of it: you can trust America’s crème de la crème, the most elevated, responsible people, no matter what weapons, what powers, you put in their hands. No need to constantly look over their shoulders.

Placed in the hands of evildoers, those weapons and powers could create a living nightmare; controlled by the best of people, they lead to measured, thoughtful, precise decisions in which bad things are (with rare and understandable exceptions) done only to truly terrible types. In the process, you simply couldn’t be better protected.

And in case you were wondering, there is no question who among us are the best, most lawful, moral, ethical, considerate, and judicious people: the officials of our national-security state. Trust them implicitly. They will never give you a bum steer.

Read More @ Antiwar.com

Total Donations this year...$10.00 Thank You James

I'm PayPal Verified

by Tom Engelhardt, Antiwar.com:

Here’s the essence of it: you can trust America’s crème de la crème, the most elevated, responsible people, no matter what weapons, what powers, you put in their hands. No need to constantly look over their shoulders.

Placed in the hands of evildoers, those weapons and powers could create a living nightmare; controlled by the best of people, they lead to measured, thoughtful, precise decisions in which bad things are (with rare and understandable exceptions) done only to truly terrible types. In the process, you simply couldn’t be better protected.

And in case you were wondering, there is no question who among us are the best, most lawful, moral, ethical, considerate, and judicious people: the officials of our national-security state. Trust them implicitly. They will never give you a bum steer.

Read More @ Antiwar.com

from ArmstrongEconomics:

The

markets have been ignoring what is developing in Europe unconvinced as

yet that this will have any inflationary impact upon gold for example.

Europe is standing up and rejecting austerity on the one hand yet

embracing Marxism at the core foundation. France has elected its first

Socialist President, François Hollande, in 24 years as Athens burns

again in protest. We are approaching the brink of a major crossroads in

civilization. There is the risk that when the tree falls, it can be

sharply to the left. Just look at all the bills being passed by the US

government right now. Little by little, the constitution is being

eliminated. We have lost so many rights in the last few years, the

America that once was, is no more. The trend is clearly toward

authoritative government and the reason for this swing back to the la la

land of Marx, is because Marxism has failed, yet at the same time,

those in the bowels of government are determined to hold on to power at

all costs. This is the classic battle between good and evil playing out

on the grand stage of life. One of the 10 Commandments is thou shalt not

covet thy neighbor’s goods.

The

markets have been ignoring what is developing in Europe unconvinced as

yet that this will have any inflationary impact upon gold for example.

Europe is standing up and rejecting austerity on the one hand yet

embracing Marxism at the core foundation. France has elected its first

Socialist President, François Hollande, in 24 years as Athens burns

again in protest. We are approaching the brink of a major crossroads in

civilization. There is the risk that when the tree falls, it can be

sharply to the left. Just look at all the bills being passed by the US

government right now. Little by little, the constitution is being

eliminated. We have lost so many rights in the last few years, the

America that once was, is no more. The trend is clearly toward

authoritative government and the reason for this swing back to the la la

land of Marx, is because Marxism has failed, yet at the same time,

those in the bowels of government are determined to hold on to power at

all costs. This is the classic battle between good and evil playing out

on the grand stage of life. One of the 10 Commandments is thou shalt not

covet thy neighbor’s goods.

Read More @ ArmstrongEconomics.org

Read More @ ArmstrongEconomics.org

[Ed. Note: Hilarious! Although Munger and Buffet think gold is "uncivilized", the IMF clearly believes otherwise.]

from Commodity Online:

The International Monetary Fund (IMF) is planning to purchase more

than $2 billion worth of gold on account of rising global risks. The IMF

currently holds around 2800 tonnes of gold at various depositories.

The International Monetary Fund (IMF) is planning to purchase more

than $2 billion worth of gold on account of rising global risks. The IMF

currently holds around 2800 tonnes of gold at various depositories.

“The Fund is facing increased credit risk in light of a surge in program lending in the context of the global crisis. While the Fund has a multi-layered framework for managing credit risks, including the strength of its lending policies and its preferred creditor status, there is a need to increase the Fund’s reserves in order to help mitigate the elevated credit risks”, Bloomberg quotes a report by an IMF staff while also adding that a $2.3 billion gold purchase is in the planning.

IMF’s borrowers include Eurozone countries like Greece and Portugal. Greece is IMF’s biggest borrower and the nation is currently caught in a political deadlock that seems bent on denying itself the much needed bailout fund.

Read More @ CommodityOnline.com

Did You BTFD...or are you waiting for $26.00...Keep some powder dry just incase...

from Commodity Online:

“The Fund is facing increased credit risk in light of a surge in program lending in the context of the global crisis. While the Fund has a multi-layered framework for managing credit risks, including the strength of its lending policies and its preferred creditor status, there is a need to increase the Fund’s reserves in order to help mitigate the elevated credit risks”, Bloomberg quotes a report by an IMF staff while also adding that a $2.3 billion gold purchase is in the planning.

IMF’s borrowers include Eurozone countries like Greece and Portugal. Greece is IMF’s biggest borrower and the nation is currently caught in a political deadlock that seems bent on denying itself the much needed bailout fund.

Read More @ CommodityOnline.com

Did You BTFD...or are you waiting for $26.00...Keep some powder dry just incase...

Merkel tells Greece to back cuts or face euro exit

"What will prevail are armed gangs with

Kalashnikovs and which one has the greatest number of Kalashnikovs will

count … we will end up in civil war."

49% of Americans saving zilch for retirement

50-State Small Business Tax Friendliness Survey

California facing higher $16 billion shortfall.

Stocks Close Down 1% on Bank, Europe Worries

Gold Drops to 4.5-month Low as Euro Sinks

Oil Falls as Greece, China Feed Economic Worry

S&P 500 Down for 4th Day of Five

Here is a sobering quote:

49% of Americans saving zilch for retirement

50-State Small Business Tax Friendliness Survey

California facing higher $16 billion shortfall.

Stocks Close Down 1% on Bank, Europe Worries

Gold Drops to 4.5-month Low as Euro Sinks

Oil Falls as Greece, China Feed Economic Worry

S&P 500 Down for 4th Day of Five

Total Donations this year...$10.00 Thank You James

Please support our efforts to keep you informed...

Thank You

I'm PayPal Verified

No comments:

Post a Comment