Lately there has been an amusing and very spurious, not to mention wrong, argument among both the "serious media" and the various tabloids, that US households have delevered to the tune of $1 trillion, primarily as a result of mortgage debt reductions (not to be confused with total consumer debt which month after month hits new record highs, primarily due to soaring student and GM auto loans). The implication here is that unlike in year past, US households are finally doing the responsible thing and are actively deleveraging of their own free will. This couldn't be further from the truth, and to put baseless rumors of this nature to rest once and for all, below we have compiled a simple chart using the NY Fed's own data, showing the total change in mortgage debt, and what portion of it is due to discharges (aka defaults) of 1st and 2nd lien debt. In a nutshell: based on NYFed calculations, there has been $800 billion in mortgage debt deleveraging since the end of 2007. This has been due to $1.2 trillion in discharges (the amount is greater than the total first lien mortgages, due to the increasing use of HELOCs and 2nd lien mortgages before the housing bubble popped).

BTFD...

by Michael Zielinski, CoinUpdate.com:

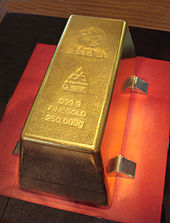

The Perth Mint of Australia has announced their latest sales figures for gold and silver sold as coins and minted products. During September 2012, sales for both metals surged to their highest levels since the start of monthly reporting. The higher sales were undoubtedly driven by the release of the new designs for popular series of gold and silver bullion coins.

Sales of silver coins and minted products rose to 1,251,580.06 troy ounces, up 269% from the prior month and more than doubling the previous highest reported monthly amount from March.

The sales for gold coins and minted products rose to 81,095.13 troy ounces, representing an increase of 118% from the prior month. This eclipsed the previous highest monthly reported amount from June.

Read More @ CoinUpdate.com

The Perth Mint of Australia has announced their latest sales figures for gold and silver sold as coins and minted products. During September 2012, sales for both metals surged to their highest levels since the start of monthly reporting. The higher sales were undoubtedly driven by the release of the new designs for popular series of gold and silver bullion coins.

Sales of silver coins and minted products rose to 1,251,580.06 troy ounces, up 269% from the prior month and more than doubling the previous highest reported monthly amount from March.

The sales for gold coins and minted products rose to 81,095.13 troy ounces, representing an increase of 118% from the prior month. This eclipsed the previous highest monthly reported amount from June.

Read More @ CoinUpdate.com

DSK's "Eyes Wide Shut" Lifestyle Exposed

A Reminder Of Why A Fiscal-Cliff Compromise Is Not Coming Any Time Soon

from ogchris100

Untitled

Harvey Organ at Harvey Organ's - The Daily Gold and Silver Report - 5 hours ago

Good

evening Ladies and Gentlemen:Gold closed the comex session down today

by a fair $22.00 dollar to close the comex session at $1636.00Silver

fell by 92 cents down to $33.80. No doubt the bankers had their

midnight oil weekend sessions and they all decided that another raid was

essential today. I am going to discuss mainly physical matters with you

today with a few major stories sprinkledBad Advice For The Greeks

They Hate Us For Our Prisons

On Nationalism And Extremism In A Nobel-Peace-Prize-Winning Europe

UPDATE: Nigel Farage 'Must-See' rant on the' destruction of nation state democracy'

The need to convince any and all that will listen (and one's own self) that the Euro project must be preserved at all costs has never been so obviously politicized as the Nobel crony committee 'blessing' the European Union for bringing peace to a continent at war. While a laudable thing of itself, as JPMorgan's Michael Cembalest notes, by 1954, Germany had already become a stable, liberal, democratic society in one of the most amazing transformations in history given what preceded it ten years earlier. Whether the Marshall Plan helped this, it seems indisputable that conditions for a lasting peace in Europe were already in place by 1954. The notion that the Euro is needed to cement these gains appears to be more about the ambition of specific political movements in Europe/Brussels than anything else. The irony of the Nobel Peace Prize for Europe is that as shown below, it comes at a time of rising social stress, extremist politics, and a deterioration of trust in the very union that is supposed to be providing the social cement.

Your support is needed...

Thank You

I'm PayPal Verified

Juice Rap News – Episode 16: Electile Dysfunction. It’s nearing the

end of 2012, and the bastion of world democracy (The United States of

America) is displaying its free and open process of elections for the

world to observe. As is customary every four years, the rigorous

selection process has served up a number of philosopher kings and queens

from which to choose. But why have so many choices when with a bit of

effort you can whittle it down to two candidates and let the people pick

from those? Especially when it makes for such scintillating debates.

Join Juice Rap News stalwart host Robert Foster as he shares his dreams

for the Presidential Debates… and then receives something of a rude

awakening.

Today legendary value investor Jean-Marie Eveillard spoke with King

World about the pull back we are seeing in the gold market right now.

Eveillard, who oversees $60 billion, also covered comments that came out

of the Fed today and how they are supportive for the gold market.

Today legendary value investor Jean-Marie Eveillard spoke with King

World about the pull back we are seeing in the gold market right now.

Eveillard, who oversees $60 billion, also covered comments that came out

of the Fed today and how they are supportive for the gold market.Here is what Eveillard had to say: “Yes we’ve had a few disappointing days, but the price of gold had gone up before that. We have, so far, a minor correction. Had gold become too popular at close to $1,800? I don’t think so, but the thing about gold, you always have the short-term players, usually with leverage, in the futures market.”

Jean-Marie Eveillard continues @ KingWorldNews.com

From Peter Schiff, Euro Pacific Capital:

Journalists, politicians and economists all seem to agree that the

biggest economic issue currently worrying voters is unemployment. It

follows then that most believe that the deciding factor in the

presidential race will be the ability of each candidate to convince the

public that his policies will create jobs. It seems that everyone got

this memo…except the voters.

Journalists, politicians and economists all seem to agree that the

biggest economic issue currently worrying voters is unemployment. It

follows then that most believe that the deciding factor in the

presidential race will be the ability of each candidate to convince the

public that his policies will create jobs. It seems that everyone got

this memo…except the voters.

According to the results of a Fox News poll released last week (a random telephone sample of more than 1,200 registered voters) 41 % identified “inflation” as “the biggest economic problem they faced.” This is nearly double the 24% that named “unemployment” as their chief concern. For further comparison, 19% identified “taxes” and 7% “the housing market” as their primary concern. A full 44% of women, who often do more of the household shopping and would therefore be more sensitive to prices changes, identified rising prices as their primary concern.

Read More @ EuroPacificCapital.com

According to the results of a Fox News poll released last week (a random telephone sample of more than 1,200 registered voters) 41 % identified “inflation” as “the biggest economic problem they faced.” This is nearly double the 24% that named “unemployment” as their chief concern. For further comparison, 19% identified “taxes” and 7% “the housing market” as their primary concern. A full 44% of women, who often do more of the household shopping and would therefore be more sensitive to prices changes, identified rising prices as their primary concern.

Read More @ EuroPacificCapital.com

by Addison Wiggin, SilverBearCafe.com:

Gold has steadily advanced over the last 60 days from $1,600 to this morning’s $1,767. Which is making some people a little nervous. For instance: “Can you comment,” a reader asks, “on what you think might happen to the price of gold if Romney gets elected?”

One of the most respected gold fund managers sees gold reaching for a new high inside the next 12 months. In his latest shareholder letter, Tocqueville Gold Fund chieftain John Hathaway bases that forecast on continued negative real interest rates: That is, as long as central banks push interest rates below the rate of inflation, gold performs well. “Some suggest,” Hathaway writes by way of answering the reader’s question, “that a Republican victory in November would be a game changer for gold. It could bring about the dismissal of Bernanke, the taming of fiscal deficits, the painless elimination of excess liquidity from bloated central bank balance sheets and the restoration of robust economic growth. While this rosy scenario is possible, we believe it would be a long shot.”

Read More @ SilverBearCafe.com

from TruthNeverTold :

Gold has steadily advanced over the last 60 days from $1,600 to this morning’s $1,767. Which is making some people a little nervous. For instance: “Can you comment,” a reader asks, “on what you think might happen to the price of gold if Romney gets elected?”

One of the most respected gold fund managers sees gold reaching for a new high inside the next 12 months. In his latest shareholder letter, Tocqueville Gold Fund chieftain John Hathaway bases that forecast on continued negative real interest rates: That is, as long as central banks push interest rates below the rate of inflation, gold performs well. “Some suggest,” Hathaway writes by way of answering the reader’s question, “that a Republican victory in November would be a game changer for gold. It could bring about the dismissal of Bernanke, the taming of fiscal deficits, the painless elimination of excess liquidity from bloated central bank balance sheets and the restoration of robust economic growth. While this rosy scenario is possible, we believe it would be a long shot.”

Read More @ SilverBearCafe.com

from TruthNeverTold :

from Deviant Investor:

Gold has been wealth and money, a store of value, and a means of exchange for more than 3,000 years. Only recently has debt been widely considered wealth. A US government T-Bond is considered “wealth” because the government promises to repay the loan with interest. Similarly, a corporate note is “wealth” because the corporation has promised to repay the note with dollars, and those dollars are still considered valuable. (Dollars are accepted because dollars are accepted.)

Counterparty (the other party in the transaction) risk to your net worth and purchasing power is now more important than ever before! The counterparty to your investment could be the US government, the corporation that issued a bond, the Federal Reserve, a bank, a broker, a clearing house, or other financial business.

What happens if the government refuses to honor the T-Bond debt? What happens if the corporation becomes insolvent and can’t pay its debts? What happens if MF Global takes “segregated” customer funds and pledges them to a bank? MF Global may owe its customers money. However, if MF Global can’t or won’t pay, then the customer has experienced an unfortunate counterparty risk that was previously unknown or misunderstood.

Read More @ DeviantInvestor.com

Gold has been wealth and money, a store of value, and a means of exchange for more than 3,000 years. Only recently has debt been widely considered wealth. A US government T-Bond is considered “wealth” because the government promises to repay the loan with interest. Similarly, a corporate note is “wealth” because the corporation has promised to repay the note with dollars, and those dollars are still considered valuable. (Dollars are accepted because dollars are accepted.)

Counterparty (the other party in the transaction) risk to your net worth and purchasing power is now more important than ever before! The counterparty to your investment could be the US government, the corporation that issued a bond, the Federal Reserve, a bank, a broker, a clearing house, or other financial business.

What happens if the government refuses to honor the T-Bond debt? What happens if the corporation becomes insolvent and can’t pay its debts? What happens if MF Global takes “segregated” customer funds and pledges them to a bank? MF Global may owe its customers money. However, if MF Global can’t or won’t pay, then the customer has experienced an unfortunate counterparty risk that was previously unknown or misunderstood.

Read More @ DeviantInvestor.com

Dear CIGAs,

This is not causative or supportive of gold’s decline, further supporting the thesis that this is pre-election manipulation off the multiple $1775-$1800 level over 18 days recently.

1.29422 +0.00392 (+0.30%)

2012-10-15 12:23:53, 0 MIN DELAY

Jim Sinclair’s Commentary

Here is the skinny on the sage review of statistics that John Williams makes.

- September Retail Sales Boosted by Inflation and Seasonal-Adjustment Issues

- Economic Recovery Is Not Possible Without Consumer Liquidity Rebound

www.ShadowStats.com

Jim Sinclair’s Commentary

This is the COMEX today. Of course the CRIMEX are the bears in this illustration. You are the salmon.

Gold is going to and through $3500.

Jim Sinclair’s Commentary

I wonder if Zimbabwe is sending observers concerning the national election this time. They should.

Jim Sinclair’s Commentary

If you are retired there is no hope. You are cannon fodder for both parties. You have been sold out by those politicians and organization that purport to protect you.

Now you cannot get a job at Walmart or McDonalds as the unemployed teenagers are in competition with you.

The only solution to Social Security and Medicare is for us geezers to die early like the government actuaries want us to.

Social Security increase for 2013 could be lowest since 1975 Published October 14, 2012

Associated Press

Social Security recipients shouldn’t expect a big increase in monthly benefits come January.

Preliminary figures show the annual benefit boost will be between 1 percent and 2 percent, which would be among the lowest since automatic adjustments were adopted in 1975.

Monthly benefits for retired workers now average $1,237, meaning the typical retiree can expect a raise of between $12 and $24 a month.

The size of the increase will be made official Tuesday, when the government releases inflation figures for September. The announcement is unlikely to please a big block of voters — 56 million people get benefits — just three weeks before elections for president and Congress.

The cost-of-living adjustment, or COLA, is tied to a government measure of inflation adopted by Congress in the 1970s. It shows that consumer prices have gone up by less than 2 percent in the past year.

"Basically, for the past 12 months, prices did not go up as rapidly as they did the year before," said Polina Vlasenko, an economist at the American Institute for Economic Research, based in Great Barrington, Mass.

The typical retiree can expect a raise of between $12 and $24 a month.

More…

Jim,

Sometimes I think these guys drive the price down to get back at you.

From the action in Asia I knew I would wake up to a huge takedown and there it is. $1800 is now a long way off. The shares are being pounded. It’s been a long time since we’ve had anything sustained to be excited about.

This might be a good week to just refrain from looking at my brokerage account.

CIGA Anonymous

Dear Anonymous,

I pointed out their blocks at $1775 and gave you the range of central banks buying between $1670 and $1750. You know I know the downs as well as the ups but I am not a free spec trading service for gambleholics. I have given you their major block on the way to $3500 which is $2111.

Jim

Jim,

Here is more pre-election bullshit. Let us see what John Williams has to say about this.

CIGA TR.

U.S. retail sales jump 1.1% in September

WASHINGTON (AP) — Americans stepped up their spending at retail businesses in September, reflecting their growing confidence in the U.S. economy.

Retail sales rose 1.1 percent last month, the Commerce Department said Monday. That followed a 1.2 percent increase in August, which was revised slightly higher. Both were the largest gains since October 2010.

Sales rose in most major categories. Electronics and appliance store sales jumped 4.5 percent. The increase was driven in part by the latest iPhone, which Apple began selling last month. Sales at auto dealers increased 1.3 percent. Gas station sales also rose 2.5 percent, reflecting higher prices.

Excluding autos and gas, sales were still up a solid 0.9 percent in September. One area of weakness was department store sales, which fell 0.2 percent after no change in August.

The retail sales report is closely watched because it is the government’s first look at consumer spending each month. Consumer spending drives nearly 70 percent of economic activity.

High unemployment and weak pay increases have kept consumers from spending more freely. That has held back growth. The economy grew at a weak 1.3 percent rate in the April-June quarter. Most economists believe growth will stay around 2 percent for the rest of the year.

More…

The Formula Continues Its Counter Trend Rally CIGA Eric

As long as the formula’s counter trend rally remains in tact, expect continued concentration of capital in the risk-on trade(s). The risk-on trade will be vulnerable when the up trends below deteriorate against an endless backdrop of bullish expectations (Chart 1, 2, 3).

Chart 1: The Formula: Gold and Federal Government Budget As A % of GDP, 12 Month Moving Average

Chart 2: The Formula: S&P 500 and Federal Government Budget As A % of GDP, 12 Month Moving Average

Chart: The Leading Formula: Gold and Federal Taxes Withheld (TW) Less Total Government Outlays (TO) As A % of GDP, 12 Month Moving Average

Headline: US runs a 4th straight $1 trillion-plus budget gap

WASHINGTON (AP) — The United States has now spent $1 trillion more than it’s taken in for four straight years.

The Treasury Department confirmed Friday what was widely expected: The deficit for the just-ended 2012 budget year — the gap between the government’s tax revenue and its spending — totaled $1.1 trillion. Put simply, that’s how much the government had to borrow.

It wasn’t quite as ugly as last year.

Tax revenue rose 6.4 percent from 2011 to $2.45 trillion. And spending fell 1.7 percent to $3.5 trillion. As a result, the deficit shrank 16 percent, or $207 billion.

A stronger economy meant more people had jobs and income that generated tax revenue. Corporations also contributed more to federal revenue than in 2011.

Source: finance.yahoo.com

More…

Jim,

Before turning in for the night Sunday I took a look at the "opening" of the access market. What was clear to me was this was the opening of the Cartel’s bombing raid on precious metals, day#2.

Sure enough, 10′ish Monday morning on the CRIMEX we again saw a paper-induced waterfall drop of prices in both Gold (from Friday’s $1758.90* close to under $1730) and Silver (from Friday’s $33.69* close to under $32.50) in mere seconds.

Big whoop! I will not be captive to these ‘seconds-by minutes-by hours’ fakey ‘boogeyman’ games, so the dog and I enjoyed a nice walk in the forest instead. His comment was ‘Meh! Let’s take the hike these clowns need to take one of these days." Neither of us was either ‘skeered’ or ‘impressed’ as we were supposed to be.

Did Central Banks suddenly make everything "all better?" Well, NO. Greece is in worse shape now than it was six months ago, and the same goes for Spain, Italy, France, Japan, Argentina, and many-many others.

Classic Cartel ‘running the Muppets back-and-forth’ with their "fear on, fear off" gimmicks hoping their pre-election price suppression scheme delays the reckoning long enough for Central Banks to solve a problem that cannot be solved. But, they cannot ‘save’ themselves in the end, and only a fool thinks they are going to ‘save’ anyone else.

We’re all completely on our own in this. Well, mea culpa, this is not exactly true…there are a few voices of reason and honesty in the current wilderness of shills peddling misinformation to the sheeple. Jim Sinclair, Eric DeGroot, Dan Norcini and Eric Sprott come to mind immediately. There are a few more out there, but precious damned few.

Want some ‘good’ news? This all coincided nicely with the announcement that JPM’s profit was UP 34%. Who friggin’ knew that processing those EBT cards could be so rewarding?

So, in all candor some full disclosure here: Having gone all-in when Gold was near $700 and Silver in the low $20′s and gotten completely OUT of Dollar-denominated paper of any type years ago, I can "do the math" without taking off my shoes or getting into the shower and the math tells me these short-term paper ‘games’ are meaningless and pointless to me, as they should be to anyone with two wits to rub together.

Whether you think Gold is going to-and-through $3500 or even higher, and Silver to-and-through $50 again… it’s crystal clear that the dollar is fast approaching zero and we have almost run out of road to kick the can down.

Sell? You’ve GOT to be sh*tting me! (channeling my best inner Lewis Black). I only wish I was flush enough to buy even more at these bargain (suppressed) prices! (But, that said, I absolutely refuse to get leveraged.)

Buckle-up, this fun ride is far from over!

CIGA Richard S

Dear CIGA Richard S,

You said it perfectly. Definitely better than the herd of gold writers. My congratulations.

Regards,

Jim

by David SafeWater, SHTFPlan:

Feeling alone or that you’re the only one who “gets it” is not uncommon for us Preppers. I’m not referring to the stereotypical Doomsday Prep…well, you know what I’m talking about. On the journey toward greater Self-Reliance (The Journey), we often find ourselves saving up for another important purchase, working on that project until we get it right, trying to perfect that recipe so we can move on to the next one, burning more midnight oil through studying, etc. Those periods of learning can be downright difficult at times. Independence has never been won without the ransom being paid…in FULL.

I’ve found that the greatest tool in fighting feelings of loneliness during The Journey is having a network you can call on. If you’re like me, it’s also possible to feel lost in a group of folks. I like what Ex-Navy SEAL David B. Rutherford has said about living the “Team Life”.

Read More @ SHTFPlan.com

Your support is needed...

Thank You

I'm PayPal Verified

No comments:

Post a Comment