from KingWorldNews:

John Williams, of Shadowstats, notes that manipulated government

statistics are not changing the fact that the true SGS Unemployment

Measure now sits at a staggering 22.2%. Williams also demonstrates that

despite the hype from Wall Street about a recovery, parts of the

economy remain collapsed. Here is what Williams had to say about the

situation: “Adding the SGS estimate of excluded long-term

discouraged workers back into the total unemployed and labor force,

unemployment—more in line with common experience as estimated by the

SGS-Alternate Unemployment Measure—notched lower to 22.2% in March from

22.4% in February.”

John Williams, of Shadowstats, notes that manipulated government

statistics are not changing the fact that the true SGS Unemployment

Measure now sits at a staggering 22.2%. Williams also demonstrates that

despite the hype from Wall Street about a recovery, parts of the

economy remain collapsed. Here is what Williams had to say about the

situation: “Adding the SGS estimate of excluded long-term

discouraged workers back into the total unemployed and labor force,

unemployment—more in line with common experience as estimated by the

SGS-Alternate Unemployment Measure—notched lower to 22.2% in March from

22.4% in February.”

John Williams continues @ KingWorldNews.com

John Williams continues @ KingWorldNews.com

Shocking Hidden Video: America’s Voting System is a Complete Farce

by Mac Slavo, SHTFPlan:

James O’Keefe, who was single handedly responsible for freezing millions of dollars of wasted government funds to the ACORN association of community organizations due to fraudulent and criminal practices, now demonstrates why it’s patently impossible for the United States to have a legitimate election.

This time O’keefe’s shocking hidden video records poll workers on Primary Day in Washington, DC offering US Attorney General Eric H. Holder’s voting ballot to a complete stranger, while other voting locations in the district offer to sign for ballots. Eric Holder has said multiple times there exists no evidence of Voter Fraud…until now.

While the police state control grid tightens all around us, tracking every email, phone call, retail purchase, and our day-to-day movements, the one thing no one in government wants to track is who is actually casting the votes for elected representatives, even though these very people hold the future of 310 million Americans in their hands.

James O’Keefe, who was single handedly responsible for freezing millions of dollars of wasted government funds to the ACORN association of community organizations due to fraudulent and criminal practices, now demonstrates why it’s patently impossible for the United States to have a legitimate election.

This time O’keefe’s shocking hidden video records poll workers on Primary Day in Washington, DC offering US Attorney General Eric H. Holder’s voting ballot to a complete stranger, while other voting locations in the district offer to sign for ballots. Eric Holder has said multiple times there exists no evidence of Voter Fraud…until now.

While the police state control grid tightens all around us, tracking every email, phone call, retail purchase, and our day-to-day movements, the one thing no one in government wants to track is who is actually casting the votes for elected representatives, even though these very people hold the future of 310 million Americans in their hands.

With

the story of Bruno Iksil refusing to be swept under the rug (for now),

we had the urge to show just how his position stacks up in comparison

to the CDS holdings for all the bank holding companies tracked by the

Office of the Currency Comptroller. Recall: "Iksil may have

built a position totaling as much as $100 billion in contracts in one

index, according to the market participants, who said they

based their estimates on the trades and price movements they witnessed

as well as their understanding of the size and structure of the

markets." We used a log scale index although even in simple linear

terms the story is quite straightforward: we are not sure what is worse -

that one trader may have amassed a CDS position (with an associated

VaR that is in the billions) which is greater than the combined

holdings of all except for 6 banks (and is greater than the combined

CDS exposure of a Wells Fargo among others), or that the top 5 banks

together account for 96.5% of all CDS holdings? One thing we are

certain of, is that JPMorgan's $71 trillion in assorted derivatives is

all purely for hedging purposes. After all Dick Bove just said so.

With

the story of Bruno Iksil refusing to be swept under the rug (for now),

we had the urge to show just how his position stacks up in comparison

to the CDS holdings for all the bank holding companies tracked by the

Office of the Currency Comptroller. Recall: "Iksil may have

built a position totaling as much as $100 billion in contracts in one

index, according to the market participants, who said they

based their estimates on the trades and price movements they witnessed

as well as their understanding of the size and structure of the

markets." We used a log scale index although even in simple linear

terms the story is quite straightforward: we are not sure what is worse -

that one trader may have amassed a CDS position (with an associated

VaR that is in the billions) which is greater than the combined

holdings of all except for 6 banks (and is greater than the combined

CDS exposure of a Wells Fargo among others), or that the top 5 banks

together account for 96.5% of all CDS holdings? One thing we are

certain of, is that JPMorgan's $71 trillion in assorted derivatives is

all purely for hedging purposes. After all Dick Bove just said so.

SP 500 and NDX Futures Daily Charts

Net Asset Value Premiums of Certain Precious Metal Trusts and Funds

An Apple A Day Once Again Kept The Market Crash Away (Until After-Hours)

Is William Cohan Right That Wall Street "Regulation" Has To First And Foremost Curb Greed?

Now that the world is covered in at least $707 trillion in assorted unregulated Over the Counter derivatives (as of June 30, the most recent number is easily tens of trillions greater) and with at least one JPMorgan prop|non-prop trader exposed to having a ~$100 billion notional position in some IG-related index trade, pundits, always eager to score political brownie points, are starting to ruminate over ways to put the half alive/half dead cat back into the box. Unfortunately they are about 20 years too late: with the world literally covered in various levered bets all of which demand hundreds of billions in variation margin on a daily basis, the second the one bank at the nexus of the derivative bubble (ahem JPMorgan) starts keeling over, it will once again be "the end of the world as we know it" unless said bank is immediately bailed out. Again.Rosenberg Ruminates On Six Roadblocks For Stocks

There is no free-lunch - especially if that lunch is liquidity-fueled - is how Gluskin-Sheff's David Rosenberg reminds us of the reality facing US markets this year and next. As (former Fed governor) Kevin Warsh noted in the WSJ "The 'fiscal cliff' in early 2013 - when government stimulus spending and tax relief are set to fall - is not misfortune. It is the inevitable result of policies that kick the can down the road." Between the jobs data and three months in a row of declining ISM orders/inventories it seems the key manufacturing sector of support for the economy may be quaking and add to that the deleveraging that is now recurring (consumer credit) and Rosenberg sees six rather sizable stumbling-blocks facing markets as we move forward. On this basis, the market as a whole is overpriced by more than 20%.2012 - 2013 Corporate Margin Bridge In One Word: "Magic"

During the third quarter of 2011, in the midst of the European banking crisis, with the Swiss Franc soaring to new safe haven heights, the Swiss National Bank came under increasing pressure to ease the burden of a too strong a currency on the swiss economy. After failed actions in August to stem the rise of the Franc against the Euro, the SNB finally bit the bullet on September 6th to the tune of reportedly 40-50 billion Euro to significantly devalue the Swiss Franc, which was otherwise becoming a much sought after alternative to the faltering Euro. Jeremy Cook, described the action on that calamatous day in The Guardian, as:

“the single largest foreign exchange move I have ever seen … The Swiss franc has lost close on 9% in the past 15 minutes. This dwarfs moves seen post-Lehman brothers, 7/7, and other major geo-political events in the past decade.”Intuitively, the largest currency devaluation witnessed by any chief economist, should be wildly bullish for gold, since gold, like the Swiss franc is historically recognized as one of THE safe haven financial instruments. Strangely, in this case no. A cool five minutes before the SNB intervention, the gold price mysteriously plunged $50. This particular event begs the question of just who has undertaken obviously, such a joint gold and foreign exchange intervention?

Read More @ Comexwehaveaproblem.com

NASA’s James Hansen previously advocated environmental terrorism

by Paul Joseph Watson, Info Wars:

Read More @ InfoWars.com

by Paul Joseph Watson, Info Wars:

NASA global warming alarmist James Hansen, who

previously endorsed a book that called for acts of environmentalist

terrorism and genocide to return the planet to the agrarian age, is set

to call for a global tax on carbon emissions in an upcoming speech.

“In his lecture, Hansen will argue that the challenge

facing future generations from climate change is so urgent that a

flat-rate global tax is needed to force immediate cuts in fossil fuel

use,” reports the Guardian.

Echoing rhetoric that skeptics of the political agenda

behind man-made climate change are akin to racists, Hansen characterizes

alleged human-induced climate change a “great moral issue” on a par

with slavery.

The report admits that the tax would “greatly increase the cost of

fossil fuel energy” even as people struggle with soaring energy costs

and that the “the carbon levy would increase year on year.”Read More @ InfoWars.com

from Zero Hedge :

Four months ago we presented what was easily the clearest and most

undiluted by media propaganda clue about the future of the European

experiment, when we noted that even immigrants from places such

as Afghanistan and Bangladesh, using Greece as a stepping stone onward

to the gateway Shengen country of Italy, no longer have the urge to

pursue their European dreams, and instead return home. As Art Cashin explained,

“Over the decades, immigrants from Afghanistan, Bangladesh and other

poor nations would work their way to Patras. They would stay for days or

weeks awaiting a chance to smuggle themselves on to a freighter headed

for Italy. Once there, they could make their way north into Europe to

find hope and opportunity and maybe a job. Last week his relatives told

him that things were changing. The immigrants still come to their way

station of Patras (hope still blooms). But now, after a couple of weeks

in Greece, they are trying to hop ships going the other way. They are

going back home. Life was better, or at least no worse, where they came

from and they had friends and family for support back there.” It appears

that the immigrant boycott is spreading, only this time instead of

“discretionary” immigrants, or those that have not been fully assumed by

society (think “cheap labor” along America’s south, such as California,

Texas and Arizona), it is starting to hit the core of the cheap PIIGS

labor force: the migrant workforce, and in this case the Albanian

diaspora working out of Greece at a fraction of the normal cost. And as

one Albanian migrant worker, so critical to keeping the Greek

construction sector supplied with cheap jobs puts it, “It looks like there’s no money left,” he said of Greece. “It all dried up.”

Four months ago we presented what was easily the clearest and most

undiluted by media propaganda clue about the future of the European

experiment, when we noted that even immigrants from places such

as Afghanistan and Bangladesh, using Greece as a stepping stone onward

to the gateway Shengen country of Italy, no longer have the urge to

pursue their European dreams, and instead return home. As Art Cashin explained,

“Over the decades, immigrants from Afghanistan, Bangladesh and other

poor nations would work their way to Patras. They would stay for days or

weeks awaiting a chance to smuggle themselves on to a freighter headed

for Italy. Once there, they could make their way north into Europe to

find hope and opportunity and maybe a job. Last week his relatives told

him that things were changing. The immigrants still come to their way

station of Patras (hope still blooms). But now, after a couple of weeks

in Greece, they are trying to hop ships going the other way. They are

going back home. Life was better, or at least no worse, where they came

from and they had friends and family for support back there.” It appears

that the immigrant boycott is spreading, only this time instead of

“discretionary” immigrants, or those that have not been fully assumed by

society (think “cheap labor” along America’s south, such as California,

Texas and Arizona), it is starting to hit the core of the cheap PIIGS

labor force: the migrant workforce, and in this case the Albanian

diaspora working out of Greece at a fraction of the normal cost. And as

one Albanian migrant worker, so critical to keeping the Greek

construction sector supplied with cheap jobs puts it, “It looks like there’s no money left,” he said of Greece. “It all dried up.”

Read More @ ZeroHedge.com

Read More @ ZeroHedge.com

from Gains Pains & Capital:

Because of a lack of foreign interest in long-term Treasuries, the Fed decided to step in to pick up the slack. As a result of this, the US Federal Reserve has accounted for 91% of all new debt issuance in the 20+years bracket. Put another way, the US Federal Reserve is now effectively the long-end of the US debt market.

Operations Twist 2 has also allowed US commercial banks to unload their long-term Treasury holdings in exchange for new capital: something most of the Primary Dealers are in dire need of. This in turn helps to explain why the US stock market has advanced despite the fact that retail investors have been pulling out of the market in droves.

Put another way, the markets have been ramped higher by more juice from the Fed (and corporate buybacks). However, the fact remains that this juice has come from the Fed reallocating its current portfolio holdings, NOT printing more money outright to monetize US debt via QE.

Read More @ GainsPainsCapital.com

Because of a lack of foreign interest in long-term Treasuries, the Fed decided to step in to pick up the slack. As a result of this, the US Federal Reserve has accounted for 91% of all new debt issuance in the 20+years bracket. Put another way, the US Federal Reserve is now effectively the long-end of the US debt market.

Operations Twist 2 has also allowed US commercial banks to unload their long-term Treasury holdings in exchange for new capital: something most of the Primary Dealers are in dire need of. This in turn helps to explain why the US stock market has advanced despite the fact that retail investors have been pulling out of the market in droves.

Put another way, the markets have been ramped higher by more juice from the Fed (and corporate buybacks). However, the fact remains that this juice has come from the Fed reallocating its current portfolio holdings, NOT printing more money outright to monetize US debt via QE.

Read More @ GainsPainsCapital.com

from Washington’s Blog:

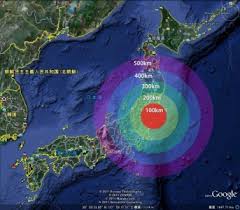

Fukushima will start burning radioactive debris containing up to 100,000 becquerels of radioactive cesium per kilogram. As Mainchi notes:

The state will start building storage facilities for debris generated by the March 2011 tsunami as early as May at two locations in a coastal area of Naraha town, Fukushima Prefecture, Environment Ministry and town officials said Saturday.

***

About 25,000 tons of debris are expected to be brought into the facilities beginning in the summer, according to the officials.

***

If more than 100,000 becquerels of radioactive cesium are found per kilogram of debris, the debris will be transferred to a medium-term storage facility to be built by the state. But if burnable debris contains 100,000 becquerels of radioactive cesium or less, it may be disposed of at a temporary incinerator to be built within the prefecture, according to the officials.

Read More @ WashingtonsBlog.com

Fukushima will start burning radioactive debris containing up to 100,000 becquerels of radioactive cesium per kilogram. As Mainchi notes:

The state will start building storage facilities for debris generated by the March 2011 tsunami as early as May at two locations in a coastal area of Naraha town, Fukushima Prefecture, Environment Ministry and town officials said Saturday.

***

About 25,000 tons of debris are expected to be brought into the facilities beginning in the summer, according to the officials.

***

If more than 100,000 becquerels of radioactive cesium are found per kilogram of debris, the debris will be transferred to a medium-term storage facility to be built by the state. But if burnable debris contains 100,000 becquerels of radioactive cesium or less, it may be disposed of at a temporary incinerator to be built within the prefecture, according to the officials.

Read More @ WashingtonsBlog.com

by Charles Hugh Smith, Of Two Minds:

We are like passengers on the Titanic ten minutes after its fatal

encounter with the iceberg: the idea that the ship will sink is beyond

belief.

We are like passengers on the Titanic ten minutes after its fatal

encounter with the iceberg: the idea that the ship will sink is beyond

belief.

As we all know, the “unsinkable” Titanic suffered a glancing collision with an iceberg on the night of April 14, 1912. Ten minutes after the iceberg had opened six of the ship’s 16 watertight compartments, it was not at all apparent that the mighty vessel had been fatally wounded, as there was no evidence of damage topside. Indeed, some eyewitnesses reported that passengers playfully scattered the ice left on the foredeck by the encounter.

But some rudimentary calculations soon revealed the truth to the officers: the ship was designed to survive four watertight compartments being compromised, and could likely stay afloat if five were opened to the sea, but not if six compartments were flooded. Water would inevitably spill over into adjacent compartments in a domino-like fashion until the ship sank.

Read More @ OfTwoMinds.com

I'm PayPal Verified

As we all know, the “unsinkable” Titanic suffered a glancing collision with an iceberg on the night of April 14, 1912. Ten minutes after the iceberg had opened six of the ship’s 16 watertight compartments, it was not at all apparent that the mighty vessel had been fatally wounded, as there was no evidence of damage topside. Indeed, some eyewitnesses reported that passengers playfully scattered the ice left on the foredeck by the encounter.

But some rudimentary calculations soon revealed the truth to the officers: the ship was designed to survive four watertight compartments being compromised, and could likely stay afloat if five were opened to the sea, but not if six compartments were flooded. Water would inevitably spill over into adjacent compartments in a domino-like fashion until the ship sank.

Read More @ OfTwoMinds.com

No comments:

Post a Comment