Full PFG CEO Suicide Note

"I have committed fraud. For this I feel constant and intense guilt...

The forgeries started nearly twenty years ago...

Should I go out of business or cheat...

I guess my ego was too big to admit failure..."

PFG Head Arrested

While unable to successfully kill himself, it appears the CEO of

PFGBest is even less successful at evading the police. As just reported,

- *PFGBEST'S WASENDORF ARRESTED IN IOWA

- *FED PROSECUTORS CHARGE IOWA FIRM CEO W/ LYING TO REGULATORS:AP

- *PEREGRINE CHIEF WASENDORF CHARGED BY FEDERAL PROSECUTORS (with making false statements to the CFTC)

- *WASENDORF FRAUD AT PEREGRINE LASTED 20 YEARS, PROSECUTORS SAY

What is probably more concerning to him now is the fact that he was not a Presidential bundler - as the Big House is definitely calling...

One Explanation For Today's Irrational Exuberance

Since the EU-Summit, US and European equity markets have (in general) outperformed. From being in sync before the Summit,

US equities went into the weekend with a sell-off, which then spurred a

short-squeeze push as the S&P 500 was over-exuberant (relative to

European equities) on the way up at the start of last week. That

cracked back to reality at the end of last week - squeezing the

over-levered longs to a significant underperformance relative to

European equities. It would appear that in the last 24 hours, US equities are now rallying back to that European 'surreality'.

Surreal because European stocks remain dramatically exuberant relative

to European (peripheral spreads unch and AAA massively bid) and US

(Treasuries bid) bonds and European corporate and financial credit. As

we stand, the S&P 500 has retraced back to Europe's 'fair' perspective.

Since the EU-Summit, US and European equity markets have (in general) outperformed. From being in sync before the Summit,

US equities went into the weekend with a sell-off, which then spurred a

short-squeeze push as the S&P 500 was over-exuberant (relative to

European equities) on the way up at the start of last week. That

cracked back to reality at the end of last week - squeezing the

over-levered longs to a significant underperformance relative to

European equities. It would appear that in the last 24 hours, US equities are now rallying back to that European 'surreality'.

Surreal because European stocks remain dramatically exuberant relative

to European (peripheral spreads unch and AAA massively bid) and US

(Treasuries bid) bonds and European corporate and financial credit. As

we stand, the S&P 500 has retraced back to Europe's 'fair' perspective.

Full PFG CEO Suicide Note

"I have committed fraud. For this I feel constant and intense guilt...

The forgeries started nearly twenty years ago...

Should I go out of business or cheat...

I guess my ego was too big to admit failure..."

PFG Head Arrested

The CME On Gold As Collateral And Its Unsurprising London-Based Custodian

from The Economic Collapse Blog:

The U.S. government has stolen $15,876,457,645,132.66 from future

generations of Americans, and we continue to add well over a hundred

million dollars to that total every single day day. The 15 trillion

dollar binge that we have been on over the past 30 years has fueled the

greatest standard of living the world has ever seen, but this wonderful

prosperity that we have been enjoying has been a lie. It isn’t real.

We have been living way above our means for so long that we do not have

any idea of what “normal” actually is anymore. But every debt addict

hits “the wall” eventually, and the same thing is going to happen to us

as a nation. At some point the weight of our national debt is going to

cause our financial system to implode, and every American will feel the

pain of that collapse. Under our current system, there is no

mathematical way that this debt can ever be paid back. The road that we

are on will either lead to default or to hyperinflation. We have piled

up the biggest debt in the history of the world, and if there are

future generations of Americans they will look back and curse us for

what we did to them. We like to think of ourselves as much wiser than

previous generations of Americans, but the truth is that we have been so

foolish that it is hard to put it into words.

The U.S. government has stolen $15,876,457,645,132.66 from future

generations of Americans, and we continue to add well over a hundred

million dollars to that total every single day day. The 15 trillion

dollar binge that we have been on over the past 30 years has fueled the

greatest standard of living the world has ever seen, but this wonderful

prosperity that we have been enjoying has been a lie. It isn’t real.

We have been living way above our means for so long that we do not have

any idea of what “normal” actually is anymore. But every debt addict

hits “the wall” eventually, and the same thing is going to happen to us

as a nation. At some point the weight of our national debt is going to

cause our financial system to implode, and every American will feel the

pain of that collapse. Under our current system, there is no

mathematical way that this debt can ever be paid back. The road that we

are on will either lead to default or to hyperinflation. We have piled

up the biggest debt in the history of the world, and if there are

future generations of Americans they will look back and curse us for

what we did to them. We like to think of ourselves as much wiser than

previous generations of Americans, but the truth is that we have been so

foolish that it is hard to put it into words.

Read More @ TheEconomicCollapseBlog.com

Today Bill Fleckenstein told King World News, “…the central banks of

the world, and in particular the Fed, are close to where they are going

to panic and do something big.” Fleckenstein, who is President of

Fleckenstein Capital, also said, “What I am salivating over is the

chance to really press my gold position. I think the next leg is going

to be really, really powerful.” Here is what Fleckenstein had to say in

what turned out to be a very powerful and timely interview: “This

all-paper experiment started in 1971, when Nixon closed the gold

window. We had horrendous inflation in the 70s, Volcker came in and

saved the day, and created an environment of credibility whereby

Greenspan could ruin things for the next 20 years. He (Greenspan) then

passed the baton to Bernanke, who is continuing the ruination.”

Today Bill Fleckenstein told King World News, “…the central banks of

the world, and in particular the Fed, are close to where they are going

to panic and do something big.” Fleckenstein, who is President of

Fleckenstein Capital, also said, “What I am salivating over is the

chance to really press my gold position. I think the next leg is going

to be really, really powerful.” Here is what Fleckenstein had to say in

what turned out to be a very powerful and timely interview: “This

all-paper experiment started in 1971, when Nixon closed the gold

window. We had horrendous inflation in the 70s, Volcker came in and

saved the day, and created an environment of credibility whereby

Greenspan could ruin things for the next 20 years. He (Greenspan) then

passed the baton to Bernanke, who is continuing the ruination.”

Bill Fleckenstein continues @ KingWorldNews.com

Read More @ TheEconomicCollapseBlog.com

from KingWorldNews:

Bill Fleckenstein continues @ KingWorldNews.com

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

I'm PayPal Verified

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

New York Fed Release Full Response On Lieborgate

The Fed has released the first of its

Lieborgate treasure trove: "Attached are materials related to the

actions of the Federal Reserve Bank of New York (“New York Fed”) in

connection with the Barclays-LIBOR matter. These include documents

requested by Chairman Neugebauer of the U.S. House of Representatives,

Committee on Financial Services, Subcommittee on Oversight and

Investigations. Chairman Neugebauer requested all transcripts that

relate to communications with Barclays regarding the setting of

interbank offered rates from August 2007 to November 2009. Please note

that the transcript of conversations between the New York Fed and

Barclays was provided by Barclays pursuant to recent regulatory

actions, and the New York Fed cannot attest to the accuracy of these

records. The packet also includes additional materials that document

our efforts in 2008 to highlight problems with LIBOR and press for

reform. We will continue to review our records and actions and will

provide updated information as warranted."

Key Highlights From Fed Lieborgate Disclosure

Here are the choice highlights from the Fed datadump as we see them.From Barclays to NYFed:

"Libor's going to come in at.. .. three-month libor is going to come in at 3.53.

...it's a touch lower than yesterday's but please don't believe it. It's absolute

rubbish. I, I, I'm, putting my libor at 4%

...I think the problem is that the market so desperately wants libors down it's actually putting wrong rates in."

Citi Goes Back To The Future: Lessons from U.S. Fiscal Deleveraging After World War II

The Transformation Of Hedge Funds Into Mutual Funds

Guide to the Confused: SP 500 Futures Intraday

from Wealth Cycles:

In our comments to Supreme Court Ruling – Healthcare Act Upheld, we wrote that a federal ruling is a decree. The fact was blatantly obvious to all when Nancy Pelosi said, “We have to pass the bill, so we can find out what is in it.” Leading us to mention that this decree is far from a reflection of the voice of the people in any state. Florida was first to refuse implementation of centralized healthcare; Texas had joined in. Now Arizona wants to re-assert that Nullification is a state’s right by re-stating the 10th amendment in its state constitution. Before we look at that text, here is what Texas said:

“If

anyone was in doubt, we in Texas have no intention to implement

so-called state exchanges or to expand Medicaid under Obamacare. I will

not be party to socializing health care and bankrupting my state in

direct contradiction to our Constitution and our founding principles of

limited government,” states Rick Perry, Texas governor.

Read More @ WealthCycles.com

People tell me that I get overly worked up about small government

regulations. But small matters. The building of civilization is revealed

in small steps, tiny, bit-by-bit improvements in the things we have and

do. In the same way, seemingly small government regulations can cause a reversal of the magnificent world that enterprise has built. Under the right conditions, these can create human catastrophes.

People tell me that I get overly worked up about small government

regulations. But small matters. The building of civilization is revealed

in small steps, tiny, bit-by-bit improvements in the things we have and

do. In the same way, seemingly small government regulations can cause a reversal of the magnificent world that enterprise has built. Under the right conditions, these can create human catastrophes.

So I offer the following scenario, based on real events very recently in the northeast of the U.S.. It is a composite of cases where government regulation is more than just a menace; it becomes absolutely life threatening.

A summer storm comes and kills your electricity for days. A tree falls on your deck, and you need to cut it away just to get out the back door. You find your chainsaw, but it is out of gas. You reach for the gas can, but the new federal regulations make it nearly impossible to pour. You hack the can with a knife because the drill doesn’t work, and you transfer the gas to another bottle and adding the gas to the saw.

Read More @ WhiskeyAndGunpowder.com

from Gordong T Long:

by Jeffrey Tucker, Whiskey and Gunpowder:

So I offer the following scenario, based on real events very recently in the northeast of the U.S.. It is a composite of cases where government regulation is more than just a menace; it becomes absolutely life threatening.

A summer storm comes and kills your electricity for days. A tree falls on your deck, and you need to cut it away just to get out the back door. You find your chainsaw, but it is out of gas. You reach for the gas can, but the new federal regulations make it nearly impossible to pour. You hack the can with a knife because the drill doesn’t work, and you transfer the gas to another bottle and adding the gas to the saw.

Read More @ WhiskeyAndGunpowder.com

from Gordong T Long:

by Nicholas West, Activist Post

The most expansive set of surveillance powers since the attacks of

2001 are set to be rolled out in Australia unless there is overwhelming

public resistance.

The most expansive set of surveillance powers since the attacks of

2001 are set to be rolled out in Australia unless there is overwhelming

public resistance.

The new proposals are being issued by the intelligence community itself, and involve collecting data on every Australian’s telephone conversations and Internet usage, then storing it for two years.

In tandem with data collection and storage, Australia’s intelligence community wants more access to social media in a sweeping overhaul to current restrictions that is reminiscent of America’s move under its own comprehensive media monitoring initiative.

Read More @ Activist Post

from Matlarson10:

The new proposals are being issued by the intelligence community itself, and involve collecting data on every Australian’s telephone conversations and Internet usage, then storing it for two years.

In tandem with data collection and storage, Australia’s intelligence community wants more access to social media in a sweeping overhaul to current restrictions that is reminiscent of America’s move under its own comprehensive media monitoring initiative.

Read More @ Activist Post

from Matlarson10:

from RTAmerica:

When it comes to Americans having trust in the mainstream media, the numbers don’t lie. According to a recent Gallup poll, only 21 percent of Americans have confidence in television News. The decrease in viewership has become an alarming trend.

When it comes to Americans having trust in the mainstream media, the numbers don’t lie. According to a recent Gallup poll, only 21 percent of Americans have confidence in television News. The decrease in viewership has become an alarming trend.

by The Daily Bell:

Market Savior? Stocks Might Be 50% Lower Without Fed … A report from the Federal Reserve Bank of New York suggests that the bulk of equity returns for more than a decade are due to actions by the US central bank. Theoretically, the S&P 500 would be more than 50 percent lower—at the 600 level—if the bullish price action preceding Fed announcements was excluded, the study showed. Posted on the New York Fed’s web site Wednesday, the study sought out to explain AP why equities receive such a high premium over less risky assets such as bonds. What they found was that the Federal Reserve has had an outsized impact on equities relative to other asset classes. For example, the market has a tendency to rise in the 24-hour period before the release of the Fed’s statement on interest rates and the economy, presumably on expectations Chairman Ben Bernanke and his predecessor, Alan Greenspan, would discuss or implement a stimulus measure to lift asset prices. – CNBC

Dominant Social Theme: Thank goodness for the Fed. O, thanks goodness.

Free-Market Analysis: One of the world’s major central banking institutions has now admitted that the impact of monetary manipulation has pushed up American equity markets, the biggest in the world, by about 50 percent for at least the past ten years.

Read More @ TheDailyBell.com

Market Savior? Stocks Might Be 50% Lower Without Fed … A report from the Federal Reserve Bank of New York suggests that the bulk of equity returns for more than a decade are due to actions by the US central bank. Theoretically, the S&P 500 would be more than 50 percent lower—at the 600 level—if the bullish price action preceding Fed announcements was excluded, the study showed. Posted on the New York Fed’s web site Wednesday, the study sought out to explain AP why equities receive such a high premium over less risky assets such as bonds. What they found was that the Federal Reserve has had an outsized impact on equities relative to other asset classes. For example, the market has a tendency to rise in the 24-hour period before the release of the Fed’s statement on interest rates and the economy, presumably on expectations Chairman Ben Bernanke and his predecessor, Alan Greenspan, would discuss or implement a stimulus measure to lift asset prices. – CNBC

Dominant Social Theme: Thank goodness for the Fed. O, thanks goodness.

Free-Market Analysis: One of the world’s major central banking institutions has now admitted that the impact of monetary manipulation has pushed up American equity markets, the biggest in the world, by about 50 percent for at least the past ten years.

Read More @ TheDailyBell.com

by J. D. Heyes, Natural News:

Most people who know about the disaster at the Fukushima Daiichi

nuclear power complex on Japan’s east coast believe it was caused by a

natural disaster: A huge, earthquake-generated a tsunami that swept over

and through the complex in March 2011, heavily damaging three of its

reactors in the process, leaving radiation-contaminated earth and sea in

its wake.

Most people who know about the disaster at the Fukushima Daiichi

nuclear power complex on Japan’s east coast believe it was caused by a

natural disaster: A huge, earthquake-generated a tsunami that swept over

and through the complex in March 2011, heavily damaging three of its

reactors in the process, leaving radiation-contaminated earth and sea in

its wake.

But a new report from Japan’s parliament says the damage to the plant was more likely caused by human error, and that the earthquake and tsunami merely exposed that.

The “man-made” failures which led to such devastation at Fukushima were the result of breakdowns between regulators and the plant’s operator, Tokyo Electric Power Company (TEPCO), that allowed the company to avoid implementing safety measures. That means the parliamentary report noted that the Japanese government itself lacked a commitment to protect the public.

Read More @ NaturalNews.com

But a new report from Japan’s parliament says the damage to the plant was more likely caused by human error, and that the earthquake and tsunami merely exposed that.

The “man-made” failures which led to such devastation at Fukushima were the result of breakdowns between regulators and the plant’s operator, Tokyo Electric Power Company (TEPCO), that allowed the company to avoid implementing safety measures. That means the parliamentary report noted that the Japanese government itself lacked a commitment to protect the public.

Read More @ NaturalNews.com

by Chriss Street Testosterone Pit.com:

The State of California was already facing a $19 billion budget

deficit, had shorted K-12 public schools $8 billion and are releasing

imprisoned rapists into “community probation” when the California

Legislature’s Democratic majority voted last week to approve selling

$4.6 billion in new state bonds to build 130 miles of railroad track

through some of the most uninhabited farm country in Central California.

The arrogance of the leveraging the already insolvent state caused a

volcanic public outrage, but the Legislature and Governor Jerry Brown

were desperate to get their paws on $3.3 billion in federal grants from

the Obama Administration. But in a shocking development, Moody’s Investor Services,

who was expected to provide the credit rating to justify selling the

debt, may have just torpedoed California’s credit rating by tripling

their estimate of the state’s unfunded public pension liability from

$38.5 billion to $109.1 billion liability and raising the annual cost of

state pension funding by $7.3 billion.

The State of California was already facing a $19 billion budget

deficit, had shorted K-12 public schools $8 billion and are releasing

imprisoned rapists into “community probation” when the California

Legislature’s Democratic majority voted last week to approve selling

$4.6 billion in new state bonds to build 130 miles of railroad track

through some of the most uninhabited farm country in Central California.

The arrogance of the leveraging the already insolvent state caused a

volcanic public outrage, but the Legislature and Governor Jerry Brown

were desperate to get their paws on $3.3 billion in federal grants from

the Obama Administration. But in a shocking development, Moody’s Investor Services,

who was expected to provide the credit rating to justify selling the

debt, may have just torpedoed California’s credit rating by tripling

their estimate of the state’s unfunded public pension liability from

$38.5 billion to $109.1 billion liability and raising the annual cost of

state pension funding by $7.3 billion.

California has long been ground zero for financially dysfunctional government. Under the California State Constitution, the Legislature is required to approve a “balanced budget” each year. At the start of the last year’s budget on July 1, 2011, California had an $8.2 billion budget deficit carry-over from the prior year. No problem for Sacramento political magicians to balance a budget, they simply estimated the state would collect $9.7 billion in capital gains taxes from the Facebook initial public offering. Twelve months later, the state has collected less than $1 billion from Facebook and the deficit has grown by another $1.4 billion to $9.6 billion. This year the Legislature passed another dicey “balanced budget” on the expectations voters would approve in November $8 billion in new sales and income taxes.

Read More @ TestosteronePit.com

California has long been ground zero for financially dysfunctional government. Under the California State Constitution, the Legislature is required to approve a “balanced budget” each year. At the start of the last year’s budget on July 1, 2011, California had an $8.2 billion budget deficit carry-over from the prior year. No problem for Sacramento political magicians to balance a budget, they simply estimated the state would collect $9.7 billion in capital gains taxes from the Facebook initial public offering. Twelve months later, the state has collected less than $1 billion from Facebook and the deficit has grown by another $1.4 billion to $9.6 billion. This year the Legislature passed another dicey “balanced budget” on the expectations voters would approve in November $8 billion in new sales and income taxes.

Read More @ TestosteronePit.com

by Shivom Seth, MineWeb.com

In

a bid to temper imports of the yellow metal, the country is considering

alternative financial routes to help bring out the gold currently

sitting in Indian households.

In

a bid to temper imports of the yellow metal, the country is considering

alternative financial routes to help bring out the gold currently

sitting in Indian households.

The Reserve Bank of India is looking to mobilise the country’s idle gold deposits. The apex bank is mulling ways other than direct curbs on imports of gold to reduce the current account deficit.

With gold imports contributing substantially to India’s current account deficit, a bank instituted panel is looking into the aspects of devising some alternative routes.

Read More @ MineWeb.com

The Reserve Bank of India is looking to mobilise the country’s idle gold deposits. The apex bank is mulling ways other than direct curbs on imports of gold to reduce the current account deficit.

With gold imports contributing substantially to India’s current account deficit, a bank instituted panel is looking into the aspects of devising some alternative routes.

Read More @ MineWeb.com

By WashingtonsBlog, The Market Oracle:

People are justifiably furious over the big banks’ manipulation of

hundreds of trillions of dollars of assets. This violates the banks’

most central function: loaning money based upon the going rate.

People are justifiably furious over the big banks’ manipulation of

hundreds of trillions of dollars of assets. This violates the banks’

most central function: loaning money based upon the going rate.

Indeed, the Libor manipulation is so serious that even mainstream economists are starting to call for heads to roll.

The Bank of England and Federal Reserve’s encouragement of Libor manipulation is not an isolated incident. Rather than being an aberration, it is their central effort.

Indeed, the big banks are rank amateurs when it comes to manipulating interest rates. Central banks have been manipulating rates in very substantial ways for a hundred years or more.

David Zervos – Managing Director and Chief Market Strategist for Jefferies, with $3 billion under management – points out:

Central bankers try to influence rates directly and indirectly EVERY day. That is their job. From the NYFED website this is description of the monetary policy objective –

“the directive for implementation of U.S. monetary policy from the FOMC to the Federal Reserve Bank of New York states that the trading desk should “create conditions in reserve markets” that will encourage fed funds to trade at a particular level. Fed open market operations change the supply of reserve balances in the system, and by affecting the supply of balances, the Fed can create upward or downward pressure on the fed funds rate.”

Read More @ TheMarketOracle.co.uk

Indeed, the Libor manipulation is so serious that even mainstream economists are starting to call for heads to roll.

The Bank of England and Federal Reserve’s encouragement of Libor manipulation is not an isolated incident. Rather than being an aberration, it is their central effort.

Indeed, the big banks are rank amateurs when it comes to manipulating interest rates. Central banks have been manipulating rates in very substantial ways for a hundred years or more.

David Zervos – Managing Director and Chief Market Strategist for Jefferies, with $3 billion under management – points out:

Central bankers try to influence rates directly and indirectly EVERY day. That is their job. From the NYFED website this is description of the monetary policy objective –

“the directive for implementation of U.S. monetary policy from the FOMC to the Federal Reserve Bank of New York states that the trading desk should “create conditions in reserve markets” that will encourage fed funds to trade at a particular level. Fed open market operations change the supply of reserve balances in the system, and by affecting the supply of balances, the Fed can create upward or downward pressure on the fed funds rate.”

Read More @ TheMarketOracle.co.uk

from TheSurvivalMom.com:

I’m a lifelong camper/backpacker, hunter/fisherman, and was also a U.S. Army foot soldier. I’ve spent MORE than my fair-share of time in the field. Today I’m a travelling consultant, and spend months away from home.

We’ve lived-aboard boats (twice in our lives.) We’ve also full-time RV’ed in with a 5th-wheel in the past. So, we know a thing or two about packing, prepping, water conservation, etc., and I’m always interested in what other people suggest packing, especially for their emergency kits.

I’ve watched lots of YouTube videos and such and double-checked countless “packing lists” for bug out bags, get-home bags, 72-hour kits, ditch bags, and vehicle kits. Most of them are pretty darned close in their contents, but I also feel that all of them are, at the same time, way off base!

Read More @ TheSurvivalMom.com

I’m a lifelong camper/backpacker, hunter/fisherman, and was also a U.S. Army foot soldier. I’ve spent MORE than my fair-share of time in the field. Today I’m a travelling consultant, and spend months away from home.

We’ve lived-aboard boats (twice in our lives.) We’ve also full-time RV’ed in with a 5th-wheel in the past. So, we know a thing or two about packing, prepping, water conservation, etc., and I’m always interested in what other people suggest packing, especially for their emergency kits.

I’ve watched lots of YouTube videos and such and double-checked countless “packing lists” for bug out bags, get-home bags, 72-hour kits, ditch bags, and vehicle kits. Most of them are pretty darned close in their contents, but I also feel that all of them are, at the same time, way off base!

Read More @ TheSurvivalMom.com

By Greg Canavan, Daily Reckoning.com.au:

The US Federal Reserve released minutes of its June 19-20 monetary policy meeting overnight. The market was not impressed. Apparently, there are no signs of QE (money printing) on the horizon.

The US Federal Reserve released minutes of its June 19-20 monetary policy meeting overnight. The market was not impressed. Apparently, there are no signs of QE (money printing) on the horizon.

This makes sense if you think, as we do, that the Fed’s underlying motive is to monetise the government’s massive deficits whenever there is a funding shortfall. Right now, there is no shortfall. We’ll come back to that in a moment.

The far more interesting — and related — piece of news overnight was the action in the US Treasury market. $21 billion worth of 10-year Treasury notes were auctioned at a near record low yield of 1.45%. Normally, ‘primary dealers’ (the big Wall Street banks) conduct these auctions and distribute the bulk of the government bonds. Put another way, these banks collect money off their clients and give it to the government. In return their clients receive a paper promise from the government.

But last night’s auction was notable for the large proportion of ‘direct’ purchases. Over 40% of the auction came from ‘direct bids’, which refers to anonymous bidding…and bypassing of the primary dealers. According to the Financial Times, the recent average for direct bids at auctions is around the 17% mark.

Read More @ DailyReckoning.com.au

This makes sense if you think, as we do, that the Fed’s underlying motive is to monetise the government’s massive deficits whenever there is a funding shortfall. Right now, there is no shortfall. We’ll come back to that in a moment.

The far more interesting — and related — piece of news overnight was the action in the US Treasury market. $21 billion worth of 10-year Treasury notes were auctioned at a near record low yield of 1.45%. Normally, ‘primary dealers’ (the big Wall Street banks) conduct these auctions and distribute the bulk of the government bonds. Put another way, these banks collect money off their clients and give it to the government. In return their clients receive a paper promise from the government.

But last night’s auction was notable for the large proportion of ‘direct’ purchases. Over 40% of the auction came from ‘direct bids’, which refers to anonymous bidding…and bypassing of the primary dealers. According to the Financial Times, the recent average for direct bids at auctions is around the 17% mark.

Read More @ DailyReckoning.com.au

from Zero Hedge:

Back on May 30 we wrote “The Second Act Of The JPM CIO Fiasco Has Arrived – Mismarking Hundreds Of Billions In Credit Default Swaps”

in which we made it abundantly clear that due to the Over The Counter

nature of CDS one can easily make up whatever marks one wants in order

to boost the P&L impact of a given position, this is precisely

what JPM was doing in order to boost its P&L? As of moments ago

this too has been proven to be the case. From a just filed very

shocking 8K which takes the “Whale” saga to a whole new level. To wit: ‘the

recently discovered information raises questions about the integrity

of the trader marks, and suggests that certain individuals may have

been seeking to avoid showing the full amount of the losses being

incurred in the portfolio during the first quarter. As a result, the

Firm is no longer confident that the trader marks used to prepare the

Firm’s reported first quarter results (although within the established

thresholds) reflect good faith estimates of fair value at quarter end.”

Back on May 30 we wrote “The Second Act Of The JPM CIO Fiasco Has Arrived – Mismarking Hundreds Of Billions In Credit Default Swaps”

in which we made it abundantly clear that due to the Over The Counter

nature of CDS one can easily make up whatever marks one wants in order

to boost the P&L impact of a given position, this is precisely

what JPM was doing in order to boost its P&L? As of moments ago

this too has been proven to be the case. From a just filed very

shocking 8K which takes the “Whale” saga to a whole new level. To wit: ‘the

recently discovered information raises questions about the integrity

of the trader marks, and suggests that certain individuals may have

been seeking to avoid showing the full amount of the losses being

incurred in the portfolio during the first quarter. As a result, the

Firm is no longer confident that the trader marks used to prepare the

Firm’s reported first quarter results (although within the established

thresholds) reflect good faith estimates of fair value at quarter end.”

As a result of this, regulators who now are only 3 years behind the curve, are most likely snooping to inquire not only how JPM did it (call us: we can brief you in 2 minutes), but who else has been doing this? Hint: everyone.

Because in other words, we have just discovered that the two key components of the entire CDS market: the LIBOR base and market “marks” have been bogus at best, and realistically, fraud. And one wonders why no bank ever will let CDS trade on an exchange…

Read More @ Zero Hedge.com

Back on May 30 we wrote “The Second Act Of The JPM CIO Fiasco Has Arrived – Mismarking Hundreds Of Billions In Credit Default Swaps”

in which we made it abundantly clear that due to the Over The Counter

nature of CDS one can easily make up whatever marks one wants in order

to boost the P&L impact of a given position, this is precisely

what JPM was doing in order to boost its P&L? As of moments ago

this too has been proven to be the case. From a just filed very

shocking 8K which takes the “Whale” saga to a whole new level. To wit: ‘the

recently discovered information raises questions about the integrity

of the trader marks, and suggests that certain individuals may have

been seeking to avoid showing the full amount of the losses being

incurred in the portfolio during the first quarter. As a result, the

Firm is no longer confident that the trader marks used to prepare the

Firm’s reported first quarter results (although within the established

thresholds) reflect good faith estimates of fair value at quarter end.”

Back on May 30 we wrote “The Second Act Of The JPM CIO Fiasco Has Arrived – Mismarking Hundreds Of Billions In Credit Default Swaps”

in which we made it abundantly clear that due to the Over The Counter

nature of CDS one can easily make up whatever marks one wants in order

to boost the P&L impact of a given position, this is precisely

what JPM was doing in order to boost its P&L? As of moments ago

this too has been proven to be the case. From a just filed very

shocking 8K which takes the “Whale” saga to a whole new level. To wit: ‘the

recently discovered information raises questions about the integrity

of the trader marks, and suggests that certain individuals may have

been seeking to avoid showing the full amount of the losses being

incurred in the portfolio during the first quarter. As a result, the

Firm is no longer confident that the trader marks used to prepare the

Firm’s reported first quarter results (although within the established

thresholds) reflect good faith estimates of fair value at quarter end.”As a result of this, regulators who now are only 3 years behind the curve, are most likely snooping to inquire not only how JPM did it (call us: we can brief you in 2 minutes), but who else has been doing this? Hint: everyone.

Because in other words, we have just discovered that the two key components of the entire CDS market: the LIBOR base and market “marks” have been bogus at best, and realistically, fraud. And one wonders why no bank ever will let CDS trade on an exchange…

Read More @ Zero Hedge.com

by Justin Menza, CNBC:

The Federal Reserve and other central banks manipulate interest rates every day, James Grant of Grant’s Interest Rate Observer told CNBC’s “Closing Bell” on Thursday.

“The Fed is in the business of trying to manipulate markets, the macro economy, interest rates, unemployment and inflation through various monetary means, including the twisting around of yield curves and interest rates,” Grant said.

Grant added, “The Federal Reserve fixes rates on principle. They have ‘operation twist’ that manipulates the credit markets. They have quantitative easing that manipulates bond yields.”

Operation twist refers to the Fed’s program of buying longer-dated bonds to bring down long-term interest rates, while quantitative easing is the purchase of securities to inject money into the economy. (Related: Biggest Holders of U.S. Government Debt).

Read more @ CNBC.com

London has always been the center for the Euro dollar deposit market,

but most banks had NY operations that also made markets in Euro depos.

For a time, I sat on one of those desks.

London has always been the center for the Euro dollar deposit market,

but most banks had NY operations that also made markets in Euro depos.

For a time, I sat on one of those desks.

This was way before the Internet and live-streaming prices. Brokers communicated market prices over squawk boxes that were piled up on every desk. There was constant drone of background noise. I can still hear the voices :

I’m 7/8th bid sixes, looking for an offer

I’m an 1/8th around the figure 4 on threes. Looking to do business in the middle.

Last at three daughters (3/4%) on the offer in twos, buyer wants to build.

I have size spot-next to go, looking for a bid.

Looking for 3 large spot a week.

I have balances to go in threes and fours, I need balances over sixes.

Anyone have an offer on a year?

Read More @ BruceKrasting.blogspot.com

Today 40 year veteran, Robert Fitzwilson, wrote the following piece exclusively for King World News. Fitzwilson is founder of The Portola Group, one of the premier boutique firms in the United States. Here are Fitzwilson’s observations: “One of the most interesting episodes in monetary history has to do with something called a tally stick. In ancient times, tally sticks were typically pieces of wood, bone, stone or some other suitable material upon which notches were made to denote numbers and other items worthy of memory. Over time, these tally sticks moved from the mere recording of information to functioning as money.”

King Henry I of England wanted to maintain an iron fist on the creation and use of money within his realm, so he took tally sticks to a new level. Crafted out of squared and polished wood, he had notches carved into them denoting denominations. The sticks were then split evenly down the middle. He kept one half for his treasury and then distributed the other half to the inhabitants of his realm.

By requiring them to be used for the payment of taxes, he insured that the sticks would function as money….”

Robert Fitzwilson continues @ KingWorldNews.com

The Federal Reserve and other central banks manipulate interest rates every day, James Grant of Grant’s Interest Rate Observer told CNBC’s “Closing Bell” on Thursday.

“The Fed is in the business of trying to manipulate markets, the macro economy, interest rates, unemployment and inflation through various monetary means, including the twisting around of yield curves and interest rates,” Grant said.

Grant added, “The Federal Reserve fixes rates on principle. They have ‘operation twist’ that manipulates the credit markets. They have quantitative easing that manipulates bond yields.”

Operation twist refers to the Fed’s program of buying longer-dated bonds to bring down long-term interest rates, while quantitative easing is the purchase of securities to inject money into the economy. (Related: Biggest Holders of U.S. Government Debt).

Read more @ CNBC.com

by Bruce Krasting, Bruce Krasting Blog:

London has always been the center for the Euro dollar deposit market,

but most banks had NY operations that also made markets in Euro depos.

For a time, I sat on one of those desks.

London has always been the center for the Euro dollar deposit market,

but most banks had NY operations that also made markets in Euro depos.

For a time, I sat on one of those desks.This was way before the Internet and live-streaming prices. Brokers communicated market prices over squawk boxes that were piled up on every desk. There was constant drone of background noise. I can still hear the voices :

I’m 7/8th bid sixes, looking for an offer

I’m an 1/8th around the figure 4 on threes. Looking to do business in the middle.

Last at three daughters (3/4%) on the offer in twos, buyer wants to build.

I have size spot-next to go, looking for a bid.

Looking for 3 large spot a week.

I have balances to go in threes and fours, I need balances over sixes.

Anyone have an offer on a year?

Read More @ BruceKrasting.blogspot.com

from KingWorldNews:

Today 40 year veteran, Robert Fitzwilson, wrote the following piece exclusively for King World News. Fitzwilson is founder of The Portola Group, one of the premier boutique firms in the United States. Here are Fitzwilson’s observations: “One of the most interesting episodes in monetary history has to do with something called a tally stick. In ancient times, tally sticks were typically pieces of wood, bone, stone or some other suitable material upon which notches were made to denote numbers and other items worthy of memory. Over time, these tally sticks moved from the mere recording of information to functioning as money.”

King Henry I of England wanted to maintain an iron fist on the creation and use of money within his realm, so he took tally sticks to a new level. Crafted out of squared and polished wood, he had notches carved into them denoting denominations. The sticks were then split evenly down the middle. He kept one half for his treasury and then distributed the other half to the inhabitants of his realm.

By requiring them to be used for the payment of taxes, he insured that the sticks would function as money….”

Robert Fitzwilson continues @ KingWorldNews.com

by Greg Hunter, USAWatchdog:

It looks like things are continuing to heat up in the Middle East. Last week, there was news that the U.S. was sending more military assets to the Persian Gulf. This week, the buildup continues with news the U.S. is sending underwater drones to combat possible Iranian mines and their drones. Meanwhile, in Syria, the Russians are reportedly sending a flotilla of 11 warships to the Syrian coast for maneuvers. NATO already has ships on the Syrian coast, and surveillance flights by the alliance are increasing in the region. This is not how you set the table for peace in the Middle East, even though the U.N. is attempting to put the East and West together to find a peaceful solution.

Read More @ USAWatchdog.com

It looks like things are continuing to heat up in the Middle East. Last week, there was news that the U.S. was sending more military assets to the Persian Gulf. This week, the buildup continues with news the U.S. is sending underwater drones to combat possible Iranian mines and their drones. Meanwhile, in Syria, the Russians are reportedly sending a flotilla of 11 warships to the Syrian coast for maneuvers. NATO already has ships on the Syrian coast, and surveillance flights by the alliance are increasing in the region. This is not how you set the table for peace in the Middle East, even though the U.N. is attempting to put the East and West together to find a peaceful solution.

Read More @ USAWatchdog.com

from Silver Doctors:

Jim Grant has given another memorable interview to CNBC tonight,

discussing the banks’ manipulation of LIBOR, and stating that outrage at

the banks for manipulating interest rates should be redirected at

central banks, who manipulate everything on a massive scale routinely

for a living!

Jim Grant has given another memorable interview to CNBC tonight,

discussing the banks’ manipulation of LIBOR, and stating that outrage at

the banks for manipulating interest rates should be redirected at

central banks, who manipulate everything on a massive scale routinely

for a living!

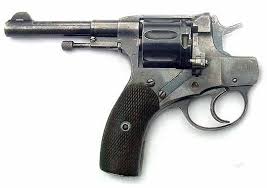

Regarding The Fed’s options going forward Grant stated:

‘The Fed is not out of bullets, the trouble is it’s gun shoots backwards!

These massive interventions in the markets distort the prices we call interest rates. There’s this great scandal with LIBOR- ‘the banks fixed the rates’. The Fed fixes everything! The banks do it opportunistically, The Fed does it for a living, it does it on principle!‘

Read More @ SilverDoctors.com

Regarding The Fed’s options going forward Grant stated:

‘The Fed is not out of bullets, the trouble is it’s gun shoots backwards!

These massive interventions in the markets distort the prices we call interest rates. There’s this great scandal with LIBOR- ‘the banks fixed the rates’. The Fed fixes everything! The banks do it opportunistically, The Fed does it for a living, it does it on principle!‘

Read More @ SilverDoctors.com

By Sabrina Gladstone, CNS News:

This year, Americans have to work until July 15 to pay for the burden of government, more than six months.

This year, Americans have to work until July 15 to pay for the burden of government, more than six months.

In a new report, Americans for Tax Reform (ATR) has calculated that Americans will spend a total of 197 days toiling to pay for the cost of government.

“Cost of Government Day is the date of the calendar year on which the average American worker has earned enough gross income to pay off his or her share of the spending and regulatory burden imposed by government at the federal, state and local levels,” reads the report.

The report, Cost of Government Day, shows that Americans will work 88 days to pay for federal spending; 40 days for state and local spending; and 69 days for total regulatory costs.

Read More @ CNSnews.com

In a new report, Americans for Tax Reform (ATR) has calculated that Americans will spend a total of 197 days toiling to pay for the cost of government.

“Cost of Government Day is the date of the calendar year on which the average American worker has earned enough gross income to pay off his or her share of the spending and regulatory burden imposed by government at the federal, state and local levels,” reads the report.

The report, Cost of Government Day, shows that Americans will work 88 days to pay for federal spending; 40 days for state and local spending; and 69 days for total regulatory costs.

Read More @ CNSnews.com

from Silver Vigilante:

Scurrying for the reasons silver was volatile this morning, the white

noise of the obvious hummed in the back of my mind. That white noise

informed me that I was likely to find no reasons for the sudden spike

this morning in the price of the devil’s metal. No war with Iran, no

quantitative easing, no technological breakthrough demanding increasing

amounts of silver. Instead the black hole of artificial intelligence

trading had been ticked at the $26.50 level, most likely where thousands

if not millions of automated buy orders are triggered, and programmed

to sell somewhere before $27.30.

Scurrying for the reasons silver was volatile this morning, the white

noise of the obvious hummed in the back of my mind. That white noise

informed me that I was likely to find no reasons for the sudden spike

this morning in the price of the devil’s metal. No war with Iran, no

quantitative easing, no technological breakthrough demanding increasing

amounts of silver. Instead the black hole of artificial intelligence

trading had been ticked at the $26.50 level, most likely where thousands

if not millions of automated buy orders are triggered, and programmed

to sell somewhere before $27.30.

These critical mass artificial intelligence trading platforms will in effect dictate the price of silver in such a way so as to benefit speculators. Thus, savers and stackers in the metals will be frustrated by extremely volatile conditions and charts totally out-of-whack.

Other markets are responding predictably to shattered fespectations over quantitative easing. The short-term price of gold and silver will remain intimately tied to Federal Reserve policy. This makes gold and silver rather exposed in the short-term, as panoply of news blitzes and market movements by market makers could send the metals down in the absence of quantitative easing hinting.

Read More @ Silver Vigilante

It may seem like just another obscure banking scandal at a 322-year-old

British bank, but there are a number of good reasons why you should

care about the LIBOR rate-rigging scandal now roiling the world’s

biggest and most powerful banks, including that it probably cost you

money if you own a mortgage.

It may seem like just another obscure banking scandal at a 322-year-old

British bank, but there are a number of good reasons why you should

care about the LIBOR rate-rigging scandal now roiling the world’s

biggest and most powerful banks, including that it probably cost you

money if you own a mortgage.

In late June, Barclays paid $453 million to regulators in the U.K and the U.S. to settle accusations that it had tried to influence LIBOR, or the London interbank offered rate — a benchmark interest rate that affects the price at which consumers and companies across the world borrow funds.

The rate, which is fixed via a poll of banks by the British Bankers’ Association, an industry group in London, is the benchmark for setting payments on some $360 trillion worth of financial instruments, ranging from credit cards to more complex derivatives, such as futures contracts.

The potential scope of the unfolding scandal, now acquiring global significance, is enormous. Other banks that have disclosed that they are under investigation for LIBOR manipulation include big U.S. banks, such as Citigroup and JPMorgan Chase, and also HSBC, Deutsche Bank and the Royal Bank of Scotland.

Read More @ MarketDay.msnbc.msn.com

These critical mass artificial intelligence trading platforms will in effect dictate the price of silver in such a way so as to benefit speculators. Thus, savers and stackers in the metals will be frustrated by extremely volatile conditions and charts totally out-of-whack.

Other markets are responding predictably to shattered fespectations over quantitative easing. The short-term price of gold and silver will remain intimately tied to Federal Reserve policy. This makes gold and silver rather exposed in the short-term, as panoply of news blitzes and market movements by market makers could send the metals down in the absence of quantitative easing hinting.

Read More @ Silver Vigilante

by Roland Jones, Market Day:

In late June, Barclays paid $453 million to regulators in the U.K and the U.S. to settle accusations that it had tried to influence LIBOR, or the London interbank offered rate — a benchmark interest rate that affects the price at which consumers and companies across the world borrow funds.

The rate, which is fixed via a poll of banks by the British Bankers’ Association, an industry group in London, is the benchmark for setting payments on some $360 trillion worth of financial instruments, ranging from credit cards to more complex derivatives, such as futures contracts.

The potential scope of the unfolding scandal, now acquiring global significance, is enormous. Other banks that have disclosed that they are under investigation for LIBOR manipulation include big U.S. banks, such as Citigroup and JPMorgan Chase, and also HSBC, Deutsche Bank and the Royal Bank of Scotland.

Read More @ MarketDay.msnbc.msn.com

from Worldeconomic collapse:

“We the people have the power to take them down.”

“We the people have the power to take them down.”

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

I'm PayPal Verified

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

No comments:

Post a Comment