by Laurence Kotlikoff and Scott Burns, Bloomberg:

Republicans and Democrats spent last summer battling how best to save $2.1 trillion over the next decade. They are spending this summer battling how best to not

save $2.1 trillion over the next decade.

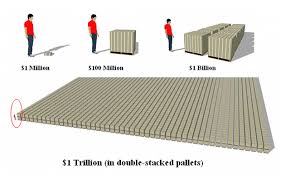

In the course of that year, the U.S. government’s fiscal gap — the true measure of the nation’s indebtedness — rose by $11 trillion.

The answer for the U.S. isn’t pretty. Closing the gap using taxes requires an immediate and permanent 64 percent increase in all federal taxes. Alternatively, the U.S. needs to cut, immediately and permanently, all federal purchases and transfer payments, including Social Security and Medicare benefits, by 40 percent. Or it can mix these terrible fiscal medicines with honey, namely radical fiscal reforms that make the economy much fairer and far stronger. What the government can’t do is pay its bills by spending more and taxing less. America’s children, whose futures are being rapidly destroyed, are smart enough to tell us this.

Read More @ Bloomberg

Republicans and Democrats spent last summer battling how best to save $2.1 trillion over the next decade. They are spending this summer battling how best to not

save $2.1 trillion over the next decade.

In the course of that year, the U.S. government’s fiscal gap — the true measure of the nation’s indebtedness — rose by $11 trillion.

The answer for the U.S. isn’t pretty. Closing the gap using taxes requires an immediate and permanent 64 percent increase in all federal taxes. Alternatively, the U.S. needs to cut, immediately and permanently, all federal purchases and transfer payments, including Social Security and Medicare benefits, by 40 percent. Or it can mix these terrible fiscal medicines with honey, namely radical fiscal reforms that make the economy much fairer and far stronger. What the government can’t do is pay its bills by spending more and taxing less. America’s children, whose futures are being rapidly destroyed, are smart enough to tell us this.

Read More @ Bloomberg

Gory Gory Man United

On Using World War 2 Flashbacks To Shame Germany Into Perpetual Bail Outs

Drought, food prices fan fears of new crisis

Eric De Groot at Eric De Groot - 6 minutes ago

The global food crisis driven by demand rising faster than supply has been

an ongoing problem for decades. Recognition of the problem has only

attracted media attention since 2008. The world is unprepared

for a resumption of the 2000 up trends highlighted by the green arrows in

the charts below. Chart 1: CRB Spot And Year-over-Year (YOY) Change Chart

2: ...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

U.S. Trade Gap Contraction Does Not Suggest An Economic Recovery

Eric De Groot at Eric De Groot - 1 hour ago

A narrowing trade gap, often applauded by the media as a sign of recovery,

is a troublesome for an economy with structural deficits. For

example, when the trade gap started to contract in 1973, 1978, 1987,

and 2006, it foreshadowed a significant economic recessions and/or crises

(chart). While an upside turn in the annual trade deficit has yet to

occur, it should...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]Visualizing European Stock Hope And Prayer

Chart Of The Day: Schrödinger (Dis)Inflation

As reported on Wednesday night, China's economy is contracting faster than anyone expected. As further reported last night, China loan creation at 540.1 billion yuan was far below economist estimates of 700 billion. In other words: the world's marginal economy is starting to crack. So the PBOC has no choice but to ease right? Wrong. As we showed yesterday, the Chinese central bank has one mandate above all: food price stability, or else suffer the consequences of "1+ billion people instability." And as the USDA report just confirmed, Soybean is going nowhere but up. Which in turn means Chinese food inflation, which makes up 30% of the headline CPI (unlike America's 7.8%) is set to follow. Still hoping and praying that the PBOC will ease even as the deep fried black swan we warned about 2 weeks ago is rapidly flapping its wings toward Beijing? Hope and pray harder.

US Corn Crop Estimate Cut 17% With Yields Forecast To Drop To 17 Year Lows

Surveying The Landscape

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

I'm PayPal Verified

Cash Out Of Gold And Send Kids To College?

The Financial Times published an interesting article on Wednesday by a Tokyo-based analyst with Arcus Research, Peter Tasker, entitled of 'Cash out of gold and send kids to college'. The article is interesting as it is an articulate synopsis of those who are either negative on and or bearish on gold. It clearly shows the continuing failure to understand the importance of gold as a diversification and as financial insurance. Tasker incorrectly states that gold is "just another financial asset, as vulnerable to the shifts of investor sentiment as an emerging market." He conveniently ignores over 2,000 years of history showing how gold is a store of value. He also ignores recent academic research showing gold to be a hedging instrument and a safe haven asset. Another fact unacknowledged is how gold has clearly been a store of value since the current financial and economic crisis began in 2007. Since then gold has protected people from depreciating financial assets (such as equities and noncore bonds) and from depreciating fiat currencies such as the dollar, the pound and more recently the euro.

Daily US Opening News And Market Re-Cap: August 10

European markets opened lower as risk-off was observed across the asset classes as participants reacted to the disappointing data from China overnight. Continental equity futures have moved horizontally throughout the session so far with little newsflow or influential data to sway price action. Heading into the European open, little has changed as all European indices are in the red, being led lower by consumer goods and utilities. China posted a sharp narrowing in their trade balance surplus to USD 25bln from USD 32bln in June, as the growth in exports slows across the month. As such, it is not a surprise to hear the usual market chatter of the Chinese central bank taking an imminent move to cut their Reserve Requirement Ratio today. However, as nothing has materialised, the riskier assets have not seen any significant lift from the talk.Frontrunning: August 10

- World’s Oldest Shipping Company Closes In Industry Slide (Bloomberg)

- Japan Growth May Slow to Half Previous Pace as Exports Wane (Bloomberg)

- China Export Growth Slides As World Recovery Slows (Bloomberg)

- Weidmann tries to muffle not spike Draghi's ECB guns (Reuters)

- Draghi lays out toolkit to save eurozone (FT)

- Concerns grow over prospects for sterling (FT)

- RIM Said To Draw Interest From IBM On Enterprise Services (Bloomberg)

- UN urges US to cut ethanol production (FT)

- Goldman Sachs Leads Split With Obama, As GE Jilts Him Too (Bloomberg)

- New apartments boost US building sector (FT)

Bill Ackman Stalked By Ghost Of Pershing Square IV As J.C. Penney Implodes

There was a time when Bill Ackman, constantly misperceived as a retail investing genius, blew up an entire fund solely dedicated to investing in Target, mostly via calls as in something out of Whitney Tilson's wettest dream (incidentally, another "investor" who could not get enough of JCP at $27), Pershing Square IV (full hilarious letter from Pershing Square Capital Punishment to the PSIV investors here). His current massive investment in JCP is luckily not a standalone fund, but it is now certainly stalked by the ghost of PSIV as JCP literally blew up overnight and any hope of the rumored "10-15 return" that Ackman predicted in the stock has now gone up in smoke. Oh well: there is always the gamble on Procter and Gamble.Overnight Sentiment: Turning

The markets have been treading water over the past week, yet courtesy of the non-existant volume and the lack of sellers, VWAP algos have been levitating the S&P ever higher despite the lack of any new or credible reason for it to do so. Call it the Merkel vacation doldrums. It is so slow in Europe even Rajoy - now the gatekeeper for the next European phase of sovereign bailouts - is soaking in the sun somewhere, whether or not he may want to return to his job is another matter. As Reuters reports, his popularity is plummeting meaning the government will not survive if and when Rajoy demands a Spanish bailout: "Spanish Prime Minister Mariano Rajoy faces a cloudy return from his short summer break as his expected request for European aid in September will spur protests on the street and deepen cracks emerging in his conservative People's Party... According to an official poll released this week, if a general election were to take place now, Rajoy's People's Party would still win but would get only a 36.6 percent of the vote, down from 40.6 percent in a poll in May and 44.6 percent in the November vote." Which in turn means that Spain demanding a bailout could well mean a violent government overthrow and a follow through mimicking precisely what we saw in Greece, with the opposition party set to undo any bailout request by Rajoy (who knows all of this). In the meantime Bloomberg confirms that sentiment in Europe is resuming its turn as European markets fall led by the Spanish and Italian markets, 10yr yields in those countries rise. Chinese import & export data and French industrial production data were below estimates earlier. The euro is weaker against the dollar and commodity prices fall led by industrial metals. U.S. import price data is released later.Today’s Items:

A Civil war implies two internal warring

sides; however, with Syria, this is clearly not the case. Mercenaries

and volunteers from other states are in the mix. In fact, Obama has

given a direct order to the CIA to help Syrian opposition that is aided by Al-Qaeda. With that in mind, Obama, and those obeying his orders, are guilty of international terrorism.

Aside from speculators, the real world

drought conditions in the U.S. are causing food prices to surge

worldwide. Food is a major U.S. export, so the drought affects prices

around the globe. Food prices jumped 6% in July, after three months of

declines. The U.N. index of cereal prices soared 17%, nearing an

all-time high, last month. One can just imagine the worldwide food crisis as the Mississippi River begins to run dry. With this said, it may be a good idea to get your long-term food supply in order.

The reality is that the collapse of the

U.S. Dollar is not a singular event, but a process. Last month, the Fed

announced that it was formulating a plan to “expand its tool kit”. The

IMF has been consistently calling for the end of the dollar as the

world’s reserve currency and replace it with the flawed SDR. In tune with France, China, Russia and the UN, the nails are slowly being hammered into the U.S. Dollar’s coffin. The Libor scandal only re-focuses the light on the manipulation of the Dollar and now everyone is looking, but not racing yet, for the exit.

Approximately 110 million Americans are on

some form of financial welfare and it is increasing. The number of

Americans on Food Stamps is about 46.4 million… Up from 17 million in

2000. The Food Stamp program cost $71.8 billion in 2011. Just imagine

the situation when Obamacare really kicks in.

46% of Americans die owning under $10,000

in financial assets, with senior citizens relying heavily on Social

Security to help get them through their retirement years. Many of

these Americans undoubtedly believed that Social Security was a

retirement plan and planned accordingly. Just imagine the impact on

people when Social Security goes the way of the dodo bird.

Well, it must be comforting for Eric Holder, and others, that their wonderful plan to attack the 2nd Amendment of

the U.S. Constitution, nearly cost the life of the Chief of police in

Tijuana, who later became the Juárez police chief. Now, gee… What

are the chances that this police chief will be willing to work with U.S.

authorities after he was targeted for assassination? Hey, Holder…

Maybe you can brainwash him!

No comments:

Post a Comment