by Reggie Middleton, BoomBustBlog.com:

In March of 2010, or roughly 2 and quarter years ago, I ridiculed

Italy’s public proclamations of austerity and fiscal responsibility. I

put out a report to my paid subscribers detailing my thoughts therein…

In March of 2010, or roughly 2 and quarter years ago, I ridiculed

Italy’s public proclamations of austerity and fiscal responsibility. I

put out a report to my paid subscribers detailing my thoughts therein…

Well, fast forward to today and Bloomberg reports Italy Moves Into Debt-Crisis Crosshairs After Spain (you know, the same Spain that we also warned about in March of 2010):

Well, fast forward to today and Bloomberg reports Italy Moves Into Debt-Crisis Crosshairs After Spain (you know, the same Spain that we also warned about in March of 2010):

Italy’s 10-year bonds reversed early

gains today in the first trading after the Spanish bailout. Their yield

rose by the most in a day since Dec. 8, adding 27 basis points to 6.04

percent. Shares of UniCredit SpA (UCG), the country’s largest bank, had

their steepest decline in five months.

“The scrutiny of Italy is high and certainly will not dissipate after the deal with Spain,” Nicola Marinelli, who oversees $153 million at Glendevon King Asset Management in London, said in an interview. “This bailout does not mean that Italy will be under attack, but it means that investors will pay attention to every bit of information before deciding to buy or to sell Italian bonds.”

Read More @ BoomBustBlog.com“The scrutiny of Italy is high and certainly will not dissipate after the deal with Spain,” Nicola Marinelli, who oversees $153 million at Glendevon King Asset Management in London, said in an interview. “This bailout does not mean that Italy will be under attack, but it means that investors will pay attention to every bit of information before deciding to buy or to sell Italian bonds.”

Credit Suisse Explains "The Real Issue", And Why There Is Two Months Tops Until France Is In The Bulls Eye

"It’s

all about Spain”, so now we are cutting to the chase. Recapitalization

of the banks versus funding the sovereign is of course a semantic

issue given the nature of the interplay. But it enables the attempted

finesse we describe below. Given the market’s adaptive learning behaviour, we suspect that this finesse might last two [months]. The eventual denouement should be flagged by symptoms of the failure of the credit of EFSF/ESM and/or France."

"It’s

all about Spain”, so now we are cutting to the chase. Recapitalization

of the banks versus funding the sovereign is of course a semantic

issue given the nature of the interplay. But it enables the attempted

finesse we describe below. Given the market’s adaptive learning behaviour, we suspect that this finesse might last two [months]. The eventual denouement should be flagged by symptoms of the failure of the credit of EFSF/ESM and/or France."

The Spanish Bailout Explained With One Image

Charting The Simple Reason Why Every 'Bailout' In Europe Will Be Faded

by Harvey Organ, HarveyOrgan.Blogspot.ca:

Good evening Ladies and Gentlemen:

Good evening Ladies and Gentlemen:

Gold closed up today by $5.40 to $1595.50. Silver added 14 cents to $28.60.

The bankers tried to knock gold down today but it was fruitless as demand is skyrocketing across the globe. I can sum the key events in one word: Spain. Spain announced that they need a bank bailout.

The 10 yr treasury bond of Spain skyrocketed in yield up to 6.50%. The 10 yr bond for Italy closed at 6.03%.

Before heading into those stories and others, let’s travel to the comex and see how trading fared on this first day of the week:

Read More @ HarveyOrgan.Blogspot.ca

Good evening Ladies and Gentlemen:

Good evening Ladies and Gentlemen:Gold closed up today by $5.40 to $1595.50. Silver added 14 cents to $28.60.

The bankers tried to knock gold down today but it was fruitless as demand is skyrocketing across the globe. I can sum the key events in one word: Spain. Spain announced that they need a bank bailout.

The 10 yr treasury bond of Spain skyrocketed in yield up to 6.50%. The 10 yr bond for Italy closed at 6.03%.

Before heading into those stories and others, let’s travel to the comex and see how trading fared on this first day of the week:

Read More @ HarveyOrgan.Blogspot.ca

Gold Pops, Stocks Drop, And Oil Plops

SP 500 and NDX Futures Daily Charts - Rough Day for the Bulls, Tyranny of Money

Goldman Sets New Speed Record In FaceBooking Clients

First thing this morning we

warned our readers that we smelt a rat. The reason: at roughly 12:30

am Eastern this morning, or just before the European open, Goldman's

Francesco Garzarelli sent out a note trying to spin the Spanish bailout

as favorable. More importantly, they told their few remaining clients

to go long Spanish 3 Year bonds... Long story short, as the chart below

shows, we probably have a new world-record in the short amount of time

it took Goldman clients to get totally Facebooked by following the

firm's advice to buy 3 Year Spanish Bonds. Note the yield on the

short-paper below.

First thing this morning we

warned our readers that we smelt a rat. The reason: at roughly 12:30

am Eastern this morning, or just before the European open, Goldman's

Francesco Garzarelli sent out a note trying to spin the Spanish bailout

as favorable. More importantly, they told their few remaining clients

to go long Spanish 3 Year bonds... Long story short, as the chart below

shows, we probably have a new world-record in the short amount of time

it took Goldman clients to get totally Facebooked by following the

firm's advice to buy 3 Year Spanish Bonds. Note the yield on the

short-paper below.

At The End Of May NYSE Short Interest Soared To November 2011 Levels, Leading To Epic Short Squeeze

Wondering

just what precipitated the near-record short covering squeeze in the

first week of June on nothing but speculation of a Spanish bailout

(hence materialized, and proven to be a massive disappointment), and

the latest Hilsenrath rumor of more QE? Look no further than the chart

below: as of the end of May, the short interest on the NYSE soared by

over 800 million shares, bringing the total to 14.3 billion, the

highest since November 30, when the market was 6% lower. And since the

street's repo desks were fully aware the market was overshorted from a

historical basis for this price level, it would be very easy to initiate

a short covering squeeze, kicking out the weakest hands which had

piled in in the second half of the month. The issue is that now that

these shorts have been burned once more, even as the market is once

again tumbling, and there is no easy way to spook a liftathon when

every offer is lifted regardless of price, the next attempt at

levitating the market on mere speculation and innuendo will be far more

difficult. At this point it is all up to the Fed: unless Ben delivers

in 9 days, it may get very ugly. And of course there is the apocalyptic

scenario, where Ben does hint at the NEW QE, and the market

pulls a Spain bailout, ramping higher as a well-habituated Pavlovian

dog, only to plunge. Because if the central bank is unable to lift the

stock market, which accounts for 68% of all US household assets... what

else is left?

Wondering

just what precipitated the near-record short covering squeeze in the

first week of June on nothing but speculation of a Spanish bailout

(hence materialized, and proven to be a massive disappointment), and

the latest Hilsenrath rumor of more QE? Look no further than the chart

below: as of the end of May, the short interest on the NYSE soared by

over 800 million shares, bringing the total to 14.3 billion, the

highest since November 30, when the market was 6% lower. And since the

street's repo desks were fully aware the market was overshorted from a

historical basis for this price level, it would be very easy to initiate

a short covering squeeze, kicking out the weakest hands which had

piled in in the second half of the month. The issue is that now that

these shorts have been burned once more, even as the market is once

again tumbling, and there is no easy way to spook a liftathon when

every offer is lifted regardless of price, the next attempt at

levitating the market on mere speculation and innuendo will be far more

difficult. At this point it is all up to the Fed: unless Ben delivers

in 9 days, it may get very ugly. And of course there is the apocalyptic

scenario, where Ben does hint at the NEW QE, and the market

pulls a Spain bailout, ramping higher as a well-habituated Pavlovian

dog, only to plunge. Because if the central bank is unable to lift the

stock market, which accounts for 68% of all US household assets... what

else is left?

from usfreedom22:

from CapitalAccount:

Welcome to Capital Account. When we talk about bank recapitalizations or rescue plans, what usually captures headlines are dollar or euro amounts, the names of various abbreviated, bailout vehicles — be they the EFSF or the ESM — top politicians, technocrats and international organizations like the IMF. This latest “Spanish bailout” is no exception. Dubbed a bailout for Spain by the media, this is really a 100 billion euro bailout for Spain’s banks that adds to the tab of the already indebted Spanish government. But is this really just a blood wedding between banks and the state that will end in a blood bath of pain threatening to consume all of Europe in its wake? Are these really solutions that channel the workhouses of the Victorian era, of a Dickens novel, in their conditions?

from morningmayan:

BTFD...Keep Stacking...

by Al Doyle, CoinWeek.com:

There’s no lack of enthusiasm just because the circulated Morgan specialist often operates with limited funds. These are the people who hang out at the local coin shop picking up a precious silver dollar or two on a regular basis.

“Circulated Morgans allow you to be a collector while investing in silver,” said Louis Fogleman of The Coin Shop in Farmington, N.M..

Even with the occasional key, circulated Morgan dollars are primarily an area for the person whose budget is closer to Ralph Kramden than Ralph Lauren. “Not everyone collects gold or MS-65s,” Fogleman said. “With circulated Morgans, you can start small and build from there.”

Read More @ CoinWeek.com

There’s no lack of enthusiasm just because the circulated Morgan specialist often operates with limited funds. These are the people who hang out at the local coin shop picking up a precious silver dollar or two on a regular basis.

“Circulated Morgans allow you to be a collector while investing in silver,” said Louis Fogleman of The Coin Shop in Farmington, N.M..

Even with the occasional key, circulated Morgan dollars are primarily an area for the person whose budget is closer to Ralph Kramden than Ralph Lauren. “Not everyone collects gold or MS-65s,” Fogleman said. “With circulated Morgans, you can start small and build from there.”

Read More @ CoinWeek.com

from TF Metals Report:

Our pal, SRSrocco, has penned another fantastic essay and he offered it as a guest post here at TFMR. I gladly obliged to print it because it’s very well done and it is imperative that you read it. Thanks to SRSrocco and Harvey Organ for providing this information.

MY CONVERSATION WITH HARVEY ORGAN:

The Situation Is Even More Dire Than I Imagined

This past Friday night I had the most interesting conversation with Harvey Organ. The inspiration to contact Harvey came from a correspondence I had with Doc at Silver Doctors. Doc was getting ready to release his interview with Harvey when he relayed this rumor of big problems at Barrick’s Pascua Lama Project… another interesting development from Harvey.

Read More @ TF Metals Report.com

Steve tell your listeners to ignore ETFs and continue buying Physical

SILVER and GOLD no matter what “spot price” is. Please tell them to take

cash out NOW!!!! Only keep in bank what you can afford to lose and what

you need to pay bills and expenses. Please tell them to get money out

NOW!!! They have till December the latest to do so. Be mindful it CAN

HAPPEN SOONER. Prices of Metals without manipulation $1000 SILVER $5000

GOLD.

Steve tell your listeners to ignore ETFs and continue buying Physical

SILVER and GOLD no matter what “spot price” is. Please tell them to take

cash out NOW!!!! Only keep in bank what you can afford to lose and what

you need to pay bills and expenses. Please tell them to get money out

NOW!!! They have till December the latest to do so. Be mindful it CAN

HAPPEN SOONER. Prices of Metals without manipulation $1000 SILVER $5000

GOLD.

Here is the latest truth on Spain. The bailout already happened by stealth from very reliable sources. My sources are never wrong. The Bank holiday is going to spill over to Spain, Portugal and France. The Flight to safe harbor now is the UK. From there you will see flights to the US dollar. The main players have moved to Gold. Watch for another shock to SLV and GLD market. This will cause shaky uncommitted hands to dump more SLV and GLD physical. ETF markets will take massive hit.

Germany will start to have massive upheaval as their banks Duetche Bank in particular is over exposed to Spanish Flue, solvency crunch will hit Germany, look for Germans to go mad over the fact they can not have access to their funds.

Read More @ SteveQuayle.com

I'm PayPal Verified

Our pal, SRSrocco, has penned another fantastic essay and he offered it as a guest post here at TFMR. I gladly obliged to print it because it’s very well done and it is imperative that you read it. Thanks to SRSrocco and Harvey Organ for providing this information.

MY CONVERSATION WITH HARVEY ORGAN:

The Situation Is Even More Dire Than I Imagined

This past Friday night I had the most interesting conversation with Harvey Organ. The inspiration to contact Harvey came from a correspondence I had with Doc at Silver Doctors. Doc was getting ready to release his interview with Harvey when he relayed this rumor of big problems at Barrick’s Pascua Lama Project… another interesting development from Harvey.

Read More @ TF Metals Report.com

By: Ron Paul, Gold Seek:

Last week the Congressional Budget Office (CBO) issued its annual

long-term budget outlook report, and the 2012 numbers are not promising.

In fact, the CBO estimates that federal debt will rise to 70% of GDP by

the end of the year– the highest percentage since World War II. The

report also paints a stark picture of entitlement spending, as retiring

Baby Boomers will cause government spending on health care, Social

Security, and Medicare to explode as a percentage of GDP in coming

years.

Last week the Congressional Budget Office (CBO) issued its annual

long-term budget outlook report, and the 2012 numbers are not promising.

In fact, the CBO estimates that federal debt will rise to 70% of GDP by

the end of the year– the highest percentage since World War II. The

report also paints a stark picture of entitlement spending, as retiring

Baby Boomers will cause government spending on health care, Social

Security, and Medicare to explode as a percentage of GDP in coming

years.

While the mainstream media correctly characterized the CBO report as highly pessimistic, they also ignored longstanding errors of methodology in CBO estimates. And those errors tend to support arguments for higher taxes and government spending, when in fact America needs exactly the opposite.

As Paul Roderick Gregory explained in a recent Forbes column (http://tinyurl.com/cf746dl), CBO has always applied wrongheaded assumptions inherent in Keynesian economics when forecasting future deficits – no matter how many times both history and economic theory have proven such assumptions incorrect. In particular, CBO seems wedded to two enduring Keynesian myths: First, that higher taxes necessarily increase federal revenue and have no negative effect on the economy; and second, that lower government spending hurts the economy. Neither is true, of course.

Read More @ GoldSeek.com

More then Plausible... I don't know this guy...you decide...

While the mainstream media correctly characterized the CBO report as highly pessimistic, they also ignored longstanding errors of methodology in CBO estimates. And those errors tend to support arguments for higher taxes and government spending, when in fact America needs exactly the opposite.

As Paul Roderick Gregory explained in a recent Forbes column (http://tinyurl.com/cf746dl), CBO has always applied wrongheaded assumptions inherent in Keynesian economics when forecasting future deficits – no matter how many times both history and economic theory have proven such assumptions incorrect. In particular, CBO seems wedded to two enduring Keynesian myths: First, that higher taxes necessarily increase federal revenue and have no negative effect on the economy; and second, that lower government spending hurts the economy. Neither is true, of course.

Read More @ GoldSeek.com

More then Plausible... I don't know this guy...you decide...

from Steve Quayle:

Here is the latest truth on Spain. The bailout already happened by stealth from very reliable sources. My sources are never wrong. The Bank holiday is going to spill over to Spain, Portugal and France. The Flight to safe harbor now is the UK. From there you will see flights to the US dollar. The main players have moved to Gold. Watch for another shock to SLV and GLD market. This will cause shaky uncommitted hands to dump more SLV and GLD physical. ETF markets will take massive hit.

Germany will start to have massive upheaval as their banks Duetche Bank in particular is over exposed to Spanish Flue, solvency crunch will hit Germany, look for Germans to go mad over the fact they can not have access to their funds.

Read More @ SteveQuayle.com

from KingWorldNews:

After the initial euphoria, following the Spanish bailout, European and US stock markets have surrendered early gains. Today King World News interviewed Bill Fleckenstein, President of Fleckenstein Capital, to get his take on where we’re headed. When KWN last spoke with Fleckenstein, he predicted that stocks would tank, and the Dow tumbled over 900 points in less than 30 days. When asked about that call and what investors should expect going forward, Fleckenstein responded, “I happen to catch that moment in time correctly. The stock market is kind of a farce, which is not to say that stocks are uniformly expensive because lots of them aren’t. On the other hand, any bid over one cent for any financial institution presupposes that you know something about what’s in the entity, and in almost all cases you can’t.”

Fleckenstein continues @ KingWorldNews.com

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution. After the initial euphoria, following the Spanish bailout, European and US stock markets have surrendered early gains. Today King World News interviewed Bill Fleckenstein, President of Fleckenstein Capital, to get his take on where we’re headed. When KWN last spoke with Fleckenstein, he predicted that stocks would tank, and the Dow tumbled over 900 points in less than 30 days. When asked about that call and what investors should expect going forward, Fleckenstein responded, “I happen to catch that moment in time correctly. The stock market is kind of a farce, which is not to say that stocks are uniformly expensive because lots of them aren’t. On the other hand, any bid over one cent for any financial institution presupposes that you know something about what’s in the entity, and in almost all cases you can’t.”

Fleckenstein continues @ KingWorldNews.com

by David Schectman, MilesFranklin.com:

I’ve noticed an interesting thing about us gold bugs. On the surface,

we reek with conviction and are certain of our bullishness. On the

surface. But so many of us harbor doubts. There is a tug of war going

on between “I know what I’m doing,” and “But what if I’m wrong.” We

don’t admit it, not even to our self, and we look outward for people to

lean on, people to tell us what we want to hear.

I’ve noticed an interesting thing about us gold bugs. On the surface,

we reek with conviction and are certain of our bullishness. On the

surface. But so many of us harbor doubts. There is a tug of war going

on between “I know what I’m doing,” and “But what if I’m wrong.” We

don’t admit it, not even to our self, and we look outward for people to

lean on, people to tell us what we want to hear.

The conflict stems from a clash between short-term market moves and long-term fundamentals. The price of gold should not trade all over the map. For around 80 years it stayed stable at $20 an ounce. Then it locked in at $35 an ounce for another near 40 years. Nobody worried about the price today or tomorrow.

But in today’s gold market, the price is set not by the buyer of the physical commodity – the price is set by large pools of money, controlled by traders and fund managers. But they are all very, very short-term oriented. It is today’s price, this hour’s price, and this minute’s price that concerns them.

Read more @ MilesFranklin.com

The conflict stems from a clash between short-term market moves and long-term fundamentals. The price of gold should not trade all over the map. For around 80 years it stayed stable at $20 an ounce. Then it locked in at $35 an ounce for another near 40 years. Nobody worried about the price today or tomorrow.

But in today’s gold market, the price is set not by the buyer of the physical commodity – the price is set by large pools of money, controlled by traders and fund managers. But they are all very, very short-term oriented. It is today’s price, this hour’s price, and this minute’s price that concerns them.

Read more @ MilesFranklin.com

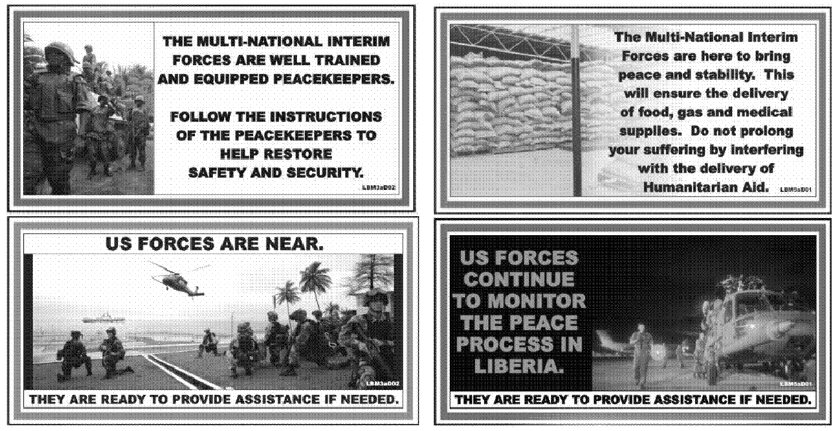

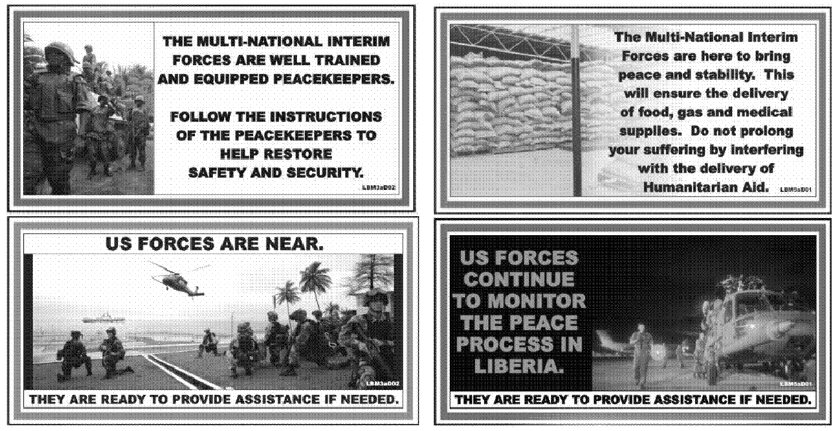

from Public Intelligence:

Psychological operations (PSYOP) have long been used by militaries

around the world to coerce populations into acting in a manner favorable

to their mission objective. The product of these operations, which is

commonly called propaganda when distributed by enemy forces, is a

mixture of complex social research, art direction and psychological

theory designed to manipulate its unsuspecting recipient into modifying

their behavior in a way favorable to those conducting the PSYOP. The

message conveyed through a PSYOP can often stray into deeply emotional

and personal territory that is intended to trigger a profound

psychological response. For example, U.S. and British troops fighting

in Italy and France during World War II were subjected to a barrage of leaflets

distributed by German forces describing the futility of their mission,

encouraging them to take the “POW life insurance policy” and instructing

them that their girlfriends back home were being taken advantage of by

Jewish businessmen. The methodology behind these persuasive

psychological tactics is described in detail in U.S. Army FM 3-05.301 Psychological Operations Process Tactics, Techniques, and Procedures, which provides fascinating insight into the methods used by PSYOP soldiers to modify the behavior of targeted populations.

Psychological operations (PSYOP) have long been used by militaries

around the world to coerce populations into acting in a manner favorable

to their mission objective. The product of these operations, which is

commonly called propaganda when distributed by enemy forces, is a

mixture of complex social research, art direction and psychological

theory designed to manipulate its unsuspecting recipient into modifying

their behavior in a way favorable to those conducting the PSYOP. The

message conveyed through a PSYOP can often stray into deeply emotional

and personal territory that is intended to trigger a profound

psychological response. For example, U.S. and British troops fighting

in Italy and France during World War II were subjected to a barrage of leaflets

distributed by German forces describing the futility of their mission,

encouraging them to take the “POW life insurance policy” and instructing

them that their girlfriends back home were being taken advantage of by

Jewish businessmen. The methodology behind these persuasive

psychological tactics is described in detail in U.S. Army FM 3-05.301 Psychological Operations Process Tactics, Techniques, and Procedures, which provides fascinating insight into the methods used by PSYOP soldiers to modify the behavior of targeted populations.

Read More @ PublicIntelligence.net

Psychological operations (PSYOP) have long been used by militaries

around the world to coerce populations into acting in a manner favorable

to their mission objective. The product of these operations, which is

commonly called propaganda when distributed by enemy forces, is a

mixture of complex social research, art direction and psychological

theory designed to manipulate its unsuspecting recipient into modifying

their behavior in a way favorable to those conducting the PSYOP. The

message conveyed through a PSYOP can often stray into deeply emotional

and personal territory that is intended to trigger a profound

psychological response. For example, U.S. and British troops fighting

in Italy and France during World War II were subjected to a barrage of leaflets

distributed by German forces describing the futility of their mission,

encouraging them to take the “POW life insurance policy” and instructing

them that their girlfriends back home were being taken advantage of by

Jewish businessmen. The methodology behind these persuasive

psychological tactics is described in detail in U.S. Army FM 3-05.301 Psychological Operations Process Tactics, Techniques, and Procedures, which provides fascinating insight into the methods used by PSYOP soldiers to modify the behavior of targeted populations.

Psychological operations (PSYOP) have long been used by militaries

around the world to coerce populations into acting in a manner favorable

to their mission objective. The product of these operations, which is

commonly called propaganda when distributed by enemy forces, is a

mixture of complex social research, art direction and psychological

theory designed to manipulate its unsuspecting recipient into modifying

their behavior in a way favorable to those conducting the PSYOP. The

message conveyed through a PSYOP can often stray into deeply emotional

and personal territory that is intended to trigger a profound

psychological response. For example, U.S. and British troops fighting

in Italy and France during World War II were subjected to a barrage of leaflets

distributed by German forces describing the futility of their mission,

encouraging them to take the “POW life insurance policy” and instructing

them that their girlfriends back home were being taken advantage of by

Jewish businessmen. The methodology behind these persuasive

psychological tactics is described in detail in U.S. Army FM 3-05.301 Psychological Operations Process Tactics, Techniques, and Procedures, which provides fascinating insight into the methods used by PSYOP soldiers to modify the behavior of targeted populations.Read More @ PublicIntelligence.net

I'm PayPal Verified

No comments:

Post a Comment