Submitted by Tyler Durden on 01/31/2015 - 11:58 Amid 'turmoiling' stock markets on Friday, CNBC's Simon Hobbs summed up the status quo's thinking on the new Greek leadership when he noted, somewhat angrily and shocked, "The Greeks are not even trying to reassure the markets," seeming to have entirely forgotten (and who can blame him in this new normal the world has been force-fed for 6 years) that political leaders are elected for the good of the people (by the people) not for the markets. Yesterday saw the clearest example yet of Europe's anger that the Greeks may choose their own path as opposed to following the EU's non-sovereign leadership's demands when the most uncomfortable moment ever caught on tape - the moment when Eurogroup chief Jeroen Dijsselbloem (he of the "template" foot in mouth disease) stood up at the end of the EU-Greece press conference, awkwardly shook hands with Greece's new finance minister, and whispered..."you have just killed the Troika," to which Varoufakis responded... "wow!"

ECB Threatens Athens With Bank Funding Cutoff If No Deal In One Month: February 28 Is Now D-Day For Greece

Submitted by Tyler Durden on 01/31/2015 - 17:40 Earlier today the ECB's Erikki Liikanen, tired of pleasantries and dealing with what to Europe is a completely incomprehensible and illogical stance, one which is essentially a massive defection by Greece in the European "prisoner's dilemma", and which while leading to a Greek financial collapse and Grexit - both prerequisites to a subsequent Greek economic recovery unburdened by the shackles of the Euro - would also unleash a European depression, came out and directly threatened Greece that it now has 1 month until the end of February to reach a deal with the Troika, or else the ECB would cut off lending to Greek banks, in the process destroying the otherwise insolvent Greek banking sector.

Market Calls Fed's Bluff - Desperation Becomes Palpable

Submitted by Tyler Durden on 01/31/2015 - 14:17 Funding Markets just called The FOMC's bluff. Policymakers are acting out rational expectations theory or at least how they see it. In other words, their job is not to analyze actual economic conditions, but to condition economic thought toward the end goal. If they convince you that they believe the economy is on track they further believe you will act accordingly (“you” being both investor and economic agent). The more the economy diverges from the “preferred” projection, the more emphatic the cries of “recovery” become. At some point, desperation becomes palpable.

16% Of Global Government Bonds Now Have A Negative Yield: Here Is Who's Buying It

Submitted by Tyler Durden on 01/31/2015 - 20:04 What happens if one expands the Eurozone NIRP universe to include the debt of other countries including Japan, Denmark, Sweden, Switzerland and so on? Conveniently, JPM has done the analysis and finds that a mindblowing $3.6 trillion of government debt traded with a negative yield as recently as last week. This represents 16% of the JPM Global Government Bond Index, or in other words nearly a fifth of all global government debt is now trading with a negative yield, meaning investors pay sovereigns, using other people's money of course, for the privilege of buying their issuance!

"King Dollar" Is Crushing 'Recovery'Dreams, 87% Of US Companies Have Guided Lower

Submitted by Tyler Durden on 01/31/2015 - 19:30 The 'souring' of the mother's milk of stock markets continues. Management guidance and commentary implies 3-5pp impact due to 'king dollar' FX headwinds as an astounding 87% of companies guided below consensus expectations for next quarter. Bottom-up consensus 2015 EPS estimates were cut by 4% during January, and, as Goldman Sachs warns, 4Q EPS is tracking 7% below the consensus estimate at the start of reporting season. Finally, and perhaps most worrisome, granular bottom-up consensus is below top-down 'strategist' consensus for the first time since 2009... as the gap between Forward P/E valuations and long-term growth is as wide as it has ever been.

The AAPL Effect: Q4 Earnings Growth Without Apple: 0%; With Apple: 2.1%

Submitted by Tyler Durden on 01/31/2015 - 18:29 Yesterday we commented on the outsized macro impact that one company already excerts on the world, when we reported that in the fourth quarter, a whopping 60% of retail sales growth was due to the launch of Apple's iPhone 6 in the fall of 2014, and the surge of Chinese tourists who tok advantage of Hong Kong's lower prices and earlier release. So how about the micro level? For the answer we present the chart below. Behold: the AAPL effect, which demonstrates that what until AAPL's release was shaping up to be a flat Q4 earnings season for the S&P 500, has since transformed into Q4 EPS growth of 2.1%, and made Apple the largest contributor to earnings growth for the S&P 500 at the company level for the fourth quarter. All this, thanks to just one company!Just in case you missed it...

What Do They Know? Why Are So Many Of The Super Wealthy Preparing Bug Out Locations?

Submitted by Tyler Durden on 01/31/2015 - 20:15 A lot of ultra-rich people are quietly preparing to “bug out” when the time comes. They are buying survival properties, they are buying farms in far away countries and they are buying deep underground bunkers. In fact, a prominent insider at the World Economic Forum in Davos, Switzerland says that “very powerful people are telling us they’re scared." So what do they know?

The Official White House Terrorist Identification Chart

Submitted by Tyler Durden on 01/31/2015 - 16:30 Presented with no comment...

We Ignore Unintended Consequences At Our Peril

Submitted by Tyler Durden on 01/31/2015 - 15:45 The grand central banking experiment being conducted around the globe right now will not end well. With little more than a lever to ham-fistedly move interest rates, the central planners are trying to keep the world's debt-addiction well-fed while simultaneously kick-starting economic growth and managing the price levels of everything from stocks to housing to fine art. The complexity of the system, the questionable credentials of the decision-makers, and the universe's proclivity towards unintended consequences all combine to give great confidence that things will not play out in the way the Fed and its brethren are counting on.

Greek Social Contagion: Tens Of Thousands Rally In Support Of Spain's Anti-Austerity Podemos Party

Submitted by Tyler Durden on 01/31/2015 - 15:00 Less than a week ago we warned, "today Athens, tomorrow Madrid," and sure enough, emboldened by the success of Syriza in Greece, the people of Spain have turned out in their tens of thousands in Madrid at a demonstration called by the insurgent Spanish leftist party Podemos. As The Independent reports, Podemos, which means "we can", has surged into first place in opinion polls in the few months since it was set up in the summer of 2014. It is now ahead of the centre-right Popular Party and centre-left Spanish Socialist Workers’ Party in many opinion polls. Podemos’s policies include a universal basic income, increased democracy, crackdowns on tax avoidance, and increased public control over the economy. Most worrying for the status-quo huggers in Brussels, Podemos has also wants to reform the European Union, describing the current euro arrangement as a "trap."

Did The Federal Reserve Make A Major Math Error When Reporting Its December Gold Withdrawals?

Submitted by Tyler Durden on 01/31/2015 - 13:28 According to the NY Fed, 177 tons of gold have been withdawn from its vault in 2014; according to foreign central banks, at least 207 tons of gold were withdrawn from the NY Fed in 2014.Did a Fed intern make a very glaring math error or is something else going on?

The Future of Medicine? Forget Private Doctor Appointments, Group Medical Visits are Coming

Submitted by Tyler Durden on 01/31/2015 - 12:44 "According to the American Academy of Family Physicians, around 10 percent of family doctors already offer shared medical appointments, sessions that bring together a dozen or more patients with similar medical conditions to meet with a doctor for 90 minutes. With pressure from the government and insurers to bring down the cost of care while treating the increasing number of people with health insurance, patients can expect group visits to become more common. “It’s efficient. It’s economical.""from The Richie Allen Show, via The Victory Report:

from KingWorldNews:

Eric King: “Andrew, I know you have some big news about a new physical market that is coming into being. Can you talk about that?”

Eric King: “Andrew, I know you have some big news about a new physical market that is coming into being. Can you talk about that?”

Andrew Maguire: “Eric, in the next two weeks you are going to hear a lot of noise as a fully-functioning, 23-hour a day global physical exchange is made mainstream….

“This is going to act as a conduit for this much needed liquidity. The trading platform is directly connected to a totally independent, fully allocated exchange — completely bypassing the LBMA

Andrew Maguire Audio Interview @ KingWorldNews.com

/  Eric King: “Andrew, I know you have some big news about a new physical market that is coming into being. Can you talk about that?”

Eric King: “Andrew, I know you have some big news about a new physical market that is coming into being. Can you talk about that?”Andrew Maguire: “Eric, in the next two weeks you are going to hear a lot of noise as a fully-functioning, 23-hour a day global physical exchange is made mainstream….

“This is going to act as a conduit for this much needed liquidity. The trading platform is directly connected to a totally independent, fully allocated exchange — completely bypassing the LBMA

Andrew Maguire Audio Interview @ KingWorldNews.com

A member of my staff caught an obscure resolution that was introduced in the US House of Representatives last week—

A member of my staff caught an obscure resolution that was introduced in the US House of Representatives last week—

The signs of the times are everywhere – all you have to do is open up

your eyes and look at them. When a pregnant woman first goes into

labor, the birth pangs are usually fairly moderate and are not that

close together. But as the time for delivery approaches, they become

much more frequent and much more intense. Economically, what we are

experiencing right now are birth pangs of the coming Great Depression.

As we get closer to the crisis that is looming on the horizon, they will

become even more powerful. This week, we learned that the Baltic Dry

Index has fallen to the lowest level that we have seen

The signs of the times are everywhere – all you have to do is open up

your eyes and look at them. When a pregnant woman first goes into

labor, the birth pangs are usually fairly moderate and are not that

close together. But as the time for delivery approaches, they become

much more frequent and much more intense. Economically, what we are

experiencing right now are birth pangs of the coming Great Depression.

As we get closer to the crisis that is looming on the horizon, they will

become even more powerful. This week, we learned that the Baltic Dry

Index has fallen to the lowest level that we have seen  Gold

has performed very well under the circumstances of declining inflation

and a surging US$ index. Since 2014 the US$ index is up nearly 18% while

Gold is up 3%. Since Gold’s November low the US$ index is up over 10%.

Had we known that at the time, we’d have thought Gold would be headed

for $1000 and not the $1300 it recently hit. At present, the US$ index

appears ripe for a correction or major pause in its uptrend. Given that

Gold is priced in US$ and that Gold has shown strength in real terms,

sustained US$ weakness could be a major boon for Gold and precious

metals as a whole.

Gold

has performed very well under the circumstances of declining inflation

and a surging US$ index. Since 2014 the US$ index is up nearly 18% while

Gold is up 3%. Since Gold’s November low the US$ index is up over 10%.

Had we known that at the time, we’d have thought Gold would be headed

for $1000 and not the $1300 it recently hit. At present, the US$ index

appears ripe for a correction or major pause in its uptrend. Given that

Gold is priced in US$ and that Gold has shown strength in real terms,

sustained US$ weakness could be a major boon for Gold and precious

metals as a whole. The

recent decisions by social media giants Facebook and LinkedIn to adopt

user crowd-censoring strategies may be less than benevolent.

The

recent decisions by social media giants Facebook and LinkedIn to adopt

user crowd-censoring strategies may be less than benevolent.  The latest update of the annual study by GFMS of world gold supply and

demand makes for some interesting reading, and correspondingly

interesting interpretations of the figures by the media. Mineweb has

reported one such analysis suggesting that India has re-overtaken China

as the World No. 1 gold consumer and some figures published within the

report suggest that this may be the case – but this may well depend on

what the interpretation of consumption actually is. The GFMS report

suggests that Indian jewellery fabrication at 690 tonnes overtook that

of China during the year, but appears to make no such bald statement

that total Chinese demand fell back below that of India, although there

are figures within the report which suggest this could be the case.

The latest update of the annual study by GFMS of world gold supply and

demand makes for some interesting reading, and correspondingly

interesting interpretations of the figures by the media. Mineweb has

reported one such analysis suggesting that India has re-overtaken China

as the World No. 1 gold consumer and some figures published within the

report suggest that this may be the case – but this may well depend on

what the interpretation of consumption actually is. The GFMS report

suggests that Indian jewellery fabrication at 690 tonnes overtook that

of China during the year, but appears to make no such bald statement

that total Chinese demand fell back below that of India, although there

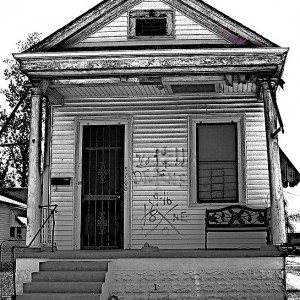

are figures within the report which suggest this could be the case. We are the generation that gets to witness the end of the American

Dream. The numbers that you are about to see tell a story. They tell a

story of a once mighty economy that is dying. For decades, the rest of

the planet has regarded the United States as “the land of opportunity”

where almost anyone can be successful if they are willing to work hard.

And when I was growing up, it seemed like almost everyone was living

the American Dream. I lived on a “middle class” street and I went to a

school where it seemed like almost everyone was middle class. When I

was in high school, it was very rare to ever hear of a parent that was

unemployed, and virtually every family that I knew had a comfortable

home and more than one nice vehicle. But now that has all changed. The

“American Dream” has been transformed into a very twisted game of

musical chairs. With each passing year, more people are falling out of

the middle class, and most of the rest of us are scrambling really hard

to keep our own places. Something has gone horribly wrong, and yet

Americans are very deeply divided when it comes to finding answers to

our problems. We love to point fingers and argue with one another, and

meanwhile things just continue to get even worse. The following are 22

numbers that are very strong evidence of the death of the American

Dream…

We are the generation that gets to witness the end of the American

Dream. The numbers that you are about to see tell a story. They tell a

story of a once mighty economy that is dying. For decades, the rest of

the planet has regarded the United States as “the land of opportunity”

where almost anyone can be successful if they are willing to work hard.

And when I was growing up, it seemed like almost everyone was living

the American Dream. I lived on a “middle class” street and I went to a

school where it seemed like almost everyone was middle class. When I

was in high school, it was very rare to ever hear of a parent that was

unemployed, and virtually every family that I knew had a comfortable

home and more than one nice vehicle. But now that has all changed. The

“American Dream” has been transformed into a very twisted game of

musical chairs. With each passing year, more people are falling out of

the middle class, and most of the rest of us are scrambling really hard

to keep our own places. Something has gone horribly wrong, and yet

Americans are very deeply divided when it comes to finding answers to

our problems. We love to point fingers and argue with one another, and

meanwhile things just continue to get even worse. The following are 22

numbers that are very strong evidence of the death of the American

Dream… Independent

DNA lab testing has verified that 100% of the corn in Kellogg’s Froot

Loops is genetically modified corn, containing DNA sequences known to be

present in insecticide producing Bt and Roundup Ready corn.

The soy also contained DNA sequences known to be present in Roundup

Ready GMO soy. What’s more, tests documented the presence of glyphosate

at 0.12 mg/kg, the main chemical ingredient of Monsanto’s best-selling

Roundup weedkiller.

Independent

DNA lab testing has verified that 100% of the corn in Kellogg’s Froot

Loops is genetically modified corn, containing DNA sequences known to be

present in insecticide producing Bt and Roundup Ready corn.

The soy also contained DNA sequences known to be present in Roundup

Ready GMO soy. What’s more, tests documented the presence of glyphosate

at 0.12 mg/kg, the main chemical ingredient of Monsanto’s best-selling

Roundup weedkiller.

A lot of ultra-rich people are quietly preparing to “bug out” when the

time comes. They are buying survival properties, they are buying farms

in far away countries and they are buying deep underground bunkers. In

fact, a prominent insider at the World Economic Forum in Davos,

Switzerland says that “very powerful people are telling us they’re

scared” and he shocked his audience when he revealed that he knows

“hedge fund managers all over the world who are buying airstrips and

farms in places like New Zealand”. So what do they know? Why are so

many of the super wealthy suddenly preparing bug out locations? When

the elite of the world start preparing for doomsday, that is a very

troubling sign. And right now the elite appear to be quietly preparing

for disaster like never before.

A lot of ultra-rich people are quietly preparing to “bug out” when the

time comes. They are buying survival properties, they are buying farms

in far away countries and they are buying deep underground bunkers. In

fact, a prominent insider at the World Economic Forum in Davos,

Switzerland says that “very powerful people are telling us they’re

scared” and he shocked his audience when he revealed that he knows

“hedge fund managers all over the world who are buying airstrips and

farms in places like New Zealand”. So what do they know? Why are so

many of the super wealthy suddenly preparing bug out locations? When

the elite of the world start preparing for doomsday, that is a very

troubling sign. And right now the elite appear to be quietly preparing

for disaster like never before. There is growing unease in stock and bond markets around the world that

the current Chair of the U.S. Federal Reserve, Janet Yellen, has

retrieved former Fed Chair Alan Greenspan’s blinders out of the

mothballs in some musty old closet at the Fed, thus setting the U.S.

economy up for more epic convulsions.

There is growing unease in stock and bond markets around the world that

the current Chair of the U.S. Federal Reserve, Janet Yellen, has

retrieved former Fed Chair Alan Greenspan’s blinders out of the

mothballs in some musty old closet at the Fed, thus setting the U.S.

economy up for more epic convulsions. We will find out the answer to the question posed in the title in the

outcome of the contest between the new Greek government, formed by the

political party Syriza, and the ECB and the private banks, with whose

interests the EU and Washington align against Greece. The Spartans,

whose red cloaks and military prowess struck fear into the hearts of

both foreign invaders and Greek opponents in the city-states, are no

more. Athens itself is a ruin of its historical self. The Greeks, who

were once to be contended with, who were able with 300 Spartans,

supplemented with a few thousand Corinthians, Thebans, and other

warriors, to stop a one hundred thousand man Persian army at

Thermopylae, with the final outcome being the defeat of the Persian

fleet in the Battle of Salamis and the defeat of the Persian army in the

Battle of Plataea, are no more.

We will find out the answer to the question posed in the title in the

outcome of the contest between the new Greek government, formed by the

political party Syriza, and the ECB and the private banks, with whose

interests the EU and Washington align against Greece. The Spartans,

whose red cloaks and military prowess struck fear into the hearts of

both foreign invaders and Greek opponents in the city-states, are no

more. Athens itself is a ruin of its historical self. The Greeks, who

were once to be contended with, who were able with 300 Spartans,

supplemented with a few thousand Corinthians, Thebans, and other

warriors, to stop a one hundred thousand man Persian army at

Thermopylae, with the final outcome being the defeat of the Persian

fleet in the Battle of Salamis and the defeat of the Persian army in the

Battle of Plataea, are no more.  Can the dollar and gold continue to rise in tandem for long? The last

three months have seen a very peculiar dollar/gold anomaly. Since mid

November, gold (and silver) have “acted” very differently. We have seen

“outside days” and even an outside week. Gold has moved nearly $160 of

its lows for a rise of nearly 15%. This has happened while the dollar

has rallied furiously versus foreign currencies (with the exception of

the franc). From a “textbook” sense, this should never happen.

Actually, I am sure there are professors out there who would have argued

“it cannot happen” …but it has. Both the dollar and gold have rallied

at the same time, so far gold outpacing the dollar. But why? Why has

the tone for gold changed and why is it not “falling” versus a rising

dollar?

Can the dollar and gold continue to rise in tandem for long? The last

three months have seen a very peculiar dollar/gold anomaly. Since mid

November, gold (and silver) have “acted” very differently. We have seen

“outside days” and even an outside week. Gold has moved nearly $160 of

its lows for a rise of nearly 15%. This has happened while the dollar

has rallied furiously versus foreign currencies (with the exception of

the franc). From a “textbook” sense, this should never happen.

Actually, I am sure there are professors out there who would have argued

“it cannot happen” …but it has. Both the dollar and gold have rallied

at the same time, so far gold outpacing the dollar. But why? Why has

the tone for gold changed and why is it not “falling” versus a rising

dollar? Our words, voice, and opinions are our birth right and are protected.

Free speech is not a luxury and it is certainly not handed down to us

from a government. In Australia, and

Our words, voice, and opinions are our birth right and are protected.

Free speech is not a luxury and it is certainly not handed down to us

from a government. In Australia, and  Now we finally come to the real agenda of the vaccine industry. After vaccines have been repeatedly

Now we finally come to the real agenda of the vaccine industry. After vaccines have been repeatedly  A critical, often forgotten event (especially by the French) occurred

on June 22, 1940. That was the day the French surrendered to the Nazis

and signed the armistice. Four days later, the Soviet Union made a

decision that ended up becoming one of the critical turning points of WW

II.

A critical, often forgotten event (especially by the French) occurred

on June 22, 1940. That was the day the French surrendered to the Nazis

and signed the armistice. Four days later, the Soviet Union made a

decision that ended up becoming one of the critical turning points of WW

II. Today, we’re going to tell you why America’s middle class is getting

poorer. Or put another way, we’re going to show you how capitalism dies.

Today, we’re going to tell you why America’s middle class is getting

poorer. Or put another way, we’re going to show you how capitalism dies.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)