Don’t Let Machines Control Your Emotions

by Jim Sinclair, JS Mineset:

Gold will trade at $3500 and beyond. The US dollar will test USDX .7200 before heading lower.

Gold will trade at $3500 and beyond. The US dollar will test USDX .7200 before heading lower.

Whatever is required, be it time or money, the Euro nations will get. The Fed will, via swaps, backstop the euro. QE will go to infinity both here and there.

The Chinese have publicly said when the gold market takes a hit they will be buying.

Calm down. Emotions are being run by machines, HFT and nerds who hide behind their computer. They will not win.

All hell is going to break lose, and its name is Currency Induced Cost Push Inflation...

fiscal cliff, Bush tax cuts

Read More @ JS Mineset

by Jim Sinclair, JS Mineset:

Gold will trade at $3500 and beyond. The US dollar will test USDX .7200 before heading lower.

Gold will trade at $3500 and beyond. The US dollar will test USDX .7200 before heading lower.Whatever is required, be it time or money, the Euro nations will get. The Fed will, via swaps, backstop the euro. QE will go to infinity both here and there.

The Chinese have publicly said when the gold market takes a hit they will be buying.

Calm down. Emotions are being run by machines, HFT and nerds who hide behind their computer. They will not win.

All hell is going to break lose, and its name is Currency Induced Cost Push Inflation...

fiscal cliff, Bush tax cuts

Read More @ JS Mineset

150 Seconds Of "You Can't Handle The European Truth" From Kyle Bass

"A popular revolt will happen" is how Kyle Bass sums up the endgame from kicking the can in Europe. Dismissing the headline-making 'But, Blackrock is buying European bonds', Bass reminds Bloomberg's Stephanie Ruhle that very few ever get the crises correct and that the herd will keep buying things until it blows apart. With massively over-leveraged banks and a Greek dependency, Bass notes that investing in Europe now is like picking up a dime in front of a bulldozer and expects Germany will eventualy leave the Euro (within 3-4 years) as the 'joint-and-several' liabilities will never happen. 150 well-spent seconds to summarise just what is going in Europe, as he concludes with Milton Friedman's quote on Europe: "when they hit a bump in the road, it will tear them apart at the core."

2 Dead, 2 Missing As Another Oil Platform Burning In Gulf Of Mexico

Mere hours after BP settles, the US Coast Guard confirms there is an offshore (shallow water) platform burning in the Gulf of Mexico in the area of West Delta Block 32 (near West Cote Blanche Bay). Local TV says that two people are dead and two people are missing after an explosion at the platform. More to come...- UPDATE:Gulf rig fire was result of rig explosion at oil/gas platform "West Delta 32"owned by Black Elk Oil, ac. to Coast Guard

Your support is needed...

Thank You

I'm PayPal Verified Anonymous Hacks Greek Finance Ministry, Finds "123456" Is Password For 37% Of All User Accounts

While

we have yet to go through the thousands of files that hacker

collective Anonymous has just released as a result of its hack of the

Greek Finance Ministry, an exploit it described as follows: "We gained

full access to the Greek Ministry of Finance. Those funky IBM servers

don't look so safe now, do they... We have new guns in our arsenal. A

sweet 0day SAP exploit is in our hands and oh boy we're gonna sploit the

hell out of it. Respectz to izl the dog for that perl candy," what we

find even more amusing, if not surprising, is that of the 136 username

accounts Anonymous hacked, the password of precisely 50 of them, or

some 37% of all workers, is .... 123456 (full list here).

While

we have yet to go through the thousands of files that hacker

collective Anonymous has just released as a result of its hack of the

Greek Finance Ministry, an exploit it described as follows: "We gained

full access to the Greek Ministry of Finance. Those funky IBM servers

don't look so safe now, do they... We have new guns in our arsenal. A

sweet 0day SAP exploit is in our hands and oh boy we're gonna sploit the

hell out of it. Respectz to izl the dog for that perl candy," what we

find even more amusing, if not surprising, is that of the 136 username

accounts Anonymous hacked, the password of precisely 50 of them, or

some 37% of all workers, is .... 123456 (full list here).BTFD...(buy the F--king dips)...Keep Stacking...

Gold & Silver Plunge Deja Deja Deja Vu

Whether

it is leveraged AAPL traders forced to sell winning collateral to meet

margin calls, correlation-driven algos running stops down and up, or

simply the whims of worried custodians managing risk for their clients'

holdings; one thing is sure - someone (or more than one) has

been a size seller of precious metals in the US-day-session-open to

Europe-close period for four days in a row now...

Whether

it is leveraged AAPL traders forced to sell winning collateral to meet

margin calls, correlation-driven algos running stops down and up, or

simply the whims of worried custodians managing risk for their clients'

holdings; one thing is sure - someone (or more than one) has

been a size seller of precious metals in the US-day-session-open to

Europe-close period for four days in a row now...Every Time You See This...BTFD...

by SGT,

Let’s take moment to admire the free and fair trade of the precious metals, unencumbered by paper manipulation! This is what a free market is all about. I’m so glad we live in a country that respects the rule of law. America is home to the shining jewel of financial markets which are the envy of the world. Stand proud Americans! It’s an honor to know that we are home to Wall Street and some of the largest banking houses on planet earth. And we are so fortunate to have the SEC and the CFTC to help safeguard these wonderful markets, always standing vigilant and ensuring that if ever there is any malfeasance in the market, it will swiftly be sought out and corrected, and those responsible, brought to justice. May God continue to bless the greatest country in the world. These United States of America.

Meanwhile In Argentina...

Dear Buenos Aires: we have three words of advice - "hide yo' catamarans" (before Paul Singer comes and collects them all once you default again in what the market now deems is inevitable to occur in the next few weeks). 5Y CDS on Argentina just reverse-Baumgartnered to over 3000bps (49/53% upfront) and short-dated CDS imply a 60% probability of default (assuming a 25% recovery).

Here Is Why The ECB Should Be Freaking Out

Given the deterioration left, right, and center in Europe's core and peripheral economies, some question the sustained 'strength' of EURUSD.

An under-the-table peg around 1.27 is the conspiracy chatter but we

fall back to a tried-and-true recipe for comprehending what the market

is thinking - the central banks are in charge and the EURUSD exchange rate merely reflects (as a main trend) the relationship between those two balance sheets

(as monetary policy escalates downwards and they battle each other to

'defend' their own currencies' demise). To wit, given the current ratio

of the Fed and ECB balance sheets, we would expect EURUSD to be

trading around 1.21. The current EURUSD rate implies a balance-sheet

ratio of 1.08x - which therefore means the market expects the ECB to expand its balance sheet by EUR740bn; this just happens to be the sum-total of Spanish sovereign debt (according to Bloomberg - while our estimate is considerably higher). So it seems, the market knows that once the ECB starts, it will not be able to stop

and will end up taking the entire Spanish debt load onto its books.

Spain can perhaps deal with its existing debt in this way - but this

appears to us merely incremental sustainability - and like

in the US where the Fed is monetizing all long-dated Gross issuance,

so the ECB will have no choice but to do the same with Spain in 2013

and 2014 - Treaty or no Treaty!!.

Given the deterioration left, right, and center in Europe's core and peripheral economies, some question the sustained 'strength' of EURUSD.

An under-the-table peg around 1.27 is the conspiracy chatter but we

fall back to a tried-and-true recipe for comprehending what the market

is thinking - the central banks are in charge and the EURUSD exchange rate merely reflects (as a main trend) the relationship between those two balance sheets

(as monetary policy escalates downwards and they battle each other to

'defend' their own currencies' demise). To wit, given the current ratio

of the Fed and ECB balance sheets, we would expect EURUSD to be

trading around 1.21. The current EURUSD rate implies a balance-sheet

ratio of 1.08x - which therefore means the market expects the ECB to expand its balance sheet by EUR740bn; this just happens to be the sum-total of Spanish sovereign debt (according to Bloomberg - while our estimate is considerably higher). So it seems, the market knows that once the ECB starts, it will not be able to stop

and will end up taking the entire Spanish debt load onto its books.

Spain can perhaps deal with its existing debt in this way - but this

appears to us merely incremental sustainability - and like

in the US where the Fed is monetizing all long-dated Gross issuance,

so the ECB will have no choice but to do the same with Spain in 2013

and 2014 - Treaty or no Treaty!!.Quote of the Day

Trader Dan at Trader Dan's Market Views - 10 minutes ago

"Society in every state is a blessing, but government, even in its best

state, is but a necessary evil; in its worst state an intolerable one."

--Thomas Paine

Rancher/Farmers - Further Casualities in the War Being Waged by the Left

Trader Dan at Trader Dan's Market Views - 11 minutes ago

Take a good, hard look at the following article and note particularly way

down in the 10th paragraph:

Many Democrats argue the tax promotes equality among classes,

Read more:

http://www.foxnews.com/politics/2012/11/16/ranchers-farmers-brace-for-death-tax-impact/#ixzz2CP5PO11S

If you will recall that article I wrote last week after the election, I

mentioned that the left in this country takes as its motto the rallying cry

of the French Revolution, "Liberty, EQUALITY, Fraternity".

They will not rest until they have reduced every citizen in this nation to

the same level of misery and ... more »

Dealing With Complexity In A Non-linear World

Eric De Groot at Eric De Groot - 1 hour ago

I realize that understanding can by crushed by weight of complexity, but I

know few processes adequately defined by linear reasoning (insert tab A

into slot A). Investors and traders even those that follow Jim's approach

as a creator of production and true wealth are challenged daily by the

complexities of a non-linear world. Insights.com was created to show the

door of possibilities in...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

Don`t Fight Change

Admin at Jim Rogers Blog - 1 hour ago

"People who fight change are fighting inevitability itself." - *in The

Ultimate Road Trip*

*Jim Rogers is an author, financial commentator and successful

international investor. He has been frequently featured in Time, The New

York Times, Barron’s, Forbes, Fortune, The Wall Street Journal, The

Financial Times and is a regular guest on Bloomberg and CNBC.*

Bullish On Southeast Asia

Admin at Marc Faber Blog - 2 hours ago

In this "Squawk Box" excerpt, Marc Faber of the Gloom, Boom & Doom Report,

says there is one area of the world that he is optimistic about.

*

**Marc Faber is an international investor known for his uncanny predictions

of the stock market and futures markets around the world.*

Retirement 'Perfect Storm' Coming in 2013

Eric De Groot at Eric De Groot - 3 hours ago

Anyone building a short list of the most over-hyped economic buzz words of

2012, might want to consider adding: Fiscal Cliff Balanced Approach Perfect

Storm George Clooney's agent has to smelling a sequel with so many perfect

storms on the horizon. Headline: Retirement 'Perfect Storm' Coming in 2013

An estimated 7 million Americans will reach the age of 65 by the start of...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]The Hostess Liquidation: A Curious Cast Of Characters As The Twinkie Tumbles

Perhaps

one of the most interesting aspects of the just announced Hostess

liquidation, one that will be largely debated and discussed in the

media, or maybe not at all, is the curious cast of characters and the

peculiar history of this particular bankruptcy. Some may not be aware

that the company's Chapter 11 (or colloquially known as 22) bankruptcy

filing this January, which today became a Chapter 7 liquidation, was

the second one in the company's recent history, with Hostess,

previously Interstate Bakeries, emerging from its previous protracted

multi-year bankruptcy in 2009. What is curious is that its emergence

had all the drama of a anti-Mitt Romney PAC funded thriller, with a PE

firm, in this case Ripplewood holdings, injecting $130 million in order

to obtain equity control of Hostess as it was emerging last time.

There were also more hedge funds, investment banks, strategic buyers,

politicians involved in this particular story than one can shake a deep

fried numismatic value Twinkie at. More importantly, however, as

America has been habituated following the last season of the reality TV

show known as the presidential election, if Private Equity then "bad." Only

this time there is a twist: because it wasn't really PE that was the

pure evil in the Obama long-term campaign, it was associating PE with

Republicans, and thus: with jobs outsourcing. And here comes the Hostess

twist: because Tim Collins of Ripplewood, was a prominent Democrat, a

position which allowed him to get involved in the first bankruptcy

process in the first place, due to his proximity with the Teamsters'

long-term heartthrob Dick Gephardt (whose consulting group just happens

to also be an equity owner of Hostess). In other words, the traditional

republican-cum-PE scapegoating strategy here will be a tough

one to pull off since the narrative collapses when considering that it

was a Democrat who rescued the firm, only to see it implode in a

trainwreck that has resulted in the liquidation of a legendary brand,

and 18,500 layoffs.

Perhaps

one of the most interesting aspects of the just announced Hostess

liquidation, one that will be largely debated and discussed in the

media, or maybe not at all, is the curious cast of characters and the

peculiar history of this particular bankruptcy. Some may not be aware

that the company's Chapter 11 (or colloquially known as 22) bankruptcy

filing this January, which today became a Chapter 7 liquidation, was

the second one in the company's recent history, with Hostess,

previously Interstate Bakeries, emerging from its previous protracted

multi-year bankruptcy in 2009. What is curious is that its emergence

had all the drama of a anti-Mitt Romney PAC funded thriller, with a PE

firm, in this case Ripplewood holdings, injecting $130 million in order

to obtain equity control of Hostess as it was emerging last time.

There were also more hedge funds, investment banks, strategic buyers,

politicians involved in this particular story than one can shake a deep

fried numismatic value Twinkie at. More importantly, however, as

America has been habituated following the last season of the reality TV

show known as the presidential election, if Private Equity then "bad." Only

this time there is a twist: because it wasn't really PE that was the

pure evil in the Obama long-term campaign, it was associating PE with

Republicans, and thus: with jobs outsourcing. And here comes the Hostess

twist: because Tim Collins of Ripplewood, was a prominent Democrat, a

position which allowed him to get involved in the first bankruptcy

process in the first place, due to his proximity with the Teamsters'

long-term heartthrob Dick Gephardt (whose consulting group just happens

to also be an equity owner of Hostess). In other words, the traditional

republican-cum-PE scapegoating strategy here will be a tough

one to pull off since the narrative collapses when considering that it

was a Democrat who rescued the firm, only to see it implode in a

trainwreck that has resulted in the liquidation of a legendary brand,

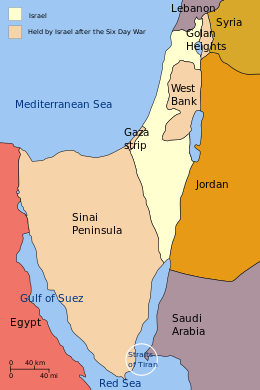

and 18,500 layoffs.Hamas Escalates - Air Raid Sirens Over Jerusalem

Markets have come to their senses a little and are selling off as news breaks of a plethora of concerning headlines from Israel:- *AIR RAID SIRENS HEARD OVER JERUSALEM

- *HAMAS CLAIMS FIRED ROCKET TOWARD JERUSALEM AREA, CHANNEL 2 SAYS

- *HAMAS CLAIMS IT HIT ISRAELI JET OVER GAZA STRIP

- *HAMAS SAYS FIRED AT ISRAELI PARLIAMENT IN JERUSALEM

- *FLASH: EXPLOSION HEARD IN JERUSALEM AREA: LOCAL MEDIA

There Is No Dollar Sign On Your Piece Of Mind

In

a word, this weekend, next week, we are facing what the boys in the

South call “chicken fried.” This is the moment when the ingredients

lounging in your kitchen get tossed in the frying pan and are cooked up

with grease (perhaps Greece) splattering everywhere and some concoction

that is decidedly unhealthy for you is tossed upon your plate. A

week ago the menu consisted of the Capitol Grill of America’s Fiscal

Cliff, the red wine (perhaps whine) of Spain and the seemingly never

ending fried in olive oil mess provided by both Athens and Brussels.

That would have been enough “Opa” for anyone as plates get smashed and

people whirl around on some table like dervishes but now we have a new

option on the menu, a special provided by the Great Chef in the sky. We get to throw in the latkes of Israel and the hummus provided by Hamas. Any

of these menu selections could provide severe heartburn all by

themselves but eaten together; a hospital stay may be required or a plot

at the cemetery.

In

a word, this weekend, next week, we are facing what the boys in the

South call “chicken fried.” This is the moment when the ingredients

lounging in your kitchen get tossed in the frying pan and are cooked up

with grease (perhaps Greece) splattering everywhere and some concoction

that is decidedly unhealthy for you is tossed upon your plate. A

week ago the menu consisted of the Capitol Grill of America’s Fiscal

Cliff, the red wine (perhaps whine) of Spain and the seemingly never

ending fried in olive oil mess provided by both Athens and Brussels.

That would have been enough “Opa” for anyone as plates get smashed and

people whirl around on some table like dervishes but now we have a new

option on the menu, a special provided by the Great Chef in the sky. We get to throw in the latkes of Israel and the hummus provided by Hamas. Any

of these menu selections could provide severe heartburn all by

themselves but eaten together; a hospital stay may be required or a plot

at the cemetery.Tumbling October Industrial Production And Capacity Utilization Blamed Solely On Hurricane Sandy

Because not one Wall

Street analyst could have possibly factored in the impact of Sandy

into their expectations of the month's Industrial Production, which in October declined by -0.4% to 96.6 from 97.0

in the Fed's index, well below consensus expectations of a 0.2% rise,

and down from last month's 0.4% increase, it is only logical to blame it all on Sandy. Sure

enough, this is what the Fed just did: "Hurricane Sandy, which held

down production in the Northeast region at the end of October, is

estimated to have reduced the rate of change in total output by nearly 1

percentage point." So let's get this straight: Sandy - which hit on October 29, or with about 94% of the month of October done and impacted New York and New Jersey, not the entire US, is responsible for 250% of the entire October 0.4% drop? Can

we please get back to the "It's all Bush's fault" excuses already. At

least those were idiotic and funny. Blaming everything on Sandy is just

the former. And yes, capacity utilization for the entire USA which

came at 77.8%, the lowest since November 2011, and well below

expectations of 78.3%, was obviously crushed by a tropical storm that

impacted New York and New Jersey for 3 days in the month. Brilliant.

Because not one Wall

Street analyst could have possibly factored in the impact of Sandy

into their expectations of the month's Industrial Production, which in October declined by -0.4% to 96.6 from 97.0

in the Fed's index, well below consensus expectations of a 0.2% rise,

and down from last month's 0.4% increase, it is only logical to blame it all on Sandy. Sure

enough, this is what the Fed just did: "Hurricane Sandy, which held

down production in the Northeast region at the end of October, is

estimated to have reduced the rate of change in total output by nearly 1

percentage point." So let's get this straight: Sandy - which hit on October 29, or with about 94% of the month of October done and impacted New York and New Jersey, not the entire US, is responsible for 250% of the entire October 0.4% drop? Can

we please get back to the "It's all Bush's fault" excuses already. At

least those were idiotic and funny. Blaming everything on Sandy is just

the former. And yes, capacity utilization for the entire USA which

came at 77.8%, the lowest since November 2011, and well below

expectations of 78.3%, was obviously crushed by a tropical storm that

impacted New York and New Jersey for 3 days in the month. Brilliant.Pre-Open Equity Ramp As Algos Track War-Ridden Oil Higher

Each

day we wake and look to the markets for guidance. Typically that

guidance means - which easily-leveragable asset class can be pulled (or

pushed) to move the US equity markets (in their algo-correlated manner)

in which ever direction we need (up as much as possible obviously

since the status quo requires it). Sometimes, it's EURUSD, other times

it's PMs; today, it is oil's turn! There has been no real escalation in

tensions in Israel in the last hour, no news of significance; and yet WTI

has popped 1.5% and in an almost perfectly correlated manner, S&P

futures have chugged along to the highs of the day to run those stops

before the US day-session open. Efficient Markets... Pin Risk... OPEX...

Each

day we wake and look to the markets for guidance. Typically that

guidance means - which easily-leveragable asset class can be pulled (or

pushed) to move the US equity markets (in their algo-correlated manner)

in which ever direction we need (up as much as possible obviously

since the status quo requires it). Sometimes, it's EURUSD, other times

it's PMs; today, it is oil's turn! There has been no real escalation in

tensions in Israel in the last hour, no news of significance; and yet WTI

has popped 1.5% and in an almost perfectly correlated manner, S&P

futures have chugged along to the highs of the day to run those stops

before the US day-session open. Efficient Markets... Pin Risk... OPEX...Risk Ramp On Boehner Banality

Great

timing. The ubiquitous post-European close trend-reversal was extended

by some 'nothing' comments from Boehner that every media outlet is

inferring means everything's fixed and compromise is close. Boehner says talks with Obama were constructive. Outlined a framework with Obama; Will accept revenue if spending cuts. It's

not - what did we expect him to say?AAPL jumped up to VWAP and

S&P 500 futures coincidentally reached overnight highs/stops. Now

let's see if anyone really believes...

Great

timing. The ubiquitous post-European close trend-reversal was extended

by some 'nothing' comments from Boehner that every media outlet is

inferring means everything's fixed and compromise is close. Boehner says talks with Obama were constructive. Outlined a framework with Obama; Will accept revenue if spending cuts. It's

not - what did we expect him to say?AAPL jumped up to VWAP and

S&P 500 futures coincidentally reached overnight highs/stops. Now

let's see if anyone really believes... Hostess

Brands, the company better known as the maker of Butternut, Ding

Dongs, Dolly Madison, Drake's, Home Pride, Ho Hos, Hostess, Merita,

Nature's Pride, and of course Wonder Bread and Twinkies, and which

previously survived one multi-year Chapter 11 bankruptcy process, when

it operated as Interstate Bakeries, has just made a splash at the NY

Southern Bankruptcy court, for the last time, with a liquidation filing.

The reason: insurmountable (and unfundable) difference in the firm's

collective bargaining agreements and pension obligations, which resulted

in a crippling strike that basically shut down the company. In other

words, Twinkies may well survive the nuclear apocalypse, but there was

one weakest link: the company making them, was unable to survive

empowered labor unions who thought they had all the negotiating

leverage... until they led their bankrupt employer right off

liquidation cliff. Will attention now turn to that another broke

government entity, the

Hostess

Brands, the company better known as the maker of Butternut, Ding

Dongs, Dolly Madison, Drake's, Home Pride, Ho Hos, Hostess, Merita,

Nature's Pride, and of course Wonder Bread and Twinkies, and which

previously survived one multi-year Chapter 11 bankruptcy process, when

it operated as Interstate Bakeries, has just made a splash at the NY

Southern Bankruptcy court, for the last time, with a liquidation filing.

The reason: insurmountable (and unfundable) difference in the firm's

collective bargaining agreements and pension obligations, which resulted

in a crippling strike that basically shut down the company. In other

words, Twinkies may well survive the nuclear apocalypse, but there was

one weakest link: the company making them, was unable to survive

empowered labor unions who thought they had all the negotiating

leverage... until they led their bankrupt employer right off

liquidation cliff. Will attention now turn to that another broke

government entity, the  We

all stand 'fingers-over-eyes and thumbs-in-ears' awestruck at the

immense wreckage that the fiscal cliff titan will wreak upon the

country. However, deep inside our socially responsible minds, all we can

really think about is - what about my needs?

We

all stand 'fingers-over-eyes and thumbs-in-ears' awestruck at the

immense wreckage that the fiscal cliff titan will wreak upon the

country. However, deep inside our socially responsible minds, all we can

really think about is - what about my needs?

The physical silver scramble continues, as a MASSIVE

The physical silver scramble continues, as a MASSIVE In his farewell address to Congress yesterday, Ron Paul blasted the dangers of what he called 'Economic Ignorance'.

He's dead right. Around the world, economic ignorance abounds. And

perhaps nowhere is this more obvious today than in the senseless

prattling over the US 'Fiscal Cliff'. US government spending falls into

three categories: Discretionary, Mandatory, and Interest on Debt. The

only thing Congress has a say over is Discretionary Spending. But here's

the problem - the US fiscal situation is so untenable that the

government fails to collect enough tax revenue to cover mandatory

spending and debt interest alone. This means that they could

cut the ENTIRE discretionary budget and still be in the hole by $251

billion. This is why the Fiscal Cliff is irrelevant. Increasing taxes

won't increase their total tax revenue. Politicians have tried this for

decades. It doesn't work. Bottom line-- the Fiscal Cliff doesn't matter. The US passed the point of no return a long time ago.

In his farewell address to Congress yesterday, Ron Paul blasted the dangers of what he called 'Economic Ignorance'.

He's dead right. Around the world, economic ignorance abounds. And

perhaps nowhere is this more obvious today than in the senseless

prattling over the US 'Fiscal Cliff'. US government spending falls into

three categories: Discretionary, Mandatory, and Interest on Debt. The

only thing Congress has a say over is Discretionary Spending. But here's

the problem - the US fiscal situation is so untenable that the

government fails to collect enough tax revenue to cover mandatory

spending and debt interest alone. This means that they could

cut the ENTIRE discretionary budget and still be in the hole by $251

billion. This is why the Fiscal Cliff is irrelevant. Increasing taxes

won't increase their total tax revenue. Politicians have tried this for

decades. It doesn't work. Bottom line-- the Fiscal Cliff doesn't matter. The US passed the point of no return a long time ago.  We

hear a lot about billionaires, millionaires, and 250,000-aires but

just where are all these tax-dodging blood-suckers skulking and just how many trips to Space on Virgin Galactic can the Top 25 Wealthiest people take per day?... Everything you wanted to know about the uber-wealthy is one simple mega-infographic.

We

hear a lot about billionaires, millionaires, and 250,000-aires but

just where are all these tax-dodging blood-suckers skulking and just how many trips to Space on Virgin Galactic can the Top 25 Wealthiest people take per day?... Everything you wanted to know about the uber-wealthy is one simple mega-infographic. As

has been widely reported previously, while the NY Fed's deep

underground gold vault remained dry during the Sandy flooding in

downtown NY, one institution which got badly hurt was the DTCC, aka Cede

& Co (profiled here in July of 2009 in "

As

has been widely reported previously, while the NY Fed's deep

underground gold vault remained dry during the Sandy flooding in

downtown NY, one institution which got badly hurt was the DTCC, aka Cede

& Co (profiled here in July of 2009 in "

Equity indices end the day marginally red as the machines tried every trick in the book to get markets up...(levering FX carry, spiking PMs, running HYG, spiking vol)

to enable more selling - especially at the close when we saw notable

size blocks being traded into that ramp to try and get green. VWAP was the anchor all day for S&P 500 futures (and since the synthetics are where the liquidity is - everything else followed) as stocks trend-reversed as normal on the EU close.

In general volatility and high-yield credit had a significantly weak

day but into the close managed to rise a little as risk-assets broadly

recoupled with equity markets to close. Despite a lot of noise and chop

stocks lost a little, Treasuries gained a little (-2bps on the week!), Silver scrambled back from its flash crash (but gold didn't do as well), and the USD ended today up a remarkably unchanged 0.04% (with EUR up 0.5% and JPY down 2.2% on the week). VIX ended back above 18% as AAPL just keeps falling with its 300DMA now in play.

Equity indices end the day marginally red as the machines tried every trick in the book to get markets up...(levering FX carry, spiking PMs, running HYG, spiking vol)

to enable more selling - especially at the close when we saw notable

size blocks being traded into that ramp to try and get green. VWAP was the anchor all day for S&P 500 futures (and since the synthetics are where the liquidity is - everything else followed) as stocks trend-reversed as normal on the EU close.

In general volatility and high-yield credit had a significantly weak

day but into the close managed to rise a little as risk-assets broadly

recoupled with equity markets to close. Despite a lot of noise and chop

stocks lost a little, Treasuries gained a little (-2bps on the week!), Silver scrambled back from its flash crash (but gold didn't do as well), and the USD ended today up a remarkably unchanged 0.04% (with EUR up 0.5% and JPY down 2.2% on the week). VIX ended back above 18% as AAPL just keeps falling with its 300DMA now in play.

In the current Bernanke-Obama-Keynes toxic triangle (defined

In the current Bernanke-Obama-Keynes toxic triangle (defined  On the near 100% probability that Germany will not voluntarily give

money to Spain, nor will Germany voluntarily modify its trade policies,

the choices facing Spain are quite bleak.

On the near 100% probability that Germany will not voluntarily give

money to Spain, nor will Germany voluntarily modify its trade policies,

the choices facing Spain are quite bleak. Israel attacked and killed the top Hamas leader yesterday. The attacks

back and forth commenced AFTER our elections; are you surprised? The

“leadership scandal” within our military has only gone public, again,

AFTER the elections. If you were watching closely for the last several

months you would know that there has been a handful of other Generals

and Admirals that have been replaced. There are several theories on

this. My theory is that these were longtime and “conservative” leaders

that were swept out of power in a clean sweep. Is this a surprise? I

could also ask the same question about the recent deluge of negative

economic reports and the suddenly declining stock market but I’ll let

you think this through.

Israel attacked and killed the top Hamas leader yesterday. The attacks

back and forth commenced AFTER our elections; are you surprised? The

“leadership scandal” within our military has only gone public, again,

AFTER the elections. If you were watching closely for the last several

months you would know that there has been a handful of other Generals

and Admirals that have been replaced. There are several theories on

this. My theory is that these were longtime and “conservative” leaders

that were swept out of power in a clean sweep. Is this a surprise? I

could also ask the same question about the recent deluge of negative

economic reports and the suddenly declining stock market but I’ll let

you think this through.

While the attention of most Americans was focused on whatever trivia

dished out from the mainstream media such as the current hot celebrity

or the David Petraeus incident, it appears that the Bilderberg Group has

arranged what some have described as an impromptu meeting in Rome,

Italy.

While the attention of most Americans was focused on whatever trivia

dished out from the mainstream media such as the current hot celebrity

or the David Petraeus incident, it appears that the Bilderberg Group has

arranged what some have described as an impromptu meeting in Rome,

Italy.  When a reader (and fellow silver-mining investor) recently expressed

his frustrations on our Forum regarding the absurd valuations which most

of these miners currently exhibit, I decided it was once again time to

try to shed some light (and sanity?) on this subject.

When a reader (and fellow silver-mining investor) recently expressed

his frustrations on our Forum regarding the absurd valuations which most

of these miners currently exhibit, I decided it was once again time to

try to shed some light (and sanity?) on this subject. Call it wishful thinking, but a small part of me thinks that the real reason why

Call it wishful thinking, but a small part of me thinks that the real reason why  Citizens from all 50 U.S. states have now filed petitions with the White House asking for “peaceful secession” from the union. According to

Citizens from all 50 U.S. states have now filed petitions with the White House asking for “peaceful secession” from the union. According to  A very important article came out from the Wall Street Journal

yesterday titled “FHA Nears Need for Taxpayer Funds,” and it outlines

the serious financial problems facing the Federal Housing

Administration. For those that are unaware or need a refresher, the FHA

has been the key element to the phony “housing recovery” the government

has been trying to create. In the wake of the collapse of 2008, Fannie

Mae and Freddie Mac blew up and what was left to pick up the pieces was

the FHA. No private player would issue loans with down payments of 3%,

but this was no problem for the FHA!

A very important article came out from the Wall Street Journal

yesterday titled “FHA Nears Need for Taxpayer Funds,” and it outlines

the serious financial problems facing the Federal Housing

Administration. For those that are unaware or need a refresher, the FHA

has been the key element to the phony “housing recovery” the government

has been trying to create. In the wake of the collapse of 2008, Fannie

Mae and Freddie Mac blew up and what was left to pick up the pieces was

the FHA. No private player would issue loans with down payments of 3%,

but this was no problem for the FHA! “If I had a world of my own,” declared Alice, Lewis Carroll’s red

pill-popping protagonist while wandering around her author’s Wonderland,

“everything would be nonsense. Nothing would be what it is, because

everything would be what it isn’t. And contrary wise, what is, it

wouldn’t be. And what it wouldn’t be, it would. You see?”

“If I had a world of my own,” declared Alice, Lewis Carroll’s red

pill-popping protagonist while wandering around her author’s Wonderland,

“everything would be nonsense. Nothing would be what it is, because

everything would be what it isn’t. And contrary wise, what is, it

wouldn’t be. And what it wouldn’t be, it would. You see?”![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)