A

very noisy gappy day with much larger volume than in recent days

(which all dried up in the afternoon session until the close - for the

heaviest volume day in a month) in US equities. European comments lifted

us early in a correlated-risk-on manner until Bernanke's speech which

hit markets like a meteor - stops were run up and down - but by the

close equities and the USD

ended fractionally lower from pre-Ben (notably up on the day to save

the month for the Dow), Gold considerably up from pre-Ben, Treasury

yields down notably from pre-Ben. Near six-month highs in Gold and five-month highs in Silver were the real movers today - with their largest gains in two months.

VIX ended marginally lower at 17.5% (-0.3vols); credit was very thin

today and tracked stocks in general (though less volatile); USD ended

the week -0.5% which matches Oil's +0.5% on the week as Copper

underperformed. Silver has overtaken Stocks as the Year-to-Date winner once again...

A

very noisy gappy day with much larger volume than in recent days

(which all dried up in the afternoon session until the close - for the

heaviest volume day in a month) in US equities. European comments lifted

us early in a correlated-risk-on manner until Bernanke's speech which

hit markets like a meteor - stops were run up and down - but by the

close equities and the USD

ended fractionally lower from pre-Ben (notably up on the day to save

the month for the Dow), Gold considerably up from pre-Ben, Treasury

yields down notably from pre-Ben. Near six-month highs in Gold and five-month highs in Silver were the real movers today - with their largest gains in two months.

VIX ended marginally lower at 17.5% (-0.3vols); credit was very thin

today and tracked stocks in general (though less volatile); USD ended

the week -0.5% which matches Oil's +0.5% on the week as Copper

underperformed. Silver has overtaken Stocks as the Year-to-Date winner once again...

from Silver Doctors:

The world doesn’t yet realize it, but the forces coming down on the gold and silver markets are truly unbelievable. These forces can’t be comprehended by any type of charting.

The world doesn’t yet realize it, but the forces coming down on the gold and silver markets are truly unbelievable. These forces can’t be comprehended by any type of charting.

Presently, much of the focus in the gold and silver community is in the MANIPULATION & FINANCIAL SYSTEM. However the physical forces coming down on the market are MUCH GREATER!!

NO ONE HAS A CLUE HOW TO PRICE GOLD AND SILVER IN A PEAK ENERGY ENVIRONMENT….ZIP…NADA….ZILCH!

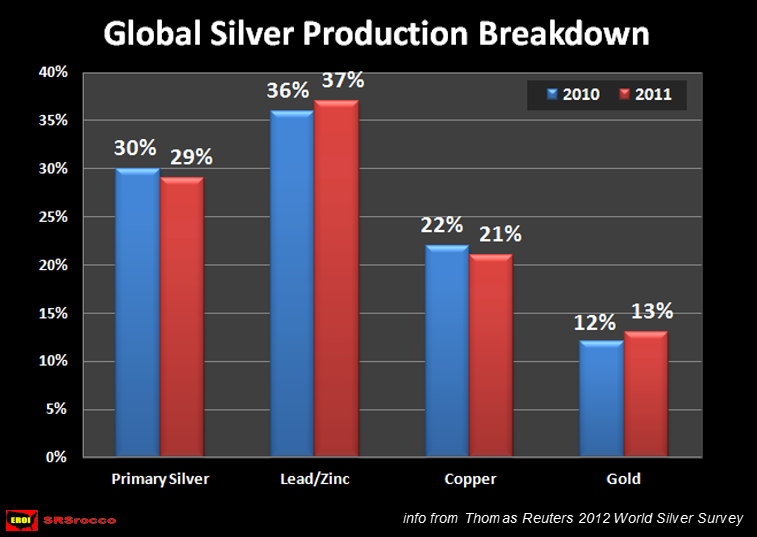

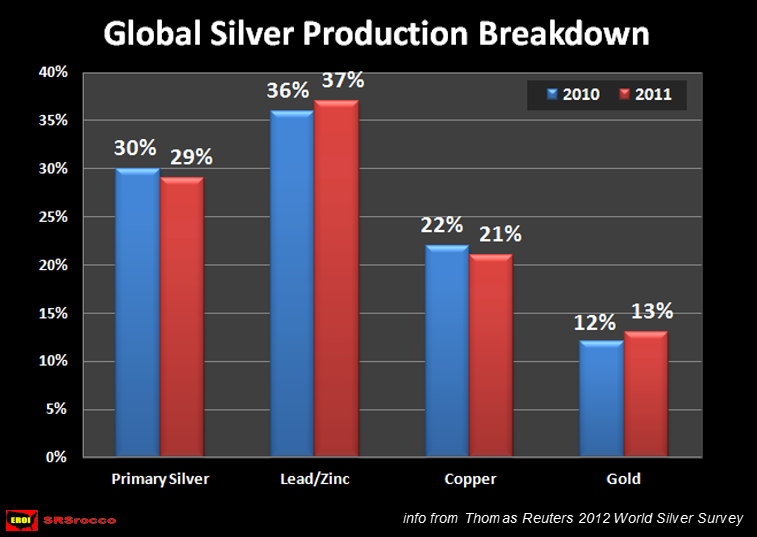

According to the 2012 World Silver Survey, primary silver production declined compared to 2010:

Read More @ Silver Doctors

The world doesn’t yet realize it, but the forces coming down on the gold and silver markets are truly unbelievable. These forces can’t be comprehended by any type of charting.

The world doesn’t yet realize it, but the forces coming down on the gold and silver markets are truly unbelievable. These forces can’t be comprehended by any type of charting.Presently, much of the focus in the gold and silver community is in the MANIPULATION & FINANCIAL SYSTEM. However the physical forces coming down on the market are MUCH GREATER!!

NO ONE HAS A CLUE HOW TO PRICE GOLD AND SILVER IN A PEAK ENERGY ENVIRONMENT….ZIP…NADA….ZILCH!

According to the 2012 World Silver Survey, primary silver production declined compared to 2010:

Read More @ Silver Doctors

The ECB 'Compromise' Cheat-Sheet

With

Bernanke leaving the door open, but not pre-committing, in a

check-raise to Draghi next week, market focus remains almost exclusively

on the bond-buying program to support Spain. Credit Suisse expects markets to be mildly disappointed by Draghi's words and deeds as they question how far he can go,

and in terms of near-term market moves, how much is said at next

week's meeting versus said at later occasions or indicated through

actions (e.g. once Spain asks for help). Draghi has already started to

manage expectations with his Die Zeit comments (pitched at the German

populous) but in order to get a handle on what the various scenarios

are - and what the implications could be - here is Credit Suisse's matrix of compromise.

With

Bernanke leaving the door open, but not pre-committing, in a

check-raise to Draghi next week, market focus remains almost exclusively

on the bond-buying program to support Spain. Credit Suisse expects markets to be mildly disappointed by Draghi's words and deeds as they question how far he can go,

and in terms of near-term market moves, how much is said at next

week's meeting versus said at later occasions or indicated through

actions (e.g. once Spain asks for help). Draghi has already started to

manage expectations with his Die Zeit comments (pitched at the German

populous) but in order to get a handle on what the various scenarios

are - and what the implications could be - here is Credit Suisse's matrix of compromise.How To Lose $400,000 With Credit Suisse Betting On A Big Jackson Hole Disappointment

This Tuesday, we gave the podium to Credit Suisse's rates group with "How To Make $500,000 With Credit Suisse Betting On A Big Jackson Hole Disappointment"

who in turn suggested that one of the best risk return opportunities

heading into J-Hole, was to go short the 10 Year betting on

disappointment by Bernanke (as a reminder earlier today we showed that

virtually 100% of QE was already priced in). Well, Bernanke came and

went, and although our personal take on the speech was broadly negative,

which highlighted the adverse side effects of what would happen if

there is another big QE round, and substantially toning the exuberant

language from the latest FOMC minutes, which had previously made it seem

that the majority of Fed presidents thought more easing should be

imminent resulting in another centrally-planned market rip, the stock

market did not agree with our take. At least not initially. As for

Credit Suisse, it said to "put on a $50K DV01 short at 1.64% and expect a steep selloff when the Fed disappoints, with a 1.75% target.

If all works out according to plan, everyone involved should be

$500,000 richer at market close on Friday with Bollingers all around."

Turns out nothing worked out quite as expected. In fact, as a result of

the J-Hole remarks, we have had another stock buying spree of anything

that is not nailed down, with gold popping the most, the DJIA soaring

as much as 150 (although rapidly taking on water), and the 10 year...

well, let's just say anyone who was on the other side of the CS prop

traders, sometimes called "flow" for Volcker Rule purposes, is now down -$400,000 on a trade that was supposed to be a +$500,000 meatpacking extravaganza.

This Tuesday, we gave the podium to Credit Suisse's rates group with "How To Make $500,000 With Credit Suisse Betting On A Big Jackson Hole Disappointment"

who in turn suggested that one of the best risk return opportunities

heading into J-Hole, was to go short the 10 Year betting on

disappointment by Bernanke (as a reminder earlier today we showed that

virtually 100% of QE was already priced in). Well, Bernanke came and

went, and although our personal take on the speech was broadly negative,

which highlighted the adverse side effects of what would happen if

there is another big QE round, and substantially toning the exuberant

language from the latest FOMC minutes, which had previously made it seem

that the majority of Fed presidents thought more easing should be

imminent resulting in another centrally-planned market rip, the stock

market did not agree with our take. At least not initially. As for

Credit Suisse, it said to "put on a $50K DV01 short at 1.64% and expect a steep selloff when the Fed disappoints, with a 1.75% target.

If all works out according to plan, everyone involved should be

$500,000 richer at market close on Friday with Bollingers all around."

Turns out nothing worked out quite as expected. In fact, as a result of

the J-Hole remarks, we have had another stock buying spree of anything

that is not nailed down, with gold popping the most, the DJIA soaring

as much as 150 (although rapidly taking on water), and the 10 year...

well, let's just say anyone who was on the other side of the CS prop

traders, sometimes called "flow" for Volcker Rule purposes, is now down -$400,000 on a trade that was supposed to be a +$500,000 meatpacking extravaganza.Silver Breaks its Downtrend

Trader Dan at Trader Dan's Market Views - 13 minutes ago

For nearly the last year and a half, silver has been in a sustained

downtrend in price although it has managed to find a floor of support near

the $26 level. This week it has finally broken that downtrend. If this

metal is going to begin a sustained rally, any setback in price should find

buying emerge near the downsloping blue line shown on the chart. Failure to

hold this level and particularly now the $30 level, will see the metal fall

back into that triangle formation with support then coming in down closer

to $28.

Note that the metal is now trading above the 50 week moving avera... more »

The Action In The Metals Today

Dave in Denver at The Golden Truth - 38 minutes ago

If you read between the lines of Bernanke's headline comments, he

essentially is saying that he's ready to print a lot of money if

"necessary." That's why the metals where ambushed hard yesterday, it's why

the dollar dropped like a rock on no other news overnight, it's why they

took the metals down as the headlines hit and it's why the metals spiked

hard after the initial hit today. We actually removed all hedges from our

fund yesterday after the ambush because I suspected this would be the case.

This is highly orchestrated at this point and frighteningly Orwellian. The

metals are... more »

More Pain for the Middle Class courtesy of Bernank...

Trader Dan at Trader Dan's Market Views - 2 hours ago

Check out the following chart of the Continuous Commodity Index or CCI and

note that it has managed to put in a weekly close above the 38.2% Fibonacci

Retracement Level of the move lower from its all time recent high made last

year. If the market pysche remains the same, look for this index to now

make an eventual run back towards the 597-600 level.

We can look at these charts as subjects of interest to us as

traders/investors but what this particular stock represents is increasing

pain for consumers and the hard-pressed middle class in one of the worst,

if not the worst "recovery" ... more »

The Bernank Jawboning the Markets

Trader Dan at Trader Dan's Market Views - 3 hours ago

The long awaited speech from Fed Chairman Ben Bernanke at the Jackson Hole

Summit has come and gone without any definitive action being announced.

However, the Helicopter Man let it be known that he believes the first two

rounds of QE were a rousing success.

Once again he promised that the Fed stands ready to act if the economic

conditions or data warrant it. As usual, the markets, hungry for more of

the spiked punch bowl, wasted no time in casting off their initial

disappointment with a huge round of indiscriminate buying directed at the

risk asset categories.

Gold blew through to... more »

M&A Is Strong In Asia

Admin at Marc Faber Blog - 3 hours ago

In Asia we have a lot of takeover activity and much more will happen. - *in

Bloomberg*

*Marc Faber is an international investor known for his uncanny predictions

of the stock market and futures markets around the world.*

You Cannot Fix Economies By Printing Money

Admin at Marc Faber Blog - 5 hours ago

I don`t believe you can fix economies by printing money. - *in Bloomberg *

*Marc Faber is an international investor known for his uncanny predictions

of the stock market and futures markets around the world.*The Real Reverse Robin Hood: The Bernank And His Merry Band Of Thieves

Listen up, debt-serfs, you have it good here on the manor estate.

You get three squares of greasy fast-food or heavily processed

faux-food a day, and if Reverse Robin Hood and his Merry Band of

Thieves is ripping you off it's for a good reason: the predatory

Neofeudalist Financial Lords need the money more than you do, as they

have a lot of political bribes to pay: it's an election year, and the

bribes are getting increasingly costly. Poor things, we're sure you

understand. Now go back to work or watching entertainment (or

"news," heh) and leave the Lords alone - but answer these 11 questions

first, before hailing the new hero.

Listen up, debt-serfs, you have it good here on the manor estate.

You get three squares of greasy fast-food or heavily processed

faux-food a day, and if Reverse Robin Hood and his Merry Band of

Thieves is ripping you off it's for a good reason: the predatory

Neofeudalist Financial Lords need the money more than you do, as they

have a lot of political bribes to pay: it's an election year, and the

bribes are getting increasingly costly. Poor things, we're sure you

understand. Now go back to work or watching entertainment (or

"news," heh) and leave the Lords alone - but answer these 11 questions

first, before hailing the new hero.Friday Humor: Gold Is A Barbeque Relish

"My Doctor’s an idiot. A few years ago, he started expressing concerns about my weight, pointing at this chart supposedly showing how much a man of my height should weigh. One glance at his stupid chart and it was clear to me that he had completely misdiagnosed my condition. There was nothing wrong with my weight, I just wasn’t tall enough. Clearly I needed to grow my way out of this. So I went home and googled “how to stimulate growth.” Once I got past the all the baldness cures and penis pumps (it’s not my bag, baby), I found hundreds of papers so incredibly boring I knew they had to be true. In no time, I was able to design and implement my own stimulus plan based on the irrefutable scientificky principles of Nobel prize winners and other people so smart they never had to do an honest day’s work in their lives. Despite the difficulty climbing stairs, I was feeling pretty good about things until my last check-up..."

On The Difference Between Bonds, Equities, And Gold; "No-QE-Without-A-Crash" Or "Flow Vs. Stock"

Is the reality of different time-horizons and event discounting really starting to tell on markets? Equities have now sagged back lower while Treasury yields are accelerating lower and Gold higher. It seems that stocks fully comprehend that QE does not come without more pain in the short-term and are starting to price for that - while given the low/no cost of carry for Treasuries and Gold, the eventual reality of further financial repression and money-printing can be discounted in from longer maturities. It seems somewhat in-the-stars that the Fed will do more as they have convinced themselves that all is well with their extreme policies and short-term benefits outweigh ultimate costs, but this afternoon's disconnect between the QE-to-the-moon feeling in Gold and Treasuries and the QE-not-so-soon feeling in Stocks may well be a trend to watch as the only sure thing is when not if The Fed acts.

Mission Intractable: ECB Bond-Buying Plan-For-A-Plan Will Self-Destruct In 24 Hours

Have no fear; Europe closed and equities leaked so a quick series of European comments are more than required... Bankia, check! Bank backstops, check! ECB Bond-Buying Plan...- *ECB SAID TO PLAN TO GIVE GOVERNORS BOND PROPOSALS ON SEPT. 4

- *ECB SAID TO HAVE NO PREFERRED OPTION FOR BOND PURCHASE PLAN YET

- *ECB SAID TO GIVE CENTRAL BANKS 24 HOURS TO DIGEST BOND PLAN

Bankia Gets 'Pre-Bailout' Bailout "Immediately" As Bad Loans Jump 44%

With Spain's new-found belief in its own incompetence omnipotence, they are now throwing bad money after bad in advance of the European bailout by pre-bailing out (bridge recap?) Bankia via the FROB (and it seems like they are in a hurry):- *SPAIN'S FROB SAYS TO INJECT CAPITAL IN BFA-BANKIA IMMEDIATELY

- *BANKIA GROUP BAD LOANS RATIO 11% IN JUNE VS 7.63% IN DEC. (a 44% rise!!)

- *BANKIA 1H NET LOSS EU4.45 BLN VS EU201 MLN PROFIT A YR AGO

*BANKIA CHAIRMAN SAYS SPAIN, EU COMMENTS ARE `GREAT SUPPORT'

Former Fed Governor Heller: "Fed Will Not Act Before Fiscal Cliff Resolved"

Perhaps

it is the weight that is lifted from having to tow the propaganda life

while under the influence of the Fed, but Robert Heller (ex Fed

Governor) just laid out the 'translated' version of Bernanke's speech

this morning. "I don't think the Federal Reserve will take any

action, certainly not until the fiscal cliff, the fiscal uncertainties

are actually addressed," which is similar to our interpretation of Bernanke's comments as he added "if they're not addressed and the economy falls off the cliff; yes, then you may get QE3," but "I don't see that happening before the election!"

This great interview - somewhat stunningly truthy for CNBC - is well

worth five minutes of your time (on this ever-so-hectic Friday before

Labor Day) as Heller discusses teh fading impact of QE, the risk of

enormous losses for the Fed, and the danger of believing in a 'safe'

exit strategy.

Perhaps

it is the weight that is lifted from having to tow the propaganda life

while under the influence of the Fed, but Robert Heller (ex Fed

Governor) just laid out the 'translated' version of Bernanke's speech

this morning. "I don't think the Federal Reserve will take any

action, certainly not until the fiscal cliff, the fiscal uncertainties

are actually addressed," which is similar to our interpretation of Bernanke's comments as he added "if they're not addressed and the economy falls off the cliff; yes, then you may get QE3," but "I don't see that happening before the election!"

This great interview - somewhat stunningly truthy for CNBC - is well

worth five minutes of your time (on this ever-so-hectic Friday before

Labor Day) as Heller discusses teh fading impact of QE, the risk of

enormous losses for the Fed, and the danger of believing in a 'safe'

exit strategy.

Donations will help maintain and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

I'm PayPal VerifiedEuropean Stocks Explode Higher As Spanish Bonds Implode

Sigh. Spain's IBEX gained over 3%; Italy's MIB gained over 2%;

and all but the UK's FTSE equity index ended very nicely green today

(all jerked higher by Spain's comments on their bad-bank and then

Bernanke's cover). However, European Government Bonds (EGBs) failed

dismally. Spain's 10Y spread to bunds ended the week 46bps wider

and Italy 15bps wider and while some point to the short-end as

evidence that all is well, Spain saw modest weakness in the 2Y today

post Bernanke (though Italy rallied). The curve steepening was

dramatic to say the least as the market appearsd to be increasingly

assuming the ECB will monetize short-dated govvies - our own view -

consider what the implied forward financing costs are given these steep

curves as clearly noone trusts this as a solution and will merely

subordinate the entire market. Spain 2s10s curve is now at its steepest on record at 328bps! and this is not helping:

Sigh. Spain's IBEX gained over 3%; Italy's MIB gained over 2%;

and all but the UK's FTSE equity index ended very nicely green today

(all jerked higher by Spain's comments on their bad-bank and then

Bernanke's cover). However, European Government Bonds (EGBs) failed

dismally. Spain's 10Y spread to bunds ended the week 46bps wider

and Italy 15bps wider and while some point to the short-end as

evidence that all is well, Spain saw modest weakness in the 2Y today

post Bernanke (though Italy rallied). The curve steepening was

dramatic to say the least as the market appearsd to be increasingly

assuming the ECB will monetize short-dated govvies - our own view -

consider what the implied forward financing costs are given these steep

curves as clearly noone trusts this as a solution and will merely

subordinate the entire market. Spain 2s10s curve is now at its steepest on record at 328bps! and this is not helping:*SPAIN’S CATALONIA REGION CUT TO JUNK BY S&P, OUTLOOK NEGATIVE

But buy stocks...

Algos Set New Speed Reading Record: 4549 Words In 20 Milliseconds

The

market is indeed a discounting mechanism it appears. In a mere 20

milliseconds, the world's 'traders' had managed to read Bernanke's

4549-word script, interpret it (as bearish in this case - which

apparently is wrong now?) and start to sell down the major equity

indices. As Nanex points out, not only was the reaction lightning fast (actually faster than lightning) but it occurred

in their newly created 'fantaseconds' as trades were timestamped

'before' the bids and offers were even seen in the data-feed. How long until the machines can interpret Bernanke's 'pre-QErimes' and really front-run reality?

The

market is indeed a discounting mechanism it appears. In a mere 20

milliseconds, the world's 'traders' had managed to read Bernanke's

4549-word script, interpret it (as bearish in this case - which

apparently is wrong now?) and start to sell down the major equity

indices. As Nanex points out, not only was the reaction lightning fast (actually faster than lightning) but it occurred

in their newly created 'fantaseconds' as trades were timestamped

'before' the bids and offers were even seen in the data-feed. How long until the machines can interpret Bernanke's 'pre-QErimes' and really front-run reality?When One Hilsenrath Is Just Not Enough, Here's Another: "Bernanke Signals Readiness To Do More"

In

the immortal words of the Jackson 5: "I'll Be There" seems to be the

meme du jour - which appears to us to be the same message that Bernanke

(and his proxy Hilsenrath) have been on for a few years now. However,

in case you hadn't had enough sycophantic central-bank-fellating

'hope', the WSJ's front-man just reiterated

for one and all that Ben's our man. In our subtle opinion, it seems

however that perhaps Bernanke was a little disingenuous with his talk of

'policy tool effectiveness' - as clearly his efforts have not had the

desired economic effect so far (or he would not need to reiterate the

ability to do more of the same).

In

the immortal words of the Jackson 5: "I'll Be There" seems to be the

meme du jour - which appears to us to be the same message that Bernanke

(and his proxy Hilsenrath) have been on for a few years now. However,

in case you hadn't had enough sycophantic central-bank-fellating

'hope', the WSJ's front-man just reiterated

for one and all that Ben's our man. In our subtle opinion, it seems

however that perhaps Bernanke was a little disingenuous with his talk of

'policy tool effectiveness' - as clearly his efforts have not had the

desired economic effect so far (or he would not need to reiterate the

ability to do more of the same).

by Simon Black, Sovereign Man :

A few weeks ago, western governments’ war on productive people took an interesting twist when US immigration authorities detained two teenage children of an asset manager based here in Switzerland.

The kids were traveling through the United States by themselves to visit extended family, and they were interrogated for six hours about their father’s business and whereabouts.

During the six-hour ordeal, the children were not allowed to contact family members who were waiting for them, nor any sort of attorney or advisor. You can just imagine grandma and grandpa waiting in the arrivals hall for six hours, petrified that something terrible had

happened to the children.

Read More @ SovereignMan.com

A few weeks ago, western governments’ war on productive people took an interesting twist when US immigration authorities detained two teenage children of an asset manager based here in Switzerland.

The kids were traveling through the United States by themselves to visit extended family, and they were interrogated for six hours about their father’s business and whereabouts.

During the six-hour ordeal, the children were not allowed to contact family members who were waiting for them, nor any sort of attorney or advisor. You can just imagine grandma and grandpa waiting in the arrivals hall for six hours, petrified that something terrible had

happened to the children.

Read More @ SovereignMan.com

from KingWorldNews:

Today acclaimed money manager Stephen Leeb told King World News that he expects the Fed will in fact ease at their September meeting. Leeb also discussed the strong move in gold and silver, but first, here is what Leeb had to say regarding Bernanke and the Fed: “I think what investors clearly wanted to hear from Bernanke is that he’s ready to ease on monetary policy, and that he’s ready to open the floodgates again. That, combined with a much more docile Merkel, and news today that China’s copper demand might be a lot stronger than people think, and you really had a trifecta here today.

The Bernanke story is right in front of us. What he said, and he made this crystal clear, is the economy is very disappointing to him. He also used a very strong adjective to describe unemployment, and he stated he’s going to do whatever he can about it. The language he used, the adjectives he used, suggested he’s ready to do something, Eric.”

Leeb continues @ KingWorldNews.com

Today acclaimed money manager Stephen Leeb told King World News that he expects the Fed will in fact ease at their September meeting. Leeb also discussed the strong move in gold and silver, but first, here is what Leeb had to say regarding Bernanke and the Fed: “I think what investors clearly wanted to hear from Bernanke is that he’s ready to ease on monetary policy, and that he’s ready to open the floodgates again. That, combined with a much more docile Merkel, and news today that China’s copper demand might be a lot stronger than people think, and you really had a trifecta here today.

The Bernanke story is right in front of us. What he said, and he made this crystal clear, is the economy is very disappointing to him. He also used a very strong adjective to describe unemployment, and he stated he’s going to do whatever he can about it. The language he used, the adjectives he used, suggested he’s ready to do something, Eric.”

Leeb continues @ KingWorldNews.com

by Frank Suess, The Daily Bell:

THE ECB SLOWLY BUT SURELY BECOMING A TWIN BROTHER OF THE FED: POSITIVE IMPLICATIONS FOR THE SHORT-TERM?

“We are in danger of being overwhelmed with irredeemable paper, mere paper, representing not gold nor silver; no sir, representing nothing but broken promises, bad faith, bankrupt corporations, cheated creditors and a ruined people.” ~ Daniel Webster, speech in the American Senate, 1833

Increasingly, Mario Draghi, the European Central Bank President, is showing his true colors. He is clearly on the road to becoming Europe´s clone of Ben Bernanke. That said, Draghi is pushing hard against Germany´s (Merkel´s) resistance of running full-speed down the Keynesian road of monetary inflation.

In this context, our regular Mountain Vision contributor, Fredrik Boe-Hanssen, as you’ll see following my introduction today, has written another insightful article on Europe’s fiscal and monetary conundrum: “How The ECB Became Intertwined in Politics and Fiscal Bailout Facilities.”

Read More @ TheDailyBell.com

THE ECB SLOWLY BUT SURELY BECOMING A TWIN BROTHER OF THE FED: POSITIVE IMPLICATIONS FOR THE SHORT-TERM?

“We are in danger of being overwhelmed with irredeemable paper, mere paper, representing not gold nor silver; no sir, representing nothing but broken promises, bad faith, bankrupt corporations, cheated creditors and a ruined people.” ~ Daniel Webster, speech in the American Senate, 1833

Increasingly, Mario Draghi, the European Central Bank President, is showing his true colors. He is clearly on the road to becoming Europe´s clone of Ben Bernanke. That said, Draghi is pushing hard against Germany´s (Merkel´s) resistance of running full-speed down the Keynesian road of monetary inflation.

In this context, our regular Mountain Vision contributor, Fredrik Boe-Hanssen, as you’ll see following my introduction today, has written another insightful article on Europe’s fiscal and monetary conundrum: “How The ECB Became Intertwined in Politics and Fiscal Bailout Facilities.”

Read More @ TheDailyBell.com

by Frank Tang, Reuters:

Gold surged to a five-month high in heavy trade on Friday after Federal

Reserve Chairman Ben Bernanke’s key speech fuelled speculation of new

U.S. stimulus in the near future.

Gold surged to a five-month high in heavy trade on Friday after Federal

Reserve Chairman Ben Bernanke’s key speech fuelled speculation of new

U.S. stimulus in the near future.

At the economic symposium in Jackson Hole, Wyoming, Bernanke said that progress reducing unemployment was too slow and the U.S. economy faced “daunting” challenges but he stopped short of providing a clear signal of further monetary policy easing.

The metal fell immediately following the release of Bernanke’s speech as markets were disappointed that the Fed chief did not send a strong message about a new round of bond-buyback known as quantitative easing (QE). However, bullion quickly rebounded $35 per ounce, or 1.5 percent, from the low as markets later interpreted his comments as stimulus friendly.

Read More @ Reuters

from matlarson10:

At the economic symposium in Jackson Hole, Wyoming, Bernanke said that progress reducing unemployment was too slow and the U.S. economy faced “daunting” challenges but he stopped short of providing a clear signal of further monetary policy easing.

The metal fell immediately following the release of Bernanke’s speech as markets were disappointed that the Fed chief did not send a strong message about a new round of bond-buyback known as quantitative easing (QE). However, bullion quickly rebounded $35 per ounce, or 1.5 percent, from the low as markets later interpreted his comments as stimulus friendly.

Read More @ Reuters

from matlarson10:

by Jeff Nielson, Silver Gold Bull:

Following the solid gains in the price of gold last week

and the much more explosive rise in the price of silver, all

expectations (even among normally bearish commentators) were that

bullion prices would continue rising this week. That all changed Monday

morning, however.

Following the solid gains in the price of gold last week

and the much more explosive rise in the price of silver, all

expectations (even among normally bearish commentators) were that

bullion prices would continue rising this week. That all changed Monday

morning, however.

At that point the Corporate Media released their Script for this week (written by the banking cabal itself). They “predicted” that B.S. Bernanke would “disappoint the market” when his prepared remarks would be released to the world on August 31st.

Experienced commentators and investors alike immediately understood the game being played, since it’s been played on countless occasions in the past.

Read More @ SilverGoldBull.com

Following the solid gains in the price of gold last week

and the much more explosive rise in the price of silver, all

expectations (even among normally bearish commentators) were that

bullion prices would continue rising this week. That all changed Monday

morning, however.

Following the solid gains in the price of gold last week

and the much more explosive rise in the price of silver, all

expectations (even among normally bearish commentators) were that

bullion prices would continue rising this week. That all changed Monday

morning, however.At that point the Corporate Media released their Script for this week (written by the banking cabal itself). They “predicted” that B.S. Bernanke would “disappoint the market” when his prepared remarks would be released to the world on August 31st.

Experienced commentators and investors alike immediately understood the game being played, since it’s been played on countless occasions in the past.

Read More @ SilverGoldBull.com

by David McWilliams, David McWilliams:

IF you want to know where the classic 1980s power ballads (the theme

from ‘Dirty Dancing’, Laura Branigan’s ‘Self Control’, Heaven 17 numbers

and assorted gems from the New Romantic era) ended up, look no further

than German radio. While I was driving through the northern bit of the

Rhine yesterday, the car radio offered up an eclectic mix, ranging from

the reasonably nostalgic to the God-awful, in a display of Catholic

music tastes befitting a journey that concluded just outside Cologne

cathedral, Europe’s biggest.

IF you want to know where the classic 1980s power ballads (the theme

from ‘Dirty Dancing’, Laura Branigan’s ‘Self Control’, Heaven 17 numbers

and assorted gems from the New Romantic era) ended up, look no further

than German radio. While I was driving through the northern bit of the

Rhine yesterday, the car radio offered up an eclectic mix, ranging from

the reasonably nostalgic to the God-awful, in a display of Catholic

music tastes befitting a journey that concluded just outside Cologne

cathedral, Europe’s biggest.

The other noticeable thing about driving in Germany on a weekday is the sheer amount of commerce on the roads. The inside lane of the autobahn is an uninterrupted convoy of trucks shipping Germany’s exports all over the continent.

Read More @ DavidMcWilliams.ie

IF you want to know where the classic 1980s power ballads (the theme

from ‘Dirty Dancing’, Laura Branigan’s ‘Self Control’, Heaven 17 numbers

and assorted gems from the New Romantic era) ended up, look no further

than German radio. While I was driving through the northern bit of the

Rhine yesterday, the car radio offered up an eclectic mix, ranging from

the reasonably nostalgic to the God-awful, in a display of Catholic

music tastes befitting a journey that concluded just outside Cologne

cathedral, Europe’s biggest.

IF you want to know where the classic 1980s power ballads (the theme

from ‘Dirty Dancing’, Laura Branigan’s ‘Self Control’, Heaven 17 numbers

and assorted gems from the New Romantic era) ended up, look no further

than German radio. While I was driving through the northern bit of the

Rhine yesterday, the car radio offered up an eclectic mix, ranging from

the reasonably nostalgic to the God-awful, in a display of Catholic

music tastes befitting a journey that concluded just outside Cologne

cathedral, Europe’s biggest.The other noticeable thing about driving in Germany on a weekday is the sheer amount of commerce on the roads. The inside lane of the autobahn is an uninterrupted convoy of trucks shipping Germany’s exports all over the continent.

Read More @ DavidMcWilliams.ie

by Christopher Manion, Lew Rockwell:

The Mitt Romney nomination reminds me of the 1976 convention that

nominated Gerald Ford. Back then, Ford’s fixers (Dick Cheney and James

Baker III) did everything they could to eviscerate Governor Reagan’s

supporters at the 1976 RNC – and then tried to “reunite” the GOP and try

to recoup the Reagan supporters they had alienated, all to no avail.

The Mitt Romney nomination reminds me of the 1976 convention that

nominated Gerald Ford. Back then, Ford’s fixers (Dick Cheney and James

Baker III) did everything they could to eviscerate Governor Reagan’s

supporters at the 1976 RNC – and then tried to “reunite” the GOP and try

to recoup the Reagan supporters they had alienated, all to no avail.

It failed because it was sheer pretense, disingenuous on its face. Baker and his sidekick, David Gergen, hated conservatives as much as Ford hated Reagan. They hated especially the millions of “blue collar” Democrats who came to provide the backbone of the “social conservatives” that supplied Reagan’s winning margins in 1980 and 1984.

Ford was adamant and unrepentant about his loyalty to the Rockefeller-Bush establishment. He bragged in the 1990s that his proudest accomplishment was the appointment of Supreme Court Justice Stevens, who quickly became a left-wing stalwart on the court, to be joined there by George H.W. Bush appointee David Souter in 1990. Time after time, the GOP Hot-Tubbers have lied to traditional conservatives, gotten their votes, and then betrayed them.

Read More @ LewRockwell.com

The Mitt Romney nomination reminds me of the 1976 convention that

nominated Gerald Ford. Back then, Ford’s fixers (Dick Cheney and James

Baker III) did everything they could to eviscerate Governor Reagan’s

supporters at the 1976 RNC – and then tried to “reunite” the GOP and try

to recoup the Reagan supporters they had alienated, all to no avail.

The Mitt Romney nomination reminds me of the 1976 convention that

nominated Gerald Ford. Back then, Ford’s fixers (Dick Cheney and James

Baker III) did everything they could to eviscerate Governor Reagan’s

supporters at the 1976 RNC – and then tried to “reunite” the GOP and try

to recoup the Reagan supporters they had alienated, all to no avail.It failed because it was sheer pretense, disingenuous on its face. Baker and his sidekick, David Gergen, hated conservatives as much as Ford hated Reagan. They hated especially the millions of “blue collar” Democrats who came to provide the backbone of the “social conservatives” that supplied Reagan’s winning margins in 1980 and 1984.

Ford was adamant and unrepentant about his loyalty to the Rockefeller-Bush establishment. He bragged in the 1990s that his proudest accomplishment was the appointment of Supreme Court Justice Stevens, who quickly became a left-wing stalwart on the court, to be joined there by George H.W. Bush appointee David Souter in 1990. Time after time, the GOP Hot-Tubbers have lied to traditional conservatives, gotten their votes, and then betrayed them.

Read More @ LewRockwell.com

from KingWorldNews:

Today Peter Schiff stunned King World News when he said the US will

be back on a gold standard “… in a year or two.” Schiff also said, “I

would have expected a (financial) collapse to have already happened.”

Schiff went on to warn, “… at this point I’m going to assume there is no

more stay of execution and we are going to have our crisis coming up

right after Europe.”

Today Peter Schiff stunned King World News when he said the US will

be back on a gold standard “… in a year or two.” Schiff also said, “I

would have expected a (financial) collapse to have already happened.”

Schiff went on to warn, “… at this point I’m going to assume there is no

more stay of execution and we are going to have our crisis coming up

right after Europe.”

But first, Schiff had this to say regarding Bernanke and his Jackson Hole speech: “QE3 is coming. He’s got that card up his sleeve. It’s been hidden up there for a long time. He’s reluctant to admit it, but he will play it eventually. He’s going to be coy about it because he doesn’t want to actually come out and reveal his hand.”

“You know we’ve got a phony recovery, so it’s going to fail. So we are going to get more QE. It’s not that we need it, but if we don’t have QE3, then we are back in recession. The Fed is going to try to stop that, even though the recession is part of the cure.

Peter Schiff continues @ KingWorldNews.com

I'm PayPal Verified

Today Peter Schiff stunned King World News when he said the US will

be back on a gold standard “… in a year or two.” Schiff also said, “I

would have expected a (financial) collapse to have already happened.”

Schiff went on to warn, “… at this point I’m going to assume there is no

more stay of execution and we are going to have our crisis coming up

right after Europe.”

Today Peter Schiff stunned King World News when he said the US will

be back on a gold standard “… in a year or two.” Schiff also said, “I

would have expected a (financial) collapse to have already happened.”

Schiff went on to warn, “… at this point I’m going to assume there is no

more stay of execution and we are going to have our crisis coming up

right after Europe.”But first, Schiff had this to say regarding Bernanke and his Jackson Hole speech: “QE3 is coming. He’s got that card up his sleeve. It’s been hidden up there for a long time. He’s reluctant to admit it, but he will play it eventually. He’s going to be coy about it because he doesn’t want to actually come out and reveal his hand.”

“You know we’ve got a phony recovery, so it’s going to fail. So we are going to get more QE. It’s not that we need it, but if we don’t have QE3, then we are back in recession. The Fed is going to try to stop that, even though the recession is part of the cure.

Peter Schiff continues @ KingWorldNews.com

Bernanke takes the wind out of the market's euphoric sails: "

Bernanke takes the wind out of the market's euphoric sails: "

Despite

high-flying equity indices, there is some underlying concern that all

is not rosy in the global economy (and that Fed/ECB/PBoC might not save

the day this time). As Morgan Stanley notes, the overcrowded trades

are overweight US and within US overweight defensives - implying

cyclicals are starting to reflect the current global macro weakness and

that there are further downgrades to global growth forecasts to come. Expectations

for a repeat of H2 2011's surge in positive surprises are misplaced as

several unique factors were at play last year - and are very much

lacking this year; moreover global growth indicators are significantly weaker than a year ago. With this background, MS also does

not expect imminent QE in the US; the Chinese policy response

continues to lag expectations; and there are several hurdles to

executing ECB action - all of which leave them expecting further substantial downgrades to 2013 consensus earning forecasts in the US.

Despite

high-flying equity indices, there is some underlying concern that all

is not rosy in the global economy (and that Fed/ECB/PBoC might not save

the day this time). As Morgan Stanley notes, the overcrowded trades

are overweight US and within US overweight defensives - implying

cyclicals are starting to reflect the current global macro weakness and

that there are further downgrades to global growth forecasts to come. Expectations

for a repeat of H2 2011's surge in positive surprises are misplaced as

several unique factors were at play last year - and are very much

lacking this year; moreover global growth indicators are significantly weaker than a year ago. With this background, MS also does

not expect imminent QE in the US; the Chinese policy response

continues to lag expectations; and there are several hurdles to

executing ECB action - all of which leave them expecting further substantial downgrades to 2013 consensus earning forecasts in the US. We

fear that the data given to us by Europe is erroneous. The resident

institutions in the world where one thinks that accurate data may be

found for Europe are Eurostat and the Bank for International

Settlements. Spain and her official admission of "dynamic

provisioning" has raised all kinds of questions in our mind and has

unsettled our belief in the data provided by Europe. It is now

quite apparent that the numbers for all of the Spanish banks, are

inaccurate. It may well be that the EU or the ECB could bury what may be

found but it would be awfully tough for the IMF to hide any material

breaches. Even when considering the IMF however, certain questions are

raised. Their projections for Europe and each and every country in

Europe have been wrong, dead wrong and far too optimistic. This

then would explain why Europe is in such trouble because if the data is

not truthful then the truth, as most often happens, leaks out from

underneath that which is hidden and provides the outcomes that the

Europeans have tried so hard to avoid. Whatever the real numbers are, they are providing the consequences that result from their actuality.

We

fear that the data given to us by Europe is erroneous. The resident

institutions in the world where one thinks that accurate data may be

found for Europe are Eurostat and the Bank for International

Settlements. Spain and her official admission of "dynamic

provisioning" has raised all kinds of questions in our mind and has

unsettled our belief in the data provided by Europe. It is now

quite apparent that the numbers for all of the Spanish banks, are

inaccurate. It may well be that the EU or the ECB could bury what may be

found but it would be awfully tough for the IMF to hide any material

breaches. Even when considering the IMF however, certain questions are

raised. Their projections for Europe and each and every country in

Europe have been wrong, dead wrong and far too optimistic. This

then would explain why Europe is in such trouble because if the data is

not truthful then the truth, as most often happens, leaks out from

underneath that which is hidden and provides the outcomes that the

Europeans have tried so hard to avoid. Whatever the real numbers are, they are providing the consequences that result from their actuality. Overnight

the WSJ's Jon Hilsenrath did his best to entirely redirect the

discussion of Bernanke's legacy by setting up so many strawmen even TS

Eliot would be totally lost. Instead of focusing on the person who was,

together with his predecessor, was directly responsible for a crisis,

which over the course of 30 years of "great moderation" pulled over $30

trillion in future demand to the present (benefiting almost exclusively

the banker class), and which will guarantee pain and suffering for

generations of Joe Sixpacks, he portrayed Bernanke in the light of St.

Ben, or the person who may or may not have done enough to save

Capitalism. We fail to fall for the bait. We hope nobody else will

either. Which is why we present the following compilation of documented

Chairsatan greatest hits from the public record. It speaks more than

any planted article ever could.

Overnight

the WSJ's Jon Hilsenrath did his best to entirely redirect the

discussion of Bernanke's legacy by setting up so many strawmen even TS

Eliot would be totally lost. Instead of focusing on the person who was,

together with his predecessor, was directly responsible for a crisis,

which over the course of 30 years of "great moderation" pulled over $30

trillion in future demand to the present (benefiting almost exclusively

the banker class), and which will guarantee pain and suffering for

generations of Joe Sixpacks, he portrayed Bernanke in the light of St.

Ben, or the person who may or may not have done enough to save

Capitalism. We fail to fall for the bait. We hope nobody else will

either. Which is why we present the following compilation of documented

Chairsatan greatest hits from the public record. It speaks more than

any planted article ever could.

Today Egon von Greyerz told King World News, “I’m seeing how massive

amounts of money are within the system, and people think they are safe,

but they are not.” Greyerz, who is founder and managing partner at

Matterhorn Asset Management out of Switzerland, also warned, “This is

the illusion that people are living under, and it’s very sad. That’s

not going to be the case. The banks are going to close if there is a

problem, and people are not going to get access to their assets.”

Today Egon von Greyerz told King World News, “I’m seeing how massive

amounts of money are within the system, and people think they are safe,

but they are not.” Greyerz, who is founder and managing partner at

Matterhorn Asset Management out of Switzerland, also warned, “This is

the illusion that people are living under, and it’s very sad. That’s

not going to be the case. The banks are going to close if there is a

problem, and people are not going to get access to their assets.”  Expectations

for tomorrow's J-Hole speech by the venerable Ben Bernanke vary from

the mundane "things-we-can-still-do; monitoring-situation" to the

exuberant

"we'll-print-our-way-out-of-this-mess-no-matter-what-and-I've-got-your-back-for-anything-more-than-a-1%-drop-in-the-Russell".

We suspect, like Morgan Stanley's Vince Reinhart that a lot of people

are going to be grossly disappointed as the FOMC (C for Committee) meeting is so close and the election being just around the corner means playing-down any miracle-making. Instead we

suspect it will be more of the same - disappointment in economic

performance, could do better, closely monitoring, Fed-has-tools; i.e. a

replay of most of his recent speeches in tone. Reinhart does

see some room for surprise though - especially on conditional policy

rules (and the potential problems with over-reaching their mandate).

Expectations

for tomorrow's J-Hole speech by the venerable Ben Bernanke vary from

the mundane "things-we-can-still-do; monitoring-situation" to the

exuberant

"we'll-print-our-way-out-of-this-mess-no-matter-what-and-I've-got-your-back-for-anything-more-than-a-1%-drop-in-the-Russell".

We suspect, like Morgan Stanley's Vince Reinhart that a lot of people

are going to be grossly disappointed as the FOMC (C for Committee) meeting is so close and the election being just around the corner means playing-down any miracle-making. Instead we

suspect it will be more of the same - disappointment in economic

performance, could do better, closely monitoring, Fed-has-tools; i.e. a

replay of most of his recent speeches in tone. Reinhart does

see some room for surprise though - especially on conditional policy

rules (and the potential problems with over-reaching their mandate). With

a price hovering around $1,600 an ounce and the prospect of "additional

monetary accommodation" hinted to in the latest meeting of the FOMC,

gold is once again becoming a hot topic of discussion. Krugman, praising

With

a price hovering around $1,600 an ounce and the prospect of "additional

monetary accommodation" hinted to in the latest meeting of the FOMC,

gold is once again becoming a hot topic of discussion. Krugman, praising

In

November 2008, President Barack Obama won the popular election for

President by 9.5 million votes. A burgeoning financial crisis and

weakening economy helped his candidacy at the time, but four years on

the sluggish pace of economic recovery is a headwind to his

re-election. Consider, for example, that there are

In

November 2008, President Barack Obama won the popular election for

President by 9.5 million votes. A burgeoning financial crisis and

weakening economy helped his candidacy at the time, but four years on

the sluggish pace of economic recovery is a headwind to his

re-election. Consider, for example, that there are  If you are a serious firearms enthusiast or what some people now

refer to as a “Prepper”, having a supply of ammunition is an absolute

must. Regardless of what the main stream media says, it is not

“abnormal” or “sinister” for people to store thousands of rounds of

ammunition. For whatever reason you choose to stockpile ammo, the

reality is that it’s a wise choice to do so. Let’s take a look at some

interesting facts about ammunition, and the bull run of “Ballistic

Precious Metals” over the last 20 years.

If you are a serious firearms enthusiast or what some people now

refer to as a “Prepper”, having a supply of ammunition is an absolute

must. Regardless of what the main stream media says, it is not

“abnormal” or “sinister” for people to store thousands of rounds of

ammunition. For whatever reason you choose to stockpile ammo, the

reality is that it’s a wise choice to do so. Let’s take a look at some

interesting facts about ammunition, and the bull run of “Ballistic

Precious Metals” over the last 20 years.  Today Tom Fitzpatrick spoke with King World News about the “decisive”

areas to watch for on both gold and silver. A break of these key areas

will ignite gold and silver to the upside. Fitzpatrick also issued

major warnings regarding the global stock markets and China.

Today Tom Fitzpatrick spoke with King World News about the “decisive”

areas to watch for on both gold and silver. A break of these key areas

will ignite gold and silver to the upside. Fitzpatrick also issued

major warnings regarding the global stock markets and China.

Even though it might have been a symbolic gesture, the delegates

behind Ron Paul were intending to at least get Rep. Paul nominated at

the convention. It would give a great boost to the grand liberty

movement Dr. Paul has built for the last 20 years and the rebellion

against establishment control of the GOP. They only needed delegate

majorities from 5 states to nominate the good doctor and to keep Romney

from going uncontested before the convention. But alas, the illegal

maneuvers of the RNC have robbed the movement of their last show before

the cameras, and contrary to assurances by an “insider” within the RNC,

Ron Paul will get no speaking slot.

Even though it might have been a symbolic gesture, the delegates

behind Ron Paul were intending to at least get Rep. Paul nominated at

the convention. It would give a great boost to the grand liberty

movement Dr. Paul has built for the last 20 years and the rebellion

against establishment control of the GOP. They only needed delegate

majorities from 5 states to nominate the good doctor and to keep Romney

from going uncontested before the convention. But alas, the illegal

maneuvers of the RNC have robbed the movement of their last show before

the cameras, and contrary to assurances by an “insider” within the RNC,

Ron Paul will get no speaking slot.![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)