Today's $1.24 Billion Targeted Gold Slam Down Makes The Mainstream Press

For the first time in what may be ages, a phenomenon that has become near and dear to anyone who trades gold, and which at best elicits a casual smirk from those who observe it several times daily, we find that the WSJ has finally picked up on the topic of the endless daily gold slam down, where the seller in complete disregard for market disruption (because in a normal world one wants to sell any given lot without notifying the market that one is selling so as to get a good price on the next lot... but not in the gold market where the seller slams the bid with reckless abandon) ignores market depth and in a demonstration of nothing but brute price manipulation force, slams every bid down just to demoralize further buying. Naturally, that this simply provides buyers with a more depressed price than is "fair" is lost on the seller, but not on the buyers who promptly bid up the metal as attempt to demoralize buying end in failure after failure. Yet it is peculiar that today, for the first time, the intraday gold slam down has finally made the MSM. To wit: "The CME Group Inc.’s Comex division recorded an unusually large transaction of 7,500 gold futures during one minute of trading at 8:31 a.m. EDT. The sale took out blocks of bids as large as 84 contracts in one fell swoop and cut prices down to $1,648.80 a troy ounce. The overall transaction was worth more than $1.24 billion... Gold traders buzzed with speculation that the transaction was an input error — a so-called “fat finger” trade. “Or a Gold Finger as it might be known in the bullion market,” traders at Citi joked in a note to clients." Well, no. It wasn't.

Biderman On The Fed: "They Control The Market, We Play With Their Money"

The pastel-wearing President of TrimTabs proffers an entirely non-perfunctory prose explaining why he believes we are now due for a stock market decline. Echoing our thoughts, Charles notes that "It's

the Federal Reserve that controls the market, it's their money,

they're the boss, we play with their money that they print or stop

printing". Sadly true (especially for all the highly-paid

economists and strategists out there), the pre-2009 drivers of equity

performance (specifically new or excess savings) are no longer so;

since the initial QE1 this has not been the case and providing us with a

thoughtful history of equity market valuations relative to the various

QE-efforts over the past few years - especially when compared to

income growth and/or macro-economic data - provides just the color

required to comprehend this essentially a obvious thread of reality

that merely four years ago would have been denigrated to the

tin-foil-hat-wearers of the world. Real-time data says that

wages and salaries are barely growing above inflation, Europe is a

disaster, and the emerging nations are seeing slowing growth; without

the Fed's new money where will cash come from to drive stock prices

higher? The question is, assuming the Fed will 'stimulate'

again pre-Election, will the market react the same way? And will the

trigger for such an event be a major decline once again in asset prices?

The pastel-wearing President of TrimTabs proffers an entirely non-perfunctory prose explaining why he believes we are now due for a stock market decline. Echoing our thoughts, Charles notes that "It's

the Federal Reserve that controls the market, it's their money,

they're the boss, we play with their money that they print or stop

printing". Sadly true (especially for all the highly-paid

economists and strategists out there), the pre-2009 drivers of equity

performance (specifically new or excess savings) are no longer so;

since the initial QE1 this has not been the case and providing us with a

thoughtful history of equity market valuations relative to the various

QE-efforts over the past few years - especially when compared to

income growth and/or macro-economic data - provides just the color

required to comprehend this essentially a obvious thread of reality

that merely four years ago would have been denigrated to the

tin-foil-hat-wearers of the world. Real-time data says that

wages and salaries are barely growing above inflation, Europe is a

disaster, and the emerging nations are seeing slowing growth; without

the Fed's new money where will cash come from to drive stock prices

higher? The question is, assuming the Fed will 'stimulate'

again pre-Election, will the market react the same way? And will the

trigger for such an event be a major decline once again in asset prices?MUST WATCH: Paul vs. Paul on Bloomberg TV

Paul Vs Paul Post-Mortem

By

way of post-mortem of this afternoon's epic Paul vs Paul Bloomberg TV

cage-match, we reflect on the various headlines the two gentlemen made

during the event and in the context of the credibility with which one

of the gentlemen discusses his ability to manage the world and the

'ease' with which he and his henchmen can control inflation (and yet an

unmanaged economy is subject to 'extreme volatility'),

we remind readers of the post-WWII years and the extreme swings in

purchasing power that their so-called managed economy created. As ever

it appears the mutually-assured-destruction fall-back premise of

Keynesian Krugman is trumped by the fact-based method of the more

Pragmatic Paul.

By

way of post-mortem of this afternoon's epic Paul vs Paul Bloomberg TV

cage-match, we reflect on the various headlines the two gentlemen made

during the event and in the context of the credibility with which one

of the gentlemen discusses his ability to manage the world and the

'ease' with which he and his henchmen can control inflation (and yet an

unmanaged economy is subject to 'extreme volatility'),

we remind readers of the post-WWII years and the extreme swings in

purchasing power that their so-called managed economy created. As ever

it appears the mutually-assured-destruction fall-back premise of

Keynesian Krugman is trumped by the fact-based method of the more

Pragmatic Paul.- *KRUGMAN SAYS UNMANAGED ECONOMY SUBJECT TO "EXTREME VOLATILITY"

- *PAUL SAYS FED IS LENDER OF LAST RESORT FOR POLITICIANS

- *KRUGMAN SAYS U.S. ECONOMY IS "PERSISTENTLY DEPRESSED"

- *RON PAUL: FED HAS DESTROYED 98% OF DOLLAR'S VALUE SINCE 1913

Liar...Krugman Claims FED Policy Doesn’t Effect Food & Oil Prices, The Dollar Hasn’t Gone Down

One Minute Chart of Gold - 7,501 contracts

Trader Dan at Trader Dan's Market Views - 2 hours ago

By request of a reader S Roche, I am providing a one minute chart showing

the enormity of the trade in gold early this morning (4-30)

Please donate...

Thank You

One Minute Chart of Gold Detailing Volume

Trader Dan at Trader Dan's Market Views - 2 hours ago

Lousy Chicago PMI figures/bad Greek retail sales/Egan Jones lowers Spanish debt to BB plus from BBB-/ECB set to do margin calls on LTRO banks

Harvey Organ at Harvey Organ's - The Daily Gold and Silver Report - 6 hours ago

Good

evening Ladies and Gentlemen:

At 8:31 we had a huge 7500 contracts sold at the opening. Some say it

was a fat finger.

I say hogwash!!!

(courtesy Tatyana Shumsky/Wall Street Journal)

Gold Shakes Off $1.24 Billion ‘Fat Finger’

By Tatyana ShumskyGold futures ended nearly unchanged Monday, after a

large early-morning sell order roiled traders and slashed prices by

almost $15.

The CME

Monthly Gold Charts

Trader Dan at Trader Dan's Market Views - 8 hours ago

Isn't it amazing that some are so ready to call for an end to the bull

market in gold. From a monthly chart perspective, there is nothing to

indicate such an occurrence.

In 2008, the CLOSING MONTHLY GOLD PRICE dropped 26.5% from its best to

worst level before it renewed its uptrend.

More recently, gold has dropped a mere 14.4% from it bests closing monthly

level to its worst level reached with a handle of "15" in front of the gold

price.

Keep in mind that purely from a long term technical chart perspective, the

metal remains in a solid uptrend.

As a side note - for those of you ... more »

FAT FINGER IN SILVER TOO?

Trader Dan at Trader Dan's Market Views - 9 hours ago

Traders continue to chatter about the so-called "FAT FINGER" trade in gold

that occurred early this morning, a trade which dropped the gold price $15

in minutes and consisted of an order of 7,500 contracts. Many seem to agree

that it was a trade placed in error.

The problem is that we also witnessed a similar surge in the volume done in

the nearby silver pit at the exact same moment. Note the time right after

the 5:00 AM hour (Pacific time) on the following 5 minute chart and see how

large the volume was compared to that for the remainder of the session.

No matter who did the trade,... more »

Economy May Be Headed Into Free Fall Again

Dave in Denver at The Golden Truth - 11 hours ago

*Many borrowers, particularly since late 2010, thought they were buying at

the bottom of a housing market that had already suffered steep declines,

but have been caught out by a continued fall in prices in wide swaths of

America. - *source link below

First things first. Remember this big dog and pony show Bernanke went on a

couple weeks ago to pontificate on how open the Fed is about how it

conducts its operations now? Well it turns out that is just another

well-crafted cover-story for the truth. Those of us who follow and

understand the truth know that Bernanke is about as ful... more »

Gold Takedown Rejected

Trader Dan at Trader Dan's Market Views - 12 hours ago

Take a look at the following 5 minute chart and note especially the volume

readings posted below each individual price bar. Look just past the 5:00 AM

Pacific time hour and you will see the enormous volume spike accompanying

the sharp downdraft that occured in the gold price dropping it $15 in the

course of minutes. Analysts are still grasping for an explanation.

The most common is that it was another one of those "fat fingered trades".

Have you ever noticed how many fat fingered human beings apparently camp

out in the trading community. Last time I checked a skinny finger could hit ... more »

The issue which has swept down the centuries and which will have to be fought sooner or later, is the people versus the banks. – Lord Acton [1834-1902]

Gold has Bottomed, Alf Fields

Elliott Wave Gold Update: In the article “What Happened to Gold” dated 1 March 2012, the “other possibilities” mentioned in the event of gold dropping below $1650 related firstly to the 61.8% retracement of the prior rise. The prior rise was from $1523 to $1792, so the 61.8% retracement was $1626. There was a further possibility of the retracement being 2/3 of the prior rise, also a Fibonacci relationship. That produced a figure of $1612. The first number $1626 did provide some support to the market but the absolute low was $1612.8 on 4 April 2012. This low came at the culmination of a double zig-zag correction, which adds to the validity of that low. The odds now suggest that the gold correction bottomed at $1612.8 on 4 April 2012 and that the gold market is in the early stages of a sharp upward move.

Apr 28, 2012

Alf Field

Dear CIGAs,

Yra Harris seriously is the brightest intellect in the Western

financial world today. He is a fully balanced individual capable of

being the Secretary of Treasury with skill sets in excess of any

individual holding that office in my lifetime. Here is his take on the

French election which I assure you has the ability of being the most

important event in the saga of Euroland. I am proud that Yra was my

Chicago floor partner in the wild 70s. Yra’s father Lenny, like Bert, is

a legend in this business, but I feel Yra will do more important and

bigger things than I or Lenny have. This man is a financial leader for

the future. He is a major resource for you.

Jim

Notes From Underground: No Box Can Contain These Thoughts (Excerpts from post)

OUTSIDE THE BOX ON THE FRENCH ELECTIONS: Everyday I think about this Sunday’s French presidential elections the outcome grows in importance. WHY? If Sarkozy were to lose, in my mind it will represent a sea change in the political fabric of the European polity. Sarkozy is a disciple of Charles de Gaulle whose policies for France, both foreign and domestic, were to return France to its role as an economic power and diplomatic hegemony. However, after the Suez debacle of 1956 when Eisenhower admonished Israel, France and Britain for their international bravado in seizing the SUEZ CANAL, the British understood their role in the world had changed and it was now the U.S. shaping global policy. De Gaulle understood the game had changed also, but his stance was to keep the U.S. from being the world’s dominant power. Under de Gaulle, whatever the U.S. favored, France was against. France as a participant in NATO … ABSURD.

De Gaulle thought to tie France and Germany together in a unified Europe that could counter-balance the global power of the U.S. The French diplomatic corp with the German economic locomotive. Remember, it was de Gaulle who crowed that Europe was France and Germany. It was also de Gaulle’s economic advisor, Jacques Reuff, who helped put an end to the Bretton Woods’ world by French demands for U.S. GOLD as they sought to exchange their vast horde of GREENBACKS all in an effort to prevent the U.S. from being the global HEGEMONY.

So as the election of 2012 reaches its end, will Francois Hollande defeat Sarkozy and put an end to MERKOZY? The SOCIALIST candidate Hollande seems to be seeking to diminish the incipient strength of Germany by espousing the belief that France should align with the peripheries and others in pushing for a GROWTH PACT rather than the FISCALSADISM PROMOTED BY THE GERMAN BUNDESBANKERS.

The death of Gaullism will create a period of confusion in a Franco-German-dominated EU. A French alliance with the weaker states would be a major statement about contemporary Europe. With Putin always looking to roil the status quo and Gerhard Schroeder heading NORDSTREAM, the pipeline arm of GAZPROM, Germany’s largest energy provider, the French election looms very large indeed. Russia can become a very significant variable as an alternative to the role that France has played in Europe during the last 50 years. As the SUNDANCE KID SAID: “YOU JUST KEEP THINKING BUTCH. THAT’S WHAT YOU’RE GOOD AT.”

More…

Jim Sinclair’s Commentary

I told you my clone would arrive. The difference is he is in the cash market.

The squeeze is on and this time it is for real. Alf sees it. I see it.

The invisible hand is a stronger long in the cash market than the obvious shenanigans of the paper trading banksters.

Gold Shakes Off $1.24 Billion ‘Fat Finger’ By Tatyana Shumsky

April 30, 2012, 3:59 PM

Gold futures ended nearly unchanged Monday, after a large early-morning sell order roiled traders and slashed prices by almost $15.

The CME Group Inc.’s Comex division recorded an unusually large transaction of 7,500 gold futures during one minute of trading at 8:31 a.m. EDT. The sale took out blocks of bids as large as 84 contracts in one fell swoop and cut prices down to $1,648.80 a troy ounce. The overall transaction was worth more than $1.24 billion.

Gold traders buzzed with speculation that the transaction was an input error — a so-called "fat finger" trade.

"Or a Gold Finger as it might be known in the bullion market," traders at Citi joked in a note to clients.

One indicator that the transaction was a mistake was its size. At 750,000 troy ounces, such large trades are rarely conducted amid very thin trading volumes. Monday trading was expected to be quiet as market participants in China and Japan are out on holiday and many European traders are preparing for a holidays there.

More…

Jim Sinclair’s Commentary

We will take it a step at a time. The true range in 2012 is $1700 to

$2111. There is no way in hell Martin is correct short term.

Gold may touch $7,000 per ounce before end of uptrend

Reuters Apr 25, 2012, 03.51AM IST

NEW YORK: While gold’s latest price gyrations may seem excessive to some investors, Bank of America analyst MacNeil Curry said the volatility was nowhere near extreme enough to convince him the precious metal’s long-term uptrend was nearing the end.

In fact, at last week’s Market Technicians Association symposium he said of gold’s secular bull trend, "From an Elliott Wave perspective, we have seen a nice, solid, orderly advance."

Though gold has swung in ranges of roughly $40 per ounce in the last week, $90 per ounce over the last four weeks, and close to $400 since last September when it reached its all-time high at $1,920.30, Curry said any long-term commodity advance tends to end with, "a massive speculative blow-off."

"They don’t end quietly," the technician told conferees. He projects gold will ascend to levels somewhere between $3,000 to $5,000 and potentially $7,000 per ounce before the rally, now in its 11th year, comes to a close.

Spot gold prices jumped on Tuesday to a high at $1,648.91, after sliding almost $22 in the previous session to $1,619.99 an ounce, nearly matching the April 4 low. It stabilized at $1,640.60 per ounce in late Tuesday trade.

More…

Jim Sinclair’s Commentary

Go Bill!

Russia Today’s ‘Capital Account’ interviews GATA’s Bill Murphy Submitted by cpowell on 06:33PM ET Monday, April 30, 2012. Section: Daily Dispatches

9:36p ET Monday, April 30, 2012

Dear Friend of GATA and Gold:

GATA Chairman Bill Murphy was interviewed today for about 20 minutes by Lauren Lyster on the cable television network Russia Today’s "Capital Account" program. There’s a reason why the subject — gold market manipulation — can be discussed only in non-Western news media, and the continuing interest shown in it by Russia Today, a creation of the Russia government, suggests that governments not part of the market rigging have long figured it out. While Lyster’s skirt is, certainly by design, shorter than JPMorgan’s position in silver, she is once again well-versed in the subject and unafraid to press it to its uncomfortable conclusion, unlike the "money honeys" of U.S. cable TV networks. The RT interview with Murphy is posted at YouTube here:

The Decline And Fall Of Suburbia

As Arch Daily

notes, for decades the suburbs and the American Dream went hand-in-hand

but the age-of-sprawl is ending; people are leaving the suburbs and

once again flocking to cities in search of a better way of life. Whether

Suburbia can be saved or not, this useful infographic looks at the key

factors (from Poverty to Transportation costs to Generation Y's

preferences) with a view to reinventing Suburbia as a sustainable

alternative to urban life.

As Arch Daily

notes, for decades the suburbs and the American Dream went hand-in-hand

but the age-of-sprawl is ending; people are leaving the suburbs and

once again flocking to cities in search of a better way of life. Whether

Suburbia can be saved or not, this useful infographic looks at the key

factors (from Poverty to Transportation costs to Generation Y's

preferences) with a view to reinventing Suburbia as a sustainable

alternative to urban life.China Manufacturing Continues To 'Contract-And-Expand' Even As April PMI Misses Expectations

The

topsy-turvy world of Chinese macroeconomic data continues to provide

the Schrodinger-prone unreality that we have come to expect in this

keep-'em-guessing Central Bank-driven fiat-fest we are experiencing. For

9 of the last 10 months, HSBC's China Manufacturing PMI has been in a

contraction (sub-50) regime, while China's own Manufacturing PMI saw

only 1 dip below the apocryphal 50-level (in Nov11) and has miraculously

expanded for the last six months. The latest data from China

(HSBC reports their final number tomorrow - as opposed to the Flash

data already reported) showed the highest level of expansion for

Chinese manufacturing in 13 months but missed economist's expectations -

notably the first miss since November 2011 - as the divergence between

HSBC and China remains near record levels. Of course, this makes

perfect sense given this evening's 2nd worst three-month plunge in Australian Manufacturing since January 2009

(which seems to fit with the HSBC data as opposed to the 'strength' of

the Chinese data). It seems tough for anyone to try to justify

expectations of a Chinese stimulus given the country's own indication of

its performance - check back to you Ben.

The

topsy-turvy world of Chinese macroeconomic data continues to provide

the Schrodinger-prone unreality that we have come to expect in this

keep-'em-guessing Central Bank-driven fiat-fest we are experiencing. For

9 of the last 10 months, HSBC's China Manufacturing PMI has been in a

contraction (sub-50) regime, while China's own Manufacturing PMI saw

only 1 dip below the apocryphal 50-level (in Nov11) and has miraculously

expanded for the last six months. The latest data from China

(HSBC reports their final number tomorrow - as opposed to the Flash

data already reported) showed the highest level of expansion for

Chinese manufacturing in 13 months but missed economist's expectations -

notably the first miss since November 2011 - as the divergence between

HSBC and China remains near record levels. Of course, this makes

perfect sense given this evening's 2nd worst three-month plunge in Australian Manufacturing since January 2009

(which seems to fit with the HSBC data as opposed to the 'strength' of

the Chinese data). It seems tough for anyone to try to justify

expectations of a Chinese stimulus given the country's own indication of

its performance - check back to you Ben.As Europe's Most Pathological Liar Departs, Questions About Europe's Band-Aid Union Reemerge

We doubt many tears will be shed over the now official departure of Europe's most embarrassing political figurehead: the head of the Euro-area finance ministers, one Jean-Claude Juncker, whose presence did more documented damage to the credibility of Europe than... well, we would say virtually anyone else, but then again since everyone else in the European pantheon is a shining example of DSM IV-level sociopathology, we are kinda stuck. But anyway: Juncker is finally gone "he’s tired of Franco-German interference in managing the region’s debt crisis." And while the decision was known for a while, the ultimate catalyst is rather unexpected, and exposes just how frail the entire Eurozone is: “They act as if they are the only members of the group,” Juncker said today at a podium discussion in Hamburg." If this is coming from the man who admittedly lies for a living, we can't imagine just how bad the truth about the internal fissures within the Eurozone must be. Actually, we can.Rosenberg Takes On The Student Loan Bubble, And The 1937-38 Collape; Summarizes The Big Picture

Few have been as steadfast in their correct call that the US economy sugar high of the first quarter was nothing but a liquidity-driven, hot weather-facilitated uptick in the economy, which has now ended with a thud, as seen by the recent epic collapse in all high-frequency economic indicators, which have not translated into a market crash simply because the market is absolutely convinced that the worse things get, the more likely the Fed is to come in with another round of nominal value dilution. Perhaps: it is unclear if the Fed will risk a spike in inflation in Q2 especially since as one of the respondents in today's Chicago PMI warned very prudently that Chinese inflation is about to hit America in the next 60 days. That said, here are some of today's must read observations on where we stand currently, on why 1937-38 may be the next imminent calendar period deja vu, and most importantly, the fact that Rosie now too has realized that the next credit bubble is student debt as we have been warning since last summer.Treasury Forecasts $447 Billion In Funding Needs Thru End Of September - $300 Billion Shy Of Trendline

Earlier

today, the Treasury forecast that in the third and fourth fiscal

quarter of 2012 (April-September), the US would need a total of $447

billion in new debt (split $182 billion in Q3 and $265 billion in Q4),

bringing the total debt balance to just over $16 trillion by the end of

September. While this is a commendable forecast, and one which

certainly has provided to alleviate rumors that the US debt ceiling of

$16.4 trillion would be breached by the mid/end of September, the chart

below shows that it may be just a tad optimistic.

Earlier

today, the Treasury forecast that in the third and fourth fiscal

quarter of 2012 (April-September), the US would need a total of $447

billion in new debt (split $182 billion in Q3 and $265 billion in Q4),

bringing the total debt balance to just over $16 trillion by the end of

September. While this is a commendable forecast, and one which

certainly has provided to alleviate rumors that the US debt ceiling of

$16.4 trillion would be breached by the mid/end of September, the chart

below shows that it may be just a tad optimistic. Treasuries And Gold Outperform As Financials Drag Stocks Down In April

April

ended on a weak tone (after another set of weak macro data) with a day

of risk-asset deterioration amid low ranges and low volumes as the

S&P 500 broke its 4-day rally streak. AAPL was a standout having given back over 60% of its post-earnings spike and nearing a break below its 50DMA once again. HY credit outperformed with an afternoon surge (in HYG also) taking it back into the green for the month - even as the S&P 500 remains marginally off March's close and underperformed along with IG credit today.

Treasuries leaked lower in yield for most of the day but gave half of

it back into the close (after Treasuries' best month in 7 months -

perhaps a modestly expected give back on some rebalancing). Gold

outperformed Silver once again today as Silver fell back to basically

retrace all of its YTD gains relative to stocks - both up just over 11%

YTD now (note that Silver was +32% prior to LTRO2). Stocks remain rich

relative to Treasuries less-than-stellar implications but financials

(which had their worst month since November) dragged the broad market

down for its first losing month in the last six, as Utilities and

Staples the only sectors with a reasonable gain this month. JPY

strength and AUD weakness were evident and implied weakness today but

in general the USD did very little on this last day of the month. VIX

ended above 17% on the day, up almost 1vol as the term structure

bear-flattened a little. Overall, a weak-end to the month with little

apparent confidence in extending the QE-hope trend of the last few days

as stocks remain hugely rich to broad risk-assets overall and most notably Treasuries.

April

ended on a weak tone (after another set of weak macro data) with a day

of risk-asset deterioration amid low ranges and low volumes as the

S&P 500 broke its 4-day rally streak. AAPL was a standout having given back over 60% of its post-earnings spike and nearing a break below its 50DMA once again. HY credit outperformed with an afternoon surge (in HYG also) taking it back into the green for the month - even as the S&P 500 remains marginally off March's close and underperformed along with IG credit today.

Treasuries leaked lower in yield for most of the day but gave half of

it back into the close (after Treasuries' best month in 7 months -

perhaps a modestly expected give back on some rebalancing). Gold

outperformed Silver once again today as Silver fell back to basically

retrace all of its YTD gains relative to stocks - both up just over 11%

YTD now (note that Silver was +32% prior to LTRO2). Stocks remain rich

relative to Treasuries less-than-stellar implications but financials

(which had their worst month since November) dragged the broad market

down for its first losing month in the last six, as Utilities and

Staples the only sectors with a reasonable gain this month. JPY

strength and AUD weakness were evident and implied weakness today but

in general the USD did very little on this last day of the month. VIX

ended above 17% on the day, up almost 1vol as the term structure

bear-flattened a little. Overall, a weak-end to the month with little

apparent confidence in extending the QE-hope trend of the last few days

as stocks remain hugely rich to broad risk-assets overall and most notably Treasuries.Egan Jones Cuts Spain For Second Time In Two Weeks, From BBB- To BB+

Even as the SEC is hell bent on destroying Egan Jones as a rating agency, in the process cementing its status as an objective, independent, and honest third party research entity, the firm is just as hell bent on milking its still existing NRSRO status for all it's worth. Because while Egan Jones was the first entity to cut Spain two weeks ago, only to be followed by Spain, it just did so again minutes ago.Money Can Buy Happiness

The oft-cited idiom that "money can't buy you happiness" - except in Phat Phong from what we hear - is summarily discussed by Michael Norton in this TED Talk as he notes that if you think that money cannot buy happiness then you are not spending it right. His point is (and his delivery is comedic yet clarifying) that money makes you anti-social or selfish

(rather than happy) as we will tend to spend that money on ourselves

(or the wrong things - a new Veyron perhaps?). But via experimentation

(among people from Vancouver to Uganda) he discovered that spending money in a pro-social way will make you happy... So money can buy you happiness as long as you give it away once you have it - a noteworthy caveat

- especially as Norton notes that the size of spending does not matter -

as long as it focused towards someone else (and not, as he notes, in a

dinner for your girlfriend with hopes of benefits later). In almost

every country in the world, people who give money to charity are happier

than people who do not give money to charity and interestingly

spending-on-other-people made teams or people (sports or sales) more

successful - of course, we assume taxation does not count as spending on other people.

The oft-cited idiom that "money can't buy you happiness" - except in Phat Phong from what we hear - is summarily discussed by Michael Norton in this TED Talk as he notes that if you think that money cannot buy happiness then you are not spending it right. His point is (and his delivery is comedic yet clarifying) that money makes you anti-social or selfish

(rather than happy) as we will tend to spend that money on ourselves

(or the wrong things - a new Veyron perhaps?). But via experimentation

(among people from Vancouver to Uganda) he discovered that spending money in a pro-social way will make you happy... So money can buy you happiness as long as you give it away once you have it - a noteworthy caveat

- especially as Norton notes that the size of spending does not matter -

as long as it focused towards someone else (and not, as he notes, in a

dinner for your girlfriend with hopes of benefits later). In almost

every country in the world, people who give money to charity are happier

than people who do not give money to charity and interestingly

spending-on-other-people made teams or people (sports or sales) more

successful - of course, we assume taxation does not count as spending on other people. Hugh

Hendry is back with a bang after a two year hiatus with what so many

have been clamoring for, for so long - another must read letter from

one of the true (if completely unsung) visionary investors of our time:

"I have not written to you at any great length since the winter of

2010. This is largely because not much has happened to change our

views. We still see the global economy as grotesquely distorted by the

presence of fixed exchange rates, the unraveling of which is creating

financial anarchy, just as it did in the 1920s and 1930s. Back then the

relevant fixes were around the gold standard. Today it is the dual

fixed pricing regimes of the euro countries and of the dollar/renminbi

peg."

Hugh

Hendry is back with a bang after a two year hiatus with what so many

have been clamoring for, for so long - another must read letter from

one of the true (if completely unsung) visionary investors of our time:

"I have not written to you at any great length since the winter of

2010. This is largely because not much has happened to change our

views. We still see the global economy as grotesquely distorted by the

presence of fixed exchange rates, the unraveling of which is creating

financial anarchy, just as it did in the 1920s and 1930s. Back then the

relevant fixes were around the gold standard. Today it is the dual

fixed pricing regimes of the euro countries and of the dollar/renminbi

peg."

"A majority of doctors support measures to deny treatment to smokers and the obese, according to a survey that has sparked a row over the NHS‘s growing use of 'lifestyle rationing'",

"A majority of doctors support measures to deny treatment to smokers and the obese, according to a survey that has sparked a row over the NHS‘s growing use of 'lifestyle rationing'",

In this case we really do hate to say we-told-you-so but our concerns over social unrest and the rise of extreme nationalism (

In this case we really do hate to say we-told-you-so but our concerns over social unrest and the rise of extreme nationalism ( On this slow news and market action day it is worth noting that Equities and Treasuries have dramatically dislocated in the last few days with Treasury yields near multi-month lows and stocks at one-month highs. Whether this is the (

On this slow news and market action day it is worth noting that Equities and Treasuries have dramatically dislocated in the last few days with Treasury yields near multi-month lows and stocks at one-month highs. Whether this is the ( Given

the TBTF's dominant oligopoly of the credit derivatives market (due

mainly to the large exchange's unwillingness to act appropriately when

they know the blow-back from their sell-side clients would be

considerable), it is perhaps surprising that ISDA (the body that

Given

the TBTF's dominant oligopoly of the credit derivatives market (due

mainly to the large exchange's unwillingness to act appropriately when

they know the blow-back from their sell-side clients would be

considerable), it is perhaps surprising that ISDA (the body that

When most people think of the economic decline that is happening in

America, most of them think of states like California and cities like

Detroit. In both cases, unemployment is rampant, government finances

are a mess, and businesses and families are both leaving in droves. So

what is causing this? What do California and Detroit have in common?

Well, for one thing, both the state of California and the city of

Detroit have been run by anti-business socialist control freaks for

decades. Once upon a time millions of young Americans that dreamed of a

better life flocked to California and Detroit was one of the most

vibrant manufacturing cities in the history of the world. But now both

of them are in an advanced state of decline, and a lot of the blame can

be placed at the feet of the politicians in both cases. Both

California and Detroit have become very unfriendly places to businesses

and families, so businesses and families have been leaving both

California and Detroit in very large numbers. At the same

time, the socialist welfare policies in both places have caused them to

become magnets for those that enjoy being dependent on the government.

Welfare recipients are not likely to pack up and move down to Texas

because they know that their benefits would not be nearly as good down

there. So both California and Detroit will continue to attract those

that want to live under socialist control freaks and it will continue to

drive away those that do not want to live under socialist control

freaks.

When most people think of the economic decline that is happening in

America, most of them think of states like California and cities like

Detroit. In both cases, unemployment is rampant, government finances

are a mess, and businesses and families are both leaving in droves. So

what is causing this? What do California and Detroit have in common?

Well, for one thing, both the state of California and the city of

Detroit have been run by anti-business socialist control freaks for

decades. Once upon a time millions of young Americans that dreamed of a

better life flocked to California and Detroit was one of the most

vibrant manufacturing cities in the history of the world. But now both

of them are in an advanced state of decline, and a lot of the blame can

be placed at the feet of the politicians in both cases. Both

California and Detroit have become very unfriendly places to businesses

and families, so businesses and families have been leaving both

California and Detroit in very large numbers. At the same

time, the socialist welfare policies in both places have caused them to

become magnets for those that enjoy being dependent on the government.

Welfare recipients are not likely to pack up and move down to Texas

because they know that their benefits would not be nearly as good down

there. So both California and Detroit will continue to attract those

that want to live under socialist control freaks and it will continue to

drive away those that do not want to live under socialist control

freaks. City and federal authorities have reacted bizarrely to the revelation

that the Red Cross has been ordered to prepare for the possible

evacuation of Chicago during next month’s NATO summit by refusing to

acknowledge that the directive came from them.

City and federal authorities have reacted bizarrely to the revelation

that the Red Cross has been ordered to prepare for the possible

evacuation of Chicago during next month’s NATO summit by refusing to

acknowledge that the directive came from them. If you’re not familiar with “Washingtonspeak” – that odd, unique

variance of the English language in which words don’t really mean what

they are supposed to mean – you might not know that the lawmakers who

wrote the new Cyber Intelligence Sharing and Protection Act (CISPA)

aren’t really too concerned about the protection aspect of the

legislation, at least as it applies to the general public’s concern

about privacy.

If you’re not familiar with “Washingtonspeak” – that odd, unique

variance of the English language in which words don’t really mean what

they are supposed to mean – you might not know that the lawmakers who

wrote the new Cyber Intelligence Sharing and Protection Act (CISPA)

aren’t really too concerned about the protection aspect of the

legislation, at least as it applies to the general public’s concern

about privacy. Hollande’s ‘Growth Bloc’ spells end of German

Hollande’s ‘Growth Bloc’ spells end of German

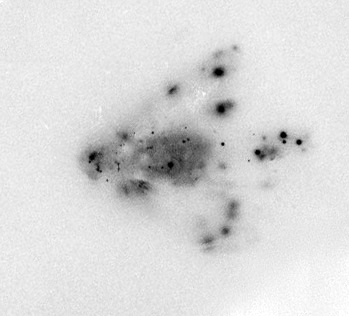

This image was published on the photo blog of Takashi Morizumi. It

appears Dr. Satoshi Mori was responsible for the x-ray-like view showing

black dots spread throughout the body of a small bird from Iitate

Village. The dots are said to be radioactive particles of Cs-137

internalized by eating contaminated insects.

This image was published on the photo blog of Takashi Morizumi. It

appears Dr. Satoshi Mori was responsible for the x-ray-like view showing

black dots spread throughout the body of a small bird from Iitate

Village. The dots are said to be radioactive particles of Cs-137

internalized by eating contaminated insects. Canada

Introduces New Plastic Currency … Canada may be permanently swapping

paper for plastic, providing its recently-released polymer $100 note is

well-received. The brand new bill was put into circulation starting Nov.

14, with $50 and $20 bills scheduled for 2012 and $10 and $5 bills

slotted to come out in 2013. Polymer currencies, first developed in the

1980s in Australia, have helped countries cut back on counterfeit bills.

Australia introduced polymer cash in 1988. A transparent maple leaf and

a clear portion on the left side of the bill with holographs that

change color in the light are designed to foil counterfeiters attempting

to create fake notes. – ABC News

Canada

Introduces New Plastic Currency … Canada may be permanently swapping

paper for plastic, providing its recently-released polymer $100 note is

well-received. The brand new bill was put into circulation starting Nov.

14, with $50 and $20 bills scheduled for 2012 and $10 and $5 bills

slotted to come out in 2013. Polymer currencies, first developed in the

1980s in Australia, have helped countries cut back on counterfeit bills.

Australia introduced polymer cash in 1988. A transparent maple leaf and

a clear portion on the left side of the bill with holographs that

change color in the light are designed to foil counterfeiters attempting

to create fake notes. – ABC News What

happens when debt-fueled false prosperity disappears? Just look at

Spain. The 4th largest economy in Europe was riding high during the

boom years, but now the Spanish economy is collapsing with no end in

sight. When a debt bubble gets interrupted, the consequences can be

rather chaotic. Just like we saw in Greece, austerity is causing the

economy to slow down in Spain. But when the economy slows down, tax

revenues fall and that makes it even more difficult to meet budget

targets. So even more austerity measures are needed to keep debt under

control and the cycle just keeps going. Unfortunately, even with all of

the recently implemented austerity measures the Spanish government is

still not even close to a balanced budget.

What

happens when debt-fueled false prosperity disappears? Just look at

Spain. The 4th largest economy in Europe was riding high during the

boom years, but now the Spanish economy is collapsing with no end in

sight. When a debt bubble gets interrupted, the consequences can be

rather chaotic. Just like we saw in Greece, austerity is causing the

economy to slow down in Spain. But when the economy slows down, tax

revenues fall and that makes it even more difficult to meet budget

targets. So even more austerity measures are needed to keep debt under

control and the cycle just keeps going. Unfortunately, even with all of

the recently implemented austerity measures the Spanish government is

still not even close to a balanced budget. American marines injured a Brazilian prostitute after throwing her out of an official Embassy car, it was reported today.

American marines injured a Brazilian prostitute after throwing her out of an official Embassy car, it was reported today.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)