from KingWorldNews:

Today 40 year veteran, Robert Fitzwilson, wrote the following piece exclusively for King World News. Fitzwilson, who is founder of The Portola Group, warned, “Changes are coming, but it doesn’t mean the world will come to an end. But financial regime changes do result in a massive transfer of wealth from those who own paper assets, to those that own real assets.”

“Reflecting upon the news and the current state of affairs, it is striking how events are playing out according to script, as history and strategists have predicted. In the beginning of our journey, it was focused on discovery, historical context and understanding as to what had changed about markets, governments and people. The answer is almost everything if one looks just at our lifetimes.

On the other hand, nothing has really changed if one takes a longer view. One of our favorite sayings is, “The only thing new is the history you have not read”

Robert Fitzwilson continues @ KingWorldNews.com

by David McWilliams, David McWilliams:

WELL that didn’t last long, did it? The financial market euphoria,

which greeted the announcement that the ECB would buy bonds in unlimited

quantities, has melted away. In its place, the realisation that

Europe’s economy is weakening quickly is puncturing short-lived

optimisms.

WELL that didn’t last long, did it? The financial market euphoria,

which greeted the announcement that the ECB would buy bonds in unlimited

quantities, has melted away. In its place, the realisation that

Europe’s economy is weakening quickly is puncturing short-lived

optimisms.

Yesterday, we had more evidence from Germany that business confidence is ebbing more quickly than anyone anticipated. The IFO index of businesspeople’s expectations about the future has now fallen for the fifth consecutive month.

The rolling recession, which started with the collapse of Lehman, initially affected highly leveraged countries like Ireland, Iceland and Greece, then mutated into a slump in Spain and Italy and it is now moving in a crashing wave to the core of Europe. Affecting France at the beginning of this year, it is now being felt in the industrial powerhouse of Europe, Germany.

Until recently, China’s demand for German exports — particularly heavy machinery, which Germany excels at — kept order books healthy. But now Chinese demand is not there any more as its exports and economy weaken. The real fear in China is that it will prove to be the mother of all property bubbles, which will burst.

Read More @ DavidMcWilliams.ie

Did you see this on the MSM?...I didn't think so...But then again... you don't see 99% of the News covered here on the MSM...

Protests against biting spending cuts continue throughout Europe, as people vent their anger over bailout sponsored austerity. Mass demonstrations in Madrid turned to violence earlier this week, as police were forced to fire rubber bullets to calm the fury of the public. There’ve been dozens of injuries and arrests.

WELL that didn’t last long, did it? The financial market euphoria,

which greeted the announcement that the ECB would buy bonds in unlimited

quantities, has melted away. In its place, the realisation that

Europe’s economy is weakening quickly is puncturing short-lived

optimisms.

WELL that didn’t last long, did it? The financial market euphoria,

which greeted the announcement that the ECB would buy bonds in unlimited

quantities, has melted away. In its place, the realisation that

Europe’s economy is weakening quickly is puncturing short-lived

optimisms.Yesterday, we had more evidence from Germany that business confidence is ebbing more quickly than anyone anticipated. The IFO index of businesspeople’s expectations about the future has now fallen for the fifth consecutive month.

The rolling recession, which started with the collapse of Lehman, initially affected highly leveraged countries like Ireland, Iceland and Greece, then mutated into a slump in Spain and Italy and it is now moving in a crashing wave to the core of Europe. Affecting France at the beginning of this year, it is now being felt in the industrial powerhouse of Europe, Germany.

Until recently, China’s demand for German exports — particularly heavy machinery, which Germany excels at — kept order books healthy. But now Chinese demand is not there any more as its exports and economy weaken. The real fear in China is that it will prove to be the mother of all property bubbles, which will burst.

Read More @ DavidMcWilliams.ie

Did you see this on the MSM?...I didn't think so...But then again... you don't see 99% of the News covered here on the MSM...

from RussiaToday:

Protests against biting spending cuts continue throughout Europe, as people vent their anger over bailout sponsored austerity. Mass demonstrations in Madrid turned to violence earlier this week, as police were forced to fire rubber bullets to calm the fury of the public. There’ve been dozens of injuries and arrests.

Presenting The World's Biggest Hedge Fund You Have Never Heard Of

The

world's largest hedge fund is not located in the top floor of some

shiny, floor-to-ceiling glass clad skyscraper in New York, London, Hong

Kong or Shanghai. It isn't in some sprawling mansion in Greenwich or

Stamford which houses a state of the art trading desk behind a

crocodile-filled moat. Instead it can be found in tiny, nondescript

office in Suite 225 located on 730 Sandhill Road in Reno, Nevada.

The

world's largest hedge fund is not located in the top floor of some

shiny, floor-to-ceiling glass clad skyscraper in New York, London, Hong

Kong or Shanghai. It isn't in some sprawling mansion in Greenwich or

Stamford which houses a state of the art trading desk behind a

crocodile-filled moat. Instead it can be found in tiny, nondescript

office in Suite 225 located on 730 Sandhill Road in Reno, Nevada.China Bails Out World's Largest Maker Of Solar Panels

Chinese local governments are facing the prospect

of major unemployment problems should the swathe of solar panel

makers, that have been subsidized from birth to now-near-death,

continue to suffer from US and European tariffs (as well as simple gross mis-allocation of capital amid massive over-capacity).

However, as is the way of the mal-investing world today, no barrier to

rational economic theory is too low for government status-quo

maintenance as it would appear that local banks have been strong-armed

into extending loans to keep them alive. As Reuters reports,

debt-laden (NYSE-traded) SunTech Power Holdings - which is close to

removal from the exchange due to its dismal equity price - has just

received new 'bailout' loans. First, it was a race to debase.

Now, we have the race to bailout the world's most worthless companies

(especially in channel-stuffed industries) as the New Normal trade wars

continue.

Chinese local governments are facing the prospect

of major unemployment problems should the swathe of solar panel

makers, that have been subsidized from birth to now-near-death,

continue to suffer from US and European tariffs (as well as simple gross mis-allocation of capital amid massive over-capacity).

However, as is the way of the mal-investing world today, no barrier to

rational economic theory is too low for government status-quo

maintenance as it would appear that local banks have been strong-armed

into extending loans to keep them alive. As Reuters reports,

debt-laden (NYSE-traded) SunTech Power Holdings - which is close to

removal from the exchange due to its dismal equity price - has just

received new 'bailout' loans. First, it was a race to debase.

Now, we have the race to bailout the world's most worthless companies

(especially in channel-stuffed industries) as the New Normal trade wars

continue.The Source of High Inflation: Government Spending...

If

we look at what's skyrocketed in price (healthcare, college tuition),

we find they are government funded and supported. This is not a

coincidence. Inflation is generally viewed as a monetary phenomenon (print money excessively and you get inflation), but let's use a very simple definition: any loss of purchasing power.

If your income buys fewer goods and services, for whatever mix of

reasons (geopolitical, weather, monetary, fiscal, etc.), that's

inflation "on the ground." Government spending and intervention

fuel inflation, and the Federal Reserve enables that spending and

inflation by monetizing Federal deficits. Eventually,

declining wages lead to demand destruction, as households consume fewer

goods and services. But inflation that is being driven by government

spending will not decrease, as the demand is being supported by a

borrow-and-spend Central State supported by a

monetize-Federal-debt-til-Doomsday Federal Reserve.

If

we look at what's skyrocketed in price (healthcare, college tuition),

we find they are government funded and supported. This is not a

coincidence. Inflation is generally viewed as a monetary phenomenon (print money excessively and you get inflation), but let's use a very simple definition: any loss of purchasing power.

If your income buys fewer goods and services, for whatever mix of

reasons (geopolitical, weather, monetary, fiscal, etc.), that's

inflation "on the ground." Government spending and intervention

fuel inflation, and the Federal Reserve enables that spending and

inflation by monetizing Federal deficits. Eventually,

declining wages lead to demand destruction, as households consume fewer

goods and services. But inflation that is being driven by government

spending will not decrease, as the demand is being supported by a

borrow-and-spend Central State supported by a

monetize-Federal-debt-til-Doomsday Federal Reserve.Exposing China's Shadow Banking System

We

have in the past attempted to take on the gargantuan task of exposing

the multi-trillion Chinese Shadow Banking system (not to be confused

with its deposit-free, rehypothecation-full Western equivalent), most recently here.

Alas, it is has consistently proven to be virtually impossible to

coherently explain something as decentralized and as pervasive as an

entire country's underground economy, especially when the country in

question is the riddle, wrapped in a mystery, inside an enigma known as

China. Today, however, courtesy of AsiaFinanceNews we get a report as

close as possible to the most comprehensive overview of what may soon be

(especially if rumors of tumbling Chinese municipal dominoes are

correct) the most talked about subject in the financial world: China's

Shadow Banking empire.

We

have in the past attempted to take on the gargantuan task of exposing

the multi-trillion Chinese Shadow Banking system (not to be confused

with its deposit-free, rehypothecation-full Western equivalent), most recently here.

Alas, it is has consistently proven to be virtually impossible to

coherently explain something as decentralized and as pervasive as an

entire country's underground economy, especially when the country in

question is the riddle, wrapped in a mystery, inside an enigma known as

China. Today, however, courtesy of AsiaFinanceNews we get a report as

close as possible to the most comprehensive overview of what may soon be

(especially if rumors of tumbling Chinese municipal dominoes are

correct) the most talked about subject in the financial world: China's

Shadow Banking empire.Goldman's Clients Are Skeptical About The Effectiveness Of QEtc., Worried About Inflation

While it is just as perplexing that Goldman still has clients, what is most surprising in this week's David Kostin "weekly kickstart" is that Goldman's clients have shown a surprising lack of stupidity (this time around) when it comes to the impact of QEtc. Shockingly, and quite accurately, said clients appear to be far more worried about the inflationary shock that endless easing may bring (picture that), than what level the S&P closes for the year. Incidentally with Q3 now over, and just 3 months left until the end of the year, Goldman's chief equity strategist refuses to budge on his year end S&P forecast, which has been at 1250 since the beginning of the year, and remains firmly there. From Goldman: "QE has succeeded in increasing asset prices and inflation expectations but has not convinced investors to raise their US growth expectations. Instead, equity investors have expressed concern about inflation risks while both gold prices and implied inflation rates show similar shifts."

by Mike Shedlock, Global Economic Analysis:

In February, five of the nation’s largest banks agreed on a $25 billion settlement over widespread, systemic mortgage fraud and related issues.

In February, five of the nation’s largest banks agreed on a $25 billion settlement over widespread, systemic mortgage fraud and related issues.The $25 Billion Deal, announced with huge fanfare, was supposed to help up to a million struggling homeowners, primarily via debt forgiveness.

Let’s flash forward a few months to see how debt forgiveness is working out in practice.

Today, the New York Times notes Banks Forgive Debt That Isn’t There.

Read More @ GlobalEconomicAnalysis.blogspot.com

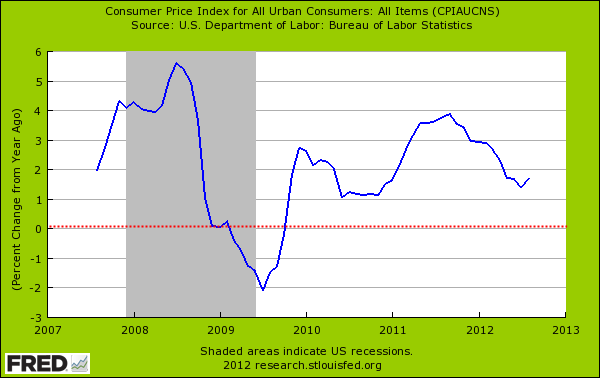

Inflation has been picking up since the recession ended in 2009. The

problem with the CPI increasing year over year with no rise in household

incomes is that the standard of living for most Americans erodes every

year that incomes do not keep up. Household incomes are back to levels

last seen in the mid-1990s while the cost of necessities has gone up.

This brings us to our article today that examines the nuts and bolts of

what constitutes the Consumer Price Index (CPI). The CPI attempts to

measure the changes in price for consumer goods and services. Overall it

did a very poor job of measuring the housing bubble because of the

owner’s equivalent of rent metric. Today, it is understating inflation

because of the excess spending on “wants” that occurred in the 2000s has

now shifted to spending on “needs” but is being dragged down by the

amount of family spending on needed goods. We will dig deep into this

data but suffice it to say that the Fed is creating inflation in items

most Americans actually need to live their daily lives and the burden on

the poor is actually increasing.

Inflation has been picking up since the recession ended in 2009. The

problem with the CPI increasing year over year with no rise in household

incomes is that the standard of living for most Americans erodes every

year that incomes do not keep up. Household incomes are back to levels

last seen in the mid-1990s while the cost of necessities has gone up.

This brings us to our article today that examines the nuts and bolts of

what constitutes the Consumer Price Index (CPI). The CPI attempts to

measure the changes in price for consumer goods and services. Overall it

did a very poor job of measuring the housing bubble because of the

owner’s equivalent of rent metric. Today, it is understating inflation

because of the excess spending on “wants” that occurred in the 2000s has

now shifted to spending on “needs” but is being dragged down by the

amount of family spending on needed goods. We will dig deep into this

data but suffice it to say that the Fed is creating inflation in items

most Americans actually need to live their daily lives and the burden on

the poor is actually increasing.Read More @ MyBudget360.com

by Anthony Wile, The Daily Bell:

ntroduction: G. Edward Griffin is a film producer, author and political lecturer. He is the founder of Freedom Force International,

a libertarian-oriented activist network focused on advancing individual

freedom. First released in 1994, Mr. Griffin’s best-selling financial

book, The Creature from Jekyll Island, is a no-holds-barred look into

the inner workings of the Federal Reserve

banking system, or cartel if you will. Mr. Griffin’s literary

contributions are especially noteworthy given the validity of his vision

and the exciting and troublesome nature of the times in which we live.

ntroduction: G. Edward Griffin is a film producer, author and political lecturer. He is the founder of Freedom Force International,

a libertarian-oriented activist network focused on advancing individual

freedom. First released in 1994, Mr. Griffin’s best-selling financial

book, The Creature from Jekyll Island, is a no-holds-barred look into

the inner workings of the Federal Reserve

banking system, or cartel if you will. Mr. Griffin’s literary

contributions are especially noteworthy given the validity of his vision

and the exciting and troublesome nature of the times in which we live.Daily Bell: Let’s jump right in. Are we seeing significant price inflation now?

G. Edward Griffin: It depends on how you define significant, I suppose. I think it’s significant. My personal feeling is the price index is greatly distorted. They keep fiddling with the formula to make it look as good as possible but real inflation, at least here in the States, in terms of the major components of what people buy to live day to day, such as groceries, gasoline and clothing, my feeling is that inflation is already at the double digits. I think it’s ten percent if not more. That I think is significant but then again it’s nothing compared to what I think we are going to see.

Read More @ TheDailyBell.com

“The

reason there is no mention of Fannie (Mae) and Freddie (Mac) in the

bill, is because it’s named after two of their puppets: Dodd and Frank.”

from ReasonTV :

Barron’s Economics Editor Gene Epstein lays into the hypocrisy of the aforementioned Dodd-Frank bill at a Freedomfest 2012 panel titled “Too Big to Regulate,” hosted by the Reason Foundation’s Director of Economic Research Anthony Randazzo. The panel focused on problems with over regulation in the financial services industry, with a specific focus on the Dodd-Frank legislation.

from ReasonTV :

Barron’s Economics Editor Gene Epstein lays into the hypocrisy of the aforementioned Dodd-Frank bill at a Freedomfest 2012 panel titled “Too Big to Regulate,” hosted by the Reason Foundation’s Director of Economic Research Anthony Randazzo. The panel focused on problems with over regulation in the financial services industry, with a specific focus on the Dodd-Frank legislation.

by Clarice Feldman, American Thinker:

In retrospect, the Democratic Convention highlighted a liar, Elizabeth

Warren. She was hired by Harvard law school because she lied about her

ethnicity to gain affirmative action benefits, exaggerated her

scholarship which was shoddy, practiced law for years in Massachusetts

out of her law school office without being a member of that state’s bar —

and possibly at the time a member of no bar at all. She gummed on

before the crowd about working for the middle class hiding from the

audience that she had made hundreds of thousands of dollars

representing big corporations in disputes against steel workers and

asbestos victims among others. This week, Professor William Jacobson

exposed all of that.

In retrospect, the Democratic Convention highlighted a liar, Elizabeth

Warren. She was hired by Harvard law school because she lied about her

ethnicity to gain affirmative action benefits, exaggerated her

scholarship which was shoddy, practiced law for years in Massachusetts

out of her law school office without being a member of that state’s bar —

and possibly at the time a member of no bar at all. She gummed on

before the crowd about working for the middle class hiding from the

audience that she had made hundreds of thousands of dollars

representing big corporations in disputes against steel workers and

asbestos victims among others. This week, Professor William Jacobson

exposed all of that.But she was hardly the only world class mythomaniac from Harvard law school on the podium at that Convention, the theme of which was Obama the bold slayer of Bin Laden and destroyer of Al Qaeda, the experienced and aggressive counter terrorist expert. After all, his domestic policies, are so bad they were hardly anything about which to spike the ball so the brain trust picked international anti-terrorist hero theme.

Read More @ AmericanThinker.com

by Ludwig von Mises, Mises:

The champions of democracy in the eighteenth century argued that only

monarchs and their ministers are morally depraved, injudicious, and

evil. The people, however, are altogether good, pure, and noble, and

have, besides, the intellectual gifts needed in order always to know and

to do what is right. This is, of course, all nonsense, no less so than

the flattery of the courtiers who ascribed all good and noble qualities

to their princes. The people are the sum of all individual citizens; and

if some individuals are not intelligent and noble, then neither are all

together.

The champions of democracy in the eighteenth century argued that only

monarchs and their ministers are morally depraved, injudicious, and

evil. The people, however, are altogether good, pure, and noble, and

have, besides, the intellectual gifts needed in order always to know and

to do what is right. This is, of course, all nonsense, no less so than

the flattery of the courtiers who ascribed all good and noble qualities

to their princes. The people are the sum of all individual citizens; and

if some individuals are not intelligent and noble, then neither are all

together.

Since mankind entered the age of democracy with such high-flown expectations, it is not surprising that disillusionment should soon have set in. It was quickly discovered that the democracies committed at least as many errors as the monarchies and aristocracies had. The comparison that people drew between the men whom the democracies placed at the head of the government and those whom the emperors and kings, in the exercise of their absolute power, had elevated to that position, proved by no means favorable to the new wielders of power. The French are wont to speak of “killing with ridicule.” And indeed, the statesmen representative of democracy soon rendered it everywhere ridiculous. Those of the old regime had displayed a certain aristocratic dignity, at least in their outward demeanor. The new ones, who replaced them, made themselves contemptible by their behavior.

Read More @ Mises.ca

Poetry can often achieve the same communication with

Poetry can often achieve the same communication with

far fewer words than prose. This poem sums it up.

BUT WHAT OF TRUTH by Hal O’Leary

For now, the loss of truth’s the only known.

The truth’s become old fashioned. Could this be?

With lies, we have decided to condone,

Just what the end will be, I cannot see.

The truth is now old fashioned. Could this be,

Like chastity and people you can trust?

Just what the end will be, I cannot see,

For those believing life was somehow just …

Read More @ PaulCraigRoberts.org

The champions of democracy in the eighteenth century argued that only

monarchs and their ministers are morally depraved, injudicious, and

evil. The people, however, are altogether good, pure, and noble, and

have, besides, the intellectual gifts needed in order always to know and

to do what is right. This is, of course, all nonsense, no less so than

the flattery of the courtiers who ascribed all good and noble qualities

to their princes. The people are the sum of all individual citizens; and

if some individuals are not intelligent and noble, then neither are all

together.

The champions of democracy in the eighteenth century argued that only

monarchs and their ministers are morally depraved, injudicious, and

evil. The people, however, are altogether good, pure, and noble, and

have, besides, the intellectual gifts needed in order always to know and

to do what is right. This is, of course, all nonsense, no less so than

the flattery of the courtiers who ascribed all good and noble qualities

to their princes. The people are the sum of all individual citizens; and

if some individuals are not intelligent and noble, then neither are all

together.Since mankind entered the age of democracy with such high-flown expectations, it is not surprising that disillusionment should soon have set in. It was quickly discovered that the democracies committed at least as many errors as the monarchies and aristocracies had. The comparison that people drew between the men whom the democracies placed at the head of the government and those whom the emperors and kings, in the exercise of their absolute power, had elevated to that position, proved by no means favorable to the new wielders of power. The French are wont to speak of “killing with ridicule.” And indeed, the statesmen representative of democracy soon rendered it everywhere ridiculous. Those of the old regime had displayed a certain aristocratic dignity, at least in their outward demeanor. The new ones, who replaced them, made themselves contemptible by their behavior.

Read More @ Mises.ca

by Dr. Paul Craig Roberts, PaulCraigRoberts.org:

Poetry can often achieve the same communication with

Poetry can often achieve the same communication withfar fewer words than prose. This poem sums it up.

BUT WHAT OF TRUTH by Hal O’Leary

For now, the loss of truth’s the only known.

The truth’s become old fashioned. Could this be?

With lies, we have decided to condone,

Just what the end will be, I cannot see.

The truth is now old fashioned. Could this be,

Like chastity and people you can trust?

Just what the end will be, I cannot see,

For those believing life was somehow just …

Read More @ PaulCraigRoberts.org

by Zig Lambo, Gold Seek:

While the markets have been on edge for the past year or so and have

left most investors bewildered as to what to do next, portfolio manager

and author John Stephenson thinks that the course is set for higher gold

prices. In this exclusive interview with The Gold Report, Stephenson

explains why he thinks we will avoid a worldwide economic crash and how

the continuing QEs and foreign government bailouts will push more

investors into the gold and mining share markets as gold moves above

$2,000/ounce.

While the markets have been on edge for the past year or so and have

left most investors bewildered as to what to do next, portfolio manager

and author John Stephenson thinks that the course is set for higher gold

prices. In this exclusive interview with The Gold Report, Stephenson

explains why he thinks we will avoid a worldwide economic crash and how

the continuing QEs and foreign government bailouts will push more

investors into the gold and mining share markets as gold moves above

$2,000/ounce.

The Gold Report: Since you last spoke with The Gold Report in January, we’ve had a seemingly self-feeding cycle of expectations, plans, bailouts, lack of results and back-to-the-drawing-board. Do you see any ultimate resolution to the world’s economic dilemma, or will we somehow just muddle through, or have to go through an actual crash of some sort?

John Stephenson: I think we’ll basically muddle through from here. We’ve had several important developments over the last few weeks. The Federal Reserve’s Quantitative Easing 3 (QE3) $40 billion program targeting mainly mortgage securities has the potential to move the needle. There was a big rally to risk assets when that was announced but that has faded somewhat.

Read More @ GoldSeek.com

While the markets have been on edge for the past year or so and have

left most investors bewildered as to what to do next, portfolio manager

and author John Stephenson thinks that the course is set for higher gold

prices. In this exclusive interview with The Gold Report, Stephenson

explains why he thinks we will avoid a worldwide economic crash and how

the continuing QEs and foreign government bailouts will push more

investors into the gold and mining share markets as gold moves above

$2,000/ounce.

While the markets have been on edge for the past year or so and have

left most investors bewildered as to what to do next, portfolio manager

and author John Stephenson thinks that the course is set for higher gold

prices. In this exclusive interview with The Gold Report, Stephenson

explains why he thinks we will avoid a worldwide economic crash and how

the continuing QEs and foreign government bailouts will push more

investors into the gold and mining share markets as gold moves above

$2,000/ounce.The Gold Report: Since you last spoke with The Gold Report in January, we’ve had a seemingly self-feeding cycle of expectations, plans, bailouts, lack of results and back-to-the-drawing-board. Do you see any ultimate resolution to the world’s economic dilemma, or will we somehow just muddle through, or have to go through an actual crash of some sort?

John Stephenson: I think we’ll basically muddle through from here. We’ve had several important developments over the last few weeks. The Federal Reserve’s Quantitative Easing 3 (QE3) $40 billion program targeting mainly mortgage securities has the potential to move the needle. There was a big rally to risk assets when that was announced but that has faded somewhat.

Read More @ GoldSeek.com

Israel and US Use False Flags and Race-Specific Bioweapons to Attack Iran

Zionist-patsy and Israeli Prime Minister Benjamin Netanyahu is warning the UN General Assembly that the world must stop Iran from acquiring a nuclear weapon. He has become impatient with President Obama who appears to not want to join in on the Zionist endeavor to destroy the Islamic world.CIA-Sponsored Cyber Attacks to Legitimize DHS Big Brother Control Grid

To justify the need for a cybersecurity legislation that will enable the US government to spy on every American citizen without purpose other than to create a totalitarian control grid, false flag attacks are incorrectly portrayed by the Obama administration in order to scare Congress into following tail behind this globalist puppet.Deviant Investor – Letter to My Grandson

I hope you read and consider these thoughts and, more importantly, I hope you direct yourself in a positive and self-fulfilling manner after pondering the bits of wisdom I have to share.Citizens Around the World Protest Austerity

Around the world, we are seeing the same story repeated again and again, as countries crumble, economies collapse, the poor become poorer, the rich become richer and the powerful gain more power. Tens of thousands of people around the world chose today to make their voices heard.Communication Items You’ll Want Before TSHTF – Part 2

It’s not a question of “IF” TPTB will shut the internet down it’s “WHEN”? The purpose of these articles it to create awareness in becoming independent of the internet and become your own beacon of news by maintaining contact through the coming difficulties.

Continue Reading →

Midland GXT1050VP4 50 Ch GMRS/FRS Radio Pack-Camo - Camping Supplies (Google Affiliate Ad)

Midland GXT1050VP4 50 Ch GMRS/FRS Radio Pack-Camo - Camping Supplies (Google Affiliate Ad)

Total Donations over the last 3 1/2 years. approx $165.00 (Thank You).

Donations will help defray the operational costs. Paypal, a leading provider of secure online money transfers, will handle the donations. Thank you for your contribution.

I'm PayPal Verified

Here...you will need one of these, for all your relatives that refused to listen to you...

Some of the dust from

Some of the dust from  Last summer, two researchers from the New England Complex Systems Institute published a

Last summer, two researchers from the New England Complex Systems Institute published a

Spanish banks will need close to €60-billion ($77.24-billion U.S.) in

new capital, according to the results of an independently conducted

stress test of the country’s 14 largest lenders that Madrid hopes will

dispel investor doubts over the true extent of losses in the sector.

Spanish banks will need close to €60-billion ($77.24-billion U.S.) in

new capital, according to the results of an independently conducted

stress test of the country’s 14 largest lenders that Madrid hopes will

dispel investor doubts over the true extent of losses in the sector.

The Vatican has been

The Vatican has been  When Britain and France launched pre-emptive military strikes last year

that would eventually depose Libyan leader Moammar Gadhafi and his

regime, one of President Barack Obama’s most senior advisers described

U.S. involvement as “leading from behind,” a most unfortunate descriptor

that haunted the administration much as George W. Bush’s “mission

accomplished” label early in the 2003 Iraq war repeatedly hounded him.

When Britain and France launched pre-emptive military strikes last year

that would eventually depose Libyan leader Moammar Gadhafi and his

regime, one of President Barack Obama’s most senior advisers described

U.S. involvement as “leading from behind,” a most unfortunate descriptor

that haunted the administration much as George W. Bush’s “mission

accomplished” label early in the 2003 Iraq war repeatedly hounded him. In its later days, the Soviet Union was desperate for strong

leadership. Instead the country found itself with a succession of weak

leaders who kept dying on the job.

In its later days, the Soviet Union was desperate for strong

leadership. Instead the country found itself with a succession of weak

leaders who kept dying on the job. The focus of analysis this week shifts back to Europe. My thesis

remains that the unfolding European debt and economic crises provide a

potential catalyst for a bout of problematic global

de-risking/de-leveraging. An argument can be made that the recent rally

and short squeeze throughout global risk markets actually heightens

market vulnerability.

The focus of analysis this week shifts back to Europe. My thesis

remains that the unfolding European debt and economic crises provide a

potential catalyst for a bout of problematic global

de-risking/de-leveraging. An argument can be made that the recent rally

and short squeeze throughout global risk markets actually heightens

market vulnerability.  Significant increase in Turkey’s Gold exports, bulk of it to Iran

helped country’s trade deficit to fall 30 percent in August, according

to Turkish Statistics Institute.

Significant increase in Turkey’s Gold exports, bulk of it to Iran

helped country’s trade deficit to fall 30 percent in August, according

to Turkish Statistics Institute. There Is No Choice

There Is No Choice ther than the fact that this is an incredibly big number, there is

nothing eye-opening about the payout. SS missed hitting the $65b

milestone by a fraction in September. In November, it will be higher

again. $70b will be hit by December 2013. The ladder to higher payouts

never stops.

ther than the fact that this is an incredibly big number, there is

nothing eye-opening about the payout. SS missed hitting the $65b

milestone by a fraction in September. In November, it will be higher

again. $70b will be hit by December 2013. The ladder to higher payouts

never stops.

Jobs at the US Mint are always safest in the midst of

Jobs at the US Mint are always safest in the midst of

To properly understand the events of the time (and to put them in today's context), we believe, like the

To properly understand the events of the time (and to put them in today's context), we believe, like the ![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)