from Sovereign Man:

A member of my staff caught an obscure resolution that was introduced in the US House of Representatives last week—Resolution no. 41.

The fact that there was essentially no coverage of this Resolution

really shows how the mainstream media is completely turning a blind eye

to the true fiscal situation of the United States of America.

A member of my staff caught an obscure resolution that was introduced in the US House of Representatives last week—Resolution no. 41.

The fact that there was essentially no coverage of this Resolution

really shows how the mainstream media is completely turning a blind eye

to the true fiscal situation of the United States of America.

The entire point of the resolution is to say that the federal government is broke.

It can’t pay its own bills, and therefore it shouldn’t be responsible to pay anyone else’s either. It doesn’t’ take a rocket scientists to figure out what a bankrupt government will do—just like any thief, they’ll go after easy targets first.

Read More @ SovereignMan.com

by Michael Snyder, The Economic Collapse Blog:

The signs of the times are everywhere – all you have to do is open up

your eyes and look at them. When a pregnant woman first goes into

labor, the birth pangs are usually fairly moderate and are not that

close together. But as the time for delivery approaches, they become

much more frequent and much more intense. Economically, what we are

experiencing right now are birth pangs of the coming Great Depression.

As we get closer to the crisis that is looming on the horizon, they will

become even more powerful. This week, we learned that the Baltic Dry

Index has fallen to the lowest level that we have seen in 29 years.

The Baltic Dry Index also crashed during the financial collapse of

2008, but right now it is already lower than it was at any point during

the last financial crisis. In addition, “Dr. Copper” and other

industrial commodities continue to plunge. This almost always happens

before we enter an economic downturn. Meanwhile, as I mentioned the other day,

orders for durable goods are declining. This is also a traditional

indicator that a recession is approaching. The warning signs are there –

we just have to be open to what they are telling us.

The signs of the times are everywhere – all you have to do is open up

your eyes and look at them. When a pregnant woman first goes into

labor, the birth pangs are usually fairly moderate and are not that

close together. But as the time for delivery approaches, they become

much more frequent and much more intense. Economically, what we are

experiencing right now are birth pangs of the coming Great Depression.

As we get closer to the crisis that is looming on the horizon, they will

become even more powerful. This week, we learned that the Baltic Dry

Index has fallen to the lowest level that we have seen in 29 years.

The Baltic Dry Index also crashed during the financial collapse of

2008, but right now it is already lower than it was at any point during

the last financial crisis. In addition, “Dr. Copper” and other

industrial commodities continue to plunge. This almost always happens

before we enter an economic downturn. Meanwhile, as I mentioned the other day,

orders for durable goods are declining. This is also a traditional

indicator that a recession is approaching. The warning signs are there –

we just have to be open to what they are telling us.

Read More…

from misesmedia:

A member of my staff caught an obscure resolution that was introduced in the US House of Representatives last week—Resolution no. 41.

The fact that there was essentially no coverage of this Resolution

really shows how the mainstream media is completely turning a blind eye

to the true fiscal situation of the United States of America.

A member of my staff caught an obscure resolution that was introduced in the US House of Representatives last week—Resolution no. 41.

The fact that there was essentially no coverage of this Resolution

really shows how the mainstream media is completely turning a blind eye

to the true fiscal situation of the United States of America.The entire point of the resolution is to say that the federal government is broke.

It can’t pay its own bills, and therefore it shouldn’t be responsible to pay anyone else’s either. It doesn’t’ take a rocket scientists to figure out what a bankrupt government will do—just like any thief, they’ll go after easy targets first.

Read More @ SovereignMan.com

"We Can't Do This Forever," Fed Admits "Market Will Overwhelm Us"

Submitted by Tyler Durden on 01/30/2015 - 21:05 "It may work out just fine, but there’s a risk to that strategy... we’re in some sense distorting what might be the normal market outcomes at some point, we’re going to have to stop doing it. At some point the pressure is going to be too great. The market forces are going to overwhelm us. We’re not going to be able to hold the line anymore. And then you get that rapid snapback in premiums as the market realizes that central banks can’t do this forever. And that’s going to cause volatility and disruption." - Charles Plosser

Another Step Down The Long, Slow Road To IRA Nationalization

Submitted by Tyler Durden on 01/30/2015 - 20:20 According to IRS estimates, there’s close to $5 trillion in individual retirement accounts in the Land of the Free. This is money that taxpayers prudently set aside for retirement, hopefully cognizant that Social Security isn’t going to be there for them. Devoid of any other easy lender, $5 trillion is far too irresistible for such a heavily indebted government to ignore. We've long warned that the government could easily nationalize a portion of all IRAs. It started happening last year with MyRA followed by the President and Treasury Secretary embarked on a blitzkrieg-style marketing campaign to pump the program... and now comes Step three.. The signs of the times are everywhere – all you have to do is open up

your eyes and look at them. When a pregnant woman first goes into

labor, the birth pangs are usually fairly moderate and are not that

close together. But as the time for delivery approaches, they become

much more frequent and much more intense. Economically, what we are

experiencing right now are birth pangs of the coming Great Depression.

As we get closer to the crisis that is looming on the horizon, they will

become even more powerful. This week, we learned that the Baltic Dry

Index has fallen to the lowest level that we have seen in 29 years.

The Baltic Dry Index also crashed during the financial collapse of

2008, but right now it is already lower than it was at any point during

the last financial crisis. In addition, “Dr. Copper” and other

industrial commodities continue to plunge. This almost always happens

before we enter an economic downturn. Meanwhile, as I mentioned the other day,

orders for durable goods are declining. This is also a traditional

indicator that a recession is approaching. The warning signs are there –

we just have to be open to what they are telling us.

The signs of the times are everywhere – all you have to do is open up

your eyes and look at them. When a pregnant woman first goes into

labor, the birth pangs are usually fairly moderate and are not that

close together. But as the time for delivery approaches, they become

much more frequent and much more intense. Economically, what we are

experiencing right now are birth pangs of the coming Great Depression.

As we get closer to the crisis that is looming on the horizon, they will

become even more powerful. This week, we learned that the Baltic Dry

Index has fallen to the lowest level that we have seen in 29 years.

The Baltic Dry Index also crashed during the financial collapse of

2008, but right now it is already lower than it was at any point during

the last financial crisis. In addition, “Dr. Copper” and other

industrial commodities continue to plunge. This almost always happens

before we enter an economic downturn. Meanwhile, as I mentioned the other day,

orders for durable goods are declining. This is also a traditional

indicator that a recession is approaching. The warning signs are there –

we just have to be open to what they are telling us.Read More…

by Jordan Roy-Byrne, TheDailyGold:

Gold

has performed very well under the circumstances of declining inflation

and a surging US$ index. Since 2014 the US$ index is up nearly 18% while

Gold is up 3%. Since Gold’s November low the US$ index is up over 10%.

Had we known that at the time, we’d have thought Gold would be headed

for $1000 and not the $1300 it recently hit. At present, the US$ index

appears ripe for a correction or major pause in its uptrend. Given that

Gold is priced in US$ and that Gold has shown strength in real terms,

sustained US$ weakness could be a major boon for Gold and precious

metals as a whole.

Gold

has performed very well under the circumstances of declining inflation

and a surging US$ index. Since 2014 the US$ index is up nearly 18% while

Gold is up 3%. Since Gold’s November low the US$ index is up over 10%.

Had we known that at the time, we’d have thought Gold would be headed

for $1000 and not the $1300 it recently hit. At present, the US$ index

appears ripe for a correction or major pause in its uptrend. Given that

Gold is priced in US$ and that Gold has shown strength in real terms,

sustained US$ weakness could be a major boon for Gold and precious

metals as a whole.

Before we get to the US$, I’d like to provide a comparison of Gold and Gold charted against foreign currencies. To create the foreign currency index we simply took US$ data and inverted it. Thus, we are charting Gold against the currency basket that comprises the US$ index. Over the past 15 years strength in Gold relative to foreign currencies has often preceded Gold strength in US$’s. Gold priced against foreign currencies bottomed in December 2013 and reached a 21-month high last week.

Read More @ TheDailyGold.com

Gold

has performed very well under the circumstances of declining inflation

and a surging US$ index. Since 2014 the US$ index is up nearly 18% while

Gold is up 3%. Since Gold’s November low the US$ index is up over 10%.

Had we known that at the time, we’d have thought Gold would be headed

for $1000 and not the $1300 it recently hit. At present, the US$ index

appears ripe for a correction or major pause in its uptrend. Given that

Gold is priced in US$ and that Gold has shown strength in real terms,

sustained US$ weakness could be a major boon for Gold and precious

metals as a whole.

Gold

has performed very well under the circumstances of declining inflation

and a surging US$ index. Since 2014 the US$ index is up nearly 18% while

Gold is up 3%. Since Gold’s November low the US$ index is up over 10%.

Had we known that at the time, we’d have thought Gold would be headed

for $1000 and not the $1300 it recently hit. At present, the US$ index

appears ripe for a correction or major pause in its uptrend. Given that

Gold is priced in US$ and that Gold has shown strength in real terms,

sustained US$ weakness could be a major boon for Gold and precious

metals as a whole.Before we get to the US$, I’d like to provide a comparison of Gold and Gold charted against foreign currencies. To create the foreign currency index we simply took US$ data and inverted it. Thus, we are charting Gold against the currency basket that comprises the US$ index. Over the past 15 years strength in Gold relative to foreign currencies has often preceded Gold strength in US$’s. Gold priced against foreign currencies bottomed in December 2013 and reached a 21-month high last week.

Read More @ TheDailyGold.com

by Janet Phelan, Activist Post:

The

recent decisions by social media giants Facebook and LinkedIn to adopt

user crowd-censoring strategies may be less than benevolent.

The

recent decisions by social media giants Facebook and LinkedIn to adopt

user crowd-censoring strategies may be less than benevolent.

According to its recent announcement, Facebook will employ an algorithm, based ostensibly on the numbers of user-generated flags, to reduce or mitigate the distribution of stories flagged as “false.” In addition, Facebook has announced that stories flagged in this manner will contain notice that the story has been determined to contain false information.

As stated in Facebook’s announcement this past week, “Today’s update to News Feed reduces the distribution of posts that people have reported as hoaxes and adds an annotation to posts that have received many of these types of reports to warn others on Facebook. We are not removing stories people report as false and we are not reviewing content and making a determination on its accuracy.”

Read More @ Activist Post

The

recent decisions by social media giants Facebook and LinkedIn to adopt

user crowd-censoring strategies may be less than benevolent.

The

recent decisions by social media giants Facebook and LinkedIn to adopt

user crowd-censoring strategies may be less than benevolent. According to its recent announcement, Facebook will employ an algorithm, based ostensibly on the numbers of user-generated flags, to reduce or mitigate the distribution of stories flagged as “false.” In addition, Facebook has announced that stories flagged in this manner will contain notice that the story has been determined to contain false information.

As stated in Facebook’s announcement this past week, “Today’s update to News Feed reduces the distribution of posts that people have reported as hoaxes and adds an annotation to posts that have received many of these types of reports to warn others on Facebook. We are not removing stories people report as false and we are not reviewing content and making a determination on its accuracy.”

Read More @ Activist Post

by Lawrence Williams, MineWeb.com:

The latest update of the annual study by GFMS of world gold supply and

demand makes for some interesting reading, and correspondingly

interesting interpretations of the figures by the media. Mineweb has

reported one such analysis suggesting that India has re-overtaken China

as the World No. 1 gold consumer and some figures published within the

report suggest that this may be the case – but this may well depend on

what the interpretation of consumption actually is. The GFMS report

suggests that Indian jewellery fabrication at 690 tonnes overtook that

of China during the year, but appears to make no such bald statement

that total Chinese demand fell back below that of India, although there

are figures within the report which suggest this could be the case.

The latest update of the annual study by GFMS of world gold supply and

demand makes for some interesting reading, and correspondingly

interesting interpretations of the figures by the media. Mineweb has

reported one such analysis suggesting that India has re-overtaken China

as the World No. 1 gold consumer and some figures published within the

report suggest that this may be the case – but this may well depend on

what the interpretation of consumption actually is. The GFMS report

suggests that Indian jewellery fabrication at 690 tonnes overtook that

of China during the year, but appears to make no such bald statement

that total Chinese demand fell back below that of India, although there

are figures within the report which suggest this could be the case.

See: India overtakes China as world’s top gold consumer – GFMS

The GFMS report does note also, however, that Shanghai Gold Exchange (physical gold) withdrawals came in at just over 2,100 tonnes for the year and if this has not been ‘consumed’ one has to wonder where it is all going.

Read More @ MineWeb.com

The latest update of the annual study by GFMS of world gold supply and

demand makes for some interesting reading, and correspondingly

interesting interpretations of the figures by the media. Mineweb has

reported one such analysis suggesting that India has re-overtaken China

as the World No. 1 gold consumer and some figures published within the

report suggest that this may be the case – but this may well depend on

what the interpretation of consumption actually is. The GFMS report

suggests that Indian jewellery fabrication at 690 tonnes overtook that

of China during the year, but appears to make no such bald statement

that total Chinese demand fell back below that of India, although there

are figures within the report which suggest this could be the case.

The latest update of the annual study by GFMS of world gold supply and

demand makes for some interesting reading, and correspondingly

interesting interpretations of the figures by the media. Mineweb has

reported one such analysis suggesting that India has re-overtaken China

as the World No. 1 gold consumer and some figures published within the

report suggest that this may be the case – but this may well depend on

what the interpretation of consumption actually is. The GFMS report

suggests that Indian jewellery fabrication at 690 tonnes overtook that

of China during the year, but appears to make no such bald statement

that total Chinese demand fell back below that of India, although there

are figures within the report which suggest this could be the case.See: India overtakes China as world’s top gold consumer – GFMS

The GFMS report does note also, however, that Shanghai Gold Exchange (physical gold) withdrawals came in at just over 2,100 tonnes for the year and if this has not been ‘consumed’ one has to wonder where it is all going.

Read More @ MineWeb.com

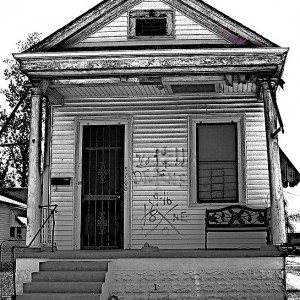

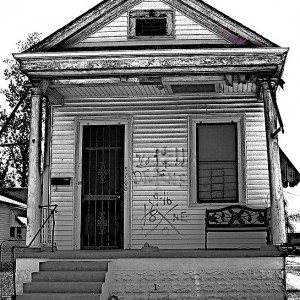

by Michael Snyder, End of The American Dream:

We are the generation that gets to witness the end of the American

Dream. The numbers that you are about to see tell a story. They tell a

story of a once mighty economy that is dying. For decades, the rest of

the planet has regarded the United States as “the land of opportunity”

where almost anyone can be successful if they are willing to work hard.

And when I was growing up, it seemed like almost everyone was living

the American Dream. I lived on a “middle class” street and I went to a

school where it seemed like almost everyone was middle class. When I

was in high school, it was very rare to ever hear of a parent that was

unemployed, and virtually every family that I knew had a comfortable

home and more than one nice vehicle. But now that has all changed. The

“American Dream” has been transformed into a very twisted game of

musical chairs. With each passing year, more people are falling out of

the middle class, and most of the rest of us are scrambling really hard

to keep our own places. Something has gone horribly wrong, and yet

Americans are very deeply divided when it comes to finding answers to

our problems. We love to point fingers and argue with one another, and

meanwhile things just continue to get even worse. The following are 22

numbers that are very strong evidence of the death of the American

Dream…

We are the generation that gets to witness the end of the American

Dream. The numbers that you are about to see tell a story. They tell a

story of a once mighty economy that is dying. For decades, the rest of

the planet has regarded the United States as “the land of opportunity”

where almost anyone can be successful if they are willing to work hard.

And when I was growing up, it seemed like almost everyone was living

the American Dream. I lived on a “middle class” street and I went to a

school where it seemed like almost everyone was middle class. When I

was in high school, it was very rare to ever hear of a parent that was

unemployed, and virtually every family that I knew had a comfortable

home and more than one nice vehicle. But now that has all changed. The

“American Dream” has been transformed into a very twisted game of

musical chairs. With each passing year, more people are falling out of

the middle class, and most of the rest of us are scrambling really hard

to keep our own places. Something has gone horribly wrong, and yet

Americans are very deeply divided when it comes to finding answers to

our problems. We love to point fingers and argue with one another, and

meanwhile things just continue to get even worse. The following are 22

numbers that are very strong evidence of the death of the American

Dream…

Read More…

We are the generation that gets to witness the end of the American

Dream. The numbers that you are about to see tell a story. They tell a

story of a once mighty economy that is dying. For decades, the rest of

the planet has regarded the United States as “the land of opportunity”

where almost anyone can be successful if they are willing to work hard.

And when I was growing up, it seemed like almost everyone was living

the American Dream. I lived on a “middle class” street and I went to a

school where it seemed like almost everyone was middle class. When I

was in high school, it was very rare to ever hear of a parent that was

unemployed, and virtually every family that I knew had a comfortable

home and more than one nice vehicle. But now that has all changed. The

“American Dream” has been transformed into a very twisted game of

musical chairs. With each passing year, more people are falling out of

the middle class, and most of the rest of us are scrambling really hard

to keep our own places. Something has gone horribly wrong, and yet

Americans are very deeply divided when it comes to finding answers to

our problems. We love to point fingers and argue with one another, and

meanwhile things just continue to get even worse. The following are 22

numbers that are very strong evidence of the death of the American

Dream…

We are the generation that gets to witness the end of the American

Dream. The numbers that you are about to see tell a story. They tell a

story of a once mighty economy that is dying. For decades, the rest of

the planet has regarded the United States as “the land of opportunity”

where almost anyone can be successful if they are willing to work hard.

And when I was growing up, it seemed like almost everyone was living

the American Dream. I lived on a “middle class” street and I went to a

school where it seemed like almost everyone was middle class. When I

was in high school, it was very rare to ever hear of a parent that was

unemployed, and virtually every family that I knew had a comfortable

home and more than one nice vehicle. But now that has all changed. The

“American Dream” has been transformed into a very twisted game of

musical chairs. With each passing year, more people are falling out of

the middle class, and most of the rest of us are scrambling really hard

to keep our own places. Something has gone horribly wrong, and yet

Americans are very deeply divided when it comes to finding answers to

our problems. We love to point fingers and argue with one another, and

meanwhile things just continue to get even worse. The following are 22

numbers that are very strong evidence of the death of the American

Dream…Read More…

from misesmedia:

by Mike Barrett, Natural Society:

Independent

DNA lab testing has verified that 100% of the corn in Kellogg’s Froot

Loops is genetically modified corn, containing DNA sequences known to be

present in insecticide producing Bt and Roundup Ready corn.

The soy also contained DNA sequences known to be present in Roundup

Ready GMO soy. What’s more, tests documented the presence of glyphosate

at 0.12 mg/kg, the main chemical ingredient of Monsanto’s best-selling

Roundup weedkiller.

Independent

DNA lab testing has verified that 100% of the corn in Kellogg’s Froot

Loops is genetically modified corn, containing DNA sequences known to be

present in insecticide producing Bt and Roundup Ready corn.

The soy also contained DNA sequences known to be present in Roundup

Ready GMO soy. What’s more, tests documented the presence of glyphosate

at 0.12 mg/kg, the main chemical ingredient of Monsanto’s best-selling

Roundup weedkiller.

Bt crops, such as Bt corn, have been shown to cause serious health problems.The EPA has registered Bt corn as a pesticide as the crop makes its own insecticide. The makers of Bt corn, primarily Monsanto and Syngenta, are responsible for selling this food-stuff to companies like Kellogg’s, but they have the choice to source their corn from organic farmers, and simply don’t.

Read More @ Natural Society

by Tim Brown, Freedom Outpost:

Bill Whittle quickly became one of my favorite commentators.

In the following monologue, Whittle brilliantly displays something I have pointed out concerning how the socialist and communist gun grabbers in America demonize guns. He exposes their bias to all of the relevant FBI data at their disposal.

Whittle rightly points out that America tops the list of guns per capita. There are 90 guns per every 100 people. Not only does this arsenal among the American people make it a force to be reckoned with against those who would seek to dominate the US population, but these weapons are the means of fighting against tyranny and oppression.

Read More @ FreedomOutpost.com

/  Independent

DNA lab testing has verified that 100% of the corn in Kellogg’s Froot

Loops is genetically modified corn, containing DNA sequences known to be

present in insecticide producing Bt and Roundup Ready corn.

The soy also contained DNA sequences known to be present in Roundup

Ready GMO soy. What’s more, tests documented the presence of glyphosate

at 0.12 mg/kg, the main chemical ingredient of Monsanto’s best-selling

Roundup weedkiller.

Independent

DNA lab testing has verified that 100% of the corn in Kellogg’s Froot

Loops is genetically modified corn, containing DNA sequences known to be

present in insecticide producing Bt and Roundup Ready corn.

The soy also contained DNA sequences known to be present in Roundup

Ready GMO soy. What’s more, tests documented the presence of glyphosate

at 0.12 mg/kg, the main chemical ingredient of Monsanto’s best-selling

Roundup weedkiller.Bt crops, such as Bt corn, have been shown to cause serious health problems.The EPA has registered Bt corn as a pesticide as the crop makes its own insecticide. The makers of Bt corn, primarily Monsanto and Syngenta, are responsible for selling this food-stuff to companies like Kellogg’s, but they have the choice to source their corn from organic farmers, and simply don’t.

Read More @ Natural Society

by Tim Brown, Freedom Outpost:

Bill Whittle quickly became one of my favorite commentators.

In the following monologue, Whittle brilliantly displays something I have pointed out concerning how the socialist and communist gun grabbers in America demonize guns. He exposes their bias to all of the relevant FBI data at their disposal.

Whittle rightly points out that America tops the list of guns per capita. There are 90 guns per every 100 people. Not only does this arsenal among the American people make it a force to be reckoned with against those who would seek to dominate the US population, but these weapons are the means of fighting against tyranny and oppression.

Read More @ FreedomOutpost.com

by Alasdair Macleod, Gold Money:

What makes this interesting is the mounting evidence that QE does not

bring about economic recovery. Even Jaime Caruana, General Manager of

the Bank for International Settlements and who is the central bankers’

central banker, has publicly expressed deep reservations about QE. However, the ECB ploughs on regardless.

What makes this interesting is the mounting evidence that QE does not

bring about economic recovery. Even Jaime Caruana, General Manager of

the Bank for International Settlements and who is the central bankers’

central banker, has publicly expressed deep reservations about QE. However, the ECB ploughs on regardless.

The Keynesians at the ECB are unclear in their thinking. They are unable to answer Caruana’s points, dismissing non-Keynesian economic theory as “religion”, and they sweep aside the empirical evidence of Keynesian policy failures. Instead they are panicking at the spectre of too little price inflation, the continuing fall in Eurozone bank lending and now falling commodity prices. To them, it is a situation that can only be resolved by monetary stimulation of aggregate demand applied through increased government deficit spending.

Read More @ GoldMoney.com

The Keynesians at the ECB are unclear in their thinking. They are unable to answer Caruana’s points, dismissing non-Keynesian economic theory as “religion”, and they sweep aside the empirical evidence of Keynesian policy failures. Instead they are panicking at the spectre of too little price inflation, the continuing fall in Eurozone bank lending and now falling commodity prices. To them, it is a situation that can only be resolved by monetary stimulation of aggregate demand applied through increased government deficit spending.

Read More @ GoldMoney.com

In Denmark You Are Now Paid To Take Out A Mortgage

Submitted by Tyler Durden on 01/30/2015 - 15:44 With NIRP raging in the Eurozone and over €1.5 trillion in European government bonds trading with negative yields, many were wondering when any of this perverted bond generosity will spill over to other debtors, not just Europe's insolvent governments (who can only print negative interest debt because of the ECB's backstop that it will buy any piece of garbage for sale in the doomed monetary union). In fact just earlier today we, rhetorically, asked a logical - in as much as nothing is logical in the new normal - question: "Who will offer the first negative rate mortgage." Little did we know that just minutes after our tweet, we would learn that at least one place is already paying homeowners to take out a mortgage. That's right - the negative rate mortgage is now a reality.

Meet Loretta Lynch – Obama’s Attorney General Nominee Who Might Be Even Worse than Eric Holder

Submitted by Tyler Durden on 01/30/2015 - 22:20 When Eric Holder announced his resignation, many breathed a sigh of relief thinking it can’t get much worse, but not so fast. The authoritarian streak and rampant cronyism of the Obama administration is a well oiled machine. You didn’t think you’d get off that easily did you? Enter Loretta Lynch.

One Of These Things Is Not Like The Other

Submitted by Tyler Durden on 01/30/2015 - 21:40 "Reality" is not "perception"

Visualizing The Cost Of Living Around The World

Submitted by Tyler Durden on 01/30/2015 - 19:40 Meet Numbeo, the world’s largest database of user contributed data about cities and countries. This infographic uses this information to show the most expensive and cheapest places to live by country. Switzerland and Norway may not surprise you as two of the most expensive countries. However, Venezuela might not have been a place that was on your radar. Of course, in retrospect, when you have inflation spiraling out of control at a rate of 64% per year, that will make things a bit pricey. Want cheap goods and services? Head over to India, Nepal, and Pakistan.

As China's Offshore Yuan Crashes To A 2 Year Low, Beijing Warns Its Citizens: "Don't Buy Dollars"

Submitted by Tyler Durden on 01/30/2015 - 19:15 We won't go into the specific details of China's burst housing bubble, the shady underworld of its pyramid scheme wealth-management products, the fact that any hard asset in China is rehypothecated literally a countless number of times, the nuances of its deflating shadow banking system, or even the complexities of its alleged capital controls (alleged, because as a reminder, they only exist for the common folks - the really wealthy Chinese are naturally exempt from any capital flow constraints). We will point out something even more disturbing. The Offshore Yuan just hit a two-year low, reaching a level not seen since September 2012.

The Fed Is Now Frontrunning Value Investors

Submitted by Tyler Durden on 01/30/2015 - 19:01 The Fed has been supporting the market since the late 1980s. But there is an important difference between the actions of the Fed under Yellen versus Greenspan and Bernanke. In 2008, the Fed allowed Bear Stearns and Lehman Brothers to fail. Given the massive wipeout that followed, this decision is now viewed as a dangerous mistake. Having learned their lesson, the Fed is now rushing in to support the market in response to even routine 20% drops. In this way, the Fed is acting like a value investor who demands a small margin of safety before investing.... Since 2010, however, the Fed has changed tactics. The Fed is now reacting far more quickly. Small market selloffs are followed by immediate responses. By quickly riding to the rescue, the Fed is effectively front-running value investors.

"Obama Is Clueless On Inequality," David Stockman Rages "The Problem Is [The Fed]"

Submitted by Tyler Durden on 01/30/2015 - 18:20 Echoing Elliott's Paul Singer's "greatest irony of politicians railing against inequality," former Reagan OMB Director David Stockman raged that when it comes to inequality, everyone can see the symptom, but "President Obama is clueless as to the cause," blasting that the problem is not capitalism, "the problem is in the Eccles Building and the 12 people sitting there thinking that zero interest rates are some magic elixir that will cause this very toubled economy to revive.! It won't, "these people are dangerous and destructive," Stockman exclaims, and sooner or later the inequality they have created is going to cause a huge political reaction.

"It's Different This Time" GDP Hockey-Sticks Edition

Submitted by Tyler Durden on 01/30/2015 - 17:10 Year after year, hope-strewn economists mark up GDP expectations for the year-ahead (in order to defend top-down their S&P 500 earnings forecasts and why investors should always BTFD)... and year after year, those GDP expectations are slashed drastically. Welcome to 2015...January Jitters Jolt Stocks - S&P Loses Key 2,000 Level; Bonds' Best Month Since June 2010

Submitted by Tyler Durden on 01/30/2015 - 16:04

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment