by Dave Hodges, The Common Sense Show:

I was almost ready to dismiss the present “Ebola crisis” as a hoax as

so many others have. Just based upon the fact that the virus is not

spreading within the United Stated as would be expected, there is a

natural tendency to reasonably suspect that we are not looking at a

strain of Ebola that has been weaponized. It would also be reasonable to

assume that this bioweapon is not nearly as contagious as “traditional

Ebola” and this would explain the extremely low transmission rate. The

obvious purpose of this bioweapon, under these conditions, would be to

scare people into taking the Bill Gates funded vaccines. However, as

this article will demonstrate, it might be a mistake to jump to the

false flag conclusion at this point in time.

I was almost ready to dismiss the present “Ebola crisis” as a hoax as

so many others have. Just based upon the fact that the virus is not

spreading within the United Stated as would be expected, there is a

natural tendency to reasonably suspect that we are not looking at a

strain of Ebola that has been weaponized. It would also be reasonable to

assume that this bioweapon is not nearly as contagious as “traditional

Ebola” and this would explain the extremely low transmission rate. The

obvious purpose of this bioweapon, under these conditions, would be to

scare people into taking the Bill Gates funded vaccines. However, as

this article will demonstrate, it might be a mistake to jump to the

false flag conclusion at this point in time.

This article is the first of a two part series which explores the differing possibilities connected to so-called presence of Ebola inside of the United States

Read More @ Thecommonsenseshow.com

I was almost ready to dismiss the present “Ebola crisis” as a hoax as

so many others have. Just based upon the fact that the virus is not

spreading within the United Stated as would be expected, there is a

natural tendency to reasonably suspect that we are not looking at a

strain of Ebola that has been weaponized. It would also be reasonable to

assume that this bioweapon is not nearly as contagious as “traditional

Ebola” and this would explain the extremely low transmission rate. The

obvious purpose of this bioweapon, under these conditions, would be to

scare people into taking the Bill Gates funded vaccines. However, as

this article will demonstrate, it might be a mistake to jump to the

false flag conclusion at this point in time.

I was almost ready to dismiss the present “Ebola crisis” as a hoax as

so many others have. Just based upon the fact that the virus is not

spreading within the United Stated as would be expected, there is a

natural tendency to reasonably suspect that we are not looking at a

strain of Ebola that has been weaponized. It would also be reasonable to

assume that this bioweapon is not nearly as contagious as “traditional

Ebola” and this would explain the extremely low transmission rate. The

obvious purpose of this bioweapon, under these conditions, would be to

scare people into taking the Bill Gates funded vaccines. However, as

this article will demonstrate, it might be a mistake to jump to the

false flag conclusion at this point in time.This article is the first of a two part series which explores the differing possibilities connected to so-called presence of Ebola inside of the United States

Read More @ Thecommonsenseshow.com

from Off Grid Survival:

In the latest Federal Land grab, the BLM and “Federal land managers”

are attempting to steal 3.1 million acres of public land in Southern

Nevada.

In the latest Federal Land grab, the BLM and “Federal land managers”

are attempting to steal 3.1 million acres of public land in Southern

Nevada.

Earlier this year we covered in great detail what happened at the Bundy Ranch in Southern Nevada. At the time, we warned this had nothing to do with one man, and was instead a coordinated plan by the federal government to steal Nevada land and restrict its public use for everyone.

Now that the media frenzy has died down, and the government’s media puppets have managed to smear anyone who supported the Bundys, the federal government is going forward with their plan to seize over 3 million acres of Nevada land – including the Bundy Ranch.

Read More @ OffGridSurvival.com

In the latest Federal Land grab, the BLM and “Federal land managers”

are attempting to steal 3.1 million acres of public land in Southern

Nevada.

In the latest Federal Land grab, the BLM and “Federal land managers”

are attempting to steal 3.1 million acres of public land in Southern

Nevada.Earlier this year we covered in great detail what happened at the Bundy Ranch in Southern Nevada. At the time, we warned this had nothing to do with one man, and was instead a coordinated plan by the federal government to steal Nevada land and restrict its public use for everyone.

Now that the media frenzy has died down, and the government’s media puppets have managed to smear anyone who supported the Bundys, the federal government is going forward with their plan to seize over 3 million acres of Nevada land – including the Bundy Ranch.

Read More @ OffGridSurvival.com

from ZeroHedge:

“The decline in asset yields especially during QE3 created large wealth effects. Since

the Fed’s QE started at the end of 2008 the PE multiple of the

S&P500 index (12-month forward) went up by five points, from 10.5 at

the end of 2008 to 15.5 currently. This PE multiple expansion is

responsible for around 650 index points or 32% of the current S&P500

index level. Extending that to the total stock of US corporate equities ($29tr currently), it implies an equity wealth boost of $9tr.”

“The decline in asset yields especially during QE3 created large wealth effects. Since

the Fed’s QE started at the end of 2008 the PE multiple of the

S&P500 index (12-month forward) went up by five points, from 10.5 at

the end of 2008 to 15.5 currently. This PE multiple expansion is

responsible for around 650 index points or 32% of the current S&P500

index level. Extending that to the total stock of US corporate equities ($29tr currently), it implies an equity wealth boost of $9tr.”

Read More @ ZeroHedge.com

“The decline in asset yields especially during QE3 created large wealth effects. Since

the Fed’s QE started at the end of 2008 the PE multiple of the

S&P500 index (12-month forward) went up by five points, from 10.5 at

the end of 2008 to 15.5 currently. This PE multiple expansion is

responsible for around 650 index points or 32% of the current S&P500

index level. Extending that to the total stock of US corporate equities ($29tr currently), it implies an equity wealth boost of $9tr.”

“The decline in asset yields especially during QE3 created large wealth effects. Since

the Fed’s QE started at the end of 2008 the PE multiple of the

S&P500 index (12-month forward) went up by five points, from 10.5 at

the end of 2008 to 15.5 currently. This PE multiple expansion is

responsible for around 650 index points or 32% of the current S&P500

index level. Extending that to the total stock of US corporate equities ($29tr currently), it implies an equity wealth boost of $9tr.” Read More @ ZeroHedge.com

By Mike Adams, Natural News:

Just days after admitted it lied about how Ebola spreads and finally

admitting the virus can spread through aerosolized particles propelled

via sneezing or coughing, the CDC yanked its document off the web.

Just days after admitted it lied about how Ebola spreads and finally

admitting the virus can spread through aerosolized particles propelled

via sneezing or coughing, the CDC yanked its document off the web.

It replaced it with a new PDF that’s almost entirely empty, except for the statement “Fact sheet is being updated and is currently unavailable.” You can see that file at this CDC link.

As the editor of Natural News, I anticipated the CDC doing this, so I saved off a copy of the original PDF on Natural News servers, which you can access at the following link:

Read More @ NaturalNews.com

from MissingSky101:

by JB Slear, Fort Wealth:

Good Morning Fiat-Nam! Let’s see what do we have on the board

today? Ah yes, the almighty American Peso is up again, Wow! What

do you think of that? Let’s see why is it up? Jobs, Income

inflation, another must have American made product? Nope, The US

Dollar is trading at 86.685, up another 45.3 points after reaching

86.83 just after Japan announced its added version of QE into the

world’s money pit, which of course means more liquidity being pumped

into a dead system that cannot stop its own heroin type addictions.

Good Morning Fiat-Nam! Let’s see what do we have on the board

today? Ah yes, the almighty American Peso is up again, Wow! What

do you think of that? Let’s see why is it up? Jobs, Income

inflation, another must have American made product? Nope, The US

Dollar is trading at 86.685, up another 45.3 points after reaching

86.83 just after Japan announced its added version of QE into the

world’s money pit, which of course means more liquidity being pumped

into a dead system that cannot stop its own heroin type addictions.

http://www.zerohedge.com/news/2014-10-31/markets-explodes-bank-japan-goes-all-er-increases-qqe-jpy-80-trillion. The problem, still, is the US Treasuries, which are at levels truly uncollectable and even after Japans announcement the US Treasuries are getting weaker and weaker. Either they’ll have to cover that body up soon enough or we’re on the verge of seeing failing bond prices.

Read More @ FortWealth.com

from KingWorldNews:

Eric King:

‘Eric, we are in the midst of this smash in gold and silver, and we

have the stock market and the dollar doing what they are doing. What do

you expect for the rest of this year, once the dust settles?”

Eric King:

‘Eric, we are in the midst of this smash in gold and silver, and we

have the stock market and the dollar doing what they are doing. What do

you expect for the rest of this year, once the dust settles?”

Sprott: “Well, God knows when the dust settles, but what I’ve expected for a long time now is that the basic fundamentals for gold and silver will win the day. That hasn’t happened yet. It hasn’t happened because entities have financial weapons that they can use on these commodity exchanges and the physical buying hasn’t gotten to a point where we have the failure (of an exchange to deliver)….

Eric Sprott Audio Interview @ KingWorldNews.com

Just days after admitted it lied about how Ebola spreads and finally

admitting the virus can spread through aerosolized particles propelled

via sneezing or coughing, the CDC yanked its document off the web.

Just days after admitted it lied about how Ebola spreads and finally

admitting the virus can spread through aerosolized particles propelled

via sneezing or coughing, the CDC yanked its document off the web.It replaced it with a new PDF that’s almost entirely empty, except for the statement “Fact sheet is being updated and is currently unavailable.” You can see that file at this CDC link.

As the editor of Natural News, I anticipated the CDC doing this, so I saved off a copy of the original PDF on Natural News servers, which you can access at the following link:

Read More @ NaturalNews.com

from MissingSky101:

Good Morning Fiat-Nam! Let’s see what do we have on the board

today? Ah yes, the almighty American Peso is up again, Wow! What

do you think of that? Let’s see why is it up? Jobs, Income

inflation, another must have American made product? Nope, The US

Dollar is trading at 86.685, up another 45.3 points after reaching

86.83 just after Japan announced its added version of QE into the

world’s money pit, which of course means more liquidity being pumped

into a dead system that cannot stop its own heroin type addictions.

Good Morning Fiat-Nam! Let’s see what do we have on the board

today? Ah yes, the almighty American Peso is up again, Wow! What

do you think of that? Let’s see why is it up? Jobs, Income

inflation, another must have American made product? Nope, The US

Dollar is trading at 86.685, up another 45.3 points after reaching

86.83 just after Japan announced its added version of QE into the

world’s money pit, which of course means more liquidity being pumped

into a dead system that cannot stop its own heroin type addictions.http://www.zerohedge.com/news/2014-10-31/markets-explodes-bank-japan-goes-all-er-increases-qqe-jpy-80-trillion. The problem, still, is the US Treasuries, which are at levels truly uncollectable and even after Japans announcement the US Treasuries are getting weaker and weaker. Either they’ll have to cover that body up soon enough or we’re on the verge of seeing failing bond prices.

Read More @ FortWealth.com

Eric King:

‘Eric, we are in the midst of this smash in gold and silver, and we

have the stock market and the dollar doing what they are doing. What do

you expect for the rest of this year, once the dust settles?”

Eric King:

‘Eric, we are in the midst of this smash in gold and silver, and we

have the stock market and the dollar doing what they are doing. What do

you expect for the rest of this year, once the dust settles?”Sprott: “Well, God knows when the dust settles, but what I’ve expected for a long time now is that the basic fundamentals for gold and silver will win the day. That hasn’t happened yet. It hasn’t happened because entities have financial weapons that they can use on these commodity exchanges and the physical buying hasn’t gotten to a point where we have the failure (of an exchange to deliver)….

Eric Sprott Audio Interview @ KingWorldNews.com

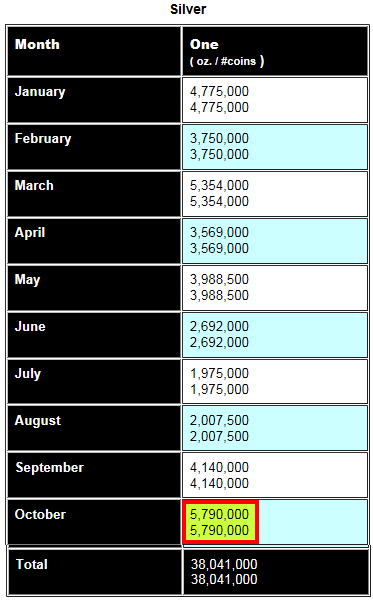

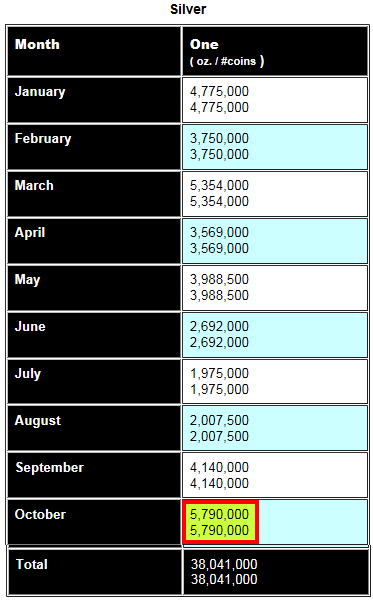

from SRS Rocco:

Investors snatched up a record number of Silver Eagles as the paper price was manipulated to new lows today. This is a very strange market phenomenon, as several “Official” analysts forecasted a drop or sell-off of physical metal if the price continued to decline.

In just the past two days, investors purchased more than 1.4 million Silver Eagles. This pushed the total sales for October to 5,790.000, surpassing the record set in March at 5,354,000.

Furthermore, total Silver Eagle sales for 2014 are now over 38 million. In 2013, the record stood at 42.7 million. If we have another strong sales month in November of 4 million, all we would need is at least 800,000 Silver Eagles sold in December to surpass the record set last year.

Read More @ SRSroccoReport.com

Investors snatched up a record number of Silver Eagles as the paper price was manipulated to new lows today. This is a very strange market phenomenon, as several “Official” analysts forecasted a drop or sell-off of physical metal if the price continued to decline.

In just the past two days, investors purchased more than 1.4 million Silver Eagles. This pushed the total sales for October to 5,790.000, surpassing the record set in March at 5,354,000.

Furthermore, total Silver Eagle sales for 2014 are now over 38 million. In 2013, the record stood at 42.7 million. If we have another strong sales month in November of 4 million, all we would need is at least 800,000 Silver Eagles sold in December to surpass the record set last year.

Read More @ SRSroccoReport.com

from Washington’s Blog:

Has Japan Just Signed Its Own Death Warrant?

Has Japan Just Signed Its Own Death Warrant?

Japan just went all-in on quantitative easing.

Bloomberg reports:

The Bank of Japan’s expansion of record stimulus today may see it buy every new bond the government issues.

The BOJ said it plans to buy 8 trillion to 12 trillion yen ($108 billion) of Japanese government bonds per month under stepped-up stimulus it announced today.

Read More @ WashingtonsBlog.com

Has Japan Just Signed Its Own Death Warrant?

Has Japan Just Signed Its Own Death Warrant?Japan just went all-in on quantitative easing.

Bloomberg reports:

The Bank of Japan’s expansion of record stimulus today may see it buy every new bond the government issues.

The BOJ said it plans to buy 8 trillion to 12 trillion yen ($108 billion) of Japanese government bonds per month under stepped-up stimulus it announced today.

Read More @ WashingtonsBlog.com

from Wolf Street:

Deutsche Skatbank, a division of VR-Bank Altenburger Land, which was

founded in 1859, is not the biggest bank in Germany, but it’s the first

bank to confirm what German savers have been dreading for a while: the

wrath of Draghi.

Deutsche Skatbank, a division of VR-Bank Altenburger Land, which was

founded in 1859, is not the biggest bank in Germany, but it’s the first

bank to confirm what German savers have been dreading for a while: the

wrath of Draghi.

Retail and business customers with over €500,000 on deposit as of November 1 will earn a “negative interest rate” of 0.25%. In less euphemistic terms, they have to pay 0.25% per annum to the bank for the privilege of handing the bank their hard-earned money or their business cash.

Inflation has had a similar effect in the zero-interest-rate environment that the ECB and other central banks have inflicted on savers, but this time it’s official, it’s open, it can’t be hidden. Instead of lending your moolah to the bank so that the bank can lend it out to businesses and retail customers for all sorts of economically beneficial purposes, you’re financially better off hiding it in the basement. Grudging respect is due the ECB and other central banks: through the perverse regime of ZIRP, they have succeeded in transmogrifying “cash in bank” from an income-producing asset to a costly liability.

Read More @ Wolfstreet.com

Deutsche Skatbank, a division of VR-Bank Altenburger Land, which was

founded in 1859, is not the biggest bank in Germany, but it’s the first

bank to confirm what German savers have been dreading for a while: the

wrath of Draghi.

Deutsche Skatbank, a division of VR-Bank Altenburger Land, which was

founded in 1859, is not the biggest bank in Germany, but it’s the first

bank to confirm what German savers have been dreading for a while: the

wrath of Draghi.Retail and business customers with over €500,000 on deposit as of November 1 will earn a “negative interest rate” of 0.25%. In less euphemistic terms, they have to pay 0.25% per annum to the bank for the privilege of handing the bank their hard-earned money or their business cash.

Inflation has had a similar effect in the zero-interest-rate environment that the ECB and other central banks have inflicted on savers, but this time it’s official, it’s open, it can’t be hidden. Instead of lending your moolah to the bank so that the bank can lend it out to businesses and retail customers for all sorts of economically beneficial purposes, you’re financially better off hiding it in the basement. Grudging respect is due the ECB and other central banks: through the perverse regime of ZIRP, they have succeeded in transmogrifying “cash in bank” from an income-producing asset to a costly liability.

Read More @ Wolfstreet.com

by Scooter Rockets, Zen Gardner:

One of the first things that most awakening souls discover is the

banking deception. Today, the Internet is replete with videos and

articles that clearly outline the deceptive practices, and the true

mechanics of money (or currency as it should be called). If you are

reading this and have not fully plumbed the depths of the banking and

money creation deceptions, please take the opportunity to seek out the

information while it is still available to you. But for the purposes of

continuity within this article, allow me to recap the main points of the

currency deception:

One of the first things that most awakening souls discover is the

banking deception. Today, the Internet is replete with videos and

articles that clearly outline the deceptive practices, and the true

mechanics of money (or currency as it should be called). If you are

reading this and have not fully plumbed the depths of the banking and

money creation deceptions, please take the opportunity to seek out the

information while it is still available to you. But for the purposes of

continuity within this article, allow me to recap the main points of the

currency deception:

Money Mechanics

“Out of Thin Air”

Currency is issued out of nothing and backed by nothing. Even when it is tied to an exchange rate for some other material (say gold or oil, for instance), it is still not backed by anything, just tied to it. More importantly, currency is issued by a privately held bank, not only in the US, but in 168 major nations. All of these so-called “central banks” report to the international bank known as the BIS (Bank for International Settlements), also privately held.

Read More @ ZenGardner.com

One of the first things that most awakening souls discover is the

banking deception. Today, the Internet is replete with videos and

articles that clearly outline the deceptive practices, and the true

mechanics of money (or currency as it should be called). If you are

reading this and have not fully plumbed the depths of the banking and

money creation deceptions, please take the opportunity to seek out the

information while it is still available to you. But for the purposes of

continuity within this article, allow me to recap the main points of the

currency deception:

One of the first things that most awakening souls discover is the

banking deception. Today, the Internet is replete with videos and

articles that clearly outline the deceptive practices, and the true

mechanics of money (or currency as it should be called). If you are

reading this and have not fully plumbed the depths of the banking and

money creation deceptions, please take the opportunity to seek out the

information while it is still available to you. But for the purposes of

continuity within this article, allow me to recap the main points of the

currency deception:Money Mechanics

“Out of Thin Air”

Currency is issued out of nothing and backed by nothing. Even when it is tied to an exchange rate for some other material (say gold or oil, for instance), it is still not backed by anything, just tied to it. More importantly, currency is issued by a privately held bank, not only in the US, but in 168 major nations. All of these so-called “central banks” report to the international bank known as the BIS (Bank for International Settlements), also privately held.

Read More @ ZenGardner.com

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment