by Dave Kranzler, Inevstment Research Dynamics:

Over

the last three days, we have reported that some of the most important

investment voices in the world are more than a little scared about the

ravenous appetite for risk playing out in the market, and the fact that

they have been ignored is beyond unnerving. Central banks are driving

all investment decisions, and what this implies is that they are in this

trade so deeply that there is no obvious or practical exit. Richard Brewlow via Zerohedge (link)

Over

the last three days, we have reported that some of the most important

investment voices in the world are more than a little scared about the

ravenous appetite for risk playing out in the market, and the fact that

they have been ignored is beyond unnerving. Central banks are driving

all investment decisions, and what this implies is that they are in this

trade so deeply that there is no obvious or practical exit. Richard Brewlow via Zerohedge (link)

Zerohedge posted an essay by Bloomberg’s Richard Breslow that needs some additional commentary. We already know that western Central Banks have been buying nearly ALL new Government bond issuance for the last 5 years. We know that Japan’s CB admits to buying equities. We know that the Fed sticks huge bids in the market for the S&P 500 eminis in order to trigger massive hedge fund HFT algo buy programs of the big S&P 500 contract. I suspect that the Fed is also buying stocks, which is one of the reasons it is spending million on lobbying to prevent Congress from passing a law forcing an audit of the Fed.

Read More @ InevstmentResearchDynamics.com

Over

the last three days, we have reported that some of the most important

investment voices in the world are more than a little scared about the

ravenous appetite for risk playing out in the market, and the fact that

they have been ignored is beyond unnerving. Central banks are driving

all investment decisions, and what this implies is that they are in this

trade so deeply that there is no obvious or practical exit. Richard Brewlow via Zerohedge (link)

Over

the last three days, we have reported that some of the most important

investment voices in the world are more than a little scared about the

ravenous appetite for risk playing out in the market, and the fact that

they have been ignored is beyond unnerving. Central banks are driving

all investment decisions, and what this implies is that they are in this

trade so deeply that there is no obvious or practical exit. Richard Brewlow via Zerohedge (link)Zerohedge posted an essay by Bloomberg’s Richard Breslow that needs some additional commentary. We already know that western Central Banks have been buying nearly ALL new Government bond issuance for the last 5 years. We know that Japan’s CB admits to buying equities. We know that the Fed sticks huge bids in the market for the S&P 500 eminis in order to trigger massive hedge fund HFT algo buy programs of the big S&P 500 contract. I suspect that the Fed is also buying stocks, which is one of the reasons it is spending million on lobbying to prevent Congress from passing a law forcing an audit of the Fed.

Read More @ InevstmentResearchDynamics.com

What Will Happen To You When The Dollar Collapses?

Submitted by Tyler Durden on 04/25/2015 - 20:25 The day after the crash (and thereafter), what will be the currency that is used to buy a bag of groceries, a tank of petrol, a meal at a restaurant? Certainly, the need will be immediate and will be on a national level in each impacted country, affecting everyone. Many believe the US will be prepared ahead of time with a new, electronic currency - US citizens will then become the most economically controlled people in the world, overnight. A further possibility is taking place in Mexico today. Mexico is remonetising silver. As the Great Unravelling proceeds, we would be wise to monitor what happens with the Libertad in Mexico and watch for a similar return to precious metals in other jurisdictions.

America's Drone-Death Outrage (Summarized In 1 Awkward Cartoon)

Submitted by Tyler Durden on 04/25/2015 - 18:05 Stunned hypocrisy...

by Jeff Nielson, Bullion Bulls:

There has been some interesting data from Zero Hedge over the past week

or so, indicating some serious bubble-formation in various asset

classes in China. However, a post and chart today provide (in my mind)

the most-stark illustration yet of this bubble-activity.

There has been some interesting data from Zero Hedge over the past week

or so, indicating some serious bubble-formation in various asset

classes in China. However, a post and chart today provide (in my mind)

the most-stark illustration yet of this bubble-activity.

Why do I react so strongly to vertical lines on charts? Because such vertical lines ALWAYS indicate two things:

1) Some extreme economic event is currently occurring.

2) That extreme event is about to end very badly.

Vertical lines tell us both of these things, because a vertical line on a chart depicts (in mathematical terms) an exponential explosion, and in more descriptive terms, it is the mathematical depiction of the phrase “out of control”. Thus when I first saw that same, vertical line with respect to U.S. money-printing (in a chart now memorized by all regular readers); I simply said “hyperinflation” — because there is no other, possible outcome for that chart.

Read More @ BullionBullsCanada.com

chart credit: Bloomberg.com

There has been some interesting data from Zero Hedge over the past week

or so, indicating some serious bubble-formation in various asset

classes in China. However, a post and chart today provide (in my mind)

the most-stark illustration yet of this bubble-activity.

There has been some interesting data from Zero Hedge over the past week

or so, indicating some serious bubble-formation in various asset

classes in China. However, a post and chart today provide (in my mind)

the most-stark illustration yet of this bubble-activity.Why do I react so strongly to vertical lines on charts? Because such vertical lines ALWAYS indicate two things:

1) Some extreme economic event is currently occurring.

2) That extreme event is about to end very badly.

Vertical lines tell us both of these things, because a vertical line on a chart depicts (in mathematical terms) an exponential explosion, and in more descriptive terms, it is the mathematical depiction of the phrase “out of control”. Thus when I first saw that same, vertical line with respect to U.S. money-printing (in a chart now memorized by all regular readers); I simply said “hyperinflation” — because there is no other, possible outcome for that chart.

Read More @ BullionBullsCanada.com

chart credit: Bloomberg.com

The "War On Cash" Migrates To Switzerland

Submitted by Tyler Durden on 04/25/2015 - 17:15 It is undoubtedly a huge red flag when in one of the countries considered to be a member of the “highest economic freedom in the world” club, commercial banks are suddenly refusing their customers access to their cash. This money doesn’t belong to the banks, and it doesn’t belong to the central bank either. If this can happen in prosperous Switzerland, based on some nebulous notion of the “collective good”, which its unelected central planners can arbitrarily determine and base decisions upon, it can probably happen anywhere. Consider yourself warned.

from Armstrong Economics:

Project Innocence has been operating as a counter-balance against a

justice system the is complete insane. In the federal prison, only about

4% of the people are even there for violence. The Ohio Project

Innocence has won a victory where men have finally been released holding

the record for the longest wrongfully held – 39 years.

Project Innocence has been operating as a counter-balance against a

justice system the is complete insane. In the federal prison, only about

4% of the people are even there for violence. The Ohio Project

Innocence has won a victory where men have finally been released holding

the record for the longest wrongfully held – 39 years.

It was 1975, Ricky Jackson and two other young black men were charged and convicted of the murder of a white businessman in Cleveland. The sole evidence against Ricky was testimony provided by an alleged eyewitness, who was 12 at the time. Ricky has met that child who is a man today. He has bluntly stated that he feels no anger. He understands the system and that the witness is typically rehearsed and coerced and becomes a victim of the system themselves.

Read More @ ArmstrongEconomics.org

Project Innocence has been operating as a counter-balance against a

justice system the is complete insane. In the federal prison, only about

4% of the people are even there for violence. The Ohio Project

Innocence has won a victory where men have finally been released holding

the record for the longest wrongfully held – 39 years.

Project Innocence has been operating as a counter-balance against a

justice system the is complete insane. In the federal prison, only about

4% of the people are even there for violence. The Ohio Project

Innocence has won a victory where men have finally been released holding

the record for the longest wrongfully held – 39 years.It was 1975, Ricky Jackson and two other young black men were charged and convicted of the murder of a white businessman in Cleveland. The sole evidence against Ricky was testimony provided by an alleged eyewitness, who was 12 at the time. Ricky has met that child who is a man today. He has bluntly stated that he feels no anger. He understands the system and that the witness is typically rehearsed and coerced and becomes a victim of the system themselves.

Read More @ ArmstrongEconomics.org

from Natural News:

After more than two decades of sweetening its sodas with aspartame — a

chemical sweetener that more and more consumers equate with a

neurological poison — PepsiCo has announced it’s dropping the chemical

and replacing it with sucralose.

After more than two decades of sweetening its sodas with aspartame — a

chemical sweetener that more and more consumers equate with a

neurological poison — PepsiCo has announced it’s dropping the chemical

and replacing it with sucralose.

The dropping of aspartame from its sodas is yet another monumental victory for the “clean food movement” — a term first coined by Gerald Celente of Trends Research. Since its launch, aspartame’s reputation has been hammered by clean food activists who point out the chemical’s association with neurological disorders, seizures, temporary blindness and other side effects. Aspartame is widely believed to be associated with the development of brain cancer tumors.

Read More @ NaturalNews.com

After more than two decades of sweetening its sodas with aspartame — a

chemical sweetener that more and more consumers equate with a

neurological poison — PepsiCo has announced it’s dropping the chemical

and replacing it with sucralose.

After more than two decades of sweetening its sodas with aspartame — a

chemical sweetener that more and more consumers equate with a

neurological poison — PepsiCo has announced it’s dropping the chemical

and replacing it with sucralose.The dropping of aspartame from its sodas is yet another monumental victory for the “clean food movement” — a term first coined by Gerald Celente of Trends Research. Since its launch, aspartame’s reputation has been hammered by clean food activists who point out the chemical’s association with neurological disorders, seizures, temporary blindness and other side effects. Aspartame is widely believed to be associated with the development of brain cancer tumors.

Read More @ NaturalNews.com

10 Must-Haves for a Financial Collapse

from victoryindependence:

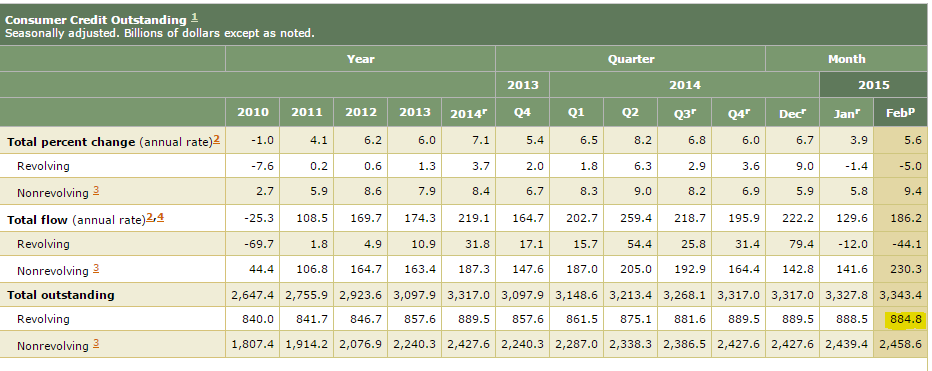

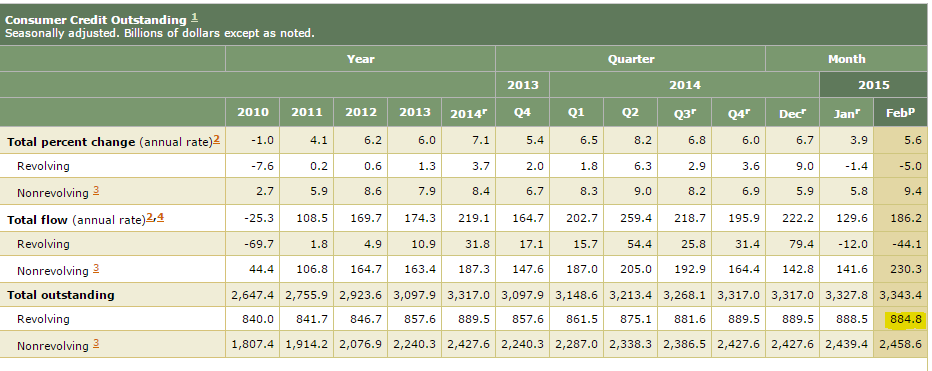

The debt addiction in your pocket.

from MyBudget360.com:

There is something alluring about swiping a card and making a purchase. It almost seems euphoric and fun. Credit cards come in a variety of sleek designs to help you part with your current and future income. Americans are deeply in debt. Mortgages, student loans, auto debt, and credit cards consume a large portion of future income. You would think that most people would reflect on the mechanics of how debt works but this is not the case. Most people are oblivious to how credit cards work but continue to use them and go into deep debt. Throw in online shopping and you can store your credit information virtually and shop with one-click. This wouldn’t be such a problem if incomes were moving ahead. Unfortunately that is not the case and many are struggling to find their economic balance in the new low wage economy. Credit card debt is once again on the rise and two-thirds of Americans do not understand how credit cards work.

Read More @ MyBudget360.com

from MyBudget360.com:

There is something alluring about swiping a card and making a purchase. It almost seems euphoric and fun. Credit cards come in a variety of sleek designs to help you part with your current and future income. Americans are deeply in debt. Mortgages, student loans, auto debt, and credit cards consume a large portion of future income. You would think that most people would reflect on the mechanics of how debt works but this is not the case. Most people are oblivious to how credit cards work but continue to use them and go into deep debt. Throw in online shopping and you can store your credit information virtually and shop with one-click. This wouldn’t be such a problem if incomes were moving ahead. Unfortunately that is not the case and many are struggling to find their economic balance in the new low wage economy. Credit card debt is once again on the rise and two-thirds of Americans do not understand how credit cards work.

Read More @ MyBudget360.com

Remember the Germans used dogs too...

My first Uber lift was in South Carolina. My driver was from Sudan

originally, but had emigrated to the US 20 years ago. Being the curious

sort, I asked him about his life in Sudan and why he moved. He said

that he left when his country had crumbled too far, past the point where

a reasonable person could have a reasonable expectation of personal

safety, when all institutions had become corrupted making business

increasingly difficult. So he left.

My first Uber lift was in South Carolina. My driver was from Sudan

originally, but had emigrated to the US 20 years ago. Being the curious

sort, I asked him about his life in Sudan and why he moved. He said

that he left when his country had crumbled too far, past the point where

a reasonable person could have a reasonable expectation of personal

safety, when all institutions had become corrupted making business

increasingly difficult. So he left. Detecting a hitch in his delivery when he spoke of coming to the US, I asked him how he felt about the US now, 20 years later. “To be honest,” he said, “the same things I saw in Sudan that led me to leave are happening here now. That saddens me greatly, because where else is there to go?”

Read More @ Peakprosperity.com

from TheAlexJonesChannel:

from The News Doctors:

Many people perceive Texas as a bastion of rugged individualism and

minimal government. Kansas not so much so. This month both states’

governments are moving toward implementing laws removing some

restrictions on people carrying handguns. Yet only Kansas is doing so

without requiring an individual to take a course, pay a fee, and put his

personal information into a government database — perfect for

facilitating surveillance — before being able to legally carry a

handgun.

Many people perceive Texas as a bastion of rugged individualism and

minimal government. Kansas not so much so. This month both states’

governments are moving toward implementing laws removing some

restrictions on people carrying handguns. Yet only Kansas is doing so

without requiring an individual to take a course, pay a fee, and put his

personal information into a government database — perfect for

facilitating surveillance — before being able to legally carry a

handgun.

On April 2, Kansas Governor Sam Brownback signed into law SB 45. The bill legalizes the carrying of concealed handguns by many people in Kansas without the requirement that they first pay a fee, take a class, obtain a permit, or provide personal information for inclusion in a government database.

Read More @ TheNewsDoctors.com

Many people perceive Texas as a bastion of rugged individualism and

minimal government. Kansas not so much so. This month both states’

governments are moving toward implementing laws removing some

restrictions on people carrying handguns. Yet only Kansas is doing so

without requiring an individual to take a course, pay a fee, and put his

personal information into a government database — perfect for

facilitating surveillance — before being able to legally carry a

handgun.

Many people perceive Texas as a bastion of rugged individualism and

minimal government. Kansas not so much so. This month both states’

governments are moving toward implementing laws removing some

restrictions on people carrying handguns. Yet only Kansas is doing so

without requiring an individual to take a course, pay a fee, and put his

personal information into a government database — perfect for

facilitating surveillance — before being able to legally carry a

handgun.On April 2, Kansas Governor Sam Brownback signed into law SB 45. The bill legalizes the carrying of concealed handguns by many people in Kansas without the requirement that they first pay a fee, take a class, obtain a permit, or provide personal information for inclusion in a government database.

Read More @ TheNewsDoctors.com

Germany Prepares For "Plan B", Says Greece Would "Need Not Only A Third Bailout, But Fourth, Fifth Or Even More"

Submitted by Tyler Durden on 04/25/2015 - 12:02

It has been a very disturbing 24 hours for Greece.

Submitted by Tyler Durden on 04/25/2015 - 12:02

It has been a very disturbing 24 hours for Greece.

by Mac Slavo, SHTFPlan:

In a communication with JP Morgan Chase shareholders earlier this month Jamie Dimon, CEO of one of the world’s largest and most influential banks, said that a more volatile crisis than 2008 is coming.

It was striking admission from a man who has close ties to the Obama inner circle and was once at the top of the list for the post of U.S. Treasury Secretary. Considering the President continues to tout economic recovery, and that a significant majority of Americans reportedly believe the economy is healthy, the fact that Dimon is warning of another financial crisis should be a clear sign of what’s to come.

Read More @ SHTFPlan.com

In a communication with JP Morgan Chase shareholders earlier this month Jamie Dimon, CEO of one of the world’s largest and most influential banks, said that a more volatile crisis than 2008 is coming.

It was striking admission from a man who has close ties to the Obama inner circle and was once at the top of the list for the post of U.S. Treasury Secretary. Considering the President continues to tout economic recovery, and that a significant majority of Americans reportedly believe the economy is healthy, the fact that Dimon is warning of another financial crisis should be a clear sign of what’s to come.

Read More @ SHTFPlan.com

“The US was the overwhelming choice (24% of respondents) for the country that represents the greatest threat to peace in the world today. This was followed by Pakistan (8%), China (6%), North Korea, Israel and Iran (5%). Respondents in Russia (54%), China (49%) and Bosnia (49%) were the most fearful of the US as a threat.”

(Some of the reasons why America is considered, by people throughout the world, to be the biggest threat to peace, will be documented below.)

Read More @ WashingtonsBlog.com

Last year, as part of his Imperial decree of amnesty

for illegal immigrants, President Barack Obama created the White House

Task Force on New Americans, whose goal is to vastly increase the

numbers and rates at which immigrants were naturalized and granted

citizenship.

Last year, as part of his Imperial decree of amnesty

for illegal immigrants, President Barack Obama created the White House

Task Force on New Americans, whose goal is to vastly increase the

numbers and rates at which immigrants were naturalized and granted

citizenship.This Task Force works hand-in-hand with the George Soros-funded, open borders-promoting Migration Policy Institute, as well as the openly racist group La Raza, a Mexican nationalist organization that has called for the mass murder of white Americans and a return of the western states to Mexico.

Read More @ WesternJournalism.com

from KingWorldNews:

Over the past seven years the Federal Reserve printed $3.7 trillion

with the hopes of spurring economic growth. But ask yourself, who did

this money actually go to?

Over the past seven years the Federal Reserve printed $3.7 trillion

with the hopes of spurring economic growth. But ask yourself, who did

this money actually go to?

At the onset of the financial crisis Ben Bernanke didn’t run around America like Ed McCann–knocking on doors and handing people checks to pay off their underwater mortgages. On the contrary, the first tranche of money in the form of TARP and the AIG bailout went to banks in order to allow them to remain solvent.

Then, three rounds of QE bought distressed assets on the books of banks with hopes this would allow them to make new, less questionable, loans. But, who were the banks supposed to lend to? Consumers were already loaded with debt because they didn’t get a Fed bailout.

Michael Pento Audio Interview @ KingWorldNews.com

Over the past seven years the Federal Reserve printed $3.7 trillion

with the hopes of spurring economic growth. But ask yourself, who did

this money actually go to?

Over the past seven years the Federal Reserve printed $3.7 trillion

with the hopes of spurring economic growth. But ask yourself, who did

this money actually go to? At the onset of the financial crisis Ben Bernanke didn’t run around America like Ed McCann–knocking on doors and handing people checks to pay off their underwater mortgages. On the contrary, the first tranche of money in the form of TARP and the AIG bailout went to banks in order to allow them to remain solvent.

Then, three rounds of QE bought distressed assets on the books of banks with hopes this would allow them to make new, less questionable, loans. But, who were the banks supposed to lend to? Consumers were already loaded with debt because they didn’t get a Fed bailout.

Michael Pento Audio Interview @ KingWorldNews.com

from Silver Doctors:

With gold & silver hammered yet again Friday, Fund Manager Dave Kranzler joins the show, discussing:

Cartel algos send gold & silver down the elevator shaft on NO NEWS- whats amazing is they don’t even try to hide it anymore

Are we setting up for a short squeeze on next week’s FOMC, or is The Fed setting up the metals to be smashed through their lows for an Epic Waterfall- washout bottom on the FOMC?

Reverse Repos Go Parabolic: Has a ‘Liquidity Shock’ Derivatives Melt-Down Begun? Kranzler provides SMOKING GUN evidence why the answer is YES.

The SD Weekly Metals & Markets With The Doc, Eric Dubin, and Fund Manager Dave Kranzler is below:

Read More @ SilverDoctors.com

by Andrew Hoffman, Miles Franklin:

from PaulBegley:

from The Money GPS:

from KingWorldNews:

The question that haunts me is whether the US dollar has topped out for the duration.

The question that haunts me is whether the US dollar has topped out for the duration.

China To Reveal The Size Of Its Gold Hoard This Year

Turning to China, its GDP will soon eclipse the US’s GDP. Personally, I don’t think China wants to surpass the US and be the new leader of the world. I think China wants to be on par with the US. We don’t know how much gold China has, but we do know that China is continually accumulating gold. It’s been a few years since China has told the world the size of its gold hoard. Before this year is out, I believe China will reveal its gold position.

Richard Russell Continues @ KingWorldNews.com

from Real Thing TV:

/With gold & silver hammered yet again Friday, Fund Manager Dave Kranzler joins the show, discussing:

Cartel algos send gold & silver down the elevator shaft on NO NEWS- whats amazing is they don’t even try to hide it anymore

Are we setting up for a short squeeze on next week’s FOMC, or is The Fed setting up the metals to be smashed through their lows for an Epic Waterfall- washout bottom on the FOMC?

Reverse Repos Go Parabolic: Has a ‘Liquidity Shock’ Derivatives Melt-Down Begun? Kranzler provides SMOKING GUN evidence why the answer is YES.

The SD Weekly Metals & Markets With The Doc, Eric Dubin, and Fund Manager Dave Kranzler is below:

Read More @ SilverDoctors.com

from Govt Slaves:

On April 20, a bill nullifying all federal gun control efforts landed

on the desk of Governor Bill Haslam of Tennessee (shown on right) for

his signature or veto. On April 13, the Tennessee House and Senate

passed a bill blocking state agencies and employees from enforcing

federal acts aimed at unconstitutionally infringing on the right to keep

and bear arms as protected by the U.S. and Tennessee constitutions.

On April 20, a bill nullifying all federal gun control efforts landed

on the desk of Governor Bill Haslam of Tennessee (shown on right) for

his signature or veto. On April 13, the Tennessee House and Senate

passed a bill blocking state agencies and employees from enforcing

federal acts aimed at unconstitutionally infringing on the right to keep

and bear arms as protected by the U.S. and Tennessee constitutions.

The bill passed the state senate unanimously (30-0), while the vote in the state house of representatives was a less impressive, though overwhelming 74 lawmakers in favor and 20 opposed.

Read More @ GovtSlaves.info

On April 20, a bill nullifying all federal gun control efforts landed

on the desk of Governor Bill Haslam of Tennessee (shown on right) for

his signature or veto. On April 13, the Tennessee House and Senate

passed a bill blocking state agencies and employees from enforcing

federal acts aimed at unconstitutionally infringing on the right to keep

and bear arms as protected by the U.S. and Tennessee constitutions.

On April 20, a bill nullifying all federal gun control efforts landed

on the desk of Governor Bill Haslam of Tennessee (shown on right) for

his signature or veto. On April 13, the Tennessee House and Senate

passed a bill blocking state agencies and employees from enforcing

federal acts aimed at unconstitutionally infringing on the right to keep

and bear arms as protected by the U.S. and Tennessee constitutions.The bill passed the state senate unanimously (30-0), while the vote in the state house of representatives was a less impressive, though overwhelming 74 lawmakers in favor and 20 opposed.

Read More @ GovtSlaves.info

by Andrew Hoffman, Miles Franklin:

by Michael Noonan, Edge Trader Plus:

Where have all the trillions of newly created “money” gone? Into the

failed and bankrupt banking scam conducted by the elites. All

world-wide monetary policy undertaken by the central banks has been for

the sole purpose of protecting the failed banking financial structure,

propping up the fiat currencies.

Where have all the trillions of newly created “money” gone? Into the

failed and bankrupt banking scam conducted by the elites. All

world-wide monetary policy undertaken by the central banks has been for

the sole purpose of protecting the failed banking financial structure,

propping up the fiat currencies.

Virtually none of the newly created “money” has ever left the banking system for loans to be used for productive means. Instead, it is being used to enslave other sovereign nations, breaking them financially, then taking control of each nation, one nation at a time. Think of Ireland, Spain, Cyprus, and now Greece most prominently in the Kabuki theater known as the elite-controlled Western press. The purpose: A no escape treadmill of debt bondage and poverty. [Kabuki theater: Performance where nothing substantive gets done]

Read More @ EdgeTraderPlus.com

Where have all the trillions of newly created “money” gone? Into the

failed and bankrupt banking scam conducted by the elites. All

world-wide monetary policy undertaken by the central banks has been for

the sole purpose of protecting the failed banking financial structure,

propping up the fiat currencies.

Where have all the trillions of newly created “money” gone? Into the

failed and bankrupt banking scam conducted by the elites. All

world-wide monetary policy undertaken by the central banks has been for

the sole purpose of protecting the failed banking financial structure,

propping up the fiat currencies.Virtually none of the newly created “money” has ever left the banking system for loans to be used for productive means. Instead, it is being used to enslave other sovereign nations, breaking them financially, then taking control of each nation, one nation at a time. Think of Ireland, Spain, Cyprus, and now Greece most prominently in the Kabuki theater known as the elite-controlled Western press. The purpose: A no escape treadmill of debt bondage and poverty. [Kabuki theater: Performance where nothing substantive gets done]

Read More @ EdgeTraderPlus.com

from Wolf Street:

Well, maybe Amazon is the greatest thing since sliced bread, but that

doesn’t explain how it gained $25 billion of market cap overnight after

reporting another loosing quarter. Give all the credit you want to its

web services business—a newly disclosed but decade old operation with

scads of competent competitors and which sports a modest $6 billion run

rate of sales that may or may not be profitable on a fully-loaded cost

basis—and it still doesn’t explain today’s buying panic.

Well, maybe Amazon is the greatest thing since sliced bread, but that

doesn’t explain how it gained $25 billion of market cap overnight after

reporting another loosing quarter. Give all the credit you want to its

web services business—a newly disclosed but decade old operation with

scads of competent competitors and which sports a modest $6 billion run

rate of sales that may or may not be profitable on a fully-loaded cost

basis—and it still doesn’t explain today’s buying panic.

What can’t be denied, however, is that Amazon’s first quarter red ink brought its bottom line over the last twelve months (LTM) to negative $406 million. That’s its worst result since way back in December 2001 when it posted a LTM loss of $567 million. And it marks the 18th straight quarter in which its LTM net income has been going downhill from the modest peak of $1.1 billion it posted for the four quarters ended in September 2010.

Read More @ Wolfstreet.com

Well, maybe Amazon is the greatest thing since sliced bread, but that

doesn’t explain how it gained $25 billion of market cap overnight after

reporting another loosing quarter. Give all the credit you want to its

web services business—a newly disclosed but decade old operation with

scads of competent competitors and which sports a modest $6 billion run

rate of sales that may or may not be profitable on a fully-loaded cost

basis—and it still doesn’t explain today’s buying panic.

Well, maybe Amazon is the greatest thing since sliced bread, but that

doesn’t explain how it gained $25 billion of market cap overnight after

reporting another loosing quarter. Give all the credit you want to its

web services business—a newly disclosed but decade old operation with

scads of competent competitors and which sports a modest $6 billion run

rate of sales that may or may not be profitable on a fully-loaded cost

basis—and it still doesn’t explain today’s buying panic.What can’t be denied, however, is that Amazon’s first quarter red ink brought its bottom line over the last twelve months (LTM) to negative $406 million. That’s its worst result since way back in December 2001 when it posted a LTM loss of $567 million. And it marks the 18th straight quarter in which its LTM net income has been going downhill from the modest peak of $1.1 billion it posted for the four quarters ended in September 2010.

Read More @ Wolfstreet.com

from PaulBegley:

from The Money GPS:

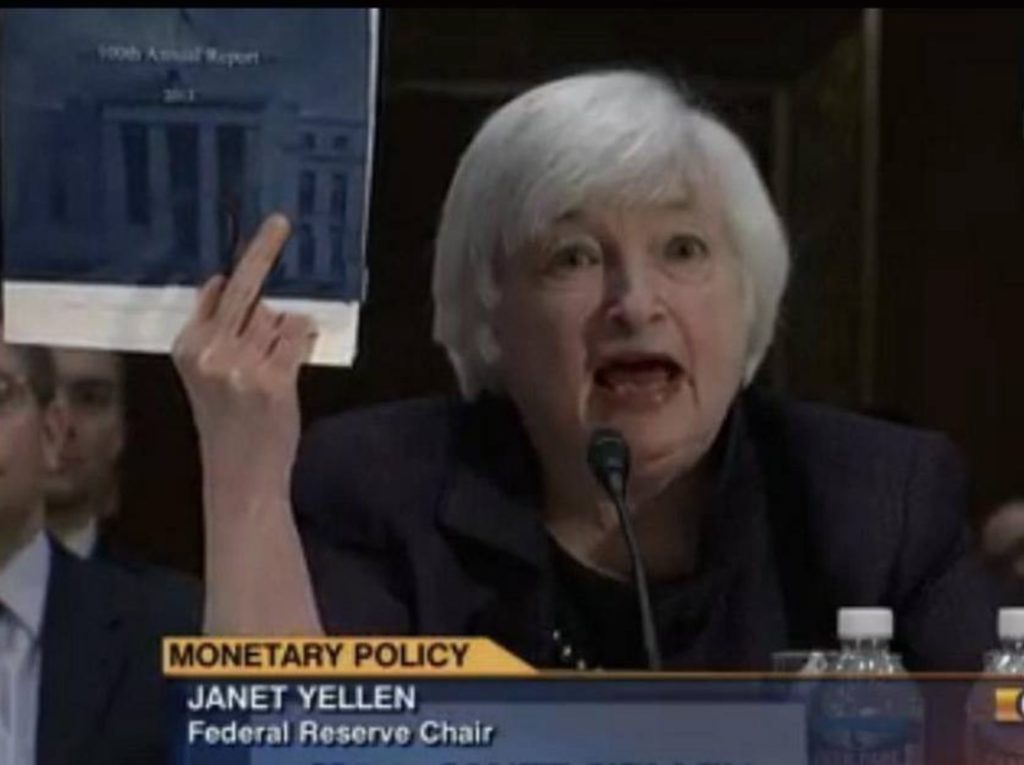

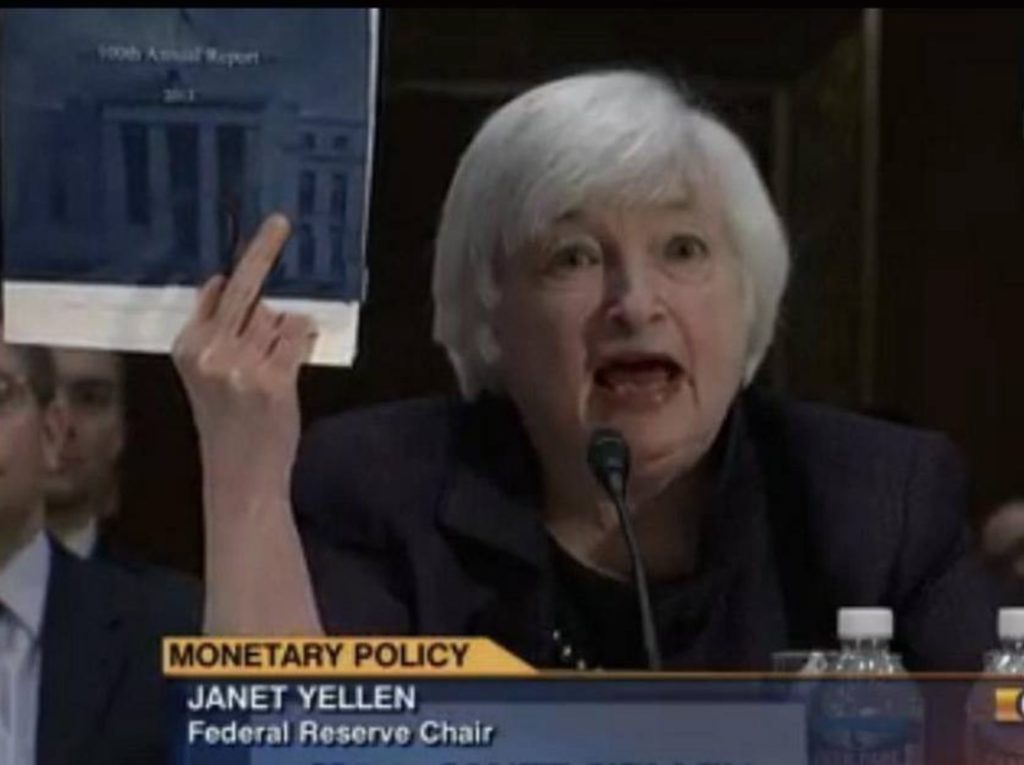

from Bullion Bulls:

For now approaching seven years; the Federal Reserve’s “Boy Who Cried Wolf”

(first B.S. Bernanke and now Janet Yellen) has promised to “raise

interest rates”. When the promise was first made, right after these

psychopathic criminals embarked upon their “0% interest” insanity; we

were told rates would be raised immediately once the “crisis” (created by the same banking crime syndicate) had passed.

For now approaching seven years; the Federal Reserve’s “Boy Who Cried Wolf”

(first B.S. Bernanke and now Janet Yellen) has promised to “raise

interest rates”. When the promise was first made, right after these

psychopathic criminals embarked upon their “0% interest” insanity; we

were told rates would be raised immediately once the “crisis” (created by the same banking crime syndicate) had passed.

That lie quickly changed to raising interest rates “as soon as the U.S. economy has recovered”. Since that second promise (six years, and counting); we’ve been told that the mighty U.S. economy has “recovered” and “recovered” and “recovered” some more. Indeed, it’s become a Never-Ending Recovery — the “Goldilocks economy” which was originally promised by B.S. Bernanke a decade ago (right before the last wave of bankster-bubbles began to burst).

Finally, after lying themselves into a corner with all the boasting of the “strength” of this imaginary recovery; the Fed liars promised the world that interest rates would be raised “very soon”. And after a couple of months of that lying; the Liars even ‘leaked’ a specific date to the sycophants of the Corporate media: June.

Read More @ Bullionbullscanada.com

from TheResistance:

from TomWoodsTV:

For now approaching seven years; the Federal Reserve’s “Boy Who Cried Wolf”

(first B.S. Bernanke and now Janet Yellen) has promised to “raise

interest rates”. When the promise was first made, right after these

psychopathic criminals embarked upon their “0% interest” insanity; we

were told rates would be raised immediately once the “crisis” (created by the same banking crime syndicate) had passed.

For now approaching seven years; the Federal Reserve’s “Boy Who Cried Wolf”

(first B.S. Bernanke and now Janet Yellen) has promised to “raise

interest rates”. When the promise was first made, right after these

psychopathic criminals embarked upon their “0% interest” insanity; we

were told rates would be raised immediately once the “crisis” (created by the same banking crime syndicate) had passed.That lie quickly changed to raising interest rates “as soon as the U.S. economy has recovered”. Since that second promise (six years, and counting); we’ve been told that the mighty U.S. economy has “recovered” and “recovered” and “recovered” some more. Indeed, it’s become a Never-Ending Recovery — the “Goldilocks economy” which was originally promised by B.S. Bernanke a decade ago (right before the last wave of bankster-bubbles began to burst).

Finally, after lying themselves into a corner with all the boasting of the “strength” of this imaginary recovery; the Fed liars promised the world that interest rates would be raised “very soon”. And after a couple of months of that lying; the Liars even ‘leaked’ a specific date to the sycophants of the Corporate media: June.

Read More @ Bullionbullscanada.com

from TheResistance:

from Liberty Blitzkieg:

Over the past week or so, I’ve written several posts highlighting the

dangers of “public-private” partnerships. This is the preferred term

being used by savvy members of the status quo to provide cover for their

relentless pursuit of economic fascism. It provides a good soundbite,

but in reality is nothing more than a license to loot and pillage with

government backing. Here’s how I described the scam in the post, Meet Cyber P3 – The U.S. Military’s Public-Private Partnership to Create Corporate/Government “Cyber Soldiers.”

Over the past week or so, I’ve written several posts highlighting the

dangers of “public-private” partnerships. This is the preferred term

being used by savvy members of the status quo to provide cover for their

relentless pursuit of economic fascism. It provides a good soundbite,

but in reality is nothing more than a license to loot and pillage with

government backing. Here’s how I described the scam in the post, Meet Cyber P3 – The U.S. Military’s Public-Private Partnership to Create Corporate/Government “Cyber Soldiers.”

Bankers are a lot of things, but the ones who reach the very top of their profession are not stupid. As such, it’s no surprise that they figured out the value of public-private schemes before most. Enter the Federal Reserve, a banking cartel partnership with government.

Read More @ libertyblitzkrieg.com

Over the past week or so, I’ve written several posts highlighting the

dangers of “public-private” partnerships. This is the preferred term

being used by savvy members of the status quo to provide cover for their

relentless pursuit of economic fascism. It provides a good soundbite,

but in reality is nothing more than a license to loot and pillage with

government backing. Here’s how I described the scam in the post, Meet Cyber P3 – The U.S. Military’s Public-Private Partnership to Create Corporate/Government “Cyber Soldiers.”

Over the past week or so, I’ve written several posts highlighting the

dangers of “public-private” partnerships. This is the preferred term

being used by savvy members of the status quo to provide cover for their

relentless pursuit of economic fascism. It provides a good soundbite,

but in reality is nothing more than a license to loot and pillage with

government backing. Here’s how I described the scam in the post, Meet Cyber P3 – The U.S. Military’s Public-Private Partnership to Create Corporate/Government “Cyber Soldiers.”It makes perfect sense if you think about it. If you’re a large corporation, there’s nothing better than guaranteed profits; and there’s no better way to guarantee profits than by going into business with the one entity that can do this: government. On the other hand, if you are an ambitious and greedy politician, what better way to earn a fortune while ostensibly engaging in “public service” than by lining the pockets of big corporations, which will then line your pockets in return in various opaque ways. Extraordinary fees for speeches is one preferred way of doing this, as is the classic revolving door that gives the person a cushy corporate job after leaving government.

Bankers are a lot of things, but the ones who reach the very top of their profession are not stupid. As such, it’s no surprise that they figured out the value of public-private schemes before most. Enter the Federal Reserve, a banking cartel partnership with government.

Read More @ libertyblitzkrieg.com

from TomWoodsTV:

The question that haunts me is whether the US dollar has topped out for the duration.

The question that haunts me is whether the US dollar has topped out for the duration.China To Reveal The Size Of Its Gold Hoard This Year

Turning to China, its GDP will soon eclipse the US’s GDP. Personally, I don’t think China wants to surpass the US and be the new leader of the world. I think China wants to be on par with the US. We don’t know how much gold China has, but we do know that China is continually accumulating gold. It’s been a few years since China has told the world the size of its gold hoard. Before this year is out, I believe China will reveal its gold position.

Richard Russell Continues @ KingWorldNews.com

by Terence P. Jeffrey, CNSnews:

According to the Daily Treasury Statement for Wednesday, April 22,

which was published by the U.S. Treasury on Thursday, April 23, that

portion of the federal debt that is subject to a legal limit set by

Congress closed the day at $18,112,975,000,000—for the 40th day in a

row.

According to the Daily Treasury Statement for Wednesday, April 22,

which was published by the U.S. Treasury on Thursday, April 23, that

portion of the federal debt that is subject to a legal limit set by

Congress closed the day at $18,112,975,000,000—for the 40th day in a

row.

According to the Daily Treasury Statement for Wednesday, April 22,

which was published by the U.S. Treasury on Thursday, April 23, that

portion of the federal debt that is subject to a legal limit set by

Congress closed the day at $18,112,975,000,000—for the 40th day in a

row.

According to the Daily Treasury Statement for Wednesday, April 22,

which was published by the U.S. Treasury on Thursday, April 23, that

portion of the federal debt that is subject to a legal limit set by

Congress closed the day at $18,112,975,000,000—for the 40th day in a

row.

$18,112,975,000,000 is about $25 million below the current legal debt limit of $18,113,000,080,959.35.

Table III-C on the Daily Treasury Statement

for April 22 shows that the federal debt subject to the legal limit

began April at $18,112,975,000,000, began the day of April 22 at

$18,112,975,000,000 and closed the day of April 22 at

$18,112,975,000,000. In fact, every Daily Treasury Statement since March 13—which was a Friday–has said that the debt subject to the limit has closed the day at $18,112,975,000,000.

Read More @ CNSnews.com

by Ed Steer, Casey Research:

Except for the spike low just after 9:30 a.m. Hong Kong time, the gold

price traded mostly in a five dollar price band through all of Far East

and London trading on their respective Thursday’s. Once the London

p.m. gold “fix” was in, the price rallied a bit before getting sold down

starting around 2:45 p.m. EDT in electronic trading.

Except for the spike low just after 9:30 a.m. Hong Kong time, the gold

price traded mostly in a five dollar price band through all of Far East

and London trading on their respective Thursday’s. Once the London

p.m. gold “fix” was in, the price rallied a bit before getting sold down

starting around 2:45 p.m. EDT in electronic trading.

The low and high ticks were reported by the crooks over at the CME Group as $1,183.60 and $1,197.40 in the June contract.

Gold finished the Thursday trading session at $1,193.50 spot, up $6.70 on the day—and would have obviously closed above $1,200 spot if the sellers of last resort hadn’t shown up during the electronic trading session in New York. Net volume was 112,000 contract, with 93 percent of that number trading in the current front month.

Read More @ CaseyResearch.com

Except for the spike low just after 9:30 a.m. Hong Kong time, the gold

price traded mostly in a five dollar price band through all of Far East

and London trading on their respective Thursday’s. Once the London

p.m. gold “fix” was in, the price rallied a bit before getting sold down

starting around 2:45 p.m. EDT in electronic trading.

Except for the spike low just after 9:30 a.m. Hong Kong time, the gold

price traded mostly in a five dollar price band through all of Far East

and London trading on their respective Thursday’s. Once the London

p.m. gold “fix” was in, the price rallied a bit before getting sold down

starting around 2:45 p.m. EDT in electronic trading.The low and high ticks were reported by the crooks over at the CME Group as $1,183.60 and $1,197.40 in the June contract.

Gold finished the Thursday trading session at $1,193.50 spot, up $6.70 on the day—and would have obviously closed above $1,200 spot if the sellers of last resort hadn’t shown up during the electronic trading session in New York. Net volume was 112,000 contract, with 93 percent of that number trading in the current front month.

Read More @ CaseyResearch.com

from Liberty Blitzkieg:

As the Russians gradually assumed control of Uranium One in three

separate transactions from 2009 to 2013, Canadian records show, a flow

of cash made its way to the Clinton Foundation. Uranium One’s chairman

used his family foundation to make four donations totaling $2.35

million. Those contributions were not publicly disclosed by the

Clintons, despite an agreement Mrs. Clinton had struck with the Obama

White House to publicly identify all donors. Other people with ties to

the company made donations as well.

As the Russians gradually assumed control of Uranium One in three

separate transactions from 2009 to 2013, Canadian records show, a flow

of cash made its way to the Clinton Foundation. Uranium One’s chairman

used his family foundation to make four donations totaling $2.35

million. Those contributions were not publicly disclosed by the

Clintons, despite an agreement Mrs. Clinton had struck with the Obama

White House to publicly identify all donors. Other people with ties to

the company made donations as well.

And shortly after the Russians announced their intention to acquire a majority stake in Uranium One, Mr. Clinton received $500,000 for a Moscow speech from a Russian investment bank with links to the Kremlin that was promoting Uranium One stock.

Read More @ libertyblitzkrieg.com

As the Russians gradually assumed control of Uranium One in three

separate transactions from 2009 to 2013, Canadian records show, a flow

of cash made its way to the Clinton Foundation. Uranium One’s chairman

used his family foundation to make four donations totaling $2.35

million. Those contributions were not publicly disclosed by the

Clintons, despite an agreement Mrs. Clinton had struck with the Obama

White House to publicly identify all donors. Other people with ties to

the company made donations as well.

As the Russians gradually assumed control of Uranium One in three

separate transactions from 2009 to 2013, Canadian records show, a flow

of cash made its way to the Clinton Foundation. Uranium One’s chairman

used his family foundation to make four donations totaling $2.35

million. Those contributions were not publicly disclosed by the

Clintons, despite an agreement Mrs. Clinton had struck with the Obama

White House to publicly identify all donors. Other people with ties to

the company made donations as well.And shortly after the Russians announced their intention to acquire a majority stake in Uranium One, Mr. Clinton received $500,000 for a Moscow speech from a Russian investment bank with links to the Kremlin that was promoting Uranium One stock.

Read More @ libertyblitzkrieg.com

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment