from Zero Hedge:

While an extension of the Patriot Act, that landmark bill which ushered in the America’s Big Brother, “turnkey totalitarian state”

(previewed here long before Edward Snowden’s shocking revelations), is

just a matter of time, supporters of the Fourth Amendment scored a brief

victory last night when following yet another marathon 10 hour filibuster…

While an extension of the Patriot Act, that landmark bill which ushered in the America’s Big Brother, “turnkey totalitarian state”

(previewed here long before Edward Snowden’s shocking revelations), is

just a matter of time, supporters of the Fourth Amendment scored a brief

victory last night when following yet another marathon 10 hour filibuster…

… and refusal to play by the script by Rand Paul, the Senate failed to extend the Patriot Act, leaving the future of America’s “war against terrorists” but really against “enemies domestic“, i.e., anyone who uses email, has a cell phone or in any other electronic way communicates with others, in limbo.

As the WSJ recalls Friday night’s events, Senators first rejected a House bill overhauling the NSA, a two-month Patriot Act extension and then increasingly short extensions of the law.

Read More @ ZeroHedge.com

from Dees Illustration, via Rense:

from Off Grid Survival:

We talk a lot about firearm safety and the need to train for criminal

attacks; today I found a video that I think highlights the importance of

firearms, and how owning one can help keep you safe from criminals. On a

side note, the video also does a lot to dispel some racial stereotypes

and myths that the mainstream media likes to perpetuate.

We talk a lot about firearm safety and the need to train for criminal

attacks; today I found a video that I think highlights the importance of

firearms, and how owning one can help keep you safe from criminals. On a

side note, the video also does a lot to dispel some racial stereotypes

and myths that the mainstream media likes to perpetuate.

You’ll never see this on the Mainstream News because:

It highlights the importance of firearms in keeping people safe from criminals, and does so in a manner that showcases responsible gun ownership.

Read More @ OffGridSurvival.com

While an extension of the Patriot Act, that landmark bill which ushered in the America’s Big Brother, “turnkey totalitarian state”

(previewed here long before Edward Snowden’s shocking revelations), is

just a matter of time, supporters of the Fourth Amendment scored a brief

victory last night when following yet another marathon 10 hour filibuster…

While an extension of the Patriot Act, that landmark bill which ushered in the America’s Big Brother, “turnkey totalitarian state”

(previewed here long before Edward Snowden’s shocking revelations), is

just a matter of time, supporters of the Fourth Amendment scored a brief

victory last night when following yet another marathon 10 hour filibuster…… and refusal to play by the script by Rand Paul, the Senate failed to extend the Patriot Act, leaving the future of America’s “war against terrorists” but really against “enemies domestic“, i.e., anyone who uses email, has a cell phone or in any other electronic way communicates with others, in limbo.

As the WSJ recalls Friday night’s events, Senators first rejected a House bill overhauling the NSA, a two-month Patriot Act extension and then increasingly short extensions of the law.

Read More @ ZeroHedge.com

Constitution 1 - 0 Government: NSA Starts Winding Down Bulk Data Collection

As we detailed earlier, in a chaotic scene during the wee hours of Saturday, Senate Republicans blocked a bill known as the USA Freedom Act - backed by President Barack Obama, House Republicans and the nation's top law enforcement and intelligence officials - which would have preserved the government's ability to search phone company records for suspected spies and terrorists. As AP reports, the failure to act means the NSA will immediately begin curtailing its previously-secret bulk data collection progreams with The DoJ noting that while it will take time to taper off the collection process, that process began Friday (according to an administration official). Sen. Rand Paul called the Senate's failure to allow an extension of the surveillance programs a victory for privacy rights, adding "we should never give up our rights for a false sense of security."from Dees Illustration, via Rense:

It Begins: US May Send "Target Spotters" To Iraq To Counter ISIS "Offensive"

The US is now considering the possibility of sending so-called "spotters" to Iraq, a move ostensibly aimed at making airstrikes against ISIS more effective. Meanwhile, the militant group has claimed responsibility for Friday's suicide bombing in Saudi Arabi that killed 21.

Cold War 2.0: Mapping All Recent "Close Encounters" Between Russian And NATO Warplanes

Lately, not a day seems to pass without news of NATO jets being scrambled to intercept/reroute a Russian warplane or reconnaisance jet. As a result, David Cenciotti's The Aviationist blog has compiled the recent history of all the "close encounters" between Russian and NATO warplanes since 2013. Here are the results.

from KingWorldNews:

What If The Dominos Start Falling?

What If The Dominos Start Falling?

Sprott: “What could end it is some country not supporting their banking system. What if the dominos start falling? What if there really was a Greek default and there were these huge bond losses to take? Or Chicago going to junk status and suddenly having to cut their pensions or declare bankruptcy?

There are so many institutions and governments where the obligations just keep going up and there is no way of paying for them. They will fail. We already had it in Detroit and now we have Chicago, and maybe some other state or teachers plan will default. But when you have rates at zero, it’s very hard to grow the value of assets because there is no return. ”

Eric Sprott Audio Interview @ KingWorldNews.com

What If The Dominos Start Falling?

What If The Dominos Start Falling?Sprott: “What could end it is some country not supporting their banking system. What if the dominos start falling? What if there really was a Greek default and there were these huge bond losses to take? Or Chicago going to junk status and suddenly having to cut their pensions or declare bankruptcy?

There are so many institutions and governments where the obligations just keep going up and there is no way of paying for them. They will fail. We already had it in Detroit and now we have Chicago, and maybe some other state or teachers plan will default. But when you have rates at zero, it’s very hard to grow the value of assets because there is no return. ”

Eric Sprott Audio Interview @ KingWorldNews.com

by Andrew Hoffman, Miles Franklin:

Nothing will please me more than when Whirlybird Janet is forced to admit the Fed has been wrong all along. That said, when said “Yellen Reversal”

inevitably occurs, it will likely usher in an unprecedented era of

financial market instability and accelerated economic decline; and

consequently, heightened social unrest, geopolitical instability, and a

host of other nasty events (like a “Grexit” or Catalonia, Spain secession) that will make life far more difficult for not just the parties involved, but all of the planet’s seven-plus billion denizens. This is why wise investors prepare for such worst-case scenarios beforehand; which in terms of financial assets, only physical Precious Metals have consistently proven their worth throughout history.

Nothing will please me more than when Whirlybird Janet is forced to admit the Fed has been wrong all along. That said, when said “Yellen Reversal”

inevitably occurs, it will likely usher in an unprecedented era of

financial market instability and accelerated economic decline; and

consequently, heightened social unrest, geopolitical instability, and a

host of other nasty events (like a “Grexit” or Catalonia, Spain secession) that will make life far more difficult for not just the parties involved, but all of the planet’s seven-plus billion denizens. This is why wise investors prepare for such worst-case scenarios beforehand; which in terms of financial assets, only physical Precious Metals have consistently proven their worth throughout history.

The Fed – as well as its Washington, Wall Street, and MSM minions – will continue to cheerlead until the bitter end, sitting atop the Titanic’s bobbing stern shouting “recovery.” As will the ECB, BOJ, and all the world’s Central bankers, in their eternal quest to maintain a murderous status quo, in which the “1%” that own them gather all the world’s wealth, at the expense of the “99%” that actually built it. However, like the Titanic, it is a mathematical certainty that history’s largest fiat Ponzi scheme will go down; and like the Titanic after it hit that fateful iceberg, the countdown to its demise has not only started, but is in its final economic “hours.”

Read More @ MilesFranklin.com

Nothing will please me more than when Whirlybird Janet is forced to admit the Fed has been wrong all along. That said, when said “Yellen Reversal”

inevitably occurs, it will likely usher in an unprecedented era of

financial market instability and accelerated economic decline; and

consequently, heightened social unrest, geopolitical instability, and a

host of other nasty events (like a “Grexit” or Catalonia, Spain secession) that will make life far more difficult for not just the parties involved, but all of the planet’s seven-plus billion denizens. This is why wise investors prepare for such worst-case scenarios beforehand; which in terms of financial assets, only physical Precious Metals have consistently proven their worth throughout history.

Nothing will please me more than when Whirlybird Janet is forced to admit the Fed has been wrong all along. That said, when said “Yellen Reversal”

inevitably occurs, it will likely usher in an unprecedented era of

financial market instability and accelerated economic decline; and

consequently, heightened social unrest, geopolitical instability, and a

host of other nasty events (like a “Grexit” or Catalonia, Spain secession) that will make life far more difficult for not just the parties involved, but all of the planet’s seven-plus billion denizens. This is why wise investors prepare for such worst-case scenarios beforehand; which in terms of financial assets, only physical Precious Metals have consistently proven their worth throughout history.The Fed – as well as its Washington, Wall Street, and MSM minions – will continue to cheerlead until the bitter end, sitting atop the Titanic’s bobbing stern shouting “recovery.” As will the ECB, BOJ, and all the world’s Central bankers, in their eternal quest to maintain a murderous status quo, in which the “1%” that own them gather all the world’s wealth, at the expense of the “99%” that actually built it. However, like the Titanic, it is a mathematical certainty that history’s largest fiat Ponzi scheme will go down; and like the Titanic after it hit that fateful iceberg, the countdown to its demise has not only started, but is in its final economic “hours.”

Read More @ MilesFranklin.com

from KingWorldNews:

Today Peter Boehringer, who led the movement to repatriate Germany’s

gold, notified King World News that he has seen credible reports that

Austria intends to repatriate 50% of its gold reserves held abroad, 80%

of which are held in London.

Today Peter Boehringer, who led the movement to repatriate Germany’s

gold, notified King World News that he has seen credible reports that

Austria intends to repatriate 50% of its gold reserves held abroad, 80%

of which are held in London.

This is a huge blow to the West’s fractional reserve gold system, which is leveraged 100/1. The fractional reserve gold system is operated out of London and is supported by the United States. It will be interesting to see how the gold market trades in coming weeks as London will have to send a large amount of gold back to Austria. It’s the leverage that makes coming up with the physical gold so tricky.

Read more @ KingWorldNews.com

Today Peter Boehringer, who led the movement to repatriate Germany’s

gold, notified King World News that he has seen credible reports that

Austria intends to repatriate 50% of its gold reserves held abroad, 80%

of which are held in London.

Today Peter Boehringer, who led the movement to repatriate Germany’s

gold, notified King World News that he has seen credible reports that

Austria intends to repatriate 50% of its gold reserves held abroad, 80%

of which are held in London.This is a huge blow to the West’s fractional reserve gold system, which is leveraged 100/1. The fractional reserve gold system is operated out of London and is supported by the United States. It will be interesting to see how the gold market trades in coming weeks as London will have to send a large amount of gold back to Austria. It’s the leverage that makes coming up with the physical gold so tricky.

Read more @ KingWorldNews.com

from Paul Sandhu:

from Sovereign Man:

from Tenth Amendment Center:

from Wolf Street:

Inflation has not been a problem recently, according to the Consumer

Price Index. Energy prices have plunged, which helped, and the rising

costs of housing, which account for over one-third of the index, are

purposefully mitigated via some elegant statistical twists, and that helped a lot.

Inflation has not been a problem recently, according to the Consumer

Price Index. Energy prices have plunged, which helped, and the rising

costs of housing, which account for over one-third of the index, are

purposefully mitigated via some elegant statistical twists, and that helped a lot.

Everyone has been lulled to sleep by the sheer absence of consumer price inflation. And the Fed has used this low inflation as pretext to keep its foot all the way on the accelerator of total interest-rate repression, though it isn’t accelerating much of anything other than asset price inflation.

Read More @ Wolfstreet.com

Inflation has not been a problem recently, according to the Consumer

Price Index. Energy prices have plunged, which helped, and the rising

costs of housing, which account for over one-third of the index, are

purposefully mitigated via some elegant statistical twists, and that helped a lot.

Inflation has not been a problem recently, according to the Consumer

Price Index. Energy prices have plunged, which helped, and the rising

costs of housing, which account for over one-third of the index, are

purposefully mitigated via some elegant statistical twists, and that helped a lot.Everyone has been lulled to sleep by the sheer absence of consumer price inflation. And the Fed has used this low inflation as pretext to keep its foot all the way on the accelerator of total interest-rate repression, though it isn’t accelerating much of anything other than asset price inflation.

Read More @ Wolfstreet.com

from Western Journalism:

The tragic Waco shootout that left nine bikers dead this month has

sparked national conversations from the perceived differences in how the

media treat black and white criminals to speculation regarding the gang

affiliation of those involved. As KTVT pointed out, local law

enforcement insisted that each of the bikers killed in the incident were

gang members. That assertion, however, is being vehemently disputed by

the family of at least one who died that day.

The tragic Waco shootout that left nine bikers dead this month has

sparked national conversations from the perceived differences in how the

media treat black and white criminals to speculation regarding the gang

affiliation of those involved. As KTVT pointed out, local law

enforcement insisted that each of the bikers killed in the incident were

gang members. That assertion, however, is being vehemently disputed by

the family of at least one who died that day.

According to the son of Jesus Delgado Rodriguez, a 65-year-old biker killed in the shootings, he was not an outlaw but was, however, a decorated veteran. The Marine reportedly earned a Purple Heart among other prestigious military commendations following four years of active duty service during the Vietnam War.

Read More @ WesternJournalism.com

The tragic Waco shootout that left nine bikers dead this month has

sparked national conversations from the perceived differences in how the

media treat black and white criminals to speculation regarding the gang

affiliation of those involved. As KTVT pointed out, local law

enforcement insisted that each of the bikers killed in the incident were

gang members. That assertion, however, is being vehemently disputed by

the family of at least one who died that day.

The tragic Waco shootout that left nine bikers dead this month has

sparked national conversations from the perceived differences in how the

media treat black and white criminals to speculation regarding the gang

affiliation of those involved. As KTVT pointed out, local law

enforcement insisted that each of the bikers killed in the incident were

gang members. That assertion, however, is being vehemently disputed by

the family of at least one who died that day.According to the son of Jesus Delgado Rodriguez, a 65-year-old biker killed in the shootings, he was not an outlaw but was, however, a decorated veteran. The Marine reportedly earned a Purple Heart among other prestigious military commendations following four years of active duty service during the Vietnam War.

Read More @ WesternJournalism.com

by Dave Hodges, The Common Sense Show:

Over the past two months, many of us in the Independent Media have

said it again and again, Jade Helm is about subjugating the American

people who will one day rise up to what is coming.

Over the past two months, many of us in the Independent Media have

said it again and again, Jade Helm is about subjugating the American

people who will one day rise up to what is coming.

As the American people are kept in the dark about the true nature of Jade Helm, members of the Independent Media have been very consistent about pointing out that Jade Helm, because of its involvement of Special Operations Forces, the “drill” is clearly designed to practice political dissident extractions which would be executed prior to the imposition of martial law. This is a simple and logical conclusion to draw because this is what Navy Seals, Green Berets, etc. do in pre-combat activities. The involvement of ARSOF in Jade Helm as a primary player, speaks clearly to intent.

Read More

Over the past two months, many of us in the Independent Media have

said it again and again, Jade Helm is about subjugating the American

people who will one day rise up to what is coming.

Over the past two months, many of us in the Independent Media have

said it again and again, Jade Helm is about subjugating the American

people who will one day rise up to what is coming.As the American people are kept in the dark about the true nature of Jade Helm, members of the Independent Media have been very consistent about pointing out that Jade Helm, because of its involvement of Special Operations Forces, the “drill” is clearly designed to practice political dissident extractions which would be executed prior to the imposition of martial law. This is a simple and logical conclusion to draw because this is what Navy Seals, Green Berets, etc. do in pre-combat activities. The involvement of ARSOF in Jade Helm as a primary player, speaks clearly to intent.

Read More

from Sputnik News:

China is planning to introduce the gold fixing reference price in

yuan. Americans fear that China could introduce a new gold standard to

displace the dollar, DWN reported.

China is planning to introduce the gold fixing reference price in

yuan. Americans fear that China could introduce a new gold standard to

displace the dollar, DWN reported.

The competition for London gold-market has grown after the Chinese Shanghai Gold Exchange (SGE) established an International Chamber of Commerce in the free trade zone of the city, providing for free capital flows, Deutsche Wirtschafts Nachrichten reported.

“The central government is gradually opening up the gold market by allowing more participants to trade,” Bloomberg cited a senior gold analyst at Industrial Bank Co. in Shanghai, Jiang Shu“.

Read More @ SputnikNews.com

China is planning to introduce the gold fixing reference price in

yuan. Americans fear that China could introduce a new gold standard to

displace the dollar, DWN reported.

China is planning to introduce the gold fixing reference price in

yuan. Americans fear that China could introduce a new gold standard to

displace the dollar, DWN reported.The competition for London gold-market has grown after the Chinese Shanghai Gold Exchange (SGE) established an International Chamber of Commerce in the free trade zone of the city, providing for free capital flows, Deutsche Wirtschafts Nachrichten reported.

“The central government is gradually opening up the gold market by allowing more participants to trade,” Bloomberg cited a senior gold analyst at Industrial Bank Co. in Shanghai, Jiang Shu“.

Read More @ SputnikNews.com

from SRSrocco Report:

There seems to be a great deal of hype put forth by the market that

rising solar demand will be a key factor in determining the price of

silver in the future. While silver consumption in the solar industry

may increase going forward, the real cause for much higher silver prices

will be investment demand.

There seems to be a great deal of hype put forth by the market that

rising solar demand will be a key factor in determining the price of

silver in the future. While silver consumption in the solar industry

may increase going forward, the real cause for much higher silver prices

will be investment demand.

Why? Because the actual data proves investment demand is the largest growth sector in the silver market. I’ll get to the figures in a moment. But, before I do that, let’s discuss the supposed wonders of solar photovoltaics.

Read More…

There seems to be a great deal of hype put forth by the market that

rising solar demand will be a key factor in determining the price of

silver in the future. While silver consumption in the solar industry

may increase going forward, the real cause for much higher silver prices

will be investment demand.

There seems to be a great deal of hype put forth by the market that

rising solar demand will be a key factor in determining the price of

silver in the future. While silver consumption in the solar industry

may increase going forward, the real cause for much higher silver prices

will be investment demand.Why? Because the actual data proves investment demand is the largest growth sector in the silver market. I’ll get to the figures in a moment. But, before I do that, let’s discuss the supposed wonders of solar photovoltaics.

Read More…

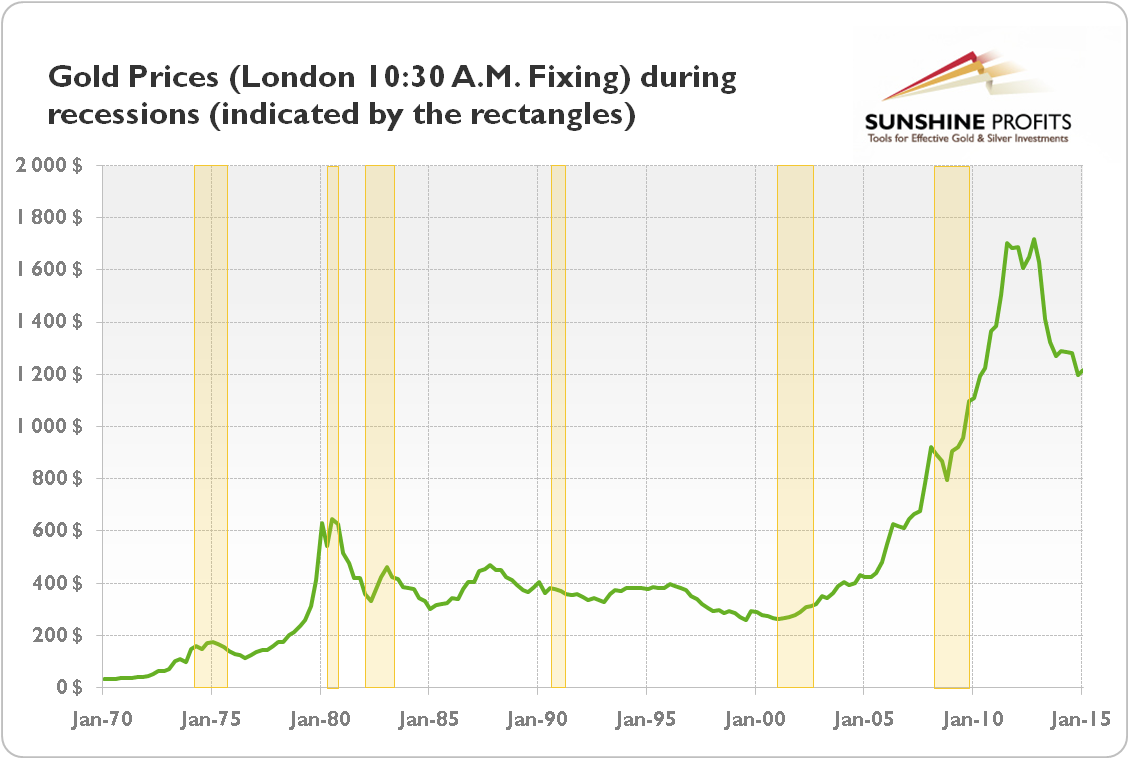

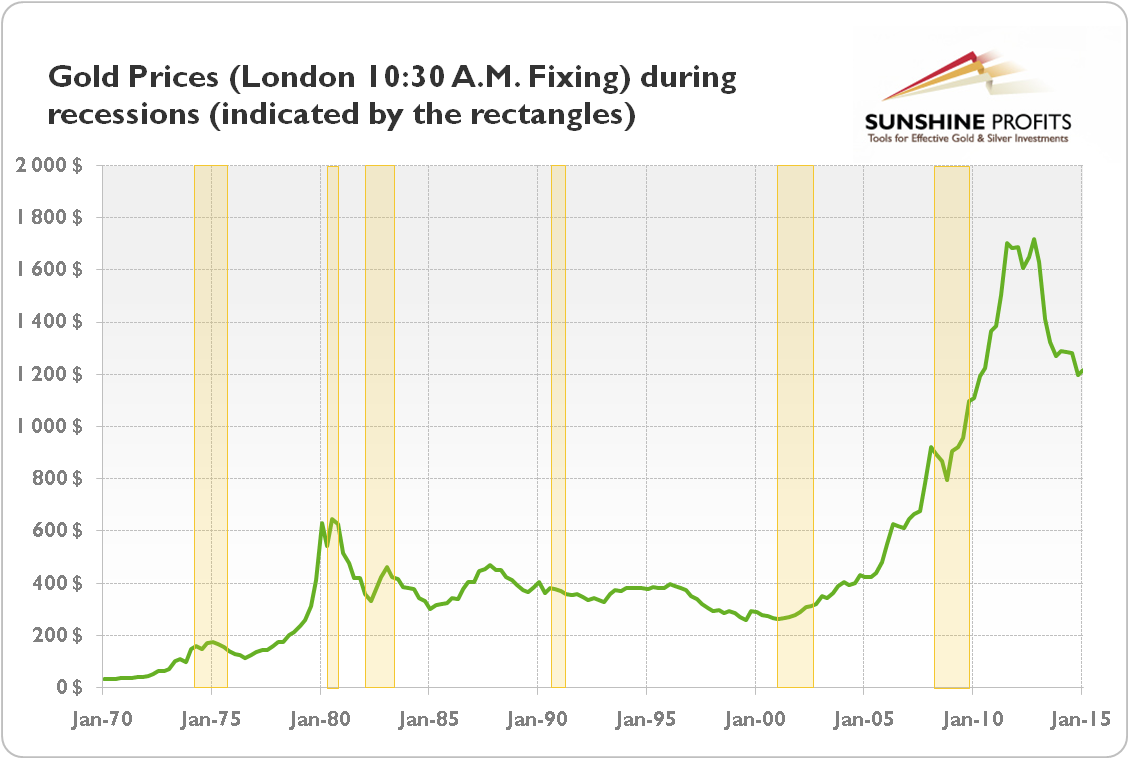

by Arkadiusz Sieron, Gold Seek:

Based on the literature, we have often claimed

that gold is the best asset class during slowdowns. However, it is

worth digging rather more deeply into this complex issue, also examining

gold’s performance during recessions. The yellow metal behaves

relatively well as an investment during economic contractions, but

consumer demand may drop during weak GDP growth, when real incomes fall

or rise very sluggishly. For example, Pushpa and Muruganandam

found that the growth rate of real GDP foresees the trend of the

ensuing gold prices (at least for China, India and the U.S.). When

consumers’ purchasing power increases, the demand for gold also raises,

which in turn moves gold prices up, and vice-versa. However their

analysis was conducted for the period of 2005-2011, i.e. only during the

gold prices boom.

Based on the literature, we have often claimed

that gold is the best asset class during slowdowns. However, it is

worth digging rather more deeply into this complex issue, also examining

gold’s performance during recessions. The yellow metal behaves

relatively well as an investment during economic contractions, but

consumer demand may drop during weak GDP growth, when real incomes fall

or rise very sluggishly. For example, Pushpa and Muruganandam

found that the growth rate of real GDP foresees the trend of the

ensuing gold prices (at least for China, India and the U.S.). When

consumers’ purchasing power increases, the demand for gold also raises,

which in turn moves gold prices up, and vice-versa. However their

analysis was conducted for the period of 2005-2011, i.e. only during the

gold prices boom.

Read More @ GoldSeek.com

Based on the literature, we have often claimed

that gold is the best asset class during slowdowns. However, it is

worth digging rather more deeply into this complex issue, also examining

gold’s performance during recessions. The yellow metal behaves

relatively well as an investment during economic contractions, but

consumer demand may drop during weak GDP growth, when real incomes fall

or rise very sluggishly. For example, Pushpa and Muruganandam

found that the growth rate of real GDP foresees the trend of the

ensuing gold prices (at least for China, India and the U.S.). When

consumers’ purchasing power increases, the demand for gold also raises,

which in turn moves gold prices up, and vice-versa. However their

analysis was conducted for the period of 2005-2011, i.e. only during the

gold prices boom.

Based on the literature, we have often claimed

that gold is the best asset class during slowdowns. However, it is

worth digging rather more deeply into this complex issue, also examining

gold’s performance during recessions. The yellow metal behaves

relatively well as an investment during economic contractions, but

consumer demand may drop during weak GDP growth, when real incomes fall

or rise very sluggishly. For example, Pushpa and Muruganandam

found that the growth rate of real GDP foresees the trend of the

ensuing gold prices (at least for China, India and the U.S.). When

consumers’ purchasing power increases, the demand for gold also raises,

which in turn moves gold prices up, and vice-versa. However their

analysis was conducted for the period of 2005-2011, i.e. only during the

gold prices boom.Read More @ GoldSeek.com

by Alasdair Macleod, Gold Money:

Statistics have become very misleading: in particular we are being

badly misled into believing that the US is teetering on the edge of

price deflation, because the US official rate of inflation is barely

positive, a level that US bonds and therefore all other financial

markets have priced in without accepting it is actually significantly

higher.

Statistics have become very misleading: in particular we are being

badly misled into believing that the US is teetering on the edge of

price deflation, because the US official rate of inflation is barely

positive, a level that US bonds and therefore all other financial

markets have priced in without accepting it is actually significantly

higher.

There are two possible approaches to assessing the true rate of price inflation. You can either reverse all the tweaks government statisticians have implemented over the decades to reduce the apparent rate, or you can collect a statistically significant sample of price data independently and turn that into an index. John Williams of Shadowstats.com is well known for his work on the former approach, but until recently I was unaware that anyone was attempting the latter. That is until Simon Hunt of Simon Hunt Strategic Services drew my attention to the Chapwood Index, which deserves wider publicity.

Read More @ GoldMoney.com

Statistics have become very misleading: in particular we are being

badly misled into believing that the US is teetering on the edge of

price deflation, because the US official rate of inflation is barely

positive, a level that US bonds and therefore all other financial

markets have priced in without accepting it is actually significantly

higher.

Statistics have become very misleading: in particular we are being

badly misled into believing that the US is teetering on the edge of

price deflation, because the US official rate of inflation is barely

positive, a level that US bonds and therefore all other financial

markets have priced in without accepting it is actually significantly

higher.There are two possible approaches to assessing the true rate of price inflation. You can either reverse all the tweaks government statisticians have implemented over the decades to reduce the apparent rate, or you can collect a statistically significant sample of price data independently and turn that into an index. John Williams of Shadowstats.com is well known for his work on the former approach, but until recently I was unaware that anyone was attempting the latter. That is until Simon Hunt of Simon Hunt Strategic Services drew my attention to the Chapwood Index, which deserves wider publicity.

Read More @ GoldMoney.com

by Michael Noonan, Edge Trader Plus:

If there is any certainty in the world, [and there is very little], it

is that the demand for gold and silver is at its highest and has been

running at a fevered pitch for several years. From John Keats “Ode On A

Grecian Urn,” “…that is all ye know on earth, and all ye need to

know.” Anything else stems from subjective conclusions drawn from lying

politicians, no matter the source or government. They all lie under

the aegis of political diplomacy. For Obama and his entire

administration there is very little diplomacy, so mostly just lies.

If there is any certainty in the world, [and there is very little], it

is that the demand for gold and silver is at its highest and has been

running at a fevered pitch for several years. From John Keats “Ode On A

Grecian Urn,” “…that is all ye know on earth, and all ye need to

know.” Anything else stems from subjective conclusions drawn from lying

politicians, no matter the source or government. They all lie under

the aegis of political diplomacy. For Obama and his entire

administration there is very little diplomacy, so mostly just lies.

If the leading economic powerhouses, China and Russia, have been accumulating as much gold and silver as is available, and keeping every ounce each of those nations produce, with nothing being exported, cut through all of the rhetoric and do as they do, and do not listen to any Western country/central bank/bought-and-paid-for-media that says gold has no value. Buy each or either metal [the gold/silver ratio favors accumulating silver more so than gold, but that is an opinion], and obtain physical possession yourself.

Read More @ EdgeTraderPlus.com

If there is any certainty in the world, [and there is very little], it

is that the demand for gold and silver is at its highest and has been

running at a fevered pitch for several years. From John Keats “Ode On A

Grecian Urn,” “…that is all ye know on earth, and all ye need to

know.” Anything else stems from subjective conclusions drawn from lying

politicians, no matter the source or government. They all lie under

the aegis of political diplomacy. For Obama and his entire

administration there is very little diplomacy, so mostly just lies.

If there is any certainty in the world, [and there is very little], it

is that the demand for gold and silver is at its highest and has been

running at a fevered pitch for several years. From John Keats “Ode On A

Grecian Urn,” “…that is all ye know on earth, and all ye need to

know.” Anything else stems from subjective conclusions drawn from lying

politicians, no matter the source or government. They all lie under

the aegis of political diplomacy. For Obama and his entire

administration there is very little diplomacy, so mostly just lies.If the leading economic powerhouses, China and Russia, have been accumulating as much gold and silver as is available, and keeping every ounce each of those nations produce, with nothing being exported, cut through all of the rhetoric and do as they do, and do not listen to any Western country/central bank/bought-and-paid-for-media that says gold has no value. Buy each or either metal [the gold/silver ratio favors accumulating silver more so than gold, but that is an opinion], and obtain physical possession yourself.

Read More @ EdgeTraderPlus.com

Hillary Clinton's Minimum Speech Requirements

Spoiler alert: these are not the requirements of an "everyday American"...

ISIS: Mapping A Militant Expansion

Submitted by Tyler Durden on 05/23/2015 - 13:45 As the US moves closer to putting boots on the ground in Iraq and Syria to counter an ISIS "offensive", The New York Times is out with a series of graphics which document the group’s spread.

Steen Jakobsen Warns, Brace For The Next Recession

The financial world today is now an island on its own – separated from the real economy, as can be seen by the paradox of record high valuation in the stock market coinciding with record low inflation, employment , productivity and no hope. There is asset inflation, but deflation in the real economy. When the world has been this long at the zero-bound, the misallocation, the inability to reform, and a toolbox without new tools creates a mandate for change. "I expect stocks to trade sideways for the balance of 2015 and have now sold all my fixed income, increased my gold exposure, and I’m looking to buy mining companies and overall to increase my exposure to commodities beyond the normal allocation."

Time To Get Real About China

The present Chinese leadership appears to be trying to gain (regain?) more - if not full - control over the country’s economic system, while at the same time (re-)boosting the growth it has lost in recent years. President Xi Jinping, prime minister Li Keqiang and all of their subservient leaders – there are 1000?s of those in a 1.4 million citizens country- apparently think this can be done. We truly doubt it. We don’t think that they ever understood what would happen if they opened up the country to a more free-market, capitalist structure. That doing so would automatically reduce their political power, since a free market, in whatever shape and form, does not rhyme with the kind of control which the Communist Party has been used to for decades, and which the current leaders have grown up taking for granted.

Bank Of England Accidentally E-mails Top-Secret Brexit Plan To Newspaper

The first rule of “Project Bookend” is that you don’t talk about “Project Bookend.” In retrospect, maybe the first rule should have been “you don’t accidentally e-mail ‘Project Bookend’ to a news agency.” We talk a lot about firearm safety and the need to train for criminal

attacks; today I found a video that I think highlights the importance of

firearms, and how owning one can help keep you safe from criminals. On a

side note, the video also does a lot to dispel some racial stereotypes

and myths that the mainstream media likes to perpetuate.

We talk a lot about firearm safety and the need to train for criminal

attacks; today I found a video that I think highlights the importance of

firearms, and how owning one can help keep you safe from criminals. On a

side note, the video also does a lot to dispel some racial stereotypes

and myths that the mainstream media likes to perpetuate.You’ll never see this on the Mainstream News because:

It highlights the importance of firearms in keeping people safe from criminals, and does so in a manner that showcases responsible gun ownership.

Read More @ OffGridSurvival.com

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment