Submitted by Tyler Durden on 02/02/2015 - 18:55

Submitted by Tyler Durden on 02/02/2015 - 18:55

In 1923 Hitler said, “Believe me, our misery will increase. The scoundrel will get by. But the decent, solid businessman who doesn’t speculate will be utterly crushed; first the little fellow on the bottom, but in the end the big fellow on top too. But the scoundrel and the swindler will remain, top and bottom. The reason: because the state itself has become the biggest swindler and crook. A robbers’ state!” Hitler wasn’t talking about hard money, he was talking about excessive money printing by a robber state. Krugman himself echoes these words, "It’s basically about revenue: when governments can’t either raise taxes or borrow to pay for their spending, they sometimes turn to the printing press." Out of control government that can’t borrow or tax enough to pay its bills? Zimbabwe, Iran, Venezuela... what country is next?

Delusional AmericaPaul Craig Roberts

Robert Parry is one of my favorite columnists. He is truthful, has a sense of justice, and delivers a firm punch. He used to be a “mainstream journalist,” like me, but we were too truthful for them. They kicked us out.

I can’t say Parry has always been one of my favorite journalists. During the 1980s he spent a lot of time on Reagan’s case. Having been on corporate boards, I know that CEOs seldom know everything that is going on in the company. There are just too many people and too many programs representing too many agendas. For presidents of countries with governments as large as the US government, there is far more going on than a president has time to learn about even if he could get accurate information.

In my day Assistant Secretaries and chiefs of staff were the most important people, because they controlled the flow of information. Presidents have to focus on fund raising for their reelection and for their party. More time and energy is used up with formalities and meetings with dignitaries and media events. At the most there are two or three issues on which a president can attempt leadership. If an organized clique such as the neoconservatives get into varied positions of authority, they can actually “create the reality” and take the government away from the president.

As I have reported on many occasions, my experience with Reagan left me with the conclusion that he was interested in two big issues. He wanted to stop the stagflation for which only the supply-side economists had a solution, and he wanted to end, not win, the cold war.

Both of these agendas put Reagan at odds with two of the most powerful of the private interest groups: Wall Street and the military/security complex.

Wall Street for the most part opposed Reagan’s economic program. They opposed it because they understood it as Keynesian deficit pump-priming that would cause an already high inflation rate to explode, which would drive down bond and stock prices.

The CIA and the military opposed any ending of the Cold War because of the obvious impact on their power and budget.

Left-wing journalists never picked up on this, and neither did right-wing journalists.

More…

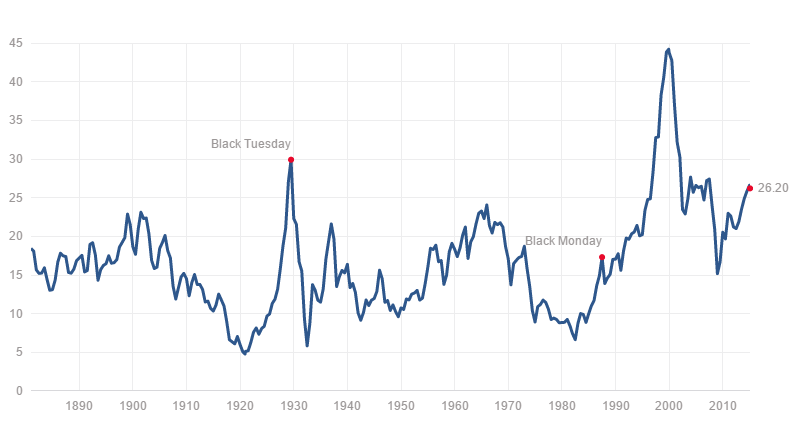

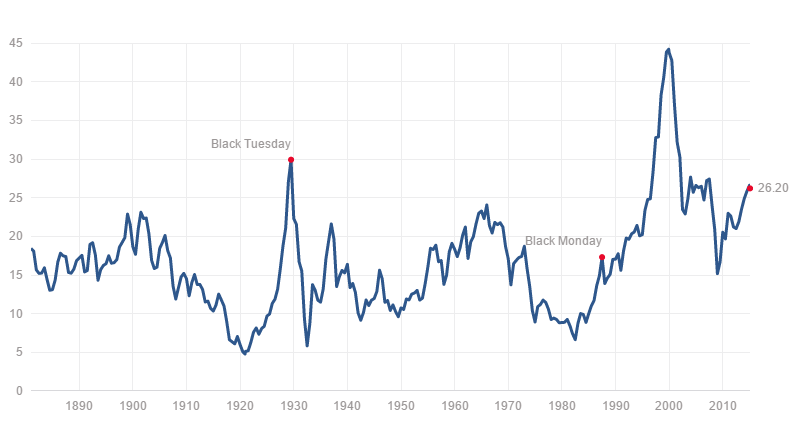

On Black Tuesday Shiller PE Ratio was at 30. Today it is at 26.2 and volatility is back in a big way.

from MyBudget360.com:

Volatility is back in a big way for the global economy. Not that it went away but for a couple of years central banks fooled the public into believing that perpetual debt was a good way to rejuvenate the markets. There will be no free lunch. Oil crashed rather dramatically. Greece is reigniting further issues with the Euro. Russia is on the brink of recession. Half of Americans live paycheck to paycheck. Inflation is alive and well only if you bother to look. Overall volatility is back in a big way in the global markets. The Baltic Dry Index which is a good measure of shipping goods has collapsed. You would think that if demand were so healthy, shipping goods would be soaring. The only thing soaring is stock markets based on inflated values. The S&P 500 is overvalued by 60 percent looking at historical price-to-earnings ratios. The Shiller PE Ratio was at 30 on Black Tuesday. Today it is at 26.2 with the historical average being closer to 16.

Read More @ MyBudget360.com

from MyBudget360.com:

Volatility is back in a big way for the global economy. Not that it went away but for a couple of years central banks fooled the public into believing that perpetual debt was a good way to rejuvenate the markets. There will be no free lunch. Oil crashed rather dramatically. Greece is reigniting further issues with the Euro. Russia is on the brink of recession. Half of Americans live paycheck to paycheck. Inflation is alive and well only if you bother to look. Overall volatility is back in a big way in the global markets. The Baltic Dry Index which is a good measure of shipping goods has collapsed. You would think that if demand were so healthy, shipping goods would be soaring. The only thing soaring is stock markets based on inflated values. The S&P 500 is overvalued by 60 percent looking at historical price-to-earnings ratios. The Shiller PE Ratio was at 30 on Black Tuesday. Today it is at 26.2 with the historical average being closer to 16.

Read More @ MyBudget360.com

Greece Changes Strategy: No Longer Demands Debt Write Off, Ask For Debt Exchange InsteadSubmitted by Tyler Durden on 02/02/2015 - 15:24

Greece Changes Strategy: No Longer Demands Debt Write Off, Ask For Debt Exchange InsteadSubmitted by Tyler Durden on 02/02/2015 - 15:24

Update, and in line with the FT report, here's Bloomberg: GREECE SAID TO DROP WRITEDOWN REQUEST AFTER OPPOSITION FROM EU

Over a week after the new Greek government came to power, it has presented its first actual proposal of how it hopes to negotiate with Europe that does not involve the infamous "debt write off", which as both Germany and the ECB have made clear, is a non-starter as it impairs the ECB's balance sheet and leads to a loss of "faith" in the money printer, the legacy monetary system and so on. So instead of yet another debt restructuring, the FT reports that Yanis Varoufakis "would no longer call for a headline write-off of Greece’s €315bn foreign debt. Rather it would request a “menu of debt swaps” to ease the burden, including two types of new bonds." Actually he still does, only he is not calling it as such.

by Ambrose Evans-Pritchard, The Telegraph:

The North European power structure has issued stern and inflexible

warnings to Greece. Syriza’s triumphant radicals must pay the country’s

debts and stick to the letter of the hated `Memorandum’ imposed by

creditors.

The North European power structure has issued stern and inflexible

warnings to Greece. Syriza’s triumphant radicals must pay the country’s

debts and stick to the letter of the hated `Memorandum’ imposed by

creditors.

If premier Alexis Tsipras breaches the terms of Greece’s EU-IMF Troika bail-out – signed by earlier leaders under duress, and deemed unjust in Athens – Europe will cut off €54bn of support for the Greek banking system and force the country out of the euro in short order. Europe must not yield to “blackmail,” said Germany’s ZEW institute.

Read More @ Telegraph.co.uk

The North European power structure has issued stern and inflexible

warnings to Greece. Syriza’s triumphant radicals must pay the country’s

debts and stick to the letter of the hated `Memorandum’ imposed by

creditors.

The North European power structure has issued stern and inflexible

warnings to Greece. Syriza’s triumphant radicals must pay the country’s

debts and stick to the letter of the hated `Memorandum’ imposed by

creditors.If premier Alexis Tsipras breaches the terms of Greece’s EU-IMF Troika bail-out – signed by earlier leaders under duress, and deemed unjust in Athens – Europe will cut off €54bn of support for the Greek banking system and force the country out of the euro in short order. Europe must not yield to “blackmail,” said Germany’s ZEW institute.

Read More @ Telegraph.co.uk

Desperately Seeking BTFDers: Greek Bank Bonds Plummet As ECB Decision Looms

Submitted by Tyler Durden on 02/02/2015 - 17:10 Despite Greek Government Bonds bouncing modestly higher (and marginal improvement in Greek stocks) today, the epicenter of the Greek crisis - their banking system - appears to continue crashing. As the ECB's decision to accept junk Greek collateral (as it does now) for ELA funding or not - a purely political decision - looms, the message from the Greek bank bond market is "nein nein nein." As Professor Karl Whelan exclaims, don’t believe for a minute that this is a technocratic thing to do with "the ECB having to follow its rules." And it has almost nothing to do with Greek government bonds being junk-rated. All of the issues come down to discretionary decisions by the ECB and there is plenty of wiggle room for them to allow Greek banks to continue receiving various sources of funding next month in the absence of an EU-IMF program agreement.

New Jersey Teens Just Learned What Happens When You Start A Business In America

Submitted by Tyler Durden on 02/02/2015 - 16:35 Two enterprising teenagers in NJ were going around their neighborhood advertising their snow-shoveling service right before the big storm hit. But in the New America where security trumps all else, a local resident called the police to report about the teens' "suspicious activity," who actually came out to investigate since, apparently running a snow-shoveling business is something that only criminal terrorists would do. Even when the police saw that it was just two harmless kids trying to earn some money, they forced them to stop (because in the Land of the Free, it seems you need a permit in order to offer to shovel snow for people). Just think about the lesson that’s being reinforced here: if you get off your ass, go out there, and try to take charge of your financial future, you’ll end up with nothing but a bunch of headaches, accusations, and unpleasant encounters with the government.

Real Estate Socialism

Submitted by Tyler Durden on 02/02/2015 - 15:10 The fundamental problem with real estate is cost. The average household, whether renters or homeowners, is allocating too much of its income to housing. As a result, public policies are likely to continue in the direction of more subsidies, such the Federal Reserve’s manipulation of long term rates, and more regulations, such as eviction and foreclosure prevention, and rent controls. Real estate, could become a lot less “real” in the foreseeable future. As the market has witnessed since 2007, the Government could dictate the conditions of real estate ownership, even when it was not the lender. Today, it is in full control.

WTF Headline Of The Day: Greek Judges Judge Judges' Pensions Cuts Unconstitutional

Submitted by Tyler Durden on 02/02/2015 - 14:39 As the new Greek government begins 'reforming' the previous administration's austerity reforms and travels the length and breadth of Europe pitching its "we don't want more loans, we want debt reduction" ultimatum, Greek judges back at home have had their own moment of clarity in the new normal. The Greek Court of Auditors ruled on Monday that a decision by the previous government to cut the pensions of judges retroactively from August 2012 was unconstitutional and in violation of the European Convention of Human Rights... Well played judges.

Baltic Dry Plunges At Fastest Pace Since Lehman, Hits New 29 Year Low

Submitted by Tyler Durden on 02/02/2015 - 14:17 The Baltic Dry Index dropped another 3% today to 590 - its first time below 600 since 1986 and not far from the all-time record low of 554 in July 1986. Of course, the absolute level is shrugged off by the over-supply-ists and the 'well fuel prices are down'-ists but the velocity of collapse (now over 60% in the last 3 months) suggests this far more than some 'blip' discrepancy between supply and demand - this is a structural convergence of massive mal-investment meets economic reality.

Tsipras Does Not Rule Out Russian Aid As UK Chancellor Calls Greece "Greatest Risk To Global Economy"

Submitted by Tyler Durden on 02/02/2015 - 13:54 "It is clear that the stand-off between Greece and the eurozone is the greatest risk to the global economy," warns UK Chancellor George Osborne adding that he hopes Greece's new finance minister "acts responsibly," as Varoufakis toured Europe to discuss Greece's 'demands'. Mainstream media's attention, however, is not focused on this warning (remember, Greece is small and contained is the meme to pay attention to), but instead proclaimed Greece's pivot to Russia over when in fact, Tsipras words did anything but 'rule out' Russian aid as he said - specifically - "we are in substantial negotiations with our partners in Europe and those that have lent to us," adding that with regards Russia, "right now, there are no other thoughts on the table." Hardly the definitive "ruling out" that US media spins.

"Drillers Are In Denial" Brynjolfsson Warns Crude Bounce Is "One More Head-Fake"

Submitted by Tyler Durden on 02/02/2015 - 13:04 The latest uptick in crude prices - Ostensibly, triggered by a notable drop in the Baker Hughes rig count - will be one more head-fake, a false breakout. Keep in mind, oil drilling rigs and oil wells are not the same thing. Armored Wolf's Jon Brynjolfsson expects global inventories to continue to build until at least June. Drillers seem to be in denial, they fail to acknowledge that as long as inventories are building toward untenable levels, there will be extreme pressure on spot crude prices. What they don’t seem to realize is that absent a universal suppliers’ cartel (which OPEC clearly is not, because its members are autonomous, and many of the largest producers, including Norway, Russia, and US are not even members), high social break even prices incentivize individual producers to pump more, not less, oil at low prices!

Why Goldman Is Closing Out Its "Tactical Pro-cyclical" European Trades On Grexit Fears

Submitted by Tyler Durden on 02/02/2015 - 12:38 It will be politics rather than economics (or Q€) that drives the shorter-term outlook in Greece. Goldman Sachs warns that the new Greek government’s position is turning more Eurosceptic and confrontational than most (and the market) had anticipated ahead of last weekend’s election. This increases the risk of a political miscalculation leading to an economic and financial accident and, possibly, Greek exit from the Euro area (“Grexit”) and while many assume European authorities have the 'tools' to address market dislocations arising from this event risk, Goldman expects significant market volatility. Rather stunningly, against this background, and in spite of Q€, recommends closing tactical pro-cyclical exposures in peripheral EMU spreads (Italy, Spain and Portugal) and equities (overweight Italy and Spain).US Moscow Embassy's "Whose Propaganda Do You Trust?" Poll Blows Up In Face

Submitted by Tyler Durden on 02/02/2015 - 11:42 In

the latest in a long list of Social Media embarrassment's for the

status quo administrations around the world, Will Stevens - spokesman

for the US Embassy in Moscow - unleashed the following tweet...

In

the latest in a long list of Social Media embarrassment's for the

status quo administrations around the world, Will Stevens - spokesman

for the US Embassy in Moscow - unleashed the following tweet... I’m betting that most of my readers can complete this phrase. The

problem is, it isn’t quite true. Edmund Burke, its supposed source, was a

good man, but that doesn’t make the saying true.

I’m betting that most of my readers can complete this phrase. The

problem is, it isn’t quite true. Edmund Burke, its supposed source, was a

good man, but that doesn’t make the saying true.Here’s the complete passage, in the form most of us know:

The only thing necessary for evil to triumph is for good men to do nothing.

Yes, there is a time when good men and women must stand up for what’s right, even when it involves risk, but that moment comes only after evil has already been well established and is powerfully on the move.

Read More @ CaseyResearch.com

Constitutional carry has been introduced in New Hampshire by Jeb

Bradley(r). David Boutin and J.R. Hoell are cosponsors. The bill

number is SB116, and is being followed at the nhliberty.org site. Here is the analysis if the bill:

Constitutional carry has been introduced in New Hampshire by Jeb

Bradley(r). David Boutin and J.R. Hoell are cosponsors. The bill

number is SB116, and is being followed at the nhliberty.org site. Here is the analysis if the bill:This bill:

I. Increases the length of time for which a license to carry a pistol or revolver is valid.

II. Allows a person to carry a loaded, concealed pistol or revolver without a license unless such person is otherwise prohibited by New Hampshire statute.

III. Requires the director of the division of state police to negotiate and enter into agreements with other jurisdictions to recognize in those jurisdictions the validity of the license to carry issued in this state.

IV. Repeals the requirement to obtain a license to carry a concealed pistol or revolver.

Read More @ Ammoland.com

Ukraine’s

top general is contradicting allegations by the Obama Administration

and by his own Ukrainian Government, by saying that no Russian troops

are fighting against the Ukrainian Government’s forces in the formerly

Ukrainian, but now separatist, area, where the Ukrainian civil war is

being waged.

Ukraine’s

top general is contradicting allegations by the Obama Administration

and by his own Ukrainian Government, by saying that no Russian troops

are fighting against the Ukrainian Government’s forces in the formerly

Ukrainian, but now separatist, area, where the Ukrainian civil war is

being waged.Here is a screen-print of a google-chrome auto-translation of that statement:

The Chief of Staff of Ukraine’s Armed Forces, General Viktor Muzhenko, is saying, in that news-report, which is dated on Thursday January 29th, that the only Russian citizens who are fighting in the contested region, are residents in that region, or of Ukraine, and also some Russian citizens (and this does not deny that perhaps some of other countries’ citizens are fighting there, inasmuch as American mercenaries have already been noted to have been participating on the Ukrainian Government’s side), who “are members of illegal armed groups,” meaning fighters who are not paid by any government, but instead are just “individual citizens” (as opposed to foreign-government-paid ones). General Muzhenko also says, emphatically, that the “Ukrainian army is not fighting with the regular units of the Russian army.”

Read More @ GlobalResearch.ca

from WSJ, via Yahoo Finance:

Edwin “Ed” Hale Sr., a retired bank executive known locally for his

sharp-elbowed approach to business, installed video surveillance on his

186-acre farm and still sleeps with a sawed-off shotgun by his bed.

Edwin “Ed” Hale Sr., a retired bank executive known locally for his

sharp-elbowed approach to business, installed video surveillance on his

186-acre farm and still sleeps with a sawed-off shotgun by his bed.His friends, former employees and even his own daughters were shocked to learn in his recently published biography that he had ample reason to do so: The former chief executive and chairman of Bank of Baltimore says he worked covertly for the Central Intelligence Agency for almost a decade in the 1990s and early 2000s.

During that time, he said, he spoke regularly with a CIA handler and allowed the agency to create a fake company under his corporate umbrella, which included shipping and trucking companies he ran at the same time he led the bank.

Read More @ Finance.yahoo.com

by Jeff Nielson, Bullion Bulls Canada:

Many previous commentaries

have detailed the mounting crises faced by the One Bank in its own

paper-bullion markets. Invariably, these “crises” are 100% self-created.

This is easily illustrated by reviewing a few of its current

(increasingly serious) problems.

Many previous commentaries

have detailed the mounting crises faced by the One Bank in its own

paper-bullion markets. Invariably, these “crises” are 100% self-created.

This is easily illustrated by reviewing a few of its current

(increasingly serious) problems.

1) No one has seen the 10,000+ tons of gold which the U.S. government claims to have been storing (on behalf of itself, and other nations) for roughly 60 years.

2) The reason why no one has seen this gold is that most of it does not exist, and of the small fraction that remains, any audit would reveal that every bar had been pledged to numerous (dozens of?) owners.

3) Those owners are now “requesting” (demanding?) that their gold be returned to them.

Why does the U.S. government (and its Big Banks) no longer hold all the gold that it used to hold – and still pretends to hold? The short answer is that the One Bank is a clan of psychopaths, which chooses to employ psychopaths as most of its senior henchmen.

Read More @ BullionBullsCanada.com

Many previous commentaries

have detailed the mounting crises faced by the One Bank in its own

paper-bullion markets. Invariably, these “crises” are 100% self-created.

This is easily illustrated by reviewing a few of its current

(increasingly serious) problems.

Many previous commentaries

have detailed the mounting crises faced by the One Bank in its own

paper-bullion markets. Invariably, these “crises” are 100% self-created.

This is easily illustrated by reviewing a few of its current

(increasingly serious) problems.1) No one has seen the 10,000+ tons of gold which the U.S. government claims to have been storing (on behalf of itself, and other nations) for roughly 60 years.

2) The reason why no one has seen this gold is that most of it does not exist, and of the small fraction that remains, any audit would reveal that every bar had been pledged to numerous (dozens of?) owners.

3) Those owners are now “requesting” (demanding?) that their gold be returned to them.

Why does the U.S. government (and its Big Banks) no longer hold all the gold that it used to hold – and still pretends to hold? The short answer is that the One Bank is a clan of psychopaths, which chooses to employ psychopaths as most of its senior henchmen.

Read More @ BullionBullsCanada.com

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment