Submitted by Tyler Durden on 02/11/2015 - 14:29 It looks reasonable that investors would not ask for an additional compensation for a source of risk that has limited direct economic bearing for other asset classes.... Such a conclusion would cease to hold, in our view, if Greece were to leave the common currency. Indeed, ‘Grexit’ would constitute a non-diversifiable event, affecting all financial assets. This is because, upon the departure of one of its members, EMU would likely be seen as a fixed exchange rate arrangement between countries which can elect to adhere or leave. Convertibility risk would resurface, exposing the possibility of a collapse of the entire project.

from trendsjournal:

from ZeroHedge:

The Nobel peace prize-winning president has been busy today: not only did he already petition Congress earlier to declare war on the Islamic State, a non-country which technically doesn’t exist, but now he plans to expands his “war powers” to any other place in the world. From Reuters:

Read More @ ZeroHedge.com

image credit: deviantart.net

The Nobel peace prize-winning president has been busy today: not only did he already petition Congress earlier to declare war on the Islamic State, a non-country which technically doesn’t exist, but now he plans to expands his “war powers” to any other place in the world. From Reuters:

- MILITARY AUTHORIZATION BILL WOULD PRESERVE PRESIDENT’S ABILITY TO ORDER OPERATIONS AGAINST ISLAMIC STATE IN COUNTRIES OTHER THAN IRAQ, SYRIA – WHITE HOUSE SPOKESMAN

- WHITE HOUSE SAYS COMBAT BOOTS ON THE GROUND MAY BE USED FOR HOSTAGE RESCUE OPERATIONS

- OBAMA NOT RULING OUT DEPLOYING COMBAT TROOPS ON GROUND TO ASSIST AIR STRIKES AGAINST ISLAMIC STATE, IF PENTAGON RECOMMENDS IT -WHITE HOUSE

Read More @ ZeroHedge.com

image credit: deviantart.net

More propaganda from supporters of ISIS…

from 21st Century Wire:

MAGE: ‘Inside Aleppo with ISIS’ – John Cantlie gives a tour of Aleppo

interviewing alleged ISIS members. SITE’s logo is embossed in the image

above, along with another ISIS media arm, Al Hayat Media Center. (Photo link thegatewaypundit.com)

MAGE: ‘Inside Aleppo with ISIS’ – John Cantlie gives a tour of Aleppo

interviewing alleged ISIS members. SITE’s logo is embossed in the image

above, along with another ISIS media arm, Al Hayat Media Center. (Photo link thegatewaypundit.com)

How to Paint a deceptive picture

British journalist John Cantlie, who is supposedly being held captive by ISIS, goes into PR overdrive in a high-produced documentary in an effort to ‘humanize’ ISIS and its future generation of fighters. The decidedly pro-ISIS video is seen being pushed once again by the intelligence group SITE and another media arm of ISIS, Al Hayat Media Center.

Read More @ 21stCenturyWire.com

from 21st Century Wire:

MAGE: ‘Inside Aleppo with ISIS’ – John Cantlie gives a tour of Aleppo

interviewing alleged ISIS members. SITE’s logo is embossed in the image

above, along with another ISIS media arm, Al Hayat Media Center. (Photo link thegatewaypundit.com)

MAGE: ‘Inside Aleppo with ISIS’ – John Cantlie gives a tour of Aleppo

interviewing alleged ISIS members. SITE’s logo is embossed in the image

above, along with another ISIS media arm, Al Hayat Media Center. (Photo link thegatewaypundit.com)How to Paint a deceptive picture

British journalist John Cantlie, who is supposedly being held captive by ISIS, goes into PR overdrive in a high-produced documentary in an effort to ‘humanize’ ISIS and its future generation of fighters. The decidedly pro-ISIS video is seen being pushed once again by the intelligence group SITE and another media arm of ISIS, Al Hayat Media Center.

Read More @ 21stCenturyWire.com

Russia Warns US, Supplying Arms To Ukraine "Will Have Dramatic Consequences"

Submitted by Tyler Durden on 02/11/2015 - 11:30 As Putin arrives at the Minsk Summit, his Deputy Foreign Minister makes the Russian position clear to Washington:*U.S. ARMS SUPPLIES TO UKRAINE WILL HAVE DRAMATIC OUTCOME: IFX

*RUSSIA WILL NOT IGNORE U.S. ARMS SUPPLIES TO UKRAINE: IFX

Hardly what Merkel or Hollande wants to hear?

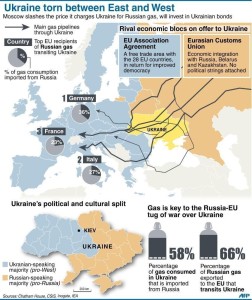

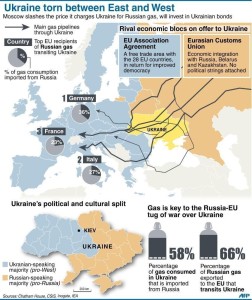

by Dave Hodges, The Common Sense Show:

German leader, Angela Merkel

is saying all the right things as she professes to be attempting to

shore up western unity with regard to the crisis in Ukraine. However,

Merkel is caught between a rock and a hard place. Germany receives a

substantial portion of its gas from Russia and the majority of that gas

flows through Ukraine. Currently, there is no nation on the face of the

planet, outside of Ukraine, that needs this crisis brought to a

conclusion than Germany. And this crisis needs to be resolved, sooner

rather than later.

German leader, Angela Merkel

is saying all the right things as she professes to be attempting to

shore up western unity with regard to the crisis in Ukraine. However,

Merkel is caught between a rock and a hard place. Germany receives a

substantial portion of its gas from Russia and the majority of that gas

flows through Ukraine. Currently, there is no nation on the face of the

planet, outside of Ukraine, that needs this crisis brought to a

conclusion than Germany. And this crisis needs to be resolved, sooner

rather than later.

Putin has made overtures to Germany in the past which would encourage Germany to forsake its Western alliances (i.e. the EU and NATO) and strike a beneficial deal with regard to obtaining its gas supplies from Russia at bargain basement prices.

Read More @ Thecommonsenseshow.com

German leader, Angela Merkel

is saying all the right things as she professes to be attempting to

shore up western unity with regard to the crisis in Ukraine. However,

Merkel is caught between a rock and a hard place. Germany receives a

substantial portion of its gas from Russia and the majority of that gas

flows through Ukraine. Currently, there is no nation on the face of the

planet, outside of Ukraine, that needs this crisis brought to a

conclusion than Germany. And this crisis needs to be resolved, sooner

rather than later.

German leader, Angela Merkel

is saying all the right things as she professes to be attempting to

shore up western unity with regard to the crisis in Ukraine. However,

Merkel is caught between a rock and a hard place. Germany receives a

substantial portion of its gas from Russia and the majority of that gas

flows through Ukraine. Currently, there is no nation on the face of the

planet, outside of Ukraine, that needs this crisis brought to a

conclusion than Germany. And this crisis needs to be resolved, sooner

rather than later.Putin has made overtures to Germany in the past which would encourage Germany to forsake its Western alliances (i.e. the EU and NATO) and strike a beneficial deal with regard to obtaining its gas supplies from Russia at bargain basement prices.

Read More @ Thecommonsenseshow.com

Move Over Syriza & Podemos: Revolutionary Indian Political Party Sweeps New Delhi Elections

Submitted by Tyler Durden on 02/11/2015 - 14:55 The nascent global political awakening against corrupt politicians, large corporations and central banks is growing louder. In the last few years we have seen the rise of Syriza in Greece, Podemos in Spain and even Bepe Grillo’s Five Star Movement in Italy. And now an upstart anti-corruption party won a smashing victory in elections to install a state government in India’s capital, dealing a huge blow to Prime Minister Narendra Modi’s Hindu nationalist party.

Checkpoint Charlie Is Back: Ukraine Starts Building A New Berlin Wall

Submitted by Tyler Durden on 02/11/2015 - 13:51 The ongoing conflict in Ukraine has fueled a resurgence in totalitarianism. Capital controls. Exchange controls. Wage and price controls... and now Border controls and people controls. As of this morning, the government of Ukraine started... “reinforcing”... the defenses of Kiev with eight barricaded checkpoints. Walls are never, ever erected to keep people out. They’re built to trap people inside.

Blistering Foreign Demand For 10 Year Treasurys, Highest Since 2011

Submitted by Tyler Durden on 02/11/2015 - 13:15 As expected following yesterday's scorching 3 Year bond auction in which Indirect, aka official foreign, demand soared to the highest in 5 years, today the trend of relentless demand from abroad for US yields continued, when the Treasury sold $21 billion in 10 Year paper, which not only priced 1.4 bps though the When Issued 2.014%, hitting the high yield precisely at 2.000%, but saw the highest Indirect Bid, of 59.5%, since December of 2011.Obama May Attack ISIS In Any Country He Chooses, Deploy Ground Troops On A Whim, Delay Afghanistan Pull Out

Submitted by Tyler Durden on 02/11/2015 - 13:03 The Nobel peace prize-winning president has been busy today: not only did he already petition Congress earlier to declare war on the Islamic State, a non-country which technically doesn't exist, but now he plans to expands his "war powers" to any other place in the world. From Reuters:- MILITARY AUTHORIZATION BILL WOULD PRESERVE PRESIDENT'S ABILITY TO ORDER OPERATIONS AGAINST ISLAMIC STATE IN COUNTRIES OTHER THAN IRAQ, SYRIA - WHITE HOUSE SPOKESMAN

- WHITE HOUSE SAYS COMBAT BOOTS ON THE GROUND MAY BE USED FOR HOSTAGE RESCUE OPERATIONS

- OBAMA NOT RULING OUT DEPLOYING COMBAT TROOPS ON GROUND TO ASSIST AIR STRIKES AGAINST ISLAMIC STATE, IF PENTAGON RECOMMENDS IT -WHITE HOUSE

Rising Interest Rates & Long Term Stock Returns

Submitted by Tyler Durden on 02/11/2015 - 12:44 There have been ZERO times that the Federal Reserve has entered into a rate hiking campaign that did not have a negative consequence...

Europe's Greek Contagion Update: Peripheral Bonds Risk Surges

Submitted by Tyler Durden on 02/11/2015 - 12:26 While US equities suggest all is well and Greece is contained, the less mainstream-news indicators of European stress are starting to flash orangey/red as the surge in spreads across European peripheral bonds since the Greek election suggests Q€ is being over-run. Italian, Spanish, and Portuguese bond spreads are all wider on the year now and up 25-30bps from ther Greek Election (fastest rise in months). Greek bank bonds and stocks remain near record lows and even broad European stock indices are struggling to hold gains post-election.

Deutsche Bank Warns, Energy Stock "Valuations Are Unsustainable" Unless Crude Hits $70 By 2H15

Submitted by Tyler Durden on 02/11/2015 - 12:16 We previously noted the extreme spike in S&P Energy sector stock valuations (and the fact that energy sector earnings will have to surge by 70% in order for this exuberant to be 'discounted' correctly). Now Deutsche Bank has run the numbers and warns that in order for S&P Energy to now be trading at what we would consider a fair ~15x normalized EPS, $70/bbl oil must return and be sustained by 2H15.

Bank Of America Used Government-Backed Funds For "Reckless, Extremely Levered" Tax Avoiding Trades

Submitted by Tyler Durden on 02/11/2015 - 11:37 A current Bank of America employee has made a number of whistleblower submissions to the U.S. Securities and Exchange Commission about the role played by the U.S. banking subsidiary in financing dividend-arbitrage trades: trades which used taxpayer-backed funds to allow hedge funds to avoid paying taxes. The employee’s submissions allege that Bank of America’s London-based Merrill Lynch International unit has extended “extreme levels of BANA leverage” to fund “increasingly aggressive and reckless” tax-avoidance trades. The submissions said the practices risked causing the bank “serious financial and reputational damage.”

End of an Era

Folks, as the hours go by, it’s becoming painfully obvious to anyone

paying attention, that no matter what path Greece takes in the days

ahead, what’s happening right now spells the end of “business as usual” in Europe.

The leaders of Syriza have managed to doggedly stand firm in their

main pledge(at least to date): to force Brussels and Germany to reduce

the debt burden upon the Greek people.Read More…

Over the past decade, there has been only one other time when the value of the U.S. dollar has increased by so much in such a short period of time. That was in mid-2008 – just before the greatest financial crash since the Great Depression. A surging U.S. dollar also greatly contributed to the Latin American debt crisis of the early 1980s and the Asian financial crisis of 1997. Today, the globe is more interconnected than ever. Most global trade is conducted in U.S. dollars, and much of the borrowing done by emerging markets all over the planet is denominated in U.S. dollars. When the U.S. dollar goes up dramatically, this can put a tremendous amount of financial stress on economies all around the world. It also has the potential to greatly threaten the stability of the 65 trillion dollars in derivatives that are directly tied to the value of the U.S. dollar. The global financial system is more vulnerable to currency movements than ever before, and history tells us that when the U.S. dollar soars the global economy tends to experience a contraction. So the fact that the U.S. dollar has been skyrocketing lately is a very, very bad sign.

Read More…

from KingWorldNews:

As the world continues to keep an eye on breaking news out of Europe,

Russia and Ukraine, today King World News has learned that India’s

Finance Ministry is about to make a decision that will have earthshaking

implications for the gold market. The Finance Ministry is set to make

the historic decision on February 28th when it submits its federal

budget to Parliament.

As the world continues to keep an eye on breaking news out of Europe,

Russia and Ukraine, today King World News has learned that India’s

Finance Ministry is about to make a decision that will have earthshaking

implications for the gold market. The Finance Ministry is set to make

the historic decision on February 28th when it submits its federal

budget to Parliament.

Shockwaves Through The Gold Market

This would slash the existing gold tax by a stunning 80%, sending shockwaves through the gold market as Indian demand for gold would soar. A reversal of this damaging policy against gold will mean billions of dollars of new gold buying in the physical market.

Dr. Paul Craig Roberts Continues @ KingWorldNews.com

As the world continues to keep an eye on breaking news out of Europe,

Russia and Ukraine, today King World News has learned that India’s

Finance Ministry is about to make a decision that will have earthshaking

implications for the gold market. The Finance Ministry is set to make

the historic decision on February 28th when it submits its federal

budget to Parliament.

As the world continues to keep an eye on breaking news out of Europe,

Russia and Ukraine, today King World News has learned that India’s

Finance Ministry is about to make a decision that will have earthshaking

implications for the gold market. The Finance Ministry is set to make

the historic decision on February 28th when it submits its federal

budget to Parliament.Shockwaves Through The Gold Market

This would slash the existing gold tax by a stunning 80%, sending shockwaves through the gold market as Indian demand for gold would soar. A reversal of this damaging policy against gold will mean billions of dollars of new gold buying in the physical market.

Dr. Paul Craig Roberts Continues @ KingWorldNews.com

from TheAlexJonesChannel:

from Silver Doctors:

In a November 2014 post title ‘With Gold’s $1180 Triple Bottom Broken, Is the Gold Bull Market Over?’ (see LINK HERE) the Gold charts below were presented comparing Gold vs. other world currencies to clearly illustrate that by Gold breaking $1180 in US dollar terms created NO long term damage whatsoever! You will also notice the charts below depict the actual bottom and exact cycle low on Gold.

In fact the November 6, 2014 low at $1130 was exactly 3.5 years (half a 7-year gold cycle) or 42-months from the April 30, 2011 – May 1, 2011 $49.00 Silver top. This November 2014 low cycle analysis forecast in advance; see Kerry Lutz interview (CLICK HERE). The important point here is a Gold cycle low/bottom arrived in November 2014 and Gold has been in an UP cycle since.

Read More @ SilverDoctors.com

In a November 2014 post title ‘With Gold’s $1180 Triple Bottom Broken, Is the Gold Bull Market Over?’ (see LINK HERE) the Gold charts below were presented comparing Gold vs. other world currencies to clearly illustrate that by Gold breaking $1180 in US dollar terms created NO long term damage whatsoever! You will also notice the charts below depict the actual bottom and exact cycle low on Gold.

In fact the November 6, 2014 low at $1130 was exactly 3.5 years (half a 7-year gold cycle) or 42-months from the April 30, 2011 – May 1, 2011 $49.00 Silver top. This November 2014 low cycle analysis forecast in advance; see Kerry Lutz interview (CLICK HERE). The important point here is a Gold cycle low/bottom arrived in November 2014 and Gold has been in an UP cycle since.

Read More @ SilverDoctors.com

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment