Submitted by Tyler Durden on 02/03/2015 - 12:22

Submitted by Tyler Durden on 02/03/2015 - 12:22

"There’s no other way to say this. The official unemployment rate, which cruelly overlooks the suffering of the long-term and often permanently unemployed as well as the depressingly underemployed, amounts to a Big Lie. And it’s a lie that has consequences, because the great American dream is to have a good job, and in recent years, America has failed to deliver that dream more than it has at any time in recent memory. I hear all the time that “unemployment is greatly reduced, but the people aren’t feeling it.” When the media, talking heads, the White House and Wall Street start reporting the truth -- the percent of Americans in good jobs; jobs that are full time and real -- then we will quit wondering why Americans aren’t “feeling” something that doesn’t remotely reflect the reality in their lives. And we will also quit wondering what hollowed out the middle class." - CEO of Gallup

3 Slides That Will Challenge Everything You Think About Investing

Submitted by Tyler Durden on 02/03/2015 - 17:00 With just three slides and 5 minutes and 44 seconds, Tim Price breaks down everything that’s wrong with the markets... and with the conventional investing mentality that most investors cling to like a warm blanket... US Domestic Vehicle Sales Disappoint In January, Drop For 2nd MonthSubmitted by Tyler Durden on 02/03/2015 - 16:18

US Domestic Vehicle Sales Disappoint In January, Drop For 2nd MonthSubmitted by Tyler Durden on 02/03/2015 - 16:18

All day mainstream media has been crowing about Auto sales being mind-blowing... record-breaking... colossal... so we have a simple question... when Ward's released its US Domestic Auto Sales (SAAR) data this afternoon... why did it miss expectations and show a 2nd monthly drop in a row? January printed 13.31 million cars SAAR, missing expectations of 13.5 million and dropping from December's 13.46 million SAAR. Paging Phil LeBeau?

Stocks Soar On "Higher Gas Prices Are Good" Narrative; Bonds & Greenback Battered

Submitted by Tyler Durden on 02/03/2015 - 16:03

Energy Company Valuations Explode To Dot Com Bubble Levels

Submitted by Tyler Durden on 02/03/2015 - 15:52 A few days ago we wrote that "Either Oil Soars Back To $88, Or Energy Stocks Have To Tumble By Over 40%." The basis for that analysis was a forward Energy Sector multiple which last week was just shy of 24X. It's time for an update because following today's latest surge in energy stocks, the most recent forward P/E multiple for energy companies is... well, see for yourself.

Argentine President Arrest Warrant Discovered At Dead Prosecutor's Home

Submitted by Tyler Durden on 02/03/2015 - 15:32 “It would have provoked a crisis without precedents in Argentina," exclaims a political analyst after, as The NYTimes reports, a draft of a warrant for the arrest of President Cristina Fernández de Kirchner - accusing her of trying to shield Iranian officials from responsibility in the 1994 bombing of a Jewish center - was found at dead prosecutor Alberto Nisman's home. The new revelation has further inflamed theories regarding the heightened tensions between him and the government before he was found dead, as "it would have been a scandal on a level previously unseen."The Health Of This Market Is Fading Fast

Submitted by Tyler Durden on 02/03/2015 - 14:52 Less than 50% of stocks are trading below their 200-day-moving-average and the correlation between the S&P 500 and its internals is remarkably negative. The last 4 times this 'setup' has occurred in the last 20 years, the broad equity market indices eventually gave up the divergence (including 2000's market top and 2007's market top). Simply put - the health of the market is fading fast...

Rates Don't Matter - Liquidity Matters

Submitted by Tyler Durden on 02/03/2015 - 14:34 If the U.S. economy is now dependent on marginal lenders and borrowers, then it is exceedingly fragile. The cure for systemic fragility is not low interest rates forever--it's a market that transparently prices credit and risk for lenders and borrowers, qualified and marginal alike.

First Germany, Now ECB Rejects "Latest Greek Bailout Plan"

Submitted by Tyler Durden on 02/03/2015 - 14:11 So much for the Greek "conciliatory proposal" story, driven by yesterday's FT article, and the catalyst for Monday's late day market surge.Who Owns Greek Debt And When Is It Due?

Submitted by Tyler Durden on 02/03/2015 - 14:20

Commodity Currencies Are Soaring

Submitted by Tyler Durden on 02/03/2015 - 13:25 As Crude's bounce gathers pace so the world's beaten-down commodity-currencies are exploding higher. Aussie Dollar has given back all its RBA rate curt losses, The Russian Ruble is soaring, and the Canadian Dollar isd back under 1.24 against the USDollar... The USD Index is now down 1.3% since Friday.

ISIS Burns Alive Jordanian Hostage Pilot; Offers Gold Reward For Death Of More Coalition Pilots

Submitted by Tyler Durden on 02/03/2015 - 13:05 Moments ago ISIS released a video showing a Jordanian pilot captured by the Islamic State extremist group being burned to death. According to AP, which could not confirm tha authenticity of the video, the clip was released on militant websites and bore the logo of the extremist group's al-Furqan media service. The 20-minute-long video "featured the slick production and graphics used in previous videos released by the group."S&P Downgrades Numerous European Banks, Warns Deutsche Bank May Be Next

Submitted by Tyler Durden on 02/03/2015 - 12:48 Just hours after apparently settling its suit with the USA (not at all retaliation for downgrading them), S&P has taken the big red marker out on a slew of European banks:- Downgrades: Credit Suisse, Barclays, Lloyds, Bank of Scotland, RBS, HSBC, and Ulster Bank

- On Watch Negative: Raiffeisen Zentralbank, MBank, Unicredit, Commerzbank, and Deutsche Bank

Like the vast majority of my constituents, I continue to be concerned

about record profits reported by petroleum companies at a time when

consumers are paying record high prices for gasoline.” . . . Mike Rogers, a politician from an era gone by

Like the vast majority of my constituents, I continue to be concerned

about record profits reported by petroleum companies at a time when

consumers are paying record high prices for gasoline.” . . . Mike Rogers, a politician from an era gone byEver since I entered this business I have heard the old stock market saw, “The best cure for high prices is high prices.” The quid pro quo is, “The best cure for low prices is low prices.” Obviously this axiom references commodities. Verily, commodities have a “clearing price” and a “cleaning price.” A clearing price is when a commodity gets so high it brings about more production of that commodity.

Jeffrey Saut Continues @ KingWorldNews.com

When widespread use of antibiotic medicines started in the early to

mid-20th century, they were hailed as miracle drugs and did help people

survive many infections like pneumonia that would otherwise have been

fatal. However, overuse of these drugs, both in mainstream medicine and

in the meat and dairy industry, has led to the rise of resistant

bacteria and to long-term health consequences due to the killing off of

the intestinal bacteria that is so important for digestion and general

health.

When widespread use of antibiotic medicines started in the early to

mid-20th century, they were hailed as miracle drugs and did help people

survive many infections like pneumonia that would otherwise have been

fatal. However, overuse of these drugs, both in mainstream medicine and

in the meat and dairy industry, has led to the rise of resistant

bacteria and to long-term health consequences due to the killing off of

the intestinal bacteria that is so important for digestion and general

health.That is why so many people are now seeking more natural forms of antibiotic treatment, such as the foods below which have natural, proven antibiotic properties.

Read More @ NaturalNews.com

from Paul Craig Roberts:

Greece’s new Finance Minister is a highly intelligent person. His

likes are not to be found in any Western government. As he stands in the

way of those who are determined to complete their looting of Greece,

the Western looters are out to get him.

Greece’s new Finance Minister is a highly intelligent person. His

likes are not to be found in any Western government. As he stands in the

way of those who are determined to complete their looting of Greece,

the Western looters are out to get him.

The BBC, as the interview in the link below demonstrates, was sicced on him. Much more is to come. Moreover, if the new Greek government is able to stand its ground and to prevent the continuation of the horrific looting of the Greek people, assassination of its leading members is not unlikely. Washington will not permit any independent governments to arise in Europe. If a Greek government succeeds in standing up for the Greek people and actually representing them, the idea might spread to Italy, Spain, Portugal, and Ireland, and then into Eastern Europe. Washington’s control over Europe would unravel.

Read More @ PaulCraigRoberts.com

Greece’s new Finance Minister is a highly intelligent person. His

likes are not to be found in any Western government. As he stands in the

way of those who are determined to complete their looting of Greece,

the Western looters are out to get him.

Greece’s new Finance Minister is a highly intelligent person. His

likes are not to be found in any Western government. As he stands in the

way of those who are determined to complete their looting of Greece,

the Western looters are out to get him.The BBC, as the interview in the link below demonstrates, was sicced on him. Much more is to come. Moreover, if the new Greek government is able to stand its ground and to prevent the continuation of the horrific looting of the Greek people, assassination of its leading members is not unlikely. Washington will not permit any independent governments to arise in Europe. If a Greek government succeeds in standing up for the Greek people and actually representing them, the idea might spread to Italy, Spain, Portugal, and Ireland, and then into Eastern Europe. Washington’s control over Europe would unravel.

Read More @ PaulCraigRoberts.com

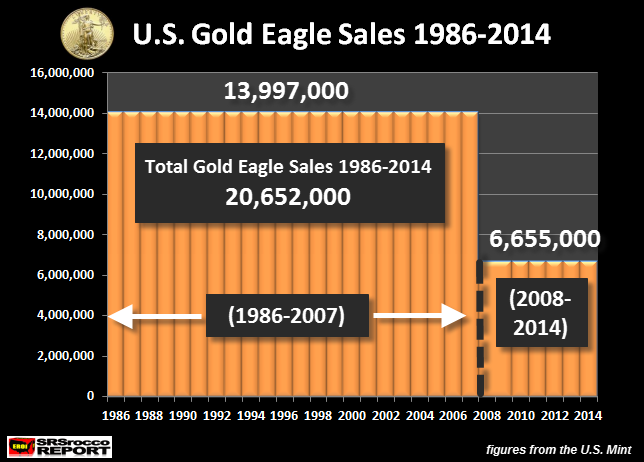

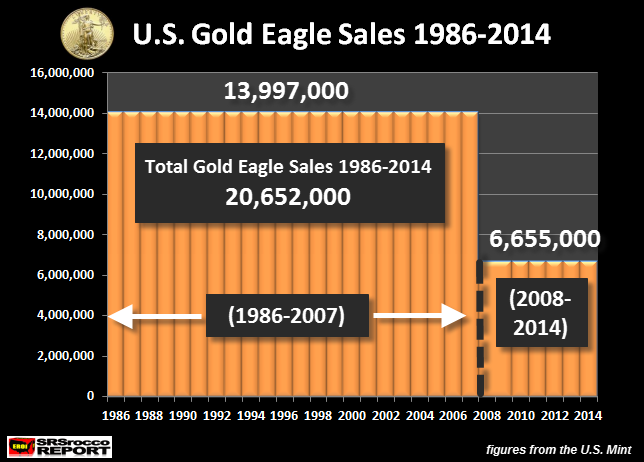

by Steven St. Angelo, SRS Rocco:

There are two charts every precious metals investor needs to see. The

U.S. Mint is celebrating its 30 year anniversary producing Gold and

Silver Eagles and if we look at the sales data of these two Official

precious metal legal tender coins going back to 1986, we find some very

interesting trends.

There are two charts every precious metals investor needs to see. The

U.S. Mint is celebrating its 30 year anniversary producing Gold and

Silver Eagles and if we look at the sales data of these two Official

precious metal legal tender coins going back to 1986, we find some very

interesting trends.

The U.S. Mint started selling Gold and Silver Eagles in 1986. The first year the U.S. Mint produced these coins, 1,787,750 oz of Gold Eagles were sold compared to 5,096,000 Silver Eagles… a 3 to 1 ratio. That was the first and last year, the Silver-Gold Eagle ratio was that low.

Read More…

There are two charts every precious metals investor needs to see. The

U.S. Mint is celebrating its 30 year anniversary producing Gold and

Silver Eagles and if we look at the sales data of these two Official

precious metal legal tender coins going back to 1986, we find some very

interesting trends.

There are two charts every precious metals investor needs to see. The

U.S. Mint is celebrating its 30 year anniversary producing Gold and

Silver Eagles and if we look at the sales data of these two Official

precious metal legal tender coins going back to 1986, we find some very

interesting trends.The U.S. Mint started selling Gold and Silver Eagles in 1986. The first year the U.S. Mint produced these coins, 1,787,750 oz of Gold Eagles were sold compared to 5,096,000 Silver Eagles… a 3 to 1 ratio. That was the first and last year, the Silver-Gold Eagle ratio was that low.

Read More…

from The AU Report:

The Gold Report:

The beginning of 2015 has been volatile for global currencies, not the

least of which was the Swiss National Bank removing its cap on the franc

versus the euro. What precipitated that and what does it mean for the

Swiss franc versus other currencies going forward?

The Gold Report:

The beginning of 2015 has been volatile for global currencies, not the

least of which was the Swiss National Bank removing its cap on the franc

versus the euro. What precipitated that and what does it mean for the

Swiss franc versus other currencies going forward?

John Mauldin: The Swiss National Bank had already expanded its balance sheet to 80% of GDP to maintain the link and would have had to buy more euros if the joint currency continued to weaken. It would be similar to the U.S. Federal Reserve having a balance sheet of $13 trillion. As late as the week before the big move, the chairman and vice chairman of the Swiss National Bank announced publicly that the peg was a cornerstone and the bank would continue to maintain it. Once it became clear that some very serious quantitative easing (QE) was coming from the European Central Bank (ECB), everything changed.

Read More @ TheAUReport.com

The Gold Report:

The beginning of 2015 has been volatile for global currencies, not the

least of which was the Swiss National Bank removing its cap on the franc

versus the euro. What precipitated that and what does it mean for the

Swiss franc versus other currencies going forward?

The Gold Report:

The beginning of 2015 has been volatile for global currencies, not the

least of which was the Swiss National Bank removing its cap on the franc

versus the euro. What precipitated that and what does it mean for the

Swiss franc versus other currencies going forward?John Mauldin: The Swiss National Bank had already expanded its balance sheet to 80% of GDP to maintain the link and would have had to buy more euros if the joint currency continued to weaken. It would be similar to the U.S. Federal Reserve having a balance sheet of $13 trillion. As late as the week before the big move, the chairman and vice chairman of the Swiss National Bank announced publicly that the peg was a cornerstone and the bank would continue to maintain it. Once it became clear that some very serious quantitative easing (QE) was coming from the European Central Bank (ECB), everything changed.

Read More @ TheAUReport.com

from The BRICS Post:

Unnamed US officials say President Barack Obama is considering

providing the Ukraine government with weapons aid as pro-Russian

separatists make territorial gains in the east of the country.

Unnamed US officials say President Barack Obama is considering

providing the Ukraine government with weapons aid as pro-Russian

separatists make territorial gains in the east of the country.

But Russian officials warn such a move would only increase the violence in eastern Ukraine.

Chairman of the Russian Federation Council Foreign Affairs Committee Konstantin Kosachev told reporters that “if this decision is taken, it might trigger further escalation of the conflict and shows that the US is choosing, after Kiev, the path of military solution”.

Read More @ TheBRICSPost.com

Unnamed US officials say President Barack Obama is considering

providing the Ukraine government with weapons aid as pro-Russian

separatists make territorial gains in the east of the country.

Unnamed US officials say President Barack Obama is considering

providing the Ukraine government with weapons aid as pro-Russian

separatists make territorial gains in the east of the country.But Russian officials warn such a move would only increase the violence in eastern Ukraine.

Chairman of the Russian Federation Council Foreign Affairs Committee Konstantin Kosachev told reporters that “if this decision is taken, it might trigger further escalation of the conflict and shows that the US is choosing, after Kiev, the path of military solution”.

Read More @ TheBRICSPost.com

by Michael Snyder, The Economic Collapse Blog:

When it comes to taking a chainsaw to the future of America, nobody

seems more eager than Barack Obama. Despite the fact that the U.S.

national debt is on pace to approximately double during his eight years

in the White House, he has just proposed a budget that would take

government spending to crazy new heights. When Barack Obama took the

oath of office, the U.S. national debt was 10.6 trillion dollars.

Today, it has surpassed the 18 trillion dollar mark. And even though we

are being told that “deficits are going down”, the truth is that the

U.S. national debt increased by more than a trillion dollars

in fiscal 2014. But that isn’t good enough for Obama. He says that we

need to come out of this period of “mindless austerity” and steal money

from our children and our grandchildren even faster. In addition,

Obama wants to raise taxes again. His budget calls for 2 trillion

dollars in tax increases over the next decade. He always touts these

tax increases as “tax hikes on the rich”, but somehow they almost always

seem to end up hitting the middle class too. But whether or not

Congress ever adopts Obama’s new budget is not really the issue. The

reality of the matter is that the “tax and spend Democrats” and the “tax and spend Republicans” are both

responsible for getting us into this mess. Future generations of

Americans are already facing the largest mountain of debt in the history

of the planet, and both parties want to make this

mountain of debt even higher. The only disagreement is about how fast

it should happen. It is a national disgrace, but most Americans have

come to accept this as “normal”. If our children and our grandchildren

get the opportunity, they will curse us for what we have done to them.

When it comes to taking a chainsaw to the future of America, nobody

seems more eager than Barack Obama. Despite the fact that the U.S.

national debt is on pace to approximately double during his eight years

in the White House, he has just proposed a budget that would take

government spending to crazy new heights. When Barack Obama took the

oath of office, the U.S. national debt was 10.6 trillion dollars.

Today, it has surpassed the 18 trillion dollar mark. And even though we

are being told that “deficits are going down”, the truth is that the

U.S. national debt increased by more than a trillion dollars

in fiscal 2014. But that isn’t good enough for Obama. He says that we

need to come out of this period of “mindless austerity” and steal money

from our children and our grandchildren even faster. In addition,

Obama wants to raise taxes again. His budget calls for 2 trillion

dollars in tax increases over the next decade. He always touts these

tax increases as “tax hikes on the rich”, but somehow they almost always

seem to end up hitting the middle class too. But whether or not

Congress ever adopts Obama’s new budget is not really the issue. The

reality of the matter is that the “tax and spend Democrats” and the “tax and spend Republicans” are both

responsible for getting us into this mess. Future generations of

Americans are already facing the largest mountain of debt in the history

of the planet, and both parties want to make this

mountain of debt even higher. The only disagreement is about how fast

it should happen. It is a national disgrace, but most Americans have

come to accept this as “normal”. If our children and our grandchildren

get the opportunity, they will curse us for what we have done to them.

Read More…

When it comes to taking a chainsaw to the future of America, nobody

seems more eager than Barack Obama. Despite the fact that the U.S.

national debt is on pace to approximately double during his eight years

in the White House, he has just proposed a budget that would take

government spending to crazy new heights. When Barack Obama took the

oath of office, the U.S. national debt was 10.6 trillion dollars.

Today, it has surpassed the 18 trillion dollar mark. And even though we

are being told that “deficits are going down”, the truth is that the

U.S. national debt increased by more than a trillion dollars

in fiscal 2014. But that isn’t good enough for Obama. He says that we

need to come out of this period of “mindless austerity” and steal money

from our children and our grandchildren even faster. In addition,

Obama wants to raise taxes again. His budget calls for 2 trillion

dollars in tax increases over the next decade. He always touts these

tax increases as “tax hikes on the rich”, but somehow they almost always

seem to end up hitting the middle class too. But whether or not

Congress ever adopts Obama’s new budget is not really the issue. The

reality of the matter is that the “tax and spend Democrats” and the “tax and spend Republicans” are both

responsible for getting us into this mess. Future generations of

Americans are already facing the largest mountain of debt in the history

of the planet, and both parties want to make this

mountain of debt even higher. The only disagreement is about how fast

it should happen. It is a national disgrace, but most Americans have

come to accept this as “normal”. If our children and our grandchildren

get the opportunity, they will curse us for what we have done to them.

When it comes to taking a chainsaw to the future of America, nobody

seems more eager than Barack Obama. Despite the fact that the U.S.

national debt is on pace to approximately double during his eight years

in the White House, he has just proposed a budget that would take

government spending to crazy new heights. When Barack Obama took the

oath of office, the U.S. national debt was 10.6 trillion dollars.

Today, it has surpassed the 18 trillion dollar mark. And even though we

are being told that “deficits are going down”, the truth is that the

U.S. national debt increased by more than a trillion dollars

in fiscal 2014. But that isn’t good enough for Obama. He says that we

need to come out of this period of “mindless austerity” and steal money

from our children and our grandchildren even faster. In addition,

Obama wants to raise taxes again. His budget calls for 2 trillion

dollars in tax increases over the next decade. He always touts these

tax increases as “tax hikes on the rich”, but somehow they almost always

seem to end up hitting the middle class too. But whether or not

Congress ever adopts Obama’s new budget is not really the issue. The

reality of the matter is that the “tax and spend Democrats” and the “tax and spend Republicans” are both

responsible for getting us into this mess. Future generations of

Americans are already facing the largest mountain of debt in the history

of the planet, and both parties want to make this

mountain of debt even higher. The only disagreement is about how fast

it should happen. It is a national disgrace, but most Americans have

come to accept this as “normal”. If our children and our grandchildren

get the opportunity, they will curse us for what we have done to them.Read More…

from Gold Broker:

The first hypothesis is that the present bear market is not finished

and it would have another one or two legs down all the way to where it

started at $300. On a technical basis, it can be defended if you believe

$1,900 was the end of a bubble started in 2000. I don’t. Many other

technical, but also fundamental, factors make me give this scenario a

very low probability.

The first hypothesis is that the present bear market is not finished

and it would have another one or two legs down all the way to where it

started at $300. On a technical basis, it can be defended if you believe

$1,900 was the end of a bubble started in 2000. I don’t. Many other

technical, but also fundamental, factors make me give this scenario a

very low probability.

The second hypothesis is that we will retrace down to the area of $1000 to $700. This scenario is more probable but, in my view, it should have happened by now and sentiment indicators are so bearish that I don’t see a move to $700, which would be a total retracement of the bull leg started in 2009. A short spike to $1000 is more possible, which would be approximately a 50% retracement from the top, but I think it should have happened by now.

Read More @ GoldBroker.com

The first hypothesis is that the present bear market is not finished

and it would have another one or two legs down all the way to where it

started at $300. On a technical basis, it can be defended if you believe

$1,900 was the end of a bubble started in 2000. I don’t. Many other

technical, but also fundamental, factors make me give this scenario a

very low probability.

The first hypothesis is that the present bear market is not finished

and it would have another one or two legs down all the way to where it

started at $300. On a technical basis, it can be defended if you believe

$1,900 was the end of a bubble started in 2000. I don’t. Many other

technical, but also fundamental, factors make me give this scenario a

very low probability.The second hypothesis is that we will retrace down to the area of $1000 to $700. This scenario is more probable but, in my view, it should have happened by now and sentiment indicators are so bearish that I don’t see a move to $700, which would be a total retracement of the bull leg started in 2009. A short spike to $1000 is more possible, which would be approximately a 50% retracement from the top, but I think it should have happened by now.

Read More @ GoldBroker.com

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment