Europe Pulls Rug From Under Greece, Says "Nein" To "Vague, Piecemeal" Proposals

Submitted by Tyler Durden on 03/29/2015 - 14:12 Despite all the talk of a "positive climate" Greek talks with their creditors have ended badly for the desperately cash-strapped nation. As WSJ reports, Greek proposals for a revised bailout program don’t have enough detail - are "piecemeal and vague" - to satisfy the government’s international creditors, eurozone officials said. Furthermore, as Dow Jones reports, EU finance ministers are unlikley to meet again until mid-April (and in the meantime, Greece has to pay salaries, pensions, and most critically IMF debts due on April 9th). It appears clear that the EU is prepared to let Greece entirely run out of money in an effort to squeeze Tspiras as much as possible (though that action will likely further force a pivot to Putin).

from Wolf Street:

Companies are selling bonds like madmen. This year through Tuesday,

investment-grade and junk-rated companies have sold $438 billion in new

bonds, up 14% from the prior record for this time of the year, set in

2013, according to Dealogic. This quarter is already in second place,

nudging up against the all-time quarterly record of $455 billion of Q2

2014.

Companies are selling bonds like madmen. This year through Tuesday,

investment-grade and junk-rated companies have sold $438 billion in new

bonds, up 14% from the prior record for this time of the year, set in

2013, according to Dealogic. This quarter is already in second place,

nudging up against the all-time quarterly record of $455 billion of Q2

2014.

About $87 billion of these bonds funded takeovers, a record for this time of the year, the Wall Street Journal reported. The four biggest bond sales in that batch were for healthcare takeovers, including the Actavis deal whose $21 billion bond sale was the second largest in history, behind Verizon’s $49 billion bond sale in 2013.

Read More @ Wolfstreet.com

- SEC Commissioner Luis Aguilar.

Companies are selling bonds like madmen. This year through Tuesday,

investment-grade and junk-rated companies have sold $438 billion in new

bonds, up 14% from the prior record for this time of the year, set in

2013, according to Dealogic. This quarter is already in second place,

nudging up against the all-time quarterly record of $455 billion of Q2

2014.

Companies are selling bonds like madmen. This year through Tuesday,

investment-grade and junk-rated companies have sold $438 billion in new

bonds, up 14% from the prior record for this time of the year, set in

2013, according to Dealogic. This quarter is already in second place,

nudging up against the all-time quarterly record of $455 billion of Q2

2014.About $87 billion of these bonds funded takeovers, a record for this time of the year, the Wall Street Journal reported. The four biggest bond sales in that batch were for healthcare takeovers, including the Actavis deal whose $21 billion bond sale was the second largest in history, behind Verizon’s $49 billion bond sale in 2013.

Read More @ Wolfstreet.com

Kyle Bass Warns "The Fed Is Backed Into A Corner... Equities Are My Biggest Liquidity Worry"

Submitted by Tyler Durden on 03/28/2015 - 23:35 "How many rich people do you know today that are poorer than they were at the peak in 06/07 (apart from Dick Fuld), I don't think I know any.. QE has been distributive to the rich... but now that the world has started this policy it is unable to end it... the next recession will be a hard one because the tools in the toolbox are not there to avert a severe downturn... where are the liquidity worries at the moment? Equities would be the toughest to exit.. it's like a 5-lane highway going in and goat trail coming out... Brazil is great example"

Both SEC And FINRA Admit That The Market Is Rigged (And They Are Powerless To Fix It)

Submitted by Tyler Durden on 03/28/2015 - 17:01 "When an HFT that is not a member of an association executes an off-exchange trade, the HFT’s identity is usually not reported to the Financial Industry Regulatory Authority, or FINRA, which is the only association currently in existence. This frustrates FINRA’s surveillance efforts as it cannot quickly link trades to the HFTs responsible for them. This is a serious problem because, according to FINRA’s current Chairman, certain market participants disperse their trading activity across multiple markets in an attempt to hide various forms of market abuse, including layering, spoofing, algorithm gaming, and wash sales."- SEC Commissioner Luis Aguilar.

Complacency Reigns Supreme - "Nothing Can Possibly Go Wrong", Right

Submitted by Tyler Durden on 03/29/2015 - 10:31 No wonder complacency reigns supreme: any time the stock market tumbles by more than 3%, a Federal Reserve flack runs to a microphone and starts talking about how the Fed stands ready to launch QE4 or "whatever it takes" to push stocks back into rally mode. For context, recall that both VIX and VXX tend to reach 40 in real moments of panic/fear. That the VXX "soaring" 2 points from 24 to 26 now qualifies as an extreme of fear is absurd. Yet this is the logical result of central banks constantly "saving" equities every time they swoon the slightest bit: traders and punters know that the Fed making reassuring sounds is all that's needed to reverse any decline and restart the Bull advance.

Finally The "Very Serious People" Get It: QE Will "Permanently Impair Living Standards For Generations To Come"

Submitted by Tyler Durden on 03/28/2015 - 23:18 "In the long run classical economics would tell us that the pricing distortions created by the current global regimes of QE will lead to a suboptimal allocation of capital and investment, which will result in lower output and lower standards of living over time. In fact, although U.S. equity prices are setting record highs, real median household incomes are 9 percent lower than 1999 highs. The report from Bank of America Merrill Lynch plainly supports the conclusion that QE and the associated currency depreciation is not leading to higher global output. The cost of QE is greater than the income lost to savers and investors. The long-term consequence of the new monetary orthodoxy is likely to permanently impair living standards for generations to come while creating a false illusion of reviving prosperity."

by Brandon Turbeville, Activist Post:

In what should come as no surprise to anyone who has followed the Syrian crisis, the top US commander in the Middle East,

General Lloyd Austin, has apparently recommended that the US military

“shield” the new death squad terrorists being trained by the United

States who are soon to be deployed across the country.

In what should come as no surprise to anyone who has followed the Syrian crisis, the top US commander in the Middle East,

General Lloyd Austin, has apparently recommended that the US military

“shield” the new death squad terrorists being trained by the United

States who are soon to be deployed across the country.

Gen. Austin told Congress on Thursday that he was currently waiting on the White House’s response to his recommendation.

The US has been supporting terrorists in Syria since the beginning of the crisis in late 2010 by a variety of means, most notably military, political, and financial. However, the US recently announced that it is going to openly train several thousand jihadist fighters to be deployed against the Syrian government.

Read More @ ActivistPost.com

In what should come as no surprise to anyone who has followed the Syrian crisis, the top US commander in the Middle East,

General Lloyd Austin, has apparently recommended that the US military

“shield” the new death squad terrorists being trained by the United

States who are soon to be deployed across the country.

In what should come as no surprise to anyone who has followed the Syrian crisis, the top US commander in the Middle East,

General Lloyd Austin, has apparently recommended that the US military

“shield” the new death squad terrorists being trained by the United

States who are soon to be deployed across the country.Gen. Austin told Congress on Thursday that he was currently waiting on the White House’s response to his recommendation.

The US has been supporting terrorists in Syria since the beginning of the crisis in late 2010 by a variety of means, most notably military, political, and financial. However, the US recently announced that it is going to openly train several thousand jihadist fighters to be deployed against the Syrian government.

Read More @ ActivistPost.com

The 'Obama' Warning System

Submitted by Tyler Durden on 03/29/2015 - 11:59

Guest Post: The Only Truly Compliant, Submissive Citizen In A Police State Is A Dead One

Submitted by Tyler Durden on 03/28/2015 - 22:15 This is the death rattle of the American dream, which was built on the idea that no one is above the law, that our rights are inalienable and cannot be taken away, and that our government and its appointed agents exist to serve us.

First Europe, Now The Gulf's Leaders Agree To Form United Arab Military Force

Submitted by Tyler Durden on 03/29/2015 - 13:30 Just a week after Jean-Claude 'I am not a hawkish warmonger' Juncker pressed for the creation of a Unified European Army to combat the 'looming' threat of their massive trade partner Russia; RT reports Arab leaders have agreed to form a joint military force from roughly 40,000 elite troops and backed by warplanes, warships and light armor at a Sharm el-Sheikh summit. Egyptian President Abdel Sisi has announced a high-level panel will work out the structure and mechanism of the future force. The work is expected to take four months. It appears The Endgame of this global game of Risk is fast approaching as one-by-one, geographically proximate nations join forces for whetever comes next.

The American Dream Part 3 - Moonshine, Scam, & The Delusion Of Democracy

Submitted by Tyler Durden on 03/29/2015 - 12:45 When we left you yesterday, we were trying to connect the bloated, cankerous ankles of the US economy (Part 1) to the sugar rush of its post-1971 credit-based money system (Part 2). Today, we look at the face of our government. It is older... with more worry lines and wrinkles. But whence cometh that pale and stupid look? That is also the result of the same advanced diabetic epizootic that has infected American society. Eric King:

“The gold market has held up incredibly well (recently). We’ve had

the U.S. Dollar Index go from the low 80s to a bit above par. Now it’s

pulled back just a bit, but during that whole time frame the anticipated

smash on gold to $900 or $1,000 never materialized, and now we’re back

to $1,200.”

Eric King:

“The gold market has held up incredibly well (recently). We’ve had

the U.S. Dollar Index go from the low 80s to a bit above par. Now it’s

pulled back just a bit, but during that whole time frame the anticipated

smash on gold to $900 or $1,000 never materialized, and now we’re back

to $1,200.”Rick Rule: “Well, you know, Eric, this discussion marks us as Americans because gold is in a bull market all around the world in every currency except the United States dollar and has been for 14-months….

“If you were a gold-holder in euros, yen, rupees, rubles, or pesos, you’ve done very well. It’s only being a gold-holder in dollars that’s been problematic. And as I said before, gold doesn’t need to win the war against the dollar, it just needs to lose the war less badly, and my suspicion is that’s beginning to be the case.

Rick Rule Continues @ KingWorldNews.com

by Michael J. Kosares, Gold Seek:

Let the seller beware! The German citizen/investor who put away a few

rolls of 20 mark gold coins (.2304 tr ozs. shown below) in 1918 would

have done so at 119 marks per ounce. By early 1920 the previous rapid

inflation had suddenly given way to deflation. Had that gold owner

decided to cash in on gold’s significant gains thinking runaway

inflation was over, a 100,000 mark investment would have made him or her

a millionaire. The glow, however, would have quickly worn off. By late

1921 the runaway inflation had resurfaced but now with a vengeance. Gold

shot to 4,000 marks per ounce. By mid-1922 gold reached 10,000 marks

per ounce and the wholesale price index went from 13 to 70. By late

1922, the roof caved in. Gold traded at 134,000 marks per ounce. In

January, 1923, it cracked 1,000,000 marks per ounce. By midyear, it

broke the 100 million marks per ounce barrier and at the peak of the

hyperinflationary breakdown, it sold for over 100 billion marks per

ounce. The individual who thought he or she had the cat by the tail and

cashed-in his or her golden chips during the 1920’s deflation became a

millionaire. In short order though, that millionaire became a pauper as

wave after wave of hyperinflation washed over the German economy. One

moral from this somewhat frightening tale is that becoming a millionaire

or even a billionaire on one’s gold holdings was inconsequential.

Another is not to give up one’s hedge until there is ample evidence that

it is no longer needed. Momentary nominal profits can be illusory.

Let the seller beware! The German citizen/investor who put away a few

rolls of 20 mark gold coins (.2304 tr ozs. shown below) in 1918 would

have done so at 119 marks per ounce. By early 1920 the previous rapid

inflation had suddenly given way to deflation. Had that gold owner

decided to cash in on gold’s significant gains thinking runaway

inflation was over, a 100,000 mark investment would have made him or her

a millionaire. The glow, however, would have quickly worn off. By late

1921 the runaway inflation had resurfaced but now with a vengeance. Gold

shot to 4,000 marks per ounce. By mid-1922 gold reached 10,000 marks

per ounce and the wholesale price index went from 13 to 70. By late

1922, the roof caved in. Gold traded at 134,000 marks per ounce. In

January, 1923, it cracked 1,000,000 marks per ounce. By midyear, it

broke the 100 million marks per ounce barrier and at the peak of the

hyperinflationary breakdown, it sold for over 100 billion marks per

ounce. The individual who thought he or she had the cat by the tail and

cashed-in his or her golden chips during the 1920’s deflation became a

millionaire. In short order though, that millionaire became a pauper as

wave after wave of hyperinflation washed over the German economy. One

moral from this somewhat frightening tale is that becoming a millionaire

or even a billionaire on one’s gold holdings was inconsequential.

Another is not to give up one’s hedge until there is ample evidence that

it is no longer needed. Momentary nominal profits can be illusory.

Read More @ GoldSeek.com

/ Let the seller beware! The German citizen/investor who put away a few

rolls of 20 mark gold coins (.2304 tr ozs. shown below) in 1918 would

have done so at 119 marks per ounce. By early 1920 the previous rapid

inflation had suddenly given way to deflation. Had that gold owner

decided to cash in on gold’s significant gains thinking runaway

inflation was over, a 100,000 mark investment would have made him or her

a millionaire. The glow, however, would have quickly worn off. By late

1921 the runaway inflation had resurfaced but now with a vengeance. Gold

shot to 4,000 marks per ounce. By mid-1922 gold reached 10,000 marks

per ounce and the wholesale price index went from 13 to 70. By late

1922, the roof caved in. Gold traded at 134,000 marks per ounce. In

January, 1923, it cracked 1,000,000 marks per ounce. By midyear, it

broke the 100 million marks per ounce barrier and at the peak of the

hyperinflationary breakdown, it sold for over 100 billion marks per

ounce. The individual who thought he or she had the cat by the tail and

cashed-in his or her golden chips during the 1920’s deflation became a

millionaire. In short order though, that millionaire became a pauper as

wave after wave of hyperinflation washed over the German economy. One

moral from this somewhat frightening tale is that becoming a millionaire

or even a billionaire on one’s gold holdings was inconsequential.

Another is not to give up one’s hedge until there is ample evidence that

it is no longer needed. Momentary nominal profits can be illusory.

Let the seller beware! The German citizen/investor who put away a few

rolls of 20 mark gold coins (.2304 tr ozs. shown below) in 1918 would

have done so at 119 marks per ounce. By early 1920 the previous rapid

inflation had suddenly given way to deflation. Had that gold owner

decided to cash in on gold’s significant gains thinking runaway

inflation was over, a 100,000 mark investment would have made him or her

a millionaire. The glow, however, would have quickly worn off. By late

1921 the runaway inflation had resurfaced but now with a vengeance. Gold

shot to 4,000 marks per ounce. By mid-1922 gold reached 10,000 marks

per ounce and the wholesale price index went from 13 to 70. By late

1922, the roof caved in. Gold traded at 134,000 marks per ounce. In

January, 1923, it cracked 1,000,000 marks per ounce. By midyear, it

broke the 100 million marks per ounce barrier and at the peak of the

hyperinflationary breakdown, it sold for over 100 billion marks per

ounce. The individual who thought he or she had the cat by the tail and

cashed-in his or her golden chips during the 1920’s deflation became a

millionaire. In short order though, that millionaire became a pauper as

wave after wave of hyperinflation washed over the German economy. One

moral from this somewhat frightening tale is that becoming a millionaire

or even a billionaire on one’s gold holdings was inconsequential.

Another is not to give up one’s hedge until there is ample evidence that

it is no longer needed. Momentary nominal profits can be illusory.Read More @ GoldSeek.com

from The News Doctors:

Obtained exclusively by The Intercept and described in a news story

on Friday, a leaked Transportation Safety Administration document

reveals the “suspicious signs”—including excessive yawning, a cold hard

stare, or a rigid posture—that TSA agents have been trained to look for

as airline passengers make their way through U.S. airports in the

post-9/11 era.

Obtained exclusively by The Intercept and described in a news story

on Friday, a leaked Transportation Safety Administration document

reveals the “suspicious signs”—including excessive yawning, a cold hard

stare, or a rigid posture—that TSA agents have been trained to look for

as airline passengers make their way through U.S. airports in the

post-9/11 era.

The document details how a 92-point checklist for TSA agent is divided into numerous categories with a point score corresponding to the various kinds of personal traits or behaviors exhibited by unwitting travelers.

Read More @ TheNewsDoctors.com

Obtained exclusively by The Intercept and described in a news story

on Friday, a leaked Transportation Safety Administration document

reveals the “suspicious signs”—including excessive yawning, a cold hard

stare, or a rigid posture—that TSA agents have been trained to look for

as airline passengers make their way through U.S. airports in the

post-9/11 era.

Obtained exclusively by The Intercept and described in a news story

on Friday, a leaked Transportation Safety Administration document

reveals the “suspicious signs”—including excessive yawning, a cold hard

stare, or a rigid posture—that TSA agents have been trained to look for

as airline passengers make their way through U.S. airports in the

post-9/11 era.The document details how a 92-point checklist for TSA agent is divided into numerous categories with a point score corresponding to the various kinds of personal traits or behaviors exhibited by unwitting travelers.

Read More @ TheNewsDoctors.com

from Washington’s Blog:

The U.S. government is toying with a war with nuclear Russia while

already waging wars in Iraq and Afghanistan, having done severe damage

to Libya, Yemen, Pakistan, and Somalia. Military spending is climbing

ever higher. Presidential war powers are ever more extreme. The

proliferation of nuclear technology is combining with the ease and

secrecy of drone wars to raise the risk of a Dr. Strangelove finish to

the human species. And, let’s face it, you had more time to give a damn

when the president was a Republican.

The U.S. government is toying with a war with nuclear Russia while

already waging wars in Iraq and Afghanistan, having done severe damage

to Libya, Yemen, Pakistan, and Somalia. Military spending is climbing

ever higher. Presidential war powers are ever more extreme. The

proliferation of nuclear technology is combining with the ease and

secrecy of drone wars to raise the risk of a Dr. Strangelove finish to

the human species. And, let’s face it, you had more time to give a damn

when the president was a Republican.

The top means by which war kills is the diversion of unfathomable piles of money away from life-saving initiatives. That spending continues without pause. President Obama and most of Congress want it increased even more next year.

Read More @ WashingtonsBlog.com

The U.S. government is toying with a war with nuclear Russia while

already waging wars in Iraq and Afghanistan, having done severe damage

to Libya, Yemen, Pakistan, and Somalia. Military spending is climbing

ever higher. Presidential war powers are ever more extreme. The

proliferation of nuclear technology is combining with the ease and

secrecy of drone wars to raise the risk of a Dr. Strangelove finish to

the human species. And, let’s face it, you had more time to give a damn

when the president was a Republican.

The U.S. government is toying with a war with nuclear Russia while

already waging wars in Iraq and Afghanistan, having done severe damage

to Libya, Yemen, Pakistan, and Somalia. Military spending is climbing

ever higher. Presidential war powers are ever more extreme. The

proliferation of nuclear technology is combining with the ease and

secrecy of drone wars to raise the risk of a Dr. Strangelove finish to

the human species. And, let’s face it, you had more time to give a damn

when the president was a Republican.The top means by which war kills is the diversion of unfathomable piles of money away from life-saving initiatives. That spending continues without pause. President Obama and most of Congress want it increased even more next year.

Read More @ WashingtonsBlog.com

from Western Journalism:

I wrote well over a year ago about how Obama’s policy in the Middle

East and appeasing of Iran could start a nuclear arms race in the Middle

East. This is now coming true.

I wrote well over a year ago about how Obama’s policy in the Middle

East and appeasing of Iran could start a nuclear arms race in the Middle

East. This is now coming true.

The news coming out of the negotiations is that the Obama administration has caved to Iran on them operating centrifuges to enrich uranium in hardened facilities which will be impervious to attack. This is an obvious effort to allow Iran to go nuclear in order to “get a deal,” which we have spoken about on these pages often.

Today, Saudi Arabia said they are considering building nuclear weapons to counter the capability Obama is giving Iran. The Independent reports:

Read More @ WesternJournalism.com

I wrote well over a year ago about how Obama’s policy in the Middle

East and appeasing of Iran could start a nuclear arms race in the Middle

East. This is now coming true.

I wrote well over a year ago about how Obama’s policy in the Middle

East and appeasing of Iran could start a nuclear arms race in the Middle

East. This is now coming true.The news coming out of the negotiations is that the Obama administration has caved to Iran on them operating centrifuges to enrich uranium in hardened facilities which will be impervious to attack. This is an obvious effort to allow Iran to go nuclear in order to “get a deal,” which we have spoken about on these pages often.

Today, Saudi Arabia said they are considering building nuclear weapons to counter the capability Obama is giving Iran. The Independent reports:

Read More @ WesternJournalism.com

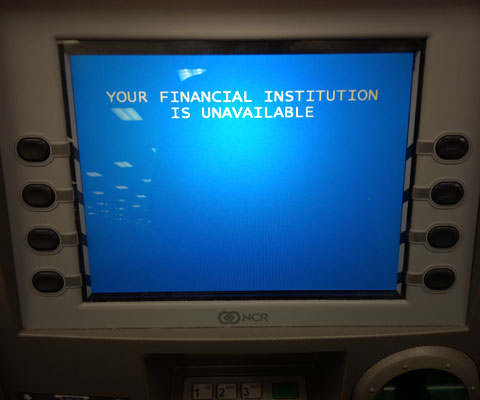

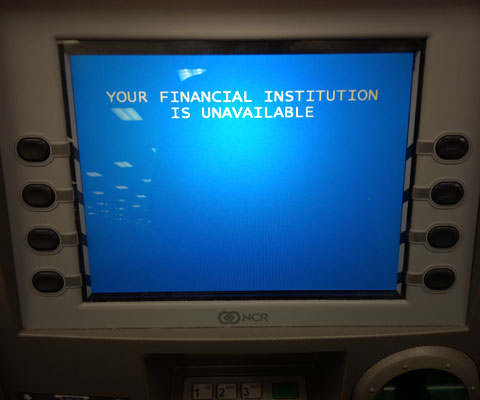

by Mac Slavo, SHTFPlan:

If ever you needed a better motivation to get your funds out of the bank, this is a clear sign that a digital clampdown is coming.

There are increasing examples of technology failures and stricter bank policies that are keep people from getting their money.

And they are happening all across the globe.

Ulster Bank in Ireland just made news after customers were locked out of their accounts by a glitch that disabled access to wage money:

Read More @ SHTFPlan.com

If ever you needed a better motivation to get your funds out of the bank, this is a clear sign that a digital clampdown is coming.

There are increasing examples of technology failures and stricter bank policies that are keep people from getting their money.

And they are happening all across the globe.

Ulster Bank in Ireland just made news after customers were locked out of their accounts by a glitch that disabled access to wage money:

Read More @ SHTFPlan.com

by Catherine J. Frompovich, Activist Post:

Something is cropping up all over Los Angeles, California, like

poisonous mushrooms, with equally toxic effects, but it’s not poisonous

mushrooms.

Something is cropping up all over Los Angeles, California, like

poisonous mushrooms, with equally toxic effects, but it’s not poisonous

mushrooms.

It’s the standard cell tower, along with RF and EMF public relations pitches that are generated. Let’s hear what’s really happening in everyday, on-the-ground life, especially in ‘cell tower haven’ Los Angeles, California.

Concerned Los Angelinos feel there are several issues regarding all the cell towers being constructed in their area, but the most prominent concerns are health effects from EMFs and Constitutional 4th Amendment privacy matters. Numerous groups around the USA also are working on these very same issues. Maybe readers will become activists after having read this information. Those 4th Amendment Constitutional issues are being considered by a member of Congress on behalf of the LA activists. I hope to report more on that as things develop.

Read More @ ActivistPost.com

Something is cropping up all over Los Angeles, California, like

poisonous mushrooms, with equally toxic effects, but it’s not poisonous

mushrooms.

Something is cropping up all over Los Angeles, California, like

poisonous mushrooms, with equally toxic effects, but it’s not poisonous

mushrooms.It’s the standard cell tower, along with RF and EMF public relations pitches that are generated. Let’s hear what’s really happening in everyday, on-the-ground life, especially in ‘cell tower haven’ Los Angeles, California.

Concerned Los Angelinos feel there are several issues regarding all the cell towers being constructed in their area, but the most prominent concerns are health effects from EMFs and Constitutional 4th Amendment privacy matters. Numerous groups around the USA also are working on these very same issues. Maybe readers will become activists after having read this information. Those 4th Amendment Constitutional issues are being considered by a member of Congress on behalf of the LA activists. I hope to report more on that as things develop.

Read More @ ActivistPost.com

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment