Submitted by Tyler Durden on 03/16/2015 - 10:19

Submitted by Tyler Durden on 03/16/2015 - 10:19

"Ladies and gentlemen. A few weeks ago, in Riyadh, I was at a small, private function along with the British central bank governor, Mark Carney. Mr Carney asked me two questions. First, why did the oil price drop? And the second, where is the price heading? I will tell you today what I said to him then."

- Ibrahim Al-Muhanna, Advisor to the Minister of Petroleum and Mineral Resources for Saudi Arabia

Putin Warns "We Were Ready" To Use Nukes To Secure Crimea

Submitted by Tyler Durden on 03/16/2015 - 15:00 Having re-emerged from his hibernation, Vladimir Putin is wasting no time getting back to business. Having paced 40,000 troops on "snap-readiness," AP reports that a documentary which aired last night shows Putin explaining that Russia was ready to bring its nuclear weapons into a state of alert during last year's tensions over the Crimean Peninsula and the overthrow of Ukraine's president, and admitted well-armed forces in unmarked uniforms who took control of Ukrainian military facilities in Crimea were Russian soldiers. In the documentary, which marks a year since the referendum, Putin says of the nuclear preparedness, "We were ready to do this ... (Crimea) is our historical territory. Russian people live there. They were in danger. We cannot abandon them."

Bob Shiller Asks "How Scary Is The Bond Market?" (Spoiler Alert: Not Very)

Submitted by Tyler Durden on 03/16/2015 - 14:36 With the bond market appearing ripe for a dramatic correction, many are wondering whether a crash could drag down markets for other long-term assets, such as housing and equities. Bond-market crashes have actually been relatively rare and mild. According to our model, long-term rates in the US should be even lower than they are now, because both inflation and short-term real interest rates are practically zero or negative. Even taking into account the impact of quantitative easing since 2008, long-term rates are higher than expected. Regarding the stock market and the housing market, there may well be a major downward correction someday. But it probably will have little to do with a bond-market crash.

Fund Managers Use Machines, "Smart" Beta To Dupe Dumb Retail Investors

Submitted by Tyler Durden on 03/16/2015 - 14:10 Active managers, stinging from the proliferation of passive indexing, are utilizing robots to transform active strategies into "passive" ones, capturing 20% of the US ETF market in the process.

Italian Bad Debt Hits Record $197 Billion As Bank Lending Contracts For Unprecedented 33 Consecutive Months

Submitted by Tyler Durden on 03/16/2015 - 13:53 For the third largest issuer of sovereign bonds in the world, Italy - the country all eyes will focus on once Greece and/or Spain exit the Eurozone - when it comes to NPLs things are going from bad to worse because as Reuters reported earlier, citing ABI, gross bad loans at Italian lenders continued to rise, totalling 185.5 billion euros ($196.5 billion) in January from 183.7 billion euros a month earlier.As the chart below shows, Italy now has over 10% of its GDP in the form of bad debt. And just as bad, even as NPLs rose, total debt issuance contracted once more, lending to families and businesses decreased 1.4 percent year-on-year in February, the 33rd consecutive monthly fall.

Caught On Tape: State Department's Psaki Smirks About US Policy Supporting Coups

Submitted by Tyler Durden on 03/16/2015 - 13:35 When even the propagandists smirk at their own propaganda, you know Washington has reached 'peak contempt' for its citizenry...

Germany Has Had It With Greece: Schauble Says "Doesn't Know What To Do With Greece Now"

Submitted by Tyler Durden on 03/16/2015 - 13:11 In his fiercest rhetoric yet, Germany's angry Finance Minister Wolfgang Schaeuble unloaded at a CDU event today:SCHAEUBLE SAYS DOESN'T KNOW WHAT TO DO WITH GREECE NOW, NEW GREEK GOVERNMENT HAS DESTROYED ALL THE TRUST THAT HAD BEEN REBUILT

He went on to explain that "no one I talk to sees how Greek approach can work," which perhaps explains why Greek 3Y bond yields spiked back above 20% for the first time since the election today.

Sign Of The Times: Santander Floats First "Deep" Subprime Deal Since Crisis

Submitted by Tyler Durden on 03/16/2015 - 12:45 Santander, fresh off the largest auto repossession-related settlement in history, finds voracious demand for a $712 million ABS deal backed by loans made to buyers classified as "deep" subprime.

The Transparent Truthlessness Of The Fed

Submitted by Tyler Durden on 03/16/2015 - 12:22 The transparent truthlessness of the Fed’s basic premises go far to explain the chasm between official policy and reality - though it does not explain the appetite for plain lying of the supposedly informed minority cohort of the public, the deciders among us in business, politics, and media. Within th enext few months (between "patient" removal, token rate hikes, and reversals to QE4), the Fed will be completely out of cred. This will be the biggest disaster of all, since the loss of faith in august institutions will rage through every polity in the advanced economies. Nobody will believe any longer in anything they say or do, and especially the value of the papers (or digits) they denominate as money.

Varoufakis' Latest Fiasco: FinMin Claims "Middle Finger To Germany" Clip Fake; Germany Disagrees

Submitted by Tyler Durden on 03/16/2015 - 11:46 It was a tough weekend (again) for Greece's embattled FinMin Yanis Varoufakis. After walking out on a CNBC interview when asked if he was a liability (after his photo shoot caused a storm in Greece), a video surfaced showing the outspoken minister giving the middle finger to Germany saying "solve the problem yourself." He has come out swinging this morning, as The Telegraph reports, Varoufakis exclaims, "That video was doctored. I've never given the finger, I've never given the middle finger ever." However, the user who uploaded it to YouTube denied it was a fake and, based on The Telegraph's poll, 67% believe Varoufakis did it. Furthemore, the German talk-show that aired the clip has confirmed "no evidence of manipulation or falsification," and, for the first time, a majority of Germans now want Greece out of the union.ECB Reports Only €9.8 Billion In Bond Purchases In First Full Week Of Q€

Submitted by Tyler Durden on 03/16/2015 - 11:27 Unlike the Fed, the ECB's Q€ program is far more opaque, far more ad-hoc, and far more improvised (and at the rate it is soaking up already negligible collateral as JPM explained yesterday, soon to be far more abbreviated). In fact, without a daily POMO preview (such as what the Fed used to provide) nobody has any idea what is going or what the ECB will be buying until a week after the fact. Today, for the first time, the ECB provided the bare minimum data on its "Public sector purchase program" i.e., how much debt it had purchased in the first week of the ECB's QE. The answer: only €9.8 billion.

Oil Tumbles Under $43 As Key Support Breached; Fresh 6 Year Lows

Submitted by Tyler Durden on 03/16/2015 - 11:05 Moments ago, soothing words by Saudi Arabians notwithstanding, both Brent and WTI, had another step move lower, with Wext-Texas Intermediate sliding under $43, a fresh 6 year low, and well below the January lows of $44.37! What may be causing it: well, aside for "more sellers than buyers", and a rumor that Genscape reporting another major inventory build at Cushing, a breach of a key support line may be the reason. BofA explains.

World's Oldest Central Bank Asks Paul Krugman To Shut Up

Submitted by Tyler Durden on 03/16/2015 - 10:45 Deputy Riksbank Governor Per Jansson "doesn't know why" Paul Krugman insists on equating Sweden with Japan but thinks "mystery" may be related to Krugman doing too much writing and not enough reading.

The Last Time This Happened, The Fed Launched QE 2

Submitted by Tyler Durden on 03/16/2015 - 09:42 The prospects of a rate hike by the Fed are looking increasingly shaky and downright laughable, not just because the start to 2015 for the US economy has been the worst in "negative surprises" terms since Lehman, or because the Atlanta Fed Q1 real-time GDP forecast is about to go negative (consensus originally expected this print to be 3.5% if not higher), but because the last time this happened, the Fed launched QE2. What is "this"? Bank of America explains.from The Wealth Watchman:

Last weekend, I listened to an engaging interview on silverdoctors,

that really got my attention. It wasn’t so much what was said, but how

it was said. The guest(long-time truth warrior, and GATA member) Bill

Murphy sounded resolved, but downcast, and the whole tone of the

exchange sounded much the same way.

Last weekend, I listened to an engaging interview on silverdoctors,

that really got my attention. It wasn’t so much what was said, but how

it was said. The guest(long-time truth warrior, and GATA member) Bill

Murphy sounded resolved, but downcast, and the whole tone of the

exchange sounded much the same way.In that interview, which can be found here, it was revealed just how bad the sentiment in the stacking community has become in the last few weeks and months. The Doc revealed that some customers who’d placed orders, had turned right around, and called them to ask to sell that same bullion back to him before it had even been shipped. They did this because they felt certain that silver would soon be able to be bought at several dollars lower.

Read More…

Olga Moroz was the editor of “Neteshinsky Vestnik”. She joins a long list of strange deaths in recent months.

from Russia-Insider:

It should be noted that there are conflicting reports about the circumstances surrounding Moroz’s death. While the following article claims there was no foul play, other sources disagree. Translated by RI’s Alina Belyanina:

It should be noted that there are conflicting reports about the circumstances surrounding Moroz’s death. While the following article claims there was no foul play, other sources disagree. Translated by RI’s Alina Belyanina:

Read More @ Russia-insider.com

from Russia-Insider:

It should be noted that there are conflicting reports about the circumstances surrounding Moroz’s death. While the following article claims there was no foul play, other sources disagree. Translated by RI’s Alina Belyanina:

It should be noted that there are conflicting reports about the circumstances surrounding Moroz’s death. While the following article claims there was no foul play, other sources disagree. Translated by RI’s Alina Belyanina:The editor-in-chief of Neteshinsky Vestnik was found dead in the Khmelnitsky region, tells the Ukranian regional MIA’s press service.To recall, the Russian Foreign Ministry said that Ukraine continues to hunt for dissidents and journalists. On Sunday, the SBU reported on the detention of the “New Russia TV” channel. On 5th of March it became known that the Ukrainian Foreign Ministry stopped accreditation of all the Russian media. The Ukrainian press is also being persecuted.

It is reported that ” 44 -year-old woman who worked as a chief editor of the city newspaper Neteshinsky Vestnik was found dead in her appartment this morning in the city Netishin by her sister.” …

Read More @ Russia-insider.com

by Chris Powell, GATA:

Dear Friend of GATA and Gold:

Bullion Star market analyst and GATA consultant Koos Jansen reports today that the international division of the Shanghai Gold Exchange is not moving gold out of China but rather supplementing the country’s gold imports. As a result, Jansen writes, withdrawals from the Shanghai Gold Exchange remain a good proxy for China’s domestic gold demand, and 456 tonnes have been withdrawn this year through March 6.

If annual gold mine production is around 2,800 tonnes and monthly mine production averages 233 tonnes and weekly production averages 54 tonnes, the Shanghai figures suggest that, as Jansen’s chart shows, Chinese demand is running at about 47 tonnes per week, or about 88 percent of world mine production.

Read More @ Gata.com

Dear Friend of GATA and Gold:

Bullion Star market analyst and GATA consultant Koos Jansen reports today that the international division of the Shanghai Gold Exchange is not moving gold out of China but rather supplementing the country’s gold imports. As a result, Jansen writes, withdrawals from the Shanghai Gold Exchange remain a good proxy for China’s domestic gold demand, and 456 tonnes have been withdrawn this year through March 6.

If annual gold mine production is around 2,800 tonnes and monthly mine production averages 233 tonnes and weekly production averages 54 tonnes, the Shanghai figures suggest that, as Jansen’s chart shows, Chinese demand is running at about 47 tonnes per week, or about 88 percent of world mine production.

Read More @ Gata.com

from KingWorldNews:

Epinephrine, also known as adrenaline, is a very powerful hormone and

neurotransmitter employed in emergency medical situations such as

cardiac arrest, superficial bleeding and anaphylaxis. An example of

anaphylaxis would be a severe reaction to a bee sting.

Epinephrine, also known as adrenaline, is a very powerful hormone and

neurotransmitter employed in emergency medical situations such as

cardiac arrest, superficial bleeding and anaphylaxis. An example of

anaphylaxis would be a severe reaction to a bee sting.

Since the final days of the Greenspan Era, the Fed has been administering a wide variety of “economic epinephrine” to address and suppress the equivalents of the medical conditions listed above. There were several economic “cardiac arrests” in the late 1990s through the 2000s, beginning with the Long-Term Capital fiasco and culminating with the ultimate fiascos around financial derivatives and the real estate market in the 2008-2009 period….

Robert Fitzwilson Continues @ KingWorldNews.com

Epinephrine, also known as adrenaline, is a very powerful hormone and

neurotransmitter employed in emergency medical situations such as

cardiac arrest, superficial bleeding and anaphylaxis. An example of

anaphylaxis would be a severe reaction to a bee sting.

Epinephrine, also known as adrenaline, is a very powerful hormone and

neurotransmitter employed in emergency medical situations such as

cardiac arrest, superficial bleeding and anaphylaxis. An example of

anaphylaxis would be a severe reaction to a bee sting.Since the final days of the Greenspan Era, the Fed has been administering a wide variety of “economic epinephrine” to address and suppress the equivalents of the medical conditions listed above. There were several economic “cardiac arrests” in the late 1990s through the 2000s, beginning with the Long-Term Capital fiasco and culminating with the ultimate fiascos around financial derivatives and the real estate market in the 2008-2009 period….

Robert Fitzwilson Continues @ KingWorldNews.com

by Michael Snyder, The Economic Collapse Blog:

Once upon a time, much of the state of California was a barren

desert. And now, thanks to the worst drought in modern American

history, much of the state is turning back into one. Scientists tell us

that the 20th century was the wettest century that the state of

California had seen in 1000 years. But now weather patterns are

reverting back to historical norms, and California is rapidly running

out of water. It is being reported that the state only has

approximately a one year supply of water left in the reservoirs, and

when the water is all gone there are no contingency plans. Back in

early 2014, California Governor Jerry Brown declared a drought emergency

for the entire state, but since that time water usage has only dropped

by 9 percent. That is not nearly enough. The state of California has

been losing more than 12 million acre-feet of total water a year

since 2011, and we are quickly heading toward an extremely painful

water crisis unlike anything that any of us have ever seen before.

Once upon a time, much of the state of California was a barren

desert. And now, thanks to the worst drought in modern American

history, much of the state is turning back into one. Scientists tell us

that the 20th century was the wettest century that the state of

California had seen in 1000 years. But now weather patterns are

reverting back to historical norms, and California is rapidly running

out of water. It is being reported that the state only has

approximately a one year supply of water left in the reservoirs, and

when the water is all gone there are no contingency plans. Back in

early 2014, California Governor Jerry Brown declared a drought emergency

for the entire state, but since that time water usage has only dropped

by 9 percent. That is not nearly enough. The state of California has

been losing more than 12 million acre-feet of total water a year

since 2011, and we are quickly heading toward an extremely painful

water crisis unlike anything that any of us have ever seen before.

Read More…

Once upon a time, much of the state of California was a barren

desert. And now, thanks to the worst drought in modern American

history, much of the state is turning back into one. Scientists tell us

that the 20th century was the wettest century that the state of

California had seen in 1000 years. But now weather patterns are

reverting back to historical norms, and California is rapidly running

out of water. It is being reported that the state only has

approximately a one year supply of water left in the reservoirs, and

when the water is all gone there are no contingency plans. Back in

early 2014, California Governor Jerry Brown declared a drought emergency

for the entire state, but since that time water usage has only dropped

by 9 percent. That is not nearly enough. The state of California has

been losing more than 12 million acre-feet of total water a year

since 2011, and we are quickly heading toward an extremely painful

water crisis unlike anything that any of us have ever seen before.

Once upon a time, much of the state of California was a barren

desert. And now, thanks to the worst drought in modern American

history, much of the state is turning back into one. Scientists tell us

that the 20th century was the wettest century that the state of

California had seen in 1000 years. But now weather patterns are

reverting back to historical norms, and California is rapidly running

out of water. It is being reported that the state only has

approximately a one year supply of water left in the reservoirs, and

when the water is all gone there are no contingency plans. Back in

early 2014, California Governor Jerry Brown declared a drought emergency

for the entire state, but since that time water usage has only dropped

by 9 percent. That is not nearly enough. The state of California has

been losing more than 12 million acre-feet of total water a year

since 2011, and we are quickly heading toward an extremely painful

water crisis unlike anything that any of us have ever seen before.Read More…

from Govt Slaves:

With the growth of e-commerce still outpacing the overall growth of retail sales, retailers are continuing to close brick-and-mortar outlets.

With the growth of e-commerce still outpacing the overall growth of retail sales, retailers are continuing to close brick-and-mortar outlets.

While total U.S. retail sales grew 3.7% in the fourth quarter of 2014 compared to the same quarter in 2013, e-commerce sales jumped 14.6% in the fourth quarter. One year earlier, total sales grew 3.8% year-over-year, while e-commerce sales increased 16.0%.

As e-commerce increasingly grabs a larger share of retail sales, several major retailers are reducing their physical presence, including department stores and specialty retailers such as clothing stores, bookstores and electronics outlets. Some retailers saw sales reduced due to strategic mistakes or consolidation through mergers and still others due to over-expansion. According to Dorothy Lakner, managing director at Topeka Capital Markets, “The new ideal store count for a U.S. national chain [of clothing retailers] is 600 to 700 stores.”

Read More @ GovtSlaves.info

With the growth of e-commerce still outpacing the overall growth of retail sales, retailers are continuing to close brick-and-mortar outlets.

With the growth of e-commerce still outpacing the overall growth of retail sales, retailers are continuing to close brick-and-mortar outlets.While total U.S. retail sales grew 3.7% in the fourth quarter of 2014 compared to the same quarter in 2013, e-commerce sales jumped 14.6% in the fourth quarter. One year earlier, total sales grew 3.8% year-over-year, while e-commerce sales increased 16.0%.

As e-commerce increasingly grabs a larger share of retail sales, several major retailers are reducing their physical presence, including department stores and specialty retailers such as clothing stores, bookstores and electronics outlets. Some retailers saw sales reduced due to strategic mistakes or consolidation through mergers and still others due to over-expansion. According to Dorothy Lakner, managing director at Topeka Capital Markets, “The new ideal store count for a U.S. national chain [of clothing retailers] is 600 to 700 stores.”

Read More @ GovtSlaves.info

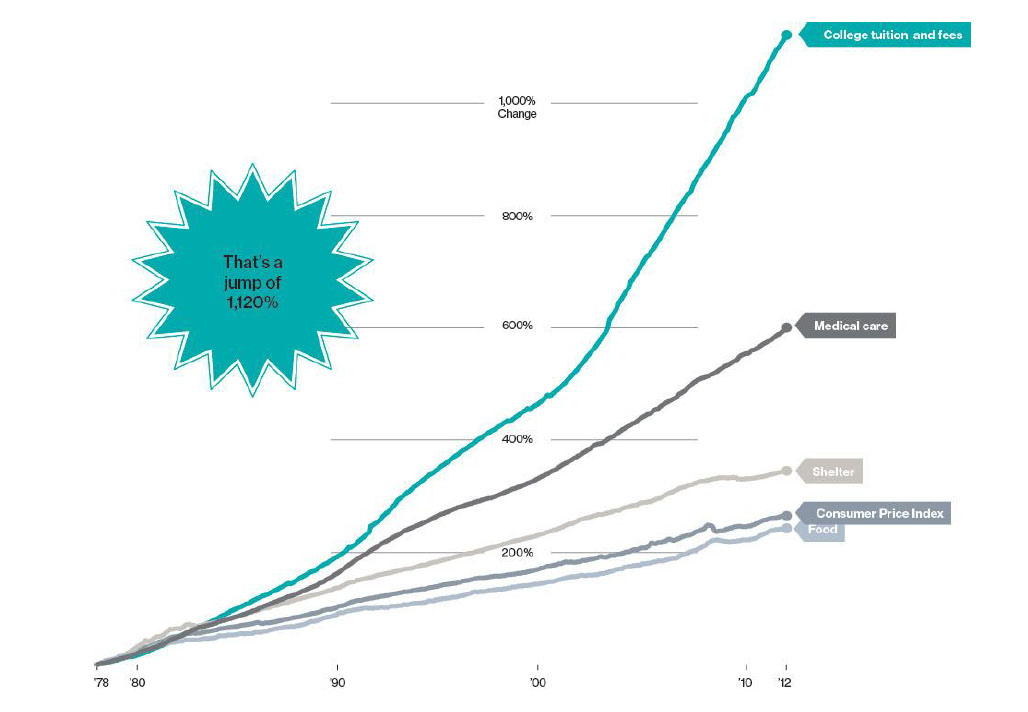

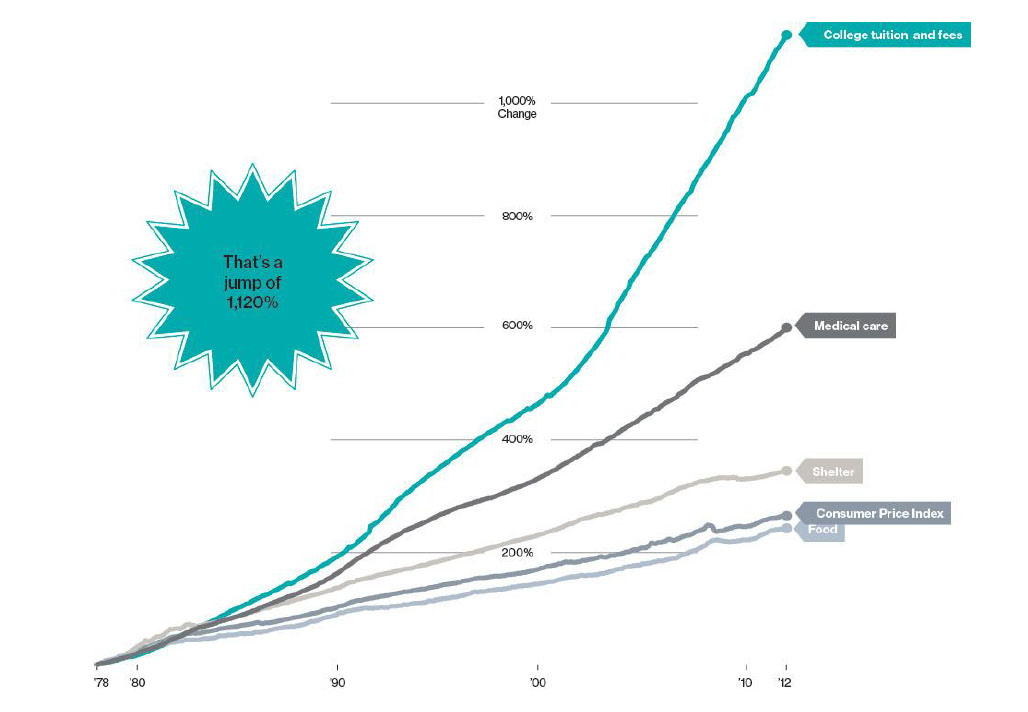

White House takes first steps in allowing a bankruptcy option for student debt. $1.2 trillion in student debt outstanding.

from MyBudget360.com:

It truly is absurd when you hear people moralizing that people should pay their student debt when virtually every other debt class can be discharged through bankruptcy. You can go to Las Vegas, run up $50,000 in credit card debt for a wild night, and if you are unable to pay it back, no problem. Sure, your credit is ruined but no one is going to garnish your wages. Can’t pay your mortgage? Foreclosure. Can’t pay your auto loan? Repossession. Can’t pay your student debt? Lifelong debtors’ prison for you. Student debt is the largest non-housing related debt class in the US. It makes sense that bankruptcy should be an option here. There is one problem, however. Most of the debt is government backed meaning the bill is going to be taken on by the government (aka the people). This is something that should have been done over a decade ago when total student debt was $200 billion, not $1.2 trillion like it is today. However, rising delinquencies show something needs to be done here.

Read More @ MyBudget360.com

from MyBudget360.com:

It truly is absurd when you hear people moralizing that people should pay their student debt when virtually every other debt class can be discharged through bankruptcy. You can go to Las Vegas, run up $50,000 in credit card debt for a wild night, and if you are unable to pay it back, no problem. Sure, your credit is ruined but no one is going to garnish your wages. Can’t pay your mortgage? Foreclosure. Can’t pay your auto loan? Repossession. Can’t pay your student debt? Lifelong debtors’ prison for you. Student debt is the largest non-housing related debt class in the US. It makes sense that bankruptcy should be an option here. There is one problem, however. Most of the debt is government backed meaning the bill is going to be taken on by the government (aka the people). This is something that should have been done over a decade ago when total student debt was $200 billion, not $1.2 trillion like it is today. However, rising delinquencies show something needs to be done here.

Read More @ MyBudget360.com

by Mike Adams, Natural News:

As Michael Snyder points out in a timely article at The Economic Collapse Blog, California is rapidly reverting back to the desert it was once.

As Michael Snyder points out in a timely article at The Economic Collapse Blog, California is rapidly reverting back to the desert it was once.

Awareness of this is only now beginning to spread, but almost no one truly grasps the implications of what losing California’s Central Valley agricultural output means to grocery shoppers.

Almost no one realizes, for example, that one-third of all the produce grown in the United States comes out of California’s Central Valley. As the NYT explains:

Unlike the Midwest, which concentrates (devastatingly) on corn and soybeans, more than 230 crops are grown in the valley… melons, lettuce, asparagus, cabbage, broccoli, chard, collards, prickly pears, almonds, pistachios, grapes and more tomatoes than anyone could conceive of in one place. (The valley is the largest supplier of canned tomatoes in the world too.)

Read More @ NaturalNews.com

As Michael Snyder points out in a timely article at The Economic Collapse Blog, California is rapidly reverting back to the desert it was once.

As Michael Snyder points out in a timely article at The Economic Collapse Blog, California is rapidly reverting back to the desert it was once.Awareness of this is only now beginning to spread, but almost no one truly grasps the implications of what losing California’s Central Valley agricultural output means to grocery shoppers.

Almost no one realizes, for example, that one-third of all the produce grown in the United States comes out of California’s Central Valley. As the NYT explains:

Unlike the Midwest, which concentrates (devastatingly) on corn and soybeans, more than 230 crops are grown in the valley… melons, lettuce, asparagus, cabbage, broccoli, chard, collards, prickly pears, almonds, pistachios, grapes and more tomatoes than anyone could conceive of in one place. (The valley is the largest supplier of canned tomatoes in the world too.)

Read More @ NaturalNews.com

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment