Submitted by Tyler Durden on 03/12/2015 - 16:29 If Vladimir Putin is alive and remotely capable of laughter (the jury is out on that one...) then he’s probably doing so right now. For the last several months, despite numerous warnings of the consequences, the US and UK governments have been pushing to block Russia from the SWIFT payments system. And so what is utterly hilarious - On Monday afternoon, not only did SWIFT not kick Russia out... but they announced that they were actually giving a Board Seat to Russia.

Worst Macro Data Since Lehman Sparks Stock Buying Frenzy

Submitted by Tyler Durden on 03/12/2015 - 16:05

Germans Furious After Varoufakis/Tsipras Admit "Greece Will Never Repay Its Debts"

Submitted by Tyler Durden on 03/12/2015 - 16:59 The Greco-Germanic war of words continues... Having pissed off The Greeks with his "Troika" remarks, Germany's Schaeuble went on today to more ad hominum attacks by reportedly calling the Greek FinMin "foolishly naive." The Greek ambassador has 'officially' complained to "friend and ally" Germany about the personal insult. But The Greeks had the last laugh, as first Varoufakis and then Tsipras explained respectively that "Greece would never pay back its debts," and "Greece cannot pretend its debt burden is sustainable." The German response, via tabloid Bild, "there must be an end to this madness. Europe must not be made to look stupid."

The Final Nail In China's Deflationary Coffin: Wages In The 4 Largest Cities Are Now Dropping

Submitted by Tyler Durden on 03/12/2015 - 15:51 "Shanghai remained the top Chinese city for average monthly salary, but major cities saw their salary decline, recruitment portal Zhaopin.com said in a survey. But the average salary in Shanghai fell from last year’s 7,214 yuan in line with the 6 percent decline from a year ago to 6,518 yuan in the four largest Chinese cities, the survey showed."

Daniel Hannan Explains How Democracy Died In Europe

Submitted by Tyler Durden on 03/12/2015 - 15:34 With Greece on the edge of being kicked out of the Eurozone , either voluntarily or otherwise, with an anti-austerity party on the verge of taking over the reins of power in Spain, with Beppe Grillo waiting in the corridors for his chance to pounce in Italy and with Marine le Pen and her nationalist party on the verge of becoming the biggest shocker of Europe over the coming years, here, according to Daniel Hannan, is what killed democracy in Europe. Europe itself.

The Richest Have Never Been Richer: US Household Assets Rise To Record $97 Trillion (As The Poor Get Poorer)

Submitted by Tyler Durden on 03/12/2015 - 14:35 In Q4 US household net worth jumped by $1.5 trillion to $82.9 trillion, driven by a rise in total assets to $97.1 trillion, even as the long awaited increase in "good debt", that of mortgage debt, remains elusive and Mortgage debt hasn't budged from $9.4 trillion in 8 quarters! This, even as the total US housing market is said to have kept rising. The biggest jump in Q4 assets was once again in financial assets, driven by a $492 billion increase in Corporate Equities as well as $323 billion added from Pension Funds. And as usual, financial assets remained at precisely 70% of total assets. Who benefits? Why America's richest of course.

Wall Street Firm Unleashes New High-Frequency Impropriety Algo

Submitted by Tyler Durden on 03/12/2015 - 14:01 “In the past, if one of our brokers wanted to exploit a questionably legal regulatory loophole or breach the covenant of good faith with an investment client, that would require hours of manually contravening the basic principles of professional integrity. But this innovative system will allow millions of such transgressions to go through every single day. Going forward, I expect this revolutionary program to be the cornerstone of our business.”

Greece Passes Law To Plunder Pension Funds

Submitted by Tyler Durden on 03/12/2015 - 13:47 Having previously hinted that they might 'dip' into public pensions funds for some short-term cash to payback The IMF, and then confirming that the plan is to repo that cash from pension cash reserves (raising concerns about how they will unwind the repo - i.e. pay it back); the Greek government finally signed the bill today that enables them to plunder the Greek people's pension funds (for their own good).The massive irony of this bill is the bill enables greek deposits to be fully invested in Greek sovereign bonds... which Tsipras and Varoufakis both admitted today is "unsustainable" and "will never be repaid."

Albert Edwards' "WOW!" Chart, Or Why "Draghi Makes Greenspan Look Like A Rank Amateur"

Submitted by Tyler Durden on 03/12/2015 - 13:23 "Mario Draghi and the ECB’s manipulation of asset prices makes Greenspan’s Fed look like a rank amateur. More shocking though than the plunge in the euro, and more shocking even that 25% of sovereign eurozone bonds now trade in negative territory, is what has happened to eurozone equity valuations. For, as we approach the sixth anniversary of the US cyclical bull market, the PE expansion of eurozone equities is simply off the scale!" - Albert Edwardsfrom MyBudget360.com:

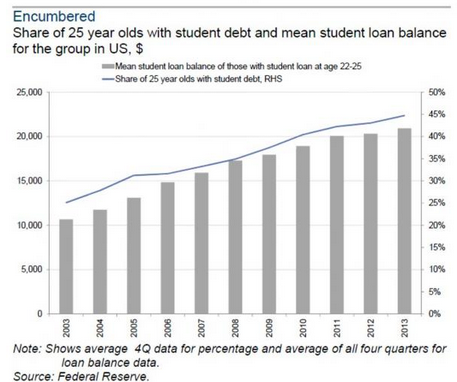

It is clear looking at economic data that young Americans were not sent the memo regarding this economic recovery. People do realize that the “Great Recession” officially ended in the summer of 2009, right? We’re heading into year six of this recovery but many are simply seeing lower paying jobs, a deeper reliance on debt, and inflation hitting in important segments of our economy. For example, some of the top employment sectors in our country are in the form of food services and retail that tend to hire a disproportionately large amount of young workers. But with more people going to college and taking on record levels of debt, working retail is not going to cut it. Back in 2000 about 25% of 25 year olds carried some form of college debt. Today that percentage is up to 45%. That is a major jump and shows that for many, simply going to college requires some form of debt assistance. And that is why we now have over $1.2 trillion in outstanding student debt across the country. But young Americans are also seeing hits to their net worth. Let us look at the “recovery” for young Americans.

Read More @ MyBudget360.com

from Off Grid Survival:

Rep. Robert Pittenger (R-NC), the chairman of the Congressional Task Force on Terrorism and Unconventional Warfare, is warning the American public to prepare for coming terrorist attacks.

The Congressman released a 24 page Terrorism Preparedness Manual to help prepare the public for what he says are multiple terror cells working inside the United States. He warns that these cells are already here, and says the public needs to prepare for what could happen.

I warned about the threat in The Ultimate Situational Survival Guide, and outlined what Americans need to do to be prepared for this very real threat. The fact is, our government is well aware of these terror cells; and people from both sides of the political aisle are warning that there are known sleeper cells operating inside the U.S.

Read More @ OffGridSurvival.com

Rep. Robert Pittenger (R-NC), the chairman of the Congressional Task Force on Terrorism and Unconventional Warfare, is warning the American public to prepare for coming terrorist attacks.

The Congressman released a 24 page Terrorism Preparedness Manual to help prepare the public for what he says are multiple terror cells working inside the United States. He warns that these cells are already here, and says the public needs to prepare for what could happen.

I warned about the threat in The Ultimate Situational Survival Guide, and outlined what Americans need to do to be prepared for this very real threat. The fact is, our government is well aware of these terror cells; and people from both sides of the political aisle are warning that there are known sleeper cells operating inside the U.S.

Read More @ OffGridSurvival.com

from KingWorldNews:

Gold stocks had suffered big losses six out of seven sessions heading

into Wednesday. Such behavior has suggested “puke” phase of prior

declines, leading to at least shorter-term gains every time (There is a

chart in this piece that gives a powerful illustration).

Gold stocks had suffered big losses six out of seven sessions heading

into Wednesday. Such behavior has suggested “puke” phase of prior

declines, leading to at least shorter-term gains every time (There is a

chart in this piece that gives a powerful illustration).

On Monday we noted that every member of the Gold Bugs Index (HUI) was trading below their 10-, 50- and 200-day averages.

That kind of depressed activity has only occurred in the midst of extremely heavy selling pressure, usually enough to precede at least a counter-trend rebound.

Jason Goepfert Continues @ KingWorldNews.com

Gold stocks had suffered big losses six out of seven sessions heading

into Wednesday. Such behavior has suggested “puke” phase of prior

declines, leading to at least shorter-term gains every time (There is a

chart in this piece that gives a powerful illustration).

Gold stocks had suffered big losses six out of seven sessions heading

into Wednesday. Such behavior has suggested “puke” phase of prior

declines, leading to at least shorter-term gains every time (There is a

chart in this piece that gives a powerful illustration).On Monday we noted that every member of the Gold Bugs Index (HUI) was trading below their 10-, 50- and 200-day averages.

That kind of depressed activity has only occurred in the midst of extremely heavy selling pressure, usually enough to precede at least a counter-trend rebound.

Jason Goepfert Continues @ KingWorldNews.com

by Michael Snyder, The Economic Collapse Blog:

Just a few days ago, the bull market for the S&P 500 turned six

years old. This six year period of time has been great for investors,

but what comes next? On March 9th, 2009 the S&P 500 hit a low of

676.53. Since that day, it has risen more than 200 percent. As you

will see below, there are only two other times within the last 100 years

when the S&P 500 performed this well over a six year time frame.

In both instances, the end result was utter disaster. And as you take in

this information, I want you to keep in mind what I said in my previous

article entitled “7 Signs That A Stock Market Peak Is Happening Right Now“.

What we are witnessing at this moment is classic “peaking behavior”,

and there is a long way to go down from here. So if historical patterns

hold up, those with lots of money in the stock market could soon be in

for a whole lot of trouble.

Just a few days ago, the bull market for the S&P 500 turned six

years old. This six year period of time has been great for investors,

but what comes next? On March 9th, 2009 the S&P 500 hit a low of

676.53. Since that day, it has risen more than 200 percent. As you

will see below, there are only two other times within the last 100 years

when the S&P 500 performed this well over a six year time frame.

In both instances, the end result was utter disaster. And as you take in

this information, I want you to keep in mind what I said in my previous

article entitled “7 Signs That A Stock Market Peak Is Happening Right Now“.

What we are witnessing at this moment is classic “peaking behavior”,

and there is a long way to go down from here. So if historical patterns

hold up, those with lots of money in the stock market could soon be in

for a whole lot of trouble.

Read More…

Just a few days ago, the bull market for the S&P 500 turned six

years old. This six year period of time has been great for investors,

but what comes next? On March 9th, 2009 the S&P 500 hit a low of

676.53. Since that day, it has risen more than 200 percent. As you

will see below, there are only two other times within the last 100 years

when the S&P 500 performed this well over a six year time frame.

In both instances, the end result was utter disaster. And as you take in

this information, I want you to keep in mind what I said in my previous

article entitled “7 Signs That A Stock Market Peak Is Happening Right Now“.

What we are witnessing at this moment is classic “peaking behavior”,

and there is a long way to go down from here. So if historical patterns

hold up, those with lots of money in the stock market could soon be in

for a whole lot of trouble.

Just a few days ago, the bull market for the S&P 500 turned six

years old. This six year period of time has been great for investors,

but what comes next? On March 9th, 2009 the S&P 500 hit a low of

676.53. Since that day, it has risen more than 200 percent. As you

will see below, there are only two other times within the last 100 years

when the S&P 500 performed this well over a six year time frame.

In both instances, the end result was utter disaster. And as you take in

this information, I want you to keep in mind what I said in my previous

article entitled “7 Signs That A Stock Market Peak Is Happening Right Now“.

What we are witnessing at this moment is classic “peaking behavior”,

and there is a long way to go down from here. So if historical patterns

hold up, those with lots of money in the stock market could soon be in

for a whole lot of trouble.Read More…

by Mac Slavo, SHTFPlan:

The former director of the SEC, John Ramsay, has stepped out to warn

that market is rigged, and that the system is headed for a major

correction “one way or another.”

The former director of the SEC, John Ramsay, has stepped out to warn

that market is rigged, and that the system is headed for a major

correction “one way or another.”

Today’s financial ‘ecosystem’ is a set up for unfair advantage to those playing a game controlled by high frequency trading (run by automated computer algorithms) and secret ‘dark pool’ investors, as Ramsay sees it. Bloomberg reports:

The SEC’s current trading rules, known as Regulation NMS, are partly responsible for the flourishing of high-frequency trading and the dispersion of trading across more than 40 venues, [Ramsay] said.

Read More @ SHTFPlan.com

/  The former director of the SEC, John Ramsay, has stepped out to warn

that market is rigged, and that the system is headed for a major

correction “one way or another.”

The former director of the SEC, John Ramsay, has stepped out to warn

that market is rigged, and that the system is headed for a major

correction “one way or another.”Today’s financial ‘ecosystem’ is a set up for unfair advantage to those playing a game controlled by high frequency trading (run by automated computer algorithms) and secret ‘dark pool’ investors, as Ramsay sees it. Bloomberg reports:

The SEC’s current trading rules, known as Regulation NMS, are partly responsible for the flourishing of high-frequency trading and the dispersion of trading across more than 40 venues, [Ramsay] said.

Read More @ SHTFPlan.com

from Gold Core:

The Federal Reserve has issued a stinging rebuke to two of Europe’s largest banks – Deutsche Bank and Santander.

The Federal Reserve has issued a stinging rebuke to two of Europe’s largest banks – Deutsche Bank and Santander.

U.S. operations of Deutsche, Germany’s largest bank, and Santander, the biggest bank in Spain and a large player in the UK market, were found to have serious deficiencies in capital planning and risk management, according to a senior Federal Reserve official.

The systems by which European banks assess risk have been called into question following the failure of the U.S. subsidiaries of the two major European banks to meet criteria set out in the Federal Reserve’s stress tests.

Read More @ GoldCore.com

The Federal Reserve has issued a stinging rebuke to two of Europe’s largest banks – Deutsche Bank and Santander.

The Federal Reserve has issued a stinging rebuke to two of Europe’s largest banks – Deutsche Bank and Santander.U.S. operations of Deutsche, Germany’s largest bank, and Santander, the biggest bank in Spain and a large player in the UK market, were found to have serious deficiencies in capital planning and risk management, according to a senior Federal Reserve official.

The systems by which European banks assess risk have been called into question following the failure of the U.S. subsidiaries of the two major European banks to meet criteria set out in the Federal Reserve’s stress tests.

Read More @ GoldCore.com

from The Daily Sheeple:

After the ATF attempted to add the popular M855 green tip ammo to its list of restricted armor piercing munitions, there was widespread backlash against the move by the public. But barely a week after the ban was proposed, the ATF has already pulled back from its controversial decision. They’ve decided to postpone any action against the M855 round, after receiving 80,000 comments from the public, most of which were “critical” of their proposal.

Yesterday morning, the agency announced on twitter “You spoke, we listened.@ATFHQ

plans more study on the proposed AP Ammo exemption framework.” However,

the White House, which most gun enthusiasts suspected of being behind

the ammo ban, has remained defiant.

Read More @ TheDailySheeple.com

After the ATF attempted to add the popular M855 green tip ammo to its list of restricted armor piercing munitions, there was widespread backlash against the move by the public. But barely a week after the ban was proposed, the ATF has already pulled back from its controversial decision. They’ve decided to postpone any action against the M855 round, after receiving 80,000 comments from the public, most of which were “critical” of their proposal.

Yesterday morning, the agency announced on twitter “You spoke, we listened.

Read More @ TheDailySheeple.com

from TRUTHstreammedia:

With all this talk about mandatory vaccination legislation,

a lot more parents are discussing homeschool as an option (while that

option is even still available). Aside from that, more and more parents

are asking how much propaganda do we really want to expose our children

to on their path to adulthood, anyway? Add Common Core to make matters

that much more ridiculous and more people are choosing homeschool as the

best option for their child’s mind.

With all this talk about mandatory vaccination legislation,

a lot more parents are discussing homeschool as an option (while that

option is even still available). Aside from that, more and more parents

are asking how much propaganda do we really want to expose our children

to on their path to adulthood, anyway? Add Common Core to make matters

that much more ridiculous and more people are choosing homeschool as the

best option for their child’s mind.

That being said, the story I’m about to discuss out of the Home School Legal Defense Association (HSLDA) shows the enormity of what homeschooling parents truly are up against in this country.

Read More @ TruthStreamMedia.com

With all this talk about mandatory vaccination legislation,

a lot more parents are discussing homeschool as an option (while that

option is even still available). Aside from that, more and more parents

are asking how much propaganda do we really want to expose our children

to on their path to adulthood, anyway? Add Common Core to make matters

that much more ridiculous and more people are choosing homeschool as the

best option for their child’s mind.

With all this talk about mandatory vaccination legislation,

a lot more parents are discussing homeschool as an option (while that

option is even still available). Aside from that, more and more parents

are asking how much propaganda do we really want to expose our children

to on their path to adulthood, anyway? Add Common Core to make matters

that much more ridiculous and more people are choosing homeschool as the

best option for their child’s mind.That being said, the story I’m about to discuss out of the Home School Legal Defense Association (HSLDA) shows the enormity of what homeschooling parents truly are up against in this country.

Read More @ TruthStreamMedia.com

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment