When

it comes to the Fed, Congress is mired in hypocrisy. The

anti-regulation, de-regulation crowd on Capitol Hill shuts its mouth

when it comes to the most powerful regulators of all – you and the

Federal Reserve. Meanwhile, Congress goes along with the out-of-control,

private government of the Fed—unaccountable to the national

legislature. Moreover, your massive monetary injections scarcely led to

any jobs on the ground, other than stock and bond processors.

When

it comes to the Fed, Congress is mired in hypocrisy. The

anti-regulation, de-regulation crowd on Capitol Hill shuts its mouth

when it comes to the most powerful regulators of all – you and the

Federal Reserve. Meanwhile, Congress goes along with the out-of-control,

private government of the Fed—unaccountable to the national

legislature. Moreover, your massive monetary injections scarcely led to

any jobs on the ground, other than stock and bond processors.– From the post: Ralph Nader Destroys the Federal Reserve in Open Letter – Calls it “Out of Control, Private Government”

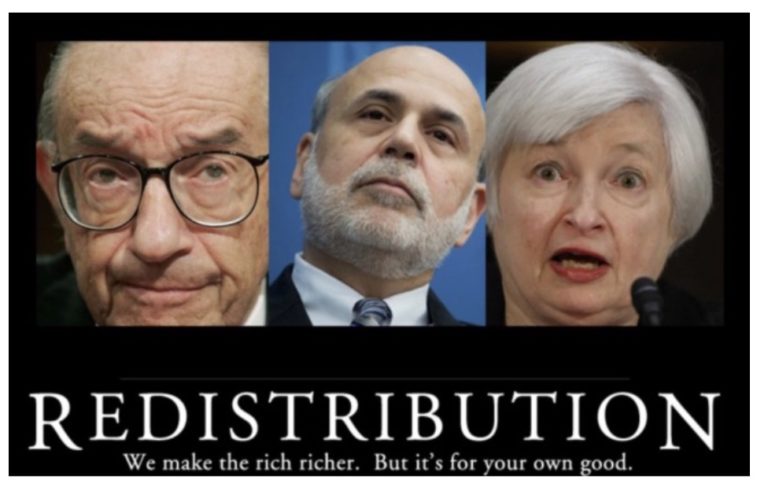

If I had to choose one single institution and one single individual most responsible for the weak, putrid and unbelievably corrupt oligarch-controlled U.S. economy, I would choose the Federal Reserve and Ben Bernanke.

Read More…

by Brandon Turbeville, Activist Post:

Ever since World War II, the United States has prided itself on being number 1. This classification of superiority has generally been reserved for things at least perceived as being positive attributes, e.g. the biggest economy, the most upward mobility, the most effective military, etc.

However, if the United States were trying to achieve the number 1 position in hypocrisy, then President Barack Obama has made a two-week jaunt the crossing of the finish line for a country racing to be labeled as the most hypocritical nation on the face of the earth.

Step 1 was his appearance and speech in Hanoi, Vietnam on May 24. In the course of delivering a speech calling for the peaceful resolution of maritime disputes, particularly in the South China Sea, Obama uttered perhaps one of the most glaringly hypocritical statements to come from the mouth of a U.S. President. Indeed, his statement was even more hypocritical than the general “America represents freedom and democracy” claptrap. “Big nations should not bully smaller ones. Disputes should be resolved peacefully,” Obama said.

Read More

Ever since World War II, the United States has prided itself on being number 1. This classification of superiority has generally been reserved for things at least perceived as being positive attributes, e.g. the biggest economy, the most upward mobility, the most effective military, etc.

However, if the United States were trying to achieve the number 1 position in hypocrisy, then President Barack Obama has made a two-week jaunt the crossing of the finish line for a country racing to be labeled as the most hypocritical nation on the face of the earth.

Step 1 was his appearance and speech in Hanoi, Vietnam on May 24. In the course of delivering a speech calling for the peaceful resolution of maritime disputes, particularly in the South China Sea, Obama uttered perhaps one of the most glaringly hypocritical statements to come from the mouth of a U.S. President. Indeed, his statement was even more hypocritical than the general “America represents freedom and democracy” claptrap. “Big nations should not bully smaller ones. Disputes should be resolved peacefully,” Obama said.

Read More

by Michael Snyder Economic Collapse Blog:

There are international news reports that claim that Turkish military forces have entered Syrian territory and have established positions near the towns of Azaz and Afrin. If these international news reports are true, then Turkey has essentially declared war on the Assad regime. Back in February, I warned that escalating tensions in the region could be the spark that sets off World War III, but things seemed to cool down a bit in March and April. However, this latest move by Turkey threatens to take the war in Syria to a whole new level, and everyone will be watching to see how the Russians and the Iranians respond to this ground incursion.

So far, it is the Russian media that it taking the lead in reporting about this movement of Syrian forces. For example, the Sputnik news agency was one of the first to report Turkish military activity around the town of Azaz…

Read More

There are international news reports that claim that Turkish military forces have entered Syrian territory and have established positions near the towns of Azaz and Afrin. If these international news reports are true, then Turkey has essentially declared war on the Assad regime. Back in February, I warned that escalating tensions in the region could be the spark that sets off World War III, but things seemed to cool down a bit in March and April. However, this latest move by Turkey threatens to take the war in Syria to a whole new level, and everyone will be watching to see how the Russians and the Iranians respond to this ground incursion.

So far, it is the Russian media that it taking the lead in reporting about this movement of Syrian forces. For example, the Sputnik news agency was one of the first to report Turkish military activity around the town of Azaz…

Read More

by Mac Slavo, SHTFPlan:

As we write about the risks of our over-indebted economy, of our unsustainable fossil fuel-dependent energy policies, and our accelerating depletion of key resources, it’s not a far leap to start worrying about the potential for a coming degradation of our modern lifestyle — or even the possibility of full-blown societal collapse.

Sadly, collapse is not just a theoretical worry for a growing number of people around the world. They’re living within it right now.

This week, we catch up with Fernando “FerFAL” Aguirre, who began blogging during the hyperinflationary destruction of Argentina’s economy in 2001 and has since dedicated his professional career to educating the public about his experiences and observations of its lingering aftermath.

Read More

As we write about the risks of our over-indebted economy, of our unsustainable fossil fuel-dependent energy policies, and our accelerating depletion of key resources, it’s not a far leap to start worrying about the potential for a coming degradation of our modern lifestyle — or even the possibility of full-blown societal collapse.

Sadly, collapse is not just a theoretical worry for a growing number of people around the world. They’re living within it right now.

This week, we catch up with Fernando “FerFAL” Aguirre, who began blogging during the hyperinflationary destruction of Argentina’s economy in 2001 and has since dedicated his professional career to educating the public about his experiences and observations of its lingering aftermath.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment