Brazilian Telecom Giant Files Largest Bankruptcy In Nation's History

WTI Crude Tumbles To $48 Handle After Nigeria 'Ceasefire' With Militants

Stocks, Sterling Slide As Brexit Poll Show Rise In "Leave" Vote

Trump Campaign Starts June With Only $1.3 Million In The Bank After Making Another $2.2 Million Loan

Regulator Alleges Sweden's Largest Bank Has $9.7 Billion Capital Shortfall

German Top Court "Reluctantly" Rejects Challenges To ECB's OMT Program, Lists 6 Conditions

Stocks, Sterling Rise As "Brexit" Fears Forgotten; Dollar Drops Ahead Of Yellen Speech

The Big Guns Are Out: Soros, Rothschild Warn Of Brexit Doom; Osborne Threatens With "Suspending" Market

"Whatever It Takes" Wasn't Enough

Anxiety Builds As Money Managers Near Record Long Gold Position

The New Iron Curtain - A Monument To Washington's Imperial Folly

The Chinese Real-Estate Bubble Has Gone Parabolic: Land Prices Soar 50% In One Year

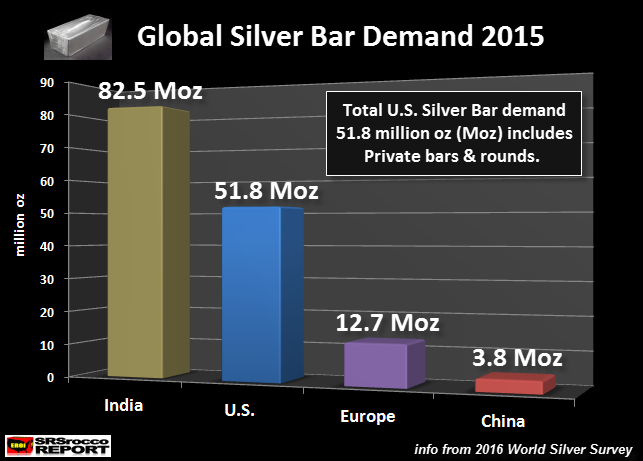

According to the figures in the 2016 World Silver Survey, Americans now

lead the world in physical silver investment. This is quite an

interesting change as India has been the number one market for silver

bar demand in the past.

According to the figures in the 2016 World Silver Survey, Americans now

lead the world in physical silver investment. This is quite an

interesting change as India has been the number one market for silver

bar demand in the past.For example, Indians purchased more than 100 million oz (Moz) of silver bar in 2008 of the approximate world total of 125 Moz. However, silver bar demand is only one segment of total global physical silver investment. There is also Official Coin demand.

If we look at the data for 2015, India continues to rank as the largest source of silver bar investment int he world:

Read More

Caterpillar retail sales decline for 42 months in a row. Obama’s economic recovery does not hold water, his predictions never came true.Baltic Dry Index declines to 582. We are in the biggest stock bubble of all time and it is getting ready to pop. Obama is calling the height of the market by telling people to buy now. BRICS banks are not issuing bonds in local currencies bypassing the dollar.

by Jeff Nielson, Bullion Bulls:

And then there were two.

And then there were two.

Donald Trump: the Mouth that Roared. Hillary Clinton: the Queen of Mean. It would make a great WWF match-up. Trump is the larger of the two, male, and could crush Clinton with his hair, alone. But Hillary is nastier, more devious, and simply smarter than her oafish opponent. The Court Jester versus the Wicked Witch. For those Americans who believed they would never be given a more inferior choice for their presidency than George Bush Jr. and John Kerry, you stand corrected.

How did it ever happen? This was already the subject of a previous commentary. It wasn’t supposed to turn out this way. Yes, Clinton was supposed to emerge atop the Blue House. She was/is the evil “opponent”, who (most of the time) is supposed to lose in their WWF matches. However, she wasn’t supposed to be head-to-head with Donald Trump, but rather with an even more-inferior boob: Jeb Bush.

Read More

And then there were two.

And then there were two.Donald Trump: the Mouth that Roared. Hillary Clinton: the Queen of Mean. It would make a great WWF match-up. Trump is the larger of the two, male, and could crush Clinton with his hair, alone. But Hillary is nastier, more devious, and simply smarter than her oafish opponent. The Court Jester versus the Wicked Witch. For those Americans who believed they would never be given a more inferior choice for their presidency than George Bush Jr. and John Kerry, you stand corrected.

How did it ever happen? This was already the subject of a previous commentary. It wasn’t supposed to turn out this way. Yes, Clinton was supposed to emerge atop the Blue House. She was/is the evil “opponent”, who (most of the time) is supposed to lose in their WWF matches. However, she wasn’t supposed to be head-to-head with Donald Trump, but rather with an even more-inferior boob: Jeb Bush.

Read More

from Liberty Blitzkrieg:

Actions

have consequences, and people can only be pushed so far before they

snap. I believe the Paris terror attacks will be a major catalyst that

will ultimately usher in nationalist type governments in many parts of

Europe, culminating in an end of the EU as we know it and a return to

true nation-states. Although I think a return to regional government and

democracy is what Europeans need and deserve, the way in which it will

come about, and the types of governments we could see emerge, are

unlikely to be particularly enlightened or democratic after the dust has

settled.

Actions

have consequences, and people can only be pushed so far before they

snap. I believe the Paris terror attacks will be a major catalyst that

will ultimately usher in nationalist type governments in many parts of

Europe, culminating in an end of the EU as we know it and a return to

true nation-states. Although I think a return to regional government and

democracy is what Europeans need and deserve, the way in which it will

come about, and the types of governments we could see emerge, are

unlikely to be particularly enlightened or democratic after the dust has

settled.

My thoughts and prayers go out to all the victims of these horrific events, but the Paris attacks didn’t happen in a vacuum. The people of Europe have already become increasingly resentful against the EU, something which is not debatable at this point. This accurate perception of an undemocratic, technocratic Brussels-led EU dictatorship was further solidified earlier this year after the Greek people went to the polls and voted for one thing, only to be instructed that their vote doesn’t actually matter.

Read More…

Actions

have consequences, and people can only be pushed so far before they

snap. I believe the Paris terror attacks will be a major catalyst that

will ultimately usher in nationalist type governments in many parts of

Europe, culminating in an end of the EU as we know it and a return to

true nation-states. Although I think a return to regional government and

democracy is what Europeans need and deserve, the way in which it will

come about, and the types of governments we could see emerge, are

unlikely to be particularly enlightened or democratic after the dust has

settled.

Actions

have consequences, and people can only be pushed so far before they

snap. I believe the Paris terror attacks will be a major catalyst that

will ultimately usher in nationalist type governments in many parts of

Europe, culminating in an end of the EU as we know it and a return to

true nation-states. Although I think a return to regional government and

democracy is what Europeans need and deserve, the way in which it will

come about, and the types of governments we could see emerge, are

unlikely to be particularly enlightened or democratic after the dust has

settled.My thoughts and prayers go out to all the victims of these horrific events, but the Paris attacks didn’t happen in a vacuum. The people of Europe have already become increasingly resentful against the EU, something which is not debatable at this point. This accurate perception of an undemocratic, technocratic Brussels-led EU dictatorship was further solidified earlier this year after the Greek people went to the polls and voted for one thing, only to be instructed that their vote doesn’t actually matter.

Read More…

RELATED: Orlando Pulse Shooting PSYOP: ALL EMERGENCY BROADCASTS SCRUBBED FROM INTERNET!

by Robert Mackey, The Intercept:

DOING NOTHING TO advance the heated political debate over what combination of factors

might have prompted Omar Mateen to open fire inside a gay nightclub in

Orlando last week, the FBI on Monday refused to release the audio or a

full transcript of the gunman’s phone conversations with the police

during the attack.

DOING NOTHING TO advance the heated political debate over what combination of factors

might have prompted Omar Mateen to open fire inside a gay nightclub in

Orlando last week, the FBI on Monday refused to release the audio or a

full transcript of the gunman’s phone conversations with the police

during the attack.

The FBI instead published a written timeline of the attack, which included a redacted transcript of one conversation between Mateen and a 911 operator, and a partial summary of what he said in three further calls with the Orlando Police Department crisis negotiators that lasted 28 minutes in total. The bureau argued that letting the public hear or even read the gunman’s justification for the attack in his own words risked encouraging further attacks.

Read More

by Robert Mackey, The Intercept:

DOING NOTHING TO advance the heated political debate over what combination of factors

might have prompted Omar Mateen to open fire inside a gay nightclub in

Orlando last week, the FBI on Monday refused to release the audio or a

full transcript of the gunman’s phone conversations with the police

during the attack.

DOING NOTHING TO advance the heated political debate over what combination of factors

might have prompted Omar Mateen to open fire inside a gay nightclub in

Orlando last week, the FBI on Monday refused to release the audio or a

full transcript of the gunman’s phone conversations with the police

during the attack.The FBI instead published a written timeline of the attack, which included a redacted transcript of one conversation between Mateen and a 911 operator, and a partial summary of what he said in three further calls with the Orlando Police Department crisis negotiators that lasted 28 minutes in total. The bureau argued that letting the public hear or even read the gunman’s justification for the attack in his own words risked encouraging further attacks.

Read More

Dates of military drill overlap timing of Democrat National Convention

by Adan Salazar, Infowars:

A

private government contractor is seeking role players for a simulated

military drill set to take place next month in Burlington, Vermont – the

site of candidate Bernie Sanders’ campaign headquarters – at the same

time as the Democratic National Convention.

A

private government contractor is seeking role players for a simulated

military drill set to take place next month in Burlington, Vermont – the

site of candidate Bernie Sanders’ campaign headquarters – at the same

time as the Democratic National Convention.

A Craigslist ad posted eight days ago by defense contractor Foreign Language Services Simulation, LLC, (FLSS) seeks “actors” and “role players” who will be made up with fake wounds and mock injuries to “support military in instructional exercises in a nearby location.”

Read More

by Adan Salazar, Infowars:

A

private government contractor is seeking role players for a simulated

military drill set to take place next month in Burlington, Vermont – the

site of candidate Bernie Sanders’ campaign headquarters – at the same

time as the Democratic National Convention.

A

private government contractor is seeking role players for a simulated

military drill set to take place next month in Burlington, Vermont – the

site of candidate Bernie Sanders’ campaign headquarters – at the same

time as the Democratic National Convention.

A Craigslist ad posted eight days ago by defense contractor Foreign Language Services Simulation, LLC, (FLSS) seeks “actors” and “role players” who will be made up with fake wounds and mock injuries to “support military in instructional exercises in a nearby location.”

Read More

from MSNBC via TheDailyTrump:

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment