Frequent readers know about Zero Hedge's fascination with the murky world of "shadow banking" a topic we have been covering since late 2009, which can best be summarized as follows: the near-infinite fungibility of electronic credit-money equivalents within the infinitely interconnected modern financial system. The recent escalation in the discovery of massive broker capital deficiency courtesy of the MF Global bankruptcy as a result of a collapse in one of the numerous shadow banking funding pathways, namely rehypothecation, is just the very tip of the iceberg. Much more is coming, as shadow banking continues to be unwound day after day (we will post an update of the Q3 data later in the day). In the meantime, we go back to that one certain Citi report from September 5, 2008 which explained just how broken the financial system was that according to some, the realization, and not some ulterior deathwish, is what sparked the run on Lehman, and subsequently money market, ABCP, repos, synthetics, structured products, securities lenders, AIG, and everything else that the Fed had to step in with a roughly $30 trillion bail out. Why was it $30 trillion? Simple: because at its heart, the "shadow banking" system has a $30+ trillion diabolic funding mechanism, where when one cuts out all the fancy nomenclature, acronyms,

abbreviations, and jargon, the bottom line is that there are increasingly less and less hard assets (i.e., cash-flow generating), funding ever more and more liabilities, and where one's assets are another's liabilities in a "fractional reserve" recursive loop, and which in that shadowy sub-center of modern banking - London (because New York is just for regulatory diversion)- the loop can go on literally in perpetuity.

The European Death Spiral

Recently, we presented and discussed one of the biggest issues for European banks: the urgent need to delever substantially (to the tune of over €2.5 trillion) by selling assets, in order to placate various regulatory entities that banks are solvent, and, far more importantly, the market, which has so far proceeded not to short banks into oblivion only due to the ongoing short selling ban, and to the explicit backstop from the ECB (and, indirectly, the Fed). However, since deleveraging into an deflationary environment will certainly require bank bailouts due to collapsing asset prices, the question is what the impact of bailouts on banks will be. And here Bloomberg's Yalman Onaran explains all too vividly how not even in ponzinomic finance is there ever a free lunch... even if bought with free money. "If the Southern governments put money in their banks, their sovereign debt will go up, exacerbating their problems,” said Karel Lannoo, chief executive officer of the Centre for European Policy Studies in Brussels. “Then the banks’ losses will rise because they hold the government debt. That’s a vicious cycle. It’s hard to know which one to stabilize first, the sovereign bonds or the banks.” And therein lies the rub, and the problem at the core of it all: when one is dealing with a continent and its insolvent financial system whose banks have underwater assets that amount to the size of the host nation's GDP, "It’s hard to know which one to stabilize first, the sovereign bonds or the banks." Recall that killing both birds with one silver bullet is what the failure that is the EFSF was supposed to do, by allowing sovereign debt rolls and fund bank nationalizations at the same time. Now that that hope is gone, all we have is the inevitable "death spiral."Guest Post: The Ghost Of The Bundesbank Haunting The Halls Of Brussels

In

his book “More money than God”, Sebastian Mallaby describes how George

Soros received a signal from Helmut Schlesinger (president of

Bundesbank at that time), to go ahead and speculate on a devaluation of

the Italian Lira and the British Pound. Germany had enjoyed a boost

from the integration of Eastern Germany, which, partially due to a

generous 1:1 exchange offer for the Eastern German Mark, led to

unacceptably high inflation. Despite numerous warnings from the

Bundesbank, fiscal policies did nothing to reign into the growing

threat to price stability. Seeing its advice ignored, the Bundesbank

fought back and raised its discount rate all the way to 8.75%. This

caused problems for other European countries, who were forced to follow

the Bundesbank unless they wanted to risk a weakening of their

currencies. They had to apply a restrictive monetary policy despite

their own economies just recovering from the recession of the early

90?s. According to Mallaby, British finance minister Lamont had insulted

Schlesinger at a meeting, trying to extract a promise to cut German

interest rates. Despite Schlesinger’s refusal, Lamont led the press to

believe Schlesinger had made concessions.The “payback” didn’t wait for

long; Schlesinger publicly denied any intention of cutting rates. He

also expressed low confidence in the fixed relationships among European

currencies, particularly the “unsoundness” of the Italian Lira.

In

his book “More money than God”, Sebastian Mallaby describes how George

Soros received a signal from Helmut Schlesinger (president of

Bundesbank at that time), to go ahead and speculate on a devaluation of

the Italian Lira and the British Pound. Germany had enjoyed a boost

from the integration of Eastern Germany, which, partially due to a

generous 1:1 exchange offer for the Eastern German Mark, led to

unacceptably high inflation. Despite numerous warnings from the

Bundesbank, fiscal policies did nothing to reign into the growing

threat to price stability. Seeing its advice ignored, the Bundesbank

fought back and raised its discount rate all the way to 8.75%. This

caused problems for other European countries, who were forced to follow

the Bundesbank unless they wanted to risk a weakening of their

currencies. They had to apply a restrictive monetary policy despite

their own economies just recovering from the recession of the early

90?s. According to Mallaby, British finance minister Lamont had insulted

Schlesinger at a meeting, trying to extract a promise to cut German

interest rates. Despite Schlesinger’s refusal, Lamont led the press to

believe Schlesinger had made concessions.The “payback” didn’t wait for

long; Schlesinger publicly denied any intention of cutting rates. He

also expressed low confidence in the fixed relationships among European

currencies, particularly the “unsoundness” of the Italian Lira.The Onion's List Of 5 Most Influential People In Economic News

Simply confirming once again that reality itself has now become a farce...

Algo Liftathon Saves The Day But Financials Falter

ES

(the e-mini S&P 500 futures contract) closed the day session

almost perfectly at its VWAP (volume-weighted average price) as the last

45 minutes of the day saw a relatively 'cheap' equity market (compared

to CONTEXT broad risk assets) rally out of its tight

post-Europe's-close range. There was heavy volume as we got close to

VWAP (although Composite volume was the lowest since Thanksgiving

Friday) and little ability to push through it and the fact that the major financials (stocks or CDS) did not really participate in the XLF's modest pull higher at the same time also suggests it was not performance chasing as higher beta was not outperforming that much. Stocks and credit stayed much more in sync than in recent days but we note that the seemingly increasingly important HYG did not sell off as much in the middle of the day and markets pulled back to it into the close. The weakness in TSYs and steepening of the curve post Europe,

as well as some recovery in commodities helped support equities as

EURUSD did not lose much more ground in the afternoon (even though SEK

did). After outperforming all day, Silver rallied back in line with Copper and Gold's 2.5-3% down day while Oil clung desperately to the safety of strengthening USD -1.3% vs DXY's +1.2%.

ES

(the e-mini S&P 500 futures contract) closed the day session

almost perfectly at its VWAP (volume-weighted average price) as the last

45 minutes of the day saw a relatively 'cheap' equity market (compared

to CONTEXT broad risk assets) rally out of its tight

post-Europe's-close range. There was heavy volume as we got close to

VWAP (although Composite volume was the lowest since Thanksgiving

Friday) and little ability to push through it and the fact that the major financials (stocks or CDS) did not really participate in the XLF's modest pull higher at the same time also suggests it was not performance chasing as higher beta was not outperforming that much. Stocks and credit stayed much more in sync than in recent days but we note that the seemingly increasingly important HYG did not sell off as much in the middle of the day and markets pulled back to it into the close. The weakness in TSYs and steepening of the curve post Europe,

as well as some recovery in commodities helped support equities as

EURUSD did not lose much more ground in the afternoon (even though SEK

did). After outperforming all day, Silver rallied back in line with Copper and Gold's 2.5-3% down day while Oil clung desperately to the safety of strengthening USD -1.3% vs DXY's +1.2%.Richard Koo On Why Europe's Austerity Will Cause Deflationary Spiral

While not new to our thoughts, Richard Koo, Nomura's Balance Sheet Recession guru, has penned a lengthy but complete treatise on why governments need to borrow and spend now or the world faces a deflationary spiral. The Real-World Economics Review

posting makes it clear how his balance sheet recessionary perspective

of the deleveraging and ZIRP trap we now live in means bigger and more

Keynesian efforts are needed to pull ourselves out of the hole. While we

agree wholeheartedly with his diagnosis of the problem, his belief in

the solution...at such times only, the government must borrow and spend the private sector’s excess savings,...is

flawed in so much as the size and scale of additional government

borrowing at this time of smaller and more risk averse balance sheets

leaves the governments (of currency issuers and users alike) more

anxious of bond vigilantes than ever before. Furthermore, the impact of

a much-bigger-than-previously-believed shadow banking system

deleveraging and de-hypothecating and the historical precedents now

engraved in manager's minds leaves them thinking 'fool me once...'.

His thoughts on the political difficulties of such a borrow-and-spend

solution and the 'when to exit this solution phase' is noteworthy in

its timing (and cyclical perspective) with the belief that there will be

plenty of time to pay down the accumulated public debt because

the next balance sheet recession of this magnitude is likely to be

generations away, given that those who learned a bitter lesson in the present episode will not make the same mistake again. The next bubble and balance sheet recession of this magnitude will happen only after we are no longer here to remember them.

Finally, he warns that perceptions of the recovery from the Lehman

shock is NOT recovery from the balance sheet recession and has an

interestingly xenophobic approach to solving Europe's problems. Its

important to note that at all times, in our view, a deflationary shock

will be met with an increasingly more powerful currency devaluation, no

matter how many Japanese economists scream, after all its never been

easier just to add a few zeros.

While not new to our thoughts, Richard Koo, Nomura's Balance Sheet Recession guru, has penned a lengthy but complete treatise on why governments need to borrow and spend now or the world faces a deflationary spiral. The Real-World Economics Review

posting makes it clear how his balance sheet recessionary perspective

of the deleveraging and ZIRP trap we now live in means bigger and more

Keynesian efforts are needed to pull ourselves out of the hole. While we

agree wholeheartedly with his diagnosis of the problem, his belief in

the solution...at such times only, the government must borrow and spend the private sector’s excess savings,...is

flawed in so much as the size and scale of additional government

borrowing at this time of smaller and more risk averse balance sheets

leaves the governments (of currency issuers and users alike) more

anxious of bond vigilantes than ever before. Furthermore, the impact of

a much-bigger-than-previously-believed shadow banking system

deleveraging and de-hypothecating and the historical precedents now

engraved in manager's minds leaves them thinking 'fool me once...'.

His thoughts on the political difficulties of such a borrow-and-spend

solution and the 'when to exit this solution phase' is noteworthy in

its timing (and cyclical perspective) with the belief that there will be

plenty of time to pay down the accumulated public debt because

the next balance sheet recession of this magnitude is likely to be

generations away, given that those who learned a bitter lesson in the present episode will not make the same mistake again. The next bubble and balance sheet recession of this magnitude will happen only after we are no longer here to remember them.

Finally, he warns that perceptions of the recovery from the Lehman

shock is NOT recovery from the balance sheet recession and has an

interestingly xenophobic approach to solving Europe's problems. Its

important to note that at all times, in our view, a deflationary shock

will be met with an increasingly more powerful currency devaluation, no

matter how many Japanese economists scream, after all its never been

easier just to add a few zeros.DOL Exposes Citigroup Plans To Fire Hundreds From Greenwich Street Office

A few days ago, Citigroup announced it would lay off 4500 bankers around the world, although with nothing more definitive, the bank's employees likely thought that "out of sight means out of mind", especially with the holiday season days away. To their chagrin, our latest favorite website, the Department of Labor's "WARN" site, which usually well ahead of various HR offices will advise New York bank employees how many and which office are going to lay people off. Sure enough, here is Citigroup, with just disclosed plans to fire 413 people, with full breakdown by which offices are to be affected. If you are one of the several hundred to be laid off from the 388/390 Greenwich location, our condolences: fear not - the economy is getting better; after all last week initial claims for unemployment benefits literally tumbled meaning the re-depression is now over. You will be back working in the comfortable confines of infinitely rehypothecated fractional reserve banking in no time.Jefferies Said To Demand Bonus Clawbacks From Terminated Bankers

Earlier today, Fox Business' Charlie Gasparino broke the news (which was really surprising only for anyone who had not seen the JEF stock slide in the past several months) that the firm has fired a substantial number of people just after the bank's fiscal year end: "People inside the firm say the cuts are occurring most heavily in Jefferies' equities division, and according to traders inside the firm, they could total as much as 11% of the entire firm when the job cutting is complete". We now have some additional, and more disturbing information: the actual number of people is roughly 65 or so, but the worst news is that Rich Handler will demand a 1 year clawback from the departees, in the form of bonus refunds for both cash and stuck. While this has been isolated to Jefferies for the time being (which has other liquidity concerns of its own, most of which are quite well known), we are certain that now that this practice has a "case study" other banks, especially of the B-grade variety, will implement comparable clawback strategies. This approach, once adopted broadly, will likely cause a substantial dent in banker spending patterns, as rarely if ever before have termination without cause been accompanied by demand for money back. In effect, this activity will force even greater spending retrenchment, and could cause a flight of the ultra high net worth retail customer who will suddenly be forced to think twice about spending not the upcoming bonus, but even the previous one, heretofore considered safe and sound, in some Cayman bank account.Huge Year For Hugh Hendry's Anti-China Fund

Unlike

some of the more noteworthy fund managers who appear on our TV screens

all too often, Hugh Hendry seems to have been head-down hard at work.

The appropriately named Eclectica fund that he manages has had a

stupendous year as The FT reports his 'China Short' fund is up over 52% for the year. We discussed his already-solid performance back in September,

when he was up a mere 40% YTD following an exceptional month in

September. Given the difficulties of shorting Chinese firms directly,

the deeply contrarian manager who makes no apologies for his view of a 1920's Japan-like crash in China is clearly doing something right. His positions in Japanese entities with large Chinese exposures makes great sense and the fact that he has kept outperforming this quarter even as Japanese credit has rallied back quite impressively, from spike wides in September and October, seems testament to our TV-Appearance-to-Performance anti-correlation thesis.

Unlike

some of the more noteworthy fund managers who appear on our TV screens

all too often, Hugh Hendry seems to have been head-down hard at work.

The appropriately named Eclectica fund that he manages has had a

stupendous year as The FT reports his 'China Short' fund is up over 52% for the year. We discussed his already-solid performance back in September,

when he was up a mere 40% YTD following an exceptional month in

September. Given the difficulties of shorting Chinese firms directly,

the deeply contrarian manager who makes no apologies for his view of a 1920's Japan-like crash in China is clearly doing something right. His positions in Japanese entities with large Chinese exposures makes great sense and the fact that he has kept outperforming this quarter even as Japanese credit has rallied back quite impressively, from spike wides in September and October, seems testament to our TV-Appearance-to-Performance anti-correlation thesis.$32 Billion 3 Year Bond Prices At Second Lowest Yield Ever, Highest Bid To Cover On Record

Following the auction of the latest $32 billion in 3 year bonds, the market is expected to relax as based on the optic the auction was a stunning success, with a High Yield of 0.352%, higher than just the 0.334% hit in September when the market was collapsing. Yet the Bid To Cover of 3.624 was the highest ever in the series of the bond. Now the bad news: Primary Dealers once again accounted for well over 53.9% of the auction: or about $17 billion, which will be promptly repo'ed back to the Fed with the proceeds used for various other purposes. In other words, the clear demand for $15 billion came in the form of Indirects taking down 39.1% and Directs with 7.0%. Nonetheless, with the When Issued trading at 0.36%, there is no doubt that the auction was a smashing success, under the parameters of the US bond issuance regime. In the meantime, we await to see what happens to German Bund auctions in the next few days if the yield once again collapses, and there is just not enough demand at auction.

Goldman Punk'd Clients Yet Again

On Friday, following the announcement from Goldman that the firm's had just turned more bullish on European financials raising banks from Underweight to Neutral, we said: "Goldman has just started selling European bank stocks to its clients, whom it is telling to buy European bank stocks. Said otherwise, the Stolpering of clients gullible enough to do what Goldman says and not does, has recommenced. Our advice, as always, do what Goldman's flow desk is doing as it begins to unload inventory of bank stocks. Translation: run from European bank exposure." Sure enough: European banks (as per BEBANKS) are now down 3.84% today alone, or -1.5% from the Thursday close, while the general MSCI Euro Fin sector, EUFN, is down 6% today. While not quite a slam dunk trade as a Stolper FX anti-reco, nobody has ever filed for bankruptcy by making money. Thank you Goldman.

French Downgrade - Even More Likely Than Yesterday

First Moody's and now Fitch are coming out with negative comments about the summit. That provides mores more air cover for S&P to downgrade France 1 notch. The EU and EIB may also get notched in that case, further hurting the reputation of the EU and their plans. Political pressure may stay the hand of S&P but if not, this should spark a steep decline in risk asset prices. It may even make it more difficult for the ECB to print as one of its strongest members stumbles.Guest Post: Headwinds For Housing

Protesters Arrested At Goldman Sachs HQ?

But fear not: the arrested are not the firm's "god's work-ing" employees; more of the OWS persuasion. From PressTV:

"US police have arrested 17 members of the Occupy movement in New York

as the nationwide crackdown on the anti-corporatism protesters

continues." When we get additional confirmation of this arrest from US

sources, and not-Iranian media, we will update.

Luckily, since none of the protesters can close a Goldman (which is

still a Bank Holding Company) checking account, we are confident the

story will end here.

But fear not: the arrested are not the firm's "god's work-ing" employees; more of the OWS persuasion. From PressTV:

"US police have arrested 17 members of the Occupy movement in New York

as the nationwide crackdown on the anti-corporatism protesters

continues." When we get additional confirmation of this arrest from US

sources, and not-Iranian media, we will update.

Luckily, since none of the protesters can close a Goldman (which is

still a Bank Holding Company) checking account, we are confident the

story will end here.Leading French Presidential Candidate Hollande Says Will Renegotiate Brussels Decision If Elected

Just because credit agency downgrade risk uncertainty is not enough, FAZ now advises there is electoral risk to add to the mix. Because if Sarkozy were to lose the presidential election, his competitor, the socialist-backed Francois Hollande has said that he would not accept the decisions of the Euro-summit, and will try to renegotiate the outcome, in effect unwinding any "progress" made so far in stabilizing the European currency. "Should he win the presidential elections, France would not ratify the treaty. "If I am elected President of the Republic, I will negotiating a new agreement," Hollande announced on the radio station RTL." Why is this concerning? Because as a recent poll indicates Hollande has a commanding lead over Sarkozy as of mid-November. "The proportion of French voters who have confidence in Sarkozy to deal effectively with the country’s problems expanded to 40 percent, according to the poll published in the French newspaper today. While Socialist Francois Hollande topped popularity ratings in the poll, he lost 5 points in the period. About 51 percent of voters said they had a “positive image” of Hollande." In other words, it is likely to quite likely that Sarko will not be reelected. Which also means that suddenly all bets are off for Europe.Complete David Cameron Statement On European Veto

"I went to Brussels with one objective: to protect Britain’s national interest. And that is what I did"Guest Post: The Last Refuge Of Wall Street: Marketing To Increasingly Insolvent Consumers

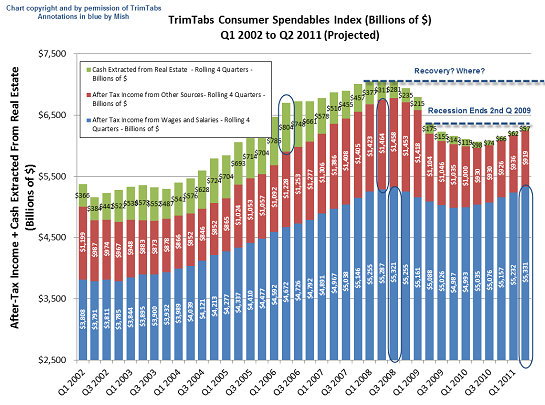

Have you noticed that all the "hot" initial public offerings (IPOs) being hyped by Wall Street are all marketing companies? The big IPO that has everyone on the Street salivating is of course Facebook in 2012--the ultimate "social media" marketing machine. What's striking about these heavily hyped Social Media companies is that they make nothing, and their service is either free (Facebook, Twitter, etc.) or a "free" marketing mechanism (Groupon). When was the last time a company went public in the U.S. that actually manufactured a good? When was the last time a "hot" company went public selling a service that had nothing to do with marketing and that actually performed a valuable function? Wall Street has nothing left to sell except marketing schemes aimed at increasingly insolvent consumers. With a hollowed-out manufacturing base and leveraged financialization finally running out of steam as the engine of "growth" (see debt saturation chart below), then chumming the waters thrashing with marketing piranhas is Wall Street's last refuge of staggering profits. In other words, marketing to increasingly insolvent consumers is a Darwinian zero-sum game. Sales can't actually increase as consumer credit and incomes both decline; sales are simply brought forward in time or ripped from the desperate grasp of a competitor. The only "hot industry" left in America that Wall Street can hype is the one promising to get to the consumer before the other marketing piranhas can strip the last shreds of cash and credit from their bones.

Submitted by Tyler Durden on 12/12/2011 - 10:35 Eurozone United Kingdom

Last

week's biggest political shock was David Cameron telling Europe to

shove its authoritarian ambitions and breaking away from the Group of

27, in effect killing any chance of a favorable summit outcome. Watch

him live now as he explains why he did what he did.

Last

week's biggest political shock was David Cameron telling Europe to

shove its authoritarian ambitions and breaking away from the Group of

27, in effect killing any chance of a favorable summit outcome. Watch

him live now as he explains why he did what he did.Guest Post: Plan B For "Breakup"

There were only two questions that mattered, going into the EU summit.- Would leaders at the summit come up with any actions of their own to help end the immediate crisis?

- Falling short of this, would any of their actions give enough confidence to the European Central Bank to allow it step up its role and be a lender of last resort to all troubled eurozone countries, but especially to wobbly Italy? In other words, could the conservative ECB now give itself the greenlight to print euros and buy up bonds from the world’s third largest issuer?

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment