IMF Loans Likely To Fall Short Of €200 Expected As UK Pulls Rescue Funding

As noted over the weekend, the UK, having vetoed the December 9 summit, has made it clear it would also likely back out of its IMF mandated contribution to save the Eurozone. In other words, the €30.9 billion that was supposed to come from the UK to rescue French and Italian banks, is now probably gone, a move which threatens to topple the latest Plan Z euro bailout in which broke countries pool money to bailout the same broke countries. Sure enough, Dow Jones confirms it:- EU loans to IMF likely to fall short of expected EUR 200bln according to sources

- Eurozone may move on IMF loans without immediate UK support according to a EU source

Did GLD And Other Gold ETFs Kill Gold Stocks?

In

a just released piece by Goldman's Eugene King which explains the

firm's justification for why gold will peak at over $1900 in 2012, and

which we will discuss in greater detail shortly, Goldman brings up a

very interesting point, namely that the ongoing weakness in gold

stocks, and the broad decoupling of gold miners from gold price can be

attributed to one primary thing: the emergence of synthetic means of

expressing a position on the gold market and "bypassing" direct gold

cost pass thru exposure in the form of gold stocks. Supposedly

this is a good thing, although we would caution that this is

potentially a very insidious scheme to allow the world's cash-rish

entities (read banks full of those ones and zeros that these days pass

for "money") to procure real gold assets at very cheap prices and

valuations, even as the broader retail investors proceeds to chase

paper gold in the form of "synthetic CDOs" such as GLD (which as we

first noted over a week ago may well disappear when the paper claims

collapse and suddenly everyone has a claim on the underlying physical),

only after the fact realizing they merely used gold as a paper pass

thru equivalent. In other words, as the broader population continues to

realize that gold is the real safe asset, yet invests in legacy forms

of exposure, i.e., paper, the real hard assets: firms that actually

extract gold from the ground and process it, remain out on the auction

block to be snapped up quietly by all those who want exposure to the

primary source of the metal, which they can then throttle at will in

order to manipulate the supply side of the equation post facto.

In

a just released piece by Goldman's Eugene King which explains the

firm's justification for why gold will peak at over $1900 in 2012, and

which we will discuss in greater detail shortly, Goldman brings up a

very interesting point, namely that the ongoing weakness in gold

stocks, and the broad decoupling of gold miners from gold price can be

attributed to one primary thing: the emergence of synthetic means of

expressing a position on the gold market and "bypassing" direct gold

cost pass thru exposure in the form of gold stocks. Supposedly

this is a good thing, although we would caution that this is

potentially a very insidious scheme to allow the world's cash-rish

entities (read banks full of those ones and zeros that these days pass

for "money") to procure real gold assets at very cheap prices and

valuations, even as the broader retail investors proceeds to chase

paper gold in the form of "synthetic CDOs" such as GLD (which as we

first noted over a week ago may well disappear when the paper claims

collapse and suddenly everyone has a claim on the underlying physical),

only after the fact realizing they merely used gold as a paper pass

thru equivalent. In other words, as the broader population continues to

realize that gold is the real safe asset, yet invests in legacy forms

of exposure, i.e., paper, the real hard assets: firms that actually

extract gold from the ground and process it, remain out on the auction

block to be snapped up quietly by all those who want exposure to the

primary source of the metal, which they can then throttle at will in

order to manipulate the supply side of the equation post facto.Never Act Upon Wishful Thinking

Admin at Jim Rogers Blog - 6 minutes ago

“Never act upon wishful thinking. Act without checking the facts, and

chances are that you will be swept away along with the mob.” - *in a Gift

To My Children*

*Jim Rogers is an author, financial commentator and successful

international investor. He has been frequently featured in Time, The New

York Times, Barron’s, Forbes, Fortune, The Wall Street Journal, The

Financial Times and is a regular guest on Bloomberg and CNBC.*

Close Correlation Between All Markets In The World

Admin at Marc Faber Blog - 9 minutes ago

There is close correlation between all markets in the world. This year, the U.S. has grossly outperformed the emerging markets In Asia, we’re down between 15 percent and 25 percent in markets. In Eastern Europe, even more. The U.S. this year is a wonderful market relative to the rest of the world. I think this outperformance may go on for a while. - *in Wall St Sheet Cheat * ETFs, iShares MSCI Emerging Markets Index ETF (EEM), SPDR S&P 500 ETF (SPY) *Marc Faber is an international investor known for his uncanny predictions of the stock market and futures markets around the world.*

2012 Gold Averages: Goldman $1,810/oz, Barclays $2,000/oz and UBS $2,050/oz

Bullion banks remain positive on gold for 2012 with major banks predicting an average gold price of between 13% and 28% above today’s spot at $1,595/oz. It will be interesting to see if these forecasts get as much international media coverage as the poll of 20 hedge fund managers has. UBS have reiterated their bullish outlook for gold and believe gold will average $2,050/oz in 2012. This is 28% above today’s spot price of $1595/oz. Goldman Sachs said overnight that gold will average $1,810/oz in 2012 – which is 13% above today’s spot price. Barclays Capital have said this morning that gold will average $2,000/oz in 2012 – which is 25% above today’s spot price.Will Congress Kill The Payroll Tax Extension - Advance Look At Today's 6:30PM Vote

Tonight at 6:30 pm the House is set to vote on the Senate’s payroll tax cut/unemployment insurance bill. As it stands right now, it appears likely that the vote will fail due to lack of support by Boehner and other house leaders. Furthermore, Senate has said it will not present an alterantive bill (as of yet). Which means that with a major portion of Q1 GDP at stake (non-renewal of payroll cuts means up to 1% of GDP being cut in Q1 2012), the futures market will be very focued on newsflow after the close. Here is Goldman's rundown of what to expect tonight in DC.Market Sentiment And Overnight Summary

Bloomberg analyst TJ Marta summarizes market developments in the last few hours since the death of Kim Jong Il pushed risk aversion, especially in Asia to an extreme, while Bloomberg's James Holloway explains why market sentiment is where it is, and what the market will be looking for today.Frontrunning: December 19

- Obituary: Kim Jong-il (FT)

- Draghi Warns on Eurozone Break-up (FT)

- EU Ministers Seek Crisis IMF Funding Deal (Bloomberg)

- China November Home Prices Post Worse Performance This Year (Bloomberg)

- China Debts Dwarf Official Data With Too-Big-to-Finish Alarm (Bloomberg)

- China opens up to offshore renminbi investors (FT)

- Voters to Read Recovery Signs (Hilsenrath)

- Germany May Pay Full ESM Contribution in 2012 (Reuters)

- U.S. Housing Heals Even as its Damage Widens (Reuters)

- S&P Cut Proves Absurd as Investors Prefer U.S. (Bloomberg)

RANsquawk European Morning Briefing - Stocks, Bonds, FX etc. – 19/12/11

Submitted by RANSquawk Video on 12/19/2011 - 06:15 ETC Morning Briefing RANSquawkBCG Presents The One Chart To Explain The Implications Of Leaving The Euro

On

a day when data confirms Spanish bad loans creeping up to recent highs

and deposits continuing to stream out of the periphery, Boston

Consulting Group has released an excellent treatise on the "What Next?

Where Next?" perspective of the impact of collateral damage in and out

of the Eurozone. The critical questions for most market watchers and

prognosticators remain, how likely is an exit, and what would be

the implications for 'leaver' and 'left behind'? BCG offers an

at-a-glance chart of the economic, social, and market expectations for

the ins-and-outs and notes, in less-than-Deutsche-Bank-like

mutually assured destruction language, the cost of leaving the Euro

varying from EUR3,500 to 11,500 depending on weak or strong exiting

country per person per year. No matter what, an exit would impact the

world economy considerably and BCG strongly suggests corporate

management consider a Euro-zone breakup as a possible scenario for next

year, along with a muddle-through, a Japanese deflation-like

evolution, or a significant inflation possibility.

On

a day when data confirms Spanish bad loans creeping up to recent highs

and deposits continuing to stream out of the periphery, Boston

Consulting Group has released an excellent treatise on the "What Next?

Where Next?" perspective of the impact of collateral damage in and out

of the Eurozone. The critical questions for most market watchers and

prognosticators remain, how likely is an exit, and what would be

the implications for 'leaver' and 'left behind'? BCG offers an

at-a-glance chart of the economic, social, and market expectations for

the ins-and-outs and notes, in less-than-Deutsche-Bank-like

mutually assured destruction language, the cost of leaving the Euro

varying from EUR3,500 to 11,500 depending on weak or strong exiting

country per person per year. No matter what, an exit would impact the

world economy considerably and BCG strongly suggests corporate

management consider a Euro-zone breakup as a possible scenario for next

year, along with a muddle-through, a Japanese deflation-like

evolution, or a significant inflation possibility.

by Greg Hunter’s USAWatchdog.com:

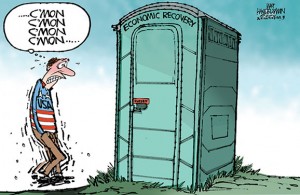

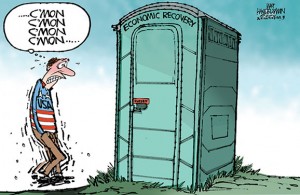

I think most people are simply oblivious to the enormous dangers the world economy faces. Oh, I think we will all get through Christmas and New Years without a meltdown, but all bets are off in 2012. A new acquaintance of mine told me last Friday, “Isn’t the economy getting better?” I just looked at her and shook my head in the negative. Then she said, “I guess if it was getting bad, the media wouldn’t tell us the truth.” I shook my head in the affirmative. My new friend is 75 years old and gets a Social Security check every month. She’s pretty sharp, but I don’t blame her for being misinformed. She gets her news the old fashioned way—from the mainstream media (MSM).

There is no wonder so many are in the dark and completely unprepared for the next crash. The front page of USA TODAY, last week, touted a headline that read: “Are We There Yet?” The article said, “The economic signs are encouraging, but we’re a long way from a comeback.” It covered recent upticks in auto and home sales. It also said the unemployment rate recently fell to “8.6%.” The USA TODAY story went on to say, “Although the decline was partly due to a 315,000 drop in the labor force as discouraged job seekers simply gave up, employment is up an average 321,000 a month since August, according to the Labor Department’s household survey. Most encouraging: Much of the hiring appears to be by small businesses, which typically fuel job growth in a recovery.” Wow, the fact that 315,000 people “simply gave up” seemed completely glossed over. Why did more than 300,000 people give up? Maybe it’s because there are precious few jobs. And what about the 400,000 people every week filing unemployment claims? Never let the facts get in the way of positive spin to please the advertisers. The USA TODAY story closes with a business professor who said, “I have a lot of confidence in the future.” (Click here for the complete USA TODAY story.)

Read More @ USAWatchdog.com

I think most people are simply oblivious to the enormous dangers the world economy faces. Oh, I think we will all get through Christmas and New Years without a meltdown, but all bets are off in 2012. A new acquaintance of mine told me last Friday, “Isn’t the economy getting better?” I just looked at her and shook my head in the negative. Then she said, “I guess if it was getting bad, the media wouldn’t tell us the truth.” I shook my head in the affirmative. My new friend is 75 years old and gets a Social Security check every month. She’s pretty sharp, but I don’t blame her for being misinformed. She gets her news the old fashioned way—from the mainstream media (MSM).

There is no wonder so many are in the dark and completely unprepared for the next crash. The front page of USA TODAY, last week, touted a headline that read: “Are We There Yet?” The article said, “The economic signs are encouraging, but we’re a long way from a comeback.” It covered recent upticks in auto and home sales. It also said the unemployment rate recently fell to “8.6%.” The USA TODAY story went on to say, “Although the decline was partly due to a 315,000 drop in the labor force as discouraged job seekers simply gave up, employment is up an average 321,000 a month since August, according to the Labor Department’s household survey. Most encouraging: Much of the hiring appears to be by small businesses, which typically fuel job growth in a recovery.” Wow, the fact that 315,000 people “simply gave up” seemed completely glossed over. Why did more than 300,000 people give up? Maybe it’s because there are precious few jobs. And what about the 400,000 people every week filing unemployment claims? Never let the facts get in the way of positive spin to please the advertisers. The USA TODAY story closes with a business professor who said, “I have a lot of confidence in the future.” (Click here for the complete USA TODAY story.)

Read More @ USAWatchdog.com

Mourning Lost Freedom in America

from King World News:

With

growing concerns about the safety of the US financial system, today

King World News released an interview with internationally followed

Martin Armstrong, founder and former head of Princeton Economics

International Ltd.. At one point Armstrong’s firm rose to be perhaps

the largest multinational corporate advisor in the world. Here are a

few snippets about what Armstrong had this to say to investors who have

been asking him about where to put their money: “At the conference that I

just gave, one of the number one questions people were asking, ‘What

happens now with this MF Global stuff. I don’t know what to tell them.

I cannot, in good conscience say your money is safe in New York

anymore. We were looking at, largely, where to put your money.”

With

growing concerns about the safety of the US financial system, today

King World News released an interview with internationally followed

Martin Armstrong, founder and former head of Princeton Economics

International Ltd.. At one point Armstrong’s firm rose to be perhaps

the largest multinational corporate advisor in the world. Here are a

few snippets about what Armstrong had this to say to investors who have

been asking him about where to put their money: “At the conference that I

just gave, one of the number one questions people were asking, ‘What

happens now with this MF Global stuff. I don’t know what to tell them.

I cannot, in good conscience say your money is safe in New York

anymore. We were looking at, largely, where to put your money.”

Martin Armstrong continues: Read More @ KingWorldNews.com

With

growing concerns about the safety of the US financial system, today

King World News released an interview with internationally followed

Martin Armstrong, founder and former head of Princeton Economics

International Ltd.. At one point Armstrong’s firm rose to be perhaps

the largest multinational corporate advisor in the world. Here are a

few snippets about what Armstrong had this to say to investors who have

been asking him about where to put their money: “At the conference that I

just gave, one of the number one questions people were asking, ‘What

happens now with this MF Global stuff. I don’t know what to tell them.

I cannot, in good conscience say your money is safe in New York

anymore. We were looking at, largely, where to put your money.”

With

growing concerns about the safety of the US financial system, today

King World News released an interview with internationally followed

Martin Armstrong, founder and former head of Princeton Economics

International Ltd.. At one point Armstrong’s firm rose to be perhaps

the largest multinational corporate advisor in the world. Here are a

few snippets about what Armstrong had this to say to investors who have

been asking him about where to put their money: “At the conference that I

just gave, one of the number one questions people were asking, ‘What

happens now with this MF Global stuff. I don’t know what to tell them.

I cannot, in good conscience say your money is safe in New York

anymore. We were looking at, largely, where to put your money.”Martin Armstrong continues: Read More @ KingWorldNews.com

from The Economic Collapse Blog:

Most

Americans have no idea that the U.S. government once issued debt-free

money directly into circulation. America once thrived under a debt-free

monetary system, and we can do it again. The truth is that the United

States is a sovereign nation and it does not need to borrow money from

anyone. Back in the days of JFK, Federal Reserve Notes were not the

only currency in circulation. Under JFK (at at various other times), a

limited number of debt-free United States Notes were issued by the U.S.

Treasury and spent by the U.S. government without any new debt being

created. In fact, each bill said “United States Note” right at the top.

Unfortunately, United States Notes are not being issued today. If you

stop right now and pull a dollar out of your wallet, what does it say

right at the top? It says “Federal Reserve Note”. Normally, the way

our current system works is that whenever more Federal Reserve Notes are

created more debt is also created. This debt-based monetary system is

systematically destroying the wealth of this nation. But it does not

have to be this way. The truth is that the U.S. government still has

the power under the U.S. Constitution to issue debt-free money, and we

need to educate the American people about this.

Most

Americans have no idea that the U.S. government once issued debt-free

money directly into circulation. America once thrived under a debt-free

monetary system, and we can do it again. The truth is that the United

States is a sovereign nation and it does not need to borrow money from

anyone. Back in the days of JFK, Federal Reserve Notes were not the

only currency in circulation. Under JFK (at at various other times), a

limited number of debt-free United States Notes were issued by the U.S.

Treasury and spent by the U.S. government without any new debt being

created. In fact, each bill said “United States Note” right at the top.

Unfortunately, United States Notes are not being issued today. If you

stop right now and pull a dollar out of your wallet, what does it say

right at the top? It says “Federal Reserve Note”. Normally, the way

our current system works is that whenever more Federal Reserve Notes are

created more debt is also created. This debt-based monetary system is

systematically destroying the wealth of this nation. But it does not

have to be this way. The truth is that the U.S. government still has

the power under the U.S. Constitution to issue debt-free money, and we

need to educate the American people about this.

Read More @ TheEconomicCollapseBlog.com

Most

Americans have no idea that the U.S. government once issued debt-free

money directly into circulation. America once thrived under a debt-free

monetary system, and we can do it again. The truth is that the United

States is a sovereign nation and it does not need to borrow money from

anyone. Back in the days of JFK, Federal Reserve Notes were not the

only currency in circulation. Under JFK (at at various other times), a

limited number of debt-free United States Notes were issued by the U.S.

Treasury and spent by the U.S. government without any new debt being

created. In fact, each bill said “United States Note” right at the top.

Unfortunately, United States Notes are not being issued today. If you

stop right now and pull a dollar out of your wallet, what does it say

right at the top? It says “Federal Reserve Note”. Normally, the way

our current system works is that whenever more Federal Reserve Notes are

created more debt is also created. This debt-based monetary system is

systematically destroying the wealth of this nation. But it does not

have to be this way. The truth is that the U.S. government still has

the power under the U.S. Constitution to issue debt-free money, and we

need to educate the American people about this.

Most

Americans have no idea that the U.S. government once issued debt-free

money directly into circulation. America once thrived under a debt-free

monetary system, and we can do it again. The truth is that the United

States is a sovereign nation and it does not need to borrow money from

anyone. Back in the days of JFK, Federal Reserve Notes were not the

only currency in circulation. Under JFK (at at various other times), a

limited number of debt-free United States Notes were issued by the U.S.

Treasury and spent by the U.S. government without any new debt being

created. In fact, each bill said “United States Note” right at the top.

Unfortunately, United States Notes are not being issued today. If you

stop right now and pull a dollar out of your wallet, what does it say

right at the top? It says “Federal Reserve Note”. Normally, the way

our current system works is that whenever more Federal Reserve Notes are

created more debt is also created. This debt-based monetary system is

systematically destroying the wealth of this nation. But it does not

have to be this way. The truth is that the U.S. government still has

the power under the U.S. Constitution to issue debt-free money, and we

need to educate the American people about this.Read More @ TheEconomicCollapseBlog.com

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment