It certainly gets lonely out there when the voices of gold all turn negative.

–Jim Sinclair

London Trader – We are Witnessing a Historic Bottom in Gold

(Courtesy of Eric King at www.KingWorldNews.com

With many investors worried the price of gold could head lower, today King World News interviewed the “London Trader” to get his take on the gold market. The source stated, “The Chinese have continued to take delivery of both physical gold and silver directly from the ETF’s GLD and SLV. They are also going directly to producers. Entities are bypassing the COMEX altogether and going straight to gold mining companies. Every single month producers have a certain amount of gold and silver they sell. Normally they sell it to the bullion banks and the bullion banks, of course, leverage this gold and sell up to 100 times that in paper markets to control prices.”

The London Trader continues:

“They (bullion banks) hold that little bit of physical gold and claim they are backed up on their position to the CFTC. I have all my large buyers now going to producers and saying to them, ‘Look, don’t sell it to the bullion banks, we’ll buy it from you.’ So we are buying directly from the producers and this includes some sovereign entities which are doing the same thing.

We’re struggling to get the physical out of these guys (producers) because they have so many people banging on their door, saying, ‘Sell it to us direct.’ What these buyers are doing is essentially taking gold out of the system, which means the bullion banks can’t leverage that gold anymore.

More…

Dear CIGAs,

Dominique Strauss-Kahn delivered a speech today in Beijing, lambasting the leadership of Europe for its “state of denial” about the severity of the credit crisis. It seems that an angry DSK is speaking his mind now that he has no official capacity and can lash out at European leaders. The former IMF managing director was well received by his Chinese hosts who showed their appreciation for all the work DSK did to elevate the status of the Chinese in the IMF.

DSK was adamant that the EUROPEAN CRISIS was a three-pronged problem: A DEBT CRISIS; A GROWTH CRISIS; and A LEADERSHIP CRISIS. The CRISIS IN EUROPE is further aggravated by the fact that the European leaders seem that time is not of the essence where DSK believes time is not a friend of the Eurocrats. It is of the utmost importance that the CRISIS be dealt with now and not later. Nothing like a dishonored and wounded leader to finally speak the truth

***Tomorrow’s Financial Times runs two interesting articles. Martin Feldstein has a piece in which he pushes the need for a weaker EURO as a way to help aid the peripheries to get back to current account balance. Feldstein suggests a need for a further 20% devaluation of the EURO to help Spain and Italy right the terrible ship of their trade situation. The problem is that Professor Feldstein doesn’t explain how he came to think that will be the magic elixir to turn the situation.

If the EURO DEPRECIATED 20%, Germany would create severe problems for U.S. and Japanese exporters. The Japanese auto sector is already being outsold by the Germans and the U.S. export sector has been one of the few positive elements of the U.S. economy. Also, Europe, the largest market for China, a 20% depreciation of the EURO would be a problem for a Chinese economy that is beginning to soften. While Feldstein’s remedy may make economic sense, the political reality of the fragile global situation is going to be a much tougher issue to resolve.

More…

Jim Sinclair’s Commentary

If Ron Paul was elected President, the general media would refuse to report it.

Gingrich Collapses in Iowa as Ron Paul Surges to the Front Dashiell Bennett

Dec 19, 2011

A new poll from Public Policy Polling shows that Ron Paul has taken the lead in the Iowa caucus race, while Newt Gingrich’s support is fading fast. A different Gallup poll shows Gringrich still holding the lead, but slipping, while The New York Times Nate Silver of FiveThirtyEight has Paul in the lead as well.

Gingrich has seen his numbers in the PPP poll drop from 27 percent to 14 percent in just three weeks, while his favorability rating is now split at 46 percent for to 47 percent against, the worst of any candidate not named Jon Huntsman. That’s quite a fall for someone who looked to be running away with the state and taking charge on the national level.

Mitt Romney has also seen his numbers tick up slightly (to 20%), putting him just behind Paul (23%) for second place. The poll measured voters who are planning to vote in the Republican caucus.

Perhaps the most telling secondary question was, "Do you think Newt Gingrich has strong principles?" Only 36 percent say that he does, but for Paul that number was 73 percent.

The bad news for Paul, however, is that when asked for their second choice for President, only 9% said they would vote for him after their preferred candidate. That means if supporters of any of the second-tier candidates sense defeat and decided to abandon their choice at the last minute, those votes are more likely to go to Romney. Even if Romney doesn’t win, the stronger than expected showing could be the snowball that starts a primary avalanche for him.

More…

Jim Sinclair’s Commentary

Let the games begin. Note that it did not even take one full day.

Arrest Order for Sunni Leader in Iraq Opens New Rift By JACK HEALY

Published: December 19, 2011

BAGHDAD — A day after the United States withdrew its last combat troops, Iraq faced a dangerous political crisis Monday as the Shiite-dominated government ordered the arrest of the Sunni vice president, accusing him of running a death squad that assassinated police officers and government officials.

The sensational charges drew a worried response from Washington and brought Iraq’s tenuous partnership government to the edge of collapse. A major Sunni-backed political coalition said its ministers would walk off their jobs, leaving adrift agencies that handle Iraq’s finances, schools and agriculture.

The accusations against Vice President Tariq al-Hashimialso underlined fears that Iraq’s leaders may now be using the very institutions America has spent millions of dollars trying to strengthen — the police, the courts, the media — as a cudgel to batter their political enemies and consolidate power.

On Monday night, Mr. Hashimi was in the northern semiautonomous region of Kurdistan, beyond the reach of security forces controlled by Baghdad. It was unclear when — or if — he would return to Baghdad.

In Washington, where officials have been quietly celebrating the end of the war, Obama administration officials sounded alarmed about the arrest order for Mr. Hashimi. “We are talking to all of the parties and expressed our concern regarding these developments,” said Tommy Vietor, the National Security Council spokesman. “We are urging all sides to work to resolve differences peacefully and through dialogue, in a manner consistent with the rule of law and the democratic political process.”

More…

Hello Mr. Sinclair,

I have been listening to your interviews on King World News. My father and I have thoroughly enjoyed them and have learned volumes. I wish to extend my complements to you on your unprecedented ability to understand and explain the complex financial situation that our world faces.

There is a question I would like to ask you about the current bull market in gold that you say we are in. As all bull markets eventually end, my question to you is not, "if" there will come a day to take profits, but when to take profits and what to do with those profits. For example, I would think of myself as a bad investor to ride the gold market from its lows clear up to its highs and back down to its lows again. If gold goes to $2,000 or $5,000 or $10,000 dollars per ounce at what point should one sell the physical metal? Hypothetically if gold were to go to $5,000 dollars per ounce or achieve a 1:1 price ratio with the Dow Jones Industrial Average, does one actually sell the physical coin for U.S. dollars (knowing the U.S. dollar is just another fiat currency)? Should one wait for an alternative currency to arise and sell the physical metal for that currency?

I hope I have been clear in what I am asking. Basically if one is holding wealth in gold/silver at what point does one take profits, and what does one roll those profits into at the end of the bull market in gold/silver? You might think my question premature as there are possibly years left in this bull market in gold, but I don’t want to be the last man standing who just watched the bull market profits disappear. (I call to your attention the gold price action of the 1980s when gold soared to $800 per ounce only to settle for the next decade between $200-$300.)

I would appreciate any advice and insight you might have.

CIGA Luke

Dear Luke,

You have presented the most difficult of questions. Last evening, I answered that via a graph of emotions that finds tops, but not necessarily with the definition of the long term top appended.

I do not think a ratio to the Dow is the answer.

The model answer is when gold sells (per ounce) at the value that equals the total dollar value of US foreign debt divided by the assumed number of ounces of gold the US government has, gold is full priced.

The reason for that is because at that price the international balance sheet of the USA and therefore the dollar is in balance. However, that number, which was $900 in 1980, is now slightly above $12,400.

If grouping of cycles is of any use time wise, that suggests 2015.

Regards,

Jim

By Greg Hunter’s USAWatchdog.com

Dear CIGAs,

I think most people are simply oblivious to the enormous dangers the world economy faces. Oh, I think we will all get through Christmas and New Years without a meltdown, but all bets are off in 2012. A new acquaintance of mine told me last Friday, “Isn’t the economy getting better?” I just looked at her and shook my head in the negative. Then she said, “I guess if it was getting bad, the media wouldn’t tell us the truth.” I shook my head in the affirmative. My new friend is 75 years old and gets a Social Security check every month. She’s pretty sharp, but I don’t blame her for being misinformed. She gets her news the old fashioned way—from the mainstream media (MSM).

There is no wonder so many are in the dark and completely unprepared for the next crash. The front page of USA TODAY, last week, touted a headline that read: “Are We There Yet?” The article said, “The economic signs are encouraging, but we’re a long way from a comeback.” It covered recent upticks in auto and home sales. It also said the unemployment rate recently fell to “8.6%.” The USA TODAY story went on to say, “Although the decline was partly due to a 315,000 drop in the labor force as discouraged job seekers simply gave up, employment is up an average 321,000 a month since August, according to the Labor Department’s household survey. Most encouraging: Much of the hiring appears to be by small businesses, which typically fuel job growth in a recovery.” Wow, the fact that 315,000 people “simply gave up” seemed completely glossed over. Why did more than 300,000 people give up? Maybe it’s because there are precious few jobs. And what about the 400,000 people every week filing unemployment claims? Never let the facts get in the way of positive spin to please the advertisers. The USA TODAY story closes with a business professor who said, “I have a lot of confidence in the future.” (Click here for the complete USA TODAY story.)

I am happy for him, but for a little balance and more accurate reporting, maybe the newspaper could have also quoted an economist who wasn’t so optimistic? John Williams of Shadowstats.com can provide that balance. In his latest report, Williams calls the recent unemployment numbers “nonsensical hype,” and “. . . help-wanted advertising has been in monthly decline since May of this year.” The report goes on to say, “November retail sales and industrial production both showed renewed faltering in the U.S. economy, reflecting the impact of the structural impairment of consumer liquidity. Although the headline CPI inflation number was flat for November, underlying detail showed the still spreading impact of high oil prices. Inflationary pressures continue to be from Federal Reserve polices, not from strong economic activity. As the Fed increasingly is pushed to support the banking system, the central bank’s actions should accelerate the pace of U.S. dollar debasement, as well as the pace of rising U.S. inflation and precious metals prices.” (Click here for the Shadowstats.com home page.) Inflation, by the way, is running at 11% annually. (According to Williams, that would be the true inflation rate if it were calculated the way Bureau of Labor Statistics did it in 1980 or earlier.)

The economy is so weak, the Fed is going to be “pushed to support the banking system!” That means the Fed will print money to continue bailing out the banks, and not just the banks here, but overseas as well. The Fed recently opened up a new round of bailouts for European banks with what are called dollar swaps. The head of the International Monetary Fund (IMF), Christine Lagarde, warned last week of the global damage that could happen if the sovereign debt crisis in the Eurozone spun out of control. FT.com reported, “There is no economy in the world, whether low-income countries, emerging markets, middle-income countries or super-advanced economies that will be immune to the crisis that we see not only unfolding but escalating.” (Click here for the FT.com story.)

More…

Dear CIGAs,

I think most people are simply oblivious to the enormous dangers the world economy faces. Oh, I think we will all get through Christmas and New Years without a meltdown, but all bets are off in 2012. A new acquaintance of mine told me last Friday, “Isn’t the economy getting better?” I just looked at her and shook my head in the negative. Then she said, “I guess if it was getting bad, the media wouldn’t tell us the truth.” I shook my head in the affirmative. My new friend is 75 years old and gets a Social Security check every month. She’s pretty sharp, but I don’t blame her for being misinformed. She gets her news the old fashioned way—from the mainstream media (MSM).

There is no wonder so many are in the dark and completely unprepared for the next crash. The front page of USA TODAY, last week, touted a headline that read: “Are We There Yet?” The article said, “The economic signs are encouraging, but we’re a long way from a comeback.” It covered recent upticks in auto and home sales. It also said the unemployment rate recently fell to “8.6%.” The USA TODAY story went on to say, “Although the decline was partly due to a 315,000 drop in the labor force as discouraged job seekers simply gave up, employment is up an average 321,000 a month since August, according to the Labor Department’s household survey. Most encouraging: Much of the hiring appears to be by small businesses, which typically fuel job growth in a recovery.” Wow, the fact that 315,000 people “simply gave up” seemed completely glossed over. Why did more than 300,000 people give up? Maybe it’s because there are precious few jobs. And what about the 400,000 people every week filing unemployment claims? Never let the facts get in the way of positive spin to please the advertisers. The USA TODAY story closes with a business professor who said, “I have a lot of confidence in the future.” (Click here for the complete USA TODAY story.)

I am happy for him, but for a little balance and more accurate reporting, maybe the newspaper could have also quoted an economist who wasn’t so optimistic? John Williams of Shadowstats.com can provide that balance. In his latest report, Williams calls the recent unemployment numbers “nonsensical hype,” and “. . . help-wanted advertising has been in monthly decline since May of this year.” The report goes on to say, “November retail sales and industrial production both showed renewed faltering in the U.S. economy, reflecting the impact of the structural impairment of consumer liquidity. Although the headline CPI inflation number was flat for November, underlying detail showed the still spreading impact of high oil prices. Inflationary pressures continue to be from Federal Reserve polices, not from strong economic activity. As the Fed increasingly is pushed to support the banking system, the central bank’s actions should accelerate the pace of U.S. dollar debasement, as well as the pace of rising U.S. inflation and precious metals prices.” (Click here for the Shadowstats.com home page.) Inflation, by the way, is running at 11% annually. (According to Williams, that would be the true inflation rate if it were calculated the way Bureau of Labor Statistics did it in 1980 or earlier.)

The economy is so weak, the Fed is going to be “pushed to support the banking system!” That means the Fed will print money to continue bailing out the banks, and not just the banks here, but overseas as well. The Fed recently opened up a new round of bailouts for European banks with what are called dollar swaps. The head of the International Monetary Fund (IMF), Christine Lagarde, warned last week of the global damage that could happen if the sovereign debt crisis in the Eurozone spun out of control. FT.com reported, “There is no economy in the world, whether low-income countries, emerging markets, middle-income countries or super-advanced economies that will be immune to the crisis that we see not only unfolding but escalating.” (Click here for the FT.com story.)

More…

Ladies and Gentlemen,

This is a quadrillion, or a thousand times one trillion. We better start to get used to these figures.

A money supply explosion will lead to accelerating inflation. It will be followed by unexpected and accelerating price inflation.

Regards,

CIGA Luis Ahlborn Sequeira

Money supply explosion will lead to accelerating inflation

Continue reading Jim’s Mailbox

Jim Sinclair’s Commentary

Extremely well presented axiom.

Jim Sinclair’s Commentary

CIGA David Madison has had it up to his neck. He sends the following and says use my full name.

David Madison’s Commentary

More proof on banker’s stupidity. Drop the paper piece and physical goes away not to be seen again for

Continue reading In The News Today

PIMCO's Humiliaton Of Europe's Failed LTRO Goes Into High Gear

The "Bond King" can't say he didn't warn you. As for the rhetorical answer to his question, we are confident readers don't need any hints. That said, we are no longer surprised to see that established managers of trillions in AUM agree on a daily basis with the hyper cynical (not to be confused with hyper-rehypothecated) musings of fringe bloggers, and it actually becomes is cool" to express agreement with said managers. How soon before every other member of the Ponzi starts exposing the Ponzi for what it is? Is the biggest Nash Equilibrium collapse in "developed world" history coming?

In Renewed Push For QE3, Bank Of America Says EURUSD Squeeze Has Run Course, Sets New Short With 1.2510 Target

It is no secret that US banks are pushing hard for a big market dump: after all that is the only thing that

could unleash QE either in Europe, or far more likely, in the US.

Whether that means the Fed will much more aggressively monetize US or,

as discussed yesterday European debt, remains unclear, but one thing is

certain: US and European banks for the most part loathe the LTRO as it

simply delays the day of printing and buys the banks time they don't

need and can't afford. Which is why Bank of America, as

it is the most exposed to a world without QE, was the first to jump in

and demand the market crash itself, by presenting an FX note saying

the EURUSD "squeeze has run its course" and is proceeding to sell the

EURUSD at 1.3045 with a target of 1.2510. Whether or not the EURUSD

gets there is irrelevant. What matters is that, as expected, the push

for QE will be renewed with far greater vigor by the very

entities that are supposed to benefit from the LTRO as paradoxically

the banks now have to scramble to offset the favorable, if very short

term, impact from the LTRO because they know it achieves nothing and

the only savior is and has always been Ben.

It is no secret that US banks are pushing hard for a big market dump: after all that is the only thing that

could unleash QE either in Europe, or far more likely, in the US.

Whether that means the Fed will much more aggressively monetize US or,

as discussed yesterday European debt, remains unclear, but one thing is

certain: US and European banks for the most part loathe the LTRO as it

simply delays the day of printing and buys the banks time they don't

need and can't afford. Which is why Bank of America, as

it is the most exposed to a world without QE, was the first to jump in

and demand the market crash itself, by presenting an FX note saying

the EURUSD "squeeze has run its course" and is proceeding to sell the

EURUSD at 1.3045 with a target of 1.2510. Whether or not the EURUSD

gets there is irrelevant. What matters is that, as expected, the push

for QE will be renewed with far greater vigor by the very

entities that are supposed to benefit from the LTRO as paradoxically

the banks now have to scramble to offset the favorable, if very short

term, impact from the LTRO because they know it achieves nothing and

the only savior is and has always been Ben.Derivatives Market: One Way Will Cease To Exist

"One day the whole derivatives market will cease to exist." - *in Reuters*

*Related, CME Group Inc. (CME), IntercontinentalExchange, Inc. (ICE)*

*Marc Faber is an international investor known for his uncanny predictions

of the stock market and futures markets around the world.*

I Plan To Short US Bonds

I plan to be short bonds. I tried a few times before and I have been wrong.

Bernanke has more money than I do and he can manipulate the market. But

soon I will short them. - *in Investment Week*

*ETFs, ProShares UltraShort 20+ Year Treasuries ETF (TBT), iShares Barclays

20+ Yr Treas.Bond ETF (TLT)*

*Jim Rogers is an author, financial commentator and successful

international investor. He has been frequently featured in Time, The New

York Times, Barron’s, Forbes, Fortune, The Wall Street Journal, The

Financial Times and is a regular guest on Bloomberg and CNBC.*

Risk on Trade/stock market rallies/Gold and silver rise/LTRO in full swing

Good evening Ladies and Gentlemen: Today the risk trade was on and as such the stock markets around the globe rallied big time on no news whatsoever. Gold finished the comex session at $1615.60 up $21.38 on the day. Silver rebounded 73 cents to $29.50. We are not finished yet with all of our gold and silver bashing by our illustrious bankers. Let us head over to the comex and see how trading

Citigroup Analyzes The Failure Of The LTRO, Muses On The Upcoming French Downgrade

Now that the LTRO flop has been digested, one of the more curious explanations for the failure comes from Citi's Steven Englander, who suggests that, surprise, surprise, Italian banks were lying yesterday when they said that they were ready and willing to buy Italian debt with LTRO proceeds. To wit: " One dose of cold water were comments from the Italian Bank Association that EBA rules won’t permit Italian banks to buy sovereign debt – this is a complete reversal from reports yesterday that indicated that Italian bank collateral would benefit from government guarantees in going to the ECB and lead to incremental Italian bank buying of sovereign debt." Gee: someone lying? NAR who could possibly conceive of that... And more to the point, Englander has an interesting observations on the market reaction to the upcoming French downgrade: "the S&P downgrade of euro zone sovereigns is hanging over the market but there is no definite timing – every day brings one rumor or another of an imminent moves. More concretely there is a chorus of French and euro zone officials managing expectations downward. S&P probably wants to manage the announcement so as to have the least market impact, but it is unclear whether that means doing it when most investors are inactive but liquidity is low or the opposite. At this point a French downgrade is no surprise. A one-step downgrade would be a positive surprise, but downgrading core-core Europe – Germany, the Netherlands, Finland – would still be a negative. Today’s LTRO may be a (reverse) template for the reaction to a downgrade: kneejerk selling followed by a rebound." Well, only one way to know for sure what happens post the downgrade - bring it on.US Housing Market Was Artificially Inflated By 14% In 2007-2010 NAR Reports

And here we go:

EXISTING U.S. HOME SALES REVISED DOWN BY 14% FROM 2007-2010

EXISTING HOME SALES REVISED DOWN BY 15% IN 2010 TO 4.19 MLN

Thank you NAR for proving what everyone knew: that the US housing market is one big lie. And next: here come the historical GDP revisions.

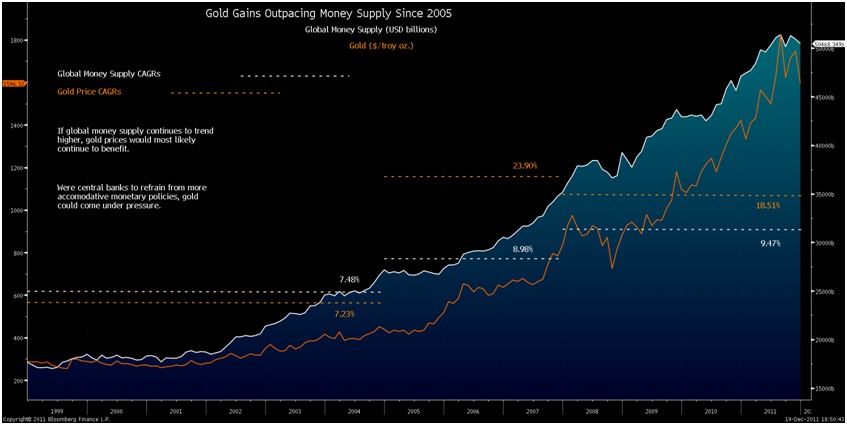

2012 Outlook For Gold – Positive Fundamentals Remain And Crucial Diversification

Stock markets globally had a torrid year with the S&P500 down 1.3%, the FTSE down 8% and the CAC and DAX down 19% and 15% respectively. Asian stock markets also fell with the Nikkei down 17%, the Hang Seng 20% and the Shanghai SE down 22%. The MSCI World Index fell 9%. Thus, gold again acted as a safe haven and protected and preserved wealth over the long term. While gold reached record nominal highs at $1,915/oz in August, it is important to continually emphasize that gold remains well below the real high, adjusted for inflation, in 1980 of $2,500/oz. Gold today at $1,625/oz is 18% below the record nominal high of $1915/oz in August 2011. More importantly, gold remains 46% below its real high of $2,500/oz. Global money supply continued to rise in 2011 and helped push gold prices to all-time highs on the fear of currency debasement. If accommodative monetary policies continue as the dominant tool for central banks, precious metals will almost certainly continue to benefit. Were this trend to turn, responsible monetary policy actions could hinder returns. We see no prospect of this in the short term – and little prospect in the medium term.

ECB's FX Swap Line With Fed Soars To $85 Billion Total

The

dollar scramble continues. In addition to the Flop Ex Machina which is

the LTRO, now confirmed to be a failure courtesy of the ECB's

relentless buying Italian and Spanish bonds, something the bank were supposed to be doing, the ECB has reported that European banks have pulled another $33 billion in

14 day funds with the ECB, which in turn means that the cumulative

total now, net of the expiring 7 day operation which runs out on

December 22 and holds $5.122 billion,

is a whopping $85 billion, and is above the level of swap line usage

before the Lehman collapse which peaked at $67 billion, then exploded to

a peak of $583 billion following the Lehman failure. Below is a chart

showing what the Fed's swap line usage will look like when the FRBNY

updates its facility usage next Thursday. This explains why both the 1

month and 3 month basis swaps (last at -130 bps, -13 bps on the day)

have been leaking wider all day once again. We, for one, can't wait for

tomorrow's H.4.1 update to see just how high the Discount Window usage

jumped to in the past week.

The

dollar scramble continues. In addition to the Flop Ex Machina which is

the LTRO, now confirmed to be a failure courtesy of the ECB's

relentless buying Italian and Spanish bonds, something the bank were supposed to be doing, the ECB has reported that European banks have pulled another $33 billion in

14 day funds with the ECB, which in turn means that the cumulative

total now, net of the expiring 7 day operation which runs out on

December 22 and holds $5.122 billion,

is a whopping $85 billion, and is above the level of swap line usage

before the Lehman collapse which peaked at $67 billion, then exploded to

a peak of $583 billion following the Lehman failure. Below is a chart

showing what the Fed's swap line usage will look like when the FRBNY

updates its facility usage next Thursday. This explains why both the 1

month and 3 month basis swaps (last at -130 bps, -13 bps on the day)

have been leaking wider all day once again. We, for one, can't wait for

tomorrow's H.4.1 update to see just how high the Discount Window usage

jumped to in the past week.Embattled Former Fannie CEO Takes Leave Of Absence From Fortress

When we first presented the surprising news of the SEC's stunning lawsuit against former Fannie Mae CEO Daniel Mudd, we said, "Incidentally, any and all LPs of Fortress Group may want to ask themselves what else (if anything) the current CEO of the company, who just happens to be Dan Mudd, is misrepresenting these days." Sure enough, it was only a matter of time before we got this:- DAN MUDD TO TAKE LEAVE OF ABSENCE AS FORTRESS CEO

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment