Submitted by Tyler Durden on 06/15/2015 - 22:01

Submitted by Tyler Durden on 06/15/2015 - 22:01

The last time the Fed tried to exit a period of massive balance sheet expansion coupled with ZIRP - back in 1937 - its strategy completely failed. The Fed tightening in H1’37 was followed in H2’37 by a severe recession and a 49% collapse in the Dow Jones. This is the ghost of 1937 and it is about to make a repeat appearance.

This could be a wild week. The volatility has already started, but

there is a good chance for more turbulence to come as the week wears on.

The overriding event of course is Greece, which is slowly inching into a

default on its massive €320 billion of debt as it lives day-by-day with

the threat of a bank bail-in hanging over its head. Add to that

unstable situation a 2-day FOMC meeting ending Wednesday.

This could be a wild week. The volatility has already started, but

there is a good chance for more turbulence to come as the week wears on.

The overriding event of course is Greece, which is slowly inching into a

default on its massive €320 billion of debt as it lives day-by-day with

the threat of a bank bail-in hanging over its head. Add to that

unstable situation a 2-day FOMC meeting ending Wednesday.The United States Is Bankrupt If Rates Rise

My point has been that the Federal Reserve cannot raise rates because the US government cannot afford to pay a fair rate of interest. It is too overleveraged and spending too much money it doesn’t have. Mr Bernanke was telling everyone rates would be raised when unemployment fell below 6.5%, a target that has long since passed. You will recall it was only a few months ago that the Fed was telling everyone to expect an increase in interest rates to be announced at this week’s meeting. That’s a remote possibility now, with the consensus saying rates won’t increase until the end of the year. So the Fed no longer has any credibility, which is the risk that needs identifying.

James Turk continues @ KingWorldNews.com

China Mocks G7 As "Gathering Of Debtors", Warns "Confrontation Will Be A Disaster For Europe"Submitted by Tyler Durden on 06/15/2015 - 20:47

China Mocks G7 As "Gathering Of Debtors", Warns "Confrontation Will Be A Disaster For Europe"Submitted by Tyler Durden on 06/15/2015 - 20:47

"Since the very beginning of the establishment of the G7, it has been a rich-man's club that consists of Western major powers and aims to maintain the collective hegemony of the US-led West. Whether the G7 will become a geopolitical tool or a Cold War relic largely depends on European countries. Unlike the US, Europe shares a closer geopolitical and economic links with Russia. If the G7 becomes a platform for the confrontation between the West and Russia, it will undoubtedly be a disaster for Europe."

China Dumps Record $120 Billion In US Treasurys In Two Month Via Belgium

Submitted by Tyler Durden on 06/15/2015 - 20:31 After a record $92.5 billion drop in March, "Belgium" sold another $24 billion in April, bringing the total liquidation to a whopping $116.4 billion for the months of March and April. This means that after adding mainland China's token increase of $2 billion in April after a $37 billion increase the month before, net of Belgium's liquidation China has sold a record $77 billion in Treasurys in the most recent two months.

Will The ECB Finally Use The Greek "Nuclear Option" This Wednesdsay?

Submitted by Tyler Durden on 06/15/2015 - 17:45 With both sides digging in and unwilling to budge, will Europe revert back to its strategy from day 1, namely creating a slow initially, then fast bank run in Greece, one which leads to gradual then sudden capital controls, resulting in civil discontent and disobedience and ultimately, a violent overthrow of the Greek government.

by Tim Price, Sovereign Man:

Today marks the end of the most notorious example of fiscal insanity in modern times.

Today marks the end of the most notorious example of fiscal insanity in modern times.

The Reserve Bank of Zimbabwe today begins a process to “demonetise” its now irrelevant currency, the Zimbabwe dollar. Between now and September 30, Zim dollars can be exchanged for the US variety.

Holders of Zim dollars should not get too excited. As the FT reports, accounts “with balances of zero to Z$175 quadrillion will be paid a flat US$5”.

As the proud owner of a Z$100 trillion note, I may not take up this generous offer. A Z$100 trillion note has far more comic potential even than a US$5 replacement.

The Central Statistics Office of Zimbabwe stopped publishing estimates of price rises in 2008, when inflation was rising at an annual 231 million percent.

Read More @ SovereignMan.com

Today marks the end of the most notorious example of fiscal insanity in modern times.

Today marks the end of the most notorious example of fiscal insanity in modern times.The Reserve Bank of Zimbabwe today begins a process to “demonetise” its now irrelevant currency, the Zimbabwe dollar. Between now and September 30, Zim dollars can be exchanged for the US variety.

Holders of Zim dollars should not get too excited. As the FT reports, accounts “with balances of zero to Z$175 quadrillion will be paid a flat US$5”.

As the proud owner of a Z$100 trillion note, I may not take up this generous offer. A Z$100 trillion note has far more comic potential even than a US$5 replacement.

The Central Statistics Office of Zimbabwe stopped publishing estimates of price rises in 2008, when inflation was rising at an annual 231 million percent.

Read More @ SovereignMan.com

from Hollands Glorie:

Transatlantic Trade and Investment Partnership is a globalist grab on democracy.

Transatlantic Trade and Investment Partnership is a globalist grab on democracy.

Guess Which Middle-East 'State' Just Beheaded Its 100th Person This Year?

Submitted by Tyler Durden on 06/15/2015 - 17:45 Nope, not ISIS... US ally Saudi Arabia just beheaded its 100th person of the year, as AFP reports, topping 2014's entire year's total of 97 already...

Consumers Are Not Following Orders

Submitted by Tyler Durden on 06/15/2015 - 20:40 Last week the government reported personal income and spending for April. After months of blaming non-existent consumer spending on cold weather, shockingly occurring during the Winter, the captured mainstream media pundits, Ivy League educated Wall Street economist lackeys, and Keynesian loving money printers at the Fed have run out of propaganda to explain why Americans are not spending money they don’t have. The corporate mainstream media is now visibly angry with the American people for not doing what the Ivy League propagated Keynesian academic models say they should be doing. An economy built upon the consumption of iGadgets, Cheetos, meat lovers stuffed crust pizza, and slave labor produced Chinese baubles, along with the production of enough arms to blow up the world ten times over, and the doling out of trillions to the non-productive class, is doomed to fail.More "Change you can Believe in"

Gap To Fire Thousands, Close A Quarter Of All Specialty Locations

Submitted by Tyler Durden on 06/15/2015 - 16:25 Moments ago, one of the biggest clothing retailers in the US confirmed the worst nightmares about the state of US consumer spending, when it reported that it would shut down over 25% of all of its specialty stores in the US, or about 175 (of which 140 will be shut in the current year), leaving the firm just 500 specialty locations and 300 outlet stores. And, in addition to the thousands of job terminations these closures would entail, the company will further fire another 250 in its headquarters.Maybe this is why...

Bridging The US Inequality Gap: Modern Women Now Weigh Same As 1960s Men

Submitted by Tyler Durden on 06/15/2015 - 16:55 While most "inequality" discussions these days are focused on male-female pay, black-white opportunities, or rich-poor wealth, there is one in which the 'lesser' half of the unequal equation is gaining... that of weight. As WaPo reports, American women now weigh the same as American men did in the 1960s.

Lying White 'African American' NAACP President Resigns Shocked By Focus On Her Race

Submitted by Tyler Durden on 06/15/2015 - 12:47 In the least shocking news of the day, white 'African American' Rachel Dolezal - the erstwhile president of Spokane's NAACP chapter, has officially resigned, seemingly surprised that "the dialogue has unexpectedly shifted internationally to my personal identity in the context of defining race and ethnicity."

Obama's Anti-Russia Policy Escalates: DoD Tells Congress Nukes Are Still On The Table

Submitted by Tyler Durden on 06/15/2015 - 21:30 The US is playing a dangerous game of nuclear brinkmanship. Robert Scher, undersecretary of defense, has even floated the idea of a nuclear first strike against Russia. Claiming that Russia has violated the INF Treaty by testing a banned ground-launched cruise missile, Scher laid out possible options in testimony before Congress...

What Comes Next, Part 2: The Looming Transformation

Submitted by Tyler Durden on 06/15/2015 - 19:50 The serial bubbles of the 2000’s are nothing more than what was wrought of the 1920’s, in general. The monetary character of both is not coincidence, as the failures that bookend each of these ages induces the transformation: from monetary to fiscal and back to monetary again. That looks like progress and accountability, but in each it only leads to more extreme measures (relative to the last) to still achieve what Robert Owen and Karl Marx conceived more than a century and a half ago. That leads us to 2015 and what is certainly the ragged end of the eurodollar standard. The third socialist age was undone by August 2007, but that did not stop its proprietors of “eurodollar socialism” under the name “investor capitalism” from trying to rebuild and restore it to full capacity. The groundwork has already been laid, and it is exactly what you would expect given the history since 1907. There are no widespread details about a return to capitalism and sound money practices, only how to overcome the third installation of that timeless barrier thrown down in the collapse of each of the asset bubbles so far – value.

Deutsche Bank Exodus Continues As Real Estate Chief Leaves For Blackstone

Submitted by Tyler Durden on 06/15/2015 - 19:25 On the heels of resignations from co-CEOs Anshu Jain and Jürgen Fitschen, Deutsche Bank loses another high profile employee as the bank's global head of commercial real estate departs for Blackstone. Jonathan Pollack's departure comes just one month after the bank's head of structured finance Elad Shraga left to start his own fund and seems to lend credence to the idea that Deutsche Bank may be in trouble.

Saxobank CIO: Credit Cycle Has Peaked, Gold Will Be Best-Performing Commodity

Submitted by Tyler Durden on 06/15/2015 - 19:00 "Forget the 1930s; inflation is different this time," says Saxobank's Steen Jakobsen, warning that while there may be a summer of growth in Europe, hell will come afterwards, "European 'cost advantage' is disappearing fast and furiously – enjoy the summer of growth – afterwards, you can expect: zero growth, zero reform and higher inflation 'expectations'... The credit cycle has peaked... and Gold will be the best performer in commodity-led rally - we see 1425/35 by year-end."

by Kurt Nimmo, Infowars:

Prime Minister David Cameron used the 800th anniversary of the Magna

Carta to argue against the Human Rights Act incorporated into British.

The Act is based on the principles of the supranational European Court

of Human Rights in Strasbourg, France. Cameron said his government plans

to replace the Act with a Bill of Rights that will affirm the supremacy

of British law over that of the internationalist European Union.

Prime Minister David Cameron used the 800th anniversary of the Magna

Carta to argue against the Human Rights Act incorporated into British.

The Act is based on the principles of the supranational European Court

of Human Rights in Strasbourg, France. Cameron said his government plans

to replace the Act with a Bill of Rights that will affirm the supremacy

of British law over that of the internationalist European Union.

“Magna Carta is something every person in Britain should be proud of. Its remaining copies may be faded, but its principles shine as brightly as ever,” Cameron said.

Mr. Cameron, however, is a bit sketchy on the document. Appearing on the David Letterman Show in 2012, Cameron was unable to answer a number of key questions about the Magna Carta and British history.

Read More @ Infowars.com

Prime Minister David Cameron used the 800th anniversary of the Magna

Carta to argue against the Human Rights Act incorporated into British.

The Act is based on the principles of the supranational European Court

of Human Rights in Strasbourg, France. Cameron said his government plans

to replace the Act with a Bill of Rights that will affirm the supremacy

of British law over that of the internationalist European Union.

Prime Minister David Cameron used the 800th anniversary of the Magna

Carta to argue against the Human Rights Act incorporated into British.

The Act is based on the principles of the supranational European Court

of Human Rights in Strasbourg, France. Cameron said his government plans

to replace the Act with a Bill of Rights that will affirm the supremacy

of British law over that of the internationalist European Union.“Magna Carta is something every person in Britain should be proud of. Its remaining copies may be faded, but its principles shine as brightly as ever,” Cameron said.

Mr. Cameron, however, is a bit sketchy on the document. Appearing on the David Letterman Show in 2012, Cameron was unable to answer a number of key questions about the Magna Carta and British history.

Read More @ Infowars.com

Visualizing The Wealth Of Nations Over 2000 Years

Submitted by Tyler Durden on 06/15/2015 - 18:35

From Year 1 to today, Angus Madison, a British economist who specialized in measurement and analysis of economic growth and development, combined modern research techniques with his own extensive knowledge of economic history to estimate the historical spread of The Wealth of Nations...

Warren Buffett And Weather Forecasts

Submitted by Tyler Durden on 06/15/2015 - 18:10 "Many investors get this one wrong. Even though they are going to be net buyers of stocks for many years to come, they are elated when stock prices rise and depressed when they fall. In effect, they rejoice because prices have risen for the "hamburgers" they will soon be buying. This reaction makes no sense. Only those who will be sellers of equities in the near future should be happy at seeing stocks rise. Prospective purchasers should much prefer sinking prices."

Bilderberg 2015 – Where Criminals Mingle With Politicians

Submitted by Tyler Durden on 06/15/2015 - 17:20 "This is what happens when you let money run riot and you allow industries to police themselves. This is what happens when the rich and powerful are endlessly granted special privileges, celebrated and permitted or even encouraged to place themselves above the law. And this is what happens when ordinary people feel bored by and excluded from politics, largely because their voices matter so little..."

from Nuclear Power Daily:

The French nuclear safety watchdog says it has found “multiple failure

modes” that carry “grave consequences” on crucial safety relief valves

on the Flamanville nuclear plant in northern France, which could lead to

meltdown. The new-build facility, that has been beset by problems for

years, will be one of the world’s biggest nuclear power plants. It was

designed by French nuclear giant Areva and is being operated by energy

giant EDF.

The French nuclear safety watchdog says it has found “multiple failure

modes” that carry “grave consequences” on crucial safety relief valves

on the Flamanville nuclear plant in northern France, which could lead to

meltdown. The new-build facility, that has been beset by problems for

years, will be one of the world’s biggest nuclear power plants. It was

designed by French nuclear giant Areva and is being operated by energy

giant EDF.

Now, the French Institute for Radiological Protection and Nuclear Safety (IRSN) has found that malfunctioning safety valves could cause its meltdown in a scenario similar to the 1979 Three Mile Island nuclear accident in the US, according to documents obtained by investigative French website Mediapart.

Read More @ Nuclearpowerdaily.com

Photo: jerseyeveningpost.com

The French nuclear safety watchdog says it has found “multiple failure

modes” that carry “grave consequences” on crucial safety relief valves

on the Flamanville nuclear plant in northern France, which could lead to

meltdown. The new-build facility, that has been beset by problems for

years, will be one of the world’s biggest nuclear power plants. It was

designed by French nuclear giant Areva and is being operated by energy

giant EDF.

The French nuclear safety watchdog says it has found “multiple failure

modes” that carry “grave consequences” on crucial safety relief valves

on the Flamanville nuclear plant in northern France, which could lead to

meltdown. The new-build facility, that has been beset by problems for

years, will be one of the world’s biggest nuclear power plants. It was

designed by French nuclear giant Areva and is being operated by energy

giant EDF.Now, the French Institute for Radiological Protection and Nuclear Safety (IRSN) has found that malfunctioning safety valves could cause its meltdown in a scenario similar to the 1979 Three Mile Island nuclear accident in the US, according to documents obtained by investigative French website Mediapart.

Read More @ Nuclearpowerdaily.com

Photo: jerseyeveningpost.com

from The Wealth Watchman:

Some of our shield brothers might remember that 3 months ago, I wrote an article detailing how Texas was on the verge of taking steps that would put their state on the cusp of a silver and gold revolution. Well, over the weekend, we got some pretty unreal news on that front. As on Friday(June 12th), Texas Governor, Greg Abbot, finally signed the bill which would codify the establishment of a state-run depository for gold and silver bullion!

This is an enormously big deal, and the word of it is spreading rapidly. Furthermore, now that Texas has signed HB 483 into law, they’ve included some extra provisions, giving this bill some real teeth, which previously didn’t exist.

What does this mean for Texas stackers? Well, this has serious implications: some which are fairly obvious, but others which are rather more hidden. However, as I continue to read commentaries on HB 483, I’m rather amazed to see that the most serious things which the bill does, are not even being discussed at all!

Read More…

In Dramatic Decision Judge Finds Fed Bailout Of AIG Was "Illegal", Government "Violated Federal Reserve Act"

Submitted by Tyler Durden on 06/15/2015 - 16:44 "Starr alleges in its own right and on behalf of other AIG shareholders that the Government’s actions in acquiring control of AIG constituted a taking without just compensation and an illegal exaction, both in violation of the Fifth Amendment to the U.S. Constitution.... Having considered the entire record, the Court finds in Starr’s favor on the illegal exaction claim. As the Court noted during closing arguments, a troubling feature of this outcome is that the Government is able to avoid any damages notwithstanding its plain violations of the Federal Reserve Act. "- U.S. Court of Claims Judge Thomas Wheeler

Magna Carta Now: Riots, Real Justice, & Reaching Our Own Runnymede Moment

Submitted by Tyler Durden on 06/15/2015 - 16:30 Right now it’s pretty clear that the temperature is rising. People are starting to wake up to the fact that, when it really counts, they’re no more free than a medieval serf. They pay taxes at gunpoint. They have no access to real justice. And many of the most important aspects of their lives, from the value of their savings to their medical care to the way they’re allowed to educate their own children, are tightly controlled. If the surge in riots and anti-government violence is any indicator, it looks like history may be repeating itself. And we may soon be reaching our own Runnymede moment.Filed under White Trash...

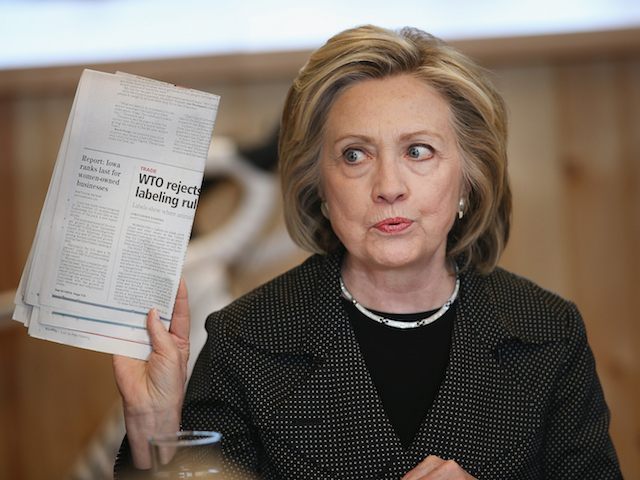

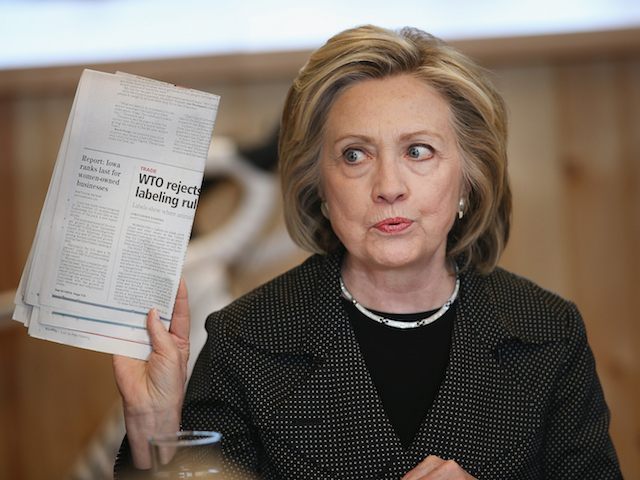

Hillary Clinton Backs Fast-Track On Obama's Trade Deals

Submitted by Tyler Durden on 06/15/2015 - 15:55 Hillary Clinton actually supports Barack Obama’s trade-policy, and even supports the way in which he is trying to get it through Congress. However, the news-media didn’t report it that way. Hilary is repeating her earlier tactics, in 2008, when she tried to give the impression that she had opposed her husband Bill Clinton’s NAFTA, though in fact she had earlier bragged about how great it was for the country and claimed it as if it were her own.

from Breitbart:

“We need to stop the flow of secret, unaccountable money,” Hillary Clinton said Saturdayduring her vaunted campaign “do over.”

“We need to stop the flow of secret, unaccountable money,” Hillary Clinton said Saturdayduring her vaunted campaign “do over.”

That she said this without a trace of irony is no real surprise. Ever since the release of “Clinton Cash” — which documented the Clintons’ love of secret and unaccountable money— the couple’s reaction has been to pretend the scandal has nothing to do with them.

Appearing on CNN, Bill Clinton claims that the millions the Clintons made from speeches paid for by foreign individuals and entities who had business before Hillary’s State Department were innocent and coincidental.

Read More @ Breitbart.com

“We need to stop the flow of secret, unaccountable money,” Hillary Clinton said Saturdayduring her vaunted campaign “do over.”

“We need to stop the flow of secret, unaccountable money,” Hillary Clinton said Saturdayduring her vaunted campaign “do over.”That she said this without a trace of irony is no real surprise. Ever since the release of “Clinton Cash” — which documented the Clintons’ love of secret and unaccountable money— the couple’s reaction has been to pretend the scandal has nothing to do with them.

Appearing on CNN, Bill Clinton claims that the millions the Clintons made from speeches paid for by foreign individuals and entities who had business before Hillary’s State Department were innocent and coincidental.

Read More @ Breitbart.com

Monday Humor: Lost In American Translation

Submitted by Tyler Durden on 06/15/2015 - 15:35 Peak Bull-Crap indeed...

from KingWorldNews:

Just when you think things in the gold and silver space can’t get any

more ridiculous, they do. Last week’s Commitment of Traders Report,

which came out on Friday, showed a massive change in positions in both

gold and silver. The large speculators, who represent primarily large

funds and black box technical players, reduced their longs substantially

and increased their shorts by a stunning amount. The commercials are on

the other side — the bullion banks primarily — and they did exactly the

opposite.

Just when you think things in the gold and silver space can’t get any

more ridiculous, they do. Last week’s Commitment of Traders Report,

which came out on Friday, showed a massive change in positions in both

gold and silver. The large speculators, who represent primarily large

funds and black box technical players, reduced their longs substantially

and increased their shorts by a stunning amount. The commercials are on

the other side — the bullion banks primarily — and they did exactly the

opposite.

15 Percent Of The Entire Annual Production Of Silver Shorted In One Week

But look at the large speculators’ position in silver, where they allegedly increased their shorts by 26,607 contracts in one week. That represents a staggering 133 million ounces of silver. Or put a different way: These speculators shorted 15 percent of the entire annual global production of silver last week. On the surface this should be wildly bullish in the near-term because the commercials routinely take the speculators to the cleaners by picking their pockets, and now the long specs are short. The only thing that defuses my short-term enthusiasm is my ongoing doubt about the veracity of numbers provided by the CFTC. In my mind, the CFTC is to the commodity world what FIFA represents to oversight in the world soccer scene and I don’t mean that as a compliment.

John Embry continues @ KingWorldNews.com

Just when you think things in the gold and silver space can’t get any

more ridiculous, they do. Last week’s Commitment of Traders Report,

which came out on Friday, showed a massive change in positions in both

gold and silver. The large speculators, who represent primarily large

funds and black box technical players, reduced their longs substantially

and increased their shorts by a stunning amount. The commercials are on

the other side — the bullion banks primarily — and they did exactly the

opposite.

Just when you think things in the gold and silver space can’t get any

more ridiculous, they do. Last week’s Commitment of Traders Report,

which came out on Friday, showed a massive change in positions in both

gold and silver. The large speculators, who represent primarily large

funds and black box technical players, reduced their longs substantially

and increased their shorts by a stunning amount. The commercials are on

the other side — the bullion banks primarily — and they did exactly the

opposite.15 Percent Of The Entire Annual Production Of Silver Shorted In One Week

But look at the large speculators’ position in silver, where they allegedly increased their shorts by 26,607 contracts in one week. That represents a staggering 133 million ounces of silver. Or put a different way: These speculators shorted 15 percent of the entire annual global production of silver last week. On the surface this should be wildly bullish in the near-term because the commercials routinely take the speculators to the cleaners by picking their pockets, and now the long specs are short. The only thing that defuses my short-term enthusiasm is my ongoing doubt about the veracity of numbers provided by the CFTC. In my mind, the CFTC is to the commodity world what FIFA represents to oversight in the world soccer scene and I don’t mean that as a compliment.

John Embry continues @ KingWorldNews.com

by Steven MacMillan, NEO, via The Phaser:

The century of ‘big data’ will be the century of unprecedented surveillance. The

dream of tyrants down through history has been the total monitoring,

control and management of the public, with the ability to predict the

behaviour of entire populations the most efficient means of achieving

this objective. For millennia, this has mainly existed in the realm of

fantasy, however with the vast leap in technology in recent decades,

this idea is becoming less a dystopian science fiction movie and more

the daily business of totalitarian high-tech regimes.

The century of ‘big data’ will be the century of unprecedented surveillance. The

dream of tyrants down through history has been the total monitoring,

control and management of the public, with the ability to predict the

behaviour of entire populations the most efficient means of achieving

this objective. For millennia, this has mainly existed in the realm of

fantasy, however with the vast leap in technology in recent decades,

this idea is becoming less a dystopian science fiction movie and more

the daily business of totalitarian high-tech regimes.

Most readers are now familiar with the predatory surveillance practices of agencies such as the NSA and GCHQ, which high-level NSA whistleblower William Binney describes as “totalitarian” in nature, adding that the goal of the NSA is “to set up the way and means to control the population”. Yet many people may not be aware of the next phase in 21st century surveillance grid; the ‘smarter city’.

Read More @ ThePhaser.com

The century of ‘big data’ will be the century of unprecedented surveillance. The

dream of tyrants down through history has been the total monitoring,

control and management of the public, with the ability to predict the

behaviour of entire populations the most efficient means of achieving

this objective. For millennia, this has mainly existed in the realm of

fantasy, however with the vast leap in technology in recent decades,

this idea is becoming less a dystopian science fiction movie and more

the daily business of totalitarian high-tech regimes.

The century of ‘big data’ will be the century of unprecedented surveillance. The

dream of tyrants down through history has been the total monitoring,

control and management of the public, with the ability to predict the

behaviour of entire populations the most efficient means of achieving

this objective. For millennia, this has mainly existed in the realm of

fantasy, however with the vast leap in technology in recent decades,

this idea is becoming less a dystopian science fiction movie and more

the daily business of totalitarian high-tech regimes.Most readers are now familiar with the predatory surveillance practices of agencies such as the NSA and GCHQ, which high-level NSA whistleblower William Binney describes as “totalitarian” in nature, adding that the goal of the NSA is “to set up the way and means to control the population”. Yet many people may not be aware of the next phase in 21st century surveillance grid; the ‘smarter city’.

Read More @ ThePhaser.com

by Pam Martens and Russ Martens, Wall Street on Parade:

The U.S. Treasury’s Office of Financial Research (OFR), the body

created under the Dodd-Frank financial reform legislation to make sure

another 2008 epic crash never happened again, quietly released a report

last week which not only suggests another 2008-style crash is possible

but that regulators will likely be blindsided again.

The U.S. Treasury’s Office of Financial Research (OFR), the body

created under the Dodd-Frank financial reform legislation to make sure

another 2008 epic crash never happened again, quietly released a report

last week which not only suggests another 2008-style crash is possible

but that regulators will likely be blindsided again.

The report, written by Jill Cetina, John McDonough, and Sriram Rajan, reveals that the big Wall Street banks are ginning up their capital measures by engaging in opaque and potentially dangerous “capital relief trades.”

To illustrate how dangerous this kind of capital relief arbitrage can be, the report says that JPMorgan’s London Whale trades (which blew a $6.2 billion hole in the insured bank) was a capital relief trade.

Read More @ Wallstreetonparade.com

The U.S. Treasury’s Office of Financial Research (OFR), the body

created under the Dodd-Frank financial reform legislation to make sure

another 2008 epic crash never happened again, quietly released a report

last week which not only suggests another 2008-style crash is possible

but that regulators will likely be blindsided again.

The U.S. Treasury’s Office of Financial Research (OFR), the body

created under the Dodd-Frank financial reform legislation to make sure

another 2008 epic crash never happened again, quietly released a report

last week which not only suggests another 2008-style crash is possible

but that regulators will likely be blindsided again.The report, written by Jill Cetina, John McDonough, and Sriram Rajan, reveals that the big Wall Street banks are ginning up their capital measures by engaging in opaque and potentially dangerous “capital relief trades.”

To illustrate how dangerous this kind of capital relief arbitrage can be, the report says that JPMorgan’s London Whale trades (which blew a $6.2 billion hole in the insured bank) was a capital relief trade.

Read More @ Wallstreetonparade.com

| Secret revealed: Bloomberg funds new gun news site, ‘The Trace’ |

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment