Submitted by Tyler Durden on 06/11/2015 - 09:02 One of the recurring explanations given why the Fed is eager to hike rates is so it has some dry powder ahead of the next recession which, some 6 years after the last one ended is overdue (especially with a negative GDP Q1). Which, incidentally, is just the topic of the next Economist cover titled simply "Watch out" adding that the world is not ready for the next recession...

This is SATIRE... Don't get your panties in a bunch just yet... You just have to love The Onion...

http://www.theonion.com/article/experts-say-best-option-now-keeping-nation-comfort-50617

Experts Agree - Best Option Now: Keep America As Comfortable As Possible Till End

Submitted by Tyler Durden on 06/11/2015 - 09:39 Saying there were no other options remaining and that continued intervention would only prolong the nation’s suffering, experts concluded Tuesday that the best course of action is to keep the United States as comfortable as possible until the end. “At a time like this, it’s completely understandable to wish for some kind of 11th-hour miracle, but expecting the U.S. to somehow magically return to the way it was in its prime isn’t healthy or realistic.”You would think this one is from The Onion but it's true...

Zimbabwe Demonetizes: Offers US$5 Per 175 Quadrillion Zim Dollars

Submitted by Tyler Durden on 06/11/2015 - 11:46 It's over! Starting June 15th and ending September 30th, the Zimbabwe Central bank will begin its process of "demonetization" of the old Zimbabwe Dollar. The Zimbabwe dollar will be removed as legal tender after the currency’s use was abandoned in 2009 following a surge in inflation to 500 billion percent. For bank accounts containing up to 175 quadrillion Zimbabwe dollars they will be paid $5, the country’s central bank said. The people remain angry slamming this as "abusing one's rights in the banking system," and claiming this is being done to enrich a chosen few.

Poll Finds Majority Of Greeks Ready To Fold To Troika, Even As Anti-Austerity Protests Return

Submitted by Tyler Durden on 06/11/2015 - 07:45 As unemployment rises to near 27%, a new poll shows more than half of Greeks support giving in to creditors "if they insist on it." Meanwhile, anti-austerity protests are back, with communist-affiliated union members demonstrating at the finance ministry in Athens.

by Mac Slavo, SHTFPlan:

The blogosphere is sounding off about a pending new Obama policy that would impact not only the 2nd Amendment, but the 1st Amendment as well.

As incredible as it seems, individuals would be in violation by “merely posting information on the Internet about common firearms” which “could be interpreted as illegally sharing sensitive information with foreign nationals”

Applying issues related to “exporting” and “foreign nations” under an international treaty to individual on-line speech (under the guise of improperly sharing technical data about firearms) may seem like a stretch, but it is apparently what is happening, unless public opposition is voiced before this oh-so quiet regulation sets in towards the end of summer.

Read More @ SHTFPlan.com

The blogosphere is sounding off about a pending new Obama policy that would impact not only the 2nd Amendment, but the 1st Amendment as well.

As incredible as it seems, individuals would be in violation by “merely posting information on the Internet about common firearms” which “could be interpreted as illegally sharing sensitive information with foreign nationals”

Applying issues related to “exporting” and “foreign nations” under an international treaty to individual on-line speech (under the guise of improperly sharing technical data about firearms) may seem like a stretch, but it is apparently what is happening, unless public opposition is voiced before this oh-so quiet regulation sets in towards the end of summer.

Read More @ SHTFPlan.com

Fighting Cronyism With The Corruption ETF

Submitted by Tyler Durden on 06/11/2015 - 11:23 It seems like there's an ETF for everything nowadays. From global warming ETFs to fertilizer ETFs, Wall Street has neatly packaged nearly every type of investment to attract your cash. One thing they forgot to package was corruption. Considering how they are already overflowing in it, perhaps they just took it for granted. However, for many investors, corruption is worth taking a second look.

Channel Stuffing The Economy: There Has Never Been More Cars "On The Sidelines"

Submitted by Tyler Durden on 06/11/2015 - 10:57 Welcome to the new normal... The "if we build it (and offer credit to anyone who can fog a mirror), they will come" economy. While LeBeau and his cronies are cock-a-hoop over auto sales (no matter how those sales are achieved), it seems the carmakers are way ahead as the value of cars on the sidelines (inventories) has never, ever, been greater than now.

IMF Crushes Greek Deal Hopes, Says "No Progress Made", Halts Talks After Major Differences Remain

Submitted by Tyler Durden on 06/11/2015 - 10:34 And just like that we are back to the rumor drawing board.IMF'S RICE SAYS NO PROGRESS MADE TOWARD DEAL WITH GREECE, IMF HAS MAJOR DIFFERENCES WITH GREECE IN KEY AREAS: SPOKESMAN

IMF'S TECHNICAL TEAM ON GREECE HAS LEFT BRUSSELS, RICE SAYS

But "two Bloomberg sources" said yesterday a deal was almost assured. What gives?

14 Reasons Why Jamie Dimon "Understands The Global Banking System"

Submitted by Tyler Durden on 06/11/2015 - 10:20 Elizabeth Warren may or may not understand the "global banking system" as Jamie Dimon alleges, but the JPM CEO certainly does as the following 14 "reasons" clearly confirm...

Business Inventories Jump Most In 11 Months, Push Sales-Ratio Into Recessionary Environment

Submitted by Tyler Durden on 06/11/2015 - 10:06 Business inventories-to-sales ratios remain in the flahing red recessionary environment as inventories surge more than expected in April. The biggest "field of dreams" appears to be Clothing and Building Materials. The 0.4% rise (against 0.2% expectations) of business inventories is the highest since May 2014. Motor Vehicles saw a 1.2% rise MoM in inventories (and 5.9% YoY) leading the surge in the "if we build it, credit will enable everyone to buy it" economy.

Consumer Comfort Plunges As Buying Climate Crashes Most Since Lehman

Submitted by Tyler Durden on 06/11/2015 - 09:53 Bloomberg's Consumer Comfort Index dropped to its lowest since November having fallen 9 straight weeks (despite all that exuberant equity market hope). Under the covers the situation is even more worrisome as the US consumer propensity to 'buy' has crashed by the most since Lehman. The drop in high income earners' comfort continues to diverge from the new highs in stocks...

Initial Jobless Claims Rise, Unchanged For 6 Months; Continuing Claims Surge Most In 6 Months

Submitted by Tyler Durden on 06/11/2015 - 08:48 Following last week's dip back towards record lows, initial jobless claims rose very modestly this week to 297k (slightly worse than expected). This leaves initial jobless claims practically unchanged for the last 6 months, despite the surge in JOLTS that we saw in recent months. Rather oddly, continuing claims rose by their most in 6 months last week to 2.265mm.

Greek Stocks Soar Most Since Election On Deal Hopes

Submitted by Tyler Durden on 06/11/2015 - 08:23 Greek Stocks are up over 7% this morning as yesterday's denied deal rumors have escalated into great deal hopes amid bank deposit runs and ELA increases. For context this brings the Athens index back to 3-day highs and is the biggest move since the optimistic surges we saw right after Tsipras was elected in late-January...

Back Then: "Regular, Frequent Corrections"; Now: "Fewer, Bigger Corrections"

Submitted by Tyler Durden on 06/11/2015 - 08:08 Citi has presented what may be the best summary of the bifurcation between the "old" normal-market, and "new" centrally-planned and increasingly illiquid "market" as follows: back then: regular, frequent corrections; now: fewer, bigger corrections If you were laid off from your job, would you be willing to train your

replacement if your company threatened to take away your severance pay

if you didn’t do it? And how would you feel if your replacement came

from India, and the only reason your company was replacing you was

because the foreign worker was a lot less expensive? Sadly, this is

happening all over America – especially in the information technology

field. Huge corporations such as Disney and Southern California Edison

are coldly firing existing tech workers and filling those jobs with much

cheaper foreign replacements. They are doing this by blatantly abusing

the H-1B temporary worker visa program. Workers that had been doing a

solid job for decades are being replaced without any hesitation just

because it will save those firms a little bit of money. There is very,

very little loyalty left in corporate America today. Even if you have

poured your heart and your soul into your company for years, that

ultimately means very little. The moment that your usefulness is over,

most firms will replace you in a heartbeat these days.

If you were laid off from your job, would you be willing to train your

replacement if your company threatened to take away your severance pay

if you didn’t do it? And how would you feel if your replacement came

from India, and the only reason your company was replacing you was

because the foreign worker was a lot less expensive? Sadly, this is

happening all over America – especially in the information technology

field. Huge corporations such as Disney and Southern California Edison

are coldly firing existing tech workers and filling those jobs with much

cheaper foreign replacements. They are doing this by blatantly abusing

the H-1B temporary worker visa program. Workers that had been doing a

solid job for decades are being replaced without any hesitation just

because it will save those firms a little bit of money. There is very,

very little loyalty left in corporate America today. Even if you have

poured your heart and your soul into your company for years, that

ultimately means very little. The moment that your usefulness is over,

most firms will replace you in a heartbeat these days.Read More…

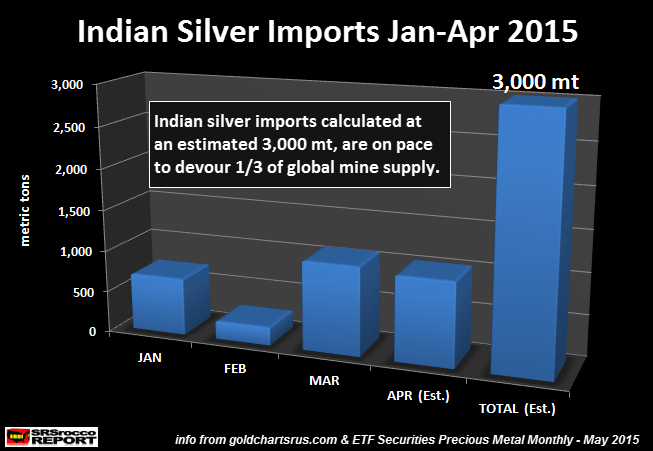

As it pertains to silver, something big is taking place in India. While investors were amazed by the massive volume of Indian silver imports last year, 2015 may turn out to be a real whopper. Indians are buying so much silver, they are on track to surpass 2014’s record by a wide margin.

So, how much silver is India importing? Well, according to Koos Jansen’s article at Bullionstar.com, India imported a record 7,063 metric tons of silver in 2014. This was up 15% from 6,125 mt in 2013. Which means, India imported 25% of world silver mine supply in 2014.

So, how about 2015? Well, ETF Securities just put out their Precious Metals Monthly Report for May 2015 and stated the following:

Read More @ SRSroccoreport.com

by Rory, The Daily Coin:

It appears that, once again, we find ourselves in situation where the

mainstream media is pure spin mode and pumping lie after lie about how

well the economy is doing. Since the beginning of this year I have been

paying close attention to two strong indicators of just how well our

global economy is doing. Time for another blue pill.

It appears that, once again, we find ourselves in situation where the

mainstream media is pure spin mode and pumping lie after lie about how

well the economy is doing. Since the beginning of this year I have been

paying close attention to two strong indicators of just how well our

global economy is doing. Time for another blue pill.

Earlier today I was speaking with Dave and we were discussing our upcoming interview with Wolf Richter. (to be recorded and released in the early part of July) and we fell into a conversation about the “ties-that-bind”. It has been shown time and again that actions always have a reaction. This is a simple law of nature. If you are looking at the Baltic Dry Index, which is one of my favorite charts, as it can not be rigged due to the fact it is based on what people get paid. Most people don’t like getting their pay jacked-around, so, in my opinion, this is a pretty “clean” set of numbers. One of charts that Mr. Richter likes to look at is the Shanghai Containerized Freight Index. Once again, this has a direct impact on an individuals livelihood, so the odds of it being rigged are greatly diminished.

Read More @ TheDailyCoin.org

It appears that, once again, we find ourselves in situation where the

mainstream media is pure spin mode and pumping lie after lie about how

well the economy is doing. Since the beginning of this year I have been

paying close attention to two strong indicators of just how well our

global economy is doing. Time for another blue pill.

It appears that, once again, we find ourselves in situation where the

mainstream media is pure spin mode and pumping lie after lie about how

well the economy is doing. Since the beginning of this year I have been

paying close attention to two strong indicators of just how well our

global economy is doing. Time for another blue pill.Earlier today I was speaking with Dave and we were discussing our upcoming interview with Wolf Richter. (to be recorded and released in the early part of July) and we fell into a conversation about the “ties-that-bind”. It has been shown time and again that actions always have a reaction. This is a simple law of nature. If you are looking at the Baltic Dry Index, which is one of my favorite charts, as it can not be rigged due to the fact it is based on what people get paid. Most people don’t like getting their pay jacked-around, so, in my opinion, this is a pretty “clean” set of numbers. One of charts that Mr. Richter likes to look at is the Shanghai Containerized Freight Index. Once again, this has a direct impact on an individuals livelihood, so the odds of it being rigged are greatly diminished.

Read More @ TheDailyCoin.org

from Washington’s Blog:

US military and families: the Oath of Enlistment is the military’s honor and foundation of armed service: “defend the Constitution against all enemies, foreign and domestic.”

Basic training includes instruction to refuse unlawful orders, with officers authorized to arrest those who issue them. The most important unlawful order to recognize is to deploy for OBVIOUS unlawful war.

Current US wars, including any attack on Syria, Iran (and here, here), and/or any other “barbaric terrorist” enemy, are Orwellian unlawful because US armed attacks, invasions, and occupations of foreign lands are unlawful Wars of Aggression. Two US treaties, the Kellogg-Briand Pact and UN Charter, make armed attacks on another nation unlawful unless in response to armed attack by that nation’s government. Under Article Six of the US Constitution, a treaty is our “supreme Law of the Land;” meaning that no order can compromise a US active treaty.

Read More @ WashingtonsBlog.com

US military and families: the Oath of Enlistment is the military’s honor and foundation of armed service: “defend the Constitution against all enemies, foreign and domestic.”

Basic training includes instruction to refuse unlawful orders, with officers authorized to arrest those who issue them. The most important unlawful order to recognize is to deploy for OBVIOUS unlawful war.

Current US wars, including any attack on Syria, Iran (and here, here), and/or any other “barbaric terrorist” enemy, are Orwellian unlawful because US armed attacks, invasions, and occupations of foreign lands are unlawful Wars of Aggression. Two US treaties, the Kellogg-Briand Pact and UN Charter, make armed attacks on another nation unlawful unless in response to armed attack by that nation’s government. Under Article Six of the US Constitution, a treaty is our “supreme Law of the Land;” meaning that no order can compromise a US active treaty.

Read More @ WashingtonsBlog.com

from Gold Core:

The first four months of 2015 saw India import possibly as much as

3,000 tonnes of silver bullion. If the momentum is maintained India is

on track to import a staggering 9,000 tonnes over the course of 2015.

The first four months of 2015 saw India import possibly as much as

3,000 tonnes of silver bullion. If the momentum is maintained India is

on track to import a staggering 9,000 tonnes over the course of 2015.

This would represent almost one third of total annual mine supply globally. Worldwide mine supply was 877 million troy ounces (27,277 metric tonnes).

It would represent a 27% increase in India’s 2014 silver imports of 7063 tonnes which itself was a 13% increase on the 2013 figure showing a steadily growing demand for physical silver in India with each passing year.

Read More @ GoldCore.com

The first four months of 2015 saw India import possibly as much as

3,000 tonnes of silver bullion. If the momentum is maintained India is

on track to import a staggering 9,000 tonnes over the course of 2015.

The first four months of 2015 saw India import possibly as much as

3,000 tonnes of silver bullion. If the momentum is maintained India is

on track to import a staggering 9,000 tonnes over the course of 2015.This would represent almost one third of total annual mine supply globally. Worldwide mine supply was 877 million troy ounces (27,277 metric tonnes).

It would represent a 27% increase in India’s 2014 silver imports of 7063 tonnes which itself was a 13% increase on the 2013 figure showing a steadily growing demand for physical silver in India with each passing year.

Read More @ GoldCore.com

from NextNewsNetwork:

If you let this happen...your personally...screwing your own future generations...

from DAHBOO777:

from DAHBOO777:

from ZenGardner:

From the 1920s to the 1990s, the Zionists controlled the storyline in

the West on the Israel-Palestine conflict. This meant that their version

of history was the only version as far as most of the people in the

West were concerned. Consequentially, they had an uncontested media

field to label the Palestinians and their supporters as “terrorists” –

the charge of anti-Semitism was not yet widely used. Also, as a

consequence of their monopoly, the Zionists did not bother to engage in

public debate.

From the 1920s to the 1990s, the Zionists controlled the storyline in

the West on the Israel-Palestine conflict. This meant that their version

of history was the only version as far as most of the people in the

West were concerned. Consequentially, they had an uncontested media

field to label the Palestinians and their supporters as “terrorists” –

the charge of anti-Semitism was not yet widely used. Also, as a

consequence of their monopoly, the Zionists did not bother to engage in

public debate.

Then, over the last 20 years the Zionists slowly lost their monopoly. In part, this was due to the fact that in 1993 the Palestine Liberation Organisation (PLO) recognised Israel’s right to exist and renounced terrorism, and in the following years many of the Arab states made or offered peace. However, the Israelis did not respond in kind. In particular, they failed to respond in a fair and just way to US-sponsored peace efforts. Why so?

Read More @ ZenGardner.com

From the 1920s to the 1990s, the Zionists controlled the storyline in

the West on the Israel-Palestine conflict. This meant that their version

of history was the only version as far as most of the people in the

West were concerned. Consequentially, they had an uncontested media

field to label the Palestinians and their supporters as “terrorists” –

the charge of anti-Semitism was not yet widely used. Also, as a

consequence of their monopoly, the Zionists did not bother to engage in

public debate.

From the 1920s to the 1990s, the Zionists controlled the storyline in

the West on the Israel-Palestine conflict. This meant that their version

of history was the only version as far as most of the people in the

West were concerned. Consequentially, they had an uncontested media

field to label the Palestinians and their supporters as “terrorists” –

the charge of anti-Semitism was not yet widely used. Also, as a

consequence of their monopoly, the Zionists did not bother to engage in

public debate.Then, over the last 20 years the Zionists slowly lost their monopoly. In part, this was due to the fact that in 1993 the Palestine Liberation Organisation (PLO) recognised Israel’s right to exist and renounced terrorism, and in the following years many of the Arab states made or offered peace. However, the Israelis did not respond in kind. In particular, they failed to respond in a fair and just way to US-sponsored peace efforts. Why so?

Read More @ ZenGardner.com

from TruthNeverTold:

from Wolf Street:

The Chinese stock-market mania has created $6.5 trillion in “value”

over the last 12 months. For perspective, that “value” amounts to 63% of

China’s 2014 GDP of $10.4 trillion. No other stock market has ever

accomplished that much in such a short time. Mainland Chinese have

borrowed $348 billion on margin, according to Bloomberg. They want to

fire up “value” creation. Everyone is doing it. People are opening new

accounts as if there were no tomorrow. And yet, the economy is heading

for a hard landing.

The Chinese stock-market mania has created $6.5 trillion in “value”

over the last 12 months. For perspective, that “value” amounts to 63% of

China’s 2014 GDP of $10.4 trillion. No other stock market has ever

accomplished that much in such a short time. Mainland Chinese have

borrowed $348 billion on margin, according to Bloomberg. They want to

fire up “value” creation. Everyone is doing it. People are opening new

accounts as if there were no tomorrow. And yet, the economy is heading

for a hard landing.

Hard-landing gurus have been predicting it for years, and have been frustrated for as long, because there was no hard landing, or even a soft landing, or any landing. China’s economy had turned into a miracle, flying at high altitude, powered by monetary and credit propellants, a construction boom, phenomenal build-out of overcapacity, and strong global demand for its goods.

Read More @ Wolfstreet.com

image/alphanow.com

The Chinese stock-market mania has created $6.5 trillion in “value”

over the last 12 months. For perspective, that “value” amounts to 63% of

China’s 2014 GDP of $10.4 trillion. No other stock market has ever

accomplished that much in such a short time. Mainland Chinese have

borrowed $348 billion on margin, according to Bloomberg. They want to

fire up “value” creation. Everyone is doing it. People are opening new

accounts as if there were no tomorrow. And yet, the economy is heading

for a hard landing.

The Chinese stock-market mania has created $6.5 trillion in “value”

over the last 12 months. For perspective, that “value” amounts to 63% of

China’s 2014 GDP of $10.4 trillion. No other stock market has ever

accomplished that much in such a short time. Mainland Chinese have

borrowed $348 billion on margin, according to Bloomberg. They want to

fire up “value” creation. Everyone is doing it. People are opening new

accounts as if there were no tomorrow. And yet, the economy is heading

for a hard landing.Hard-landing gurus have been predicting it for years, and have been frustrated for as long, because there was no hard landing, or even a soft landing, or any landing. China’s economy had turned into a miracle, flying at high altitude, powered by monetary and credit propellants, a construction boom, phenomenal build-out of overcapacity, and strong global demand for its goods.

Read More @ Wolfstreet.com

image/alphanow.com

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment