Global markets are changing drastically and showing volatilities like

we saw back in late 2008. I am not talking about stock markets, it is

the debt and currency markets that are schizophrenic. Oddly, even after

all of the various Western “QE’s”, liquidity suddenly looks like it is

drying up. A great article as to why even the depth in the U.S.

Treasury market has disappeared can be read here http://www.zerohedge.com/

Global markets are changing drastically and showing volatilities like

we saw back in late 2008. I am not talking about stock markets, it is

the debt and currency markets that are schizophrenic. Oddly, even after

all of the various Western “QE’s”, liquidity suddenly looks like it is

drying up. A great article as to why even the depth in the U.S.

Treasury market has disappeared can be read here http://www.zerohedge.com/First and foremost, I believe we are about to find out central banks are not the omnipotent powers we’ve been led to believe. You might as well say central banks have been perceived as all powerful, all knowing and the savior of any and all things “bad”. The confidence in central bank’s abilities to fix anything and everything has grown to epic proportions and is now ingrained everywhere. This thought process is so prevalent, we might as well say it is “imprinted” in the mass psyche from birth!

Read More…

from KingWorldNews:

Even though the former Chairman of the Federal Reserve is now getting

paid privately for his economic and market prognostications, he is still

unable to identify or acknowledge the monumental bubbles that central

banks have engineered. Mr. Bernanke, who was recently interviewed in

Korea, tried to assure investors that rate hikes (whenever they begin)

would be good news for the U.S. economy.

Even though the former Chairman of the Federal Reserve is now getting

paid privately for his economic and market prognostications, he is still

unable to identify or acknowledge the monumental bubbles that central

banks have engineered. Mr. Bernanke, who was recently interviewed in

Korea, tried to assure investors that rate hikes (whenever they begin)

would be good news for the U.S. economy.

He was also very “optimistic” there would not be a hard landing in China. And, not surprisingly, the man who is now gainfully employed at the Brookings Institution, Pimco and hedge fund Citadel, is also “encouraged” by Japanese Premier Shinzo Abe’s growth strategy. This is despite the fact that the thrust of Abenomics has been to depreciate the value of the Yen by 35 percent in the past two and a half years.

Michael Pento Continues @ KingWorldNews.com

Even though the former Chairman of the Federal Reserve is now getting

paid privately for his economic and market prognostications, he is still

unable to identify or acknowledge the monumental bubbles that central

banks have engineered. Mr. Bernanke, who was recently interviewed in

Korea, tried to assure investors that rate hikes (whenever they begin)

would be good news for the U.S. economy.

Even though the former Chairman of the Federal Reserve is now getting

paid privately for his economic and market prognostications, he is still

unable to identify or acknowledge the monumental bubbles that central

banks have engineered. Mr. Bernanke, who was recently interviewed in

Korea, tried to assure investors that rate hikes (whenever they begin)

would be good news for the U.S. economy.He was also very “optimistic” there would not be a hard landing in China. And, not surprisingly, the man who is now gainfully employed at the Brookings Institution, Pimco and hedge fund Citadel, is also “encouraged” by Japanese Premier Shinzo Abe’s growth strategy. This is despite the fact that the thrust of Abenomics has been to depreciate the value of the Yen by 35 percent in the past two and a half years.

Michael Pento Continues @ KingWorldNews.com

Everything's Fine... If You Ignore History

Submitted by Tyler Durden on 06/08/2015 - 13:23 "...at the end of the day, the "new normal" shouldn't be one where our current best is still worse than our prior worst."

from ENE and Citizen of Gotham:

Gov’t Expert: West Coast will soon be hit by 800 Trillion Bq of Fukushima Cesium-137 — Nearly equal to amount of fallout deposited on Japan — Levels in Pacific “higher than expected” — “Main body of surface plume has reached off coast of US” — Never slowed down while crossing ocean, contrary to prediction.

Gov’t Expert: West Coast will soon be hit by 800 Trillion Bq of Fukushima Cesium-137 — Nearly equal to amount of fallout deposited on Japan — Levels in Pacific “higher than expected” — “Main body of surface plume has reached off coast of US” — Never slowed down while crossing ocean, contrary to prediction.

from Fukushima Diary:

Tepco reported still 960,000 Bq / hour of Cesium-134 and 137 is assumed

to be discharged from Reactor 1 -4 to the air this April. This is 2.7

times much as their provisional figure published in the end of April.

Tepco reported still 960,000 Bq / hour of Cesium-134 and 137 is assumed

to be discharged from Reactor 1 -4 to the air this April. This is 2.7

times much as their provisional figure published in the end of April.

Tepco states the difference is caused by the change of calculation method. It strongly suggests the entire historical discharged volume of Cs-134/137 has been underestimated since 311 however they did not disclose the recalculated discharged volume before April of 2014.

Comparing to May of 2014, the discharged volume of Cs-134/137 increased to 180% this April. Tepco however states this is lower than 10% of the set point of “discharge control”, and they haven’t made any explanation on this increase.

Read More @ Fukushima-Diary.com

Tepco reported still 960,000 Bq / hour of Cesium-134 and 137 is assumed

to be discharged from Reactor 1 -4 to the air this April. This is 2.7

times much as their provisional figure published in the end of April.

Tepco reported still 960,000 Bq / hour of Cesium-134 and 137 is assumed

to be discharged from Reactor 1 -4 to the air this April. This is 2.7

times much as their provisional figure published in the end of April.Tepco states the difference is caused by the change of calculation method. It strongly suggests the entire historical discharged volume of Cs-134/137 has been underestimated since 311 however they did not disclose the recalculated discharged volume before April of 2014.

Comparing to May of 2014, the discharged volume of Cs-134/137 increased to 180% this April. Tepco however states this is lower than 10% of the set point of “discharge control”, and they haven’t made any explanation on this increase.

Read More @ Fukushima-Diary.com

White House Admits Economies Of European Allies Crippled By Russian Sanctions

Submitted by Tyler Durden on 06/08/2015 - 14:21 Overnight it was none other than the White House itself which finally admitted that the entire brilliant idea of collapsing the Russian economy by way of sanctions across the western world, ended up hurting European nations (i.e., US partners) who had no choice but to "sacrifice their own economies."

from Armstrong Economics:

Presidential approval ratings show that Obama now enjoys the status of

a lower approval rating than George W. Bush, and that is really saying

something. Obama is clearly a Marxist. He buys into the problem that the

people are saving too much, and is using this to entertain the idea of

placing a cap on how much an individual is allowed to contribute to

their retirement plan. Additionally, he is considering adding a 10% or

so tax on your 401k or IRA account. He believe that you should not be

allowed to leave your children anything, unless you are a politician who

can be bribed by redirecting payments directly to family members to

avoid inheritance and accountability. Obama is also considering a

provision that would require, in many circumstances, you to empty your

inherited retirement account in 5 years or less.

Presidential approval ratings show that Obama now enjoys the status of

a lower approval rating than George W. Bush, and that is really saying

something. Obama is clearly a Marxist. He buys into the problem that the

people are saving too much, and is using this to entertain the idea of

placing a cap on how much an individual is allowed to contribute to

their retirement plan. Additionally, he is considering adding a 10% or

so tax on your 401k or IRA account. He believe that you should not be

allowed to leave your children anything, unless you are a politician who

can be bribed by redirecting payments directly to family members to

avoid inheritance and accountability. Obama is also considering a

provision that would require, in many circumstances, you to empty your

inherited retirement account in 5 years or less.

Read More @ ArmstrongEconomics.com

Presidential approval ratings show that Obama now enjoys the status of

a lower approval rating than George W. Bush, and that is really saying

something. Obama is clearly a Marxist. He buys into the problem that the

people are saving too much, and is using this to entertain the idea of

placing a cap on how much an individual is allowed to contribute to

their retirement plan. Additionally, he is considering adding a 10% or

so tax on your 401k or IRA account. He believe that you should not be

allowed to leave your children anything, unless you are a politician who

can be bribed by redirecting payments directly to family members to

avoid inheritance and accountability. Obama is also considering a

provision that would require, in many circumstances, you to empty your

inherited retirement account in 5 years or less.

Presidential approval ratings show that Obama now enjoys the status of

a lower approval rating than George W. Bush, and that is really saying

something. Obama is clearly a Marxist. He buys into the problem that the

people are saving too much, and is using this to entertain the idea of

placing a cap on how much an individual is allowed to contribute to

their retirement plan. Additionally, he is considering adding a 10% or

so tax on your 401k or IRA account. He believe that you should not be

allowed to leave your children anything, unless you are a politician who

can be bribed by redirecting payments directly to family members to

avoid inheritance and accountability. Obama is also considering a

provision that would require, in many circumstances, you to empty your

inherited retirement account in 5 years or less.Read More @ ArmstrongEconomics.com

The US Recovery Is Strong... In "Loan Shark" Terms

Submitted by Tyler Durden on 06/08/2015 - 15:52 It looks like this 'recovery' is going to need a triple-seasonal-adjustment to bring reality back to perception...

Why Stocks Are Not "Cheap Relative To Bonds"

Submitted by Tyler Durden on 06/08/2015 - 15:29 At present, John Hussman notes that market losses that may seem like “worst case” scenarios are actually quite run-of-the-mill expectations. As Santayana wrote, “Those who do not remember the past are condemned to repeat it." In other words, "panic before everyone else."

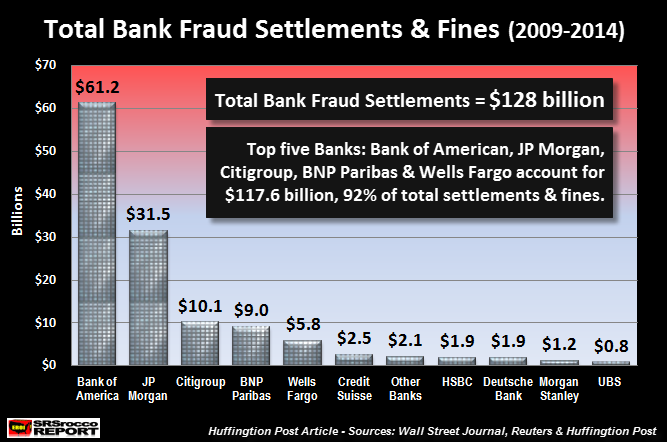

The amount of fraud taking place in the major banks throughout the world is staggering to say the least. Ironically, the only market that isn’t manipulated, is the silver market… or so they say. To make it seem as if the regulators are on the ball, many of the major banks have been found guilty of one fraud or another, paying large fines or settlements.

The most recent settlement by the criminal bankers was a cool $5.6 billion for rigging the foreign currency markets for their own financial benefit. The banks responsible for this sort of illicit behavior was from the typical list of seedy characters; Citigroup, JP Morgan, Barclays, RBS and UBS. You can read all about it in the Wall Street Journal article.

Even though $5.6 billion is a hefty figure, when we add up the total fines and settlements paid by the Banking Industry since 2009… it’s a serious amount of fiat currency. How Much?

Read More…

from CrushTheStreet:

by Michael Snyder, The Economic Collapse Blog:

A horse named “American Pharoah” just won the Triple Crown.

Is this some sort of a sign for America? The office of the presidency

was greatly strengthened under previous administrations, but now Barack

Obama has grabbed an unprecedented amount of power for himself. In this

article, I am going to focus on immigration, but Obama’s power grab is

certainly not limited to this area. And as I have written about previously,

if there is some sort of major “national emergency” over the next year

or so, the legal framework has already been created for Obama to use his

“emergency powers” to take total control of virtually everything.

So is comparing Obama to the pharoahs of ancient Egypt unfair? I don’t

think so at all. He is certainly acting as if he would like the powers

of a dictator, his policies in the Middle East would make the pharoahs proud,

and without a doubt Obama loves the adoration and worship of his fans.

In my opinion, he is the closest thing to a pharoah that the United

States has ever seen.

A horse named “American Pharoah” just won the Triple Crown.

Is this some sort of a sign for America? The office of the presidency

was greatly strengthened under previous administrations, but now Barack

Obama has grabbed an unprecedented amount of power for himself. In this

article, I am going to focus on immigration, but Obama’s power grab is

certainly not limited to this area. And as I have written about previously,

if there is some sort of major “national emergency” over the next year

or so, the legal framework has already been created for Obama to use his

“emergency powers” to take total control of virtually everything.

So is comparing Obama to the pharoahs of ancient Egypt unfair? I don’t

think so at all. He is certainly acting as if he would like the powers

of a dictator, his policies in the Middle East would make the pharoahs proud,

and without a doubt Obama loves the adoration and worship of his fans.

In my opinion, he is the closest thing to a pharoah that the United

States has ever seen.

Read More…

A horse named “American Pharoah” just won the Triple Crown.

Is this some sort of a sign for America? The office of the presidency

was greatly strengthened under previous administrations, but now Barack

Obama has grabbed an unprecedented amount of power for himself. In this

article, I am going to focus on immigration, but Obama’s power grab is

certainly not limited to this area. And as I have written about previously,

if there is some sort of major “national emergency” over the next year

or so, the legal framework has already been created for Obama to use his

“emergency powers” to take total control of virtually everything.

So is comparing Obama to the pharoahs of ancient Egypt unfair? I don’t

think so at all. He is certainly acting as if he would like the powers

of a dictator, his policies in the Middle East would make the pharoahs proud,

and without a doubt Obama loves the adoration and worship of his fans.

In my opinion, he is the closest thing to a pharoah that the United

States has ever seen.

A horse named “American Pharoah” just won the Triple Crown.

Is this some sort of a sign for America? The office of the presidency

was greatly strengthened under previous administrations, but now Barack

Obama has grabbed an unprecedented amount of power for himself. In this

article, I am going to focus on immigration, but Obama’s power grab is

certainly not limited to this area. And as I have written about previously,

if there is some sort of major “national emergency” over the next year

or so, the legal framework has already been created for Obama to use his

“emergency powers” to take total control of virtually everything.

So is comparing Obama to the pharoahs of ancient Egypt unfair? I don’t

think so at all. He is certainly acting as if he would like the powers

of a dictator, his policies in the Middle East would make the pharoahs proud,

and without a doubt Obama loves the adoration and worship of his fans.

In my opinion, he is the closest thing to a pharoah that the United

States has ever seen.Read More…

by Jim Rickards, Daily Reckoning.com:

Investors have long understood that gold is an excellent hedge against inflation. The analysis is straightforward.

Investors have long understood that gold is an excellent hedge against inflation. The analysis is straightforward.

Inflation is caused, in part, by excessive money printing. That’s something central banks can do in unlimited amounts. On the other hand, gold is scarce and costly to produce. It emerges in small quantities.

The total growth in global gold supplies is only about 1.5% per year…and has been slowing lately. Compare this to the 400% growth in base money that the US Federal Reserve has engineered since 2008. It’s easy to see how a lot more money chasing a small amount of gold can cause the dollar price of gold to rise over time.

Read More @ DailyReckoning.com

Investors have long understood that gold is an excellent hedge against inflation. The analysis is straightforward.

Investors have long understood that gold is an excellent hedge against inflation. The analysis is straightforward.Inflation is caused, in part, by excessive money printing. That’s something central banks can do in unlimited amounts. On the other hand, gold is scarce and costly to produce. It emerges in small quantities.

The total growth in global gold supplies is only about 1.5% per year…and has been slowing lately. Compare this to the 400% growth in base money that the US Federal Reserve has engineered since 2008. It’s easy to see how a lot more money chasing a small amount of gold can cause the dollar price of gold to rise over time.

Read More @ DailyReckoning.com

from International Man:

Faustian

bargain: An agreement in which a person abandons his or her spiritual

values or moral principles in order to obtain wealth or other benefits. A

deal with the devil.

Faustian

bargain: An agreement in which a person abandons his or her spiritual

values or moral principles in order to obtain wealth or other benefits. A

deal with the devil.

The argument over the existence of an Elite, who plan to control the entire world under a New World Order like some great yo-yo, has been around for a long time. Not surprisingly, events created by world leaders of all stripes in recent years give rise to an increasing belief in the likelihood of the existence of such an effort.

There are two great dangers in attempting to describe this perceived secret endeavour, and they are at opposite ends of the spectrum: a) being so naive as to assume that no collusion exists amongst various groups of leaders to further their respective ends, and b) over-simplifying such alliances to suggest that there is an Elite Master Plan that all members implicitly agree upon and follow in every respect.

Read More @ InternationalMan.com

Faustian

bargain: An agreement in which a person abandons his or her spiritual

values or moral principles in order to obtain wealth or other benefits. A

deal with the devil.

Faustian

bargain: An agreement in which a person abandons his or her spiritual

values or moral principles in order to obtain wealth or other benefits. A

deal with the devil.The argument over the existence of an Elite, who plan to control the entire world under a New World Order like some great yo-yo, has been around for a long time. Not surprisingly, events created by world leaders of all stripes in recent years give rise to an increasing belief in the likelihood of the existence of such an effort.

There are two great dangers in attempting to describe this perceived secret endeavour, and they are at opposite ends of the spectrum: a) being so naive as to assume that no collusion exists amongst various groups of leaders to further their respective ends, and b) over-simplifying such alliances to suggest that there is an Elite Master Plan that all members implicitly agree upon and follow in every respect.

Read More @ InternationalMan.com

by Dave Kranzler, Investment Research Dynamics:

Before I start in on subject matter of the title, I wanted to post a

comment someone sent me about the Martin Armstrong assertion that the

decline in Swiss exports to Asia signals a decline in demand from China.

An assertion that I said was invalid and that – by design – the

Chinese Government has made it impossible to track the amount of gold

imported to China. Here’s the remark from a very well-respected

market analyst:

Before I start in on subject matter of the title, I wanted to post a

comment someone sent me about the Martin Armstrong assertion that the

decline in Swiss exports to Asia signals a decline in demand from China.

An assertion that I said was invalid and that – by design – the

Chinese Government has made it impossible to track the amount of gold

imported to China. Here’s the remark from a very well-respected

market analyst:

The decline of gold shipments from Switzerland to China can be due to a declining supply of gold at current prices. And for a guy [Armstrong] who’s smart, he should be able to figure out the LBMA paper market fraud in a second but he just can’t seem to get it.

Read More @ InvestmentResearchDynamics.com

Before I start in on subject matter of the title, I wanted to post a

comment someone sent me about the Martin Armstrong assertion that the

decline in Swiss exports to Asia signals a decline in demand from China.

An assertion that I said was invalid and that – by design – the

Chinese Government has made it impossible to track the amount of gold

imported to China. Here’s the remark from a very well-respected

market analyst:

Before I start in on subject matter of the title, I wanted to post a

comment someone sent me about the Martin Armstrong assertion that the

decline in Swiss exports to Asia signals a decline in demand from China.

An assertion that I said was invalid and that – by design – the

Chinese Government has made it impossible to track the amount of gold

imported to China. Here’s the remark from a very well-respected

market analyst:The decline of gold shipments from Switzerland to China can be due to a declining supply of gold at current prices. And for a guy [Armstrong] who’s smart, he should be able to figure out the LBMA paper market fraud in a second but he just can’t seem to get it.

Read More @ InvestmentResearchDynamics.com

Today we will cover some approaches to A-bags (or “Bug-out Bags” if

you prefer) and specialty bags for your person and vehicle. Hopefully

after Part 1 you took a look at your own posture and assessed it for its

strengths and for areas you wish to improve upon it. I digress for one

second and stress this concept: it is self-assessment that takes

priority, and you must be both realistic and objective in assessing all

things and actions under your control.

Today we will cover some approaches to A-bags (or “Bug-out Bags” if

you prefer) and specialty bags for your person and vehicle. Hopefully

after Part 1 you took a look at your own posture and assessed it for its

strengths and for areas you wish to improve upon it. I digress for one

second and stress this concept: it is self-assessment that takes

priority, and you must be both realistic and objective in assessing all

things and actions under your control.You may be single, may have others who rely on you (children, elderly) to be the “point man,” or your family depends on your function within it (as a dependable “cog” in the family’s “engine,” so to speak). I also invite all of you to participate in the discussion in the comments and share your way, your particular “idiosyncrasies” and leanings for the A-bags. There is no true right or wrong except as weighed by your paradigm and your needs. The needs are as varied as the human race; rarely will the needs of two individuals be identical.

Read More @ ReadyNutrition.com

interventionists you might think they would pause before taking on

more projects. Each of their past projects has ended in disaster yet

still they press on. Last week the website Zero Hedge posted a report

about hacked emails between billionaire George Soros and Ukrainian

President Poroshenko.

interventionists you might think they would pause before taking on

more projects. Each of their past projects has ended in disaster yet

still they press on. Last week the website Zero Hedge posted a report

about hacked emails between billionaire George Soros and Ukrainian

President Poroshenko.Soros is very close to the Ukrainian president, who was put in power after a US-backed coup deposed the elected leader of Ukraine last year. In the email correspondence, Soros tells the Ukrainian leadership that the US should provide Ukraine “with same level of sophistication in defense weapons to match the level of opposing force.” In other words, despite the February ceasefire, Soros is pushing behind the scenes to make sure Ukraine receives top-of-the-line lethal weapons from the United States. Of course it will be up to us to pay the bill because Ukraine is broke.

Read More @ Infowars.com

from The News Doctors:

The viscousness of the Saudi regime’s assault against the people of

Yemen is largely being ignored by western media. The Saudi regime has

unleashed white phosphorous, a deadly chemical weapon, into civilian

areas. The Saudi regime has bombed hospitals, schools, power plants, and

other civilian infrastructure. The death toll has already surpassed

4,000 people, and is constantly rising, with the number of critically

wounded nearing 10,000.

The viscousness of the Saudi regime’s assault against the people of

Yemen is largely being ignored by western media. The Saudi regime has

unleashed white phosphorous, a deadly chemical weapon, into civilian

areas. The Saudi regime has bombed hospitals, schools, power plants, and

other civilian infrastructure. The death toll has already surpassed

4,000 people, and is constantly rising, with the number of critically

wounded nearing 10,000.

Saudi Arabia’s viscous, criminal attack on the people of Yemen is illegal under all standards of international law. Yemen has not attacked or in any way threatened Saudi Arabia. Saudi Arabia has no justifiable reason for unleashing such horrific terrorism on the people of Yemen.

Read More @ TheNewsDoctors.com

The viscousness of the Saudi regime’s assault against the people of

Yemen is largely being ignored by western media. The Saudi regime has

unleashed white phosphorous, a deadly chemical weapon, into civilian

areas. The Saudi regime has bombed hospitals, schools, power plants, and

other civilian infrastructure. The death toll has already surpassed

4,000 people, and is constantly rising, with the number of critically

wounded nearing 10,000.

The viscousness of the Saudi regime’s assault against the people of

Yemen is largely being ignored by western media. The Saudi regime has

unleashed white phosphorous, a deadly chemical weapon, into civilian

areas. The Saudi regime has bombed hospitals, schools, power plants, and

other civilian infrastructure. The death toll has already surpassed

4,000 people, and is constantly rising, with the number of critically

wounded nearing 10,000.Saudi Arabia’s viscous, criminal attack on the people of Yemen is illegal under all standards of international law. Yemen has not attacked or in any way threatened Saudi Arabia. Saudi Arabia has no justifiable reason for unleashing such horrific terrorism on the people of Yemen.

Read More @ TheNewsDoctors.com

by Aaron and Melissa Dykes, TruthStreamMedia:

When the American flag is flown upside down, if you were not aware, it is a signal of dire distress.

When the American flag is flown upside down, if you were not aware, it is a signal of dire distress.

Can you imagine what it is like to suddenly have low-flying military helicopters, explosions, and gunfire rocking your home in the middle of the night?

This message went out on Facebook around midnight last night from the official Lapeer County Police, EMS, and Fire Facebook page:

“ATTENTION VIEWERS: PER FLINT POLICE OPERATIONS (FPO) THE US ARMY IS DOING TRAINING IN FLINT THIS WEEKEND AND YOU MAY HEAR HELCOPTERS, GUNFIRE, & EXPLOSIONS. PLEASE DO NOT BE ALARMED.”

That message was sent out last night around midnight.

Read More @ TRUTHStreamMedia.com

When the American flag is flown upside down, if you were not aware, it is a signal of dire distress.

When the American flag is flown upside down, if you were not aware, it is a signal of dire distress.Can you imagine what it is like to suddenly have low-flying military helicopters, explosions, and gunfire rocking your home in the middle of the night?

This message went out on Facebook around midnight last night from the official Lapeer County Police, EMS, and Fire Facebook page:

“ATTENTION VIEWERS: PER FLINT POLICE OPERATIONS (FPO) THE US ARMY IS DOING TRAINING IN FLINT THIS WEEKEND AND YOU MAY HEAR HELCOPTERS, GUNFIRE, & EXPLOSIONS. PLEASE DO NOT BE ALARMED.”

That message was sent out last night around midnight.

Read More @ TRUTHStreamMedia.com

by Matt Agorist, Infowars:

Nothing says Police State USA quite like a SWAT team raiding a family home and killing their dog because they are unable to pay their natural gas bill.

Nothing says Police State USA quite like a SWAT team raiding a family home and killing their dog because they are unable to pay their natural gas bill.

The woman whose dog was killed and home destroyed by SWAT officers is Angela Zorich, and her story about her police state experience will shock the conscious.

According to a federal lawsuit filed this month, Zorich was the victim of a massive military-style raid and subsequent puppycide. The raid was carried out because police said they needed “to check if her home had electricity and natural gas service.”

Read More @ Infowars.com

Nothing says Police State USA quite like a SWAT team raiding a family home and killing their dog because they are unable to pay their natural gas bill.

Nothing says Police State USA quite like a SWAT team raiding a family home and killing their dog because they are unable to pay their natural gas bill.The woman whose dog was killed and home destroyed by SWAT officers is Angela Zorich, and her story about her police state experience will shock the conscious.

According to a federal lawsuit filed this month, Zorich was the victim of a massive military-style raid and subsequent puppycide. The raid was carried out because police said they needed “to check if her home had electricity and natural gas service.”

Read More @ Infowars.com

from Common Dreams:

Though outnumbered by police by approximately two-to-one, thousands of

people took to the streets of the Alpine resort town of

Garmisch-Partenkirchen in Germany on Saturday to express their

opposition to the hegemonic and neoliberal policies of the G7 nations as

they gathered in a nearby luxury hotel ahead their annual summit which

begins Sunday.

Though outnumbered by police by approximately two-to-one, thousands of

people took to the streets of the Alpine resort town of

Garmisch-Partenkirchen in Germany on Saturday to express their

opposition to the hegemonic and neoliberal policies of the G7 nations as

they gathered in a nearby luxury hotel ahead their annual summit which

begins Sunday.

Speaking out against the destructive policies of the world’s leading industrialized nations—which includes the U.S., U.K., Canada, France, Japan, Italy, and Germany—organized groups and individuals who participated in the protest carried signs and banners decrying inaction on climate change, the pending TransAtlantic Trade in Partnership (TTIP) agreement, ongoing wars and militarization, and the overarching assault on global democracy that has seen the power of corporations rise alongside nearly unprecedented levels of economic inequality.

Read More @ CommonDreams.com

Though outnumbered by police by approximately two-to-one, thousands of

people took to the streets of the Alpine resort town of

Garmisch-Partenkirchen in Germany on Saturday to express their

opposition to the hegemonic and neoliberal policies of the G7 nations as

they gathered in a nearby luxury hotel ahead their annual summit which

begins Sunday.

Though outnumbered by police by approximately two-to-one, thousands of

people took to the streets of the Alpine resort town of

Garmisch-Partenkirchen in Germany on Saturday to express their

opposition to the hegemonic and neoliberal policies of the G7 nations as

they gathered in a nearby luxury hotel ahead their annual summit which

begins Sunday.Speaking out against the destructive policies of the world’s leading industrialized nations—which includes the U.S., U.K., Canada, France, Japan, Italy, and Germany—organized groups and individuals who participated in the protest carried signs and banners decrying inaction on climate change, the pending TransAtlantic Trade in Partnership (TTIP) agreement, ongoing wars and militarization, and the overarching assault on global democracy that has seen the power of corporations rise alongside nearly unprecedented levels of economic inequality.

Read More @ CommonDreams.com

from Truth Never Told:

by John Rubino, Dollar Collapse:

China, India and Russia are accumulating a lot of gold, but they’re virtually alone. Traditional money managers, for a variety of reasons, view the metal as neither a viable investment (because it doesn’t pay interest) nor a substitute for cash (because they don’t understand monetary history).

But what if they changed their minds? From Chapter 21 of The Money Bubble: What To Do Before It Pops:

The fact that the East stands ready to buy all their gold at late-2013 exchange rates presents developed-world central banks with a dilemma: They can continue their manipulation, in which case they will soon run out of metal. Or they can step back – like they did when the London Gold Pool collapsed in 1968 – and let market forces choose an exchange rate, which will almost certainly be far higher than at present.

Read More @ DollarCollapse.com

China, India and Russia are accumulating a lot of gold, but they’re virtually alone. Traditional money managers, for a variety of reasons, view the metal as neither a viable investment (because it doesn’t pay interest) nor a substitute for cash (because they don’t understand monetary history).

But what if they changed their minds? From Chapter 21 of The Money Bubble: What To Do Before It Pops:

The fact that the East stands ready to buy all their gold at late-2013 exchange rates presents developed-world central banks with a dilemma: They can continue their manipulation, in which case they will soon run out of metal. Or they can step back – like they did when the London Gold Pool collapsed in 1968 – and let market forces choose an exchange rate, which will almost certainly be far higher than at present.

Read More @ DollarCollapse.com

from Wolf Street:

“I recognize the tremendous liquidity problems and the ups and the

downs on a daily basis, or even on a minute basis, and it scares the

hell out of me,” explained Bill Gross, head of the Janus Global

Unconstrained Bond Fund. The media had crowned him “bond king” when he

was still riding high, but then he was fired from Pimco, which he’d

co-founded, and whose Total Return Fund was until recently the largest

bond fund in the world.

“I recognize the tremendous liquidity problems and the ups and the

downs on a daily basis, or even on a minute basis, and it scares the

hell out of me,” explained Bill Gross, head of the Janus Global

Unconstrained Bond Fund. The media had crowned him “bond king” when he

was still riding high, but then he was fired from Pimco, which he’d

co-founded, and whose Total Return Fund was until recently the largest

bond fund in the world.

Bonds with long maturities have gotten hit the most. Since the beginning of April, the 30-year Treasury Bond Price Index has dropped 9%, crashing through the 50-day moving average and closing below the 200-day moving average on Friday. The yield rose to 3.1%, highest since October 2014.

Read More @ Wolfstreet.com

image/wsj.net

“I recognize the tremendous liquidity problems and the ups and the

downs on a daily basis, or even on a minute basis, and it scares the

hell out of me,” explained Bill Gross, head of the Janus Global

Unconstrained Bond Fund. The media had crowned him “bond king” when he

was still riding high, but then he was fired from Pimco, which he’d

co-founded, and whose Total Return Fund was until recently the largest

bond fund in the world.

“I recognize the tremendous liquidity problems and the ups and the

downs on a daily basis, or even on a minute basis, and it scares the

hell out of me,” explained Bill Gross, head of the Janus Global

Unconstrained Bond Fund. The media had crowned him “bond king” when he

was still riding high, but then he was fired from Pimco, which he’d

co-founded, and whose Total Return Fund was until recently the largest

bond fund in the world.Bonds with long maturities have gotten hit the most. Since the beginning of April, the 30-year Treasury Bond Price Index has dropped 9%, crashing through the 50-day moving average and closing below the 200-day moving average on Friday. The yield rose to 3.1%, highest since October 2014.

Read More @ Wolfstreet.com

image/wsj.net

Kansas Poor Tax A Reflection Of Nationwide Fiscal Crisis

Submitted by Tyler Durden on 06/08/2015 - 15:10 "Kansas is in trouble. After slashing income taxes in 2012, the state faces a revenue gap of more than $400 million. Republican Governor Sam Brownback and state legislators are debating how to make up the shortfall. So far they’ve agreed on one way to control how state money is spent. Starting in July, people on the dole will be limited to a single ATM withdrawal of no more than $25 per day," Bloomberg says, adding that "Kansas is among several Republican-controlled states that have recently cut or limited public-assistance funds."

First Fed Rate Hike Timing Expectations Plunge To Lowest In 5 Years

Submitted by Tyler Durden on 06/08/2015 - 14:57 If stocks discount six-months forward... bulls may have a problem/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment