from KingWorldNews:

I believe the coming collapse will be more devastating. One of the

things I remember thinking in 2004 was that unless we fix the banking

system, which was involved in all the corporate frauds at Enron,

Worldcom, and all the settlements that were going on back then, without

decoupling people’s deposits and loans from these types of risky global

endeavors and trading operations and derivatives transactions that these

banks are allowed to have in such bulk, we are going to have another

(catastrophic) problem. Of course we had the 2008 crisis. And now we

have a situation where not only have none of these banks readjusted such

that their risk is decoupled from individuals’ money and loans, but

there has been that immense infusion — $7 trillion just between the Fed

and the ECB, not to mention the other global central banks — of

effectively zero interest rates or free cash into the system.

I believe the coming collapse will be more devastating. One of the

things I remember thinking in 2004 was that unless we fix the banking

system, which was involved in all the corporate frauds at Enron,

Worldcom, and all the settlements that were going on back then, without

decoupling people’s deposits and loans from these types of risky global

endeavors and trading operations and derivatives transactions that these

banks are allowed to have in such bulk, we are going to have another

(catastrophic) problem. Of course we had the 2008 crisis. And now we

have a situation where not only have none of these banks readjusted such

that their risk is decoupled from individuals’ money and loans, but

there has been that immense infusion — $7 trillion just between the Fed

and the ECB, not to mention the other global central banks — of

effectively zero interest rates or free cash into the system.

So there are bubbles (created) from the central banks, and we add that to all the parameters that gave us the last crisis, which was banks trying to find places to extend credit to engage in non-transparent transactions, to trade with each other and then create new securities that they then sell to small towns, municipalities and pension funds.

Nomi Prins continues @ KingWorldNews.com

I believe the coming collapse will be more devastating. One of the

things I remember thinking in 2004 was that unless we fix the banking

system, which was involved in all the corporate frauds at Enron,

Worldcom, and all the settlements that were going on back then, without

decoupling people’s deposits and loans from these types of risky global

endeavors and trading operations and derivatives transactions that these

banks are allowed to have in such bulk, we are going to have another

(catastrophic) problem. Of course we had the 2008 crisis. And now we

have a situation where not only have none of these banks readjusted such

that their risk is decoupled from individuals’ money and loans, but

there has been that immense infusion — $7 trillion just between the Fed

and the ECB, not to mention the other global central banks — of

effectively zero interest rates or free cash into the system.

I believe the coming collapse will be more devastating. One of the

things I remember thinking in 2004 was that unless we fix the banking

system, which was involved in all the corporate frauds at Enron,

Worldcom, and all the settlements that were going on back then, without

decoupling people’s deposits and loans from these types of risky global

endeavors and trading operations and derivatives transactions that these

banks are allowed to have in such bulk, we are going to have another

(catastrophic) problem. Of course we had the 2008 crisis. And now we

have a situation where not only have none of these banks readjusted such

that their risk is decoupled from individuals’ money and loans, but

there has been that immense infusion — $7 trillion just between the Fed

and the ECB, not to mention the other global central banks — of

effectively zero interest rates or free cash into the system.So there are bubbles (created) from the central banks, and we add that to all the parameters that gave us the last crisis, which was banks trying to find places to extend credit to engage in non-transparent transactions, to trade with each other and then create new securities that they then sell to small towns, municipalities and pension funds.

Nomi Prins continues @ KingWorldNews.com

Carl Icahn: Donald Trump Is Completely Correct That "We Are In A Bubble Like You've Never Seen Before"

Submitted by Tyler Durden on 06/19/2015 - 19:27 I am knowledgeable concerning markets and believe Donald is completely correct to be concerned that we have “a big fat bubble coming up. We have artificially induced low interest rates.” I personally believe we are sailing in dangerous unchartered waters. I can only hope we get to shore safely. Never in the history of the Federal Reserve have interest rates been artificially held down for so long at the extremely low rates existing today. I applaud Donald for speaking out on this issue – more people should.

"The Fed Has Wreaked Havoc" Ron Paul Warns Markets' "Day Of Reckoning" Looms

Submitted by Tyler Durden on 06/19/2015 - 18:00 "I am utterly amazed at how the Federal Reserve can play havoc with the market," Ron Paul exclaimed on CNBC's "Futures Now" referring to Thursday's surge in stocks, warnings that he sees it as "being very unstable." As Paul rages, "the fallacy of economic planning" has created such a "horrendous bubble" in the bond market that it's only a matter of time before the bottom falls out. And when it does, it will lead to "stock market chaos." The current situation is Greece is coming down to the wire, with

Greece having less than 15 days to pay more than $1 billion in debt

repayments to its international creditors. The prospect of a Greece

default has led European leaders to prepare contingency plans and US

officials saying their country should do the same. A major puzzle piece

to the eurozone project, Greece, is on the precipice of becoming a poor

country to the eurozone’s south.

The current situation is Greece is coming down to the wire, with

Greece having less than 15 days to pay more than $1 billion in debt

repayments to its international creditors. The prospect of a Greece

default has led European leaders to prepare contingency plans and US

officials saying their country should do the same. A major puzzle piece

to the eurozone project, Greece, is on the precipice of becoming a poor

country to the eurozone’s south.Opinion in Greece is split. The Bank of Greece has given plenty of warning about the reality of default, while parliament’s speaker Zoe Konstantopoulou of the Syriza party published a report from the “Debt Truth Committee” saying that Greece’s debt is “odious” and should not be repaid:

Read More @ DollarVigilante.com

from Zero Hedge:

The writing has been on the wall for quite sometime.

The writing has been on the wall for quite sometime.

Deposit flight from Greece’s ailing banking sector has been running north of €500 million per day this week as the threat of capital controls casts a pall over the Greek government’s efforts to reassure the public and head off a terminal bank run.

Sparking a panic has been the most powerful tool at the troika’s disposal to bring PM Alexis Tsipras to the negotiating table and forcing Syriza to either concede to pension cuts and a VAT hike or risk social and political upheaval in the face of dark ATMs and public protests – we said this first in February and finally even the Greek government realized just what game Europe is playing.

Read More @ ZeroHedge.com

The writing has been on the wall for quite sometime.

The writing has been on the wall for quite sometime.Deposit flight from Greece’s ailing banking sector has been running north of €500 million per day this week as the threat of capital controls casts a pall over the Greek government’s efforts to reassure the public and head off a terminal bank run.

Sparking a panic has been the most powerful tool at the troika’s disposal to bring PM Alexis Tsipras to the negotiating table and forcing Syriza to either concede to pension cuts and a VAT hike or risk social and political upheaval in the face of dark ATMs and public protests – we said this first in February and finally even the Greek government realized just what game Europe is playing.

Read More @ ZeroHedge.com

from Gold Core:

We are here, staring into the abyss. The greatest monetary experiment

of the modern world – the euro, encapsulating the largest middle class

market of consumers ever assembled is about to face its greatest test to

date.

We are here, staring into the abyss. The greatest monetary experiment

of the modern world – the euro, encapsulating the largest middle class

market of consumers ever assembled is about to face its greatest test to

date.

To say anxieties are high is an understatement. Normally the broad markets will weigh up downside risk as the markets formulate and assimilate varying views on matters of importance, but not so in this case.

The markets are decidedly sanguine, as if an “invisible hand” is propping them up, guiding them, nudging them, buying any dips in stock and bond markets and maintaining calm.

Read More @ GoldCore.com

We are here, staring into the abyss. The greatest monetary experiment

of the modern world – the euro, encapsulating the largest middle class

market of consumers ever assembled is about to face its greatest test to

date.

We are here, staring into the abyss. The greatest monetary experiment

of the modern world – the euro, encapsulating the largest middle class

market of consumers ever assembled is about to face its greatest test to

date.To say anxieties are high is an understatement. Normally the broad markets will weigh up downside risk as the markets formulate and assimilate varying views on matters of importance, but not so in this case.

The markets are decidedly sanguine, as if an “invisible hand” is propping them up, guiding them, nudging them, buying any dips in stock and bond markets and maintaining calm.

Read More @ GoldCore.com

by Rachel Blevins, Truth in Media:

After his suspension for false reporting ends in August, NBC has

announced that Brian Williams will not return as the anchor of the

“Nightly News,” but he will move to covering breaking news and special

reports at NBC’s sister network, MSNBC.

After his suspension for false reporting ends in August, NBC has

announced that Brian Williams will not return as the anchor of the

“Nightly News,” but he will move to covering breaking news and special

reports at NBC’s sister network, MSNBC.Brian Williams, the NBC Nightly News anchor who was suspended from the network for six months after revealing that he had lied about his coverage of the Iraq War, will not return to the “Nightly News” after his suspension ends.

Instead, he will appear on NBC’s sister-network, MSNBC. Williams admitted that he lied about being on a helicopter that was shot down by RPG fire during the invasion of Iraq in 2003 on Feb. 4, and from there his overall credibility as a journalist was called into question.

Related: Brian Williams Admits Lying For 12 Years About Iraq War

Read More @ Truthinmedia.com

s Fraud Metastasizes on Wall Street, Regulators Ponder the Culture

by Pam Martens and Russ Martens, Wall Street on Parade:

Yesterday, Mary Jo White was in London to address the International Organization of Securities Commissions (IOSCO). While there, she commented on the U.K.’s new plan to hold senior managers in the finance industry responsible for fraud in their departments. Each senior manager will have a specific delegated responsibility and if fraud occurs in their area, he or she can be terminated and banned for life from the industry if the senior manager had knowledge of the fraud. White called the idea “intriguing.”

While White was chatting with her fellow securities regulators in London on this novel idea of actually holding crooked Wall Street bosses accountable, Thomas Hayes was on trial in another section of London over charges that he rigged the benchmark interest rate, Libor, on which interest rates on loans and financial instruments are set around the world. Yesterday, Hayes produced for the jury a “Guide to Publishing Libor Rates,” which his superiors at UBS had crafted for traders, teaching them how to manipulate Libor to benefit trading positions of UBS. Hayes’ bosses are not on trial.

Read More @ WallStreetonParade.com

Yesterday, Mary Jo White was in London to address the International Organization of Securities Commissions (IOSCO). While there, she commented on the U.K.’s new plan to hold senior managers in the finance industry responsible for fraud in their departments. Each senior manager will have a specific delegated responsibility and if fraud occurs in their area, he or she can be terminated and banned for life from the industry if the senior manager had knowledge of the fraud. White called the idea “intriguing.”

While White was chatting with her fellow securities regulators in London on this novel idea of actually holding crooked Wall Street bosses accountable, Thomas Hayes was on trial in another section of London over charges that he rigged the benchmark interest rate, Libor, on which interest rates on loans and financial instruments are set around the world. Yesterday, Hayes produced for the jury a “Guide to Publishing Libor Rates,” which his superiors at UBS had crafted for traders, teaching them how to manipulate Libor to benefit trading positions of UBS. Hayes’ bosses are not on trial.

Read More @ WallStreetonParade.com

from TheAlexJonesChannel:

from The News Doctors:

TND

Editor’s Note: Paul-Martin Foss was energetic enough to check

yesterday’s FOMC Press Conference transcript against tape and he

published an improved transcript. Click here to read it.

Oh, and yes, I must admit I’m quite fond of the above photo. As

powerful as the Fed is, it’s still run by humans well qualified to screw

things up! Yellen is small, fallible, and a bit like the Wizard of Oz — Eric Dubin

TND

Editor’s Note: Paul-Martin Foss was energetic enough to check

yesterday’s FOMC Press Conference transcript against tape and he

published an improved transcript. Click here to read it.

Oh, and yes, I must admit I’m quite fond of the above photo. As

powerful as the Fed is, it’s still run by humans well qualified to screw

things up! Yellen is small, fallible, and a bit like the Wizard of Oz — Eric Dubin

In an undererported piece of news, the Federal Reserve took the first step towards raising the federal funds rate. What exactly did the Fed do, and why is it so important?

Read More @ TheNewsDoctors.com

TND

Editor’s Note: Paul-Martin Foss was energetic enough to check

yesterday’s FOMC Press Conference transcript against tape and he

published an improved transcript. Click here to read it.

Oh, and yes, I must admit I’m quite fond of the above photo. As

powerful as the Fed is, it’s still run by humans well qualified to screw

things up! Yellen is small, fallible, and a bit like the Wizard of Oz — Eric Dubin

TND

Editor’s Note: Paul-Martin Foss was energetic enough to check

yesterday’s FOMC Press Conference transcript against tape and he

published an improved transcript. Click here to read it.

Oh, and yes, I must admit I’m quite fond of the above photo. As

powerful as the Fed is, it’s still run by humans well qualified to screw

things up! Yellen is small, fallible, and a bit like the Wizard of Oz — Eric DubinIn an undererported piece of news, the Federal Reserve took the first step towards raising the federal funds rate. What exactly did the Fed do, and why is it so important?

Read More @ TheNewsDoctors.com

from The Daily Coin:

Eric Dubin, Managing Editor of The News Doctors, wrote the following

comment to a reader on Facebook. This is, generally speaking, a HUGE

part of the dumbing-down process over the past forty or so years in this

country. The American public has been taught that gold is a “barbarous

relic” and “is not money”–both of these sentiments were uttered by Ben

Bernanke, former Federal Reserve Chairman. If people here this type of

nonsense from someone that is suppose to be “knowledgable” and a subject

matter expert, they simply take it as gospel and go on about their

business.

Eric Dubin, Managing Editor of The News Doctors, wrote the following

comment to a reader on Facebook. This is, generally speaking, a HUGE

part of the dumbing-down process over the past forty or so years in this

country. The American public has been taught that gold is a “barbarous

relic” and “is not money”–both of these sentiments were uttered by Ben

Bernanke, former Federal Reserve Chairman. If people here this type of

nonsense from someone that is suppose to be “knowledgable” and a subject

matter expert, they simply take it as gospel and go on about their

business.

How many times have we heard the argument that gold has no intrinsic value? Here’s an interesting comment and my response on Facebook:

Read More @ TheDailyCoin.org

Eric Dubin, Managing Editor of The News Doctors, wrote the following

comment to a reader on Facebook. This is, generally speaking, a HUGE

part of the dumbing-down process over the past forty or so years in this

country. The American public has been taught that gold is a “barbarous

relic” and “is not money”–both of these sentiments were uttered by Ben

Bernanke, former Federal Reserve Chairman. If people here this type of

nonsense from someone that is suppose to be “knowledgable” and a subject

matter expert, they simply take it as gospel and go on about their

business.

Eric Dubin, Managing Editor of The News Doctors, wrote the following

comment to a reader on Facebook. This is, generally speaking, a HUGE

part of the dumbing-down process over the past forty or so years in this

country. The American public has been taught that gold is a “barbarous

relic” and “is not money”–both of these sentiments were uttered by Ben

Bernanke, former Federal Reserve Chairman. If people here this type of

nonsense from someone that is suppose to be “knowledgable” and a subject

matter expert, they simply take it as gospel and go on about their

business.How many times have we heard the argument that gold has no intrinsic value? Here’s an interesting comment and my response on Facebook:

Read More @ TheDailyCoin.org

from Gold Silver Worlds:

As I see it, the following are true:

As I see it, the following are true:

a) Debt is increasing far more rapidly than growth in the underlying economies that must support that debt. Although this is also true in Japan, the UK, and Europe, I’ll focus on the US.

b) Revenue is increasing but less rapidly than debt. This is a problem.

c) There will come a time when the interest payments on exponentially increasing government debt will exceed what the economy can support. Call that point “hitting the wall.”

d) Higher interest rates will cause the US economy to “hit the wall” sooner. Lower interest rates merely delay the “day of reckoning.”

Read More @ GoldSilverWorlds.com

As I see it, the following are true:

As I see it, the following are true:a) Debt is increasing far more rapidly than growth in the underlying economies that must support that debt. Although this is also true in Japan, the UK, and Europe, I’ll focus on the US.

b) Revenue is increasing but less rapidly than debt. This is a problem.

c) There will come a time when the interest payments on exponentially increasing government debt will exceed what the economy can support. Call that point “hitting the wall.”

d) Higher interest rates will cause the US economy to “hit the wall” sooner. Lower interest rates merely delay the “day of reckoning.”

Read More @ GoldSilverWorlds.com

by Dave Kranzler, Investment Research Dynamics:

The enormous effort by eastern hemisphere countries to diversify their

reserves out of the dollar and into physical gold is quite remarkable.

The latest reports out of Russia show that is has cut its dollar

exposure in half since January 2014 and appears to be accelerating its

accumulation of gold:

The enormous effort by eastern hemisphere countries to diversify their

reserves out of the dollar and into physical gold is quite remarkable.

The latest reports out of Russia show that is has cut its dollar

exposure in half since January 2014 and appears to be accelerating its

accumulation of gold:

OUT OF DOLLARS (source: Smaulgld.com, U.S. Treasury):

Meanwhile, physical gold held in western custodial accounts at Central Banks and trading exchanges continues its exodus.

Koos Jansen has reported that custodial gold at the Bank of England dropped another 351 tonnes in the latest reporting period: Bank of England Custodial Gold Drops 351 tonnes

Read More @ Investmentresearchdynamics.com

The enormous effort by eastern hemisphere countries to diversify their

reserves out of the dollar and into physical gold is quite remarkable.

The latest reports out of Russia show that is has cut its dollar

exposure in half since January 2014 and appears to be accelerating its

accumulation of gold:

The enormous effort by eastern hemisphere countries to diversify their

reserves out of the dollar and into physical gold is quite remarkable.

The latest reports out of Russia show that is has cut its dollar

exposure in half since January 2014 and appears to be accelerating its

accumulation of gold:OUT OF DOLLARS (source: Smaulgld.com, U.S. Treasury):

Meanwhile, physical gold held in western custodial accounts at Central Banks and trading exchanges continues its exodus.

Koos Jansen has reported that custodial gold at the Bank of England dropped another 351 tonnes in the latest reporting period: Bank of England Custodial Gold Drops 351 tonnes

Read More @ Investmentresearchdynamics.com

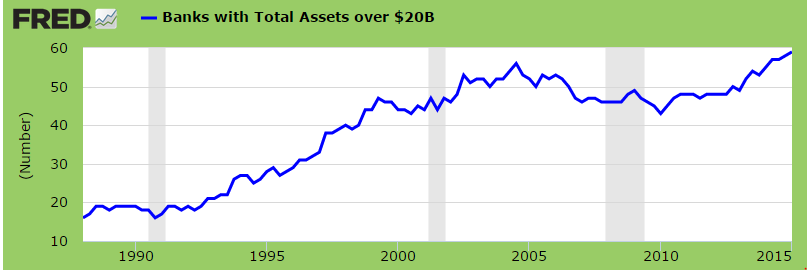

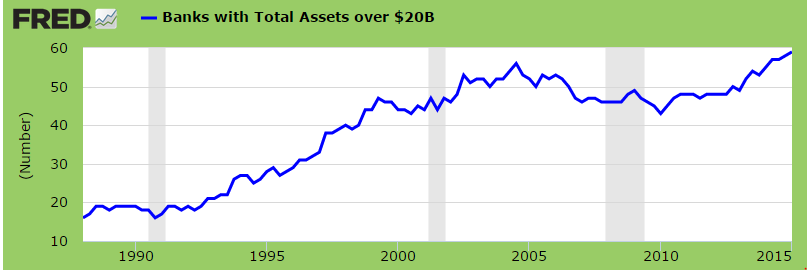

59 banks in the United States now have over $20 billion in assets. Top 3 US banks hold $6.3 trillion in assets.

from MyBudget360.com:

Remember when too big to fail was being uttered like “good morning” or some other daily phrase? Apparently people have forgotten about the dangers of too big to fail and have allowed the banking system to grow like weeds in an unattended garden. The previous peak of massive big banks was in 2004 when we had 54 banks with more than $20 billion in assets. Today we are at a new peak of 59 banks. These assets are being inflated thanks to the new property bubble that is catering to the investor class. The majority of families are being pushed to the sidelines being crowded out in the housing market and then being offered 0 percent on savings accounts while banks speculate like wild banshees. Too big to fail is back and not much attention is being placed on this. People might be too busy struggling in the low wage economy to care about banks getting dangerously large. We are now at a peak in regards to too big to fail banks.

Read More @ MyBudget360.com

from MyBudget360.com:

Remember when too big to fail was being uttered like “good morning” or some other daily phrase? Apparently people have forgotten about the dangers of too big to fail and have allowed the banking system to grow like weeds in an unattended garden. The previous peak of massive big banks was in 2004 when we had 54 banks with more than $20 billion in assets. Today we are at a new peak of 59 banks. These assets are being inflated thanks to the new property bubble that is catering to the investor class. The majority of families are being pushed to the sidelines being crowded out in the housing market and then being offered 0 percent on savings accounts while banks speculate like wild banshees. Too big to fail is back and not much attention is being placed on this. People might be too busy struggling in the low wage economy to care about banks getting dangerously large. We are now at a peak in regards to too big to fail banks.

Read More @ MyBudget360.com

Girls, Gardening, Puppies, And Pigs: Life On China's Disputed Man-Made Islands

Submitted by Tyler Durden on 06/19/2015 - 15:10 Amid criticism from Washington, Beijing has embarked on a propaganda campaign to show that despite attempts by the US and its regional allies to cast aspersions, island life in the Spratlys is all about girls, gardening, puppies, and pigs.

The Last Rebels: 25 Things We Did As Kids That Would Get Someone Arrested Today

Submitted by Tyler Durden on 06/19/2015 - 22:00 All of this babying creates incompetent, fearful adults. Our children have been enveloped in this softly padded culture of fear, and it’s creating a society of people who are fearful, out of shape, overly cautious, and painfully politically correct. They are incredibly incompetent when they go out on their own because they’ve never actually done anything on their own. Raise your hand if you survived a childhood in the 60s, 70s, and 80s that included one or more of the following, frowned-upon activities...

Cities, States Shun Moody's For Blowing The Whistle On Pension Liabilities

Submitted by Tyler Durden on 06/19/2015 - 21:30 In the wake of the Chicago downgrade, state and local governments are moving away from Moody's as the ratings agency questions pension fund return assumptions.

IMF Humiliates Greece, Repeats It Will Keep Funding Ukraine Even If It Defaults

Submitted by Tyler Durden on 06/19/2015 - 20:40 "I ... welcome the government's continued efforts to reach a collaborative agreement with all creditors," IMF Managing Director Christine Lagarde said in a statement. "This is important since this means that the Fund will be able to continue to support Ukraine through its Lending-into-Arrears Policy even in the event that a negotiated agreement with creditors in line with the program cannot be reached in a timely manner."

Fearing Capital Controls, Tourists Request Hotel Safes In Greece

Submitted by Tyler Durden on 06/19/2015 - 20:30 “Clients want to feel secure that if something happens, they’ll have funds. They’re coming with more cash.”

Rand Paul: "Americans See The Rot In The System...And Want It To End!"

Submitted by Tyler Durden on 06/19/2015 - 20:00 "My tax plan would blow up the tax code and start over. Today, the American people see the rot in the system that is degrading our economy day after day and want it to end. That is exactly what the Fair and Flat Tax will do through a plan that’s the boldest restoration of fairness to American taxpayers in over a century."

The "Obvious" Question

Submitted by Tyler Durden on 06/19/2015 - 19:30 What everyone is really thinking...

Inciting Bank Runs As A Negotiating Tactic

Submitted by Tyler Durden on 06/19/2015 - 18:30 The troika of Greek creditors has gone into full-frontal morals-be-damned attack mode. This has turned into the kind of economic warfare one would expect to see between sworn and lethal enemies, that the US would gladly use against Russia for instance, but not between partners in a union founded on principles based entirely and exclusively on being mutually beneficial to everyone involved. And all EU nations should understand by now that this is not about Greece anymore, it’s about all of them.

The Glorious Imbecility of War

Submitted by Tyler Durden on 06/19/2015 - 17:30 Today, on the eve of the bicentennial of the Battle of Waterloo, we do not celebrate war. Only a fool would celebrate something so horrible. But we pay our respects to the glorious imbecility of it. War may be dreadful, little more than a racket in many ways, but it is also a magnificent undertaking. It engages the heart and the brain at once and exposes both the genius of our race and its incredible stupidity. But we are talking about real war. Not phony wars against enemies who pose no real threat. Phony wars earn real profits for the war industry, but only an ersatz glory for the warriors. Real soldiers take no pride in them. Instead, to a real hero, they are a source of shame and embarrassment./

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment