"They’re kind of pulling a Patriot Act." When Obama signs the $1.1 trillion Spending Bill in a few hours, as he will, it will be official: the second Patriot Act will become the law, and with it what little online privacy US citizens may have had, will be gone.

Wait and see what the asshole signs on Christmas Eve...

House Passes $1.15 Trillion Spending Bill: Here Is What's In It

Submitted by Tyler Durden on 12/18/2015 - 11:53 Moments ago, the House of Representatives just passed the $1.15 trillion spending bill that includes a $680 billion package of tax-break extensions, in a 316 to 113 vote, and will now move to the Senate, where its passage is likewise assured and will be signed by the president over the next few days. For those wondering what are the main components of the spending bill, here is a quick summary.

Crude Crashes To Cycle Lows After Oil Rig Count Surges

WTI crude has collapsed to cycle lows after the US oil rig count surged by 17, the largest jump in 5 months.David Stockman Warns "Dread The Fed!" - Sell The Bonds, Sell The Stocks, Sell The House

Submitted by Tyler Durden on 12/18/2015 - 11:50 Yellen and her cohort have no clue, however, that all of their massive money printing never really left the canyons of Wall Street, but instead inflated the mother of all financial bubbles. So they are fixing to blow-up the joint for the third time this century. That was plain as day when our Keynesian school marm insisted that the Third Avenue credit fund failure this past week was a one-off event - a lone rotten apple in the barrel. Now that is the ultimate in cluelessness.

OPEC Members In Jeopardy, How Long Can They Hold Out?

Submitted by Tyler Durden on 12/18/2015 - 12:37 The Saudi strategy has yet to bear itself out, but early indications suggest it is generating returns. Non-OPEC supply is expected to suffer its steepest decline in two decades in 2016, at a drop of nearly 0.5 mbpd. Moreover, U.S. shale producers are among the hardest hit. Oil production across the seven most prolific shale plays is expected to plummet a combined 116,000 bpd in January 2016. Still, the strategy is not without sacrifice, and several OPEC members are struggling to find – and, more importantly, endure – that magical balance between non-OPEC pain, market share retention/growth, and self-inflicted damage. Their tipping points are nearly impossible to predict, but there will be more losers than winners in this game of brinksmanship.

Japan Prepares Missile Blockade In East China Sea To Halt Chinese "Maritime Aggression"

Submitted by Tyler Durden on 12/18/2015 - 12:13 "To be sure, there is nothing to stop Chinese warships from sailing through under international law, but they will have to do so in within the crosshairs of Japanese missiles."

For Caterpillar, The Depression Just Turned Three: CAT Hasn't Had A Sales Increase In 36 Consecutive Months

Submitted by Tyler Durden on 12/18/2015 - 11:32 For CAT the global manufacturing depression just turned 3 years old as the company has now suffered through 36 consecutive months of declining annual retail sales - something unprecedented in company history, and set to surpass the "only" 19 months of declining during the great financial crisis by a factor of two!Kansas City Fed Survey Collapses As New Orders Crash Most Since Great Recession

Submitted by Tyler Durden on 12/18/2015 - 11:15 Another data point to ignore... Kansas City Fed's business survey has crashed from a hope-full bounce. Dumping from a +1 print in October, Kansas collapsed to -9, the weakest since May 2015 as across the board components were abysmal. Production, Prices Paid, Employees, and inventories all cliff-dived with New Orders falling the most YoY since the Great Recession.Trannies Trounced To 20-Month Lows, Bear Market Builds

"Unequivocally terrible."

Our "Star Wars" Economy: The Fed-Farce Awakens

Submitted by Tyler Durden on 12/18/2015 - 10:50 The Fed's hubris has led it to the Dark Side.

In Largest Ever Muni Restructuring, Puerto Rico Power Authority Strikes Deal With Creditors, Insurers

Submitted by Tyler Durden on 12/18/2015 - 10:36 When last we checked in on Puerto Rico’s seemingly intractable debt debacle, Governor Alejandro Garcia Padilla was busy using an absurd revenue clawback end-around to avoid defaulting on $273 million in GO debt. On Friday, we get the latest out of Puerto Rico and the news is ... well, good we suppose. PREPA - Puerto Rico’s power authority - has reached a restructuring agreement with bondholders and insurers to refinance some $9 billion in debt via securitization.

Dow Dumps 500 Points From Post-Yellen Highs Amid "Policy Error" Fears

Submitted by Tyler Durden on 12/18/2015 - 10:21 Just in case yesterday's weakness was mistaken for "well, it's just stabilizing before the next leg higher," US equity markets are pooping the bed this morning with the Dow down over 500 points from its post-Yellen highs, FANGs plunging red, credit collapsing, and bond yields slumping. Between the widely watched quad-witching, Fed policy error concerns, and the utter failure of the Bank of Japan's efforts to save the world, global stocks and bonds are flashing red warnings for the end of centrally planned markets.

Ukraine "Crooks" Default On $3 Billion Bond To Putin

Submitted by Tyler Durden on 12/18/2015 - 10:05 “I have a feeling that they will not pay us back because they are crooks.”

"Services Will Save Us" Meme Collapses As Non-Manufacturing PMI Plunges To 2015 Lows

Submitted by Tyler Durden on 12/18/2015 - 10:03 While correlation is not causation, one would have to be an ignorant unicorn-worshipper to believe that a collapse in America's manufacturing would not have some follow-through. Following the crash in Manufacturing, Markit reported America's Services economy massively missed expectations and plunged to 53.7, lowest since Dec 2014. New orders plunged to the lowest since January 2015 and employment tumbled. As Markit reports, this is "disappointing news for an economy which has seen the first US interest rate hike for almost a decade."

Syria Stunner: German Intelligence "Cooperating" With Assad, Berlin May Reopen Embassy In Damascus

Submitted by Tyler Durden on 12/18/2015 - 09:28 On Friday we get still more evidence that the West is begrudgingly coming to terms with the fact that Assad will be sticking around for the foreseeable future in Syria, as Bild (citing anonymous sources) says German spies have been "cooperating" with Assad for "some time" and are set to establish an intelligence cell in Damascus.

Moody's Downgrades Glencore To Lowest Investment Grade Rating As CDS Trade A Multi-Year Highs

Submitted by Tyler Durden on 12/18/2015 - 09:15 Weak earnings performance in marketing operations below the current EBIT guidance of $2.4-$2.7 billion could place negative pressure on the Baa3 ratings in the absence of any mitigating measures. A weakening of the company's liquidity position, delays with the planned divestments in 2016 or a material reduction in its working capital funding capacities by the banks, as well as sustained high leverage with adjusted debt/EBITDA exceeding 4x, will also put negative pressure on the Baa3 ratings."

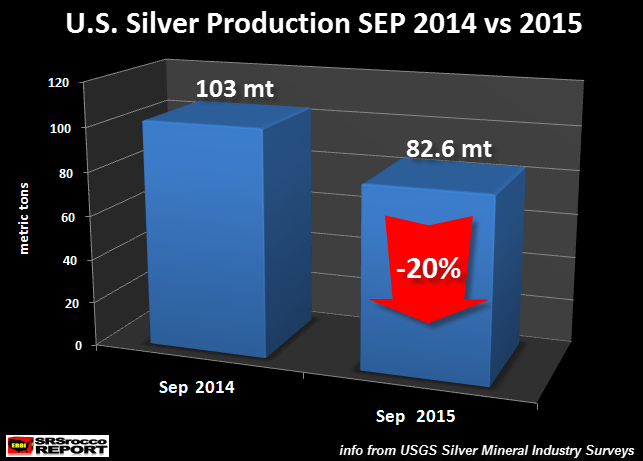

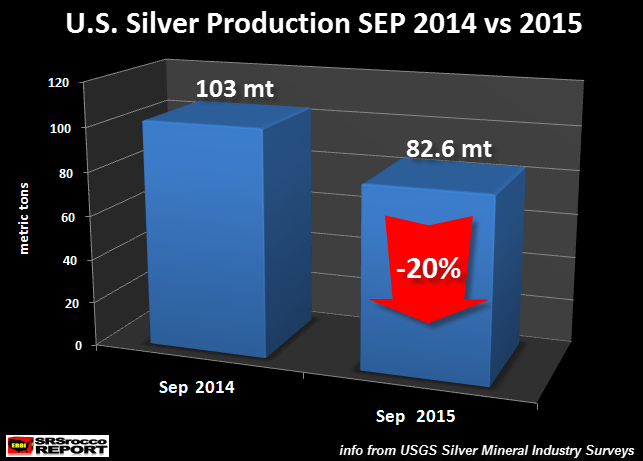

by Steve St. Angelo, SRS Rocco Report:

While the Federal Reserve continues to rig the financial markets by way of its insane interest rate policy, U.S. silver production took a big hit in September. How big? Well, let’s just say…. it took me by surprise.

According to the U.S. Geological Survey (USGS), overall domestic silver production for 2015 has trended lower compared to last year. However, the recent data for September show a much larger decline.

U.S. silver production for September fell a staggering 20% compared to the same month last year:

Read More

While the Federal Reserve continues to rig the financial markets by way of its insane interest rate policy, U.S. silver production took a big hit in September. How big? Well, let’s just say…. it took me by surprise.

According to the U.S. Geological Survey (USGS), overall domestic silver production for 2015 has trended lower compared to last year. However, the recent data for September show a much larger decline.

U.S. silver production for September fell a staggering 20% compared to the same month last year:

Read More

by Daisy Luther, The Organic Prepper:

For some people, preparedness is about the big things: the well-stocked retreat home, buying yet another firearm, or getting a super-fancy generator. While these things can certainly be classified as preparedness endeavors, it isn’t the expensive and dramatic gestures that make us truly prepared people.

The way prepared people spend their time before an emergency is the real key to survival, and this is something that no amount of money can buy.

It’s the small daily habits that become an innate part of our everyday lives – habits that may not even be noticeable to someone outside the lifestyle.

Read More

For some people, preparedness is about the big things: the well-stocked retreat home, buying yet another firearm, or getting a super-fancy generator. While these things can certainly be classified as preparedness endeavors, it isn’t the expensive and dramatic gestures that make us truly prepared people.

The way prepared people spend their time before an emergency is the real key to survival, and this is something that no amount of money can buy.

It’s the small daily habits that become an innate part of our everyday lives – habits that may not even be noticeable to someone outside the lifestyle.

Read More

from The Sleuth Journal:

Fraud. An intentional perversion of truth for the purpose of inducing another in reliance upon it to part with some valuable thing belonging to him or to surrender a legal right; Anything calculated to deceive, whether by a single act or combination, or by suppression of truth, or suggestion of what is false, whether it be by direct falsehood or innuendo, by speech or silence, word of mouth, or look or gesture.-Black’s Law Dictionary, 6th Edition

Three years ago the public learned of the most significant mass shooting in recent US history involving the deaths of 20 young school children and seven adults.

Read More

Fraud. An intentional perversion of truth for the purpose of inducing another in reliance upon it to part with some valuable thing belonging to him or to surrender a legal right; Anything calculated to deceive, whether by a single act or combination, or by suppression of truth, or suggestion of what is false, whether it be by direct falsehood or innuendo, by speech or silence, word of mouth, or look or gesture.-Black’s Law Dictionary, 6th Edition

Three years ago the public learned of the most significant mass shooting in recent US history involving the deaths of 20 young school children and seven adults.

Read More

by Pam Martens and Russ Martens, Wall Street on Parade:

In a properly functioning, rational, and efficient market, any form of

Fed tightening after seven years of filling the punch bowl with an

elixir of easy money should have been viewed by the markets as a

contraction of monetary policy and sent both stocks and risky bonds

plunging. But what we saw in the markets yesterday can only be described

as bizarre.

In a properly functioning, rational, and efficient market, any form of

Fed tightening after seven years of filling the punch bowl with an

elixir of easy money should have been viewed by the markets as a

contraction of monetary policy and sent both stocks and risky bonds

plunging. But what we saw in the markets yesterday can only be described

as bizarre.

The Dow Jones Industrial Average, composed of 30 large cap stocks which are viewed as a barometer of the overall U.S. economy, soared 244 points by the close of trading. The Nasdaq, made up mostly of smaller companies than those in the Dow, which would have a harder time in a higher interest rate environment because their debt is rated lower generally, also soared and closed up 75.77 points.

Read More…

In a properly functioning, rational, and efficient market, any form of

Fed tightening after seven years of filling the punch bowl with an

elixir of easy money should have been viewed by the markets as a

contraction of monetary policy and sent both stocks and risky bonds

plunging. But what we saw in the markets yesterday can only be described

as bizarre.

In a properly functioning, rational, and efficient market, any form of

Fed tightening after seven years of filling the punch bowl with an

elixir of easy money should have been viewed by the markets as a

contraction of monetary policy and sent both stocks and risky bonds

plunging. But what we saw in the markets yesterday can only be described

as bizarre.The Dow Jones Industrial Average, composed of 30 large cap stocks which are viewed as a barometer of the overall U.S. economy, soared 244 points by the close of trading. The Nasdaq, made up mostly of smaller companies than those in the Dow, which would have a harder time in a higher interest rate environment because their debt is rated lower generally, also soared and closed up 75.77 points.

Read More…

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment