"I’ll show up with $2 million bail money no fucking problem.”

Paul Craig Roberts On Who Really Benefits From The Rate Hike

Submitted by Tyler Durden on 12/17/2015 - 09:26 A different way of putting it is that the “rate hike” favors banks sitting on excess reserves over banks who are lending to businesses and consumers in their community. In other words, the rate hike just facilitates more looting by the One Percent."Let Them Fly There Now": Putin Threatens To Shoot Down Turkish Jets In Syria, Calls Erdogan An Ass Kisser

Submitted by Tyler Durden on 12/17/2015 - 09:00

How The Fed Just Launched The Next Bear Market: BofA's Unexpected Conclusion In 8 Charts

Submitted by Tyler Durden on 12/17/2015 - 09:40 "Rising rates and falling profits are not a good combination for asset prices, so we will turn sellers of risk in early 2016."

The Average Stock Is Just Shy Of Being In A Bear Market

Submitted by Tyler Durden on 12/17/2015 - 08:51 Depsite the exuberant buying-panic of the first Fed rate-hike in 9 years lifting stocks to within spitting distance of record highs, under the surface, equities are roiling. In fact, the average stock's distance from its highs is now at 19%... just outside of bear market territory.

Philly Fed Collapses To Lowest Since Feb 2013 As 'Hope' Crashes

Submitted by Tyler Durden on 12/17/2015 - 08:37 Following last month's bounce, driven by a surge in 'hope', The Philly Fed collapsed to -5.9 (dramaticlaly missing expectations of +1.0) and hitting its lowest levels since Feb 2013. With 'hope' plunging back to its lowest levels since Dec 2012, there was little to support the dream as Prices Paid and Received plunged, and New Orders cratered to 3 year lows. Future CapEx expectations crashed as did workweek and employment outlooks.

Argentine Peso Collapses 29% After Government Lifts Currency Controls

Submitted by Tyler Durden on 12/17/2015 - 08:35 New President Mauricio Macri's move to unify the official and black market exchange rates for the peso in the face of depleted FX reserves and still sky high inflation has the currency plunging by nearly 30% on Thursday.

Money Velocity Is Crashing - Here's Why

Submitted by Tyler Durden on 12/17/2015 - 08:20 Manipulating the PR optics (i.e. perception management) as a substitute for an open market doesn't make you omnipotent, it makes you a hubris-soaked fool.

Caught On Tape: Spanish PM Rajoy Punched In Face By "Selfie-Seeking Teen"

Submitted by Tyler Durden on 12/17/2015 - 07:57 While campaigning ahead of elections, Spanish prime minister Mariano Rajoy was rocked with a right cross when a "selfie-seeking teen" approached and went full Balboa on the side of his face, breaking his glasses, before Rajoy's security detail wrestled the assailant to the floor. As El-Pais reports, the 17-year-old told police "I'm very happy I did it," while Rajoy later tweeted that he "was fine." It appears it is time for a European ban on teenagers (who are suffering massive unemployment) and fists.

Slump In Smallest Stocks Vs. Biggest Stocks Is Getting Worse

Submitted by Tyler Durden on 12/17/2015 - 07:39 Micro-cap stocks have suffered a key breakdown relative to mega-cap stocks, suggesting a “risk-off” shift on the part of investors.

Global Stocks, Futures Continue Surge On Lingering Rate Hike Euphoria

Submitted by Tyler Durden on 12/17/2015 - 06:59 Heading into the Fed's first "dovish" rate hike in nearly a decade, the consensus was two-fold: as a result of relentless telegraphing of the Fed's intentions, the hike is priced in, and it will be a "dovish" hike, with the Fed lowering its forecast for the number of hikes over the next year. Consensus was once again wrong on both accounts: first the rate hike was far more hawkish than most had expected (see previous post), and - judging by the surge in Asian, European stocks and US equity futures - the "market" simply is enamored with such hawkish hikes which will soon soak up trillions in liquidity from the financial system.

What The Market Chose To Ignore In Yesterday's Fed Announceent

Submitted by Tyler Durden on 12/17/2015 - 05:45 The hard part now is how to ween the market away from the old narrative, the one which has pushed the S&P to record highs over the past 7 years on bad economic news, and to renomralize the market's own "reaction function" to that of the Fed. The problem is that from day one there is a major discrepancy between the two: as previouslly observed, the Fed did not deliver the desired dovish hike, and kept its 2016 year-end fed funds rate unchanged at 1.4% suggesting 4 rate hikes in the coming year, and which as Breslow notes means "being less dovish than the meeting previews suggested is now a sign of bullishness on the economy." This sets the Fed on a collision course with the market because "with the market pricing fewer hikes than the Fed suggests, someone is going to end up being wrong."

Something Strange Is Taking Place In The Middle Of The Atlantic Ocean

Submitted by Tyler Durden on 12/16/2015 - 23:55 In the latest sign that the world is simply running out of capacity when it comes to coping with an inexorable supply of commodities, three diesel tankers en route from the Gulf to Europe did something rather odd on Wednesday: they stopped, turned around in the middle of the ocean, and headed back the way they came.

Ecological Panic: The New Rationale For Globalist Cultism

Submitted by Tyler Durden on 12/16/2015 - 22:00 If ecological panic is the primary trigger of collapse, war and industrialized death, the elites escape all blame. They are the ones, after all, trying to “save us” from ourselves by introducing carbon emissions controls, not to mention the idea of population controls. Global warming becomes a catch-all bogeyman, a Frankenstein monstrosity created by humanity and plaguing humanity. Those who deny the existence of global warming or who question the legitimacy of its high priests (climate scientists) are not exercising their right to skepticism; they are contributing to inevitable genocide. Therefore, climate denial would have to be punished by governments, as climate scientists have been publicly suggesting. President

Vladimir Putin has signed into law the bill allowing the Constitutional

Court to overrule the decisions of international courts if such

decisions contradict the principle of supremacy of the Russian

Constitution.

President

Vladimir Putin has signed into law the bill allowing the Constitutional

Court to overrule the decisions of international courts if such

decisions contradict the principle of supremacy of the Russian

Constitution.The new act published on the government website on Tuesday reads that the Constitutional Court will look into every decision of any intergovernmental body based on an international treaty and find if it matches the Russian Constitution and the rights and freedoms guaranteed by it. Upon such consideration the Constitutional Court can allow the decision to be executed in Russia, in full or in part, or ban its execution – also in full or in part. The ban would automatically cancel any national acts allowing the execution of the unconstitutional ruling.

Read More

The war on drugs officially kicked off in 1971 when president Richard Nixon addressed the nation in a press conference explaining how the recent passage of the Comprehensive Drug Abuse Prevention and Control Act of 1970 would provide the legal framework and material support for a new kind of war, the war on drugs.

“We must wage what I have called total war against public enemy number one in the United States, the problem of dangerous drugs.” –Richard Nixon, 1972

His address spoke of the need for a coordinated federal response that addressed both the demand side, and the supply side of the issue, noting that although America had the highest rate of heroin addicts in the world, the drug was not grown or sourced in the US The door was thereby opened for the destructive interventionist policies that have since greatly affected mostly Latin American nations.

Read More

from RT:

Ankara’s Chief Prosecutor’s Office opened the case against Istanbul MP Eren Erdem of Republican People’s Party (CHP) after his interview about sarin was aired on RT on Monday.

Ankara’s Chief Prosecutor’s Office opened the case against Istanbul MP Eren Erdem of Republican People’s Party (CHP) after his interview about sarin was aired on RT on Monday.

from Wolf Street:

The transportation sector just keeps getting worse. Even after today’s uptick, the Dow Jones Transportation Average is back where it was in April 2014, and down 18% from its peak a year ago. Within this transportation sector is freight, a gauge of the goods-based economy, which is having a rough time.

In November, the number of freight shipments in North America plunged 5.1% from a year ago, according to the Cass Freight Index. It hit the worst level for any November since 2011.

Read More

The transportation sector just keeps getting worse. Even after today’s uptick, the Dow Jones Transportation Average is back where it was in April 2014, and down 18% from its peak a year ago. Within this transportation sector is freight, a gauge of the goods-based economy, which is having a rough time.

In November, the number of freight shipments in North America plunged 5.1% from a year ago, according to the Cass Freight Index. It hit the worst level for any November since 2011.

Read More

by David Dayen, The Intercept:

One of the biggest policy debates in America today concerns the

unparalleled rise in prescription drug costs. Enormous pharmaceutical

industry profit margins; tales of companies like Turing, Valeant, and Gilead Sciences jacking up the price of life-saving medicines; and a spate of industry mergers (the latest being a $150 billion deal between Pfizer and Allergan, designed mostly to lower their tax rates) havelawmakers and presidential candidates scrambling for answers.

One of the biggest policy debates in America today concerns the

unparalleled rise in prescription drug costs. Enormous pharmaceutical

industry profit margins; tales of companies like Turing, Valeant, and Gilead Sciences jacking up the price of life-saving medicines; and a spate of industry mergers (the latest being a $150 billion deal between Pfizer and Allergan, designed mostly to lower their tax rates) havelawmakers and presidential candidates scrambling for answers.

But one point has been lost among the various proposals: The U.S. has had antitrust laws on the books for over 100 years to reduce the power of monopolies and restrain consumer costs. They could come in handy in situations like these.

Read More

One of the biggest policy debates in America today concerns the

unparalleled rise in prescription drug costs. Enormous pharmaceutical

industry profit margins; tales of companies like Turing, Valeant, and Gilead Sciences jacking up the price of life-saving medicines; and a spate of industry mergers (the latest being a $150 billion deal between Pfizer and Allergan, designed mostly to lower their tax rates) havelawmakers and presidential candidates scrambling for answers.

One of the biggest policy debates in America today concerns the

unparalleled rise in prescription drug costs. Enormous pharmaceutical

industry profit margins; tales of companies like Turing, Valeant, and Gilead Sciences jacking up the price of life-saving medicines; and a spate of industry mergers (the latest being a $150 billion deal between Pfizer and Allergan, designed mostly to lower their tax rates) havelawmakers and presidential candidates scrambling for answers.But one point has been lost among the various proposals: The U.S. has had antitrust laws on the books for over 100 years to reduce the power of monopolies and restrain consumer costs. They could come in handy in situations like these.

Read More

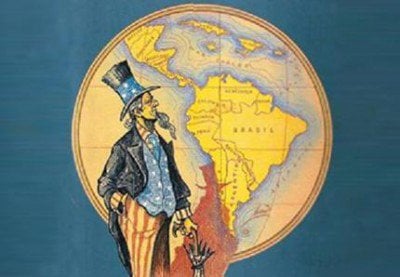

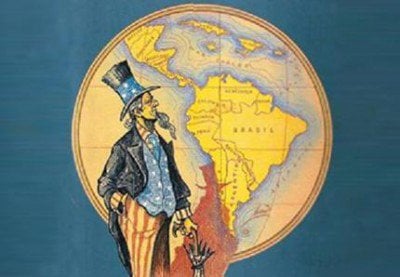

by Prof. James Petras and Prof. Henry Veltmeyer, Global Research:

The literature on imperialism suffers from a fundamental confusion

about the relationship between capitalism and imperialism. The aim of

this paper is to remove this confusion. The paper is organised in three

parts.

The literature on imperialism suffers from a fundamental confusion

about the relationship between capitalism and imperialism. The aim of

this paper is to remove this confusion. The paper is organised in three

parts.

In Part I we state our own position of the capitalism-imperialism relation. In part II we discuss some major points at issue in the Marxist debate on imperialism. And in Part III we review the changing forms that imperialism has taken in Latin America in the course of the capitalist development process.

Read More

The literature on imperialism suffers from a fundamental confusion

about the relationship between capitalism and imperialism. The aim of

this paper is to remove this confusion. The paper is organised in three

parts.

The literature on imperialism suffers from a fundamental confusion

about the relationship between capitalism and imperialism. The aim of

this paper is to remove this confusion. The paper is organised in three

parts.In Part I we state our own position of the capitalism-imperialism relation. In part II we discuss some major points at issue in the Marxist debate on imperialism. And in Part III we review the changing forms that imperialism has taken in Latin America in the course of the capitalist development process.

Read More

by Mike Barrett, Natural Society:

The

government in Taiwan recently passed legislation that would effectively

prohibit any food containing genetically modified ingredients from

being served to children in school meals. [1]

The

government in Taiwan recently passed legislation that would effectively

prohibit any food containing genetically modified ingredients from

being served to children in school meals. [1]

The decision was made primarily due to potential health and environmental hazards revolving around genetically modified foods, as stated by Democratic Progressive Party Legislator Lin Shu-fen, one of the amendments’ sponsors.

Read More

The

government in Taiwan recently passed legislation that would effectively

prohibit any food containing genetically modified ingredients from

being served to children in school meals. [1]

The

government in Taiwan recently passed legislation that would effectively

prohibit any food containing genetically modified ingredients from

being served to children in school meals. [1]The decision was made primarily due to potential health and environmental hazards revolving around genetically modified foods, as stated by Democratic Progressive Party Legislator Lin Shu-fen, one of the amendments’ sponsors.

Read More

from Survival Blog:

Most people I know enjoy a little adventure. While it may not be sky diving, even the more reserved, quiet spirits appreciate a change of pace. Some get their kicks from visiting the mouse at his Magic Kingdom, while others get it from a morning in the tree stand or an afternoon under the hood. Regardless of what they do, folks like to break up the monotony of the daily grind. Doing the same ole’ same ole’ gets old, but the day to day life we live is what we’ve come to expect. Yesterday was the same as the day before it, so we expect today to be the same as yesterday and tomorrow to be the same as today. For the most part, that is exactly what will happen. In fact, what does happen when our routine is disrupted? We can get thrown off fairly easily.

Read More

Most people I know enjoy a little adventure. While it may not be sky diving, even the more reserved, quiet spirits appreciate a change of pace. Some get their kicks from visiting the mouse at his Magic Kingdom, while others get it from a morning in the tree stand or an afternoon under the hood. Regardless of what they do, folks like to break up the monotony of the daily grind. Doing the same ole’ same ole’ gets old, but the day to day life we live is what we’ve come to expect. Yesterday was the same as the day before it, so we expect today to be the same as yesterday and tomorrow to be the same as today. For the most part, that is exactly what will happen. In fact, what does happen when our routine is disrupted? We can get thrown off fairly easily.

Read More

by J. D. Heyes, Natural News:

For countries that depend primarily on oil revenues to fund government

services, hard times are upon them. And they are likely to continue,

analysts say.

For countries that depend primarily on oil revenues to fund government

services, hard times are upon them. And they are likely to continue,

analysts say.

That’s because oil prices have collapsed, thanks to several different factors, and while that is good news for consumers, truckers, airlines and other industries that rely on oil products to produce goods and services, it’s bad for the producers of oil, and for nations that depend on oil sales to fund everything from social service and welfare programs to defense.

Venezuela is one such country. Already mired in deep depression thanks to the government’s socialist policies, the South American nation cannot take a loss of oil revenue without suffering mass unrest, say analysts who have been monitoring that country and others dependent on the “black gold” for most of their revenue.

Read More

For countries that depend primarily on oil revenues to fund government

services, hard times are upon them. And they are likely to continue,

analysts say.

For countries that depend primarily on oil revenues to fund government

services, hard times are upon them. And they are likely to continue,

analysts say.That’s because oil prices have collapsed, thanks to several different factors, and while that is good news for consumers, truckers, airlines and other industries that rely on oil products to produce goods and services, it’s bad for the producers of oil, and for nations that depend on oil sales to fund everything from social service and welfare programs to defense.

Venezuela is one such country. Already mired in deep depression thanks to the government’s socialist policies, the South American nation cannot take a loss of oil revenue without suffering mass unrest, say analysts who have been monitoring that country and others dependent on the “black gold” for most of their revenue.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment