Submitted by Tyler Durden on 12/15/2015 - 12:51

Submitted by Tyler Durden on 12/15/2015 - 12:51

Just last week, controversial Shiite lawmaker Hanan Fatlawi suggested that John McCain was planning to coordinate with the Saudis, Qatar, the UAE, and Turkey on a troop deployment to number 100,000 in Iraq. With the announcement of a new, 34 country military alliance, deputy crown prince and Defense Minister Mohammed bin Salman might have just verified Fatlawi's claims.

European Nations Throw Up On EU Plan To Seize Border Sovereignty, Impose Standng Border Force

Submitted by Tyler Durden on 12/15/2015 - 15:13 “Strengthening Frontex, creating a kind of border guard would by all means be needed, beneficial,” he said on his way into a meeting of EU foreign ministers in Brussels. “But the way the commission proposed it—for it to be a structure independent from nation states—is astounding.” He added: “There’d be an undemocratic structure reporting to no one knows who.”

3 Charts The Fed Should Consider

Submitted by Tyler Durden on 12/15/2015 - 15:00 With economic growth currently running at THE LOWEST average growth rate in American history, the time frame between the first rate and next recession will not be long. For investors, there is little “reward” in the current environment for taking on excess exposure to risk assets. The deteriorating junk bond market, declining profitability and weak economic underpinnings suggest that the clock has already begun ticking. The only question is how much time is left.

Well, it’s “T minus 1” until the most ballyhooed FOMC decision of all time – in which, ironically, they appear to be targeting the “policy error” that will once and for all destroy their “credibility.” So much so, that David Stockman, whose “Great Deformation” concept has shaped my historically bearish economic outlook, had a special conference call last night to discuss the ugly ramifications of the “watershed event” a rate hike will be. Not that ¼ point has any realeconomic impact. However, such a move will likely, once and for all, demonstrate that the Fed has run out of excuses to “push the string” of zero rates any longer, given how long it has purported the mythical U.S. “recovery.” Even if, comically, the “recovery” only exists in the fabricated “unemployment rate” they themselves stopped using as a quantitative input to monetary policy two years ago.

Read More

Better Pissed off... then Pissed on...

Maine Resident Calls Police On Neighbor Over Urine-Stained ISIS Christmas Light Display

See something, say something...

Goldman Warns IG Credit Collapse Signals S&P 500 Notably Overvalued

Submitted by Tyler Durden on 12/15/2015 - 14:40 The sell-off in credit over the past week has led many investors to ask what it means for equities. Credit spread widening usually has negative implications for equity but as Goldman notes, it is critical to estimate the degree to which the equity market has already priced the weakness to determine the potential risks to equity going forward. Interestingly, Goldman finds the weakness in high yield credit was foreshadowed by weakness in the equities of high yield companies (like for like), but the weakness in Investment Grade credit spreads relative to their corresponding equities represents a new divergence suggesting meaningful downside for S&P 500 investors.

NatGas Crashes To Lowest Since 1999

Submitted by Tyler Durden on 12/15/2015 - 14:39 One word... "glut"

Salient Partners Issues A "Storm Warning" For The Market

Submitted by Tyler Durden on 12/15/2015 - 14:20 There is a Category 5 deflationary hurricane forming off the Chinese coast as Beijing accelerates the devaluation of the yuan against the dollar under the guise of “reform”. I say forming … the truth is that this deflationary storm has already laid waste to the global commodity complex, doing trillions of dollars in damage. I say forming … the truth is that this deflationary storm has driven inflation expectations down to levels last seen when the world was coming to an end in the Lehman aftermath. And now the Fed is going to tighten? Are you kidding me?16 Charts Showing Just How Confused "The Smartest Guys In The Room" Are Right Now

Submitted by Tyler Durden on 12/15/2015 - 14:03"Credible" Threat That Closed LA Schools Was "Hoax", NYC Says

Submitted by Tyler Durden on 12/15/2015 - 13:55 Update: NYC GOT SAME THREAT THAT CLOSED LA SCHOOLS, DETERMINED HOAX: APLos Angeles police confirmed that all Los Angeles Unified School District (LAUSD) schools are closed Tuesday as police investigate what The LA Times reports as a bomb threat was called into a LAUSD board member. LAUSD is the nation's 2nd largest district. The LAUSD superintendent said "I am not going to take a chance when it comes to the lives of students," stating that the threat was made to many schools, involved packages and backpacks, and says he wants every school is system searched. L.A. police chief says threat still being analyzed, FBI has been notified.

Common Sense Declares "Something Far Worse Is At Work In The Economy"

Submitted by Tyler Durden on 12/15/2015 - 13:51 Since that transition in mid-year, oil prices have again persisted rather than rebounded and of late have turned to new “cycle” lows. Yet, neither transportation nor retailers have traded as if further benefits were accruing in terms of that “stimulus.” This is not to say that stock investors have boarded the recession view, only that there is a clear shift in risk perception that has undoubtedly rebalanced and reprioritized risk parameters. If the left side of the chart below was risks being viewed very favorable in terms of the economic fallout of low oil prices, the right is undoubtedly (much) less certain.

One Of These Things Is Not Like The Other

Today's stock market brought to you the number '25' and the word 'algo'...

As US Commandos Arrive In Syria, Kurds Ask "Is This It?"

Submitted by Tyler Durden on 12/15/2015 - 13:24 "The U.S. troops are about to see for themselves what they're up against, and if America is serious about defeating ISIS, it will need to contribute more than guns and bullets; America's new allies will need artillery, armored vehicles and antitank weapons to match ISIS' firepower."

Tens Of Thousands Of Properties To Be "Dumped" On London Real Estate Market By 2017

Submitted by Tyler Durden on 12/15/2015 - 13:04 "As many as 60,000 homes bought off-plan in new developments in areas such as Nine Elms are scheduled for completion by the end of 2017 and many will be put up for sale immediately because of the growing disillusion with London... Of these, we believe between 50 to 60 per cent have been sold off-plan to international buyers. Therefore, it is likely that up to 30,000 properties could be returning to the market in the coming two years.”

Dow Completes 1000 Point Roundtrip

Submitted by Tyler Durden on 12/15/2015 - 12:50 The new normal... 1000 point swings in less than 3 trading days...

"Fool Me Thrice?" - WTI Crude Nears $38, Up Over 10% In 28 Hours

Submitted by Tyler Durden on 12/15/2015 - 12:41 Presented with little comment.. aside to note that every rip from a dip is greeted by the mainstream stock enthusiasts as a balls-deep buying opportunity in every oil & gas stock... only to be grossly disappointed a day or two later...

Why Has The Labor Participation Rate Plunged?

Submitted by Tyler Durden on 12/15/2015 - 12:22 Combine the rising regulatory burden with the decline of entrepreneurship, and you get a bubbling brew that is toxic to self-employment/small business.

Copper's Dumping As Crude's Pumping

Submitted by Tyler Durden on 12/15/2015 - 12:14 Dr. Copper and Captain Crude are in significant disagreement over the state of the world... or it is just algos gone wild once again?Did The Terrorists (Or Fearmongers) Win?

Submitted by Tyler Durden on 12/15/2015 - 12:00

This is the highest percentage of Americans to mention terrorism in a decade... So are the terrorists winning? Or the fearmongers?

The Fixed Income Bloodbath Continues: Wall Street Harbinger Jefferies Reports Another Terrible Bond Trading Quarter

Submitted by Tyler Durden on 12/15/2015 - 11:39 Earlier today Jefferies reported another quarter in which its Fixed Income revenue could best be described as dismal: Fixed Income posted a nominal $8.4 million in revenue: a whopping 83% collapse from the already subdued $48.6 million a year ago. The biggest irony is that while other banks are clamoring to be allowed to "prop trade" again, Jefferies which has had the green light to do just that as it never got an FDIC bailout and remains the only sizable pure-play investment bank, just got crushed precisely due to its junk bond prop trading.

Don't Believe The Hope

Submitted by Tyler Durden on 12/15/2015 - 11:22 If there is one chart that tells the 'truth' about the US equity 'market' it is this. Not only has breadth collapsed back to Black Monday lows (despite elevated index prices) but yesterday's exuberant rip higher diverged dramatically from a very significant drop (3 decliners for every advancer) in overall market breadth. Yes, it's Fed week, and OPEX, but the underlying support for the ponzi is waning rapidly.

The US Dollar (and Treasury Yields) Is Melting Up

Submitted by Tyler Durden on 12/15/2015 - 11:09 Despite already record levels of "long USD", from Cable to EUR, traders are dumping everything and buying USDollars, sending the USD Index surging off overnight lows. At the same time, Treasuries are being dumped en masse with the bellyu of the curve up 15-17bps since Friday. But stocks have decoupled from USDJPY...

Government Influence Over Asset Prices Growing

Submitted by Tyler Durden on 12/15/2015 - 10:46 Where most analysis on oil markets tends to fall short is on the depth of analysis vs. reading headlines and group think, the latter of which is heavily shaped by misinformed media and government propaganda.

by Dave Hodges, The Common Sense Show:

Most Americans and denizens of the West live in a world that is relatively uneventful, at least for the most part. We are raised to believe certain things about how the world around us works. From adolescence to adulthood, our beliefs are molded by our parents, family, teachers and “real world” experience.

Whether deliberately or unwittingly, we have been groomed – and some might even say programmed – to live in a world where reality is very neat and orderly. Most of us tend to reject anything outside of what we’ve been taught. Anything outside of this orderly realm is termed conspiracy fodder, and those who dare venture into the disorder searching for truth are pejoratively assailed as conspiracy theorists.

Read More

Most Americans and denizens of the West live in a world that is relatively uneventful, at least for the most part. We are raised to believe certain things about how the world around us works. From adolescence to adulthood, our beliefs are molded by our parents, family, teachers and “real world” experience.

Whether deliberately or unwittingly, we have been groomed – and some might even say programmed – to live in a world where reality is very neat and orderly. Most of us tend to reject anything outside of what we’ve been taught. Anything outside of this orderly realm is termed conspiracy fodder, and those who dare venture into the disorder searching for truth are pejoratively assailed as conspiracy theorists.

Read More

from Outsider Club:

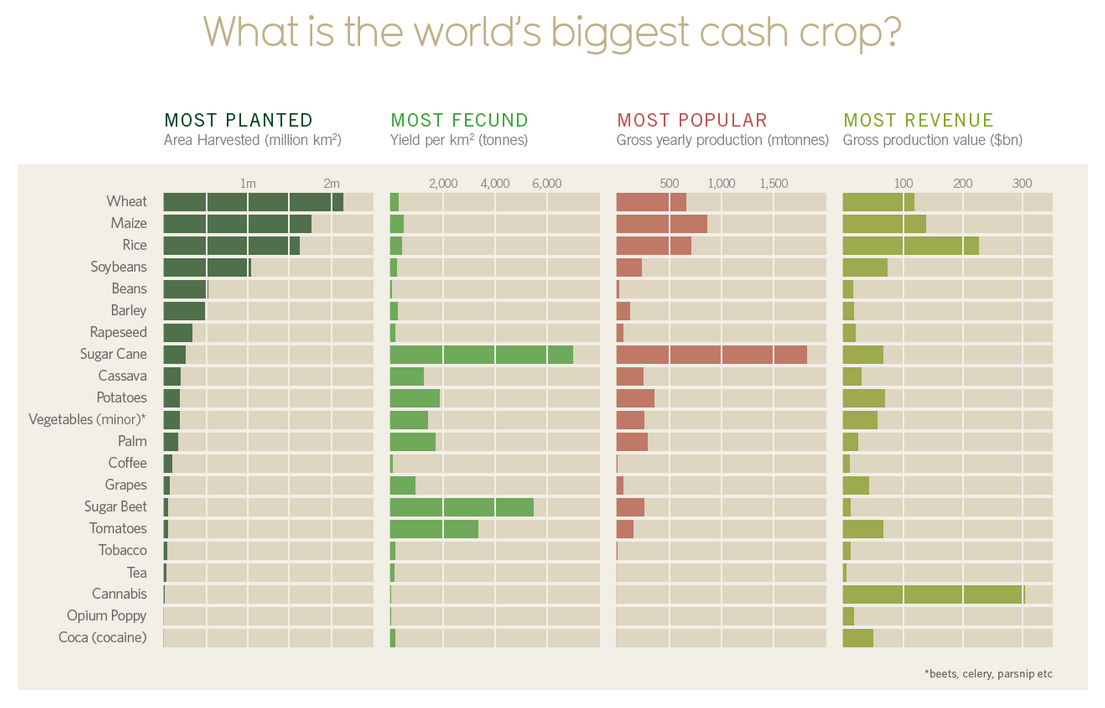

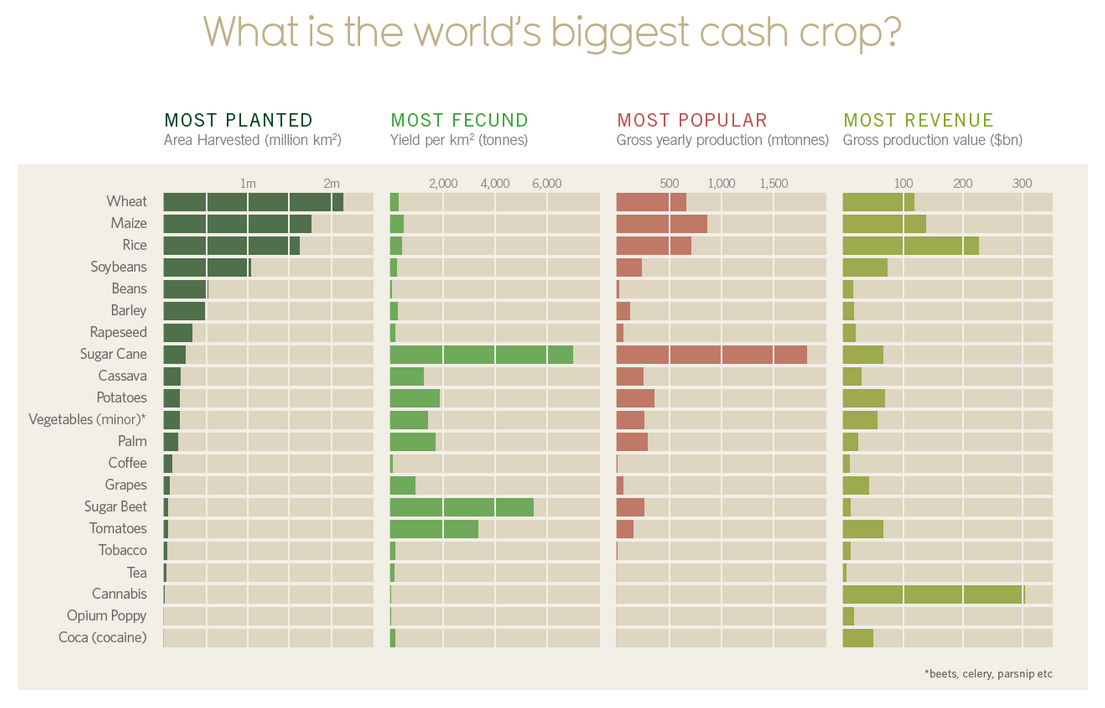

Agriculture is one of the biggest industries in the world as measured by annual revenue — with the top five revenue crops bringing in more than $850 billion annually.

All in all, more than 2 million square miles of the Earth’s surface is committed to producing these five crops — more than half the total square miles of the entire U.S., Alaska and Hawaii included.

It’s an enormous undertaking, involving an enormous number and variety of workers to execute.

However, looking at some of the vital metrics behind these top five crops, you will quickly notice a glaring disparity.

Read More

Agriculture is one of the biggest industries in the world as measured by annual revenue — with the top five revenue crops bringing in more than $850 billion annually.

All in all, more than 2 million square miles of the Earth’s surface is committed to producing these five crops — more than half the total square miles of the entire U.S., Alaska and Hawaii included.

It’s an enormous undertaking, involving an enormous number and variety of workers to execute.

However, looking at some of the vital metrics behind these top five crops, you will quickly notice a glaring disparity.

Read More

from The News Doctors:

Turkey is complicit with Washington, other rogue NATO regimes, Israel,

and despotic Arab states in waging war on Syria – including smuggled use

of various type banned chemical weapons, Assad wrongfully blamed for

their crimes.

Turkey is complicit with Washington, other rogue NATO regimes, Israel,

and despotic Arab states in waging war on Syria – including smuggled use

of various type banned chemical weapons, Assad wrongfully blamed for

their crimes.

Turkish Republican People’s Party (CHP) opposition member Eren Erdem accused Ankara of covering up a major war crime, likely direct high-level involvement in smuggling materials used to make deadly sarin gas to ISIS and other terrorists – US proxy foot soldiers waging war on Syria.

Various attacks occurred. The most notorious targeted the Damascus Ghouta suburb in August 2013, killing and injuring scores of civilians.

Read More

Turkey is complicit with Washington, other rogue NATO regimes, Israel,

and despotic Arab states in waging war on Syria – including smuggled use

of various type banned chemical weapons, Assad wrongfully blamed for

their crimes.

Turkey is complicit with Washington, other rogue NATO regimes, Israel,

and despotic Arab states in waging war on Syria – including smuggled use

of various type banned chemical weapons, Assad wrongfully blamed for

their crimes.Turkish Republican People’s Party (CHP) opposition member Eren Erdem accused Ankara of covering up a major war crime, likely direct high-level involvement in smuggling materials used to make deadly sarin gas to ISIS and other terrorists – US proxy foot soldiers waging war on Syria.

Various attacks occurred. The most notorious targeted the Damascus Ghouta suburb in August 2013, killing and injuring scores of civilians.

Read More

from Western Journalism:

GOP frontrunner Donald Trump continues to take slings and arrows for his idea of temporarily banning Muslims from immigrating to the U.S. because of global terrorism; and late last week, Saudi Prince Alwaleed bin Talal added his voice to that criticism of Trump. But Trump had a one-line comeback to the Saudi prince’s attack that has supporters cheering.

On Friday, December 11, the prince tweeted out his slam on Trump, calling the real estate mogul a “disgrace.”

Still, two days later, on Sunday, The Donald had a retort that some might say completely undercut the prince’s lashing.

Read More

GOP frontrunner Donald Trump continues to take slings and arrows for his idea of temporarily banning Muslims from immigrating to the U.S. because of global terrorism; and late last week, Saudi Prince Alwaleed bin Talal added his voice to that criticism of Trump. But Trump had a one-line comeback to the Saudi prince’s attack that has supporters cheering.

On Friday, December 11, the prince tweeted out his slam on Trump, calling the real estate mogul a “disgrace.”

Still, two days later, on Sunday, The Donald had a retort that some might say completely undercut the prince’s lashing.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment