Today one of the legends in the gold world told King World News what we are looking at right now is “financial Armaggedon.” Keith Barron is responsible for one of the largest gold discoveries in history and consults with major gold companies around the world as well as international brokerage houses. Barron described the current situation as “Lehman times 1,000.” Here is how Barron described the financial nightmare: “Once their is a resolution to this situation in Greece, we will see a resurgence in the gold price. We will see some major moves. The only way to get out of this Greek mess right now is to bail it out with money. We don’t know who’s going to do it. They were talking with the Chinese today about getting them involved in a rescue fund.”

Keith Barron continues: Read More @ KingWorldNews.com

from King World News:

Today legendary trader and investor Jim Sinclair told King World News that central banks are trying to keep the price of gold from rising violently. Sinclair also believes we are entering a period where currencies will lose their ability to function as money and instead will act more like casino chips, while gold ascends. Here is what Sinclair had to say about the ongoing financial crisis: “What needs to be understood by our listeners, Eric, is when a haircut takes place, what you give with one hand, you take with another. Now the problem becomes the problem of a bank’s asset having been reduced and the bank’s ability to function reduced and the bank’s abilities to positively pass tests of liquidity have been reduced. And the psychology of the stability of a system has been reduced.”

Jim Sinclair continues: Read More @ KingWorldNews.com

Today legendary trader and investor Jim Sinclair told King World News that central banks are trying to keep the price of gold from rising violently. Sinclair also believes we are entering a period where currencies will lose their ability to function as money and instead will act more like casino chips, while gold ascends. Here is what Sinclair had to say about the ongoing financial crisis: “What needs to be understood by our listeners, Eric, is when a haircut takes place, what you give with one hand, you take with another. Now the problem becomes the problem of a bank’s asset having been reduced and the bank’s ability to function reduced and the bank’s abilities to positively pass tests of liquidity have been reduced. And the psychology of the stability of a system has been reduced.”

Jim Sinclair continues: Read More @ KingWorldNews.com

FEB 14th Judge Napolitano: Final Word After Being Fired on FOX NEWS Last Episode of Freedom

by Kurt Nimmo, InfoWars.com:

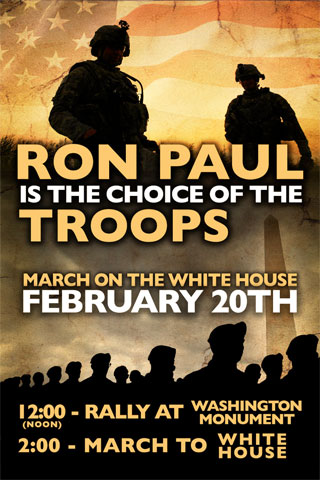

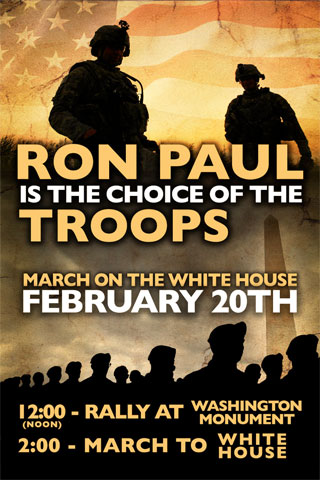

One thousand veterans and active duty troops will shatter the corporate media hoax that insists members of the American military do not support Ron Paul due to his opposition to the unconstitutional forever war agenda of the establishment.

Despite this myth, the New York Times was obliged to admit reality last December, even if the admission wasn’t featured on the front page of the newspaper but instead posted on a remote area of its website.

“Representative Ron Paul, the congressman who favors the most minimalist American combat role of any major presidential candidate and who said all of the above quotes, has more financial support from active duty members of the service than any other politician,” Timothy Egan wrote.

“As of the last reporting date, at the end of September, Paul leads all candidates by far in donations from service members. This trend has been in place since 2008, when Paul ran for president with a similar stance: calling nonsense at hawk squawk from both parties.”

Read More @ InfoWars.com

One thousand veterans and active duty troops will shatter the corporate media hoax that insists members of the American military do not support Ron Paul due to his opposition to the unconstitutional forever war agenda of the establishment.

Despite this myth, the New York Times was obliged to admit reality last December, even if the admission wasn’t featured on the front page of the newspaper but instead posted on a remote area of its website.

“Representative Ron Paul, the congressman who favors the most minimalist American combat role of any major presidential candidate and who said all of the above quotes, has more financial support from active duty members of the service than any other politician,” Timothy Egan wrote.

“As of the last reporting date, at the end of September, Paul leads all candidates by far in donations from service members. This trend has been in place since 2008, when Paul ran for president with a similar stance: calling nonsense at hawk squawk from both parties.”

Read More @ InfoWars.com

Japan begins Hyper-Printing/Greek GDP falters/European meeting cancelled tomorrow/Moody's threaten UK with downgrade

Harvey Organ at Harvey Organ's - The Daily Gold and Silver Report - 1 hour ago

Good evening Ladies and Gentlemen: Gold closed down by $6.10 to $1715.90 while silver, the object of interest to our bankers, fell by 38 cents to $33.32. Yesterday we had the silver and gold equity shares weak together with a negative lease on silver. These two red flags signaled to all the bankers and to the HFT traders that a raid was on and they did not disappoint. However our bankers were

The Rise of Extreme Nationalism in Europe

from RT.com:

Iranian

patrol boats and planes have trailed the American aircraft carrier USS

Abraham Lincoln as it passed through the Strait of Hormuz on Tuesday.

Iranian

patrol boats and planes have trailed the American aircraft carrier USS

Abraham Lincoln as it passed through the Strait of Hormuz on Tuesday.

Iran’s navy never approached the battle group closer than half a mile, making a point to stay in the Iranian waters. Radar operators also revealed an Iranian drone and surveillance helicopter zooming in the Persian country’s airspace near the strategic strait. A patrol plane buzzed over the Lincoln, said Rear Adm. Troy Shoemaker, commander of the Abraham Lincoln Carrier Strike Force.

“We would do the same things off the coast of the United States… It’s more than reasonable. We’re operating in their backyard,” he said.

Flanked by several choppers and enforced by the cruiser USS Cape St. George and destroyer USS Sterett, the American battle group passed the narrow strait without incident, reports the Associated Press.

Read More @ RT.com

Iranian

patrol boats and planes have trailed the American aircraft carrier USS

Abraham Lincoln as it passed through the Strait of Hormuz on Tuesday.

Iranian

patrol boats and planes have trailed the American aircraft carrier USS

Abraham Lincoln as it passed through the Strait of Hormuz on Tuesday.Iran’s navy never approached the battle group closer than half a mile, making a point to stay in the Iranian waters. Radar operators also revealed an Iranian drone and surveillance helicopter zooming in the Persian country’s airspace near the strategic strait. A patrol plane buzzed over the Lincoln, said Rear Adm. Troy Shoemaker, commander of the Abraham Lincoln Carrier Strike Force.

“We would do the same things off the coast of the United States… It’s more than reasonable. We’re operating in their backyard,” he said.

Flanked by several choppers and enforced by the cruiser USS Cape St. George and destroyer USS Sterett, the American battle group passed the narrow strait without incident, reports the Associated Press.

Read More @ RT.com

by Andrew Hoffman, MilesFranklin.com:

After yesterday’s marathon RANT – and Webinar to boot – I am thankful to present a “guest speaker of sorts” for today’s topic. The below article by Ron Holland, though written in March 2011, is an excellent synopsis of the upcoming “confiscation” of U.S. retirement plans I have written of for some time now – perhaps in other nations as well.

Americans: Here’s How to Protect Your Retirement Assets From Coming Gov’t “Confiscation”

The article does not mention everything I have discussed, and I do not agree with all its investment recommendations. For example, while recommending gold bullion, which I whole-heartedly concur with, he also cites Euros, Swiss Francs, foreign annuities, and mining stocks, which all possess their own set of risks, in my view.

Read More @ MilesFranklin.com

After yesterday’s marathon RANT – and Webinar to boot – I am thankful to present a “guest speaker of sorts” for today’s topic. The below article by Ron Holland, though written in March 2011, is an excellent synopsis of the upcoming “confiscation” of U.S. retirement plans I have written of for some time now – perhaps in other nations as well.

Americans: Here’s How to Protect Your Retirement Assets From Coming Gov’t “Confiscation”

The article does not mention everything I have discussed, and I do not agree with all its investment recommendations. For example, while recommending gold bullion, which I whole-heartedly concur with, he also cites Euros, Swiss Francs, foreign annuities, and mining stocks, which all possess their own set of risks, in my view.

Read More @ MilesFranklin.com

President Obama has revealed the military defense budget and in it $3

billion are set aside for post-war Iraq. The initiative which is being

called operation “Post-New Dawn,” is unclear as to where the money will

go – and some believe it will almost certainly go into the pockets of

war contractors. This will add to the $800 billion the US has spent in

the last ten years to fight the war on terror. Jake Diliberto, US Marine

and RT Blogger, joins us look deeper as to where this money could go.

Hint: When Others Stop

by Brian Pretti, FinancialSense.com:

To

suggest that there’s plenty to worry about in the current financial

market and economic cycle is an understatement. I could spend pages of

discussion space. Although scenario planning and assigning probabilities

to a series of multiple outcomes is essential to the risk management

process, so too is the abandonment of personal ego in being emotionally

accepting of short term outcomes. Although I’ve heard it said many a

time that the four most dangerous words in investing are “it’s different

this time”, I’d suggest that’s partially true. There exist another four

words that can be equally, if not more costly. And those words are

“this shouldn’t be happening”. Especially for those with short term

investment mandates, being right and making money can be two very

different things. So in one sense, at perhaps the most basic level

really any investor needs to honestly ask themselves that very question.

Just what do they expect to get out of investing? To be right about

future outcomes? Or simply to grow and compound capital over time? If

the answer is the former I strongly suggest the investor fund their

account with monopoly money so they can do zero damage to their net

worth. My personal view is that being right is in very large measure the

need to stand on an emotional pedestal of intellectual triumph. Growing

and compounding capital over time is about discipline and risk

management, in other words it’s an exercise in emotional self control.

To

suggest that there’s plenty to worry about in the current financial

market and economic cycle is an understatement. I could spend pages of

discussion space. Although scenario planning and assigning probabilities

to a series of multiple outcomes is essential to the risk management

process, so too is the abandonment of personal ego in being emotionally

accepting of short term outcomes. Although I’ve heard it said many a

time that the four most dangerous words in investing are “it’s different

this time”, I’d suggest that’s partially true. There exist another four

words that can be equally, if not more costly. And those words are

“this shouldn’t be happening”. Especially for those with short term

investment mandates, being right and making money can be two very

different things. So in one sense, at perhaps the most basic level

really any investor needs to honestly ask themselves that very question.

Just what do they expect to get out of investing? To be right about

future outcomes? Or simply to grow and compound capital over time? If

the answer is the former I strongly suggest the investor fund their

account with monopoly money so they can do zero damage to their net

worth. My personal view is that being right is in very large measure the

need to stand on an emotional pedestal of intellectual triumph. Growing

and compounding capital over time is about discipline and risk

management, in other words it’s an exercise in emotional self control.

Read More @ FinancialSense.com

. by Brian Pretti, FinancialSense.com:

To

suggest that there’s plenty to worry about in the current financial

market and economic cycle is an understatement. I could spend pages of

discussion space. Although scenario planning and assigning probabilities

to a series of multiple outcomes is essential to the risk management

process, so too is the abandonment of personal ego in being emotionally

accepting of short term outcomes. Although I’ve heard it said many a

time that the four most dangerous words in investing are “it’s different

this time”, I’d suggest that’s partially true. There exist another four

words that can be equally, if not more costly. And those words are

“this shouldn’t be happening”. Especially for those with short term

investment mandates, being right and making money can be two very

different things. So in one sense, at perhaps the most basic level

really any investor needs to honestly ask themselves that very question.

Just what do they expect to get out of investing? To be right about

future outcomes? Or simply to grow and compound capital over time? If

the answer is the former I strongly suggest the investor fund their

account with monopoly money so they can do zero damage to their net

worth. My personal view is that being right is in very large measure the

need to stand on an emotional pedestal of intellectual triumph. Growing

and compounding capital over time is about discipline and risk

management, in other words it’s an exercise in emotional self control.

To

suggest that there’s plenty to worry about in the current financial

market and economic cycle is an understatement. I could spend pages of

discussion space. Although scenario planning and assigning probabilities

to a series of multiple outcomes is essential to the risk management

process, so too is the abandonment of personal ego in being emotionally

accepting of short term outcomes. Although I’ve heard it said many a

time that the four most dangerous words in investing are “it’s different

this time”, I’d suggest that’s partially true. There exist another four

words that can be equally, if not more costly. And those words are

“this shouldn’t be happening”. Especially for those with short term

investment mandates, being right and making money can be two very

different things. So in one sense, at perhaps the most basic level

really any investor needs to honestly ask themselves that very question.

Just what do they expect to get out of investing? To be right about

future outcomes? Or simply to grow and compound capital over time? If

the answer is the former I strongly suggest the investor fund their

account with monopoly money so they can do zero damage to their net

worth. My personal view is that being right is in very large measure the

need to stand on an emotional pedestal of intellectual triumph. Growing

and compounding capital over time is about discipline and risk

management, in other words it’s an exercise in emotional self control.Read More @ FinancialSense.com

from KitcoNews:

From the California Resource Investment Conference, Roger Wiegand joins Kitco News’ Daniela Cambone to discuss the recent “mystery trade” in which an anonymous New York entity bought 10,000 gold spreads for August on a trade, to paid out in July, followed by another “mystery trade”. Feb. 13, 2012.

From the California Resource Investment Conference, Roger Wiegand joins Kitco News’ Daniela Cambone to discuss the recent “mystery trade” in which an anonymous New York entity bought 10,000 gold spreads for August on a trade, to paid out in July, followed by another “mystery trade”. Feb. 13, 2012.

On

Tuesday the European Union received another blow after Moody’s

downgraded the debt ratings of six Eurozone countries. Portugal, Italy

and Spain received the downgrade, while tens of thousands of Greeks took

to the streets to demonstrate their dissatisfaction with their

government’s decision to grant another round of austerity measures. Here

is the latest from Greece.

from Jesse’s Café Américain:

Chris Whalen at The Institutional Risk Analyst lays out the entire MF Global scandal in a few plain words, taking the Wall Street demimonde to task in the process.

It is nice to see that someone who occasionally appears on the mainstream media can tell the truth on this. Usually one has to look for sources overseas, small cafes, and the occasional economic maverick to hear what really happened.

Read More @ JessesCrossRoadsCafe.Blogspot.com

“But

please, to our friends in the Big Media, could we stop saying that we

don’t know the location of the missing $1.6 billion of client funds from

MF Global? The money is safe and sound at JPM and other counterparties.

As with Goldman Sachs et al and American International Group, the banks

have been bailed out at the cost of somebody else. And the various

agencies of the federal government are complicit in the fraud…

The

effort by former New Jersey governor and MF Global CEO Jon Corzine to

save his firm by stealing customer funds seems to warrant further

discussion, yet instead we have silence…

So

why is it that the Large Media have such trouble reporting this story?

The fact seems to be that the political powers that be in Washington are

protecting JPM CEO Jamie Dimon from a possible career ending kind of

stumble with respect to MF Global.”

Chris Whalen, Institutional Risk Analyst

Chris Whalen at The Institutional Risk Analyst lays out the entire MF Global scandal in a few plain words, taking the Wall Street demimonde to task in the process.

It is nice to see that someone who occasionally appears on the mainstream media can tell the truth on this. Usually one has to look for sources overseas, small cafes, and the occasional economic maverick to hear what really happened.

Read More @ JessesCrossRoadsCafe.Blogspot.com

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment