My Dear Extended Family,

The replacement of lost liquidity is NOT arithmetic. Booms, like busts, turn geometric on their liquidity effect because of the impact of mass financial psychology. Management of Perspective Economics primarily operated by mainstream media can make the gestation period of this event long, but it cannot reverse the underlying process.

With there being no question whatsoever that a credit event is on the near horizon for Greece, there is no avoidance of a further haircut in the valuation of Greek debt held by international banks, primarily Euroland institutions. What you take away with one hand you must provide with another if the banking system of Euroland is to remain viable. As you haircut (reduce in value for balance sheet considerations) Greek debt you reduce the value of that debt held as assets of financial institutions, therein reducing their viability to borrow in order to conduct their banking activities. This mark down is in full gear as speculation advertises to the world that the next step in this Greek tragedy is a haircut of value to just 30%.

How is it possible for the Euro wizards of words to punish Greek debt severely but not hammer others equally now under assault both by mainstream media as well as the undertakers of bond ratings in the USA?

The argument takes a position that the International Swaps and Derivative Association, which is made up of the manufacturers of these devices, will not self immolate by declaring credit events to be credit defaults. This is the ultimate irreversible can kick directly into the dead end sign at the end of the road of postponement to perdition.

Financial currency inflated hell by global debt monetization is the condition from which there is no escape, except though burning down the old system and making a new one. This is the dead end sign at the end of the road for can kicking. It is the condition of financial perdition. It is not something coming in a distant future. It is here and now, clear and present, if you have the eyes to see.

The means to this end is the combination of sick sovereign debt, risk insurance issued against the default of debt without sufficient liquid capital to do so, and the fact that those entities who issued this insurance are themselves and in truth illiquid under strain thanks to the capitulation of FASB on true market value of their legacy and other assets. This is the construction of the house of financial cards that will not survive intact during the period of 2012 to 2015. This is what gold at $1700 is indicating to those unfortunate enough to understand the practical workings of a system whose life force has been stolen to a degree that can only be deemed epic.

Never in written history has anything this size occurred where trillions has been bled away from an economic system with impunity. In all history when this has occurred the then monetary system imploded, to be replaced always by a commodity based money. That is what the Retenmark was in the Weimar experience. This is what the virtual reserve currency will be that replaces the US dollar in the next three years. The commodity currency definition will be derived by a connection to the gold held by the central banks of all the currencies that make up the Western world averaged virtual currency. This virtual currency will be a computer based settlement mechanism that cannot be traded in by other than central banks on behalf of trade settlement. Each contributing nation will also contribute to a universal M3 that will be the percentage measure of gold’s value to determined percentage-wise appreciation of depreciation, constituting value of the position held by each central bank in gold. Few if any central banks need to make transactions to adjust value as the squids of the world will invent derivatives upon which to speculate on the value of gold as a product of the growth or contraction of the western world M3.

This is not by any means a gold convertible system. This is not by any means a perfect system. There will be automaticity in this system but an agreement only by members to perform as above. However this system will work the same as the Retenmark worked. When the need becomes so great to believe in something solid anything that sounds solid has and will again work.

Only a resurgence of business based on solid foundations of equity and not debt can do the final clean up and provide a door to a better future.

No politician anywhere can do the necessary without causing the explosion of the results being heard almost as a new big bang. We are going to inflate this debt away or those in power will be swept away by the violence inherent in the suffering citizen.

Gold and only those things gold will provide the bridge to maintaining a lifestyle, maintain some freedom of choice and most importantly give you options you would not otherwise have. This has been as it always has been and will continue so. The drama of the market is nothing but that – sound and fury presaging but not defining change.

Do not allow anything to deter you from holding that which will build your bridge to tomorrow safely.

I am personally 100% in. It is my intention to hold as much gold as possible lending to me leverage without borrowing or margin. What was done in the 70s cannot be done now because we are only on the cusp of the volatility in the price of gold and it is already impossible to carry leverage except in the manner I have devised for myself participated in by others. I invite you to join with me.

This is a lonely road we are on where its direction does not tend to make friends. The road to freedom of any kind never does.

Stay focused. “Non Carborumdum Est,” do not let the hateful, vengeful bashers get you down.

Respectfully,

Jim

Greek Lawmakers Approve Austerity Bill as Athens Burns

http://www.reuters.com/article/2012/02/12/us-greece-idUSTRE8120HI20120212

Obama Budget Bets Other Concerns Will Trump the Deficit

http://www.cnbc.com/id/46351552

Justice Department Calls Swiss Bank a "Fugitive"

http://hosted.ap.org/dynamic/stories/U/US_SWISS_BANK_IRS

Did Ron Paul Win Iowa, Nevada, Minnesota, Colorado and Missouri? How about Maine Today?

http://www.youtube.com/watch?v=jxiPLaWd1Lc

Journalist Finds Himself on Food Stamps

http://www.youtube.com/watch?v=q0T3pE4pdxI

http://teapartyatperrysburg.blogspot.com/2012/02/food-stamp-president-will-cu...

US Government Desperate & Scared Regarding Gold

http://kingworldnews.com

Looming Debt Market Collapse to Destroy the Dollar

http://kingworldnews.com

Silver For The People - Explained - Office Series 16

BTFD...(Buy The ...Dips)

from GoldCore:

Gold’s London AM fix this morning was USD 1,727.00, EUR 1,302.22, and GBP 1,093.17 per ounce.

Gold’s London AM fix this morning was USD 1,727.00, EUR 1,302.22, and GBP 1,093.17 per ounce.

Friday’s AM fix was USD 1,715.50, EUR 1,295.21, and GBP 1,084.25 per ounce.

Gold opened in Asia nearly $13 higher at $1,734.90/oz (after closing at $1,719.60 on Friday) prior to giving up those gains and trading back near Friday’s close at $1,720/oz in early Asian trade. It then gradually rose back to challenge the $1,734/oz level and is currently in the middle of the range between $1,720 and $1,735 (see chart below).

Traders in Hong Kong say that the Chinese continue to buy gold on any weakness. Bullion buying from China and the rest of Asia (more below) may have led to the spike higher at the open in Asia.

Read More @ GoldCore.com

Gold’s London AM fix this morning was USD 1,727.00, EUR 1,302.22, and GBP 1,093.17 per ounce.

Gold’s London AM fix this morning was USD 1,727.00, EUR 1,302.22, and GBP 1,093.17 per ounce.Friday’s AM fix was USD 1,715.50, EUR 1,295.21, and GBP 1,084.25 per ounce.

Gold opened in Asia nearly $13 higher at $1,734.90/oz (after closing at $1,719.60 on Friday) prior to giving up those gains and trading back near Friday’s close at $1,720/oz in early Asian trade. It then gradually rose back to challenge the $1,734/oz level and is currently in the middle of the range between $1,720 and $1,735 (see chart below).

Traders in Hong Kong say that the Chinese continue to buy gold on any weakness. Bullion buying from China and the rest of Asia (more below) may have led to the spike higher at the open in Asia.

Read More @ GoldCore.com

Global stock markets look good in first half of 2012

from FinancialSense.com:

In

part two of Jim’s interview with Felix Zulauf the discussion turns to

the stock markets and gold. Felix believes gold will eventually rise two

to three times in price and stresses the difference between paper and

physical gold. He also sees the stock markets performing well in the

first half of 2012, but believes things could turn around in the second

half of this year.

In

part two of Jim’s interview with Felix Zulauf the discussion turns to

the stock markets and gold. Felix believes gold will eventually rise two

to three times in price and stresses the difference between paper and

physical gold. He also sees the stock markets performing well in the

first half of 2012, but believes things could turn around in the second

half of this year.Felix has worked in the financial markets and asset management for almost 40 years. He started his investment career as a trader for a large Swiss Bank and received training in research and portfolio management thereafter with several leading investment banks in New York, Zurich and in Paris. Felix joined Union Bank of Switzerland (UBS), Zurich, in 1977 and held several positions over the years including managing global mutual funds, heading the institutional portfolio management unit and at the same time acting as the global strategist for the UBS Group. After two years with a medium-sized Financial Organization as a member of the executive board, he founded his wholly owned Zulauf Asset Management AG in 1990, allowing him to independently practice his own individual investment philosophy.

In 2001, he made two of his staff members to partners and sold the majority of his company to them in steps and acted only as advisor from 2003 onwards. Mr. Zulauf focused on macro and strategic issues within the firm. In spring 2009 Zulauf Asset Management was split in two parts and Felix Zulauf fully owns the split-off Zulauf Asset Management AG focusing on some advisory activities to selected family offices and institutions including a US based global macro fund.

Click Here to Listen to the Interview

Click Here to Listen to the Interview

by Gregor Macdonald, ChrisMartenson.com:

An emotional, jubilant hooray! could be heard earlier this month when the Bureau of Labor Statistics (BLS) released its latest jobs numbers for January 2012, showing the addition of 243,000 net new jobs. That’s the kind of news both the financial markets and the political complex were yearning for, because it implies that growth is finally greater than the rate at which new workers enter the labor force due to US population growth alone.

But the report was not without controversy. Significant revisions to BLS sampling were introduced in this report as a result of the recent integration of the 2010 census data. Recalibrated, this altered the size of the workforce, and thus changed the number of Americans either working, looking for work, or dropped out of the workforce altogether. And so the cries of Foul! began.

Those who see politics in the numbers are perhaps overreaching. Likewise, those who see the dawn of a new era of resumed job growth are also likely premature in their celebration.

Read More @ ChrisMartenson.com

An emotional, jubilant hooray! could be heard earlier this month when the Bureau of Labor Statistics (BLS) released its latest jobs numbers for January 2012, showing the addition of 243,000 net new jobs. That’s the kind of news both the financial markets and the political complex were yearning for, because it implies that growth is finally greater than the rate at which new workers enter the labor force due to US population growth alone.

But the report was not without controversy. Significant revisions to BLS sampling were introduced in this report as a result of the recent integration of the 2010 census data. Recalibrated, this altered the size of the workforce, and thus changed the number of Americans either working, looking for work, or dropped out of the workforce altogether. And so the cries of Foul! began.

Those who see politics in the numbers are perhaps overreaching. Likewise, those who see the dawn of a new era of resumed job growth are also likely premature in their celebration.

Read More @ ChrisMartenson.com

Germany’s finance minister has declared that promises aren’t enough

anymore, saying that Greece must now implement reforms to prove it’s not

a bottomless pit. John Laughland, of the Institute of Democracy and

Cooperation in Paris, says there are more radical plans currently being

drawn up by the Germans…

RON PAUL-FOX NEWS CANCELS FREEDOM WATCH FOR FAVOURING RON PAUL.

BREAKING NEWS - Judge Napolitano fired from fox news for speaking out ABOUT THIS!

Slams mainstream media, suggests Romney may have had a hand in canceling key county caucuses

by Steve Watson, InfoWars.com

The

Ron Paul 2012 campaign has pointed to anomalies in Saturday’s

announcement of the Maine caucuses results, as Mitt Romney was declared

the winner with Paul in second by the slimmest of margins.

The

Ron Paul 2012 campaign has pointed to anomalies in Saturday’s

announcement of the Maine caucuses results, as Mitt Romney was declared

the winner with Paul in second by the slimmest of margins.

The official tally in Maine has 84% of the votes counted so far. Romney took close to 39% of that vote, with Paul scoring 36%, trailing by just 194 votes.

In an email to supporters on Saturday evening, Paul campaign manager John Tate hit out at the mainstream media for calling a Romney victory before all of the votes have been tallied, suggesting that the establishment is acting to prevent any potential surge or momentum gain for Paul.

“The national political establishment and their pals in the national media will do ‘anything’ to silence our message of liberty,” Tate stated.

Read More @ InfoWars.com

by Steve Watson, InfoWars.com

The

Ron Paul 2012 campaign has pointed to anomalies in Saturday’s

announcement of the Maine caucuses results, as Mitt Romney was declared

the winner with Paul in second by the slimmest of margins.

The

Ron Paul 2012 campaign has pointed to anomalies in Saturday’s

announcement of the Maine caucuses results, as Mitt Romney was declared

the winner with Paul in second by the slimmest of margins.The official tally in Maine has 84% of the votes counted so far. Romney took close to 39% of that vote, with Paul scoring 36%, trailing by just 194 votes.

In an email to supporters on Saturday evening, Paul campaign manager John Tate hit out at the mainstream media for calling a Romney victory before all of the votes have been tallied, suggesting that the establishment is acting to prevent any potential surge or momentum gain for Paul.

“The national political establishment and their pals in the national media will do ‘anything’ to silence our message of liberty,” Tate stated.

Read More @ InfoWars.com

Fire-bombs

and tear gas greeted negotiations at Greek Parliament on Sunday over

the contraversial loan and austerity package to avoid the country facing

financial meltdown and being thrown out of the euro-zone.

by Roland Gribben, and Louise Armitstead, Telegraph.co.uk:

More

than 45,000 protestors, many facing steep cuts in pensions, wages and a

bigger fall in living standards besieged the building in two

demonstrations. A minority were met with tear gas by the 4,000 policemen

after throwing fire bombs.

More

than 45,000 protestors, many facing steep cuts in pensions, wages and a

bigger fall in living standards besieged the building in two

demonstrations. A minority were met with tear gas by the 4,000 policemen

after throwing fire bombs.

Inside emotions ran high over the price the country was being forced to pay for its second bail out, a EURO130bn (£108bn) loan from the EU and the International Monetary Fund to head off the threat of bankruptcy and withdrawal from the euro.

Finance minister Evangelos Venizelos, in a passionate appeal for support before the midnight vote, said: “We must show that Greeks, when they are called on to choose between the bad and the worst, choose the bad to avoid the worst.”

Read More @ Telegraph.co.uk

by Roland Gribben, and Louise Armitstead, Telegraph.co.uk:

More

than 45,000 protestors, many facing steep cuts in pensions, wages and a

bigger fall in living standards besieged the building in two

demonstrations. A minority were met with tear gas by the 4,000 policemen

after throwing fire bombs.

More

than 45,000 protestors, many facing steep cuts in pensions, wages and a

bigger fall in living standards besieged the building in two

demonstrations. A minority were met with tear gas by the 4,000 policemen

after throwing fire bombs.Inside emotions ran high over the price the country was being forced to pay for its second bail out, a EURO130bn (£108bn) loan from the EU and the International Monetary Fund to head off the threat of bankruptcy and withdrawal from the euro.

Finance minister Evangelos Venizelos, in a passionate appeal for support before the midnight vote, said: “We must show that Greeks, when they are called on to choose between the bad and the worst, choose the bad to avoid the worst.”

Read More @ Telegraph.co.uk

by Tibor Machan, The Daily Bell:

Seeing

that it looks like Mitt Romney may well win the Republican nomination –

though it’s too early to be sure about that – it has been a concern of

freedom loving Americans whether the nod given to human individual

liberty by the Tea Party back in 2010 will have staying power. When the

Republicans began their primaries it looked like one or another of the

champions of serious liberty, such as former New Mexico Governor Gary

Johnson or Texas Representative Ron Paul, could either make it or at

least have an influence on who will. This last is still a possibility

but not very likely now.

Seeing

that it looks like Mitt Romney may well win the Republican nomination –

though it’s too early to be sure about that – it has been a concern of

freedom loving Americans whether the nod given to human individual

liberty by the Tea Party back in 2010 will have staying power. When the

Republicans began their primaries it looked like one or another of the

champions of serious liberty, such as former New Mexico Governor Gary

Johnson or Texas Representative Ron Paul, could either make it or at

least have an influence on who will. This last is still a possibility

but not very likely now.

With Gingrich injecting the influence of the Beltway Republican insiders into the race and with Mitt Romney derailing any progress toward a consistent political philosophy of liberty among Republicans, prospects for repeating, let alone enhancing, the central trends represented by the Tea Party – which itself has never been fully focused on true liberty – are waning. And that is very disturbing because it looks more and more like Barack Obama has no interest whatever in individual rights, in a bona fide free society and market, or even in civil liberties. What he is after is a populist reformation of the American polity, one that will usher in democratic socialism, with its confusing “market” socialism added.

Read More @ TheDailyBell.com

Seeing

that it looks like Mitt Romney may well win the Republican nomination –

though it’s too early to be sure about that – it has been a concern of

freedom loving Americans whether the nod given to human individual

liberty by the Tea Party back in 2010 will have staying power. When the

Republicans began their primaries it looked like one or another of the

champions of serious liberty, such as former New Mexico Governor Gary

Johnson or Texas Representative Ron Paul, could either make it or at

least have an influence on who will. This last is still a possibility

but not very likely now.

Seeing

that it looks like Mitt Romney may well win the Republican nomination –

though it’s too early to be sure about that – it has been a concern of

freedom loving Americans whether the nod given to human individual

liberty by the Tea Party back in 2010 will have staying power. When the

Republicans began their primaries it looked like one or another of the

champions of serious liberty, such as former New Mexico Governor Gary

Johnson or Texas Representative Ron Paul, could either make it or at

least have an influence on who will. This last is still a possibility

but not very likely now.With Gingrich injecting the influence of the Beltway Republican insiders into the race and with Mitt Romney derailing any progress toward a consistent political philosophy of liberty among Republicans, prospects for repeating, let alone enhancing, the central trends represented by the Tea Party – which itself has never been fully focused on true liberty – are waning. And that is very disturbing because it looks more and more like Barack Obama has no interest whatever in individual rights, in a bona fide free society and market, or even in civil liberties. What he is after is a populist reformation of the American polity, one that will usher in democratic socialism, with its confusing “market” socialism added.

Read More @ TheDailyBell.com

by Julian D. W. Phillips, GoldSeek.com:

In Part I of this article we looked at the growing trend of governments moving their gold into their own home vaults to remove the influence and potential seizure of their gold when political policies clash with the country where the holding central bank was situated. We covered the dangers of holding gold at home and the difference in attitude individual’s should have towards the problem of where and how to hold gold.

We also highlighted that a law in China that makes it illegal to export gold allowing the nation’s total stock of gold to rise. Should the day come when the People’s Bank of China believes that it should harness the nation’s gold, then it will be in a position to confiscate its citizen’s gold. It appears difficult to reach any other conclusion to that law. With this policy it appears that the importance to gold in a nation’s stocks will be of rising importance in the years to come. It follows then that other nations, including those in the developed world, may follow suit if the global financial scene deteriorates or if a change in the monetary system warrants it. Such a move would place all gold investors in danger of having their gold appropriated in the national interests. When U.S. citizens had gold ownership returned to them in 1974 after 40 years, they were informed by government that gold ownership was a privilege, not a right! What does this imply to you?

Read More @ GoldSeek.com

In Part I of this article we looked at the growing trend of governments moving their gold into their own home vaults to remove the influence and potential seizure of their gold when political policies clash with the country where the holding central bank was situated. We covered the dangers of holding gold at home and the difference in attitude individual’s should have towards the problem of where and how to hold gold.

We also highlighted that a law in China that makes it illegal to export gold allowing the nation’s total stock of gold to rise. Should the day come when the People’s Bank of China believes that it should harness the nation’s gold, then it will be in a position to confiscate its citizen’s gold. It appears difficult to reach any other conclusion to that law. With this policy it appears that the importance to gold in a nation’s stocks will be of rising importance in the years to come. It follows then that other nations, including those in the developed world, may follow suit if the global financial scene deteriorates or if a change in the monetary system warrants it. Such a move would place all gold investors in danger of having their gold appropriated in the national interests. When U.S. citizens had gold ownership returned to them in 1974 after 40 years, they were informed by government that gold ownership was a privilege, not a right! What does this imply to you?

Read More @ GoldSeek.com

from Greg Hunter’s USAWatchdog.com:

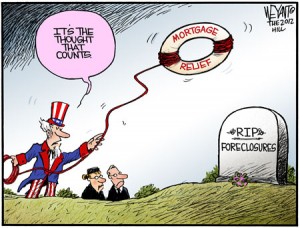

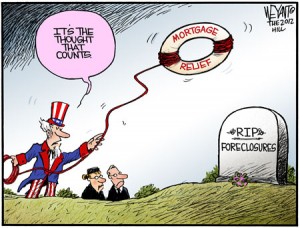

It is official. State and federal governments have condoned forgery, perjury and fraud in what’s been called the “robo-signing” foreclosure debacle. Last week, the five biggest banks in America signed on to a $26 billion deal that, basically, lets them off with a slap on the wrist for fraudulently foreclosing on homes in the last few years. I am not going to go on and on about how unfair and unjust this deal was or how the rule of law has been thrown down the stairs. I am going to focus on the fallout of this morally corrupt deal.

There is $700 billion in negative home equity with nearly half (11 million) of all houses underwater. Meaning, more is owed on the mortgage than the home is worth. This settlement may help a few folks, but it is a drop in an ocean of debt. Now that the deal is done, look for the pace of foreclosures to pick up speed and home values to take another cliff dive. If you thought the negative equity problem was at the bottom–forget it. The plunge in real estate prices is far from over, and it’s not going to turn positive anytime soon. Consider the latest Case-Shiller report where year-over-year declines in home values averaged 3.7% nationwide. This is despite 30-year mortgage rates at or below 4% and a big slowdown in foreclosures because federal and state governments were negotiating a deal for the past 16 months.

Read More @ USAWatchdog.com

It is official. State and federal governments have condoned forgery, perjury and fraud in what’s been called the “robo-signing” foreclosure debacle. Last week, the five biggest banks in America signed on to a $26 billion deal that, basically, lets them off with a slap on the wrist for fraudulently foreclosing on homes in the last few years. I am not going to go on and on about how unfair and unjust this deal was or how the rule of law has been thrown down the stairs. I am going to focus on the fallout of this morally corrupt deal.

There is $700 billion in negative home equity with nearly half (11 million) of all houses underwater. Meaning, more is owed on the mortgage than the home is worth. This settlement may help a few folks, but it is a drop in an ocean of debt. Now that the deal is done, look for the pace of foreclosures to pick up speed and home values to take another cliff dive. If you thought the negative equity problem was at the bottom–forget it. The plunge in real estate prices is far from over, and it’s not going to turn positive anytime soon. Consider the latest Case-Shiller report where year-over-year declines in home values averaged 3.7% nationwide. This is despite 30-year mortgage rates at or below 4% and a big slowdown in foreclosures because federal and state governments were negotiating a deal for the past 16 months.

Read More @ USAWatchdog.com

The

US dollar may have until June of 2012 before it replaces the euro as

the currency of deep concern. Gold can continue for a period of time

being played by the hedge funds but its next test is not at $1500 but

rather at $2111.

by Eric De Groot:

I agree, Jim

The 2011-2012 D-wave decline has a window of time with a mean of March and range of December (2011) to July. Its window of price has a mean of $1530 and range of $1414 to $1680. These parameters are calculated in table 1.

Table 1: Gold’s D-Wave Analysis

The sharp decline in Gold’s DI from its second peak increases the probability that D-wave ended at $1530 on December 29th 2011 (see chart 1). That is, it likely illustrates an end to the massive transfer of paper ownership from weak to strong hands during the emotional panic of 2011 D-wave decline.

Chart 1: Gold London P.M Fixed and Gold Diffusion Index (DI)

Read More @ EDeGrootInsights.Blogspot.com

by Eric De Groot:

I agree, Jim

The 2011-2012 D-wave decline has a window of time with a mean of March and range of December (2011) to July. Its window of price has a mean of $1530 and range of $1414 to $1680. These parameters are calculated in table 1.

Table 1: Gold’s D-Wave Analysis

The sharp decline in Gold’s DI from its second peak increases the probability that D-wave ended at $1530 on December 29th 2011 (see chart 1). That is, it likely illustrates an end to the massive transfer of paper ownership from weak to strong hands during the emotional panic of 2011 D-wave decline.

Chart 1: Gold London P.M Fixed and Gold Diffusion Index (DI)

Read More @ EDeGrootInsights.Blogspot.com

by Michael S. Rozeff, LewRockwell.com:

No

matter what anyone says, Iran is not a threat to the U.S. and not even

close to being a threat to the U.S. The forces of the U.S. are so

extensive and so overwhelming on so many dimensions that for Iran to

attack the U.S. would be sheer madness. The Iranians know this. The U.S.

knows this. Israel knows this.

No

matter what anyone says, Iran is not a threat to the U.S. and not even

close to being a threat to the U.S. The forces of the U.S. are so

extensive and so overwhelming on so many dimensions that for Iran to

attack the U.S. would be sheer madness. The Iranians know this. The U.S.

knows this. Israel knows this.

We know for a fact that Iran was unable to defeat Iraq in the Iran-Iraq War (1980-1988).

Anyone with access to the internet can easily determine that Iran doesn’t stand a chance in a war with the U.S. Anyone who says or thinks that Iran is a threat to the U.S. that should be taken seriously is talking nonsense.

The Iranians cannot want war and do not want war with the U.S. There are absolutely no signs that the Iranians want or intend a war against the U.S. In fact, they have already absorbed a number of aggressive acts from Israel and the U.S. without any kind of retaliation.

Read More @ LewRockwell.com

No

matter what anyone says, Iran is not a threat to the U.S. and not even

close to being a threat to the U.S. The forces of the U.S. are so

extensive and so overwhelming on so many dimensions that for Iran to

attack the U.S. would be sheer madness. The Iranians know this. The U.S.

knows this. Israel knows this.

No

matter what anyone says, Iran is not a threat to the U.S. and not even

close to being a threat to the U.S. The forces of the U.S. are so

extensive and so overwhelming on so many dimensions that for Iran to

attack the U.S. would be sheer madness. The Iranians know this. The U.S.

knows this. Israel knows this.We know for a fact that Iran was unable to defeat Iraq in the Iran-Iraq War (1980-1988).

Anyone with access to the internet can easily determine that Iran doesn’t stand a chance in a war with the U.S. Anyone who says or thinks that Iran is a threat to the U.S. that should be taken seriously is talking nonsense.

The Iranians cannot want war and do not want war with the U.S. There are absolutely no signs that the Iranians want or intend a war against the U.S. In fact, they have already absorbed a number of aggressive acts from Israel and the U.S. without any kind of retaliation.

Read More @ LewRockwell.com

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment