"Uh, Marriner Eccles: We Have A Problem" - Obama Predicts He Will Breach Debt Ceiling Two Months Before Election

In light of the epic fiasco from last August, when the US debt ceiling hike became a 2 month televized affair, culminating with the GOP caving, but not before the S&P downgraded the US (and in the process breaking the US stock market), Zero Hedge has long been analyzing the chronology of future debt breaches, as with the presidential election in November, what happens in the months and weeks ahead of it as pertains to the number one problem facing America - its lethal debt addiction - will be by far the biggest weakness of Obama's campaign. This is something we believe the GOP has finally understood, and they want a full replay of last August's insanity, to remind America just how broke (and broken) this country is. Yet it turns out all of our analyses have been for naught (if 100% correct). Because it is none other than President Barack Obama who has been kind enough to point out, that on September 30, 2012, or in just over 7 months, total US debt subject to the limit will be, wait for it, $16,333,900,000,000. Why is this an issue: because the final debt ceiling that Obama has been afforded with automatic Senatorial roll overs (even as Congress theatrically votes these down), is $16,394,000,000. In other words, with two months ahead of the election, the US will have a de minimis $60 billion in debt capacity. And since the implied burn rate is $133 billion/month this means that the United States will be in full blown debt ceiling hike chaos just as the final electoral debates take place. And one wonders why the GOP rushed to green light Obama an additional $160 billion in debt issuance. If indeed the $160 billion in new debt is added, the US may not even last to September before Tim Geithner is forced to start plundering G-fund and other retirement accounts. It also means that two months of America in a debt ceiling breach situation will deal a dramatic blow to Obama's reelection chances as the last thing the US population will want is a replay of last summer.It's Not Just Gasoline Consumption That's Tanking, It's All Energy

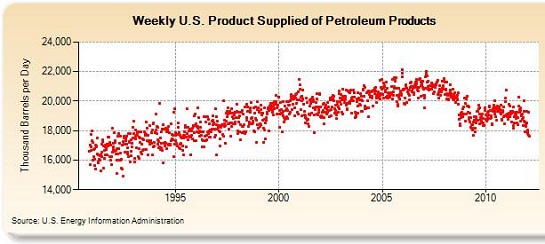

A number of readers kindly forwarded additional data sources to me as followup on last week's entry describing sharply lower deliveries of gasoline. The basic thesis here is that petroleum consumption is a key proxy of economic activity. In periods of economic expansion, energy consumption rises. In periods of contraction, consumption levels off or declines. This common sense correlation calls into question the Status Quo's insistence that the U.S. economy has decoupled from the global ecoomy and is still growing. This growth will create more jobs, the story goes, and expand corporate profits which will power the stock market ever higher.... Here are links and charts of petroleum consumption, imports/exports, and electricity consumption. Let's start with a chart of total petroleum products, which includes all products derived from petroleum (distillates, fuels, etc.) provided by Bob C. The chart shows the U.S. consumed about 21 million barrels a day (MBD) at the recent peak of economic activity 2005-07; from that peak, "product supplied" has fallen to 18 MBD. The current decline is very steep and has not bottomed.

Standard of Livings Are Declining Across Most of the Western World

Chart Notes:Gold-adjusted retail sales, or constant currency sales, have

contracted year-over-year (YOY) since 2000. 2005 and 2007 saw brief periods

of constant currency YOY gains, but they didn't last long. Constant

currency retail sales hasn't been able surpass a -10% contraction since

2008. This contraction rates sits like an anvil over spending. Ever wonder

why that trip to brick and mortar...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

Are the Gold Shares Following Gold?

The short-term emotional response says, hell no. Mathematic-based

discipline says, yes. The correlation between gold and the gold stocks has

been 0.86 since 2000*. This is a strong correlation. Does this suggest gold

and the gold stocks are comparable investments? Yes and no. While gold

stocks are tightly correlated with gold, their unique business risks alter

their reward profile relative to...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

Buy Gold Stock Weakness, Says The Market

Ephrem, The market’s message after a massive, multi-decade breakout is buy

weakness. Unfortunately, human behavior is hardwired for selling rather

than buying fear. This means gold shares train, fueled by rising gold

prices, will shed a lot of passengers along the way. S&P Gold (Formerly

Precious Metals Mining)* The gold shares mania phase, characterized by

rising dividends and higher...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

I Am Worried About 2013, 2014

Things look better, but whether it is actually real or not is the question.

I am worried about the U.S., especially in 2013 and 2014. In the U.S., they

are going to continue printing money and sending out good news to win votes

this year. - *in Money News*

Related, SPDR S&P 500 ETF (SPY), iShares Russell 2000 Index ETF (IWM)

*Jim Rogers is an author, financial commentator and successful

international investor. He has been frequently featured in Time, The New

York Times, Barron’s, Forbes, Fortune, The Wall Street Journal, The

Financial Times and is a regular guest on Bloomberg and C... more »

Greece Is Just A Small Appetizer

It’s a symptom of a wider problem that we have over-indebted governments in the Western world and Japan and this is just a small plate, a small appetizer to much larger problems and a much larger crisis. - *in Fox Business News* *Marc Faber is an international investor known for his uncanny predictions of the stock market and futures markets around the world.*

"Spain Is Fine"

If

there is one physics rule that the central planners know all about, in

their utter disdain of virtually every other natural principle, regression to the mean being the most prominent one, it is the law of communicating vessels.

Only instead of water, the central banks use monetary liquidity to

achieve equivalency across the various different vessels a/k/a capital

shortfall locations. Such as the Spanish financial sector. Think that

"Spain is fine"? Look at the chart below and think again. And don't even

get us started on Portugal. How long before the residents of Portugal

and Spain pull a Greece and

withdraw 20% of statutory bank deposits in a year, in the process

starting the terminal unwind of these two countries financial cores and

putting them on day to day ECB life support? Oh wait, they already have.

The chart below, showing Spanish bank borrowings from the ECB, is

self-explanatory, even when factored in for "seasonal adjustments."

If

there is one physics rule that the central planners know all about, in

their utter disdain of virtually every other natural principle, regression to the mean being the most prominent one, it is the law of communicating vessels.

Only instead of water, the central banks use monetary liquidity to

achieve equivalency across the various different vessels a/k/a capital

shortfall locations. Such as the Spanish financial sector. Think that

"Spain is fine"? Look at the chart below and think again. And don't even

get us started on Portugal. How long before the residents of Portugal

and Spain pull a Greece and

withdraw 20% of statutory bank deposits in a year, in the process

starting the terminal unwind of these two countries financial cores and

putting them on day to day ECB life support? Oh wait, they already have.

The chart below, showing Spanish bank borrowings from the ECB, is

self-explanatory, even when factored in for "seasonal adjustments."US Financial Stocks Catching Up To Credit Weakness

We

noted last week that credit spreads (particularly for financials in

Europe and the US) were deteriorating rapidly. In Europe we saw

financial stocks hold and then drop to catch up and once again today we

see them holding up as credit drops further. In the US, from

yesterday's gap up open exuberance, the major financials are

significantly underperforming as they catch up to the ugly reality of

the credit markets. Morgan Stanley and Citi are down 6% from

yesterday's opening level, BofA and Goldman are down 3.5-4% and Wells

Fargo is tracking the financial ETF (XLF) down around 2%. Even JPMorgan

is down 1.4%. Several of these names are retesting their 200DMAs from

above and volumes are picking up.

We

noted last week that credit spreads (particularly for financials in

Europe and the US) were deteriorating rapidly. In Europe we saw

financial stocks hold and then drop to catch up and once again today we

see them holding up as credit drops further. In the US, from

yesterday's gap up open exuberance, the major financials are

significantly underperforming as they catch up to the ugly reality of

the credit markets. Morgan Stanley and Citi are down 6% from

yesterday's opening level, BofA and Goldman are down 3.5-4% and Wells

Fargo is tracking the financial ETF (XLF) down around 2%. Even JPMorgan

is down 1.4%. Several of these names are retesting their 200DMAs from

above and volumes are picking up.Handelsblatt Warns Insufficient PSI Participation Will Lead To Greek Default

A few weeks ago, some of the more naive media elements reported that Greece has "all the cards" in its negotiations with private creditors, a topic we had the pleasure of deconstructing in its entirety to its constituent flaws? Well, a day ahead of the February 15 Eurozone meeting at which Greece's fate is finally supposed to be settled, things appear to be quite amiss. As a reminder, a critical part of the Greek debt deal is the private sector's agreement to roll over existing holdings into new bonds, which as we learned may now see the 15 cent per bond sweetener into new EFSF debt reduced. According to the Handelsblatt, that is now off the table. Dow Jones summarizes: "Some central bankers expect that Greece will fail to enlist enough private investors in a voluntary debt restructuring to avoid a technical default, a German newspaper reported Tuesday. Greece is likely to make its case for a voluntary debt swap after a meeting of euro group finance ministers Wednesday, the Handelsblatt newspaper says. The Greek government is seeking to lower its burden by EUR100 billion. Handelsblatt cites unnamed central bank sources as saying the country will fail to achieve that goal, leaving the government little choice but to make the write-down mandatory for investors holding out. Requiring investors to take a loss would prompt credit rating agencies to declare a debt default for Greece, an event with unforeseeable consequences for financial markets. The report doesn't specify whether its sources are with the European Central Bank or with the German Bundesbank. Neither bank would comment early Tuesday." Which of course is not news: after all even the rating agencies have long warned a Greek default is now inevitable, and a CDS trigger will follow. The only thing that there is massive confusion over is whether and how this event will impact everyone else, and whether it will lead to an explusion of Greece from the Eurozone. Optimism is that it is all priced in. So was Lehman.Unadjusted January Retail Sales Post Biggest Sequential Plunge In History

The

topic of BLS propaganda seasonal adjustments has been discussed

extensively here especially in light of January's NFP beat. We'll leave

it at that. However, we were rather surprised to note that the Census

Bureau may have also ramped up its seasonal adjustment "fudge factoring"

because when looking at the January headline retail sales data, which

naturally was a smoothly continuous line on a Seasonally Adjusted

basis, rising from $399.9 billion in December to $401.4 billion in

January, something rather odd happened in the Unadjusted data set: the plunge from $459.8 billion in December to $361.4 billion in January, or -$98.5 billion in one month, was the biggest one month drop in retail sales in history.

Now we won't say much on this topic, suffice to say that it would be

far more useful if the BLS and Census Bureaus were to open up their

models and explain in nuanced detail just what "old normal" adjustments

they still incorporate into data sets. Because as many have already

noted, seasonal adjustments used for data from 1980 to 2008 when "up"

was the only allowed direction for everything, are completely

irrelevant and misleading in the New Deleveraging Normal. Which reminds

us: Zero Hedge will offer $10,000 to the first BLS employee to share

with us the full and complete excel model set, including assumptions,

data tables, and comprehensive output parameters that the agency uses to

go from input A to output X. We hope that by spending that money we

will finally do society a service and open up to everyone just how it is

that the BLS adjusts its Non-Farm Payrolls data.

The

topic of BLS propaganda seasonal adjustments has been discussed

extensively here especially in light of January's NFP beat. We'll leave

it at that. However, we were rather surprised to note that the Census

Bureau may have also ramped up its seasonal adjustment "fudge factoring"

because when looking at the January headline retail sales data, which

naturally was a smoothly continuous line on a Seasonally Adjusted

basis, rising from $399.9 billion in December to $401.4 billion in

January, something rather odd happened in the Unadjusted data set: the plunge from $459.8 billion in December to $361.4 billion in January, or -$98.5 billion in one month, was the biggest one month drop in retail sales in history.

Now we won't say much on this topic, suffice to say that it would be

far more useful if the BLS and Census Bureaus were to open up their

models and explain in nuanced detail just what "old normal" adjustments

they still incorporate into data sets. Because as many have already

noted, seasonal adjustments used for data from 1980 to 2008 when "up"

was the only allowed direction for everything, are completely

irrelevant and misleading in the New Deleveraging Normal. Which reminds

us: Zero Hedge will offer $10,000 to the first BLS employee to share

with us the full and complete excel model set, including assumptions,

data tables, and comprehensive output parameters that the agency uses to

go from input A to output X. We hope that by spending that money we

will finally do society a service and open up to everyone just how it is

that the BLS adjusts its Non-Farm Payrolls data. European (like US) stocks remain in a narrow range just above the cliff of the unbelievably good NFP print of 2/3. US

and European credit markets have lost significant ground since then

and it seems equity investors just want to ignore this 'uglier' reality

for now. The BE500 (Bloomberg's broad European equity index)

is unchanged from immediately after the NFP 'jump', investment grade

credit is +10bps from its post-NFP tights, crossover (or high yield)

credit is around 50bps wider, Subordinated financial credit is +50bps

off its post-NFP wides at 382bps, and senior financial credit is an incredible 36bps wider at 225bps (by far the largest on a beta adjusted basis).

The divergence is very large, increasing, and a week old now and

perhaps most importantly as we look forward to LTRO Part Deux, LTRO-ridden

banks have underperformed dramatically (40bps wider since 2/7 as

opposed to non-LTRO banks which are only 10bps wider) - how's

that for a Stigma? Some 'banks' have suggested the underperformance of

credit is due to 'technicals' from profit-taking in the CDS market -

perhaps they should reflect on why there is profit-taking as opposed to

relying on recency bias to maintain their bullish and self-interest

positioning as the clear message across all of the credit asset class is - all is not well.

European (like US) stocks remain in a narrow range just above the cliff of the unbelievably good NFP print of 2/3. US

and European credit markets have lost significant ground since then

and it seems equity investors just want to ignore this 'uglier' reality

for now. The BE500 (Bloomberg's broad European equity index)

is unchanged from immediately after the NFP 'jump', investment grade

credit is +10bps from its post-NFP tights, crossover (or high yield)

credit is around 50bps wider, Subordinated financial credit is +50bps

off its post-NFP wides at 382bps, and senior financial credit is an incredible 36bps wider at 225bps (by far the largest on a beta adjusted basis).

The divergence is very large, increasing, and a week old now and

perhaps most importantly as we look forward to LTRO Part Deux, LTRO-ridden

banks have underperformed dramatically (40bps wider since 2/7 as

opposed to non-LTRO banks which are only 10bps wider) - how's

that for a Stigma? Some 'banks' have suggested the underperformance of

credit is due to 'technicals' from profit-taking in the CDS market -

perhaps they should reflect on why there is profit-taking as opposed to

relying on recency bias to maintain their bullish and self-interest

positioning as the clear message across all of the credit asset class is - all is not well.Headline Retail Sales Miss For Third Month In A Row, First Threepeat Miss Since July 2008

And so the great American retail recovery continues being delayed following the third consecutive miss in headline retail sales in a row, despite what was ridiculous and erroneously touted as a record spending season. Well here come the 'product returns' as retailer margins shrink further into negative territory. Today's advance retail sales number came at 0.4% on expectations of a 0.8% increase, from a downward revised 0.0% (0.1% previously), which makes a mockery of both the car sales numbers in December which were the weakest link in today's retail sales, and of surging consumer credit as it proves beyond a shadow of a doubt that US consumers are now using credit cards for the most basic of staples, forget discretionary purchases! And while the number below the headlines was modestly better with ex autos and gas coming at 0.6% on expectations of 0.5%, the prior revision took December to a decline -0.2% from a previously unchanged number. In other words, expect today's ex cars and gas number to be revised to a miss next month as as the Census Bureau learns some key number fudging lessons from the BLS. Yet here is the punchline: there have not been three consecutive retail sales misses since... drumroll please... July 2008. And we all know what happened in the months following. For those who don't, here it is.

Iran Patrol Boats, Drones Shadow CVN-72 Abraham Lincoln As It Passes Through Straits Of Hormuz

The US aircraft carrier Abrham Lincoln, which demonstratively passed through the Straits of Hormuz a month ago just to "test the waters", has now sailed out of the Persian Gulf following a several day stay in the 5th Fleet base in Bahrain. And unlike the previous passage, Iran decided to get up close and personal. As AP reports: "The American aircraft carrier USS Abraham Lincoln has passed through the Strait of Hormuz, shadowed by Iranian patrol boats. But there were no incidents on Tuesday as the Lincoln’s battle group crossed through the narrow strait, which Iran has threatened to close in retaliation for tighter Western sanctions. Several U.S. choppers flanked the carrier group throughout the voyage from the Gulf. Radar operators also picked up an Iranian drone and surveillance helicopter in Iran’s airspace near the strait, which is jointly controlled by Iran and Oman. The Lincoln entered the Gulf last month amid heightened tensions with Iran. It is scheduled to begin providing aiding the NATO mission in Afghanistan starting Thursday." Which mission would that be: the one where the US has withdrawn from? Luckily, this time no "hacker" managed to take over an Iranian boat and to send a few stray torpedoes in the Lincoln's general direction. Hopefully that continues. Also, it is unclear if the drones shadowing CVN-72 were the same that Iran with China's help, reverse engineered after the US drone fell in the middle of Tehran and did not self-destruct.

Greek Economic Deterioration Accelerates As Q4 GDP Slides By 7%, Unemployment Over 20%

There had been some hopes for Greece following the Q3 GDP number which slowed the decline in the country's economy when it dropped by just 5%, following drops of 8% and 7.3% in Q1 and Q2. These may have to be doused following a report that Q4 GDP came in at a disappointing -7%. As Athensnews reports: "The country's economic slump is headed towards a record annual plunge close to 7 percent in 2011, the fourth consecutive year of a deepening recession. After an official confirmation by the Hellenic Statistical Authority (Elstat) on Tuesday that GDP dropped 7 percent year-on-year in the fourth quarter of 2011, the economy has shrunk by an average of 6.8 percent. The latest quarterly contraction followed a slight slowdown of the depression in the preceding quarter, with GDP shrinking 5 percent due to the customary seasonal surge of tourist revenues in the summer." The full year drop was a record 6.8%, compared to the expected 6% projected in the 2012 budget. No comment there.Inevitable US, UK, Japan, Euro Downgrades Lead To Further Currency Debasement

While all the focus has been on Greece in recent days, the global nature of the debt crisis came to the fore yesterday and overnight. This was seen in the further desperate measures by the BOJ and Moodys warning that the UK could lose its AAA rating. Some of us have been saying for some years that this was inevitable but markets remain myopic of the risks posed by this. Possibly the greatest risk is that of the appalling US fiscal situation which continues to be downplayed and not analysed appropriately. President Obama unveiled a massive $3.8 trillion budget yesterday and he is to increase Federal spending by 53% to $5.820 trillion by 2022. The US government is projected to spend over $6 trillion a year by 2022. Still bizarrely unaccounted for is the ticking time bomb of unfunded entitlement liabilities - Social Security and Medicare, which Washington continues to deal with by completely ignoring them. While Washington and markets are for now ignoring the fiscal train wreck that is the US. This will change with inevitable and likely extremely negative consequences for markets – particularly US bond markets and for the dollar.European Recession Deepens As German Industrial Output Slides More Than Greek, Despite Favorable ZEW

Earlier today we got another indication that Europe's recession will hardly be a "technical" or "transitory" or whatever it is that local spin doctors call it, after the European December Industrial Output declined by 1.1% led by a whopping 2.7% drop by European growth dynamo Germany, which slid by 2.7% compared to November (which in turn was a 0.3% decline). This was worse than the Greek number which saw a 2.4% drop, however starting at zero somewhat limits one's downside. Yet even as the German economic decline accelerated, German ZEW investor expectations, which just like all of America's own consumer "CONfidence" metrics are driven primarily off the stock market, which in turn is a function of investor myopia to focus only on nominal numbers and not purchasing power loss - a fact well known to central bankers everywhere - do not indicate much if anything about the economy, and all about how people view the DAX stock index, which courtesy of the ECB's massive balance sheet expansion, has been going up. And if there has been any light at all in an otherwise dreary European tunnel, it has been the dropping EURUSD, which however has since resumed climbing, and with it making German industrial exports once again problematic. Which in turn brings us back to the primary these of this whole charade: that Germany needs controlled chaos to keep the EURUSD low - the last thing Merkel needs is a fixed Europe. It is surprising how few comprehend this.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment