by Jim Sinclair, JSMineset.com:

My Dear Friends,

There are various points that I feel are critically important to define so that going forward we can better understand the implications of developments.

1. Definition of ‘Notional Value: The total value of a leveraged position’s assets. This term is commonly used in the options, futures, derivative and currency markets because a very small amount of invested money can control a large position (and have a large consequence for the trader). (From Investopedia.com…)

2. Keep in mind the notional value of the total amount of OTC derivatives outstanding reported by the BIS was reduced by 50% about two years ago when the BIS changed their computer basis for valuation by considering all derivatives as going to closure as value to maturity. The actual total value of all outstanding OTC derivatives that was then carried for two reporting periods on the books of the BIS is one quadrillion, one hundred and forty four trillion US dollars notional value. This is fact. The $700 trillion US dollars that is quoted now has not changed since it was manufactured by a change in the method of accounting for notional value by reducing the number by approximately 50%.

3. The size of notional value of derivatives outstanding granted by US banking entities is reported to the US Controller of the Currency. US Banks that have non-US financial entities on their books as non consolidated subsidiaries do not report to the US Controller of the Currency.

Now for the most important concept to understand:

Read More @ JSMineset.com

My Dear Friends,

There are various points that I feel are critically important to define so that going forward we can better understand the implications of developments.

1. Definition of ‘Notional Value: The total value of a leveraged position’s assets. This term is commonly used in the options, futures, derivative and currency markets because a very small amount of invested money can control a large position (and have a large consequence for the trader). (From Investopedia.com…)

2. Keep in mind the notional value of the total amount of OTC derivatives outstanding reported by the BIS was reduced by 50% about two years ago when the BIS changed their computer basis for valuation by considering all derivatives as going to closure as value to maturity. The actual total value of all outstanding OTC derivatives that was then carried for two reporting periods on the books of the BIS is one quadrillion, one hundred and forty four trillion US dollars notional value. This is fact. The $700 trillion US dollars that is quoted now has not changed since it was manufactured by a change in the method of accounting for notional value by reducing the number by approximately 50%.

3. The size of notional value of derivatives outstanding granted by US banking entities is reported to the US Controller of the Currency. US Banks that have non-US financial entities on their books as non consolidated subsidiaries do not report to the US Controller of the Currency.

Now for the most important concept to understand:

Read More @ JSMineset.com

German Showdown With IMF Looms As Bundestag Blocks Rescue Funds

Germany’s

ruling parties are to introduce a resolution in parliament blocking any

further boost to the EU’s bail-out machinery, vastly complicating

Greece’s rescue package and risking a major clash with the International

Monetary Fund.

by Ambrose Evans-Pritchard, Telegraph.co.uk:

“European

solidarity is not an end in itself and should not be a one-way street.

Germany’s engagement has reached it limits,” said the text, drafted by

Chancellor Angela Merkel’s Christian Democrats and Free Democrat (FDP)

allies.

“European

solidarity is not an end in itself and should not be a one-way street.

Germany’s engagement has reached it limits,” said the text, drafted by

Chancellor Angela Merkel’s Christian Democrats and Free Democrat (FDP)

allies.

“Germany itself faces strict austerity to comply with the national debt brake,” said the declaration, which will go to the Bundestag next week. Lawmakers said there is no scope to boost the EU’s “firewall” to €750bn, either by increasing the new European Stability Mechanism (ESM) or by running it together with the old bail-out fund (EFSF).

The tough stance reflects popular disgust in Germany at escalating demands. Bowing to pressure, Chancellor Merkel’s office said an increase in the ESM was “not necessary” since Italian and Spanish bond markets have recovered.

Read More @ Telegraph.co.uk

by Ambrose Evans-Pritchard, Telegraph.co.uk:

“European

solidarity is not an end in itself and should not be a one-way street.

Germany’s engagement has reached it limits,” said the text, drafted by

Chancellor Angela Merkel’s Christian Democrats and Free Democrat (FDP)

allies.

“European

solidarity is not an end in itself and should not be a one-way street.

Germany’s engagement has reached it limits,” said the text, drafted by

Chancellor Angela Merkel’s Christian Democrats and Free Democrat (FDP)

allies.“Germany itself faces strict austerity to comply with the national debt brake,” said the declaration, which will go to the Bundestag next week. Lawmakers said there is no scope to boost the EU’s “firewall” to €750bn, either by increasing the new European Stability Mechanism (ESM) or by running it together with the old bail-out fund (EFSF).

The tough stance reflects popular disgust in Germany at escalating demands. Bowing to pressure, Chancellor Merkel’s office said an increase in the ESM was “not necessary” since Italian and Spanish bond markets have recovered.

Read More @ Telegraph.co.uk

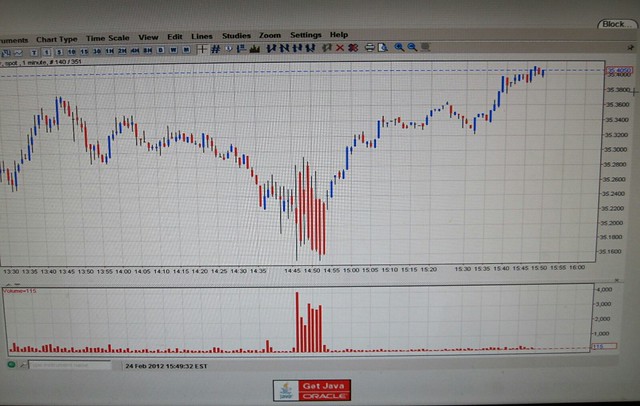

Cartel Dumps 102.5 Million Ounces of Paper Silver in 7 Minutes, Yet RAID FAILS!

The Doc at SilverDoctors - 1 hour ago

[image: photo]*If you happen to need to take a trip to an NYC ER room

tonight and experience an extraordinarily long wait, The Doc's about to

explain why.*

Silver has put in a monster rally this week, and much to the cartel's

dismay, was preparing to close the week above $35.50 today, preparing a

break-out next week that could potentially fill the gap from the September

smash to $40, and see silver off to the races back to challenge the

all-time nominal highs near $50. *Obviously, the cartel stepped in with a

massive paper raid to prevent such a bullish weekly close.

That's where ... more »

IS The United States Bankrupt?

Dave in Denver at The Golden Truth - 1 hour ago

*"it depends on what the meaning of the word 'IS' is" - *Bill Clinton

Have a great weekend. I hope everyone has been accumulating gold and

silver at these fire sale prices.

Commercials Nearly Double Net Silver Shorts to 200 Million Ounces Over Past Month!

The Doc at SilverDoctors - 2 hours ago

*The commercials increased their net silver shorts another 1,878 contracts

(9.39 million ounces) in the week ending 2/21/12.* *This brings the

commercial's net short silver futures position back up to 39,188 contracts,

or 195.94 million ounces!*

A mere 5 weeks ago, the commercials' net short position in silver had been

reduced to 20,382 contracts (101.91 million ounces). * In only 5 weeks

time, the commercials have increased their net silver shorts an astonishing

94.03 million ounces, or 92.2%! *

Expect this number to have significantly increased again during the $2+

rally in the 2... more »

Banking Cartel Prepares 17 tonne Silver Heist

The Doc at SilverDoctors - 4 hours ago

*Odyssey Phyzz

Headed to Banksters* *The 17 tonnes of silver discovered and salvaged by

Odyssey Marine Exploration in 2007 are being flown to Spain today, and will

become property of the Spanish Gov't. *The US Supreme Court this week

ruled in favor of Spain over Odyssey who discovered the silver as well as

spent millions recovering it, and the Peruvian descendents of the merchants

who actually owned the silver. Clearly the phyzz rightfully belongs to the

gov't to which the ship was licensed under, rather than the treasure

seekers who discovered it, the country whose waters it was... more »

Global money-printing to accelerate

from FinancialSense.com:

Jim

welcomes back Greg Weldon, CEO of Weldon Financial, for another

wide-ranging discussion. Greg sees Japan cranking up the money-printing

in 2012, as a tsunami of sovereign debt matures in Japan. Greg is

bullish on gold, as well as commodities, and sees a coming breakout in

silver.

Jim

welcomes back Greg Weldon, CEO of Weldon Financial, for another

wide-ranging discussion. Greg sees Japan cranking up the money-printing

in 2012, as a tsunami of sovereign debt matures in Japan. Greg is

bullish on gold, as well as commodities, and sees a coming breakout in

silver.

Click Here to Listen to the Interview

Click Here to Listen to the Interview

from FinancialSense.com:

Jim

welcomes back Greg Weldon, CEO of Weldon Financial, for another

wide-ranging discussion. Greg sees Japan cranking up the money-printing

in 2012, as a tsunami of sovereign debt matures in Japan. Greg is

bullish on gold, as well as commodities, and sees a coming breakout in

silver.

Jim

welcomes back Greg Weldon, CEO of Weldon Financial, for another

wide-ranging discussion. Greg sees Japan cranking up the money-printing

in 2012, as a tsunami of sovereign debt matures in Japan. Greg is

bullish on gold, as well as commodities, and sees a coming breakout in

silver. Click Here to Listen to the Interview

Click Here to Listen to the Interview

by Gary Gibson, Whiskey and Gun Powder:

In a world of rising gasoline prices, Forbes tells us that gasoline prices are not actually rising, and in fact are lower than ever.

And they ain’t lyin’!

Writing for Forbes Louis Woodhill gets this seeming contradiction right. He views the price of gas not in terms of the depreciating monopoly money issued by the politically-empowered central bank…but in terms of the market’s favorite money: gold.

When viewed in relation to gold, gas prices are low…only 82% of their average over the past 41 years.

Gas prices aren’t high. The dollar is just falling, its value being undermined by politically-driven over-issue. So if you count the Fed-issued dollars as money — and are actually using it as a savings vehicles — then your world is being rocked by rising gas prices (and rising prices in everything else, too, except for computing power).

But it’s not just the rising prices of everything that threaten all of us. In his article Mr. Woodhill reminds us:

Read More @ WhiskeyAndGunPowder.com

In a world of rising gasoline prices, Forbes tells us that gasoline prices are not actually rising, and in fact are lower than ever.

And they ain’t lyin’!

Writing for Forbes Louis Woodhill gets this seeming contradiction right. He views the price of gas not in terms of the depreciating monopoly money issued by the politically-empowered central bank…but in terms of the market’s favorite money: gold.

When viewed in relation to gold, gas prices are low…only 82% of their average over the past 41 years.

Gas prices aren’t high. The dollar is just falling, its value being undermined by politically-driven over-issue. So if you count the Fed-issued dollars as money — and are actually using it as a savings vehicles — then your world is being rocked by rising gas prices (and rising prices in everything else, too, except for computing power).

But it’s not just the rising prices of everything that threaten all of us. In his article Mr. Woodhill reminds us:

Read More @ WhiskeyAndGunPowder.com

from King World News:

Today

Art Cashin told King World News that we are witnessing a slow motion

bank run in Greece. Cashin, who is Head of Floor Operations at UBS

(which has $612 billion under management), also said it needs watching

because if it accelerates it would be the first sign Greece is going to

default. Here is what Art Cashin had to say: “What you are watching,

and people always use the example of a slow motion train wreck, what we

are seeing so far is a slow motion bank run. If you were a Greek

citizen and you thought there was some risk that over the weekend

suddenly the euro could be replaced with the drachma you would be

worried.”

Today

Art Cashin told King World News that we are witnessing a slow motion

bank run in Greece. Cashin, who is Head of Floor Operations at UBS

(which has $612 billion under management), also said it needs watching

because if it accelerates it would be the first sign Greece is going to

default. Here is what Art Cashin had to say: “What you are watching,

and people always use the example of a slow motion train wreck, what we

are seeing so far is a slow motion bank run. If you were a Greek

citizen and you thought there was some risk that over the weekend

suddenly the euro could be replaced with the drachma you would be

worried.”

Art Cashin continues: Read More @ KingWorldNews.com

Today

Art Cashin told King World News that we are witnessing a slow motion

bank run in Greece. Cashin, who is Head of Floor Operations at UBS

(which has $612 billion under management), also said it needs watching

because if it accelerates it would be the first sign Greece is going to

default. Here is what Art Cashin had to say: “What you are watching,

and people always use the example of a slow motion train wreck, what we

are seeing so far is a slow motion bank run. If you were a Greek

citizen and you thought there was some risk that over the weekend

suddenly the euro could be replaced with the drachma you would be

worried.”

Today

Art Cashin told King World News that we are witnessing a slow motion

bank run in Greece. Cashin, who is Head of Floor Operations at UBS

(which has $612 billion under management), also said it needs watching

because if it accelerates it would be the first sign Greece is going to

default. Here is what Art Cashin had to say: “What you are watching,

and people always use the example of a slow motion train wreck, what we

are seeing so far is a slow motion bank run. If you were a Greek

citizen and you thought there was some risk that over the weekend

suddenly the euro could be replaced with the drachma you would be

worried.”Art Cashin continues: Read More @ KingWorldNews.com

Four

key elements suggest that gold is due for a break-out from its current

trading range and point to such a move happening very soon with new

highs by the summer.

by Barry Stuppler, MineWeb.com:

WOODLAND HILLS, CA – I believe that all the elements are now in place for a Gold break-out move from the current $1700/$1760 trading range. This move will happen very soon. There will be a short pause when it breaks into the $1,800 level, and then we are heading for new highs before the summer.

WHAT ARE THE KEY ELEMENTS TO THE COMING GOLD MOVE?

1) More Global Quantitative Easing (monetary stimulus) is on the way

Both Great Britain and Japan have recently announced massive increases in monetary stimulus programs. The Eurozone countries have currently given problem banks that are holding sovereign debt massive injections of euros, and are also preparing massive amounts of monetary assistance for Greece, Spain, Italy, and Portugal. While in the U.S., more than a majority of Federal Reserve Open Market Committee Governors favor another round of monetary stimulus (QE3) to keep our economic recovery on course within the United States.

Read More @ MineWeb.com

by Barry Stuppler, MineWeb.com:

WOODLAND HILLS, CA – I believe that all the elements are now in place for a Gold break-out move from the current $1700/$1760 trading range. This move will happen very soon. There will be a short pause when it breaks into the $1,800 level, and then we are heading for new highs before the summer.

WHAT ARE THE KEY ELEMENTS TO THE COMING GOLD MOVE?

1) More Global Quantitative Easing (monetary stimulus) is on the way

Both Great Britain and Japan have recently announced massive increases in monetary stimulus programs. The Eurozone countries have currently given problem banks that are holding sovereign debt massive injections of euros, and are also preparing massive amounts of monetary assistance for Greece, Spain, Italy, and Portugal. While in the U.S., more than a majority of Federal Reserve Open Market Committee Governors favor another round of monetary stimulus (QE3) to keep our economic recovery on course within the United States.

Read More @ MineWeb.com

The

record volatility, and 400 point up and down days in the DJIA of last

summer seem like a lifetime ago, having been replaced by a smooth,

unperturbed, 45 degree-inclined see of stock market appreciation, rising

purely on the $2 trillion or so in liquidity pumped into global markets

by the central printers, ever since Italy threatened to blow up the

Ponzi last fall. In short – we have once again hit peak complacency. Yet

with crude now matching every liquidity injection tick for tick (and

then some: Crude’s WTI return is now higher than that of stocks), there

is absolutely no more space for the world central banks to inject any

more stock appreciation without blowing up Obama’s reelection chances

(and you can be sure they know it). Suddenly the market finds itself without an explicit backstop. So

what are some of the “realizations” that can pop the complacency bubble

leading to a stock market plunge, and filling the liquidity-filled gap?

Here are, courtesy of David Rosenberg, six distinct hurdles that loom

ever closer on the horizon, and having been ignored for too long,

courtesy of Bernanke et cie, will almost certainly become the market’s preoccupation all too soon.

Read More @ ZeroHedge.com

Please consider making a small donation, to help cover some of the labor and costs to run this blog.

Thank You

I'm PayPal Verified.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment