The 'Big Reset' Is Coming: Here Is What To Do

A week ago, Zero Hedge first presented the

now viral presentation by Raoul Pal titled "The End Game." We dubbed

the presentation scary because it was: in very frank terms it laid out

the reality of the current absolutely unsustainable situation while

pulling no punches. Yet some may have misread the underlying narrative:

Pal did not predict armageddon. Far from it: he forecast the end of the

current broken economic, monetary, and fiat system... which following its collapse will be replaced with something different, something stable. Which, incidentally, is why the presentation was called a big "reset", not the big "end." But what does that mean, and how does one protect from such an event? Luckily,

we have another presentation to share with readers, this time from

Eidesis Capital, given at the Grant's April 11 conference, which picks

up where Pal left off. Because if the Big Reset told us what is coming, Eidesis tells us how to get from there to the other side...

A week ago, Zero Hedge first presented the

now viral presentation by Raoul Pal titled "The End Game." We dubbed

the presentation scary because it was: in very frank terms it laid out

the reality of the current absolutely unsustainable situation while

pulling no punches. Yet some may have misread the underlying narrative:

Pal did not predict armageddon. Far from it: he forecast the end of the

current broken economic, monetary, and fiat system... which following its collapse will be replaced with something different, something stable. Which, incidentally, is why the presentation was called a big "reset", not the big "end." But what does that mean, and how does one protect from such an event? Luckily,

we have another presentation to share with readers, this time from

Eidesis Capital, given at the Grant's April 11 conference, which picks

up where Pal left off. Because if the Big Reset told us what is coming, Eidesis tells us how to get from there to the other side...Mrs. Watanabe, Meet Mrs. Brown

"Risk

on, risk off" might be the most essential hallmark of the current

market, but just focusing on the day-to-day whims of capital markets

ignores longer term changes to investor risk preferences. Nic Colas, of

ConvergEx looks at the topic from the vantage point of gender-specific

investment choices. For example, more women are participating in

deferred compensation (DC) plans, and the data from millions of 401(k)

accounts tells a useful story. Their retirement accounts still lag

those of their male counterparts in total value and they remain a bit

more risk-averse. But for the first time in at least a decade they are

more likely than men to contribute to a retirement account and are

contributing a greater percentage of their earnings. You’ll never see

pink or blue dots on the “Efficient Frontier” of academic models, to be

sure. However, both empirical data and psychological studies

do point to subtle – but notable – differences in how men and women

consider the classic risk-reward tradeoff inherent in the challenge of

investing. Nick suggests it may make sense to reconsider the

notion that continued money flows into bonds and other safe haven

investments are really "Risk off" market behavior. At least a piece of

it may well be "Risk shifting," driven by the demographic and

psychological factors as assets controlled by women are clearly

increasing. "Risk off" may well be "risk shift."

"Risk

on, risk off" might be the most essential hallmark of the current

market, but just focusing on the day-to-day whims of capital markets

ignores longer term changes to investor risk preferences. Nic Colas, of

ConvergEx looks at the topic from the vantage point of gender-specific

investment choices. For example, more women are participating in

deferred compensation (DC) plans, and the data from millions of 401(k)

accounts tells a useful story. Their retirement accounts still lag

those of their male counterparts in total value and they remain a bit

more risk-averse. But for the first time in at least a decade they are

more likely than men to contribute to a retirement account and are

contributing a greater percentage of their earnings. You’ll never see

pink or blue dots on the “Efficient Frontier” of academic models, to be

sure. However, both empirical data and psychological studies

do point to subtle – but notable – differences in how men and women

consider the classic risk-reward tradeoff inherent in the challenge of

investing. Nick suggests it may make sense to reconsider the

notion that continued money flows into bonds and other safe haven

investments are really "Risk off" market behavior. At least a piece of

it may well be "Risk shifting," driven by the demographic and

psychological factors as assets controlled by women are clearly

increasing. "Risk off" may well be "risk shift."SP 500 and NDX Futures Daily Charts

Asia Opens And Risk-On Closes

Update: Gold and Silver are extending losses now.

Asian markets have been open for an hour or two now and markets have done nothing but extend the late-day derisking from the last hour of the US day-session.

S&P 500 e-mini futures (ES) are down around 8pts from the close,

Treasury yields are 5-7bps off their intraday highs now (3-4bps lower

than where they closed), JPY is strengthening (carry-off - even though

Noda is scheduled to speak), AUD is weakening (carry-off - almost back

to post Aussie jobs print levels), and Copper & Oil are tumbling

(WTI back under $83). Gold and Silver are falling off quicker now

(having suffered during the day session and stabilized a little) as it

seems markets are playing catch up to their signals (still around unch

from 5/28 closing levels while WTI is down almost 9% and Copper -3.5%

from those swing equity highs). Broadly speaking risk assets are increasing in correlation and ES is getting dragged lower.

Update: Gold and Silver are extending losses now.

Asian markets have been open for an hour or two now and markets have done nothing but extend the late-day derisking from the last hour of the US day-session.

S&P 500 e-mini futures (ES) are down around 8pts from the close,

Treasury yields are 5-7bps off their intraday highs now (3-4bps lower

than where they closed), JPY is strengthening (carry-off - even though

Noda is scheduled to speak), AUD is weakening (carry-off - almost back

to post Aussie jobs print levels), and Copper & Oil are tumbling

(WTI back under $83). Gold and Silver are falling off quicker now

(having suffered during the day session and stabilized a little) as it

seems markets are playing catch up to their signals (still around unch

from 5/28 closing levels while WTI is down almost 9% and Copper -3.5%

from those swing equity highs). Broadly speaking risk assets are increasing in correlation and ES is getting dragged lower.

Hitler Is Long The USD, Gets A Margin Call

It's

been a while since we had a close encounter with Hitler and

specifically his trading prowess. Today we learn just how truly

powerless the German is when faced with the terrible trio of Geithner's

"strong dollar policy", a CFTC barrage of margin calls, and the fine

print of various precious metal ETFs. And of course FX sellside

"recommendations" by the TBTFs.

It's

been a while since we had a close encounter with Hitler and

specifically his trading prowess. Today we learn just how truly

powerless the German is when faced with the terrible trio of Geithner's

"strong dollar policy", a CFTC barrage of margin calls, and the fine

print of various precious metal ETFs. And of course FX sellside

"recommendations" by the TBTFs.

The World Before Central Banking

In

today’s world, there are many who want government to regulate and

control everything. The most bizarre instance, though — more bizarre

even than banning the sale of large-sized sugary drinks — is surely

central banking. Why? Well, central banking was created to replace something that was already working well.

Banking panics and bank runs happen, and they have always happened as

long as there has been banking. But the old system that the Fed

displaced wasn’t really malfunctioning — unlike what the defenders of

central banking today would have us believe. Does central

banking retard the economy by providing liquidity insurance and a

backstop to bad companies that would not otherwise be saved under a

free market “bailout” (like that of 1907)? And is it this

effect — that we call zombification — that is the force that has

prevented Japan from fully recovering from its housing bubble, and that

is keeping the West depressed from 2008? Will we only return to growth

once the bad assets and bad companies have been liquidated? That

conclusion, we think, is becoming inescapable.

In

today’s world, there are many who want government to regulate and

control everything. The most bizarre instance, though — more bizarre

even than banning the sale of large-sized sugary drinks — is surely

central banking. Why? Well, central banking was created to replace something that was already working well.

Banking panics and bank runs happen, and they have always happened as

long as there has been banking. But the old system that the Fed

displaced wasn’t really malfunctioning — unlike what the defenders of

central banking today would have us believe. Does central

banking retard the economy by providing liquidity insurance and a

backstop to bad companies that would not otherwise be saved under a

free market “bailout” (like that of 1907)? And is it this

effect — that we call zombification — that is the force that has

prevented Japan from fully recovering from its housing bubble, and that

is keeping the West depressed from 2008? Will we only return to growth

once the bad assets and bad companies have been liquidated? That

conclusion, we think, is becoming inescapable.

Europe's Banking Union 'Non-Solution'

While not quite Biderman-rant-worthy, Stratfor's more-attractive-than-Charles Kristen Cooper provides a brief and clear explanation, in this clip, of why the creation

of a European banking union, which seems to be the cure-du-jour, will

do little to help the eurozone's ongoing crisis in the short-term.

The degree of political integration required in order to agree on such

a solution will take years to conclude in her opinion with the various

constituencies all with different levels of urgency and time-horizon.

The sad truth is that while focusing on yet another grand plan will

make the leaders of Europe appear as though they are doing 'something'

(to themselves and others), a banking union in and of itself does little to solve the raging unemployment and more specifically the distrust of Spanish banks.

The idea of a banking union is not new (where Berlin would share

liabilities for deposits held by Spanish banks, for example, and in

return would enable an integrate supervisor of the financial sector -

some sovereignty give-ups), but as Kristen concludes: "How long

can the eurozone's political elite focus on long-term solutions

concerned with sovereign debt and banking bailouts before a genuine

social crisis emerges."

While not quite Biderman-rant-worthy, Stratfor's more-attractive-than-Charles Kristen Cooper provides a brief and clear explanation, in this clip, of why the creation

of a European banking union, which seems to be the cure-du-jour, will

do little to help the eurozone's ongoing crisis in the short-term.

The degree of political integration required in order to agree on such

a solution will take years to conclude in her opinion with the various

constituencies all with different levels of urgency and time-horizon.

The sad truth is that while focusing on yet another grand plan will

make the leaders of Europe appear as though they are doing 'something'

(to themselves and others), a banking union in and of itself does little to solve the raging unemployment and more specifically the distrust of Spanish banks.

The idea of a banking union is not new (where Berlin would share

liabilities for deposits held by Spanish banks, for example, and in

return would enable an integrate supervisor of the financial sector -

some sovereignty give-ups), but as Kristen concludes: "How long

can the eurozone's political elite focus on long-term solutions

concerned with sovereign debt and banking bailouts before a genuine

social crisis emerges."It sounds like a deal was cut... to have Rand Paul be romneys VP... romney can't win without Ron Paul supporters...I need to go puke now...

Rand Endorses Mitt [& Libertarians Puke]

by Alexander Burns, Politico:

File this under signs the Ron Paul campaign is really, truly over: Kentucky Sen. Rand Paul threw his support tonight to Mitt Romney.

File this under signs the Ron Paul campaign is really, truly over: Kentucky Sen. Rand Paul threw his support tonight to Mitt Romney.The endorsement came in an appearance on “Hannity,” a little less than 24 hours after the elder Paul acknowledged in an email that his delegate total is “not enough to win the nomination.”

Romney embraced the endorsement in a press release, calling Rand Paul a “leading voice in the effort to scale back the size and reach of government and promote liberty.”

“Over the past three and half years, President Obama has made government more and more of a presence in our lives, and Americans can’t afford four more years of the same failed policies,” Romney said. “As president, I will reform the federal government and make it smaller, simpler, and smarter. I am grateful for Sen. Paul’s support and look forward to working with him to get America back on the right track.”

Read More @ Politico

I would like to Thank Kevin O. our 7th donor, for his very generous donation.

Who will be our 8th?

Thank You

I'm PayPal Verified

by Jim Willie, Gold Seek:

Man-made financial phenomena imitate nature, but more importantly they

are subject to the powerful laws of economic nature. The Wall Street

financial engineers have built vast structures, which tragically are

crumbling and soon will fall to the ground. Vast illusory wealth will be

lost, never truly garnered. The fiat currency system has required

tremendous efforts not only to build the financial skyscrapers ever

higher each year, but also to provide support structures that prevent

their topple. With the aid of the subservient press, an illusion of

wealth, prosperity, and stability has been fashioned and defended. It is

all being blown away by the powerful storms known as the global

financial crisis. The term has even earned an acronym for the popular

lexicon GFC. My alternative view is that the global monetary war is in

full swing, World War III with the USDollar at the epicenter of the

conflict and pecuniary violence. A few years ago in June 2005, the

Jackass penned an obscure article entitled “Financial Market Physics” just for amusement. Thanks to Vronsky and his intrepid work, the Gold-Eagle archive still lives (for old article CLICK HERE).

In it was described momentum, pendulums, traction, leverage,

resistance, support, inertia, coiled springs, meltdowns, high versus low

pressure differentials, flow dynamics, imbalances, and the infamous

black hole. The final concept is of extreme relevance today.

Man-made financial phenomena imitate nature, but more importantly they

are subject to the powerful laws of economic nature. The Wall Street

financial engineers have built vast structures, which tragically are

crumbling and soon will fall to the ground. Vast illusory wealth will be

lost, never truly garnered. The fiat currency system has required

tremendous efforts not only to build the financial skyscrapers ever

higher each year, but also to provide support structures that prevent

their topple. With the aid of the subservient press, an illusion of

wealth, prosperity, and stability has been fashioned and defended. It is

all being blown away by the powerful storms known as the global

financial crisis. The term has even earned an acronym for the popular

lexicon GFC. My alternative view is that the global monetary war is in

full swing, World War III with the USDollar at the epicenter of the

conflict and pecuniary violence. A few years ago in June 2005, the

Jackass penned an obscure article entitled “Financial Market Physics” just for amusement. Thanks to Vronsky and his intrepid work, the Gold-Eagle archive still lives (for old article CLICK HERE).

In it was described momentum, pendulums, traction, leverage,

resistance, support, inertia, coiled springs, meltdowns, high versus low

pressure differentials, flow dynamics, imbalances, and the infamous

black hole. The final concept is of extreme relevance today. Read More @ GoldSeek.com

By Chris Powell, GATA:

Dear Friend of GATA and Gold:

In support of the campaign for Germany to repatriate its gold reserves from foreign central banks, the Bavarian chapter of the German Taxpayer Association has translated into German and French the June 1975 letter from Federal Reserve Chairman Arthur Burns to President Ford confirming a secret agreement with the German chancellor about surreptitiously controlling the gold market. The translations are posted at the Internet site of our friend, the German freelance journalist Lars Schall, here

Read More @ gata.org

Dear Friend of GATA and Gold:

In support of the campaign for Germany to repatriate its gold reserves from foreign central banks, the Bavarian chapter of the German Taxpayer Association has translated into German and French the June 1975 letter from Federal Reserve Chairman Arthur Burns to President Ford confirming a secret agreement with the German chancellor about surreptitiously controlling the gold market. The translations are posted at the Internet site of our friend, the German freelance journalist Lars Schall, here

Read More @ gata.org

from David McWilliams:

SPAIN is trying to call Gemany’s bluff. Yesterday, the Spanish finance

minister made a direct appeal to the rest of Europe to bail out Spanish

banks or at least to put together a fund to recapitalise the Spanish

banks. This is exactly what Germany didn’t want but may have to

ultimately accept. If it wants to keep the euro, Germany will have to

pay through the nose for the pleasure. By opening up another front, the

Spaniards have rammed home the point that Europe’s problems are not

about fiscal deficits as the Germans maintain, but about the

consequences of hyper-borrowing and lending in the boom.

SPAIN is trying to call Gemany’s bluff. Yesterday, the Spanish finance

minister made a direct appeal to the rest of Europe to bail out Spanish

banks or at least to put together a fund to recapitalise the Spanish

banks. This is exactly what Germany didn’t want but may have to

ultimately accept. If it wants to keep the euro, Germany will have to

pay through the nose for the pleasure. By opening up another front, the

Spaniards have rammed home the point that Europe’s problems are not

about fiscal deficits as the Germans maintain, but about the

consequences of hyper-borrowing and lending in the boom.

The banking crisis in Spain is not destroying wealth but merely reflecting the extent to which Spanish and European wealth has already been destroyed via too much borrowing and lending to stupid investments which have now gone sour.

This leaves Spain in the same bind as Ireland: the banks are facing mass defaults as the price of property keeps falling. Independent estimates suggest that Spanish house prices could fall by another 35pc if they mirror similar crashes from peak to trough in the sunbelt states of the US. This obviously has an impact on the extent to which the loans go bad. At the moment, Spanish banks have made provision for 2.5pc of loans going bad, yet we know from Irish experience that this can rise very quickly.

Read More @ DavidMcWilliams.ie

[Ed. note: Cartel throws 125 million ounces of paper silver at the market the moment the Bernank's remarks are released. Terrific! More opportunity for the informed. I propose we keep on dollar cost averaging the stackin' of PHYSICAL. We WIN. They LOSE.]

from BrotherJohnF:

SPAIN is trying to call Gemany’s bluff. Yesterday, the Spanish finance

minister made a direct appeal to the rest of Europe to bail out Spanish

banks or at least to put together a fund to recapitalise the Spanish

banks. This is exactly what Germany didn’t want but may have to

ultimately accept. If it wants to keep the euro, Germany will have to

pay through the nose for the pleasure. By opening up another front, the

Spaniards have rammed home the point that Europe’s problems are not

about fiscal deficits as the Germans maintain, but about the

consequences of hyper-borrowing and lending in the boom.

SPAIN is trying to call Gemany’s bluff. Yesterday, the Spanish finance

minister made a direct appeal to the rest of Europe to bail out Spanish

banks or at least to put together a fund to recapitalise the Spanish

banks. This is exactly what Germany didn’t want but may have to

ultimately accept. If it wants to keep the euro, Germany will have to

pay through the nose for the pleasure. By opening up another front, the

Spaniards have rammed home the point that Europe’s problems are not

about fiscal deficits as the Germans maintain, but about the

consequences of hyper-borrowing and lending in the boom.The banking crisis in Spain is not destroying wealth but merely reflecting the extent to which Spanish and European wealth has already been destroyed via too much borrowing and lending to stupid investments which have now gone sour.

This leaves Spain in the same bind as Ireland: the banks are facing mass defaults as the price of property keeps falling. Independent estimates suggest that Spanish house prices could fall by another 35pc if they mirror similar crashes from peak to trough in the sunbelt states of the US. This obviously has an impact on the extent to which the loans go bad. At the moment, Spanish banks have made provision for 2.5pc of loans going bad, yet we know from Irish experience that this can rise very quickly.

Read More @ DavidMcWilliams.ie

[Ed. note: Cartel throws 125 million ounces of paper silver at the market the moment the Bernank's remarks are released. Terrific! More opportunity for the informed. I propose we keep on dollar cost averaging the stackin' of PHYSICAL. We WIN. They LOSE.]

from BrotherJohnF:

from FractalSigns :

by Clif High, Half Past Human:

There are indications that the [unexpected military actions] that will

[soooo upset/anger/infuriate] the [populace/usofa] are now being moved

up by (7/seven to 9/nine days) from the end of June time frame discussed

in the ticks in time… article.

There are indications that the [unexpected military actions] that will

[soooo upset/anger/infuriate] the [populace/usofa] are now being moved

up by (7/seven to 9/nine days) from the end of June time frame discussed

in the ticks in time… article.

If so, then we can expect [officialdom] to be [pimping] their [lying 'experts'] starting on or about June 20th. The forecasts for the [unexpected military events] have a few sub sets that pointed to [corruption (being forced)] onto the [populace/usa] by [lying experts/authorities]. The issue arising within these data sets has always been the [unending river of lies (from officialdom)] that will run smack into a [gathering wall of disbelief] from the [populace/usofa]. From our (populace’s) view point it will seem as though the [officialdom] is [trotting out magicians and sorcerers in great numbers]…

Read More @ HalfPastHuman.com

from The Daily Bell:

Best day of 2012 for Dow industrials and S&P 500 … U.S. stocks

surged Wednesday, with the Dow industrials and S&P 500 both

tallying their best day this year, on increasing optimism that central

bankers would move to bolster the economy. “It appears the market is

under the belief that Uncle Ben and his band of merry makers are going

to be coming to the rescue,” Bob Pavlik, chief market strategist at

Banyan Partners, said of Federal Reserve Chairman Ben Bernanke

and other Federal Open Market Committee members. The Dow Jones

Industrial Average DJIA +1.05% climbed 286.84 points, or 2.4%, to

12,414.79. The S&P 500 Index SPX +0.99% advanced 29.63 points, or

2.3%, to 1,315.13. The Nasdaq Composite COMP +0.82% added 66.61 points, or 2.4%, to 2,844.72. – MarketWatch

Best day of 2012 for Dow industrials and S&P 500 … U.S. stocks

surged Wednesday, with the Dow industrials and S&P 500 both

tallying their best day this year, on increasing optimism that central

bankers would move to bolster the economy. “It appears the market is

under the belief that Uncle Ben and his band of merry makers are going

to be coming to the rescue,” Bob Pavlik, chief market strategist at

Banyan Partners, said of Federal Reserve Chairman Ben Bernanke

and other Federal Open Market Committee members. The Dow Jones

Industrial Average DJIA +1.05% climbed 286.84 points, or 2.4%, to

12,414.79. The S&P 500 Index SPX +0.99% advanced 29.63 points, or

2.3%, to 1,315.13. The Nasdaq Composite COMP +0.82% added 66.61 points, or 2.4%, to 2,844.72. – MarketWatch

Dominant Social Theme: Happy Days Are Here Again.

Free-Market Analysis: Or are they? Europe is failing, China just cut interest rates and US markets moved up hard on a hope and a prayer.

Read More @ TheDailyBell.com

I would like to Thank Kevin O. our 7th donor, for his very generous donation.

Who will be our 8th?

Thank You

I'm PayPal Verified

There are indications that the [unexpected military actions] that will

[soooo upset/anger/infuriate] the [populace/usofa] are now being moved

up by (7/seven to 9/nine days) from the end of June time frame discussed

in the ticks in time… article.

There are indications that the [unexpected military actions] that will

[soooo upset/anger/infuriate] the [populace/usofa] are now being moved

up by (7/seven to 9/nine days) from the end of June time frame discussed

in the ticks in time… article.If so, then we can expect [officialdom] to be [pimping] their [lying 'experts'] starting on or about June 20th. The forecasts for the [unexpected military events] have a few sub sets that pointed to [corruption (being forced)] onto the [populace/usa] by [lying experts/authorities]. The issue arising within these data sets has always been the [unending river of lies (from officialdom)] that will run smack into a [gathering wall of disbelief] from the [populace/usofa]. From our (populace’s) view point it will seem as though the [officialdom] is [trotting out magicians and sorcerers in great numbers]…

Read More @ HalfPastHuman.com

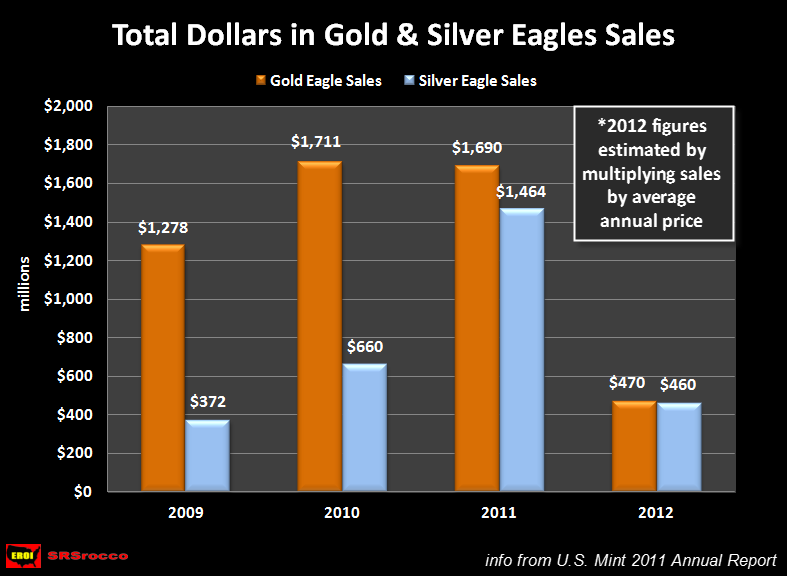

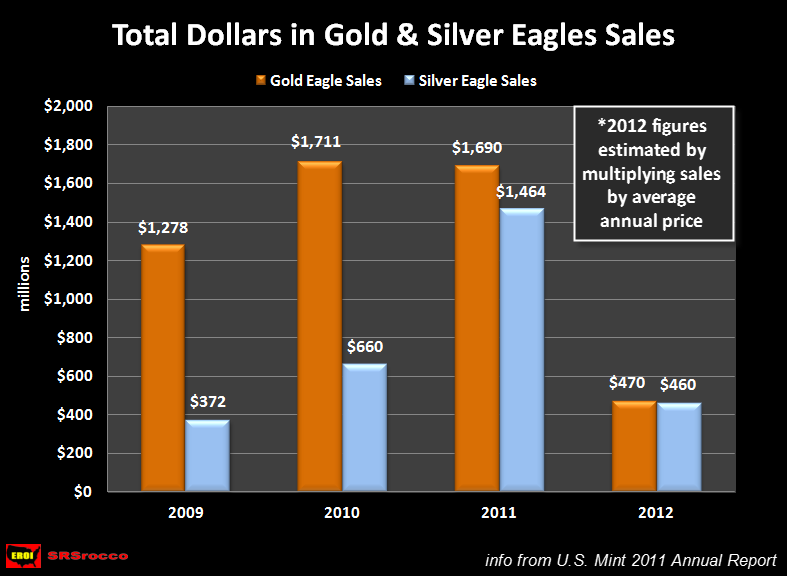

by SRSrocco Silver Doctors:

In 2011 total Silver Eagle Sales in Dollars were 86% compared to Gold Eagle sales.

In 2011 total Silver Eagle Sales in Dollars were 86% compared to Gold Eagle sales.

In 2012, that ratio has now moved up significantly to nearly 98%. 2009-2011 total dollar figures came from the 2011 US MINT ANNUAL REPORT. The 2012 figures were calculated taking the total sales ending in MAY 2012 times their respective average annual price according to Kitco.com.

It is plain to see that SILVER EAGLE SALES have been gaining on GOLD EAGLE SALES since 2009 and may even surpass them in 2012.

Read More @ SilverDoctors.com

In 2011 total Silver Eagle Sales in Dollars were 86% compared to Gold Eagle sales.

In 2011 total Silver Eagle Sales in Dollars were 86% compared to Gold Eagle sales.In 2012, that ratio has now moved up significantly to nearly 98%. 2009-2011 total dollar figures came from the 2011 US MINT ANNUAL REPORT. The 2012 figures were calculated taking the total sales ending in MAY 2012 times their respective average annual price according to Kitco.com.

It is plain to see that SILVER EAGLE SALES have been gaining on GOLD EAGLE SALES since 2009 and may even surpass them in 2012.

Read More @ SilverDoctors.com

by Jeff Nielson, Bullion Bulls Canada:

Nearly two and a half years ago, I first began warning readers of the “economic terrorism”

which Wall Street had unleashed upon Europe – via the fraudulent

manipulation of credit default swaps, and equally fraudulent “ratings

cuts” from their accomplices, the ratings agencies. At a time when only

Greece had begun to experience financial turmoil, I wrote:

Nearly two and a half years ago, I first began warning readers of the “economic terrorism”

which Wall Street had unleashed upon Europe – via the fraudulent

manipulation of credit default swaps, and equally fraudulent “ratings

cuts” from their accomplices, the ratings agencies. At a time when only

Greece had begun to experience financial turmoil, I wrote:

Read More @ BullionBullsCanada.com

Nearly two and a half years ago, I first began warning readers of the “economic terrorism”

which Wall Street had unleashed upon Europe – via the fraudulent

manipulation of credit default swaps, and equally fraudulent “ratings

cuts” from their accomplices, the ratings agencies. At a time when only

Greece had begun to experience financial turmoil, I wrote:

Nearly two and a half years ago, I first began warning readers of the “economic terrorism”

which Wall Street had unleashed upon Europe – via the fraudulent

manipulation of credit default swaps, and equally fraudulent “ratings

cuts” from their accomplices, the ratings agencies. At a time when only

Greece had begun to experience financial turmoil, I wrote:…It will be even more interesting to see what happens next. If the CDS [credit default swap] spreads now begin to “mysteriously” widen for Spain, Portugal, and perhaps other EU members, this will signal that these financial psychopaths are going to continue to simply nuke one vulnerable economy after another.In fact this is precisely what we have seen transpire. As this made-in-Wall-Street financial holocaust intensified, roughly one year ago I wrote a four-part series (“Economic Rape of Europe Nearly Complete”) where I first explained what had already taken place, and then detailed what was to come.

Read More @ BullionBullsCanada.com

by Mike Shedlock, Global Economic Analysis:

China surprised economists today with a surprise cut in interest rates by a quarter point, the first cut in rates since 2008.

China surprised economists today with a surprise cut in interest rates by a quarter point, the first cut in rates since 2008.

Just a couple of months ago, few analysts had forecast that Beijing would cut rates, believing that China was on track for a “soft landing”. But after growth slowed to 8.1 per cent in the first quarter, recent data showed the economy was on track for a sharp deceleration.

With the cut, China’s benchmark one-year lending rate will now be 6.31 per cent, while the one-year deposit rate will be 3.25 per cent.

Read More @ GlobalEconomicAnalysis.blogspot.com

China surprised economists today with a surprise cut in interest rates by a quarter point, the first cut in rates since 2008.

China surprised economists today with a surprise cut in interest rates by a quarter point, the first cut in rates since 2008.

Just a couple of months ago, few analysts had forecast that Beijing would cut rates, believing that China was on track for a “soft landing”. But after growth slowed to 8.1 per cent in the first quarter, recent data showed the economy was on track for a sharp deceleration.

With the cut, China’s benchmark one-year lending rate will now be 6.31 per cent, while the one-year deposit rate will be 3.25 per cent.

Read More @ GlobalEconomicAnalysis.blogspot.com

By Ambrose Evans-Pritchard, The Telegraph:

While the International Monetary Fund thinks Spanish banks require

€40bn or so in fresh capital, any loan package may have to be much

larger to restore shattered confidence in the country.

While the International Monetary Fund thinks Spanish banks require

€40bn or so in fresh capital, any loan package may have to be much

larger to restore shattered confidence in the country.

Megan Greene from Roubini Global Economics says Spain’s banks will need up to €250bn, a claim that no longer looks extreme. New troubles are emerging daily. The Bank of Spain said on Thursday that Catalunya Caixa and Novagalicia will need a total of €9bn in new state funds.

JP Morgan is expecting the final package for Spain to rise above €350bn, while RBS says the rescue will “morph” into a full-blown rescue of €370bn to €450bn over time — by far the largest in world history.

Read More @ Telegraph.co.uk

While the International Monetary Fund thinks Spanish banks require

€40bn or so in fresh capital, any loan package may have to be much

larger to restore shattered confidence in the country.

While the International Monetary Fund thinks Spanish banks require

€40bn or so in fresh capital, any loan package may have to be much

larger to restore shattered confidence in the country.Megan Greene from Roubini Global Economics says Spain’s banks will need up to €250bn, a claim that no longer looks extreme. New troubles are emerging daily. The Bank of Spain said on Thursday that Catalunya Caixa and Novagalicia will need a total of €9bn in new state funds.

JP Morgan is expecting the final package for Spain to rise above €350bn, while RBS says the rescue will “morph” into a full-blown rescue of €370bn to €450bn over time — by far the largest in world history.

Read More @ Telegraph.co.uk

by John Rubino, DollarCollapse.com:

If central bankers weren’t the main architects of the coming

depression, it might be tempting to pity them. The world is falling

apart and everyone expects them to save the day with lower rates and/or

exotic new stimulus programs. But at the same time everyone assumes this

debt monetization will destabilize the financial system, bringing about

the end of the world as we know it.

If central bankers weren’t the main architects of the coming

depression, it might be tempting to pity them. The world is falling

apart and everyone expects them to save the day with lower rates and/or

exotic new stimulus programs. But at the same time everyone assumes this

debt monetization will destabilize the financial system, bringing about

the end of the world as we know it.

The bankers can’t win, in other words, because whatever they do or don’t do will be seen as causing a global meltdown of one kind or another. And the poor bastards know it.

So it’s not surprising that they’re dithering and seemingly working at cross purposes. First the European Central Bank decides to hold rates steady despite the imminent implosions of Spain and Greece:

Read More @ DollarCollapse.com

If central bankers weren’t the main architects of the coming

depression, it might be tempting to pity them. The world is falling

apart and everyone expects them to save the day with lower rates and/or

exotic new stimulus programs. But at the same time everyone assumes this

debt monetization will destabilize the financial system, bringing about

the end of the world as we know it.

If central bankers weren’t the main architects of the coming

depression, it might be tempting to pity them. The world is falling

apart and everyone expects them to save the day with lower rates and/or

exotic new stimulus programs. But at the same time everyone assumes this

debt monetization will destabilize the financial system, bringing about

the end of the world as we know it.The bankers can’t win, in other words, because whatever they do or don’t do will be seen as causing a global meltdown of one kind or another. And the poor bastards know it.

So it’s not surprising that they’re dithering and seemingly working at cross purposes. First the European Central Bank decides to hold rates steady despite the imminent implosions of Spain and Greece:

Read More @ DollarCollapse.com

by James West, MidasLetter.com:

The apparent end to momentum in the 12-year bull market in the gold

price is a carefully coordinated exercise in perception management. J.P.

Morgan and a handful of the world’s largest banks have been permitted

the right to originate contracts for forward sales and purchases of

various commodity products far in excess of what is produced of each

commodity annually.

The apparent end to momentum in the 12-year bull market in the gold

price is a carefully coordinated exercise in perception management. J.P.

Morgan and a handful of the world’s largest banks have been permitted

the right to originate contracts for forward sales and purchases of

various commodity products far in excess of what is produced of each

commodity annually.

There is seldom any delivery of physical metals, and the contracts are originated on completely false premises equivalent to a casino where every game is rigged in favour of the house. Thus, the effect of real

supply has been replaced by the effect of artificial supply.

Read More @ MidasLetter.com

The apparent end to momentum in the 12-year bull market in the gold

price is a carefully coordinated exercise in perception management. J.P.

Morgan and a handful of the world’s largest banks have been permitted

the right to originate contracts for forward sales and purchases of

various commodity products far in excess of what is produced of each

commodity annually.

The apparent end to momentum in the 12-year bull market in the gold

price is a carefully coordinated exercise in perception management. J.P.

Morgan and a handful of the world’s largest banks have been permitted

the right to originate contracts for forward sales and purchases of

various commodity products far in excess of what is produced of each

commodity annually.There is seldom any delivery of physical metals, and the contracts are originated on completely false premises equivalent to a casino where every game is rigged in favour of the house. Thus, the effect of real

supply has been replaced by the effect of artificial supply.

Read More @ MidasLetter.com

by Michael Robeson, Activist Post

Within days of September 11, 2001, Henry Kissinger, former US

Secretary of State, made a proposal that would have really changed

everything forever.

Within days of September 11, 2001, Henry Kissinger, former US

Secretary of State, made a proposal that would have really changed

everything forever.

In a nationally syndicated Op Ed, entitled “Destroy the Terrorist’s Network” he wrote that the attack “which is a threat to our social way of life . . . has to be dealt with (by) an attack on the system that produces it.”

He also wrote that the US government “should be charged with a systematic response that . . . will end with the destruction of the system that is responsible for it.”

In a May 2012 television interview, current Secretary of State, Hillary Clinton, admitted for the first time that the US had created Al Qaeda in the late 1970s and funded its participation in the war against the Soviet Union in Afghanistan. “We had helped to create the problem that we are now fighting”, Ms. Clinton said. “The people we are fighting today, we were supporting when we were fighting the Soviets.”

Read More @ Activist Post

Within days of September 11, 2001, Henry Kissinger, former US

Secretary of State, made a proposal that would have really changed

everything forever.

Within days of September 11, 2001, Henry Kissinger, former US

Secretary of State, made a proposal that would have really changed

everything forever.In a nationally syndicated Op Ed, entitled “Destroy the Terrorist’s Network” he wrote that the attack “which is a threat to our social way of life . . . has to be dealt with (by) an attack on the system that produces it.”

He also wrote that the US government “should be charged with a systematic response that . . . will end with the destruction of the system that is responsible for it.”

In a May 2012 television interview, current Secretary of State, Hillary Clinton, admitted for the first time that the US had created Al Qaeda in the late 1970s and funded its participation in the war against the Soviet Union in Afghanistan. “We had helped to create the problem that we are now fighting”, Ms. Clinton said. “The people we are fighting today, we were supporting when we were fighting the Soviets.”

Read More @ Activist Post

By: John Mauldin, The Market Oracle:

Nobody, in my book, slices and dices data more thoroughly or

convincingly than Greg Weldon. In this week’s Outside the Box, he first

dispels the illusion that either of the two most-expected outcomes of

the growing eurozone crisis is really any kind of a solution – neither

expelling Greece nor keeping Greece in the club is going to work, he

argues – and then, in a feat of legerdemain, he conjures up an

alternative that just might work – and backs up his idea as only Greg

can. But is this a rabbit he’s pulled out of his hat, or is it … a Black

Eagle?

Nobody, in my book, slices and dices data more thoroughly or

convincingly than Greg Weldon. In this week’s Outside the Box, he first

dispels the illusion that either of the two most-expected outcomes of

the growing eurozone crisis is really any kind of a solution – neither

expelling Greece nor keeping Greece in the club is going to work, he

argues – and then, in a feat of legerdemain, he conjures up an

alternative that just might work – and backs up his idea as only Greg

can. But is this a rabbit he’s pulled out of his hat, or is it … a Black

Eagle?

Soros understands the price movements of currencies better than anyone else. This is how he became a multi-billionaire. He has used massive leverage – extremely high risk – to speculate in the currency futures markets, often taking the opposite side of trades with central banks. When a man has enough wisdom to beat the currency futures markets, I give him credit. He knows something about currencies.

Read More @ TheMarketOracle.co.uk

Nobody, in my book, slices and dices data more thoroughly or

convincingly than Greg Weldon. In this week’s Outside the Box, he first

dispels the illusion that either of the two most-expected outcomes of

the growing eurozone crisis is really any kind of a solution – neither

expelling Greece nor keeping Greece in the club is going to work, he

argues – and then, in a feat of legerdemain, he conjures up an

alternative that just might work – and backs up his idea as only Greg

can. But is this a rabbit he’s pulled out of his hat, or is it … a Black

Eagle?

Nobody, in my book, slices and dices data more thoroughly or

convincingly than Greg Weldon. In this week’s Outside the Box, he first

dispels the illusion that either of the two most-expected outcomes of

the growing eurozone crisis is really any kind of a solution – neither

expelling Greece nor keeping Greece in the club is going to work, he

argues – and then, in a feat of legerdemain, he conjures up an

alternative that just might work – and backs up his idea as only Greg

can. But is this a rabbit he’s pulled out of his hat, or is it … a Black

Eagle?Soros understands the price movements of currencies better than anyone else. This is how he became a multi-billionaire. He has used massive leverage – extremely high risk – to speculate in the currency futures markets, often taking the opposite side of trades with central banks. When a man has enough wisdom to beat the currency futures markets, I give him credit. He knows something about currencies.

Read More @ TheMarketOracle.co.uk

By Bill Bonner, Daily Reckoning:

And here comes another world improver, Larry Summers.

And here comes another world improver, Larry Summers.

“What is to be done,” he asks.

The question reveals the conceit. Why is it any of his business? Left alone, people generally get what they have coming – at least in the world of economics. Why not give markets a chance?

Ah…but then Mr. World Improver would not be such a very big shot, would he?

What if Mr. Summers could only throw his weight around in his own home…in his own businesses…at his own club? Imagine how lucky his family would be, with all that problem-solving brainpower focused on such a small enterprise.

Instead, his fixit energies are dispersed all over the world. Solve China’s problems one day…Japan’s the next…and America’s the day after. So what if it’s Saturday? There’s work to be done!

Read More @ DailyReckoning.com.au

Ron Paul or No Vote in November...

And here comes another world improver, Larry Summers.

And here comes another world improver, Larry Summers. “What is to be done,” he asks.

The question reveals the conceit. Why is it any of his business? Left alone, people generally get what they have coming – at least in the world of economics. Why not give markets a chance?

Ah…but then Mr. World Improver would not be such a very big shot, would he?

What if Mr. Summers could only throw his weight around in his own home…in his own businesses…at his own club? Imagine how lucky his family would be, with all that problem-solving brainpower focused on such a small enterprise.

Instead, his fixit energies are dispersed all over the world. Solve China’s problems one day…Japan’s the next…and America’s the day after. So what if it’s Saturday? There’s work to be done!

Read More @ DailyReckoning.com.au

Ron Paul or No Vote in November...

from RTAmerica:

Best day of 2012 for Dow industrials and S&P 500 … U.S. stocks

surged Wednesday, with the Dow industrials and S&P 500 both

tallying their best day this year, on increasing optimism that central

bankers would move to bolster the economy. “It appears the market is

under the belief that Uncle Ben and his band of merry makers are going

to be coming to the rescue,” Bob Pavlik, chief market strategist at

Banyan Partners, said of Federal Reserve Chairman Ben Bernanke

and other Federal Open Market Committee members. The Dow Jones

Industrial Average DJIA +1.05% climbed 286.84 points, or 2.4%, to

12,414.79. The S&P 500 Index SPX +0.99% advanced 29.63 points, or

2.3%, to 1,315.13. The Nasdaq Composite COMP +0.82% added 66.61 points, or 2.4%, to 2,844.72. – MarketWatch

Best day of 2012 for Dow industrials and S&P 500 … U.S. stocks

surged Wednesday, with the Dow industrials and S&P 500 both

tallying their best day this year, on increasing optimism that central

bankers would move to bolster the economy. “It appears the market is

under the belief that Uncle Ben and his band of merry makers are going

to be coming to the rescue,” Bob Pavlik, chief market strategist at

Banyan Partners, said of Federal Reserve Chairman Ben Bernanke

and other Federal Open Market Committee members. The Dow Jones

Industrial Average DJIA +1.05% climbed 286.84 points, or 2.4%, to

12,414.79. The S&P 500 Index SPX +0.99% advanced 29.63 points, or

2.3%, to 1,315.13. The Nasdaq Composite COMP +0.82% added 66.61 points, or 2.4%, to 2,844.72. – MarketWatchDominant Social Theme: Happy Days Are Here Again.

Free-Market Analysis: Or are they? Europe is failing, China just cut interest rates and US markets moved up hard on a hope and a prayer.

Read More @ TheDailyBell.com

I would like to Thank Kevin O. our 7th donor, for his very generous donation.

Who will be our 8th?

Thank You

I'm PayPal Verified

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment