Today top Citibank analyst, Tom Fitzpatrick, warned that, despite the

rally, if Europe does not take decisive action we will see this crisis

accelerate. Fitzpatrick, a 28 year veteran and top analyst at Citibank,

which has $1.3 trillion in assets, also said, “the concern levels are

still there, and if anything they are becoming elevated.” Fitzpatrick

also provided some excellent charts which illustrate the ongoing train

wreck that is Europe. Here is what he had to say about the

deteriorating situation in Europe: “Overall we continue to push

higher, both in terms of Spanish yields and in terms of the interest

differential we are seeing between Spain and Germany, which has to be an

increasing concern.”

Today top Citibank analyst, Tom Fitzpatrick, warned that, despite the

rally, if Europe does not take decisive action we will see this crisis

accelerate. Fitzpatrick, a 28 year veteran and top analyst at Citibank,

which has $1.3 trillion in assets, also said, “the concern levels are

still there, and if anything they are becoming elevated.” Fitzpatrick

also provided some excellent charts which illustrate the ongoing train

wreck that is Europe. Here is what he had to say about the

deteriorating situation in Europe: “Overall we continue to push

higher, both in terms of Spanish yields and in terms of the interest

differential we are seeing between Spain and Germany, which has to be an

increasing concern.” Fitzpatrick continues @ KingWorldNews.com

In Case Of NEW QE, Gold To $1,900-$8,500 Says SocGen

In a previous post we showed how, despite Goldman's best wishes, the market may have just priced itself out of a treat from the Fed tomorrow, and right into a trick. That said, in case the Fed has in fact succumbed to the pleadings of its superiors (read Primary Dealers) and does proceed with some seriously unsterilized dollar mauling, the next question is what is the best hedge. SocGen asked the same, and provided several strategies to take advantage of central planners exhibiting a rare case of Einstein's definition on insanity... over and over. Their "Strategy #1: Bolster Positions In Gold Ahead of QE3." Why? Because once the next round of the gold juggernaut is unleashed, gold may go to anywhere between $1900, just shy of the all time nominal high, and $8500... just a tad higher than the nominal high.

G20 summit: perils of a half-baked rescue for Spain and Italy

Germany

and France are doubling up on a high-risk gamble. The tentative deal at

the G20 summit to mobilise the EU’s rescue machinery to douse the

raging fire in Spain and Italy comes in the nick of time, but is fraught

with fresh dangers.

by Ambrose Evans-Pritchard, The Telegraph:

Chancellor Angela Merkel and President Francois Hollande have to do

something. The market reaction to Spain’s €100bn EMU rescue for its

banks has been calamitous. Monday’s explosive rise in Spanish two-year

bond yields was a warning that Spain’s crisis would spiral out of

control within days, taking Italy with it.

Chancellor Angela Merkel and President Francois Hollande have to do

something. The market reaction to Spain’s €100bn EMU rescue for its

banks has been calamitous. Monday’s explosive rise in Spanish two-year

bond yields was a warning that Spain’s crisis would spiral out of

control within days, taking Italy with it.

Yet the deal explored over ceviche and mango at Los Cabos in Mexico remains murky. Any plan will backfire horribly unless conducted in the right way, and with overwhelming force.

From what we know, the eurozone’s leaders aim to deploy the European Stability Mechanism (ESM) to cap borrowing costs for Spain and Italy by purchasing sovereign bonds on the open market.

Unfortunately, the ESM fund does not yet exist. It has not been ratified by Germany and Italy. When it does come into being, it won’t have much money. It has a theoretical limit of €500bn — a nice wish — but its paid up capital will start at just €22bn.

Read More @ Telegraph.co.uk

by Ambrose Evans-Pritchard, The Telegraph:

Chancellor Angela Merkel and President Francois Hollande have to do

something. The market reaction to Spain’s €100bn EMU rescue for its

banks has been calamitous. Monday’s explosive rise in Spanish two-year

bond yields was a warning that Spain’s crisis would spiral out of

control within days, taking Italy with it.

Chancellor Angela Merkel and President Francois Hollande have to do

something. The market reaction to Spain’s €100bn EMU rescue for its

banks has been calamitous. Monday’s explosive rise in Spanish two-year

bond yields was a warning that Spain’s crisis would spiral out of

control within days, taking Italy with it.Yet the deal explored over ceviche and mango at Los Cabos in Mexico remains murky. Any plan will backfire horribly unless conducted in the right way, and with overwhelming force.

From what we know, the eurozone’s leaders aim to deploy the European Stability Mechanism (ESM) to cap borrowing costs for Spain and Italy by purchasing sovereign bonds on the open market.

Unfortunately, the ESM fund does not yet exist. It has not been ratified by Germany and Italy. When it does come into being, it won’t have much money. It has a theoretical limit of €500bn — a nice wish — but its paid up capital will start at just €22bn.

Read More @ Telegraph.co.uk

Spanish 10 year bond yield remains elevated at 7.06%/Italian bonds close at 5.91%/Bruce Krasting and his fellow from Athens/Germany denies the constant rumours of a Eurobond/

Harvey Organ at Harvey Organ's - The Daily Gold and Silver Report - 11 minutes ago

Good

evening Ladies and Gentlemen:

Yesterday, I was sent for an ultrasound test on my GI tract and they and

discovered that my gallbladder was inflamed and I needed surgery

immediately. I waited 8 hours for a surgical room but other emergencies

kept coming. So late in the evening they sent me home with antibiotics

and they will try and schedule me as soon as possible.

I would likeMapping The Deepening Political Divide Within The Eurozone

Is

a fiscal union possible? Is it possible to credibly remove risk from

the market and enforce budgetary and deficit targets? As Barclays notes,

it appears that, given the apparently deepening divide among euro area

politicians, any credible solution will be difficult to attain.

Is

a fiscal union possible? Is it possible to credibly remove risk from

the market and enforce budgetary and deficit targets? As Barclays notes,

it appears that, given the apparently deepening divide among euro area

politicians, any credible solution will be difficult to attain.By Frontrunning QE, Did The Market Make QE Impossible?

Ever since the beginning of the year we have been saying that in order for the Fed to unleash QE, stocks have to drop by 20-30% to give political cover to the Fed (and/or ECB) to engage in another round of wanton currency destruction. Because while on one hand the temptation to boost stocks is so very high in an election year, the threat to one's presidential re-election chances that soaring gas prices late into the summer does, is simply far too big to be ignored. Yet here we are: stocks are just 4% off their 2012 highs, even as bonds are near all time low yields, and mortgages are at their all time lows. As such, even with the latest batch of economic data coming in simply atrocious, the Fed finds itself in a Catch 22 - it wants to help the stock market hoping that in itself will boost the "economy", yet it knows what more QE here will do to the priced of gold and inflation expectations: something which as Hilsenrath himself said yesterday does not compute, as it runs against everything "Economic textbooks" teach. What is more important, is that the market, like a true addict, is oblivious to any of these considerations, and has priced in a massive bout of Quantitative Easing to be announced tomorrow at 2:15 pm. There is one problem though: has the market, by pricing in QE on every down day - the only buying catalyst in the past month have been hopes of more QE - made QE impossible? Observe the following chart from SocGen which shows 6 month forward equity vol. What is obvious is that due to precisely being priced in, QE is now virtually unfeasible, irrelevant of what Goldman and its "FLOW QE" model tell us. As SocGen simply states: "More stress is needed to trigger ample policy response."

Truth In Reporting

Dave in Denver at The Golden Truth - 1 hour ago

Before I correct a comment from another daily metals report, I wanted to

mention the housing starts number. Housing starts for May were reported

today to be down 4.8% from April: LINK Don't be fooled by the headline

"spin" about housing permit applications spiking higher. A certificate to

build does not mean that a home will be sold, as evidenced by downward

trend in mortgage purchase applications.

As I have mentioned in previous posts, I'm not sure how trustworthy the

housing start numbers reported by the Government are, and certainly the

trend reported by the Government recen... more »

SP 500 September Futures Daily Chart Closeup

Hope Of The Bernank Ex Machina Drives Low Volume Equity Surge As Gold Defies QE Dream

S&P

500 e-mini futures managed to get back above their 50DMA, fill the gap

back to the 5/4 ugly-NFP print levels, and retrace 61.8% of the recent

swing high-to-low ahead of tomorrow's hope-laden FOMC-print-fest. As we noted here,

credit markets do not agree that QE is coming anytime soon and today's

Gold deterioration suggests expectations for anything more than a

twist extension are overblown (which we suspect would be a

huge disappointment to a market only 4% off its highs and a VIX with a

17 handle earlier in the day. As the afternoon wore on and the

incredible reporting falsehoods were denied, equity markets (and EUR)

reverted lower (led by financials) pulling back to VWAP (and VIX pushed

back rapidly to 18.5 - ending the day higher in vol (despite a 10pt

jump in the S&P). Low volume and falling average trade size

suggests this was far from the start of a new trend in stocks and the

push higher (and steeper) in TSY yields to Monday's opening highs seems

more like QE hope fading than growth hope. Silver just

underperformed Gold on the day (both leaking lower) as Oil and Copper

rallied (leaving WTI in the green for the week) as USD weakened and

round-tripped to Monday's opening lows (with AUD now 1.3% stronger on

the week). Investment grade credit remains a considerable underperformer

relative to the high beta equity and high yield markets but 'agrees'

with Gold and Treasuries in its view of no LSAP tomorrow- and the surge in implied correlation into the close suggests macro overlays as opposed to a market with any conviction.

S&P

500 e-mini futures managed to get back above their 50DMA, fill the gap

back to the 5/4 ugly-NFP print levels, and retrace 61.8% of the recent

swing high-to-low ahead of tomorrow's hope-laden FOMC-print-fest. As we noted here,

credit markets do not agree that QE is coming anytime soon and today's

Gold deterioration suggests expectations for anything more than a

twist extension are overblown (which we suspect would be a

huge disappointment to a market only 4% off its highs and a VIX with a

17 handle earlier in the day. As the afternoon wore on and the

incredible reporting falsehoods were denied, equity markets (and EUR)

reverted lower (led by financials) pulling back to VWAP (and VIX pushed

back rapidly to 18.5 - ending the day higher in vol (despite a 10pt

jump in the S&P). Low volume and falling average trade size

suggests this was far from the start of a new trend in stocks and the

push higher (and steeper) in TSY yields to Monday's opening highs seems

more like QE hope fading than growth hope. Silver just

underperformed Gold on the day (both leaking lower) as Oil and Copper

rallied (leaving WTI in the green for the week) as USD weakened and

round-tripped to Monday's opening lows (with AUD now 1.3% stronger on

the week). Investment grade credit remains a considerable underperformer

relative to the high beta equity and high yield markets but 'agrees'

with Gold and Treasuries in its view of no LSAP tomorrow- and the surge in implied correlation into the close suggests macro overlays as opposed to a market with any conviction.

Dimon To Ackerman: "We Don't Gamble. Gamblers Lose"

In a somewhat inspired line of questioning by Rep. Gary Ackerman on the differences between 'investing' and 'gambling', the JPMorgan CEO diligently notes that "on average Gamblers lose" implicitly stating, we assume, that 'investors on average win'.

Ackerman interestingly takes up the common myth that banks (and Wall

Street in general) were 'on the level' and 'facilitated investing' but

to him the 'hedges' that JPM (among others) are placing are nothing but

gambling as he correctly notes the dismal truth that banks are not in

fact there for the common good in "helping jobs and being good for

America". Betting against your initial bet suggests a lack of 'knowing what you are doing'

is how Ackerman frames his concerns, and furthermore (as we pointed

out), hedging against your hedge just makes the whole thing farcical as

if "throwing darts at a dartboard" and in the process does not help the

economy or create one job. The main thrust being that: if JPM is

right a majority of the time it helps the company, but if they are

wrong it puts systemically everything at risk - the public investing

confidence in the system (an unhedgeable risk). Dimon's contrite response is: "We don't gamble; we do make mistakes."

In a somewhat inspired line of questioning by Rep. Gary Ackerman on the differences between 'investing' and 'gambling', the JPMorgan CEO diligently notes that "on average Gamblers lose" implicitly stating, we assume, that 'investors on average win'.

Ackerman interestingly takes up the common myth that banks (and Wall

Street in general) were 'on the level' and 'facilitated investing' but

to him the 'hedges' that JPM (among others) are placing are nothing but

gambling as he correctly notes the dismal truth that banks are not in

fact there for the common good in "helping jobs and being good for

America". Betting against your initial bet suggests a lack of 'knowing what you are doing'

is how Ackerman frames his concerns, and furthermore (as we pointed

out), hedging against your hedge just makes the whole thing farcical as

if "throwing darts at a dartboard" and in the process does not help the

economy or create one job. The main thrust being that: if JPM is

right a majority of the time it helps the company, but if they are

wrong it puts systemically everything at risk - the public investing

confidence in the system (an unhedgeable risk). Dimon's contrite response is: "We don't gamble; we do make mistakes."

Beggars Can Be Choosers As Pro-Bailout Greeks Debate What Conditions They Hand Over To Merkel

For the second time in a few short months we are amazed to learn that

beggars can be choosers. The Greek pseudo-coalition between ND, Pasok,

which promptly determined it would only be part of a

coalition if Syriza joined, then even promptlier completely forget what

it had said hours ago after Syriza said "no way, Jose", and some other

party with the word "Democracy" in its name, are in deep discussions

over what conditions they should give Europe in exchange for a coalition

government. That's right: the Greek coalition government is debating

over a set of demands to hand over to Europe in order to form a government which will last at most weeks.

S&P

500 e-mini futures managed to get back above their 50DMA, fill the gap

back to the 5/4 ugly-NFP print levels, and retrace 61.8% of the recent

swing high-to-low ahead of tomorrow's hope-laden FOMC-print-fest. As we noted here,

credit markets do not agree that QE is coming anytime soon and today's

Gold deterioration suggests expectations for anything more than a

twist extension are overblown (which we suspect would be a

huge disappointment to a market only 4% off its highs and a VIX with a

17 handle earlier in the day. As the afternoon wore on and the

incredible reporting falsehoods were denied, equity markets (and EUR)

reverted lower (led by financials) pulling back to VWAP (and VIX pushed

back rapidly to 18.5 - ending the day higher in vol (despite a 10pt

jump in the S&P). Low volume and falling average trade size

suggests this was far from the start of a new trend in stocks and the

push higher (and steeper) in TSY yields to Monday's opening highs seems

more like QE hope fading than growth hope. Silver just

underperformed Gold on the day (both leaking lower) as Oil and Copper

rallied (leaving WTI in the green for the week) as USD weakened and

round-tripped to Monday's opening lows (with AUD now 1.3% stronger on

the week). Investment grade credit remains a considerable underperformer

relative to the high beta equity and high yield markets but 'agrees'

with Gold and Treasuries in its view of no LSAP tomorrow- and the surge in implied correlation into the close suggests macro overlays as opposed to a market with any conviction.

S&P

500 e-mini futures managed to get back above their 50DMA, fill the gap

back to the 5/4 ugly-NFP print levels, and retrace 61.8% of the recent

swing high-to-low ahead of tomorrow's hope-laden FOMC-print-fest. As we noted here,

credit markets do not agree that QE is coming anytime soon and today's

Gold deterioration suggests expectations for anything more than a

twist extension are overblown (which we suspect would be a

huge disappointment to a market only 4% off its highs and a VIX with a

17 handle earlier in the day. As the afternoon wore on and the

incredible reporting falsehoods were denied, equity markets (and EUR)

reverted lower (led by financials) pulling back to VWAP (and VIX pushed

back rapidly to 18.5 - ending the day higher in vol (despite a 10pt

jump in the S&P). Low volume and falling average trade size

suggests this was far from the start of a new trend in stocks and the

push higher (and steeper) in TSY yields to Monday's opening highs seems

more like QE hope fading than growth hope. Silver just

underperformed Gold on the day (both leaking lower) as Oil and Copper

rallied (leaving WTI in the green for the week) as USD weakened and

round-tripped to Monday's opening lows (with AUD now 1.3% stronger on

the week). Investment grade credit remains a considerable underperformer

relative to the high beta equity and high yield markets but 'agrees'

with Gold and Treasuries in its view of no LSAP tomorrow- and the surge in implied correlation into the close suggests macro overlays as opposed to a market with any conviction. A report just released by the US Government Accountability Office explains how the Federal Reserve

divvied up more than $4 trillion in low-interest loans after the fiscal

crisis of 2008, and the news shouldn’t be all that surprising. When the

Federal Reserve looked towards bailing out some of the biggest banks in

the country, more than one dozen of the financial institutions that

benefited from the Fed’s Hail Mary were members of the central bank‘s

own board, reports the GAO. At least 18 current and former directors of

the Fed’s regional branches saw to it that their own banks were awarded

loans with often next-to-no interest by the country’s central bank

during the height of the financial crisis that crippled the American

economy and spurred rampant unemployment and home foreclosures for those

unable to receive assistance. – RT

A report just released by the US Government Accountability Office explains how the Federal Reserve

divvied up more than $4 trillion in low-interest loans after the fiscal

crisis of 2008, and the news shouldn’t be all that surprising. When the

Federal Reserve looked towards bailing out some of the biggest banks in

the country, more than one dozen of the financial institutions that

benefited from the Fed’s Hail Mary were members of the central bank‘s

own board, reports the GAO. At least 18 current and former directors of

the Fed’s regional branches saw to it that their own banks were awarded

loans with often next-to-no interest by the country’s central bank

during the height of the financial crisis that crippled the American

economy and spurred rampant unemployment and home foreclosures for those

unable to receive assistance. – RTDominant Social Theme: It is necessary for Fed board members to bail out their own banks. That’s what it is there for.

Free-Market Analysis: ”Quantitative Easing” … “Operation Twist” … “Discount Window” … The mavens at the Fed have so much jargon at their disposal.

Not anymore. This is really simple to understand – see above.

Read More @ TheDailyBell.com

The Moneylender

The pound of flesh which I demand of him

Is dearly bought, ‘tis mine, and I will have it.

If you deny me, fie upon your law!

There is no force in the decrees of Venice.

I stand for judgment. Answer: shall I have it?

by Garrett Pace, Naked Capitalism:

So says Shylock, the villain and most interesting character in

Shakespeare’s tragicomedy The Merchant of Venice. He says it in open

court, and refers to a pound of flesh “nearest the heart” of Antonio,

the reckless merchant who borrowed a capital sum to fund a dubious

venture.

So says Shylock, the villain and most interesting character in

Shakespeare’s tragicomedy The Merchant of Venice. He says it in open

court, and refers to a pound of flesh “nearest the heart” of Antonio,

the reckless merchant who borrowed a capital sum to fund a dubious

venture.

The venture is ultimately successful, but too late for Antonio, who cannot cover the bond and is forced into default. The condition of default is a pound of flesh, cut from Antonio’s body by the moneylender. Revenge for past wrongs drove Shylock to demand fulfillment, but he was nonetheless undone when the agreement is taken even more literally than he himself had taken it – after all, the agreement calls for flesh and not for blood.

Read More @ NakedCapitalism.com

The pound of flesh which I demand of him

Is dearly bought, ‘tis mine, and I will have it.

If you deny me, fie upon your law!

There is no force in the decrees of Venice.

I stand for judgment. Answer: shall I have it?

by Garrett Pace, Naked Capitalism:

So says Shylock, the villain and most interesting character in

Shakespeare’s tragicomedy The Merchant of Venice. He says it in open

court, and refers to a pound of flesh “nearest the heart” of Antonio,

the reckless merchant who borrowed a capital sum to fund a dubious

venture.

So says Shylock, the villain and most interesting character in

Shakespeare’s tragicomedy The Merchant of Venice. He says it in open

court, and refers to a pound of flesh “nearest the heart” of Antonio,

the reckless merchant who borrowed a capital sum to fund a dubious

venture.The venture is ultimately successful, but too late for Antonio, who cannot cover the bond and is forced into default. The condition of default is a pound of flesh, cut from Antonio’s body by the moneylender. Revenge for past wrongs drove Shylock to demand fulfillment, but he was nonetheless undone when the agreement is taken even more literally than he himself had taken it – after all, the agreement calls for flesh and not for blood.

Read More @ NakedCapitalism.com

Historically, major gold exploration has occurred when the Dow was down and out. In this exclusive interview with The Gold Report, geologist and Exploration Insights writer Quinton Hennigh talks about the coming gold rush and what that could mean for existing companies.

by Streetwise Reports Editors, Gold Seek:

The Gold Report:

While the NYSE Arca Gold BUGS Index (HUI) is up a bit from its May low,

it is still lagging the price of gold and not living up to expectations

based on the role it has traditionally played as a safe haven for

investors. Are we close to a turning point in that dynamic?

The Gold Report:

While the NYSE Arca Gold BUGS Index (HUI) is up a bit from its May low,

it is still lagging the price of gold and not living up to expectations

based on the role it has traditionally played as a safe haven for

investors. Are we close to a turning point in that dynamic?

Quinton Hennigh: Many investors and speculators are deservedly frustrated and dejected by the recent performance of gold and, more specifically, the gold mining sector. For many of us in this business these ups and downs are the norm; however, I see the current down as a critical one. Something is going to happen. It could be a month, six months, a year or two years from now. We can’t know. We may continue to see more pain in junior stocks until then, but a change is coming, and investors should take heed.

TGR: Where are we in the cycle now?

QH: Below is a chart of the Dow:gold ratio over the past 112 years. The peaks generally mark points when the Dow was running hot and gold was in the dumper. Conversely, troughs mark times when gold was riding high and the Dow was down. I have added a few interpretations to the chart. First, I projected this chart forward 25 years with a red line that I believe reflects a pattern that we are likely to experience, given a look back at history. Note that the red line bottoms out as the chart did in 1932 and 1980 and then slowly rises over the subsequent 25 years.

Read More @ GoldSeek.com

by Streetwise Reports Editors, Gold Seek:

The Gold Report:

While the NYSE Arca Gold BUGS Index (HUI) is up a bit from its May low,

it is still lagging the price of gold and not living up to expectations

based on the role it has traditionally played as a safe haven for

investors. Are we close to a turning point in that dynamic?

The Gold Report:

While the NYSE Arca Gold BUGS Index (HUI) is up a bit from its May low,

it is still lagging the price of gold and not living up to expectations

based on the role it has traditionally played as a safe haven for

investors. Are we close to a turning point in that dynamic?Quinton Hennigh: Many investors and speculators are deservedly frustrated and dejected by the recent performance of gold and, more specifically, the gold mining sector. For many of us in this business these ups and downs are the norm; however, I see the current down as a critical one. Something is going to happen. It could be a month, six months, a year or two years from now. We can’t know. We may continue to see more pain in junior stocks until then, but a change is coming, and investors should take heed.

TGR: Where are we in the cycle now?

QH: Below is a chart of the Dow:gold ratio over the past 112 years. The peaks generally mark points when the Dow was running hot and gold was in the dumper. Conversely, troughs mark times when gold was riding high and the Dow was down. I have added a few interpretations to the chart. First, I projected this chart forward 25 years with a red line that I believe reflects a pattern that we are likely to experience, given a look back at history. Note that the red line bottoms out as the chart did in 1932 and 1980 and then slowly rises over the subsequent 25 years.

Read More @ GoldSeek.com

by Henry Shivley, fromthetrenchesworldreport:

Obama is in Mexico for yet another G20 meeting of the international

socialist politburo. We are told the discussions at the meeting are

centered on the European economic crisis.

Obama is in Mexico for yet another G20 meeting of the international

socialist politburo. We are told the discussions at the meeting are

centered on the European economic crisis.

The United States government is set to spend about $2.4 trillion this year. The mainstream propagandists are telling us that if Spain and Greece fold on their debt, it will wipe out our economy. Spain is in debt $2.4 trillion and Greece is in debt $553 billion. These are not little numbers by any stretch of the imagination, but the fact remains the total is about $553 billion more than we spend in a year.

Considering we do not owe the Greek debt nor the Spanish debt, how could this relatively small amount wipe up out? Are we a part of some kind of bizarre international insurance pool wherein the guy across town totals his Volkswagen and we lose our farm?

Read More @ fromthetrenchesworldreport.com

Obama is in Mexico for yet another G20 meeting of the international

socialist politburo. We are told the discussions at the meeting are

centered on the European economic crisis.

Obama is in Mexico for yet another G20 meeting of the international

socialist politburo. We are told the discussions at the meeting are

centered on the European economic crisis.The United States government is set to spend about $2.4 trillion this year. The mainstream propagandists are telling us that if Spain and Greece fold on their debt, it will wipe out our economy. Spain is in debt $2.4 trillion and Greece is in debt $553 billion. These are not little numbers by any stretch of the imagination, but the fact remains the total is about $553 billion more than we spend in a year.

Considering we do not owe the Greek debt nor the Spanish debt, how could this relatively small amount wipe up out? Are we a part of some kind of bizarre international insurance pool wherein the guy across town totals his Volkswagen and we lose our farm?

Read More @ fromthetrenchesworldreport.com

from RonPaulCC2012 :

from MSNBC via, R11110000 :

The rachel maddow show explains how Ron Paul is still a factor in the presidential race. Will there be a showdown in Tampa at the RNC? Aired June 18, 2012.

The rachel maddow show explains how Ron Paul is still a factor in the presidential race. Will there be a showdown in Tampa at the RNC? Aired June 18, 2012.

from, Gold Money:

Gold and silver prices have crept higher during Asian trading today,

with the US Federal Reserve about to start a two-day Open Market

Committee meeting that will provide important clues as to precious

metals’ likely short and medium-term price trajectories. Gold has nudged

above resistance at $1,630, while silver looks like challenging $29. We

likely won’t see any big moves in the metals until the end of play

tomorrow, when Ben Bernanke gives his post-FOMC press conference, and it

becomes clear whether or not the Fed is in fact going to try to juice

the US economy with more newly-printed money.

Gold and silver prices have crept higher during Asian trading today,

with the US Federal Reserve about to start a two-day Open Market

Committee meeting that will provide important clues as to precious

metals’ likely short and medium-term price trajectories. Gold has nudged

above resistance at $1,630, while silver looks like challenging $29. We

likely won’t see any big moves in the metals until the end of play

tomorrow, when Ben Bernanke gives his post-FOMC press conference, and it

becomes clear whether or not the Fed is in fact going to try to juice

the US economy with more newly-printed money.

This “QE3” speculation has been rumbling on ever since the QE2 finished in June 2011, though clear signs in recent months that the US economy is slowing – with the horrific June 1 jobs report a particularly telling indicator – is raising dovish expectations. Goldman Sachs thinks it possible that the Fed could resort to regular open-market purchases of $50-$75 billion, perhaps as part of efforts to target nominal GDP increases.

Read More @ GoldMoney.com

Gold and silver prices have crept higher during Asian trading today,

with the US Federal Reserve about to start a two-day Open Market

Committee meeting that will provide important clues as to precious

metals’ likely short and medium-term price trajectories. Gold has nudged

above resistance at $1,630, while silver looks like challenging $29. We

likely won’t see any big moves in the metals until the end of play

tomorrow, when Ben Bernanke gives his post-FOMC press conference, and it

becomes clear whether or not the Fed is in fact going to try to juice

the US economy with more newly-printed money.

Gold and silver prices have crept higher during Asian trading today,

with the US Federal Reserve about to start a two-day Open Market

Committee meeting that will provide important clues as to precious

metals’ likely short and medium-term price trajectories. Gold has nudged

above resistance at $1,630, while silver looks like challenging $29. We

likely won’t see any big moves in the metals until the end of play

tomorrow, when Ben Bernanke gives his post-FOMC press conference, and it

becomes clear whether or not the Fed is in fact going to try to juice

the US economy with more newly-printed money.This “QE3” speculation has been rumbling on ever since the QE2 finished in June 2011, though clear signs in recent months that the US economy is slowing – with the horrific June 1 jobs report a particularly telling indicator – is raising dovish expectations. Goldman Sachs thinks it possible that the Fed could resort to regular open-market purchases of $50-$75 billion, perhaps as part of efforts to target nominal GDP increases.

Read More @ GoldMoney.com

from Silver Doctors:

The SilverStockReport’s Jason Hommel has released a full

point-by-point rebuttal of Martin Armstrong’s recent article regarding

Armstrong’s disbelief that paper ‘gold’ is artificially suppressing the

price of physical gold.

The SilverStockReport’s Jason Hommel has released a full

point-by-point rebuttal of Martin Armstrong’s recent article regarding

Armstrong’s disbelief that paper ‘gold’ is artificially suppressing the

price of physical gold.

Hommel’s rebuttal is in-depth, and an excellent review of what money is, what functions gold (and silver) hold, and how the futures markets and fiat currency system artificially have suppressed the prices of both.

From Jason Hommel:

“On June 14th, Martin Armstrong bashed the idea that gold would be worth about $55,000 if there were no paper gold. He used only ridicule, not rational arguments, and he is wrong, as I will show.”

Read More @ SilverDoctors.com

The SilverStockReport’s Jason Hommel has released a full

point-by-point rebuttal of Martin Armstrong’s recent article regarding

Armstrong’s disbelief that paper ‘gold’ is artificially suppressing the

price of physical gold.

The SilverStockReport’s Jason Hommel has released a full

point-by-point rebuttal of Martin Armstrong’s recent article regarding

Armstrong’s disbelief that paper ‘gold’ is artificially suppressing the

price of physical gold.Hommel’s rebuttal is in-depth, and an excellent review of what money is, what functions gold (and silver) hold, and how the futures markets and fiat currency system artificially have suppressed the prices of both.

From Jason Hommel:

“On June 14th, Martin Armstrong bashed the idea that gold would be worth about $55,000 if there were no paper gold. He used only ridicule, not rational arguments, and he is wrong, as I will show.”

Read More @ SilverDoctors.com

from TruthNeverTold :

from Wealth Wire:

In New York huge lots of commodities get traded every day on the COMEX

(Commodity Exchange) between market makers, speculators, producers and

consumers.

In New York huge lots of commodities get traded every day on the COMEX

(Commodity Exchange) between market makers, speculators, producers and

consumers.

It can be very confusing – because we can’t know why banker X, trader Y, consumer Z or producer A buys, sells or holds at any given time. There’s lots of noise – and most investors simply will never buy or sell a commodity contract.

It’s somewhat complicated, but one easy way to get a reading on what’s really going on for a specific commodity is to see how many contracts are long, and how many are short.

The chart above shows us that right now, on a net basis, there are more contracts short than at any time during the last two years.

Read More @ WealthWire.com

The head of Denmark’s central bank has warned that the Danish krone is

coming under intense pressure from investors seeking a haven in Europe

and betting that the currency’s peg to the euro could be cracked by the

crisis.

The head of Denmark’s central bank has warned that the Danish krone is

coming under intense pressure from investors seeking a haven in Europe

and betting that the currency’s peg to the euro could be cracked by the

crisis.

Nils Bernstein, the governor of the Danish central bank, said that the upward pressure on the krone was the most severe he had seen in his seven years as governor, and warned that negative interest rates could be on the cards if the problem continues.

“You can see from our history that we like to keep the krone within a narrow band, half a percentage point or less,” said governor Nils Bernstein. “I think we have to tools to continue to do that, and if it is necessary to move into negative interest rate territory, we will be ready for that.”

Investors are pouring money into Danish bonds attracted by the country’s narrow budget deficit and current account surplus, leaving it fighting to maintain the very narrow peg with the euro it has held since 1999. Rates were cut twice in the past month to a record low of 0.45 per cent.

Read More @ gata.org

In New York huge lots of commodities get traded every day on the COMEX

(Commodity Exchange) between market makers, speculators, producers and

consumers.

In New York huge lots of commodities get traded every day on the COMEX

(Commodity Exchange) between market makers, speculators, producers and

consumers.It can be very confusing – because we can’t know why banker X, trader Y, consumer Z or producer A buys, sells or holds at any given time. There’s lots of noise – and most investors simply will never buy or sell a commodity contract.

It’s somewhat complicated, but one easy way to get a reading on what’s really going on for a specific commodity is to see how many contracts are long, and how many are short.

The chart above shows us that right now, on a net basis, there are more contracts short than at any time during the last two years.

Read More @ WealthWire.com

By Michael Stothard, Alice Ross, and Robin Wigglesworth, GATA:

The head of Denmark’s central bank has warned that the Danish krone is

coming under intense pressure from investors seeking a haven in Europe

and betting that the currency’s peg to the euro could be cracked by the

crisis.

The head of Denmark’s central bank has warned that the Danish krone is

coming under intense pressure from investors seeking a haven in Europe

and betting that the currency’s peg to the euro could be cracked by the

crisis.Nils Bernstein, the governor of the Danish central bank, said that the upward pressure on the krone was the most severe he had seen in his seven years as governor, and warned that negative interest rates could be on the cards if the problem continues.

“You can see from our history that we like to keep the krone within a narrow band, half a percentage point or less,” said governor Nils Bernstein. “I think we have to tools to continue to do that, and if it is necessary to move into negative interest rate territory, we will be ready for that.”

Investors are pouring money into Danish bonds attracted by the country’s narrow budget deficit and current account surplus, leaving it fighting to maintain the very narrow peg with the euro it has held since 1999. Rates were cut twice in the past month to a record low of 0.45 per cent.

Read More @ gata.org

Suspicions have been confirmed for those wary of vaccinating their

children. A recent large study corroborates other independent study

surveys comparing unvaccinated children to vaccinated children.

Suspicions have been confirmed for those wary of vaccinating their

children. A recent large study corroborates other independent study

surveys comparing unvaccinated children to vaccinated children.They all show that vaccinated children have two to five times more childhood diseases, illnesses, and allergies than unvaccinated children.

Originally, the recent still ongoing study compared unvaccinated children against a German national health survey conducted by KiGGS involving over 17,000 children up to age 19. This currently ongoing survey study was initiated by classical homoeopathist Andreas Bachmair.

Read More @ NaturalNews.com

from ArmstrongEconomics:

I began writing what I thought would be a report. Toward the final

chapters in Adam Smith’s Wealth of Nations, he wrote about Public Debt

asking why anyone considered it to be quality since all governments

defaulted on their debts and never paid them off. I assumed the list

wasn’t that long, since everyone knew about the defaults of Spain,

France, and England. The more I began to investigate since Smith merely

made that statement with no reference to such defaults, the more I was

left in a state of devastating shock. When it comes to research, those

that know me understand that I leave no stone unturned. I allow the

research to carry me along a journey of exploration. I never PRESUME

anything and try to LEARN myself to round out my knowledge.

I began writing what I thought would be a report. Toward the final

chapters in Adam Smith’s Wealth of Nations, he wrote about Public Debt

asking why anyone considered it to be quality since all governments

defaulted on their debts and never paid them off. I assumed the list

wasn’t that long, since everyone knew about the defaults of Spain,

France, and England. The more I began to investigate since Smith merely

made that statement with no reference to such defaults, the more I was

left in a state of devastating shock. When it comes to research, those

that know me understand that I leave no stone unturned. I allow the

research to carry me along a journey of exploration. I never PRESUME

anything and try to LEARN myself to round out my knowledge.

It is almost finished. I am publishing for the first time the Table of Contents. There just seems to be such profound conviction that everyone will flee to gold, gold will save the world, and there is always an alternative for capital to flee. The emails from the Goldbugs just refuse to understand that there is also DEFLATION. Here is the latest:

Read More @ ArmstrongEconomics.org

I began writing what I thought would be a report. Toward the final

chapters in Adam Smith’s Wealth of Nations, he wrote about Public Debt

asking why anyone considered it to be quality since all governments

defaulted on their debts and never paid them off. I assumed the list

wasn’t that long, since everyone knew about the defaults of Spain,

France, and England. The more I began to investigate since Smith merely

made that statement with no reference to such defaults, the more I was

left in a state of devastating shock. When it comes to research, those

that know me understand that I leave no stone unturned. I allow the

research to carry me along a journey of exploration. I never PRESUME

anything and try to LEARN myself to round out my knowledge.

I began writing what I thought would be a report. Toward the final

chapters in Adam Smith’s Wealth of Nations, he wrote about Public Debt

asking why anyone considered it to be quality since all governments

defaulted on their debts and never paid them off. I assumed the list

wasn’t that long, since everyone knew about the defaults of Spain,

France, and England. The more I began to investigate since Smith merely

made that statement with no reference to such defaults, the more I was

left in a state of devastating shock. When it comes to research, those

that know me understand that I leave no stone unturned. I allow the

research to carry me along a journey of exploration. I never PRESUME

anything and try to LEARN myself to round out my knowledge.It is almost finished. I am publishing for the first time the Table of Contents. There just seems to be such profound conviction that everyone will flee to gold, gold will save the world, and there is always an alternative for capital to flee. The emails from the Goldbugs just refuse to understand that there is also DEFLATION. Here is the latest:

Read More @ ArmstrongEconomics.org

[Ed. Note:

This change by the CME reeks. Is the new Silver Market that Andrew

McGuire and Ned Naylor-Leyland are working on about to be rolled out?]

by Frank Tang, MineWeb.com

CME Group is allowing investors in its short-term gold option

contracts to take delivery of physical bullion in a bid to increase the

product’s appeal against over-the-counter gold options.

CME Group is allowing investors in its short-term gold option

contracts to take delivery of physical bullion in a bid to increase the

product’s appeal against over-the-counter gold options.

The biggest operator of U.S. futures exchanges said it will amend the contract of its weekly gold options to let investors exercise into futures contracts effective July 1, pending approval from the U.S. Commodity Futures Trading Commission, CME said in a notice late last week.

Prior to the change, the options, which were launched in July last year on CME’s COMEX metals platform, were settled by cash only and physical delivery was not permitted.

Chicago-based CME is trying to make the options more attractive as some investors favor owning physical precious metals as a safe haven in market turbulence.

In a similar move to woo investors who favor physical metals in October last year, CME more than doubled the amount of physical gold it can accept from its clearing members as collateral.

Read More @ MineWeb.com

by Frank Tang, MineWeb.com

CME Group is allowing investors in its short-term gold option

contracts to take delivery of physical bullion in a bid to increase the

product’s appeal against over-the-counter gold options.

CME Group is allowing investors in its short-term gold option

contracts to take delivery of physical bullion in a bid to increase the

product’s appeal against over-the-counter gold options.The biggest operator of U.S. futures exchanges said it will amend the contract of its weekly gold options to let investors exercise into futures contracts effective July 1, pending approval from the U.S. Commodity Futures Trading Commission, CME said in a notice late last week.

Prior to the change, the options, which were launched in July last year on CME’s COMEX metals platform, were settled by cash only and physical delivery was not permitted.

Chicago-based CME is trying to make the options more attractive as some investors favor owning physical precious metals as a safe haven in market turbulence.

In a similar move to woo investors who favor physical metals in October last year, CME more than doubled the amount of physical gold it can accept from its clearing members as collateral.

Read More @ MineWeb.com

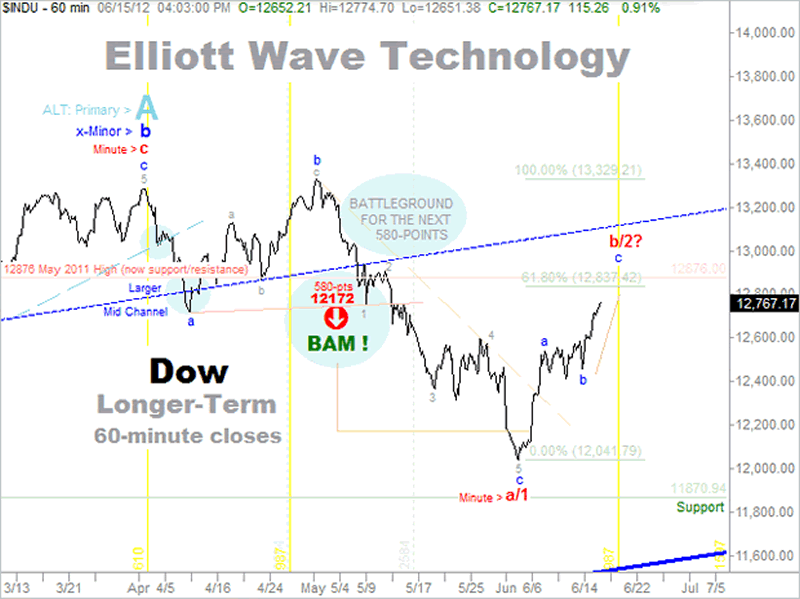

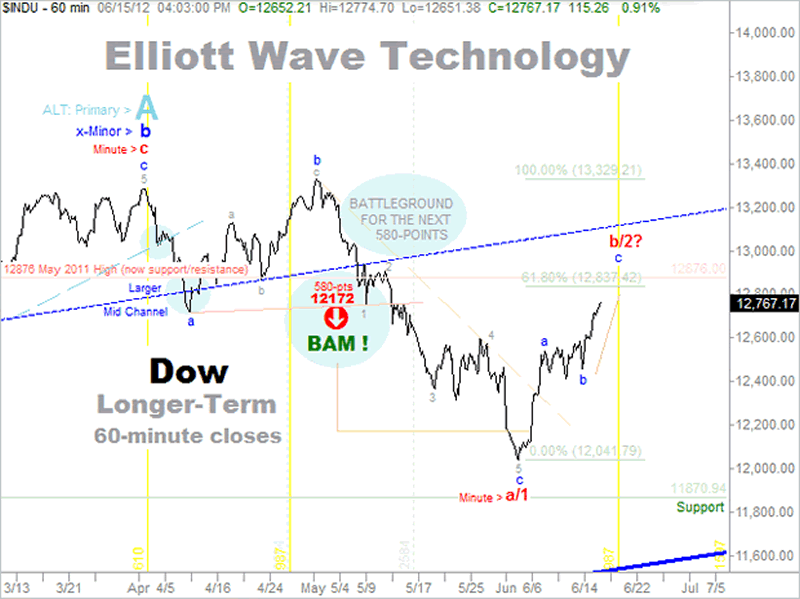

By Joseph Russo, The Market Oracle:

Given the heightened sense of both fear and euphoria respectively

associated with the outcome of Greek elections and the cartel of global

central bankers pledging if need be, to do all that is necessary to

further distort the price mechanism, we thought it appropriate to

publically share our forecast for the Dow.

Given the heightened sense of both fear and euphoria respectively

associated with the outcome of Greek elections and the cartel of global

central bankers pledging if need be, to do all that is necessary to

further distort the price mechanism, we thought it appropriate to

publically share our forecast for the Dow.

In our view, there is no better means by which to observe the rapidly changing state of global economic conditions than to grasp and interpret the clear inferences attained in accurately reading the price mechanism at work in real time.

Before we render our general forecast based on such, we will first explain the charts mark-ups, which slowly walk you through how we have arrived at our current conclusions.

Read More @ TheMarketOracle.co.uk

Given the heightened sense of both fear and euphoria respectively

associated with the outcome of Greek elections and the cartel of global

central bankers pledging if need be, to do all that is necessary to

further distort the price mechanism, we thought it appropriate to

publically share our forecast for the Dow.

Given the heightened sense of both fear and euphoria respectively

associated with the outcome of Greek elections and the cartel of global

central bankers pledging if need be, to do all that is necessary to

further distort the price mechanism, we thought it appropriate to

publically share our forecast for the Dow.In our view, there is no better means by which to observe the rapidly changing state of global economic conditions than to grasp and interpret the clear inferences attained in accurately reading the price mechanism at work in real time.

Before we render our general forecast based on such, we will first explain the charts mark-ups, which slowly walk you through how we have arrived at our current conclusions.

Read More @ TheMarketOracle.co.uk

from, The Daily Sheeple:

That most dangerous year begins as soon as Spain and Greece default on their bonds if there is no systematic worldwide program of scientific and rational debt cancellation.

In France bank runs take the form of computers going down when too may customers demand their money. In Italy BNI shut down leaving customers with as little as ten or twenty euros to feed their families for a month. People with automatic paycheck deposit saw their wages deposited into a bank that legally did not have to give them any money to buy food and pay their bills.

Lessons Learned: Cash in hand is more valuable than credit at a bank. And automatic check deposit might not be such a good idea in times of bank runs and banking holidays.

On July 4, 2008 a bottle of beer in Zimbabwe cost 100 billion dollars at 5:00 PM but at 6:30 the price had soared to 150 billion dollars. Inflation was running about 11% in America until the euro crisis.

Read More @ TheDailySheeple.com

That most dangerous year begins as soon as Spain and Greece default on their bonds if there is no systematic worldwide program of scientific and rational debt cancellation.

In France bank runs take the form of computers going down when too may customers demand their money. In Italy BNI shut down leaving customers with as little as ten or twenty euros to feed their families for a month. People with automatic paycheck deposit saw their wages deposited into a bank that legally did not have to give them any money to buy food and pay their bills.

Lessons Learned: Cash in hand is more valuable than credit at a bank. And automatic check deposit might not be such a good idea in times of bank runs and banking holidays.

On July 4, 2008 a bottle of beer in Zimbabwe cost 100 billion dollars at 5:00 PM but at 6:30 the price had soared to 150 billion dollars. Inflation was running about 11% in America until the euro crisis.

Read More @ TheDailySheeple.com

from Testosterone Pit.com:

The first summit of the G-20 in today’s configuration took place in

November 2008 in Washington, DC, during the heady days after the Lehman

collapse. Before, it was limited to finance ministers. Since then, twice

a year, 19 heads of state, the President of the EU, finance ministers,

the heads of the IMF and the World Bank, a gaggle of central bankers,

and a whole slew of lesser characters get together to solve the problems

of the world.

The first summit of the G-20 in today’s configuration took place in

November 2008 in Washington, DC, during the heady days after the Lehman

collapse. Before, it was limited to finance ministers. Since then, twice

a year, 19 heads of state, the President of the EU, finance ministers,

the heads of the IMF and the World Bank, a gaggle of central bankers,

and a whole slew of lesser characters get together to solve the problems

of the world.

G-20 summits have a checkered history of accomplishments though they don’t lack in grandiose announcements. At the summit in London in April 2009, French President Nicolas Sarkozy announced with fanfare, “The era of bank secrecy is over.” Its big accomplishment: a blacklist of tax havens. And a whole new game of political football, namely deciding which country would get to see its name on the list and which wouldn’t. Yet, tax havens have since sprouted around the world far faster than President Obama’s “green shoots.”

Read More @ TestosteronePit.com

The first summit of the G-20 in today’s configuration took place in

November 2008 in Washington, DC, during the heady days after the Lehman

collapse. Before, it was limited to finance ministers. Since then, twice

a year, 19 heads of state, the President of the EU, finance ministers,

the heads of the IMF and the World Bank, a gaggle of central bankers,

and a whole slew of lesser characters get together to solve the problems

of the world.

The first summit of the G-20 in today’s configuration took place in

November 2008 in Washington, DC, during the heady days after the Lehman

collapse. Before, it was limited to finance ministers. Since then, twice

a year, 19 heads of state, the President of the EU, finance ministers,

the heads of the IMF and the World Bank, a gaggle of central bankers,

and a whole slew of lesser characters get together to solve the problems

of the world.G-20 summits have a checkered history of accomplishments though they don’t lack in grandiose announcements. At the summit in London in April 2009, French President Nicolas Sarkozy announced with fanfare, “The era of bank secrecy is over.” Its big accomplishment: a blacklist of tax havens. And a whole new game of political football, namely deciding which country would get to see its name on the list and which wouldn’t. Yet, tax havens have since sprouted around the world far faster than President Obama’s “green shoots.”

Read More @ TestosteronePit.com

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment