On The Verge Of A Historic Inversion In Shadow Banking

While everyone's attention was focused on details surrounding the household sector in the recently released Q1 Flow of Funds report (ours included),

something much more important happened in the US economy from a flow

perspective, something which, in fact, has not happened since December

of 1995, when liabilities in the deposit-free

US Shadow Banking system for the first time ever became larger than

liabilities held by traditional financial institutions, or those whose

funding comes primarily from deposits. As a reminder, Zero Hedge has

been covering the topic of Shadow Banking for over two years,

as it is our contention that this massive, and virtually undiscussed

component of the US real economy (that which is never covered by hobby

economists' three letter economic theories used to validate socialism,

or even any version of (neo-)Keynesianism as shadow banking in its

proper, virulent form did not exist until the late 1990s and yet is the same size as total US GDP!), is, on the margin, the most important one: in

fact one that defines, or at least should, monetary policy more than

most imagine, and also explains why despite trillions in new money

having been created out of thin air, the flow through into the general

economy has been negligible.

While everyone's attention was focused on details surrounding the household sector in the recently released Q1 Flow of Funds report (ours included),

something much more important happened in the US economy from a flow

perspective, something which, in fact, has not happened since December

of 1995, when liabilities in the deposit-free

US Shadow Banking system for the first time ever became larger than

liabilities held by traditional financial institutions, or those whose

funding comes primarily from deposits. As a reminder, Zero Hedge has

been covering the topic of Shadow Banking for over two years,

as it is our contention that this massive, and virtually undiscussed

component of the US real economy (that which is never covered by hobby

economists' three letter economic theories used to validate socialism,

or even any version of (neo-)Keynesianism as shadow banking in its

proper, virulent form did not exist until the late 1990s and yet is the same size as total US GDP!), is, on the margin, the most important one: in

fact one that defines, or at least should, monetary policy more than

most imagine, and also explains why despite trillions in new money

having been created out of thin air, the flow through into the general

economy has been negligible.The Obamacare Outcome Matrix

With

the Supreme Court likely to announce its decision on the

constitutionality of Health Care Reform Law this Thursday, BofA outlines

five possible scenarios and their potential impact across the healthcare sectors.

They base the likelihood of their scenarios on a review of the March

oral arguments, previous circuit court decisions, as well as surveys of

legal experts and former Supreme Court clerks. Everything you need to

know about the possible outcomes and actions to take.

With

the Supreme Court likely to announce its decision on the

constitutionality of Health Care Reform Law this Thursday, BofA outlines

five possible scenarios and their potential impact across the healthcare sectors.

They base the likelihood of their scenarios on a review of the March

oral arguments, previous circuit court decisions, as well as surveys of

legal experts and former Supreme Court clerks. Everything you need to

know about the possible outcomes and actions to take.Biderman On The Bernanke Put, Black Swans, And The Failure Of 'Perceived Truths'

The

underlying premise for much of the management of other-people's-money

(OPM) is that if the market drops by an appreciable amount, then

Bernanke will step in and save the day. The problem with these

'perceived truths', as Charles Biderman of TrimTabs notes, is that they

come-and-go; much like buy-and-hold and

China-as-the-engine-of-the-world's-growth. The belief in the Bernanke

Put has been around since the end of 2009 and is why the biggest

holders of stocks are today mostly fully invested because they really

believe that the Fed will remain the buyer of last resort.

Unfortunately, as Charles points out, 'market truths always end badly'

and in this case what is underlying the belief is that sooner of later

the US economy will grow fast enough to allow the Fed to stop priming

the pump with newly minted money into stocks; and in this case, he

fears, "the headwinds are just too big and that rapid growth will not happen any time soon".

The

underlying premise for much of the management of other-people's-money

(OPM) is that if the market drops by an appreciable amount, then

Bernanke will step in and save the day. The problem with these

'perceived truths', as Charles Biderman of TrimTabs notes, is that they

come-and-go; much like buy-and-hold and

China-as-the-engine-of-the-world's-growth. The belief in the Bernanke

Put has been around since the end of 2009 and is why the biggest

holders of stocks are today mostly fully invested because they really

believe that the Fed will remain the buyer of last resort.

Unfortunately, as Charles points out, 'market truths always end badly'

and in this case what is underlying the belief is that sooner of later

the US economy will grow fast enough to allow the Fed to stop priming

the pump with newly minted money into stocks; and in this case, he

fears, "the headwinds are just too big and that rapid growth will not happen any time soon".Spain officially requests bailout money/Also Cypress/Moody's set to downgrade Spanish banks/Greece finance minister resigns/

Harvey Organ at Harvey Organ's - The Daily Gold and Silver Report - 2 hours ago

Good

evening Ladies and Gentlemen:

Gold closed up by $12.30 to $1587.30. Silver also followed suit rising

by 87 cents to $27.52.

Today's big news comes from the official asking for funds from Spain. I

can remember that Rajoy stated that the bailout will be unconditional.

Guess again, there will be strings attached. We are waiting momentarily

for Moody's to place the entire Spanish bankingOil Price Differentials: Caught Between The Sands And The Pipelines

from Jeff Clark, Senior Precious Metals Analyst, Casey Research:

For the past eighteen months, gold stocks have been pummeled.

They showed some life from mid-May to mid-June – GDX, the gold miner’s index, was up 21%, while gold rose 5.5%. That bounce was exciting, but they’ve still got a lot of lost ground to make up. Since January 1, 2011, GDX is down 28%, while gold is up 10%.

So what’s going to move these darn stocks? Will their day ever come? Could our research – gulp – be wrong? Jokes have even started circulating…

- What’s the difference between a seagull and a gold stock investor? The seagull can still make a deposit on a Mercedes.

- Gold equities may be bad, but I slept like a baby last night. I woke up every hour and cried.

That’s a strong statement, I know, but there are numerous well-researched reasons why I’m convinced gold stocks are one spark away from igniting the portfolios of those with the cash to buy, courage to act, and patience to hold. And it’s not just because they’re undervalued, something that’s been the case for at least eight months.

Let’s review the core reasons why gold stocks are the place to invest right now, and why I’m convinced much higher prices will be had before this bull market is over…

Read More @ CaseyResearch.com

from KingWorldNews:

With tremendous volatility in global markets, today King World News interviewed James Turk out of Europe. Turk told KWN that we are headed into an extraordinarily dangerous time for both the markets and the financial system, that will end in a massive panic. Here is what Turk had to say about what is taking place: “Today was a very important day, Eric, because gold was strong while the stock markets were weak. This is a trend I expect to continue, and one that will baffle many financial analysts, going forward, that don’t understand this type of cycle.”

“I was hoping to see more strength in the precious metals at the end of last week, Eric, given the pummeling gold and silver were given. But I guess that was too much to ask for with July option expiry this week.

Having driven the price of gold and silver down to this low level, I assume the paper-shorts will try to keep prices as low as possible, in order to maximize their profit by having calls they sold expire out of the money. We’ve seen this happen many times over the years….

James Turk continues @ KingWorldNews.com

By The Daily Reckoning, Daily Reckoning.com.au:

Dear Chairman Bernanke,

Dear Chairman Bernanke,

I’ve been in business for more than 25 years and if there’s one thing I have learned it’s that every real business leader worth a damn has a number.

That’s the figure where they throw in the towel and admit defeat. It’s the precise instant they acknowledge that they will no longer throw more money at a bad idea. It’s the point in time where they seek fresh counsel and new ideas because the pain of staying the course becomes too great.

Chairman Bernanke, what exactly is your number?

You’ve just announced Operation Twist (again). You’re preparing to spend another $267 billion buying long-term securities as part of a plan to keep rates low through 2014.

You position this as a means of stimulating hiring and supporting a flagging economy that needs more support. You counsel that it will spur borrowing and spending.

We all submit that your plan is not working.

Four years and trillions of dollars into this mess, your Fed has taken a buzzsaw to growth estimates, most recently cutting them to 1.9% from 2.4% for this year. If the government multiplier everybody always cites actually worked, our economy should be screaming along at 8% a year or more.

Read More @ DailyReckoning.com.au

Dear Chairman Bernanke,

Dear Chairman Bernanke,I’ve been in business for more than 25 years and if there’s one thing I have learned it’s that every real business leader worth a damn has a number.

That’s the figure where they throw in the towel and admit defeat. It’s the precise instant they acknowledge that they will no longer throw more money at a bad idea. It’s the point in time where they seek fresh counsel and new ideas because the pain of staying the course becomes too great.

Chairman Bernanke, what exactly is your number?

You’ve just announced Operation Twist (again). You’re preparing to spend another $267 billion buying long-term securities as part of a plan to keep rates low through 2014.

You position this as a means of stimulating hiring and supporting a flagging economy that needs more support. You counsel that it will spur borrowing and spending.

We all submit that your plan is not working.

Four years and trillions of dollars into this mess, your Fed has taken a buzzsaw to growth estimates, most recently cutting them to 1.9% from 2.4% for this year. If the government multiplier everybody always cites actually worked, our economy should be screaming along at 8% a year or more.

Read More @ DailyReckoning.com.au

by Thomas J Smith, Financial Sense:

Markets are under pressure this morning. Spain formally requested 100 billion Euros to recapitalize its banks. Yields on both Italian and Spanish bonds are rising. Financial stocks are being aggressively sold today. Energy is another area that is selling off sharply today. August crude hit a session low this morning of $78.19. WTI crude has attempted to rally above $79 but failed and is trading at roughly $78.50 as I write. The metals space is slightly higher today. Gold and silver are flat to slightly up today depending on when you check for a price. This area, as are all areas, remains volatile.

The technical picture has been a mess over the last few weeks. There have been false breakdowns and thwarted breakout attempts. To say the market is volatile is an understatement. We had all the major indexes move below their 200 day moving averages only to rally back above their 50 day moving averages. The most recent rally attempt fizzled last week and we are back at critical support levels. Support for the major indexes is being tested as I write.

Read More @ Financial Sense.com

BTFD...

Markets are under pressure this morning. Spain formally requested 100 billion Euros to recapitalize its banks. Yields on both Italian and Spanish bonds are rising. Financial stocks are being aggressively sold today. Energy is another area that is selling off sharply today. August crude hit a session low this morning of $78.19. WTI crude has attempted to rally above $79 but failed and is trading at roughly $78.50 as I write. The metals space is slightly higher today. Gold and silver are flat to slightly up today depending on when you check for a price. This area, as are all areas, remains volatile.

The technical picture has been a mess over the last few weeks. There have been false breakdowns and thwarted breakout attempts. To say the market is volatile is an understatement. We had all the major indexes move below their 200 day moving averages only to rally back above their 50 day moving averages. The most recent rally attempt fizzled last week and we are back at critical support levels. Support for the major indexes is being tested as I write.

Read More @ Financial Sense.com

BTFD...

by Michael Taylor, Reuters:

Weak bullion prices and prospects for bargain buying by central banks

will take centre stage at a gold industry gathering in Indonesia this

week, along with the country’s plans for a raft of new mining

regulations that could be worrying for investors.

Weak bullion prices and prospects for bargain buying by central banks

will take centre stage at a gold industry gathering in Indonesia this

week, along with the country’s plans for a raft of new mining

regulations that could be worrying for investors.

Gold has lost some of its safe-haven appeal in recent weeks, as investors cash in despite market turmoil partly due to the euro zone debt crisis, but there are expectations that lower prices could attract buyers.

“The retracement in gold is one feature,” said Nick Moore, head of commodity research at RBS, speaking ahead of the Asia Gold Summit in Jakarta this week. “From the consumer side, the fall-off in prices in dollar terms is welcome.”

Read More @ Reuters.com

Gold has lost some of its safe-haven appeal in recent weeks, as investors cash in despite market turmoil partly due to the euro zone debt crisis, but there are expectations that lower prices could attract buyers.

“The retracement in gold is one feature,” said Nick Moore, head of commodity research at RBS, speaking ahead of the Asia Gold Summit in Jakarta this week. “From the consumer side, the fall-off in prices in dollar terms is welcome.”

Read More @ Reuters.com

from Off Grid Survival:

While the emergency management community heralds the new Wireless

Emergency Alerts (WEA) as a great technological achievement that will

save a number of lives, some in the privacy community are not so sure.

It seems the new alert system may have a dark side.

While the emergency management community heralds the new Wireless

Emergency Alerts (WEA) as a great technological achievement that will

save a number of lives, some in the privacy community are not so sure.

It seems the new alert system may have a dark side.

One not so publicized feature of the new WEA system is the presidential alert feature. Without the ability to opt-out, your cell phone will now be able to receive presidential alerts directly from the President of the United States.

In compliance with the National Alerting Program, new cell phones will all be chipped to allow these alerts. For those with older cell phones, software upgrades will be loaded to their phones through the phones connection with the cell network.

While government officials insist the Presidential Alerts will only be used in the case of a national emergency, what constitutes an national emergency has yet to be defined.

Read More @ OffGridSurvival.com

from TrimTabs:

[Ed. Note: Ann Barnhardt has become something of a polarizing figure with one foot firmly planted in a anti-Islamic paradigm. It causes us to wonder what her views are on the events of 9/11. But her views on the collapse are always worth tuning in for.]

from wepollock:

While the emergency management community heralds the new Wireless

Emergency Alerts (WEA) as a great technological achievement that will

save a number of lives, some in the privacy community are not so sure.

It seems the new alert system may have a dark side.

While the emergency management community heralds the new Wireless

Emergency Alerts (WEA) as a great technological achievement that will

save a number of lives, some in the privacy community are not so sure.

It seems the new alert system may have a dark side.One not so publicized feature of the new WEA system is the presidential alert feature. Without the ability to opt-out, your cell phone will now be able to receive presidential alerts directly from the President of the United States.

In compliance with the National Alerting Program, new cell phones will all be chipped to allow these alerts. For those with older cell phones, software upgrades will be loaded to their phones through the phones connection with the cell network.

While government officials insist the Presidential Alerts will only be used in the case of a national emergency, what constitutes an national emergency has yet to be defined.

Read More @ OffGridSurvival.com

from TrimTabs:

[Ed. Note: Ann Barnhardt has become something of a polarizing figure with one foot firmly planted in a anti-Islamic paradigm. It causes us to wonder what her views are on the events of 9/11. But her views on the collapse are always worth tuning in for.]

from wepollock:

by Mac Slavo of SHTFPlan:

Whether the system is going to collapse is not the question.

Most informed individuals understand that out of control spending fueled by trillions of dollars in debt, unprecedented monetary expansion and ever increasing dependence on a government social safety net overburdened by millions of people in need of essential services can not be sustained forever.

For many Americans and our counterparts in Europe, the collapse is now.

To suggest that we are somehow on the road to recovery is nothing but conjecture.

Whether the system is going to collapse is not the question.

Most informed individuals understand that out of control spending fueled by trillions of dollars in debt, unprecedented monetary expansion and ever increasing dependence on a government social safety net overburdened by millions of people in need of essential services can not be sustained forever.

For many Americans and our counterparts in Europe, the collapse is now.

To suggest that we are somehow on the road to recovery is nothing but conjecture.

We have no doubt that everyone is tired of bad news, but we are compelled to review the facts: Europe is currently experiencing severe bank runs, budgets in virtually every western country on the planet are out of control, the banking system is running excessive leverage and risk, the costs of servicing the ever-increasing amounts of government debt are rising rapidly, and the economies of Europe, Asia and the United States are slowing down or are in full contraction. There’s no sugar coating it and we have to stop listening to politicians and central planners who continue to downplay, obfuscate and flat out lie about the current economic reality. Stop listening to them.

Read More @ SHTFPlan.com

by Michael Krieger, Liberty Blitzkreig

This is a must read article from Bloomberg. So the banksters steal

billions (if not trillions) from the American economy and then they spit

out a couple of million to desperate charities at black tie events in

order to feel good about themselves. Robot-man himself, John Thain (I

remain unconvinced that he is human), then comes out and says the

following: “The demonization of Wall Street and bankers is very much a

function of the press and of Washington, and not much more broadly

held.” Really?! Thanks for the memo Johnny. Oh and the best part…his

three children have apparently followed him into finance. I need a

shower.

This is a must read article from Bloomberg. So the banksters steal

billions (if not trillions) from the American economy and then they spit

out a couple of million to desperate charities at black tie events in

order to feel good about themselves. Robot-man himself, John Thain (I

remain unconvinced that he is human), then comes out and says the

following: “The demonization of Wall Street and bankers is very much a

function of the press and of Washington, and not much more broadly

held.” Really?! Thanks for the memo Johnny. Oh and the best part…his

three children have apparently followed him into finance. I need a

shower.

Key Quotes: Dimon was named executive of the year by the University of Rochester’s Simon Graduate School of Business at its May 3 conference, “Economic Action and the Management of Risk.” The honor is given to a leader who “demonstrates a deep respect for our nation’s fiscal health,” according to the school’s website.

A week later, Dimon, 56, disclosed a $2 billion trading loss in a division that helps manage the firm’s risk.

Read More @ LibertyBlitzkreig.com

This is a must read article from Bloomberg. So the banksters steal

billions (if not trillions) from the American economy and then they spit

out a couple of million to desperate charities at black tie events in

order to feel good about themselves. Robot-man himself, John Thain (I

remain unconvinced that he is human), then comes out and says the

following: “The demonization of Wall Street and bankers is very much a

function of the press and of Washington, and not much more broadly

held.” Really?! Thanks for the memo Johnny. Oh and the best part…his

three children have apparently followed him into finance. I need a

shower.

This is a must read article from Bloomberg. So the banksters steal

billions (if not trillions) from the American economy and then they spit

out a couple of million to desperate charities at black tie events in

order to feel good about themselves. Robot-man himself, John Thain (I

remain unconvinced that he is human), then comes out and says the

following: “The demonization of Wall Street and bankers is very much a

function of the press and of Washington, and not much more broadly

held.” Really?! Thanks for the memo Johnny. Oh and the best part…his

three children have apparently followed him into finance. I need a

shower.Key Quotes: Dimon was named executive of the year by the University of Rochester’s Simon Graduate School of Business at its May 3 conference, “Economic Action and the Management of Risk.” The honor is given to a leader who “demonstrates a deep respect for our nation’s fiscal health,” according to the school’s website.

A week later, Dimon, 56, disclosed a $2 billion trading loss in a division that helps manage the firm’s risk.

Read More @ LibertyBlitzkreig.com

from CapitalAccount:

On Friday, we had a week to save Europe, now we’ve got three days according to George Soros! He said the upcoming summit later this week could be a fiasco and fatal to the future of the Euro. George Soros is changing his rhetoric a little. Remember, in the beginning of June he said Europe had three months to get it together.

Meanwhile, Spain has formally requested its bank bailout. Cyprus has now requested EU bailout aid citing spillover from Greece. Greece’s new finance minister resigns and Merkel puts the breaks on Eurobonds — once again. The Bank of International Settlements — the central bank of central banks — says that their money printing buddies may need to think about giving the presses a rest, lest they run out of ink! Sowhat exactly can one more EU summit solve? We’ll try and answer that question with our guest Edward Harrison, founder of Creditwritedowns!

On Friday, we had a week to save Europe, now we’ve got three days according to George Soros! He said the upcoming summit later this week could be a fiasco and fatal to the future of the Euro. George Soros is changing his rhetoric a little. Remember, in the beginning of June he said Europe had three months to get it together.

Meanwhile, Spain has formally requested its bank bailout. Cyprus has now requested EU bailout aid citing spillover from Greece. Greece’s new finance minister resigns and Merkel puts the breaks on Eurobonds — once again. The Bank of International Settlements — the central bank of central banks — says that their money printing buddies may need to think about giving the presses a rest, lest they run out of ink! Sowhat exactly can one more EU summit solve? We’ll try and answer that question with our guest Edward Harrison, founder of Creditwritedowns!

from KingWorldNews:

With global markets trading in a sea of red, the Godfather of

newsletter writers, Richard Russell, issued the following warning: “…

it is dawning on Bernanke that the Fed cannot defeat the powers of

deflation and the primary bear trend … and Bernanke knows it, but cannot

talk about it – it’s too frightening.” Russell also discussed gold at

length, but first, this was Russell’s disturbing conclusion regarding

the precarious situation we face: “The Russell view — The Fed

and all central banks are fighting the implacable forces of global

deflation. This is really the primary bear trend that I’ve been writing

about. It’s the result of a fundamental change in the world markets.

Suddenly, within the space of a few years, Asia has entered the global

economy.”

With global markets trading in a sea of red, the Godfather of

newsletter writers, Richard Russell, issued the following warning: “…

it is dawning on Bernanke that the Fed cannot defeat the powers of

deflation and the primary bear trend … and Bernanke knows it, but cannot

talk about it – it’s too frightening.” Russell also discussed gold at

length, but first, this was Russell’s disturbing conclusion regarding

the precarious situation we face: “The Russell view — The Fed

and all central banks are fighting the implacable forces of global

deflation. This is really the primary bear trend that I’ve been writing

about. It’s the result of a fundamental change in the world markets.

Suddenly, within the space of a few years, Asia has entered the global

economy.”

Richard Russell continues @ KingWorldNews.com

With global markets trading in a sea of red, the Godfather of

newsletter writers, Richard Russell, issued the following warning: “…

it is dawning on Bernanke that the Fed cannot defeat the powers of

deflation and the primary bear trend … and Bernanke knows it, but cannot

talk about it – it’s too frightening.” Russell also discussed gold at

length, but first, this was Russell’s disturbing conclusion regarding

the precarious situation we face: “The Russell view — The Fed

and all central banks are fighting the implacable forces of global

deflation. This is really the primary bear trend that I’ve been writing

about. It’s the result of a fundamental change in the world markets.

Suddenly, within the space of a few years, Asia has entered the global

economy.”

With global markets trading in a sea of red, the Godfather of

newsletter writers, Richard Russell, issued the following warning: “…

it is dawning on Bernanke that the Fed cannot defeat the powers of

deflation and the primary bear trend … and Bernanke knows it, but cannot

talk about it – it’s too frightening.” Russell also discussed gold at

length, but first, this was Russell’s disturbing conclusion regarding

the precarious situation we face: “The Russell view — The Fed

and all central banks are fighting the implacable forces of global

deflation. This is really the primary bear trend that I’ve been writing

about. It’s the result of a fundamental change in the world markets.

Suddenly, within the space of a few years, Asia has entered the global

economy.”Richard Russell continues @ KingWorldNews.com

by John Butler, Financial Sense:

In what might be the most underreported financial story of the year,

US banking regulators recently circulated a memorandum for comment,

including proposed adjustments to current regulatory capital

risk-weightings for various assets. For the first time,

unencumbered gold bullion is to be classified as zero risk, in line with

dollar cash, US Treasuries and other explicitly government-guaranteed

assets. If implemented, this will be an important step in the

re-monetisation of gold and, other factors equal, should be strongly

supportive of the gold price, both outright and relative to that for

government bonds, the primary beneficiaries of the most recent flight to

safety. Stay tuned.

In what might be the most underreported financial story of the year,

US banking regulators recently circulated a memorandum for comment,

including proposed adjustments to current regulatory capital

risk-weightings for various assets. For the first time,

unencumbered gold bullion is to be classified as zero risk, in line with

dollar cash, US Treasuries and other explicitly government-guaranteed

assets. If implemented, this will be an important step in the

re-monetisation of gold and, other factors equal, should be strongly

supportive of the gold price, both outright and relative to that for

government bonds, the primary beneficiaries of the most recent flight to

safety. Stay tuned.

Read More @ FinancialSense.com

In what might be the most underreported financial story of the year,

US banking regulators recently circulated a memorandum for comment,

including proposed adjustments to current regulatory capital

risk-weightings for various assets. For the first time,

unencumbered gold bullion is to be classified as zero risk, in line with

dollar cash, US Treasuries and other explicitly government-guaranteed

assets. If implemented, this will be an important step in the

re-monetisation of gold and, other factors equal, should be strongly

supportive of the gold price, both outright and relative to that for

government bonds, the primary beneficiaries of the most recent flight to

safety. Stay tuned.

In what might be the most underreported financial story of the year,

US banking regulators recently circulated a memorandum for comment,

including proposed adjustments to current regulatory capital

risk-weightings for various assets. For the first time,

unencumbered gold bullion is to be classified as zero risk, in line with

dollar cash, US Treasuries and other explicitly government-guaranteed

assets. If implemented, this will be an important step in the

re-monetisation of gold and, other factors equal, should be strongly

supportive of the gold price, both outright and relative to that for

government bonds, the primary beneficiaries of the most recent flight to

safety. Stay tuned.Read More @ FinancialSense.com

by Kurt Nimmo, Info Wars:

On Saturday, the Israeli newspaper Haartez

reported a senior Israeli official as saying Prime Minister Benjamin

Netanyahu has decided to attack Iran prior to the elections in the U.S.

On Saturday, the Israeli newspaper Haartez

reported a senior Israeli official as saying Prime Minister Benjamin

Netanyahu has decided to attack Iran prior to the elections in the U.S.

“U.S. defense contracts, an Iranian F-16 acquisition, and Israel’s new military preparations suggest that all sides are getting ready for whatever may come,” Haaretz wrote, citing a report posted by Business Insider.

Business Insider and Haaretz did not venture to speculate when Israel would launch an attack.

On Sunday, Michael Carmichael suggested the attack would occur during the Democrat national convention.

Read More @ InfoWars.com

“U.S. defense contracts, an Iranian F-16 acquisition, and Israel’s new military preparations suggest that all sides are getting ready for whatever may come,” Haaretz wrote, citing a report posted by Business Insider.

Business Insider and Haaretz did not venture to speculate when Israel would launch an attack.

On Sunday, Michael Carmichael suggested the attack would occur during the Democrat national convention.

Read More @ InfoWars.com

by Dr. Jeffrey Lewis, Silver Seek:

The last years of mining silver could well be compared to studies that

indicate the world is approaching the last years of pumping oil.

The last years of mining silver could well be compared to studies that

indicate the world is approaching the last years of pumping oil.

While the earth’s stores of silver may not actually run out anytime soon, increasing demand and increasingly difficult mining opportunities for silver tends to put upward pressure on the cost of extracting what silver is left from the planet.

Those mining costs are also getting more and more complex as new processes and resource scouting techniques are required.

Energy prices ultimately will go up. If not because of dwindling supply, then they will very likely rise due to inflation. The same is true of precious metal prices.

Read More @ Silver Seek

The last years of mining silver could well be compared to studies that

indicate the world is approaching the last years of pumping oil.

The last years of mining silver could well be compared to studies that

indicate the world is approaching the last years of pumping oil.While the earth’s stores of silver may not actually run out anytime soon, increasing demand and increasingly difficult mining opportunities for silver tends to put upward pressure on the cost of extracting what silver is left from the planet.

Those mining costs are also getting more and more complex as new processes and resource scouting techniques are required.

Energy prices ultimately will go up. If not because of dwindling supply, then they will very likely rise due to inflation. The same is true of precious metal prices.

Read More @ Silver Seek

from Gains Pains & Capital:

Europe is heading into a full-scale disaster.

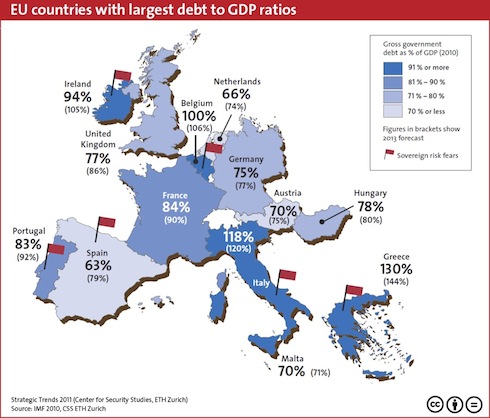

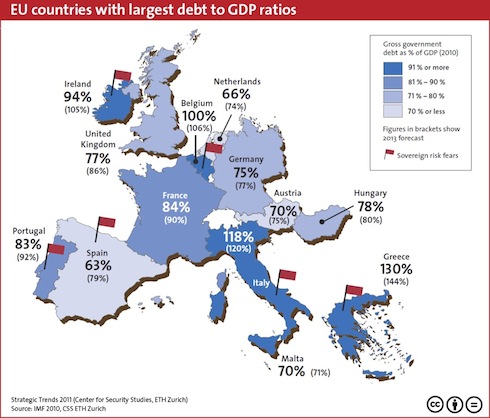

You see, the debt problems in Europe are not simply related to Greece. They are SYSTEMIC. The below chart shows the official Debt to GDP ratios for the major players in Europe.

As you can see, even the more “solvent” countries like Germany and France are sporting Debt to GDP ratios of 75% and 84% respectively.

These numbers, while bad, don’t account for unfunded liabilities. And Europe is nothing if not steeped in unfunded liabilities.

Read More @ GainsPainsCapital.com

by Susanne Posel, Activist Post

The efforts of the Global Elite are to enable an environmentally-based

economy within a one world government. This includes replacing the

currency and economic structures in place.

The efforts of the Global Elite are to enable an environmentally-based

economy within a one world government. This includes replacing the

currency and economic structures in place.

The Royal Canadian Mint (RCM) has announced that they will stop printing pennies. The RCM have unveiled a digital RFID-chip based currency that can be loaded up, stored and spent in-store and online.

The RCM calls this currency MintChip; which will be a virtual payment method accessible through microchips, microSD cards and USB sticks.

This RFID-chip currency is collaboration with the US corporations and research and development outfits. Ian Bennett, president and CEO of the Mint explains:

My Dear Extended Family,

Jim Sinclair’s Commentary

My center has collapsed, my right flank is weakening. Situation excellent. I am attacking. – Arshall Foch

Jim Sinclair’s Commentary

Egypt’s Morsi to rethink Israel peace pact: report

Egypt’s Islamist president-elect, Mohamed Morsi, wants to "reconsider" the peace deal with Israel and build ties with Iran to "create a strategic balance" in the Middle East, according to an interview published by Iran’s Fars news agency on Monday.

But an Egyptian presidential spokesman rejected the Fars report, saying that Morsi never spoke to the Iranian news agency.

"Mr Morsi did not give any interview to Fars and everything that this agency has published is without foundation," a spokesman for the Egyptian presidency told the official news agency MENA.

Fars had said that Morsi spoke to one of its reporters in Cairo on Sunday just before his election triumph was announced.

It provided an audio link to what it said was a recording of Morsi speaking Arabic in the interview (http://www.farsnews.com/newstext.php?nn=13910405000223).

"We will reconsider the Camp David Accord" that, in 1979, forged a peace between Egypt and Israel that has held for more than three decades, the audio file Fars attributed to Morsi says.

More…

Jim Sinclair’s Commentary

This is 1937 and Bernanke is fearing the ghost of Andrew Mellon and the French bankers–remember he promised Milton Friedman at his 90th birthday that deflation would not take place on his watch and the same mistakes repeated. –Yra Harris

Jim Sinclair’s Commentary

Jim Sinclair’s Commentary

Greek finance minister resigns, crisis deepens By Harry Papachristou and Karolina Tagaris

(Reuters) – Greece’s new finance minister resigned because of ill health on Monday, throwing the government’s drive to soften the terms of an international bailout into confusion days before a European summit.

Vassilis Rapanos, 64, chairman of the National Bank of Greece, was rushed to hospital on Friday, before he could be sworn in, complaining of abdominal pain, nausea and dizziness. Greek media said he had a history of ill-health.

The office of Prime Minister Antonis Samaras, who himself only took office last Wednesday following a June 17 election, said Rapanos had sent a letter of resignation because of his health problems and it had been accepted.

Samaras himself has only just emerged from hospital after undergoing eye surgery to repair a damaged retina. Both he and Rapanos had already said they would not be able to attend the June 28-29 European summit.

It was a worryingly chaotic start for the new government, formed after the second election in a month, which faces a rocky road in responding to huge domestic opposition to a harsh international bailout in the face of steadfast European opposition to any watering down of its terms.

More…

Jim Sinclair’s Commentary

Russia may be preparing second attempt at Syrian arms shipment

Ship carrying air defence systems and helicopters that was forced to return to port has been refitted with Russian flag Miriam Elder in Moscow

guardian.co.uk, Monday 25 June 2012 14.22 BST

A Russian ship carrying attack helicopters that was prevented from sailing to Syria has been refitted with a Russian flag, rousing suspicions it is preparing for a second attempt.

The MV Alaed, carrying air defence systems and helicopters to Syria, was forced to return to port last week after its British insurers withdrew their coverage as the ship rounded the coast of Scotland. The Foreign Office and Treasury had warned the insurance company, Standard Club, that it could be in breach of sanctions against the regime of Bashar al-Assad if they allowed the ship to pass.

Sailing under the Curaçao flag, the ship returned on Sunday to the northern port of Murmansk, where it was "awaiting further instructions", the ship’s owner, Femco, said in a statement. It said it would not comment on "the nature of the cargo on board".

The vague statement stood in stark contrast to official attempts to justify the weapons delivery.

Last week Russia’s foreign minister, Sergei Lavrov, admitted that the Alaed was carrying supplies for Syria. "The ship was carrying air defence systems, which can be used only for repelling foreign aggression and not against peaceful demonstrators, and it was carrying three repaired helicopters," he told Ekho Mosvky radio.

More…

Jim,

According to a report from the Troika of international creditors the European Union, International Monetary Fund and the European Central Bank; and data given by outgoing finance minister George Zannias. Greece may have breached troika deal by hiring 70,000 staff.

Later, the EU Commission denies issuing such document.

QE for Greece will happen despite the fact that Greece has breached the troika deal or not as they have no other choice at this moment of time. Europe (and the market, and the US) is not ready for a Greek exit.

Best regards,

CIGA Christopher

EU Commission denies issuing document on Greek bulk hires 13:15 25 GIU 2012

(AGI) Brussels- The EU Commission denies issuing a document saying Greece had hired 70,000 public sector staff between 2010-2011. Such mass hiring would mean that the country breached the rules of its EU-IMF loan agreement, as was claimed by the Greek press. "I cannot confirm the figure of 70,000 public sector staff having been hired. We are members of the troika and that figure was not issued by the Commission", stated the spokesman for European Union Economic and Monetary Affairs Commissioner Olli Rehn, Amadeu Altafaj…

More…

Report claims Greece breached troika deal by hiring 70,000 staff Updated: 13:21, Monday, 25 June 2012

A report suggests that Greece breached the rules of its EU/IMF loan agreement by taking on some 70,000 public sector staff.

A report by Greece’s outgoing finance minister George Zannias showed that civil servant numbers had not dropped despite cuts

Greek newspaper To Vima said that the hirings in 2010 and 2011 were highest in local administration, health, the police and culture.

It cited a report from the Troika of international creditors the European Union, International Monetary Fund and the European Central Bank; and data given by outgoing finance minister George Zannias.

An unidentified troika official said that while they legislated rules to reduce the number of civil servants, they were bringing people in through the window.

The official added that over 12,000 people were hired by local councils even as a cost-cutting initiative merging municipalities was underway.

Mr Zannias’ report to the new government coalition after 17 June elections allegedly reveals that although over 53,000 civil servants retired in 2010.

It also said that the overall number of state staff was almost steady at 692,000 people.

More…

Dear Jim,

Regard the Day of the Deflationist:

Yeah, you can see the ass kissing in his commentary. I simply try not to read them much beyond the historical content now. And, I can do that on my own.

His argument that hyperinflation can’t happen in a reserve currency is correct, but this outcome assumes a predictable change in confidence of paper money and zero alternatives. Gold is both a commodity and private money. More so the later when confidence is shaken. Hyperinflation, though I don’t expect it in the US dollar, is possible because a flight to private money is still possible. I expect the transition to be managed, but history is full of the unexpected. I do expect accelerating inflation in the periphery economies first.

Eventually, money will focus on the elephant in the room. It’s kind of like Stalin’s no aggressive pact with Hilter. Everyone, even Stalin, knew Hitler would attack Russia. He still signed the pact to buy time.

CIGA Eric

Dear Jim,

"The BIS said that euro-zone banks’ balance sheets in general continued to show massive liquidity mismatches after losing many traditional sources of funding. The overall ratio of loans to deposits at euro-zone banks "rose to 130% during the crisis and has hardly fallen since," the BIS said, noting that the same ratio in other banking systems averages around 75%.

The most wrenching change since 2008 has arguably been a collapse in interbank lending in the euro zone, especially across national borders. The BIS noted that the volume of interbank lending in the euro zone had fallen from over $2.25 trillion in 2008, before the crisis, to less than $1 trillion by the end of 2011.

The BIS said banks were often their own worst enemy…"

Link to full article…

CIGA Christopher.

Dear Christopher,

Europe is heading into a full-scale disaster.

You see, the debt problems in Europe are not simply related to Greece. They are SYSTEMIC. The below chart shows the official Debt to GDP ratios for the major players in Europe.

As you can see, even the more “solvent” countries like Germany and France are sporting Debt to GDP ratios of 75% and 84% respectively.

These numbers, while bad, don’t account for unfunded liabilities. And Europe is nothing if not steeped in unfunded liabilities.

Read More @ GainsPainsCapital.com

by Susanne Posel, Activist Post

The efforts of the Global Elite are to enable an environmentally-based

economy within a one world government. This includes replacing the

currency and economic structures in place.

The efforts of the Global Elite are to enable an environmentally-based

economy within a one world government. This includes replacing the

currency and economic structures in place.The Royal Canadian Mint (RCM) has announced that they will stop printing pennies. The RCM have unveiled a digital RFID-chip based currency that can be loaded up, stored and spent in-store and online.

The RCM calls this currency MintChip; which will be a virtual payment method accessible through microchips, microSD cards and USB sticks.

This RFID-chip currency is collaboration with the US corporations and research and development outfits. Ian Bennett, president and CEO of the Mint explains:

As part of its research and development efforts, the Mint has developed MintChip, which could be characterized as an evolution of physical money, with the added benefits of being electronic.Read More @ Activist Post

My Dear Extended Family,

Never before in the entire period of 1968 to 1980, or 2001 to

present, have I received so many copies of classical deflationist

scenarios in one day. It would seem as if the God of Deflation overflew

the gold guys and dropped their leaflets.

Classical deflation does not have a snowball’s chance in hell of

occurring now for any length of time. To assume that you have to hold

the belief that Bernanke is a mole in the present administration, placed

their covertly to bury the present administration so deep that there

will never be a democrat in office after 2013 anywhere.

If you believe there is a political appetite for the collapse of the

Western financial system, they had a perfect chance in 2008 and did not

accept that great opportunity to purge the system of Banksters for

political reasons.

The problems of 2008 are here now and greater. Derivatives still

challenge the entire system at a greater level. A major under the covers

audit is being done right now of some major banks for serious OTC

derivative problems. Market miscreant activity allowed the break to near

nothing for many financial institutions. The activity specifically is

the absence of the uptick rule, which is still missing. The regulators

are controlled by Washington which in turn is owned by the hedge fund

and bankster’s lobby.

Nothing whatsoever has changed except the degree of difficulty which has risen to a level never existing in market history.

The rescue will come in the form of QE to infinity for the entire western world’s financial system.

The market historians making fun of the gold community may not like

the fact that it was the huge communication to his prison authorities

and the system that actually got him the opportunity for freedom.

Whatever the mental level reason for his hate of “Gold Bugs,” he is

wrong.

Gold is going to and through $2111 on its way towards Alf’s levels.

The euro and the dollar, in that order, will be bailed out. QE will

rise to infinity the longer Bernanke plays chicken with the present

administration for perseverance of the private bank, the Fed, and its

power.

Please stop sending me copies of the latest tome from our respected

market historian. The history he is going to make now is his largest

market error in his career, scaring the life out of investment

protection insurance non trading gold holders, so much so that when they

leave they will never return to the gold market.

I have written about Currency Induced Cost Push Inflation hundreds of

times. They are all in the compendium. Our beloved historian does not

understand this concept, but will be defrocked by it.

This popular writer is determined to walk the halls of ivy again,

doing anything necessary to make that happen. Part of that is not having

a history of being rescued by the “Gold Bugs,” which he was. I knew him

in the 70s when he looked down at me as not in his high circles.

Nothing has changed.

Respectfully,

Jim

Jim

Jim Sinclair’s Commentary

This has to be the quote of the day where we gold guys are concerned.

My center has collapsed, my right flank is weakening. Situation excellent. I am attacking. – Arshall Foch

Jim Sinclair’s Commentary

Arab Spring will definitely become Arab Long Winter for Western interests.

Egypt’s Morsi to rethink Israel peace pact: report

Egypt’s Islamist president-elect, Mohamed Morsi, wants to "reconsider" the peace deal with Israel and build ties with Iran to "create a strategic balance" in the Middle East, according to an interview published by Iran’s Fars news agency on Monday.

But an Egyptian presidential spokesman rejected the Fars report, saying that Morsi never spoke to the Iranian news agency.

"Mr Morsi did not give any interview to Fars and everything that this agency has published is without foundation," a spokesman for the Egyptian presidency told the official news agency MENA.

Fars had said that Morsi spoke to one of its reporters in Cairo on Sunday just before his election triumph was announced.

It provided an audio link to what it said was a recording of Morsi speaking Arabic in the interview (http://www.farsnews.com/newstext.php?nn=13910405000223).

"We will reconsider the Camp David Accord" that, in 1979, forged a peace between Egypt and Israel that has held for more than three decades, the audio file Fars attributed to Morsi says.

More…

Jim Sinclair’s Commentary

Yra Harris reminds us of Bernanke’s promise to Milton Friedman.

This is 1937 and Bernanke is fearing the ghost of Andrew Mellon and the French bankers–remember he promised Milton Friedman at his 90th birthday that deflation would not take place on his watch and the same mistakes repeated. –Yra Harris

Jim Sinclair’s Commentary

We have just heard that Cyprus needs a bail out.

It is my experience that any time you are doing business with Russians the money moves through Cyprus.

The two most dangerous people to lose money for are the Chinese and

Russians. If Nick Deak was still with us he would assure you of that.

Jim Sinclair’s Commentary

This crisis in a major fiat currency as a storehouse of value is not a situation that can last months.

It will be measured in history as weeks to go at most.

(Reuters) – Greece’s new finance minister resigned because of ill health on Monday, throwing the government’s drive to soften the terms of an international bailout into confusion days before a European summit.

Vassilis Rapanos, 64, chairman of the National Bank of Greece, was rushed to hospital on Friday, before he could be sworn in, complaining of abdominal pain, nausea and dizziness. Greek media said he had a history of ill-health.

The office of Prime Minister Antonis Samaras, who himself only took office last Wednesday following a June 17 election, said Rapanos had sent a letter of resignation because of his health problems and it had been accepted.

Samaras himself has only just emerged from hospital after undergoing eye surgery to repair a damaged retina. Both he and Rapanos had already said they would not be able to attend the June 28-29 European summit.

It was a worryingly chaotic start for the new government, formed after the second election in a month, which faces a rocky road in responding to huge domestic opposition to a harsh international bailout in the face of steadfast European opposition to any watering down of its terms.

More…

Jim Sinclair’s Commentary

The highest risk poker game is the game countries play with each other from prominence in a strategic area.

Russia may be preparing second attempt at Syrian arms shipment

Ship carrying air defence systems and helicopters that was forced to return to port has been refitted with Russian flag Miriam Elder in Moscow

guardian.co.uk, Monday 25 June 2012 14.22 BST

A Russian ship carrying attack helicopters that was prevented from sailing to Syria has been refitted with a Russian flag, rousing suspicions it is preparing for a second attempt.

The MV Alaed, carrying air defence systems and helicopters to Syria, was forced to return to port last week after its British insurers withdrew their coverage as the ship rounded the coast of Scotland. The Foreign Office and Treasury had warned the insurance company, Standard Club, that it could be in breach of sanctions against the regime of Bashar al-Assad if they allowed the ship to pass.

Sailing under the Curaçao flag, the ship returned on Sunday to the northern port of Murmansk, where it was "awaiting further instructions", the ship’s owner, Femco, said in a statement. It said it would not comment on "the nature of the cargo on board".

The vague statement stood in stark contrast to official attempts to justify the weapons delivery.

Last week Russia’s foreign minister, Sergei Lavrov, admitted that the Alaed was carrying supplies for Syria. "The ship was carrying air defence systems, which can be used only for repelling foreign aggression and not against peaceful demonstrators, and it was carrying three repaired helicopters," he told Ekho Mosvky radio.

More…

Jim,

According to a report from the Troika of international creditors the European Union, International Monetary Fund and the European Central Bank; and data given by outgoing finance minister George Zannias. Greece may have breached troika deal by hiring 70,000 staff.

Later, the EU Commission denies issuing such document.

QE for Greece will happen despite the fact that Greece has breached the troika deal or not as they have no other choice at this moment of time. Europe (and the market, and the US) is not ready for a Greek exit.

Best regards,

CIGA Christopher

EU Commission denies issuing document on Greek bulk hires 13:15 25 GIU 2012

(AGI) Brussels- The EU Commission denies issuing a document saying Greece had hired 70,000 public sector staff between 2010-2011. Such mass hiring would mean that the country breached the rules of its EU-IMF loan agreement, as was claimed by the Greek press. "I cannot confirm the figure of 70,000 public sector staff having been hired. We are members of the troika and that figure was not issued by the Commission", stated the spokesman for European Union Economic and Monetary Affairs Commissioner Olli Rehn, Amadeu Altafaj…

More…

Report claims Greece breached troika deal by hiring 70,000 staff Updated: 13:21, Monday, 25 June 2012

A report suggests that Greece breached the rules of its EU/IMF loan agreement by taking on some 70,000 public sector staff.

A report by Greece’s outgoing finance minister George Zannias showed that civil servant numbers had not dropped despite cuts

Greek newspaper To Vima said that the hirings in 2010 and 2011 were highest in local administration, health, the police and culture.

It cited a report from the Troika of international creditors the European Union, International Monetary Fund and the European Central Bank; and data given by outgoing finance minister George Zannias.

An unidentified troika official said that while they legislated rules to reduce the number of civil servants, they were bringing people in through the window.

The official added that over 12,000 people were hired by local councils even as a cost-cutting initiative merging municipalities was underway.

Mr Zannias’ report to the new government coalition after 17 June elections allegedly reveals that although over 53,000 civil servants retired in 2010.

It also said that the overall number of state staff was almost steady at 692,000 people.

More…

Dear Jim,

Regard the Day of the Deflationist:

Yeah, you can see the ass kissing in his commentary. I simply try not to read them much beyond the historical content now. And, I can do that on my own.

His argument that hyperinflation can’t happen in a reserve currency is correct, but this outcome assumes a predictable change in confidence of paper money and zero alternatives. Gold is both a commodity and private money. More so the later when confidence is shaken. Hyperinflation, though I don’t expect it in the US dollar, is possible because a flight to private money is still possible. I expect the transition to be managed, but history is full of the unexpected. I do expect accelerating inflation in the periphery economies first.

Eventually, money will focus on the elephant in the room. It’s kind of like Stalin’s no aggressive pact with Hilter. Everyone, even Stalin, knew Hitler would attack Russia. He still signed the pact to buy time.

CIGA Eric

Dear Jim,

"The BIS said that euro-zone banks’ balance sheets in general continued to show massive liquidity mismatches after losing many traditional sources of funding. The overall ratio of loans to deposits at euro-zone banks "rose to 130% during the crisis and has hardly fallen since," the BIS said, noting that the same ratio in other banking systems averages around 75%.

The most wrenching change since 2008 has arguably been a collapse in interbank lending in the euro zone, especially across national borders. The BIS noted that the volume of interbank lending in the euro zone had fallen from over $2.25 trillion in 2008, before the crisis, to less than $1 trillion by the end of 2011.

The BIS said banks were often their own worst enemy…"

Link to full article…

CIGA Christopher.

Dear Christopher,

There is only one way the Western world banking system can be truly

healed and that is to recognize its losses which is called "Asset Mark

to Market." Since there is no chance of doing that or returning the

market to a true determining mechanism for price, the crisis cannot be

contained. Yes, I know what could cure all this but why even think about

what does not have the chance of a snowball in hell of happening?

History will see that the collapse was set in cement by the capitulation

of FASB concerning the need for "Asset Mark to Market." There is not

one honest balance sheet in the financial industry where the institution

carries any OTC derivative on its balance sheet not marked to market.

This Mr. Historian is what differentiates Weimar and today, making today worse.

Regards,

Jim

Jim

By Greg hunter’s USAWatchdog.com

Dear CIGAs,

You

might remember Dr. Michael Burry as the hedge fund manager who made

hundreds of millions of dollars betting on the collapse of the housing

market. You, also, might remember everyone from the mainstream media

(MSM) to the Federal Reserve claimed nobody could have seen the 2008

financial collapse coming. How did Dr. Burry know a financial

catastrophe was on the way while most financial experts and media were

totally in the dark? This year’s commencement address at UCLA’s

Department of Economics was given by Dr. Burry, and he says, “The

ignorance is willful.” (Click here to see Dr. Burry’s June 20, 2012,UCLA address.)

You

might remember Dr. Michael Burry as the hedge fund manager who made

hundreds of millions of dollars betting on the collapse of the housing

market. You, also, might remember everyone from the mainstream media

(MSM) to the Federal Reserve claimed nobody could have seen the 2008

financial collapse coming. How did Dr. Burry know a financial

catastrophe was on the way while most financial experts and media were

totally in the dark? This year’s commencement address at UCLA’s

Department of Economics was given by Dr. Burry, and he says, “The

ignorance is willful.” (Click here to see Dr. Burry’s June 20, 2012,UCLA address.)

“The ignorance is willful.” I think you can say the same thing about the ongoing banking crisis. Last Thursday, credit rating giant Moody’s downgraded the long-term credit ratings of 15 of the biggest North American and European banks. All but four were cut at least two notches, and these are some of the biggest banks in the world. RBC, JP Morgan, BNP Paribas, RBS and UBS are household names in Canada, U.S., France, UK and Switzerland. (Japan’s Numara and Australia’s Macquarie were downgraded earlier by Moody’s.) (Click here for a complete list of downgraded banks from Business Insider.) I can’t find a time when a major credit ratings company like Moody’s has downgraded this many major banks in so many parts of the world at the same time. Sure, critics of Moody’s will say they are way behind the curve, but the fact is the company has come out with bold and devastating bank downgrades when the world is being told it is in “recovery.” Please keep in mind, dozens of Italian and Spanish banks were, also, downgraded in the last few months by Moody’s.

The MSM greeted this enormously negative bank news with a yawn. USA Today, which touts itself as “The Nations Newspaper,” covered the story, last Friday, in the newspaper with less than 75 words! What kind of reporting is this? Both Goldman Sachs and JP Morgan were downgraded two notches by Moody’s, and both own more than 15 million shares (combined) of Gannett stock, which is the parent company of the newspaper. I am sure that had nothing to do with the very light coverage and analysis of this story. Bloomberg did a story that underplayed Moody’s downgrades titled “Bank Investors Dismiss Moody’s Cuts as Years Too Late.” The story ended by saying, “The reductions by Moody’s are “a mea culpa from 2007 and 2008,” said James Leonard, a credit analyst in Chicago at Morningstar Inc. (MORN) “The banks have gotten so much better in the last few years in terms of capital, yet their ratings keep going down. What does that tell you? That the ratings were so wrong before.” (Click here for the complete story.) As for the rest of the MSM, not a peep about this on any of the Sunday talk shows. It appears to me it is being played as no big deal.

This is the same treatment the financial press gives to what I call “government sanctioned accounting fraud” that the banks use to value underwater assets on their books such as real estate and mortgage-backed securities. The Financial Accounting Standards Board (FASB) changed the rules in 2009, and the banks can value these assets at whatever they think they will be worth at some fictional date in the future. Instead of “mark to market” accounting where assets are valued at what they will sell for today (this is how the IRS does it), you have “mark to fantasy” accounting where you value the assets at what you hope to get for them in the future. This is an insolvency problem so big that FASB had to change the accounting rules to make people think some banks are still solvent.

The same kind of accounting rule changes have taken place in Europe, where banks can “mark to fantasy” sovereign debt. It is not only the countries going broke, but the banks that hold sour debt that are insolvent. It appears things there are a bit more desperate and dire because, last week, The Guardian UK reported, “Mario Monti: we have a week to save the Eurozone . . . Italy’s prime minister . . . has warned of the apocalyptic consequences of failure at next week’s summit of EU leaders, outlining a potential death spiral that could threaten the political and economic future of Europe.” (Click here for the complete story.) What kind of financial management is this where you are down to a single week to fill an enormous financial black hole? Mr. Monti is an unelected banker, and I am sure his main concern is the survival of key European banks and not the well-being of the people. This is all about preserving the status quo and the power of the banks.

More…

Dear CIGAs,

You

might remember Dr. Michael Burry as the hedge fund manager who made

hundreds of millions of dollars betting on the collapse of the housing

market. You, also, might remember everyone from the mainstream media

(MSM) to the Federal Reserve claimed nobody could have seen the 2008

financial collapse coming. How did Dr. Burry know a financial

catastrophe was on the way while most financial experts and media were

totally in the dark? This year’s commencement address at UCLA’s

Department of Economics was given by Dr. Burry, and he says, “The

ignorance is willful.” (Click here to see Dr. Burry’s June 20, 2012,UCLA address.)

You

might remember Dr. Michael Burry as the hedge fund manager who made

hundreds of millions of dollars betting on the collapse of the housing

market. You, also, might remember everyone from the mainstream media

(MSM) to the Federal Reserve claimed nobody could have seen the 2008

financial collapse coming. How did Dr. Burry know a financial

catastrophe was on the way while most financial experts and media were

totally in the dark? This year’s commencement address at UCLA’s

Department of Economics was given by Dr. Burry, and he says, “The

ignorance is willful.” (Click here to see Dr. Burry’s June 20, 2012,UCLA address.) “The ignorance is willful.” I think you can say the same thing about the ongoing banking crisis. Last Thursday, credit rating giant Moody’s downgraded the long-term credit ratings of 15 of the biggest North American and European banks. All but four were cut at least two notches, and these are some of the biggest banks in the world. RBC, JP Morgan, BNP Paribas, RBS and UBS are household names in Canada, U.S., France, UK and Switzerland. (Japan’s Numara and Australia’s Macquarie were downgraded earlier by Moody’s.) (Click here for a complete list of downgraded banks from Business Insider.) I can’t find a time when a major credit ratings company like Moody’s has downgraded this many major banks in so many parts of the world at the same time. Sure, critics of Moody’s will say they are way behind the curve, but the fact is the company has come out with bold and devastating bank downgrades when the world is being told it is in “recovery.” Please keep in mind, dozens of Italian and Spanish banks were, also, downgraded in the last few months by Moody’s.

The MSM greeted this enormously negative bank news with a yawn. USA Today, which touts itself as “The Nations Newspaper,” covered the story, last Friday, in the newspaper with less than 75 words! What kind of reporting is this? Both Goldman Sachs and JP Morgan were downgraded two notches by Moody’s, and both own more than 15 million shares (combined) of Gannett stock, which is the parent company of the newspaper. I am sure that had nothing to do with the very light coverage and analysis of this story. Bloomberg did a story that underplayed Moody’s downgrades titled “Bank Investors Dismiss Moody’s Cuts as Years Too Late.” The story ended by saying, “The reductions by Moody’s are “a mea culpa from 2007 and 2008,” said James Leonard, a credit analyst in Chicago at Morningstar Inc. (MORN) “The banks have gotten so much better in the last few years in terms of capital, yet their ratings keep going down. What does that tell you? That the ratings were so wrong before.” (Click here for the complete story.) As for the rest of the MSM, not a peep about this on any of the Sunday talk shows. It appears to me it is being played as no big deal.

This is the same treatment the financial press gives to what I call “government sanctioned accounting fraud” that the banks use to value underwater assets on their books such as real estate and mortgage-backed securities. The Financial Accounting Standards Board (FASB) changed the rules in 2009, and the banks can value these assets at whatever they think they will be worth at some fictional date in the future. Instead of “mark to market” accounting where assets are valued at what they will sell for today (this is how the IRS does it), you have “mark to fantasy” accounting where you value the assets at what you hope to get for them in the future. This is an insolvency problem so big that FASB had to change the accounting rules to make people think some banks are still solvent.

The same kind of accounting rule changes have taken place in Europe, where banks can “mark to fantasy” sovereign debt. It is not only the countries going broke, but the banks that hold sour debt that are insolvent. It appears things there are a bit more desperate and dire because, last week, The Guardian UK reported, “Mario Monti: we have a week to save the Eurozone . . . Italy’s prime minister . . . has warned of the apocalyptic consequences of failure at next week’s summit of EU leaders, outlining a potential death spiral that could threaten the political and economic future of Europe.” (Click here for the complete story.) What kind of financial management is this where you are down to a single week to fill an enormous financial black hole? Mr. Monti is an unelected banker, and I am sure his main concern is the survival of key European banks and not the well-being of the people. This is all about preserving the status quo and the power of the banks.

More…

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment