from Silver Doctors:

LEAP/2020′s red alert states the Western banking system’s trumpet blast will occur in September or October.

The seven blasts of the trumpets of Jericho marking the September October 2012 period will cause the “Dollar Wall’s” last sections and the walls which have protected the world as we know it since 1945 to collapse.

The shock of the autumn 2008 will seem like a small summer storm compared to what will affect planet in several months.

Read More @ SilverDoctors.com

European Bloodbath As Merkel Won't Go Dutch

Equity, credit, and sovereigns all ugly. Merkel's

unequivocal comment on her nation's unwillingness to 'share' burdens

and slap the proverbial cheek of Monsieur Hollande, Italy's banking

union looking for more 'aid', Spain actually asking for their bailout,

Greece 'avoiding' reality, and Cyprus pulling the 'China rescue plan'

last ditch retort to market angst; but apart from that, things are dismal in Europe. Italy down over 4% and Spain almost as bad

on the day as every major equity index is well into the red. Italian

banks monkey-hammered down 6/7.5% and halted a number of times.

Investment grade credit outperformed (though was notably wider) as financials (subs and seniors), XOver, and stocks are plummeted to 11-day lows.

After breaking below the pre-Spanish bailout levels on Friday, Spain

and Italy 10Y are now 20-40bps wider with Italy and Spain 5Y CDS notably

wider and well over 500bps. Notably the short-end of the Italian and Spanish curves underperformed significantly (curves flattened):

2Y BTPs +57bps vs 10Y +21bps; 2Y SPG +37bps vs 10Y +17bps. Europe's VIX

snapped back above 27% (and we note that our EU-US Vol compression

trade is moving well in our favor). EURUSD has been smacked lower by

over 80pips ending under 1.25 once again.

Equity, credit, and sovereigns all ugly. Merkel's

unequivocal comment on her nation's unwillingness to 'share' burdens

and slap the proverbial cheek of Monsieur Hollande, Italy's banking

union looking for more 'aid', Spain actually asking for their bailout,

Greece 'avoiding' reality, and Cyprus pulling the 'China rescue plan'

last ditch retort to market angst; but apart from that, things are dismal in Europe. Italy down over 4% and Spain almost as bad

on the day as every major equity index is well into the red. Italian

banks monkey-hammered down 6/7.5% and halted a number of times.

Investment grade credit outperformed (though was notably wider) as financials (subs and seniors), XOver, and stocks are plummeted to 11-day lows.

After breaking below the pre-Spanish bailout levels on Friday, Spain

and Italy 10Y are now 20-40bps wider with Italy and Spain 5Y CDS notably

wider and well over 500bps. Notably the short-end of the Italian and Spanish curves underperformed significantly (curves flattened):

2Y BTPs +57bps vs 10Y +21bps; 2Y SPG +37bps vs 10Y +17bps. Europe's VIX

snapped back above 27% (and we note that our EU-US Vol compression

trade is moving well in our favor). EURUSD has been smacked lower by

over 80pips ending under 1.25 once again.

Equity, credit, and sovereigns all ugly. Merkel's

unequivocal comment on her nation's unwillingness to 'share' burdens

and slap the proverbial cheek of Monsieur Hollande, Italy's banking

union looking for more 'aid', Spain actually asking for their bailout,

Greece 'avoiding' reality, and Cyprus pulling the 'China rescue plan'

last ditch retort to market angst; but apart from that, things are dismal in Europe. Italy down over 4% and Spain almost as bad

on the day as every major equity index is well into the red. Italian

banks monkey-hammered down 6/7.5% and halted a number of times.

Investment grade credit outperformed (though was notably wider) as financials (subs and seniors), XOver, and stocks are plummeted to 11-day lows.

After breaking below the pre-Spanish bailout levels on Friday, Spain

and Italy 10Y are now 20-40bps wider with Italy and Spain 5Y CDS notably

wider and well over 500bps. Notably the short-end of the Italian and Spanish curves underperformed significantly (curves flattened):

2Y BTPs +57bps vs 10Y +21bps; 2Y SPG +37bps vs 10Y +17bps. Europe's VIX

snapped back above 27% (and we note that our EU-US Vol compression

trade is moving well in our favor). EURUSD has been smacked lower by

over 80pips ending under 1.25 once again.

Equity, credit, and sovereigns all ugly. Merkel's

unequivocal comment on her nation's unwillingness to 'share' burdens

and slap the proverbial cheek of Monsieur Hollande, Italy's banking

union looking for more 'aid', Spain actually asking for their bailout,

Greece 'avoiding' reality, and Cyprus pulling the 'China rescue plan'

last ditch retort to market angst; but apart from that, things are dismal in Europe. Italy down over 4% and Spain almost as bad

on the day as every major equity index is well into the red. Italian

banks monkey-hammered down 6/7.5% and halted a number of times.

Investment grade credit outperformed (though was notably wider) as financials (subs and seniors), XOver, and stocks are plummeted to 11-day lows.

After breaking below the pre-Spanish bailout levels on Friday, Spain

and Italy 10Y are now 20-40bps wider with Italy and Spain 5Y CDS notably

wider and well over 500bps. Notably the short-end of the Italian and Spanish curves underperformed significantly (curves flattened):

2Y BTPs +57bps vs 10Y +21bps; 2Y SPG +37bps vs 10Y +17bps. Europe's VIX

snapped back above 27% (and we note that our EU-US Vol compression

trade is moving well in our favor). EURUSD has been smacked lower by

over 80pips ending under 1.25 once again.The Two Scariest Charts In Europe (Got Scarier)

It

seems, as JPMorgan's CIO Michael Cembalest notes, that ahead of yet

another EU Summit; everyone understands now why Europe matters (even the

once-bloviating decoupling diehards). The summit is likely to focus on

bank recapitalization, easier repayment timetables for Greece, bank

deposit guarantees and an alleged “roadmap” for EU integration. The

challenge, Cembalest confirms, is that Germany cannot afford a blank check given debt levels already over 80% of GDP. However, if policymakers don’t do something about growth in the Periphery (bailouts primarily designed to aid German and French banks don’t count),

the North-South divide will continue to widen, putting pressure on the

ECB and EU taxpayers. Sometimes there are no easy answers. Italy,

Spain, Greece and Portugal are contracting at a 2%-5% annualized pace,

and unemployment in Spain and Greece is sky-rocketing (1st chart). These levels are notable from an historical perspective. As shown in the 2nd chart, 20%+

unemployment was the level at which National Socialists in Germany

began to take seats away from liberal democratic parties during the

1930’s. If the jobs picture does not improve, other EU policy decisions may not matter much (as we noted six months ago)!

It

seems, as JPMorgan's CIO Michael Cembalest notes, that ahead of yet

another EU Summit; everyone understands now why Europe matters (even the

once-bloviating decoupling diehards). The summit is likely to focus on

bank recapitalization, easier repayment timetables for Greece, bank

deposit guarantees and an alleged “roadmap” for EU integration. The

challenge, Cembalest confirms, is that Germany cannot afford a blank check given debt levels already over 80% of GDP. However, if policymakers don’t do something about growth in the Periphery (bailouts primarily designed to aid German and French banks don’t count),

the North-South divide will continue to widen, putting pressure on the

ECB and EU taxpayers. Sometimes there are no easy answers. Italy,

Spain, Greece and Portugal are contracting at a 2%-5% annualized pace,

and unemployment in Spain and Greece is sky-rocketing (1st chart). These levels are notable from an historical perspective. As shown in the 2nd chart, 20%+

unemployment was the level at which National Socialists in Germany

began to take seats away from liberal democratic parties during the

1930’s. If the jobs picture does not improve, other EU policy decisions may not matter much (as we noted six months ago)!Turkey Claims Syria Fired On Second Turkish Jet, Says "Act Won't Go Unpunished", Has Invoked NATO Articles 4 And 5

At this point even those who have never heard of the Gulf of Tonkin know where this is headed:- SYRIAN ACT 'WON'T GO UNPUNISHED,' TURKEY'S ARINC SAYS

- SYRIAN ACT 'HOSTILE,' 'COLD-BLOODED,' ARINC SAYS

- SYRIA SHOT DOWN TURKISH JET WITHOUT WARNING, NULAND SAYS

- TURKEY INVOKED ARTICLES 4 & 5 FOR NATO MEETING, ARINC SAYS

- TURKEY TO PROCEED AGAINST SYRIA USING LEGAL RIGHTS, ARINC SAYS

- TURKISH JET SHOT DOWN IN INTERNATIONAL AIRSPACE, ARINC SAYS

- TURKISH JET 'MISTAKENLY' ENTERED SYRIAN AIRSPACE, ARINC SAYS

- TURKISH JET WAS IN SYRIAN AIRSPACE ONLY 5 MINUTES, ARINC SAYS

Greek Finance Minister Resigns Just Days After Appointment; Cyprus Officially Requests Bailout

This has to be a record:

GREEK FINANCE MINISTER RAPANOS RESIGNS; PRIME MINISTER ACCEPTS

This is the same guy who was appointed last week, and who fainted after seeking the official Greek numbers. In fact we are not sure he ever got an official appointment. And elsewhere:

CYPRUS REQUESTS EU AID

CYPRUS SEEKS EXTERNAL FINANCIAL ASSISTANCE FROM EURO AREA: China just said NEIN

Prepare the bath salt firehose.

Your ad here, on a fire truck? Broke cities sell naming rights

Eric De Groot at Eric De Groot - 1 hour ago

Expect the unexpected as the sovereign debt crisis claims more victims not

ready for the social, political, and economic changes coming. Headline:

Your ad here, on a fire truck? Broke cities sell naming rights By MICHAEL

COOPER updated 6/25/2012 3:57:47 AM ET BALTIMORE — Should this city’s red

fire trucks be transformed into rolling billboards? After Baltimore

officials made the...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

NAV Premiums of Certain Precious Metal Trusts and Funds - Silver Undervalued

Safety Flows Redirect From Facebook To Precious Metals As Europe Implodes

With

Facebook down over 3.5%, it appears the only real safe haven from

Europe's catastrophe headline-fest is the precious metals complex. Gold

and Silver are surgiung as Europe closes.

With

Facebook down over 3.5%, it appears the only real safe haven from

Europe's catastrophe headline-fest is the precious metals complex. Gold

and Silver are surgiung as Europe closes.

from John Galt FLA:

To give one a perspective on the background of Bashar al-Assad and the

mentality of the Alawi minority ruling Syria via their monopoly of the

Ba’ath party in that nation, I provide this historical perspective from

an article by Daniel Pipes titled The Alawi Capture of Power in Syria, published in 1989 via danielpipes.org:

To give one a perspective on the background of Bashar al-Assad and the

mentality of the Alawi minority ruling Syria via their monopoly of the

Ba’ath party in that nation, I provide this historical perspective from

an article by Daniel Pipes titled The Alawi Capture of Power in Syria, published in 1989 via danielpipes.org:“‘Alawi” is the term that ‘Alawis (also called ‘Alawites) usually apply to themselves ; but until 1920 they were known to the outside world as Nusayris or Ansaris. The change in name – imposed by the French upon their seizure of control in Syria – has significance. Whereas “Nusayri” emphasizes the group’s differences from Islam, “‘Alawi” suggests an adherent of ‘Ali (the son-in-law of the Prophet Muhammad) and accentuates the religion’s similarities to Shi’i Islam. Consequently, opponents of the Asad regime habitually use the former term, supporters of the regime use the latter.

Why is the imposition of this new term important? During the French mandate period after World War I, the French administration imposed the term in 1920 to identify this group and remove their prior identity for political purposes and to further isolate this minority from the center of national power in the cities of Hama, Homs, and Damascus; names which are currently reported in the mainstream media on a daily basis.

Read More @ John Galt FLA

from Liberty CPM:

Last week, the attack on the precious metals prices which took place

after a FOMC meeting, in which the Federal Reserve announced an

extension of Operation Twist, brought out enthusiastic buying pubic.

Adding to the demand, today the precious metals are dipping in the

Rupee, which means the precious metals will be visited by increased

demand in India and the United States early this week, before European

leaders meet later in the week over the EU crisis. Prices should then

remain stable early in this week, but anything goes as contagion grips

world markets.

Last week, the attack on the precious metals prices which took place

after a FOMC meeting, in which the Federal Reserve announced an

extension of Operation Twist, brought out enthusiastic buying pubic.

Adding to the demand, today the precious metals are dipping in the

Rupee, which means the precious metals will be visited by increased

demand in India and the United States early this week, before European

leaders meet later in the week over the EU crisis. Prices should then

remain stable early in this week, but anything goes as contagion grips

world markets.Early Monday, amid concerns regarding Europe and the stability of the Wall Street financial sector, all major indices declined. Particularly hit by the sell off were JP Morgan and Bank of America, whilst Wall Street was the only stock on the index. In Europe, markets also fell, as London, Frankfurt and Paris were all down between 1% and 2%. The Euro was down about half-a-percent against the dollar.

In other news, the BRIC nations are experiencing their worst currency devaluation since 1998. For the first time in thirteen years, the rube and rupee are falling the most among developing-nation currencies. The yuan has depreciated more than in any period since 1994.

Read More @ LibertyCPM.com

by The Daily Bell:

The EU‘s

‘beneficial crisis’ has spun out of control … ‘Europe’ expected to be

united through emergencies, but this one will tear it apart … As long

ago as 1957, Jean Monnet – who was the real organising genius behind the

gradual building of “Europe” into a single, unified state – suggested

that it was only through monetary and economic union that the “political

union which is the goal” could be achieved. “There are no premature

ideas,” he wrote, “only opportunities for which we must learn to wait.”

By 1970, Monnet’s ideas were being fleshed out by the Werner report,

which saw monetary union as the key step

towards political union. But in 1978, another report for the European

Commission, by Sir Donald McDougall, warned that it would be reckless to

create a single currency unless Europe was first given an all-powerful

government, with the power to tax, and to make a massive transfer of

resources from the richer states to the poorer. In the 1980s, though,

that other great integrator Jacques Delors (second only to Monnet in his

influence on the drive to European political union) decided to ignore

the advice of McDougall and others and to launch the single currency

without the suggested preconditions. To move straight to fiscal union,

he knew, was not on the cards. But if the single currency was put in

place first, it would create exactly the kind of strains which had been

foreseen – making fiscal union the only way out. – UK Telegraph

The EU‘s

‘beneficial crisis’ has spun out of control … ‘Europe’ expected to be

united through emergencies, but this one will tear it apart … As long

ago as 1957, Jean Monnet – who was the real organising genius behind the

gradual building of “Europe” into a single, unified state – suggested

that it was only through monetary and economic union that the “political

union which is the goal” could be achieved. “There are no premature

ideas,” he wrote, “only opportunities for which we must learn to wait.”

By 1970, Monnet’s ideas were being fleshed out by the Werner report,

which saw monetary union as the key step

towards political union. But in 1978, another report for the European

Commission, by Sir Donald McDougall, warned that it would be reckless to

create a single currency unless Europe was first given an all-powerful

government, with the power to tax, and to make a massive transfer of

resources from the richer states to the poorer. In the 1980s, though,

that other great integrator Jacques Delors (second only to Monnet in his

influence on the drive to European political union) decided to ignore

the advice of McDougall and others and to launch the single currency

without the suggested preconditions. To move straight to fiscal union,

he knew, was not on the cards. But if the single currency was put in

place first, it would create exactly the kind of strains which had been

foreseen – making fiscal union the only way out. – UK Telegraph

Dominant Social Theme: Ends justifying means …

Free-Market Analysis: All the dirty laundry is being aired now. This UK Telegraph article explains it succinctly in the above excerpt. As we’ve pointed out in the past, the EU exercise, especially the euro, was an exercise in cynicism. The idea was to implement a currency union, which would then collapse and usher in a full-fledged political union. First an economic calamity and then a political salvation.

Read More @ TheDailyBell.com

The EU‘s

‘beneficial crisis’ has spun out of control … ‘Europe’ expected to be

united through emergencies, but this one will tear it apart … As long

ago as 1957, Jean Monnet – who was the real organising genius behind the

gradual building of “Europe” into a single, unified state – suggested

that it was only through monetary and economic union that the “political

union which is the goal” could be achieved. “There are no premature

ideas,” he wrote, “only opportunities for which we must learn to wait.”

By 1970, Monnet’s ideas were being fleshed out by the Werner report,

which saw monetary union as the key step

towards political union. But in 1978, another report for the European

Commission, by Sir Donald McDougall, warned that it would be reckless to

create a single currency unless Europe was first given an all-powerful

government, with the power to tax, and to make a massive transfer of

resources from the richer states to the poorer. In the 1980s, though,

that other great integrator Jacques Delors (second only to Monnet in his

influence on the drive to European political union) decided to ignore

the advice of McDougall and others and to launch the single currency

without the suggested preconditions. To move straight to fiscal union,

he knew, was not on the cards. But if the single currency was put in

place first, it would create exactly the kind of strains which had been

foreseen – making fiscal union the only way out. – UK Telegraph

The EU‘s

‘beneficial crisis’ has spun out of control … ‘Europe’ expected to be

united through emergencies, but this one will tear it apart … As long

ago as 1957, Jean Monnet – who was the real organising genius behind the

gradual building of “Europe” into a single, unified state – suggested

that it was only through monetary and economic union that the “political

union which is the goal” could be achieved. “There are no premature

ideas,” he wrote, “only opportunities for which we must learn to wait.”

By 1970, Monnet’s ideas were being fleshed out by the Werner report,

which saw monetary union as the key step

towards political union. But in 1978, another report for the European

Commission, by Sir Donald McDougall, warned that it would be reckless to

create a single currency unless Europe was first given an all-powerful

government, with the power to tax, and to make a massive transfer of

resources from the richer states to the poorer. In the 1980s, though,

that other great integrator Jacques Delors (second only to Monnet in his

influence on the drive to European political union) decided to ignore

the advice of McDougall and others and to launch the single currency

without the suggested preconditions. To move straight to fiscal union,

he knew, was not on the cards. But if the single currency was put in

place first, it would create exactly the kind of strains which had been

foreseen – making fiscal union the only way out. – UK TelegraphDominant Social Theme: Ends justifying means …

Free-Market Analysis: All the dirty laundry is being aired now. This UK Telegraph article explains it succinctly in the above excerpt. As we’ve pointed out in the past, the EU exercise, especially the euro, was an exercise in cynicism. The idea was to implement a currency union, which would then collapse and usher in a full-fledged political union. First an economic calamity and then a political salvation.

Read More @ TheDailyBell.com

from JPMHater001:

How will the dollar die? Slowly at first. Then all at once.

…The slow phase is coming to an end.

How will the dollar die? Slowly at first. Then all at once.

…The slow phase is coming to an end.

by Jonathan Benson, Natural News:

A special needs school in Canton, Massachusetts, known as The Judge

Rotenberg Center (JRC) is once again in the news, this time for its use

of a controversial form of therapy that is no longer officially approved

by the U.S. Food and Drug Administration (FDA). According to a recent

report by CNN’s Anderson Cooper, the FDA has essentially refused to even

address JRC’s continued use of electroshock therapy, despite the fact

that the agency announced an investigation into the matter roughly two

years ago.

A special needs school in Canton, Massachusetts, known as The Judge

Rotenberg Center (JRC) is once again in the news, this time for its use

of a controversial form of therapy that is no longer officially approved

by the U.S. Food and Drug Administration (FDA). According to a recent

report by CNN’s Anderson Cooper, the FDA has essentially refused to even

address JRC’s continued use of electroshock therapy, despite the fact

that the agency announced an investigation into the matter roughly two

years ago.

As we reported last year, JRC has a 20-year legacy of using electroshock therapy on its students, a process that involves attaching electrodes to students’ arms, legs and torsos, and delivering “moderately painful” jolts of electrocution when students get out of line.

Read More @ NaturalNews.com

A special needs school in Canton, Massachusetts, known as The Judge

Rotenberg Center (JRC) is once again in the news, this time for its use

of a controversial form of therapy that is no longer officially approved

by the U.S. Food and Drug Administration (FDA). According to a recent

report by CNN’s Anderson Cooper, the FDA has essentially refused to even

address JRC’s continued use of electroshock therapy, despite the fact

that the agency announced an investigation into the matter roughly two

years ago.

A special needs school in Canton, Massachusetts, known as The Judge

Rotenberg Center (JRC) is once again in the news, this time for its use

of a controversial form of therapy that is no longer officially approved

by the U.S. Food and Drug Administration (FDA). According to a recent

report by CNN’s Anderson Cooper, the FDA has essentially refused to even

address JRC’s continued use of electroshock therapy, despite the fact

that the agency announced an investigation into the matter roughly two

years ago.As we reported last year, JRC has a 20-year legacy of using electroshock therapy on its students, a process that involves attaching electrodes to students’ arms, legs and torsos, and delivering “moderately painful” jolts of electrocution when students get out of line.

Read More @ NaturalNews.com

By : Raul I. Meijer, The Market Oracle:

Over the past few days, Henry Blodget at Business Insider posted a number of graphs, here and here,

which depict something about the US economy that everybody knows to

some extent or another, but that most of us won’t have let thoroughly

sink in. For some because the consequences are too opaque, for others

because they are too scary. But make no mistake: we can only continue to

ignore or misinterpret them at our own peril. And even then it’s

terribly late in the game.

Over the past few days, Henry Blodget at Business Insider posted a number of graphs, here and here,

which depict something about the US economy that everybody knows to

some extent or another, but that most of us won’t have let thoroughly

sink in. For some because the consequences are too opaque, for others

because they are too scary. But make no mistake: we can only continue to

ignore or misinterpret them at our own peril. And even then it’s

terribly late in the game.

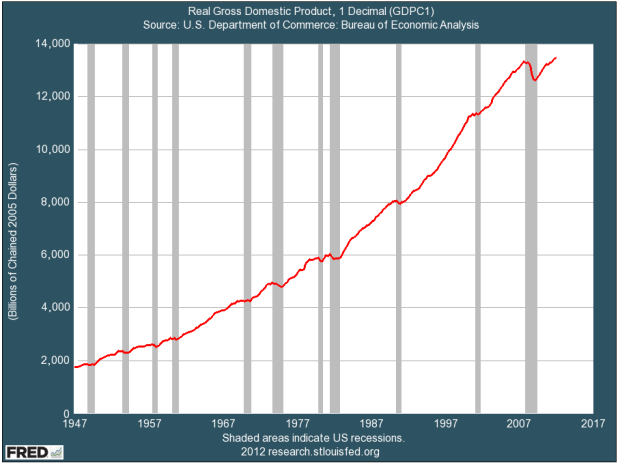

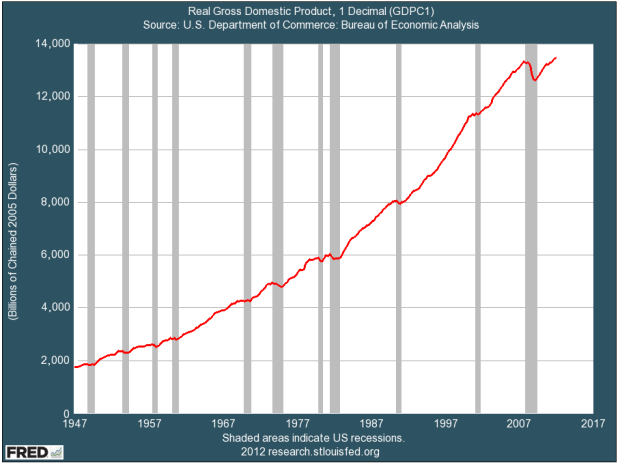

The essence of Blodget’s argument is this:

“… over the past 30 years, we’ve generated about $1 of economic growth for every $3 we’ve borrowed.”

So while real (inflation-adjusted) GDP growth looks sort of strong over the past 6 decades:

Read More @ TheMarketOracle.co.uk

Over the past few days, Henry Blodget at Business Insider posted a number of graphs, here and here,

which depict something about the US economy that everybody knows to

some extent or another, but that most of us won’t have let thoroughly

sink in. For some because the consequences are too opaque, for others

because they are too scary. But make no mistake: we can only continue to

ignore or misinterpret them at our own peril. And even then it’s

terribly late in the game.

Over the past few days, Henry Blodget at Business Insider posted a number of graphs, here and here,

which depict something about the US economy that everybody knows to

some extent or another, but that most of us won’t have let thoroughly

sink in. For some because the consequences are too opaque, for others

because they are too scary. But make no mistake: we can only continue to

ignore or misinterpret them at our own peril. And even then it’s

terribly late in the game.The essence of Blodget’s argument is this:

“… over the past 30 years, we’ve generated about $1 of economic growth for every $3 we’ve borrowed.”

So while real (inflation-adjusted) GDP growth looks sort of strong over the past 6 decades:

Read More @ TheMarketOracle.co.uk

by Rick Ackerman, Rick Ackerman.com:

Crude oil prices appear primed for a nearly 30% collapse, implying

that the global economic slowdown is starting to take hold. Our minimum

downside projection for August Crude, currently trading for around $80 a

barrel, is $55.69. That target was derived using our proprietary method of technical analysis

and would imply a decline of 27% from current levels. Please note that

this is our minimum bear-market price objective and that crude’s

ultimate bottom could be significantly lower. How much lower? If the

“Hidden Pivot support” at $55.70 were to give way easily, we’d infer

that quotes as low as $35-$40 a barrel impend.

Crude oil prices appear primed for a nearly 30% collapse, implying

that the global economic slowdown is starting to take hold. Our minimum

downside projection for August Crude, currently trading for around $80 a

barrel, is $55.69. That target was derived using our proprietary method of technical analysis

and would imply a decline of 27% from current levels. Please note that

this is our minimum bear-market price objective and that crude’s

ultimate bottom could be significantly lower. How much lower? If the

“Hidden Pivot support” at $55.70 were to give way easily, we’d infer

that quotes as low as $35-$40 a barrel impend.

That might be viewed as great news by the mainstream media, since it suggests that gasoline prices are headed below $2 a gallon. But that’s like saying a nuclear detonation in midtown Manhattan would be great news for apartment dwellers because it would solve everyone’s cockroach problem. CNBC’s “experts” seem to think that a mere softening of crude prices would act as a kind of tax-cut stimulus for the U.S. economy. But softening is not what we foresee — more like a deflationary bust in a key global commodity to which huge swaths of financial assets are tied. And although we’ll concede that more travelers will hit the roads this summer if gasoline prices fall below $3, the gain in tourism dollars would not be much of an offset to the global economic collapse that appears to be gathering force.

Read More @ RickAckerman.com

Crude oil prices appear primed for a nearly 30% collapse, implying

that the global economic slowdown is starting to take hold. Our minimum

downside projection for August Crude, currently trading for around $80 a

barrel, is $55.69. That target was derived using our proprietary method of technical analysis

and would imply a decline of 27% from current levels. Please note that

this is our minimum bear-market price objective and that crude’s

ultimate bottom could be significantly lower. How much lower? If the

“Hidden Pivot support” at $55.70 were to give way easily, we’d infer

that quotes as low as $35-$40 a barrel impend.

Crude oil prices appear primed for a nearly 30% collapse, implying

that the global economic slowdown is starting to take hold. Our minimum

downside projection for August Crude, currently trading for around $80 a

barrel, is $55.69. That target was derived using our proprietary method of technical analysis

and would imply a decline of 27% from current levels. Please note that

this is our minimum bear-market price objective and that crude’s

ultimate bottom could be significantly lower. How much lower? If the

“Hidden Pivot support” at $55.70 were to give way easily, we’d infer

that quotes as low as $35-$40 a barrel impend. That might be viewed as great news by the mainstream media, since it suggests that gasoline prices are headed below $2 a gallon. But that’s like saying a nuclear detonation in midtown Manhattan would be great news for apartment dwellers because it would solve everyone’s cockroach problem. CNBC’s “experts” seem to think that a mere softening of crude prices would act as a kind of tax-cut stimulus for the U.S. economy. But softening is not what we foresee — more like a deflationary bust in a key global commodity to which huge swaths of financial assets are tied. And although we’ll concede that more travelers will hit the roads this summer if gasoline prices fall below $3, the gain in tourism dollars would not be much of an offset to the global economic collapse that appears to be gathering force.

Read More @ RickAckerman.com

from GoldCore:

Our Market Update on Friday led to queries regarding the nature of “paper gold”.

Our Market Update on Friday led to queries regarding the nature of “paper gold”.

The important difference between actual physical gold and paper gold is something we have addressed frequently since 2003.

Some of our readers sought clarification as to whether Perth Mint Certificates are paper gold.

By paper gold, we do not mean Perth Mint Certificates. Perth Mint Certificates are fully backed by physical gold, silver, and platinum bullion.

Read More @ GoldCore.com

Our Market Update on Friday led to queries regarding the nature of “paper gold”.

Our Market Update on Friday led to queries regarding the nature of “paper gold”. The important difference between actual physical gold and paper gold is something we have addressed frequently since 2003.

Some of our readers sought clarification as to whether Perth Mint Certificates are paper gold.

By paper gold, we do not mean Perth Mint Certificates. Perth Mint Certificates are fully backed by physical gold, silver, and platinum bullion.

Read More @ GoldCore.com

by James Corbett, The International Forecaster:

Last week in these pages we forecasted: that a pro-bailout party would

win the Greek election; that the socialists would take a majority in

the French elections; that Spain would require a significantly larger

bailout to prop its banking sector up; and that the Fed would likely

extend Operation Twist as a way of keeping everything moving along

sideways. Check, check, check, and check. In most areas of life, 4 for 4

is something to be happy about, but when forecasting during the death

throes of the global economic system as we’ve known it, getting things

right is hardly cause for celebration.

Last week in these pages we forecasted: that a pro-bailout party would

win the Greek election; that the socialists would take a majority in

the French elections; that Spain would require a significantly larger

bailout to prop its banking sector up; and that the Fed would likely

extend Operation Twist as a way of keeping everything moving along

sideways. Check, check, check, and check. In most areas of life, 4 for 4

is something to be happy about, but when forecasting during the death

throes of the global economic system as we’ve known it, getting things

right is hardly cause for celebration.

Here’s a prediction I’d like to see come true: the American public, finally realizing the extent of the depravity on Wall Street, will start to examine what really happened in the past five years. Following the trail of trillions in bailouts and stimulus funny money to the same groups of banksters and treasurers who created the housing crisis in the first place, the public will see through to completion the criminal investigations and prosecutions of the criminals behind the subprime loan fiasco, the too-big-to-failouts, the mortgagegate scandal, the quadrillion dollar derivative black hole, and all the other frauds that have been pulled on the people of the US and the world in general over the past five years. After which, the path will be clear to the discovery of the deeper truth behind the economic charade: the rigging of the markets via the President’s Working Group on Financial Matters; the control of both political parties by the same banking factions; the funny money dollar propped up by nothing more than the promise of the labor (and taxes) of future generations. One can always dream…

Read More @ TheInternationalForecaster.com

Last week in these pages we forecasted: that a pro-bailout party would

win the Greek election; that the socialists would take a majority in

the French elections; that Spain would require a significantly larger

bailout to prop its banking sector up; and that the Fed would likely

extend Operation Twist as a way of keeping everything moving along

sideways. Check, check, check, and check. In most areas of life, 4 for 4

is something to be happy about, but when forecasting during the death

throes of the global economic system as we’ve known it, getting things

right is hardly cause for celebration.

Last week in these pages we forecasted: that a pro-bailout party would

win the Greek election; that the socialists would take a majority in

the French elections; that Spain would require a significantly larger

bailout to prop its banking sector up; and that the Fed would likely

extend Operation Twist as a way of keeping everything moving along

sideways. Check, check, check, and check. In most areas of life, 4 for 4

is something to be happy about, but when forecasting during the death

throes of the global economic system as we’ve known it, getting things

right is hardly cause for celebration.Here’s a prediction I’d like to see come true: the American public, finally realizing the extent of the depravity on Wall Street, will start to examine what really happened in the past five years. Following the trail of trillions in bailouts and stimulus funny money to the same groups of banksters and treasurers who created the housing crisis in the first place, the public will see through to completion the criminal investigations and prosecutions of the criminals behind the subprime loan fiasco, the too-big-to-failouts, the mortgagegate scandal, the quadrillion dollar derivative black hole, and all the other frauds that have been pulled on the people of the US and the world in general over the past five years. After which, the path will be clear to the discovery of the deeper truth behind the economic charade: the rigging of the markets via the President’s Working Group on Financial Matters; the control of both political parties by the same banking factions; the funny money dollar propped up by nothing more than the promise of the labor (and taxes) of future generations. One can always dream…

Read More @ TheInternationalForecaster.com

By Dan Denning, Daily Reckoning.com.au:

A quick recap of the weekend: Syria has shot down a Turkish military

jet, the Muslim Brotherhood has won power in Egypt, England lost on

penalties (again), North smashed Adelaide, and the blithering idiots who

pretend to run Europe’s economy have decided that spending more money

is the answer!

A quick recap of the weekend: Syria has shot down a Turkish military

jet, the Muslim Brotherhood has won power in Egypt, England lost on

penalties (again), North smashed Adelaide, and the blithering idiots who

pretend to run Europe’s economy have decided that spending more money

is the answer!

All in all, it was an eventful couple of days. As we settle in for another big week at our headquarters in St Kilda, the first cab off the rank is the plan by Spain, Italy, France, and Germany to spend $163 billion to promote ‘growth’. Growth is the antidote to austerity, apparently.

As if the government knows anything about creating prosperity. Just look at Australia’s soon-to-be live carbon tax and you’ll see that all the government can really do is take away from one group (companies that produce carbon dioxide emissions in their manufacturing operations) and give it to another group of people (voters who will face higher power bills because of the carbon price, and wonder what’s going on).

Read More @ DailyReckoning.com.au

A quick recap of the weekend: Syria has shot down a Turkish military

jet, the Muslim Brotherhood has won power in Egypt, England lost on

penalties (again), North smashed Adelaide, and the blithering idiots who

pretend to run Europe’s economy have decided that spending more money

is the answer!

A quick recap of the weekend: Syria has shot down a Turkish military

jet, the Muslim Brotherhood has won power in Egypt, England lost on

penalties (again), North smashed Adelaide, and the blithering idiots who

pretend to run Europe’s economy have decided that spending more money

is the answer!All in all, it was an eventful couple of days. As we settle in for another big week at our headquarters in St Kilda, the first cab off the rank is the plan by Spain, Italy, France, and Germany to spend $163 billion to promote ‘growth’. Growth is the antidote to austerity, apparently.

As if the government knows anything about creating prosperity. Just look at Australia’s soon-to-be live carbon tax and you’ll see that all the government can really do is take away from one group (companies that produce carbon dioxide emissions in their manufacturing operations) and give it to another group of people (voters who will face higher power bills because of the carbon price, and wonder what’s going on).

Read More @ DailyReckoning.com.au

By Maria Petrakis and Tom Stoukas, Bloomberg:

Greece will push its creditors to extend fiscal deadlines under the

country’s bailout program by at least two years, according to a policy

document drawn up by the three parties in the country’s governing

coalition.

Greece will push its creditors to extend fiscal deadlines under the

country’s bailout program by at least two years, according to a policy

document drawn up by the three parties in the country’s governing

coalition.

New Democracy, Pasok and the Democratic Left agree that plans to cut 150,000 public-sector jobs should be scrapped, the document, received by e-mail from the Greek government today, showed. Proposals also include reducing sales tax for cafes, bars, restaurants and the agricultural industry, and increasing the threshold for paying income tax.

The government affirmed its commitment for the need to reduce deficits, control debt and implement the structural reforms the country needs, the policy statement showed.

Read More @ Bloomberg

Greece will push its creditors to extend fiscal deadlines under the

country’s bailout program by at least two years, according to a policy

document drawn up by the three parties in the country’s governing

coalition.

Greece will push its creditors to extend fiscal deadlines under the

country’s bailout program by at least two years, according to a policy

document drawn up by the three parties in the country’s governing

coalition.New Democracy, Pasok and the Democratic Left agree that plans to cut 150,000 public-sector jobs should be scrapped, the document, received by e-mail from the Greek government today, showed. Proposals also include reducing sales tax for cafes, bars, restaurants and the agricultural industry, and increasing the threshold for paying income tax.

The government affirmed its commitment for the need to reduce deficits, control debt and implement the structural reforms the country needs, the policy statement showed.

Read More @ Bloomberg

by Greg Hunter, USAWatchdog:

You might remember Dr. Michael Burry as the hedge fund manager who

made hundreds of millions of dollars betting on the collapse of the

housing market. You, also, might remember everyone from the mainstream

media (MSM) to the Federal Reserve claimed nobody could have seen the

2008 financial collapse coming. How did Dr. Burry know a financial

catastrophe was on the way while most financial experts and media were

totally in the dark? This year’s commencement address at UCLA’s Department of Economics was given by Dr. Burry, and he says, “The ignorance is willful.” (Click here to see Dr. Burry’s June 20, 2012,UCLA address.)

You might remember Dr. Michael Burry as the hedge fund manager who

made hundreds of millions of dollars betting on the collapse of the

housing market. You, also, might remember everyone from the mainstream

media (MSM) to the Federal Reserve claimed nobody could have seen the

2008 financial collapse coming. How did Dr. Burry know a financial

catastrophe was on the way while most financial experts and media were

totally in the dark? This year’s commencement address at UCLA’s Department of Economics was given by Dr. Burry, and he says, “The ignorance is willful.” (Click here to see Dr. Burry’s June 20, 2012,UCLA address.)

“The ignorance is willful.” I think you can say the same thing about the ongoing banking crisis. Last Thursday, credit rating giant Moody’s downgraded the long-term credit ratings of 15 of the biggest North American and European banks. All but four were cut at least two notches, and these are some of the biggest banks in the world. RBC, JP Morgan, BNP Paribas, RBS and UBS are household names in Canada, U.S., France, UK and Switzerland.

Read More @ USAWatchdog.com

You might remember Dr. Michael Burry as the hedge fund manager who

made hundreds of millions of dollars betting on the collapse of the

housing market. You, also, might remember everyone from the mainstream

media (MSM) to the Federal Reserve claimed nobody could have seen the

2008 financial collapse coming. How did Dr. Burry know a financial

catastrophe was on the way while most financial experts and media were

totally in the dark? This year’s commencement address at UCLA’s Department of Economics was given by Dr. Burry, and he says, “The ignorance is willful.” (Click here to see Dr. Burry’s June 20, 2012,UCLA address.)

You might remember Dr. Michael Burry as the hedge fund manager who

made hundreds of millions of dollars betting on the collapse of the

housing market. You, also, might remember everyone from the mainstream

media (MSM) to the Federal Reserve claimed nobody could have seen the

2008 financial collapse coming. How did Dr. Burry know a financial

catastrophe was on the way while most financial experts and media were

totally in the dark? This year’s commencement address at UCLA’s Department of Economics was given by Dr. Burry, and he says, “The ignorance is willful.” (Click here to see Dr. Burry’s June 20, 2012,UCLA address.) “The ignorance is willful.” I think you can say the same thing about the ongoing banking crisis. Last Thursday, credit rating giant Moody’s downgraded the long-term credit ratings of 15 of the biggest North American and European banks. All but four were cut at least two notches, and these are some of the biggest banks in the world. RBC, JP Morgan, BNP Paribas, RBS and UBS are household names in Canada, U.S., France, UK and Switzerland.

Read More @ USAWatchdog.com

[Ed. Note: We are all slaves to Central Bankers now.]

from Zero Hedge

S&P 500 e-mini futures are over 20pts below their day-session

closing highs on Friday as energy and financials lead the plunge. The

major financials appear to have finally woken up to the hypothecated

reality of huge collateral calls on the back of their downgrades, the

lack of a simple debt mutualization burden-sharing pile-on to Germany,

and now Italian banks asking for a bailout from the ECB; with Citi and BofA down almost 7% from pre-downgrades and JPM/MS/GS all down around 5%.

VIX has extended its after-hours spike in futures from Friday and

trades back above 21% (up almost 3 vols from day-session close). With

oil tumbling once again and Treasury yields giving all of Friday’s rise

back, risk assets in general are leading stocks lower and as we opened

this morning, ES snapped down to converge with CONTEXT. Gold and Silver

are sideways as Copper and Oil fall while USD pushes higher still on

EUR weakness below 1.25 (and only JPY stronger among the majors as

carry gets unwound in a hurry). Not pretty. Spanish and Italian

bank stocks (and credit) are being crushed/halted and Spanish 10Y

yields are back over 6.50% (and spreads over 500bps).

S&P 500 e-mini futures are over 20pts below their day-session

closing highs on Friday as energy and financials lead the plunge. The

major financials appear to have finally woken up to the hypothecated

reality of huge collateral calls on the back of their downgrades, the

lack of a simple debt mutualization burden-sharing pile-on to Germany,

and now Italian banks asking for a bailout from the ECB; with Citi and BofA down almost 7% from pre-downgrades and JPM/MS/GS all down around 5%.

VIX has extended its after-hours spike in futures from Friday and

trades back above 21% (up almost 3 vols from day-session close). With

oil tumbling once again and Treasury yields giving all of Friday’s rise

back, risk assets in general are leading stocks lower and as we opened

this morning, ES snapped down to converge with CONTEXT. Gold and Silver

are sideways as Copper and Oil fall while USD pushes higher still on

EUR weakness below 1.25 (and only JPY stronger among the majors as

carry gets unwound in a hurry). Not pretty. Spanish and Italian

bank stocks (and credit) are being crushed/halted and Spanish 10Y

yields are back over 6.50% (and spreads over 500bps).

Read More @ Zero Hedge.com

from Zero Hedge

S&P 500 e-mini futures are over 20pts below their day-session

closing highs on Friday as energy and financials lead the plunge. The

major financials appear to have finally woken up to the hypothecated

reality of huge collateral calls on the back of their downgrades, the

lack of a simple debt mutualization burden-sharing pile-on to Germany,

and now Italian banks asking for a bailout from the ECB; with Citi and BofA down almost 7% from pre-downgrades and JPM/MS/GS all down around 5%.

VIX has extended its after-hours spike in futures from Friday and

trades back above 21% (up almost 3 vols from day-session close). With

oil tumbling once again and Treasury yields giving all of Friday’s rise

back, risk assets in general are leading stocks lower and as we opened

this morning, ES snapped down to converge with CONTEXT. Gold and Silver

are sideways as Copper and Oil fall while USD pushes higher still on

EUR weakness below 1.25 (and only JPY stronger among the majors as

carry gets unwound in a hurry). Not pretty. Spanish and Italian

bank stocks (and credit) are being crushed/halted and Spanish 10Y

yields are back over 6.50% (and spreads over 500bps).

S&P 500 e-mini futures are over 20pts below their day-session

closing highs on Friday as energy and financials lead the plunge. The

major financials appear to have finally woken up to the hypothecated

reality of huge collateral calls on the back of their downgrades, the

lack of a simple debt mutualization burden-sharing pile-on to Germany,

and now Italian banks asking for a bailout from the ECB; with Citi and BofA down almost 7% from pre-downgrades and JPM/MS/GS all down around 5%.

VIX has extended its after-hours spike in futures from Friday and

trades back above 21% (up almost 3 vols from day-session close). With

oil tumbling once again and Treasury yields giving all of Friday’s rise

back, risk assets in general are leading stocks lower and as we opened

this morning, ES snapped down to converge with CONTEXT. Gold and Silver

are sideways as Copper and Oil fall while USD pushes higher still on

EUR weakness below 1.25 (and only JPY stronger among the majors as

carry gets unwound in a hurry). Not pretty. Spanish and Italian

bank stocks (and credit) are being crushed/halted and Spanish 10Y

yields are back over 6.50% (and spreads over 500bps).Read More @ Zero Hedge.com

from Testosterone Pit.com:

An unrelenting, horrid wave of scandals about toxic ingredients in foods and medicines in China shows that regulators are unwilling and incapable of controlling it. It also shows a penchant—some evil tongues say it’s cultural—for pandemic cheating in order to get ahead in some way. And Chinese economic data falls into that category.

Every country has its own bureaucratic madness in pursuing obfuscation. In the US, one of the hardest things to get is a truthful, or at least a somewhat realistic, or at the very least a not totally fabricated unemployment and jobs number. But at least, the Bureau of Labor Statistics issues a slew of supplemental data. So, in addition to the nearly worthless headline numbers that media and politicians wave in proclaiming victory, we get numbers that point at deeper fissures [for a fun head-butting on this issue, read Yves Smith’s post!].

But in China, the art of data manipulation is such that even the government might not know the true status of the economy. Officials even at the local level are rewarded, promoted, or demoted, based on achieving their economic quotas as measured by tax receipts, business revenues, real estate developments, and so on. Hence, the incentive to fudge the numbers on an individual basis is high. According to the New York Times, “The officials do so by urging businesses to keep separate sets of books, showing improving business results and tax payments that do not exist.”

Read More @ TestosteronePit.com

An unrelenting, horrid wave of scandals about toxic ingredients in foods and medicines in China shows that regulators are unwilling and incapable of controlling it. It also shows a penchant—some evil tongues say it’s cultural—for pandemic cheating in order to get ahead in some way. And Chinese economic data falls into that category.

Every country has its own bureaucratic madness in pursuing obfuscation. In the US, one of the hardest things to get is a truthful, or at least a somewhat realistic, or at the very least a not totally fabricated unemployment and jobs number. But at least, the Bureau of Labor Statistics issues a slew of supplemental data. So, in addition to the nearly worthless headline numbers that media and politicians wave in proclaiming victory, we get numbers that point at deeper fissures [for a fun head-butting on this issue, read Yves Smith’s post!].

But in China, the art of data manipulation is such that even the government might not know the true status of the economy. Officials even at the local level are rewarded, promoted, or demoted, based on achieving their economic quotas as measured by tax receipts, business revenues, real estate developments, and so on. Hence, the incentive to fudge the numbers on an individual basis is high. According to the New York Times, “The officials do so by urging businesses to keep separate sets of books, showing improving business results and tax payments that do not exist.”

Read More @ TestosteronePit.com

As

a growing number of British families are feeling the pinch of rising

household costs and taxes amid the recession, Queen Elizabeth II is

getting a pay rise!

by Jacque Fresco, Hang the Bankers.com:

The Queen’s annual pay is about to jump by 20 percent from 30 to 36

million pounds, at a time when Britain is in recession and many families

are feeling the pinch of higher household costs and taxes.

The Queen’s annual pay is about to jump by 20 percent from 30 to 36

million pounds, at a time when Britain is in recession and many families

are feeling the pinch of higher household costs and taxes.

She has been paid by taxpayers through an allowance set by Parliament and via other government grants since King George III ceded all property profits to the Treasury in 1760.

Her property holdings, known as the Crown Estate, posted a record profit of 240.2 million pounds ($377.4 million), a net rise of 4 percent in the year through March 2012 largely due to strong tenant demand for its shops in the up-market Regent Street and St James’s districts of London.

Read More @ HangtheBankers.com

by Jacque Fresco, Hang the Bankers.com:

The Queen’s annual pay is about to jump by 20 percent from 30 to 36

million pounds, at a time when Britain is in recession and many families

are feeling the pinch of higher household costs and taxes.

The Queen’s annual pay is about to jump by 20 percent from 30 to 36

million pounds, at a time when Britain is in recession and many families

are feeling the pinch of higher household costs and taxes.She has been paid by taxpayers through an allowance set by Parliament and via other government grants since King George III ceded all property profits to the Treasury in 1760.

Her property holdings, known as the Crown Estate, posted a record profit of 240.2 million pounds ($377.4 million), a net rise of 4 percent in the year through March 2012 largely due to strong tenant demand for its shops in the up-market Regent Street and St James’s districts of London.

Read More @ HangtheBankers.com

from RussiaToday:

by Tibor Machan, The Daily Bell:

I have been reading into Herbert Croly’s The Promise of American Life (1909). Croly was the founder of The New Republic, which has remained a foremost middle way publication on the American political scene, a champion of the welfare state, of a half way between capitalism and socialism. The central theme of the book is that America should be made into a country that promotes “the welfare of the whole people,” the policy “intelligently informed by the desire to maintain a join process of individual and social amelioration.”

Socialism is the idea that what counts for most is the social whole, even humanity in its entirety. Individualist capitalism focuses, instead, on protecting the rights to life, liberty and property of each individual, leaving it to their own discretion whether to embark on various groups efforts, including the improvement of some “whole,” whatever that would be. (As Margaret Thatcher famously said, there is no society as such, suggesting that there are in fact only human individuals who come together in various ways − family, club, corporation, orchestra, choir, team and so forth. As with my college classes, they are merely useful fictions, the only reality being the students who comprise them.)

What American leftists have tried to do is create some kind of hybrid, one that merges the individualist and the collectivist systems of various Platonic dreamers. America itself has been an experiment in which the hybrid has been rejected as futile and even vile, usually an excuse for some in society ruling the rest. Just as Croly and all who have followed him have argued, of importance to the detractors has been some kind of group − the tribe, or race or ethnic bunch or whatever. Even now the major domestic opposition to the American alternative is the communitarian, welfare statist regime, such as the one recently promoted very vigorously by Harvard professor of government, Michael Sandel, in his recently published attack on individualism, What Money Can’t Buy: The Moral Limits of Markets (Farrar, Straus and Giroux, 2012).

Read More @ TheDailyBell.com

I have been reading into Herbert Croly’s The Promise of American Life (1909). Croly was the founder of The New Republic, which has remained a foremost middle way publication on the American political scene, a champion of the welfare state, of a half way between capitalism and socialism. The central theme of the book is that America should be made into a country that promotes “the welfare of the whole people,” the policy “intelligently informed by the desire to maintain a join process of individual and social amelioration.”

Socialism is the idea that what counts for most is the social whole, even humanity in its entirety. Individualist capitalism focuses, instead, on protecting the rights to life, liberty and property of each individual, leaving it to their own discretion whether to embark on various groups efforts, including the improvement of some “whole,” whatever that would be. (As Margaret Thatcher famously said, there is no society as such, suggesting that there are in fact only human individuals who come together in various ways − family, club, corporation, orchestra, choir, team and so forth. As with my college classes, they are merely useful fictions, the only reality being the students who comprise them.)

What American leftists have tried to do is create some kind of hybrid, one that merges the individualist and the collectivist systems of various Platonic dreamers. America itself has been an experiment in which the hybrid has been rejected as futile and even vile, usually an excuse for some in society ruling the rest. Just as Croly and all who have followed him have argued, of importance to the detractors has been some kind of group − the tribe, or race or ethnic bunch or whatever. Even now the major domestic opposition to the American alternative is the communitarian, welfare statist regime, such as the one recently promoted very vigorously by Harvard professor of government, Michael Sandel, in his recently published attack on individualism, What Money Can’t Buy: The Moral Limits of Markets (Farrar, Straus and Giroux, 2012).

Read More @ TheDailyBell.com

by Brian Sylvester of The Gold Report, Gold Seek:

Ian Gordon of Longwave Analytics and Longwave Strategies believes

we’re on the precipice of very difficult and frightening times and

predicts complete financial collapse. But it’s in those periods of

darkness that gold really shines. Gordon, who recently published a

special edition of his Investment Insights entitled “The Gold Rush of

the 1930s Will Rise Again,” believes that companies with gold in the

ground now will be the ones to prosper. In this exclusive Gold Report

interview, Gordon discusses where he thinks the Dow will bottom.

Ian Gordon of Longwave Analytics and Longwave Strategies believes

we’re on the precipice of very difficult and frightening times and

predicts complete financial collapse. But it’s in those periods of

darkness that gold really shines. Gordon, who recently published a

special edition of his Investment Insights entitled “The Gold Rush of

the 1930s Will Rise Again,” believes that companies with gold in the

ground now will be the ones to prosper. In this exclusive Gold Report

interview, Gordon discusses where he thinks the Dow will bottom.

The Gold Report: In a recent edition of Investment Insights, you charted the NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) of senior gold stocks, gold itself, the TSX Venture Exchange as a proxy for junior mining stocks and one particular gold company from Dec. 29, 2000. All four were equalized to $100 to make the comparison accurate. What did they show?

Ian Gordon: I wanted to look at relative performance since 2000, when gold bottomed out at around $250/ounce (oz)—that was the beginning of the big bull market. The chart shows that the HUI has outperformed all the other benchmarks since 2000. Since then the value of the HUI has increased about 10 times. The second best performer has been gold itself, which has increased about six times. The Venture Exchange has increased just over two times.

Read More @ GoldSeek.com

Ian Gordon of Longwave Analytics and Longwave Strategies believes

we’re on the precipice of very difficult and frightening times and

predicts complete financial collapse. But it’s in those periods of

darkness that gold really shines. Gordon, who recently published a

special edition of his Investment Insights entitled “The Gold Rush of

the 1930s Will Rise Again,” believes that companies with gold in the

ground now will be the ones to prosper. In this exclusive Gold Report

interview, Gordon discusses where he thinks the Dow will bottom.

Ian Gordon of Longwave Analytics and Longwave Strategies believes

we’re on the precipice of very difficult and frightening times and

predicts complete financial collapse. But it’s in those periods of

darkness that gold really shines. Gordon, who recently published a

special edition of his Investment Insights entitled “The Gold Rush of

the 1930s Will Rise Again,” believes that companies with gold in the

ground now will be the ones to prosper. In this exclusive Gold Report

interview, Gordon discusses where he thinks the Dow will bottom.The Gold Report: In a recent edition of Investment Insights, you charted the NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) of senior gold stocks, gold itself, the TSX Venture Exchange as a proxy for junior mining stocks and one particular gold company from Dec. 29, 2000. All four were equalized to $100 to make the comparison accurate. What did they show?

Ian Gordon: I wanted to look at relative performance since 2000, when gold bottomed out at around $250/ounce (oz)—that was the beginning of the big bull market. The chart shows that the HUI has outperformed all the other benchmarks since 2000. Since then the value of the HUI has increased about 10 times. The second best performer has been gold itself, which has increased about six times. The Venture Exchange has increased just over two times.

Read More @ GoldSeek.com

by J. D. Heyes, Natural News:

As the Federal Aviation Administration (FAA) continues to approve

scores of drone applications for a range of federal, state and local

agencies, concern among Americans and privacy groups is rising about the

use of these drones for illegal surveillance.

As the Federal Aviation Administration (FAA) continues to approve

scores of drone applications for a range of federal, state and local

agencies, concern among Americans and privacy groups is rising about the

use of these drones for illegal surveillance.

The latest federal agency to potentially have violated constitutional protections against invasive, unauthorized drone surveillance is the Environmental Protection Agency (EPA), a federal leviathan within a leviathan that is developing quite a reputation for flexing authority it doesn’t really have.

In fact, Congress recently launched a probe into whether this out-of-control, rogue agency has used drones to monitor the activities of farmers in Missouri, Kansas, Nebraska and Iowa.

Read More @ NaturalNews.com

As the Federal Aviation Administration (FAA) continues to approve

scores of drone applications for a range of federal, state and local

agencies, concern among Americans and privacy groups is rising about the

use of these drones for illegal surveillance.

As the Federal Aviation Administration (FAA) continues to approve

scores of drone applications for a range of federal, state and local

agencies, concern among Americans and privacy groups is rising about the

use of these drones for illegal surveillance.The latest federal agency to potentially have violated constitutional protections against invasive, unauthorized drone surveillance is the Environmental Protection Agency (EPA), a federal leviathan within a leviathan that is developing quite a reputation for flexing authority it doesn’t really have.

In fact, Congress recently launched a probe into whether this out-of-control, rogue agency has used drones to monitor the activities of farmers in Missouri, Kansas, Nebraska and Iowa.

Read More @ NaturalNews.com

by Mark Karlin, Truth-Out:

A recent article in The Guardian UK

offers evidence that “while cocaine production ravages countries in

Central America, consumers in the US and Europe are helping developed

economies grow rich from the profits.”

A recent article in The Guardian UK

offers evidence that “while cocaine production ravages countries in

Central America, consumers in the US and Europe are helping developed

economies grow rich from the profits.”According to The Guardian UK story, the study by two Colombian professors found that “2.6% of the total street value of cocaine produced remains within the country [Columbia], while a staggering 97.4% of profits are reaped by criminal syndicates and laundered by banks, in first-world consuming countries.”

One of the researchers, Alejandro Gaviria said: “We know that authorities in the US and UK know far more than they act upon. The authorities realize things about certain people they think are moving money for the drug trade – but the DEA [US Drug Enforcement Administration] only acts on a fraction of what it knows.”

“It’s taboo to go after the big banks,” added Gaviria’s co-researcher Daniel Mejía. “It’s political suicide in this economic climate, because the amounts of money recycled are so high.”

Read More @ Truth-Out.org

by Anthony Gucciardi, Activist Post

Another report of genetically modified creations taking the lives of

livestock has hit the media, and this time genetically modified grass

has been identified as the culprit according to CBS News.

Another report of genetically modified creations taking the lives of

livestock has hit the media, and this time genetically modified grass

has been identified as the culprit according to CBS News.

Shockingly (and quite disturbingly), the GM grass actually produced

toxic cyanide and sent the cattle into a life-ending fit that included

painful bellowing and convulsions. The deaths have led to a federal

investigation centered in Central Texas, where the cattle had resided.

Just east of Austin, the cows lived on an 80-acre ranch owned by

Jerry Abel. Abel says that the fields were used for over 15 years for

cattle grazing and hay, and that the genetically modified grass was

‘tested’ previously and should have been ‘perfect’. The GM grass

however, known as Tifton 85, appears have been producing toxic cyanide.

Read More @ Activist Post![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment