Forget Operation Twist: Rosenberg Says Bernanke Will Shock Everyone With What Is About To Come

As we have been pointing out since the beginning of the week, the one defining feature of the past 5 days has been a relentless short covering rally. And while the mechanics were obvious, one thing was missing: the reason. Well, courtesy of David Rosenberg's latest, we may now know what it is. Bottom line: for all who think that Bernanke is about to serve just Operation Twist next week... you ain't seen nothing yet. "The consensus view that the Fed is going to stop at 'Operation Twist' may be in for a surprise. It may end up doing much, much more." Rosie continues: "Look, we are talking about the same man who, on October 2, 2003, delivered a speech titled Monetary Policy and the Stock Market: Some Empirical Results. I kid you not. This is someone who clearly sees the stock market as a transmission mechanism from Fed policy to the rest of the economy. In other words, if Bernanke wants to juice the stock market, then he must do something to surprise the market. 'Operation Twist' is already baked in, which means he has to do that and a lot more to generate the positive surprise he clearly desires (this is exactly what he did on August 9th with the mid-2013 on- hold commitment). It seems that Bernanke, if he wants the market to rally, is going to have to come out with a surprise next Wednesday." In other words, stocks are now pricing in not just OT 2, and a reduction in the IOER, but also an LSAP of a few hundred billion. There is, however, naturally a flipside, to Bernanke's priced in announcement: "If he doesn't, then expect a big selloff." In everything, mind you, stocks, bonds, and certainly precious metals. And, of course, vice versa.Bill Ackman's HKD Revaluation Trade As Predicted By Deutsche Bank In 2010... And Why DB Thinks It Is Wrong

Following recent disclosure that Bill Ackman's latest so-called 'slam dunk' idea is a bet on a revaluation of the Hong Kong dollar (as described here), it is interesting to see what someone like Deustche Bank's Mirza Baig thought precisely about the trade that Ackman is proposing as some unique concept (in 151 pages no less) as long ago as November 2010. To wit: "Public complaints against inflation are already loud, and may intensify if the reflationary tide swells further. This could turn up the heat on the authorities. Since 1983 when the current regime was adopted, Hong Kong has experienced CPI inflation as high as 12% and deflation as low as -6%. The current inflation rate of roughly 3% looks benign in this context. In 2008 when inflation crossed 5%, the public debate on monetary policy became more intense, but Hong Kong ultimately braced the peg. In short, we feel the situation will have to become far more extreme, and other policy tools prove ineffective before authorities capitulate and allow a revaluation of HKD. At present, the probability of this scenario is low, in our view. This is why we noted earlier that we expect the reval trade to attract more interest from offshore investors, and possibly reach blow-out levels by the middle of [2011]." And after highlighting the Ackman's trade from 10 months later, DB concludes that "[t]he more likely scenario is that Hong Kong will attempt to ride out the reflation tide with its current policy. The public would gradually move to using RMB for payments, and the HKD would fall into relative disuse. Once China’s capital account is sufficiently open (5-10 years later), Hong Kong would endorse the shift towards China through a formal peg vs. RMB at the then prevailing exchange rate (i.e. without any revaluation)."FINRA Drowning In Complaints About Market Manipulation

Whether it is due to the general investing public finally realizing that the market is neither fair nor efficient, that the scales are tipped against the common man from the moment the 'Buy' (or, more rarely, 'Short') button is pressed, or that as the past two years have shown the market is dominated by insider trading, "expert networks" and big legacy investors surviving only due to the government's intervention on their behalf at critical times, is unknown, but Finra is now officially and finally drowning in a barrage of complaints about market manipulation. And to be sure such glaring reminders as 30 year-old UBS traders being singlehandedly responsible (of course, nobody noticed anything over the months and months of creeping illegal trades) for massive cumulative losses that amount to more than the entire net income for the bank (an odd and convenient scapegoat that), will surely not make Finra's life any easier. As Reuters reports: "A Wall Street regulator said industry complaints about market manipulation and trade reporting have spiked this year, raising questions about the adequacy of banks' internal controls over their traders. FINRA has received complaints this year about banks' audit systems, canceled orders, and brokers misrepresenting whether orders were on behalf of customers. "These are areas that for a long time we were not receiving complaints in, and all of a sudden this past year it's really spiked up," DeMaio, senior vice president in FINRA's market regulation unit, told a FIA options industry conference." That's great: so US investors can sleep soundly knowing full well fiascoes such as UBS' Delta One implosion will be confined to the UK (where, incidentally, the director of market at the local regulator, FSA, just resigned - it is unclear if he will follow a recent previous FSA departure straight into the willing clutches of such a non-market manipulative entity as JP Morgan), and that manipulation is being rooted out in the US at its core at a brisk pace.HUI bounces from key support level

Trader Dan at Trader Dan's Market Views - 4 hours ago

The mining shares were hit rather hard this week with a bout of selling

after the HUI made a new all time high but the price action still looks very

good considering where it saw the buyers stepping up.

If you notice on the chart, the region marked as the "GAP and GO" - That

constituted a gap higher above the former all time high ( A very bullish

development). Normally, on a subsequent price reaction lower, one would like

to see this gap region function as a level of chart support which sees the

buyers come back in and bid prices back up again. That is indeed what did

occur the fir... more »

Cautious consumers pull back on retail spending

Eric De Groot at Eric De Groot - 4 hours ago

I find no disagreement with the headline below. The downward acceleration of

gold adjusted retail sales suggests trying times ahead not only for the US

households but also economy. Consumption, representing over 70% of GDP, is a

key driver of US economic growth. The pressure to do something domestically

is mounting. Gold-Adjusted Retail Sales (RSGLDR) and YOY Change Headline:

Cautious...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

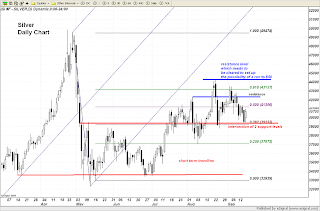

Silver Chart Update

Trader Dan at Trader Dan's Market Views - 5 hours ago

Silver continues to hold very firm at the horizontal red line drawn in on

the price chart. Each time it has moved down to this level, a level which I

might add is the intersection of TWO important support levels, it has drawn

out solid buying and then moved higher. This region is a former congestion

zone which seems to attract buyers and forces shorts to cover. The longer

this impasse continues, the better for the bulls as it is basically

base-building here.

Must-Listen Interview On The Global Physical Gold Market

Dave in Denver at The Golden Truth - 5 hours ago

* *

*"It appears that India wants to buy the entire world's gold supply at the

right price"* - John Brimelow

This is about an 18 minute interview by James Turk of John Brimelow, someone

who most you have never heard of but who provides invaluable

reporting/information on the gold trading globally - specifically on the

massive physical buying markets in India and Asia. I access the publicly

available commentary by Brimelow in the nightly Midas report at

http://www.lemetropolecafe.com/ It is one of the key tools we use to manage

our fund.

If you are interested in learning about... more »

Weekly Bull/Bear Recap: September 12-16, 2011

Despite all the negative news, markets are hanging tough. Why? I believe financial markets continue to have a "Moral Hazard" premium priced-in. The idea that governments will step in to save the day remains entrenched in the minds' of investors. There are signs, however, that this premium may soon be re-priced. Indeed, this week's rally has left much to be desired. Copper, nor the credit markets, have confirmed the move higher in equity markets. Breadth has lagged as well. These are signs that this latest rally isn't healthy. Should government authorities fail to come through and Eurozone contagion takes hold, financial markets would begin to compress this premium. A strong break of 1120 would signal that a re-pricing is ongoing. Overall, the global economy is at a crossroads. Until the Eurozone issues are structurally taken care of, I remain very cautious. Capital preservation remains the name of the game.Moody's Continues Review Of Italy's Aa2 Ratings For Possible Downgrade, To Conclude Review Within Next Month

"In light of the increasingly challenging economic and financial environment and fluid political developments in the euro area, Moody's is continuing to evaluate Italy's local and foreign currency bond ratings in the context of the risks identified. Moody's will strive to conclude the review within the next month."From Arab Spring To Greek Autumn To European Winter

SocGen's 6 Easy Charts On What Happens To Gold And Stocks Under "QE2.5"

Looks like SocGen pulled a TGIF today and in response to its Corporate Market Alert, in which it asked the rhetorical question, "Fed QE '2.5': gold and equities to take off again?" it answers itself quickly and to the point in just 6 simple charts. Here they are...

We

discussed earlier how various non-US-equity asset classes were

differing in their opinions on the likely events going forward. Even

more short-termist, it seemed a large number of people really didn't

want European financials exposure. Well, this afternoon has seen volumes

dry up in ES and limp higher as IG and HY credit spreads have moved

wider and wider quite comfortably. While we can never be sure, it seems

credit professionals are not so comfortable being long and unhedged

into the weekend.

We

discussed earlier how various non-US-equity asset classes were

differing in their opinions on the likely events going forward. Even

more short-termist, it seemed a large number of people really didn't

want European financials exposure. Well, this afternoon has seen volumes

dry up in ES and limp higher as IG and HY credit spreads have moved

wider and wider quite comfortably. While we can never be sure, it seems

credit professionals are not so comfortable being long and unhedged

into the weekend.Euro Oversold As Shorts Surge To Highest Since June 2010

For those seeking an oversold security, look no further than the EUR, which in the week ended Sept. 13, was the biggest FX loser, as non-commercial exposure rose 50% to a net short of -54,459 from -36,443 contracts the week before. This is the most bearish net exposure in the EUR since July 2010, and positions the currency for a short squeeze, although if history is any guide it still has a ways to go: the 2010 trough was -114k net contracts hit in May of 2010, just after it became apparent that Europe is falling apart. Also, despite speculation that traders have left the safe-haven status of the CHF following last week's SNB intervention, the Swiss Franc retained its bullishness, with net exposure remaining long, although declining modestly from 7,549 to 5,493 contracts. Also not surprising is that bullish bets in the JPY rose from 32,787 to 34,955 after declining past week. It seems that Yoda will be watching, watching, watching his Bberg terminal very closely in the coming days.

Dear Extended Family,

I am back in Dar for a working early weekend, and then returning to Connecticut.

It is like old days here in that I may well be traveling much more often doing exciting things.

You see that we here never forget you when traveling.

It looks like Kenny has nailed this week’s gold market.

Respectfully,

Jim

Jim Sinclair’s Commentary

Words from Master Kenny:

"If gold does hold and bottom from this current support level of 1770 / 1790 – at this point in time, the very near term positive bias just now emerging, may very quickly return to its longer term bull much sooner than many expected."

David Duval’s Commentary

Leverage your way out of the problem that leverage created!

Geithner presses EU to act; meets resistance By John O’Donnell and Robin Emmott

WROCLAW, Poland | Fri Sep 16, 2011 1:28pm EDT

(Reuters) – U.S. Treasury Secretary Timothy Geithner urged EU finance ministers on Friday to leverage their bailout fund to better tackle the debt crisis, and to start speaking with one voice, but there was no agreement on what steps to take.

In a 30-minute meeting with euro zone ministers, Geithner pressed for the 440 billion euros European Financial Stability Facility (EFSF) to be scaled up to give greater capacity to combat the problems infecting Greece, Portugal, Italy and other states, a senior euro zone official said.

One analyst familiar with the proposal said it would involve the EFSF guaranteeing a portion — perhaps 20 percent — of potential losses on euro zone debt, so that its capital would effectively stretch five times further.

But ministers were resistant to Washington telling the 17-country euro zone and its finance chiefs what they should do.v

More…

Jim Sinclair’s Commentary

QE, a stealth default, on US debt!

China to ‘liquidate’ US Treasuries, not dollars By Ambrose Evans-Pritchard

The debt markets have been warned.

A key rate setter-for China’s central bank let slip – or was it a slip? – that Beijing aims to run down its portfolio of US debt as soon as safely possible.

"The incremental parts of our of our foreign reserve holdings should be invested in physical assets," said Li Daokui at the World Economic Forum in the very rainy city of Dalian – former Port Arthur from Russian colonial days.

"We would like to buy stakes in Boeing, Intel, and Apple, and maybe we should invest in these types of companies in a proactive way."

"Once the US Treasury market stabilizes we can liquidate more of our holdings of Treasuries," he said.

To my knowledge, this is the first time that a top adviser to China’s central bank has uttered the word "liquidate". Until now the policy has been to diversify slowly by investing the fresh $200bn accumulated each quarter into other currencies and assets – chiefly AAA euro debt from Germany, France and the hard core.

We don’t know how much US debt is held by SAFE (State Administration of Foreign Exchange), the bank’s FX arm. The figure is thought to be over $2.2 trillion.

The Chinese are clearly vexed with Washington, viewing the Fed’s QE as a stealth default on US debt. Mr Li came close to calling America a basket case, saying the picture is far worse than when Ronald Reagan and Margaret Thatcher took over in the early 1980s.

More…

Quoting Jim Sinclair: “Gold stocks are the utilities of the future.”

Dear CIGAs,

Few would dispute that the twelve year (and still counting) bull market in gold has been the opportunity of this investment lifetime. Even fewer have participated. From its 20 year bear market low in August of 1999, bullion has appreciated more than seven fold. That works out to a $US compound return of 18.0% compared to 0.7% for the S&P 500. There is a paltry $2 trillion of investment gold, approximately 1% of global financial assets. It is not main stream. It is not widely held. The rationale for investing is antithetical to mainstream thinking. The opportunity has been missed by almost every conceivable category of investor including pension funds, endowments, mutual funds, and central banks, all of whom could be safely described as underweight the metal, overweight dicey financial assets. Despite the headlines, gold remains under owned.

To regard the lengthy bull market in gold as an isolated fact would be simplistic and superficial. The media and most of the financial community are captivated by daily price action, but see nothing more. To most, it is a speculation, probably an overcrowded trade, and maybe a bubble. It is seen in the narrowest of terms, as an odd curiosity that will at some point just go away.

Gold’s advance is but one aspect of a much bigger picture. The collapse of the dot com and housing bubbles, the 2008 credit collapse, the eleven year bear market in stocks, sovereign debt woes in Europe, zero interest rates, intractable sovereign fiscal deficits, and, yes, the steady rise of gold in all currencies are rooted in the breakdown of confidence in paper currencies linked only to political agendas.

Since the demotion of gold to non-monetary status by the Nixon administration in 1970, fiat money and credit based upon it have been a fundamental source of global wealth generation. What is the value in real terms of the $200 trillion of wealth denominated in currency if nobody wants the paper?

In golf parlance, a “mulligan” is a second chance to make good on a bad tee shot. Mulligans are routinely granted and gratefully accepted by every golfer at the beginning of a friendly match, after a bad first shot. In the world of investing, second chances, or “do overs” are not routine. Sideline huggers who have missed the bull market of a lifetime must “pay up” if they wish to participate in a long-established trend. Late to the party entry points are inherently more risky, as the sharp correction in bullion during the last week of August in bullion illustrates.

More…

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment