European MF Global Clients Furious After KPMG Releases Their Home Address, Holdings Details

MF Global's creditors (and clients) in Europe, and everywhere else, have many reasons to be furious. Now those in Europe have one more to add to their list of grievances: a complete and totally public disclosure, courtesy of KPMG, of not only how much they are owed, but their mailing, and in many cases, home address. In other words, not only will these individuals not receive their full claims in the insolvent entity whose primary specialty as it turned out was rehypothecating what little assets it did have, but now have to worry about the taxman coming after them.... As well as promptly changing their home address. One party, however, that will hardly mind, is JPMorgan which is supposedly owed just over €100 million. Luckily for them, they already quote unquote collected the (client) money.Philly Fed Is Out With Latest "Schrodinger" Economy Print

Remember when the Chinese PMI posted both a contraction an expansion for the month of March, with Markit showing a sub-50 contractionary print, while the Chinese version showed 51, or expansion, in other words China was both stagnating and growing at the same time,

merely the latest indication of our modern day Schrodinger-ness macro

insanity? Well, we just got the US version of this Heisenberg Economic

Uncertainty principle, when as part of the just released Philly Fed index (which also printed

better than expected despite a drop in New Orders and Shipments), we

saw Priced Paid.... tumble from 38.7 to 18.7!!?? Why the surprise?

Because 90 minutes prior to this, we just got The New York Fed telling

the world that prices paid in fact soared by virtually the highest

amount in real terms on record! In other words, in New York survey

respondents are experiencing soaring inflation, while 90 miles

Southwest, manufacturing firms were awash in deflation. Do they even try

to manipulate the data anymore?

Remember when the Chinese PMI posted both a contraction an expansion for the month of March, with Markit showing a sub-50 contractionary print, while the Chinese version showed 51, or expansion, in other words China was both stagnating and growing at the same time,

merely the latest indication of our modern day Schrodinger-ness macro

insanity? Well, we just got the US version of this Heisenberg Economic

Uncertainty principle, when as part of the just released Philly Fed index (which also printed

better than expected despite a drop in New Orders and Shipments), we

saw Priced Paid.... tumble from 38.7 to 18.7!!?? Why the surprise?

Because 90 minutes prior to this, we just got The New York Fed telling

the world that prices paid in fact soared by virtually the highest

amount in real terms on record! In other words, in New York survey

respondents are experiencing soaring inflation, while 90 miles

Southwest, manufacturing firms were awash in deflation. Do they even try

to manipulate the data anymore?As Whistleblowing Becomes The Most Profitable Financial 'Industry', Many More 'Greg Smiths' Are Coming

Minutes ago on CNBC, Jim Cramer announced that Greg Smith will never get a job on Wall Street again as "one never goes to the press. Ever." Naturally, the assumption is that the secrets of Wall Street's dirty clothing are supposed to stay inside the family, or else one may wake up with a horsehead in their bed. There is one small problem with that. Now that compensations on Wall Street have plunged, and terminations are set for the biggest spike since the Lehman collapse, the opportunity cost to defect from the club has also collapsed. And if anything, Greg Smith's NYT OpEd has shown that it is not only ok to go to the press, but is in fact cool. So what happens next? Well, as the following Reuters article reports, 'whistleblowing' over corrupt and criminal practices on Wall Street is suddenly becoming the next growth industry. Yes - people may get 'priced out' of the industry, but since the industry will likely fire you regardless in the "New Normal" where fundamentals don't matter, and where the only thing that does matter is the H.4.1 statement (as Zero Hedge incidentally pointed out back in early 2010), why not expose some of the dirt that has been shovelled deep under the coach, and get paid some serious cash while doing it?Source Links for Today’s Items:

While everyone seems to be interested in

the unfolding drama in Greece, it may be a preamble to the next scene of

this horrible worldwide play… Spain. Spain has the highest rate of

unemployment in the euro-zone at over 22%. A possible Spanish

potential default would have much larger implications for the euro zone

than Greece.

A Reuters/Ipsos poll found that 56% of

Americans do not understand the big picture when it comes to Iran. 56%

of Americans do not understand the consequences of military action

against Iran. 56% of Americans do not know that military action with

Iran could lead to nuclear war. 56% of Americans are completely in the

dark to what is going on outside of their little world.

The CME (Chicago Mercantile Exchange) no

longer wants to be a clearing house for European derivatives. Why? Most

likely Greece and its eventual fallout. The question is… When will

Greece formally default and how much are U.S. banks going to lose when

this happens? At any rate, the race for liquidity, and stability, will

exponentially increase when the sovereign defaults start appearing.

Four of the 19 Banks, did not pass the

FED’s laugh-out-loud so-called worse scenario stress test. To get an

idea of how bogus this test was… Citigroup failed but Bank of America passed? Give me a break… This is just too easy folks!

With less above ground silver than gold, here are some the uses that silver is essential for.

1. Medical Uses

2. Cell Phones

3. Solar Panels

4. Batteries

5. Robotics

It’s uses are increasing and silver is not getting any more abundant; therefore, keep stacking!

1. Medical Uses

2. Cell Phones

3. Solar Panels

4. Batteries

5. Robotics

It’s uses are increasing and silver is not getting any more abundant; therefore, keep stacking!

After repeatedly hearing horror stories

about the TSA at his airport, the president of the Orlando Sanford

International Airport wants the TSA Nazi goon squad out of his

airport. This is the first major airport that, if permitted, will

allow private operators to screen passengers. It will also lead to a

landslide of other airports to get out of sickening procedures by the

TSA.

Next…

The Recession Has Changed How People Walk Through A Grocery Store

http://www.businessinsider.com/

The Recession Has Changed How People Walk Through A Grocery Store

http://www.businessinsider.com/

Supermarkets are designed for impulse

buying; however, people are mostly only going to selected aisle and it

is killing store margins. So, in tough times, people are more selective

about their buying choices? Gee, what a revelation. Good advice is to

shop on the edges of the store, that is where the dairy, meat, breads

and produce are.

Well, James O’Keefe

has done it again. This time showing how easy it is to illegally vote

without an ID. His undercover video shows you need an ID for a beer or a

hotel room, but not to vote. Even registered dead people can vote

without an ID is exposed.

Finally, Please prepare now for the escalating economic and social unrest. Good Day

People Have Forgotten How To Work Hard

Admin at Jim Rogers Blog - 4 minutes ago

A lot of the problems we're facing today is that people have forgotten how

to work hard. It's a generational thing. - *in Gulf News*

*Jim Rogers is an author, financial commentator and successful

international investor. He has been frequently featured in Time, The New

York Times, Barron’s, Forbes, Fortune, The Wall Street Journal, The

Financial Times and is a regular guest on Bloomberg and CNBC.*

False Breakdown In Gold Shares

Eric De Groot at Eric De Groot - 2 hours ago

Richard Wyckoff made millions by being able to recognize false breakouts and breakdowns. He recognized that relative volume was the key to this recognition. A breakout from significant resistance (or support) on contracting volume increased the probability that price would return to the previous trading range once short-term momentum broke. Wyckoff would classify recent action in gold shares... [[ This is a content summary only. Visit my website for full links, other content, and more! ]]

Jamie Dimon Warns Employees To Stay Mum On Muppetgate

AAPL $600

Three 'Unfilled-so-far' Opening-Gap-Ups in a row and a 4% jump from yesterday's lows...nothing to see here, move along...

Three 'Unfilled-so-far' Opening-Gap-Ups in a row and a 4% jump from yesterday's lows...nothing to see here, move along...What Do $100 Billion Of Ponzi Bonds Mean?

So Italian banks have issued about $100 billion of these ponzi bonds and even in this day, that is a big number. Banks issue bonds to themselves. Then they get an Italian government guarantee. Then they take those bonds to the ECB and get money, which I assume they use to pay down other debt mostly. The Italian banks and Italian sovereign debt markets are essentially becoming one and the same. The sovereign has added 100 billion of risk to the banks (that today no one is focused on) and the banks and ECB would have to come up with some new gimmick if the sovereign had problems. The circularity has been powerful during this rally, but it seems too clever by half. It is an all or none strategy, and the ultimate double down. If it all works, then it is genius. If we see another round of weakness, we have the start of a death spiral.As Apple Gaps Up To Nearly $600/Share, Dan Loeb Rejoices

UPDATE: As Apple Crosses $600, Dan Loeb RejoicesTwo weeks ago we first reported that Dan Loeb was the latest entrant into the Apple hedge fund hotel, which at last estimation has now risen to nearly 250 hedge fund holders in the name, having made the company a top 5 position in his hedge fund Third Point at some point during the month of February. According to his latest monthly update, Apple is now the second best performer for Third Point, having been held at most 45 days. And considering that the vortex of Hotel Applefornia is now actively snaring every single "asset manager" starving to outperform the market, it is very likely that today's latest gap up in the name, is about to take out $600 as the company proceeds to add many more billions in market cap as somehow the launch of a pipeline of products that was known a year ago, is priced in over and over and over each and every day.

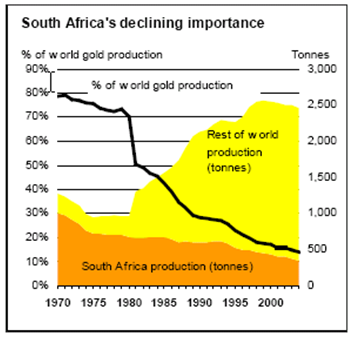

South African Gold Production Dives Again To 90 Year Lows

South Africa's gold output fell again in January and was down a very large 11.3% in volume terms in January. Annual gold production is set to be close to 220 tonnes which is a level of gold production not seen since 1922 (see chart below). The falls were seen only in the gold market with production of other minerals holding up with total mineral production down only 2.5% compared with the same month last year. South Africa as recently as two decades ago was the world's largest producer of gold by a huge margin. Only 40 years ago South Africa produced more than 1,000 tonnes of gold per annum but will only produce some 220 tonnes in 2012. Production peaked in 1970 and has been falling steadily and sharply since. The nearly 80% fall in South African gold production has led to it being recently overtaken by China, Australia and the U.S. It is now even at risk of being overtaken by Russia. The massive 11.3% decline in South Africa was more than even that seen in December when gold output fell by 8.2%. The continuing output decline is due to many of the country's biggest gold mining operations having reached the ends of their lives and having closed down.

Today's Full Economic Data Dump: Claims, Empire Manufacturing And PPI, Where Prices Paid Literally Explodes

Here is today's full data dump, presented in summary form- Initial claims: 351K vs 356K Expected, Previous revised higher of course from 362K to 365K, just as we predicted last week.

- Empire Fed: 20.21, Exp. 17.50, up from 19.53 previously

- New Orders 6.8 vs 9.7

- Prices Paid explodes to 50.62, 25.88 previous. One of the highest rises on record

- PPI: 0.4% vs 0.5% Exp, 0.1% Previous

- PPI ex food and energy: 0.2%, Exp 0.2%

Investment Grade Bonds And The Retail Love Affair

Without a doubt, retail has fallen in love with corporate bonds. Fund flows were originally into mutual funds, and have shifted more and more into the ETF’s. The ETF’s are gaining a greater institutional following as well – their daily trading volumes cannot be ignored, and for the high yield space, many hedgers believe it mimics their portfolio far better than the CDS indices. The investment grade market looks extremely dangerous right now as the rationale for investing in corporate bonds – spreads are cheap – and the investment vehicles – yield based products. With corporate bonds spreads (investment grade and high yield) already reflecting a lot of the move in equities, it will be critical to see how well they can withstand the pressure from the treasury markets.Frontrunning: March 15

- Obama, Cameron discussed tapping oil reserves (Reuters)

- Greek Bonds Signal $2.6 Billion Payout on Credit-Default Swaps (Bloomberg)

- China leader's ouster roils succession plans (Reuters)

- China’s Foreign Direct Investment Falls for Fourth Month (Bloomberg)

- Greek Restructuring Delay Helps Banks as Risks Shift (Bloomberg)

- Concerns Rise Over Eurozone Fiscal Treaty (FT)

- Home default notices rise in February: RealtyTrac (Reuters)

- China PBOC Drains Net CNY57 Bln (WSJ)

Market Sentiment: Mixed

Relatively quiet overnight session in the markets, where Europe has seen several bond auctions, most notably in France and Spain, whose good results has in turn sent the German 30 Year Bund yield to the highest since December 12, all courtesy of the recently printed (and collateralized with second and third-hand Trojans) $1.3 trillion. Per BBG, Spain sold 976 million euros of 3.25 percent notes due April 2016 at an average yield of 3.37 percent. The bid-to-cover ratio was 4.13, compared with 2.21 when the notes were sold in January, the Bank of Spain said in Madrid today. It also auctioned 2015 and 2018 securities. France sold 3.26 billion euros of benchmark five-year debt at an average yield of 1.78 percent. The borrowing cost for the 1.75 percent note due in February 2017 was less than the yield of 1.93 percent at the previous sale of the securities on Feb. 16. Elsewhere, we got confirmation of the collapse in Greece, where Q4 unemployment rose to 20.7%, up from 17.7% in the prior quarter. China weighed on Asian market action again following ongoing concerns about domestic property curbs, and a slide in the Chinese Foreign Direct Investment of -0.9% on Exp of +14.6%. ECB deposit facility usage, primarily by German banks, was flattish at €686.4 billion, while in Keynesian news, Italian debt rose to a new record in January of €1.936 trillion. Watch this space, once inflection point occurs and vigilantes realize that not only has nothing been fixed in Italy, but the current account situation in Italy, and Spain, is getting progressively worse as shown yesterday, all at the expense of Germany.Please consider making a small donation, to help cover some of the labor and costs to run this blog.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment