Jim Grant Must Watch: "Capitalism Is An Alternative For What We Have Now"

Jim Grant is simply brilliant in this must watch interview with CNBC's Bartiromo, which we won't spoil with commentary, suffice to provide the following pearl of an exchange:Maria Bartiromo: "What are the alternatives?" Jim Grant: "Capitalism is an alternative for what we have now. I highly recommend it." Maria: "We all do." Grant: "No we don't." Maria: "The Federal Reserve may not." Grant:

"We ought to be discussing an intelligent move to a sound currency by

which i mean a currency that is based on a standard and not at the whim

and the discretion of a bunch of mandarins sitting around Washington

D.C." In other news, Joseph Stalin is now delighted that Ben Bernanke

has decided to shoulder the legacy of central planning and is firmly

committed to proving that where Vissarionovich failed, the ChairSatan

will succeed.

Jim Grant is simply brilliant in this must watch interview with CNBC's Bartiromo, which we won't spoil with commentary, suffice to provide the following pearl of an exchange:Maria Bartiromo: "What are the alternatives?" Jim Grant: "Capitalism is an alternative for what we have now. I highly recommend it." Maria: "We all do." Grant: "No we don't." Maria: "The Federal Reserve may not." Grant:

"We ought to be discussing an intelligent move to a sound currency by

which i mean a currency that is based on a standard and not at the whim

and the discretion of a bunch of mandarins sitting around Washington

D.C." In other news, Joseph Stalin is now delighted that Ben Bernanke

has decided to shoulder the legacy of central planning and is firmly

committed to proving that where Vissarionovich failed, the ChairSatan

will succeed.

from GoldSilver.com:

The German Federal Audit Office has criticized lax Bundesbank controls of and management of Germany’s 3,396.3 tons in gold reserves. It is believed that some 60% of Germany’s gold is stored outside of Germany and much of it in the Federal Reserve Bank of New York, to facilitate payment and trade, according to German newspaper Bild. A Parliamentary Budget Committee will assess how the bank manages the inventory of bullion totaling 42% of Germany’s money held as savings in reserve.

Other central banks will follow Hugo Chavez’s “mission accomplished” (detail here), and now Germany’s footsteps in bringing home – repatriating – their gold, retaining direct possession of and therefore true ownership, not multiple paper promises of ownership (re-hypothecated).

Read More @ GoldSilver.com

The German Federal Audit Office has criticized lax Bundesbank controls of and management of Germany’s 3,396.3 tons in gold reserves. It is believed that some 60% of Germany’s gold is stored outside of Germany and much of it in the Federal Reserve Bank of New York, to facilitate payment and trade, according to German newspaper Bild. A Parliamentary Budget Committee will assess how the bank manages the inventory of bullion totaling 42% of Germany’s money held as savings in reserve.

Other central banks will follow Hugo Chavez’s “mission accomplished” (detail here), and now Germany’s footsteps in bringing home – repatriating – their gold, retaining direct possession of and therefore true ownership, not multiple paper promises of ownership (re-hypothecated).

Read More @ GoldSilver.com

Switzerland Wants Its Gold Back From The New York Fed

Earlier today, we reported that Germans are increasingly concerned that their gold, at over 3,400 tons a majority of which is likely stored in the vault 80 feet below street level of 33 Liberty (recently purchased by the Fed with freshly printed money at far higher than prevailing commercial real estate rates for the Downtown NY area), may be in jeopardy,and will likely soon formally inquire just how much of said gold is really held by the Fed. As it turns out, Germany is not alone: as part of the "Rettet Unser Schweizer Gold", or the “Gold Initiative”: A Swiss Initiative to Secure the Swiss National Bank’s Gold Reserves initiative, launched recently by four members of the Swiss parliament, the Swiss people should have a right to vote on 3 simple things: i) keeping the Swiss gold physically in Switzerland; ii) forbidding the SNB from selling any more of its gold reserves, and iii) the SNB has to hold at least 20% of its assets in gold. Needless the say the implications of this vote actually succeeding are comparable to the Greeks holding a referendum on whether or not to be in the Eurozone. And everyone saw how quickly G-Pap was "eliminated" within hours of making that particular threat. Yet it begs the question: how many more international grassroots outcries for if not repatriation, then at least an audit of foreign gold held by the New York Fed have to take place, before Goldman's (and New York Fed's) Bill Dudley relents? And why are the international central banks not disclosing what their people demand, if only to confirm that the gold is present and accounted for, even if it is at the Federal Reserve?Yields on Bonds Are Negative After Inflation

Admin at Marc Faber Blog - 3 hours ago

I don’t know when bonds will cease to be a good investment but it will

happen. Yields on bonds are negative after inflation. - *in Arabian Money*

*Related, iShares Barclays 20+ Year Treasury Bond ETF (TLT), iShares

Barclays 7-10 Year Treasury Bond Fund (IEF)*

*Marc Faber is an international investor known for his uncanny predictions

of the stock market and futures markets around the world.*

Greece/Student Loans/German manufacturing down/Germany 'reviewing their gold reserves'/ Hug margin calls now on ECB books/

Harvey Organ at Harvey Organ's - The Daily Gold and Silver Report - 3 hours ago

Good morning Ladies and Gentlemen: The price of gold rose today with news that the USA was sending out feelers that they would engage in QEIII. However the purchases would be sterilized in the same manner as the "twist" by buying longer term mortgage based assets from the banks with electronic credits and somehow these dollars are borrowed back in 28 days. Supposedly this would not increase the

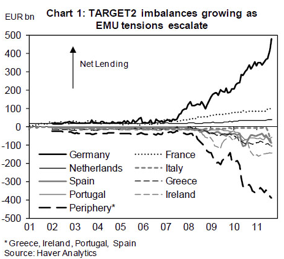

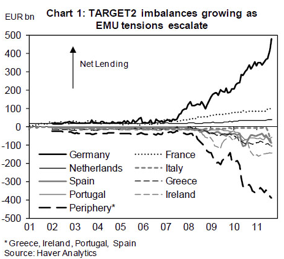

Is Gold Suffering Under ECB Margin Calls?

Last night we noted

the very concerning rise in margin calls for European banks thanks to

collateral degradation at the ECB. This story has become very popular as

traders try to figure out which assets were deteriorating rapidly and

which banks face immediate cash calls. One thing that came to mind for us was - what about Gold? Coincidentally

or not, the last time we saw a big surge in collateral margin calls by

the ECB (in September of last year), not only did Gold lease rates

explode (implode) but Gold prices fell off a cliff as the

squeeze came on from gold liquidity providers pushing prices down to

exacerbate the negative lease rates on the gold collateral. The

point here is that as margin calls come in from the ECB, we wonder

whether banks will be forced to liquidate their gold (last quality

collateral standing) to meet the ECB's risk standards. The key will be to watch gold lease rates (as we explained here and here)

and ECB Margin calls to see if Gold is merely suffering a short-term

dip from USD strength derisking or if this is a more broad based

meeting of collateral desperation need that might have legs - only to be

bought back later. MtM losses combined with collateral calls (as we noted earlier) was never a recipe for success and we will be watching closely.

Last night we noted

the very concerning rise in margin calls for European banks thanks to

collateral degradation at the ECB. This story has become very popular as

traders try to figure out which assets were deteriorating rapidly and

which banks face immediate cash calls. One thing that came to mind for us was - what about Gold? Coincidentally

or not, the last time we saw a big surge in collateral margin calls by

the ECB (in September of last year), not only did Gold lease rates

explode (implode) but Gold prices fell off a cliff as the

squeeze came on from gold liquidity providers pushing prices down to

exacerbate the negative lease rates on the gold collateral. The

point here is that as margin calls come in from the ECB, we wonder

whether banks will be forced to liquidate their gold (last quality

collateral standing) to meet the ECB's risk standards. The key will be to watch gold lease rates (as we explained here and here)

and ECB Margin calls to see if Gold is merely suffering a short-term

dip from USD strength derisking or if this is a more broad based

meeting of collateral desperation need that might have legs - only to be

bought back later. MtM losses combined with collateral calls (as we noted earlier) was never a recipe for success and we will be watching closely.Central Bank Attempt To Sucker In Retail Investors Back Into Stocks Has Failed

In

what should come as no surprise to anyone who has a frontal lobe, yet

will come as a total shock to the central planners of the world and

their media marionettes, the latest attempt to sucker in retail

investors courtesy of a completely artificial 20% stock market ramp over

the past 4 months driven entirely by the global liquidity tsunami discussed extensively here in past weeks and months, has suffered a massive failure. Exhibit 1 and only: as ICI shows today,

following what is now a 20% ramp in the stock market, not only have

retail investors continued to pull out cash from domestic equity mutual

funds (about $66 billion since the recent lows in October, the bulk of

which has gone into bonds and hard commodities), but the week of

February 29, when the market peaked so far in 2012, saw the biggest weekly outflow of 2012 to date, at -$3 billion.

Alas, this means that the traditional happy ending for the

authoritarian regime, whereby stocks get offloaded from Primary Dealers,

and GETCO's subsidiaries, to the retail investor, is not coming, and

soon the scramble for the exits among the so-called "smart money" will

be a sight to behold.

In

what should come as no surprise to anyone who has a frontal lobe, yet

will come as a total shock to the central planners of the world and

their media marionettes, the latest attempt to sucker in retail

investors courtesy of a completely artificial 20% stock market ramp over

the past 4 months driven entirely by the global liquidity tsunami discussed extensively here in past weeks and months, has suffered a massive failure. Exhibit 1 and only: as ICI shows today,

following what is now a 20% ramp in the stock market, not only have

retail investors continued to pull out cash from domestic equity mutual

funds (about $66 billion since the recent lows in October, the bulk of

which has gone into bonds and hard commodities), but the week of

February 29, when the market peaked so far in 2012, saw the biggest weekly outflow of 2012 to date, at -$3 billion.

Alas, this means that the traditional happy ending for the

authoritarian regime, whereby stocks get offloaded from Primary Dealers,

and GETCO's subsidiaries, to the retail investor, is not coming, and

soon the scramble for the exits among the so-called "smart money" will

be a sight to behold. Murdered Andrew Breitbart Held Obama Missing Link (Part 2)

by Stephen Lendman:

On March 6, the BBC reported Obama saying Washington won’t intervene in Syria unilaterally. At the same time, he stopped short of ruling out joint Western aggression. In his first 2012 news conference, he said:

“The notion that the way to solve every one of these problems is to deploy our military, that hasn’t been true in the past, and it won’t be true now.”

“We’ve got to think through what we do through the lens of what’s going to be effective – but also through what’s critical for US security interests.”

Since taking office, Obama launched more belligerence than all his predecessors. He’s not shy about initiating more. As a result, his comments ring hollow, especially given his record as a serial liar. Believe nothing he says.

Read More @ SJLendman.Blogspot.com

On March 6, the BBC reported Obama saying Washington won’t intervene in Syria unilaterally. At the same time, he stopped short of ruling out joint Western aggression. In his first 2012 news conference, he said:

“The notion that the way to solve every one of these problems is to deploy our military, that hasn’t been true in the past, and it won’t be true now.”

“We’ve got to think through what we do through the lens of what’s going to be effective – but also through what’s critical for US security interests.”

Since taking office, Obama launched more belligerence than all his predecessors. He’s not shy about initiating more. As a result, his comments ring hollow, especially given his record as a serial liar. Believe nothing he says.

Read More @ SJLendman.Blogspot.com

Super Tuesday A “Super Letdown” As America Realizes That Her Presidential Candidates “Just Suck” (with Dr. Paul Craig Roberts)

from The Financial Survival Network:

Mish

Shedlock and I had a big laugh at the Fed’s expense today. They

announced they might buy bonds differently, printing up money out of

thin air, and then sterilizing the proceeds of their bond purchases to

prevent inflation from taking hold. However, this is pure folly. If

their intention is to give business lending a jump-start, it will have

the opposite effect because many businesses looking to borrow are not

credit worthy. Those that are credit worthy aren’t interested in

borrowing since they have no profitable avenues in which to invest it.

Mish

Shedlock and I had a big laugh at the Fed’s expense today. They

announced they might buy bonds differently, printing up money out of

thin air, and then sterilizing the proceeds of their bond purchases to

prevent inflation from taking hold. However, this is pure folly. If

their intention is to give business lending a jump-start, it will have

the opposite effect because many businesses looking to borrow are not

credit worthy. Those that are credit worthy aren’t interested in

borrowing since they have no profitable avenues in which to invest it.Like putting the toothpaste back in the tube, the thought that somehow the Fed can print money, use it to monetize debt, and then stop the recipients of the new money from spending it is somewhat absurd. This hasn’t worked before, and it won’t work now. So sit back, buckle your seatbelt and enjoy the flight into the tumultuous financial skies. It’s going to get quite turbulent, but having gold and silver might very well make the ride smoother.

Click Here to Listen to the Podcast

Click Here to Listen to the Podcast

from King World News:

With

tremendous volatility in gold and silver, today KWN wanted to speak

with the firm that is calling for $10,000 gold to get their take on what

readers should be focused on at this point. Paul Brodsky, who

co-founded QB Asset Management Company, had this to say about his firm’s

strategy and where he sees things headed: “The macroeconomics behind

gold have never been more attractive. When we look at bank assets

versus base money, across the world, it makes sense that they (precious

metals) are fundamentally cheap.”

With

tremendous volatility in gold and silver, today KWN wanted to speak

with the firm that is calling for $10,000 gold to get their take on what

readers should be focused on at this point. Paul Brodsky, who

co-founded QB Asset Management Company, had this to say about his firm’s

strategy and where he sees things headed: “The macroeconomics behind

gold have never been more attractive. When we look at bank assets

versus base money, across the world, it makes sense that they (precious

metals) are fundamentally cheap.”

Paul Brodsky continues: Read More @ KingWorldNews.com

With

tremendous volatility in gold and silver, today KWN wanted to speak

with the firm that is calling for $10,000 gold to get their take on what

readers should be focused on at this point. Paul Brodsky, who

co-founded QB Asset Management Company, had this to say about his firm’s

strategy and where he sees things headed: “The macroeconomics behind

gold have never been more attractive. When we look at bank assets

versus base money, across the world, it makes sense that they (precious

metals) are fundamentally cheap.”

With

tremendous volatility in gold and silver, today KWN wanted to speak

with the firm that is calling for $10,000 gold to get their take on what

readers should be focused on at this point. Paul Brodsky, who

co-founded QB Asset Management Company, had this to say about his firm’s

strategy and where he sees things headed: “The macroeconomics behind

gold have never been more attractive. When we look at bank assets

versus base money, across the world, it makes sense that they (precious

metals) are fundamentally cheap.”Paul Brodsky continues: Read More @ KingWorldNews.com

by Jim Sinclair, JSMineset.com:

My Dear Friends,

Today’s statement by the Federal Reserve may be the lowest of the low for anyone who understands the mechanics of what they are speaking about. You cannot drive a car nor run an economy with one foot on the brake and one foot on the gas.

The claim that QE can be controlled by equal stimulation and draining adds up to nothing whatsoever. The idea that the Fed could so perfectly orchestrate pulling and pushing is denied by the fact of where we are right now.

The Western economic world is a leaderless sinking ship that is bouncing from one crisis to the other, attempting to save itself by MOPE, obscuration and downright fabrication. There is no way this type of double talk is going to accomplish anything other than scaring the hell out of those who understand.

Read More @ JSMineset.com

My Dear Friends,

Today’s statement by the Federal Reserve may be the lowest of the low for anyone who understands the mechanics of what they are speaking about. You cannot drive a car nor run an economy with one foot on the brake and one foot on the gas.

The claim that QE can be controlled by equal stimulation and draining adds up to nothing whatsoever. The idea that the Fed could so perfectly orchestrate pulling and pushing is denied by the fact of where we are right now.

The Western economic world is a leaderless sinking ship that is bouncing from one crisis to the other, attempting to save itself by MOPE, obscuration and downright fabrication. There is no way this type of double talk is going to accomplish anything other than scaring the hell out of those who understand.

Read More @ JSMineset.com

James Grant, Grant’s Interest Rate Observer, explains why he thinks the Federal Reserve’s new bond-buying program will do more harm than good, saying the U.S. Treasury should begin to issue longer-dated bonds back by gold, with CNBC’s Kelly Evans.

Ed Steer – Short Interest in Gold and Silver

by John Browne, EuroPac.net via GoldSeek.com:

This past week, gold and silver experienced one of their steeper drops in recent months. After gold had touched a four month high, and silver came close to a six month high, prices abruptly reversed course. By the end of the week gold had sold off more than 5 percent, and silver was down almost 10 percent (down 6.5 percent on Leap Day alone). Often, such sudden price falls create downward momentum. And it looks as if that may be the case this week. Thus far this week silver has dipped 3 percent.

Based on these sharp movements it would have been logical to assume that some great piece of economic news had been issued that kindled hopes of a strong and sustainable economic recovery either in the U.S. or in Europe. In such case, investors would be expected to pull money out of “defensive” metals and into “aggressive” stocks. But the news on that front was far from reassuring. Alternatively, a selloff in metals would normally be expected if central bankers were to move to tighten monetary policy. That did not happen either.

Read More @ GoldSeek.com

This past week, gold and silver experienced one of their steeper drops in recent months. After gold had touched a four month high, and silver came close to a six month high, prices abruptly reversed course. By the end of the week gold had sold off more than 5 percent, and silver was down almost 10 percent (down 6.5 percent on Leap Day alone). Often, such sudden price falls create downward momentum. And it looks as if that may be the case this week. Thus far this week silver has dipped 3 percent.

Based on these sharp movements it would have been logical to assume that some great piece of economic news had been issued that kindled hopes of a strong and sustainable economic recovery either in the U.S. or in Europe. In such case, investors would be expected to pull money out of “defensive” metals and into “aggressive” stocks. But the news on that front was far from reassuring. Alternatively, a selloff in metals would normally be expected if central bankers were to move to tighten monetary policy. That did not happen either.

Read More @ GoldSeek.com

from CaseyResearch.com:

(Interviewed by Louis James, Editor, International Speculator)

L: Doug, we’ve had a lot of questions from readers about the apparent push governments are making to go to paperless currency – all electronic, no cash. Do you think that’s likely, and what would be the implications?

Doug: I think it’s probably inevitable. It’s not just cash, but the whole world is becoming increasingly digital. Credit cards already work very well all around the world, and everyone in the world, it seems, will soon have a smartphone – or at least everyone who might have any cash.

But it’s not just a question of evolving technology. Governments hate cash for lots of reasons, starting with the fact it costs a couple of cents to print a piece of paper currency, and they have to be replaced quite often. As the US has destroyed the value of the dollar, they’ve had to take the copper out of pennies, and soon they’ll take the nickel out of nickels. Furthermore, with modern technology, counterfeiters – including unfriendly foreign governments – can turn out US currency that’s almost indistinguishable from the real thing. And the stuff takes up a lot of space if it’s enough to be of value. So sure, governments would like to get rid of tangible currency. They’d like to see all money kept in banks, which are today no more than arms of the state. But it’s not so simple: increasing numbers of people trust neither banks – most of which are insolvent – or currencies – most of which are on their way to their intrinsic values.

Read More @ CaseyResearch.com

(Interviewed by Louis James, Editor, International Speculator)

L: Doug, we’ve had a lot of questions from readers about the apparent push governments are making to go to paperless currency – all electronic, no cash. Do you think that’s likely, and what would be the implications?

Doug: I think it’s probably inevitable. It’s not just cash, but the whole world is becoming increasingly digital. Credit cards already work very well all around the world, and everyone in the world, it seems, will soon have a smartphone – or at least everyone who might have any cash.

But it’s not just a question of evolving technology. Governments hate cash for lots of reasons, starting with the fact it costs a couple of cents to print a piece of paper currency, and they have to be replaced quite often. As the US has destroyed the value of the dollar, they’ve had to take the copper out of pennies, and soon they’ll take the nickel out of nickels. Furthermore, with modern technology, counterfeiters – including unfriendly foreign governments – can turn out US currency that’s almost indistinguishable from the real thing. And the stuff takes up a lot of space if it’s enough to be of value. So sure, governments would like to get rid of tangible currency. They’d like to see all money kept in banks, which are today no more than arms of the state. But it’s not so simple: increasing numbers of people trust neither banks – most of which are insolvent – or currencies – most of which are on their way to their intrinsic values.

Read More @ CaseyResearch.com

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment