Dear CIGAs,

Brazil, Russia, India China and South Africa are meeting next week because of the use of SWIFT as a weapon of war. Expect the formation of a competitive SWIFT system in three blocks. The dollar will test .7200 USDX and fail on the third tap.

There will be an audio interview on this development with Erik King of King World News tomorrow morning.

I have been doubted on many things, much of which has come to fruition. There was a time when $1650 in gold was considered the ludicrous dream of a madman.

2012 is the year that the US dollar will suffer from a significant drop in utilization as the international settlement currency. The utilization of the SWIFT system as a means of making war is the singular greatest mistake dollar managers have ever made.

Phil, that might have seemed logical to you, but you fail to focus on the consequences now in motion soon to isolate the dollar in a three currency block (Yuan/Euro/Dollar) losing at least 1/2 of its previous strength from the international settlement mechanism provided. It is too late now to rethink the use of the SWIFT system as a weapon of war. The cat is out of the bag and the damage is done.

As a product of acceleration of this process, the US dollar will test .7200 on the outdated USDX. The test will fail on the third tap.

Brics’ move to unseat US dollar as trade currency 2012-03-25 10:00

Thandeka Gqubule and Andile Ntingi

South Africa will this week take some initial steps to unseat the US dollar as the preferred worldwide currency for trade and investment in emerging economies.

Thus, the nation is expected to become party to endorsing the Chinese currency, the renminbi, as the currency of trade in emerging markets.

This means getting a renminbi-denominated bank account, in addition to a dollar account, could be an advantage for African businesses that seek to do business in the emerging markets.

The move is set to challenge the supremacy of the US dollar. This, experts say, is the latest salvo in the greatest worldwide currency war since the 1930s.

In the 30s, several nations competitively devalued their currencies to give their domestic economies an advantage over others.

And this led to a worldwide decline in overall trade volumes at the time.

The north will be pitted against the entire south in a historic competitive currency battle – whose terrain has moved to the Indian capital New Dehli – where the Brics (Brazil, Russia, India China and South Africa) nations will assemble next week.

China seeks to find new markets for its currency and to lobby to internationalise it throughout the Brics states.

More…

People are bereft of gratitude, which is not right. One should be grateful for the help they have received from others as long as one is alive. There are two things you must forget: the help you have rendered to others and the harm others have done to you. If you remember the help you have rendered, you will always expect something in return. Remembrance of the harm done to you by others generates in you a sense of revenge. You should remember only the help you received from others. –SSB

Jim Sinclair’s Commentary

Not that many of us would remember these. I can.

Comments made in the year 1955:

I’ll tell you one thing, if things keep going the way they are, it’s going to be impossible to buy a week’s groceries for $10.00.

Tim Price And Don Coxe: "We Have Entered The Most Favourable Era For Gold Prices In Our Lifetime”

In Don Coxe's latest and typically excellent letter, "All Clear?", he highlights the opportunity in precious metals mining companies: "If there were one over-arching theme at the BMO Global Metals & Mining Conference, it was that the gold miners are upset and even embarrassed that their shares have so dramatically underperformed bullion... "On the one hand, they were delighted in 2011 when it was reported that since Nixon closed the gold window, a bar of bullion had delivered higher investment returns than the S&P 500 for forty years-- with dividends reinvested. But some gold mining CEOs find it an insult that what they mine is more respected than their companies' shares... "In our view, we have entered the most favourable era for gold prices in our lifetime, and the share prices of the great mining companies will eventually outperform bullion prices." As Don Coxe makes clear, governments are running deficits "beyond the forecasts of all but the hardiest goldbugs five years ago; central banks are printing money and creating liquidity beyond the forecasts of all but the most paranoid goldbugs a year ago." The choice for the saver is essentially binary: hold money in ever-depreciating paper, or in a tangible vehicle that has the potential to rise dramatically as expressed in paper money terms.Presenting The US Economy's Coming Fiscal Cliff

The

size and scale of 'current law' expectations for spending in 2012 and

2013 are dramatic to say the least. As Morgan Stanley notes, these are huge economic and political challenges to any deficit reduction - which we discussed last week (courtesy of James Montier) is critical if we are to maintain corporate profit margins. Presenting, with little pomp and circumstance, the US economic fiscal cliff...

The

size and scale of 'current law' expectations for spending in 2012 and

2013 are dramatic to say the least. As Morgan Stanley notes, these are huge economic and political challenges to any deficit reduction - which we discussed last week (courtesy of James Montier) is critical if we are to maintain corporate profit margins. Presenting, with little pomp and circumstance, the US economic fiscal cliff...Housing And Economy Starting To Crash Hard

Dave in Denver at The Golden Truth - 27 minutes ago

*Just reviewed March buyer clicks, Google’s analytics on all the sites we

monitor – March is turning out to be the weakest month since last October

re: Buyer interest * - email from

a Realtor in New Jersey to Zerohedge

For many reasons explained in earlier posts, I have been thinking that -

contrary to the what is being reported in the mainstream media - the small

bounce we have seen in housing was nothing more than a product of the

historically record low interest rates, an easing of credit availability

and - probably most significant - t... more »

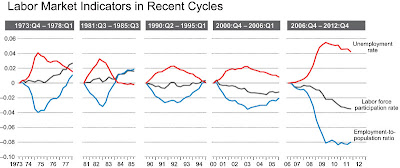

Pass the Juice Please

Trader Dan at Trader Dan's Market Views - 1 hour ago

In news this morning that most of the gold community was completely

expecting I might add , Chairman 'Easy Money Ben' Bernanke announced this

morning that he was concerned whether economic recovery was strong enough

to sustain itself without supportive and accomodative monetary policy.

Translation - near zero interest rates will remain as far as the eye can

see.

Talk about messing with the heads of the Fed Funds Futures traders - they

are getting beat to death by this Fed. Every single time they start

anticipating a rise in the short term interest rates based on economic data

rele... more »

Store-brand groceries now on premium shelves

Eric De Groot at Eric De Groot - 1 hour ago

It wasn't long ago when analysts predicted "trading up" brands, driven largely by leveraged consumption from ever-rising real estate prices, had become the new norm. Then poof, this illusion faded like a mirage in the desert as Lehman Brothers collapsed and money flew out the backdoor from New York to London. Since then, citizens of Western economies have watched their standard of livings being... [[ This is a content summary only. Visit my website for full links, other content, and more! ]]

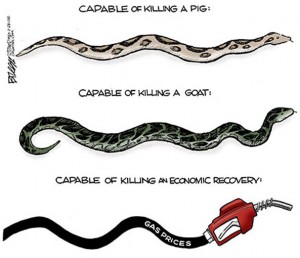

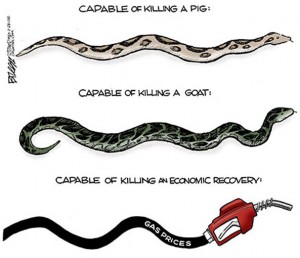

EU Gas Now Over $10: Charting The Global Gas Pump Price Shock

For the first time since June 2011, the average price for Gas across the 27 European nations just broke above USD10/gallon.

With the US on average above USD4/gallon (at its highest since May),

it is perhaps worth looking under the covers at just what nations have

been hurt the most in the last year by the money-printing-insanity-experiment rising price of crude. Italy has been hit the hardest with Fiat Uno drivers paying 18% more this year than last for a litre of petrol. As The Economist

points out, only the Dutch and Norwegians pay more than the Vespa

riders but perhaps it is worthwhile noting just how low (on average) the

US price is compared to its global peers (for now) and the fact that

only the French are paying less this year than last.

For the first time since June 2011, the average price for Gas across the 27 European nations just broke above USD10/gallon.

With the US on average above USD4/gallon (at its highest since May),

it is perhaps worth looking under the covers at just what nations have

been hurt the most in the last year by the money-printing-insanity-experiment rising price of crude. Italy has been hit the hardest with Fiat Uno drivers paying 18% more this year than last for a litre of petrol. As The Economist

points out, only the Dutch and Norwegians pay more than the Vespa

riders but perhaps it is worthwhile noting just how low (on average) the

US price is compared to its global peers (for now) and the fact that

only the French are paying less this year than last.Did Ben Unleash The "New" QE? Not So Fast Says JP Morgan

Earlier we presented the view by one of the TBAC's co-chairmen, Goldman Sachs, former employer of such NY Fed presidents as Bull Dudley. Now we present the only other view that matters - that of Fed boss (recall the JPM dividend announcement and how Jamie Dimon pushed Ben B around like a windsock) JP Morgan, and specifically chief economist Michael Feroli who is a little less sanguine than the market about interpreting Bernanke's promise to always support stocks, using the traditional stock vs flow obfuscations which is about as irrelevant as they come. To wit " How one views the word "continued" in this context depends in part on whether it is the stock (or total announced amount) of asset purchases that matter for financial conditions, or whether it is the monthly or weekly flow of those purchases.... according to the stock effect view the end of Twist purchases in June does not amount to a tightening, but rather is a continuation of the current accommodative stance of monetary policy. Thus, "continued accommodative policies" for a stock effect adherent would not necessarily imply an extension of asset purchases beyond June." That said, all of this is semantics. Recall that the US has $1.4 trillion in debt issuance each and every year. Unless the Fed steps in to buy at least a material portion, this debt will never be parked, rendering all other plot lines, narratives and justifications for QE moot.Guest Post: Welcome To The United States of Orwell, Part 1: Our One Last Chance to Preserve the Bill of Rights

We have one last chance to restore at least a part of the Bill of Rights. Some members of Congress awakened from their fund-raising somnambulance and proposed the Due Process Guarantee Act which would restore the Bill of Rights to its proper place in US law. So do one thing today for the nation and its liberties: contact your representative and senators to press them to support this bill. Ask them which military or law enforcement agencies requested that Congress nullify the Bill of Rights with the NDAA. Advise them to do the correct thing for once in their sordid little careers and vote for the Due Process Guarantee Act. This page lists other articles about the NDAA and also provides links to find your representative and Senators: It's treason. Call it what it is.

by Tyler Cowen, New York Times:

I RECENTLY asked a group of colleagues — and myself — to identify the single most important development to emerge from America’s financial crisis. Most of us had a common answer: The age of the bank run has returned.

Since the end of World War II, economists have generally thought that runs on banks were dead, at least as a phenomenon in advanced nations. In the United States, for example, bank deposits are insured by the Federal Deposit Insurance Corporation, and, as a last resort, the Federal Reserve can back deposits by printing money.

I RECENTLY asked a group of colleagues — and myself — to identify the single most important development to emerge from America’s financial crisis. Most of us had a common answer: The age of the bank run has returned.

Since the end of World War II, economists have generally thought that runs on banks were dead, at least as a phenomenon in advanced nations. In the United States, for example, bank deposits are insured by the Federal Deposit Insurance Corporation, and, as a last resort, the Federal Reserve can back deposits by printing money.

The new complication is that bank deposits are no longer the dominant

form of modern short-term finance. The modern bank run means a rush to

withdraw from money market funds, the disappearance of reliable

collateral for overnight loans between banks or the sudden pulling of

short-term credit to a troubled financial institution. But these new

versions are in some ways still similar to the old: both reflect the

desire to pull money out of an endeavor — and to be the first out the

door. And both can set off a crash.

Read More @ NYTimes.comGerald Celente – Gary Null – 23 March 2012

German

Chancellor Angela Merkel says it would be “catastrophic” to allow

Greece to leave the eurozone because of its debt problems.

from Telegraph.co.uk:

She

said Athens had a “long and arduous road” to recovery after being

forced to seek two international rescue packages, but it would be a

“huge political mistake to allow Greece to leave” the single European

currency.

She

said Athens had a “long and arduous road” to recovery after being

forced to seek two international rescue packages, but it would be a

“huge political mistake to allow Greece to leave” the single European

currency.

“We have taken the decision to be in a currency union. This is not only a monetary decision it is a political one,” Ms Merkel said in an interview to be broadcast on BBC’s Newsnight programme tonight.

“It would be catastrophic if we were to say (to) one of those who have decided to be with us, ‘We no longer want you.’

Read More @ Telegraph.co.uk

I'm PayPal Verified

from Telegraph.co.uk:

She

said Athens had a “long and arduous road” to recovery after being

forced to seek two international rescue packages, but it would be a

“huge political mistake to allow Greece to leave” the single European

currency.

She

said Athens had a “long and arduous road” to recovery after being

forced to seek two international rescue packages, but it would be a

“huge political mistake to allow Greece to leave” the single European

currency.“We have taken the decision to be in a currency union. This is not only a monetary decision it is a political one,” Ms Merkel said in an interview to be broadcast on BBC’s Newsnight programme tonight.

“It would be catastrophic if we were to say (to) one of those who have decided to be with us, ‘We no longer want you.’

Read More @ Telegraph.co.uk

by Frank Suess, The Daily Bell:

“A

great wave of oppressive tyranny isn´t going to strike, but rather a

slow seepage of oppressive laws and regulations from within will sink

the American dream of liberty.” ~ George Baumler (Libertarian, Blogger

‘Baumler’s Rant’)

“A

great wave of oppressive tyranny isn´t going to strike, but rather a

slow seepage of oppressive laws and regulations from within will sink

the American dream of liberty.” ~ George Baumler (Libertarian, Blogger

‘Baumler’s Rant’)

Across the world, but particularly in OECD countries, a growing number of regulations are being enacted at a continuously accelerating pace. Ultimately, this trend leads to a convoluted system of barriers to your personal movement and the movement of your wealth.

America has certainly been at the forefront in this regard. On March 18th, 2010, as part of the HIRE Act and as a politically safe “revenue offset for the tax being waived under the HIRE Act incentives,” the US Administration enacted the Foreign Account Tax Compliance Act (FATCA). For the first time, we informed you about FATCA in the Update of April 8th, 2010.

Read More @ TheDailyBell.com

“A

great wave of oppressive tyranny isn´t going to strike, but rather a

slow seepage of oppressive laws and regulations from within will sink

the American dream of liberty.” ~ George Baumler (Libertarian, Blogger

‘Baumler’s Rant’)

“A

great wave of oppressive tyranny isn´t going to strike, but rather a

slow seepage of oppressive laws and regulations from within will sink

the American dream of liberty.” ~ George Baumler (Libertarian, Blogger

‘Baumler’s Rant’)Across the world, but particularly in OECD countries, a growing number of regulations are being enacted at a continuously accelerating pace. Ultimately, this trend leads to a convoluted system of barriers to your personal movement and the movement of your wealth.

America has certainly been at the forefront in this regard. On March 18th, 2010, as part of the HIRE Act and as a politically safe “revenue offset for the tax being waived under the HIRE Act incentives,” the US Administration enacted the Foreign Account Tax Compliance Act (FATCA). For the first time, we informed you about FATCA in the Update of April 8th, 2010.

Read More @ TheDailyBell.com

Ron Paul: Stop the Fed’s Covert Bailout of Europe

by Greg Hunter, USA Watchdog:

Buying gasoline these days has turned into a horror show. I filled up my car and handed the attendant a $50 bill to turn the pump on. I had a little more than a quarter of a tank. So, I thought that would do the trick and peg the needle past full with change to spare. I was wrong. I stood in shock as the pump rolled right past $40 and up to $50. The car (which is a Buick Lacrosse) was still not quite full. I thought, $50 is not enough to fill up a standard size car with already more than a quarter of a tank? You could say fuel has gotten expensive, but in reality, the dollar is losing its buying power. Money printing and monster deficits in America are the big problems for the buck. The more dollars we produce, the less each one is worth. The rest of the world has been noticing and moving away from the dollar.

Oil and almost everything else is traded mostly in U.S. dollars globally, but that is changing. There has been a definite move by some of the biggest economies in the world in the last few years to not trade in dollars. China is the second biggest economy in the world and is leading the charge to do business in its own currency–the renminbi. The Financial Times reported last week, “China has signed a $31bn currency swap agreement with Australia, a step towards boosting the renminbi’s profile in developed markets. Beijing has established nearly 20 bilateral swap lines over the past four years, but Australia ranks as the biggest economy yet to sign such a deal, which analysts said could give a shot in the arm to Beijing’s goal of internationalising its currency.” (Click here for the complete FT.com story.) This is bad news for the dollar in the long term.

Read More @ USAWatchdog.com

Buying gasoline these days has turned into a horror show. I filled up my car and handed the attendant a $50 bill to turn the pump on. I had a little more than a quarter of a tank. So, I thought that would do the trick and peg the needle past full with change to spare. I was wrong. I stood in shock as the pump rolled right past $40 and up to $50. The car (which is a Buick Lacrosse) was still not quite full. I thought, $50 is not enough to fill up a standard size car with already more than a quarter of a tank? You could say fuel has gotten expensive, but in reality, the dollar is losing its buying power. Money printing and monster deficits in America are the big problems for the buck. The more dollars we produce, the less each one is worth. The rest of the world has been noticing and moving away from the dollar.

Oil and almost everything else is traded mostly in U.S. dollars globally, but that is changing. There has been a definite move by some of the biggest economies in the world in the last few years to not trade in dollars. China is the second biggest economy in the world and is leading the charge to do business in its own currency–the renminbi. The Financial Times reported last week, “China has signed a $31bn currency swap agreement with Australia, a step towards boosting the renminbi’s profile in developed markets. Beijing has established nearly 20 bilateral swap lines over the past four years, but Australia ranks as the biggest economy yet to sign such a deal, which analysts said could give a shot in the arm to Beijing’s goal of internationalising its currency.” (Click here for the complete FT.com story.) This is bad news for the dollar in the long term.

Read More @ USAWatchdog.com

Our sponsors were chosen to help you prepare for the coming global financial collapse...If you wait until TSHTF (the shi! hits the fan) it will be too late...

Please consider making a small donation, to help cover some of the labor and costs to run this blog.

Thank You

I'm PayPal Verified

Thank You

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment