Egan Jones Downgrades Goldman Sachs From A- To BBB+

The juggernaut continues as Egan Jones exposes a key issue we have been discussing: namely that in the absence of actual trading, banks, which can no longer rely on Net Interest Margin, will have to get smaller, leaner and more efficient, or else lose some of the competition. Such as Bear. Such as Lehman. Maybe, even, such as Knight.Fed Orders Banks To Create 'Super Secret, Entirely Useless' Plan To Avoid Blowing Each Other Up

Just

when you had got over the entirely inane creation of a living-will

that purports to solve the taxpayer's dilemma should a large SIFI hit an

iceberg; Reuters reports

- this time super secret - the Fed, in 2010, asked for a plan from the

US' Big 5 Banks for staving off collapse if they faced serious

problems - critically emphasizing that the banks can't rely on government help. Read that again and we dare you not to laugh.

It seems regulators are trying hard to ensure banks have plans for

worst-case scenarios - in order to act rationally in times of distress.

Recovery plans differ from living wills, also known as 'resolution

plans', and are about protecting the crown jewels - the

shareholders - while a resolution plan is about protecting the system,

taxpayers and creditors; of course it's all ridiculous smoke and

mirrors. Interestingly, Reuters has uncovered an 'Orderly Liquidation of a Failed SIFI' presentation - embedded below - sponsored by JPMorgan which is reassuringly positive of this end of the world contagion scenario.

Just

when you had got over the entirely inane creation of a living-will

that purports to solve the taxpayer's dilemma should a large SIFI hit an

iceberg; Reuters reports

- this time super secret - the Fed, in 2010, asked for a plan from the

US' Big 5 Banks for staving off collapse if they faced serious

problems - critically emphasizing that the banks can't rely on government help. Read that again and we dare you not to laugh.

It seems regulators are trying hard to ensure banks have plans for

worst-case scenarios - in order to act rationally in times of distress.

Recovery plans differ from living wills, also known as 'resolution

plans', and are about protecting the crown jewels - the

shareholders - while a resolution plan is about protecting the system,

taxpayers and creditors; of course it's all ridiculous smoke and

mirrors. Interestingly, Reuters has uncovered an 'Orderly Liquidation of a Failed SIFI' presentation - embedded below - sponsored by JPMorgan which is reassuringly positive of this end of the world contagion scenario.Californicated: From Facebook To Stockton And San Bernardino: How CalPERS Became A Golden State Worrier

The

last few weeks have not been fun for California. Facebook's face-plant

removed a large part of the unbelievably 'expected' tax revenues for

the state, Stockton BK'd, and now we find out that San Bernadino - the

latest and greatest city to file for municipal bankruptcy (after a $46

million shortfall in its budget was irreconcilable). The reason it's a

big deal - unfortunately the state's retirement fund - CalPERS - is the city's largest creditor by far with a wonderful $143.3 million exposure.

This is more than half the entire debt load of $281.4 million of the

Top 20 creditors alone! The deadline for creditors to challenge

bankruptcy eligibility is September 21st and we suspect that until

then, the comptrollers should be renamed the Golden State Worriers?

What is ironic is the same unions that we suppose are fighting the

city over cuts and forcing it to take such drastic action are likely to

be entirely beholden to their pension benefits from the very same

CalPERS which is about to take a sizable haircut.

The

last few weeks have not been fun for California. Facebook's face-plant

removed a large part of the unbelievably 'expected' tax revenues for

the state, Stockton BK'd, and now we find out that San Bernadino - the

latest and greatest city to file for municipal bankruptcy (after a $46

million shortfall in its budget was irreconcilable). The reason it's a

big deal - unfortunately the state's retirement fund - CalPERS - is the city's largest creditor by far with a wonderful $143.3 million exposure.

This is more than half the entire debt load of $281.4 million of the

Top 20 creditors alone! The deadline for creditors to challenge

bankruptcy eligibility is September 21st and we suspect that until

then, the comptrollers should be renamed the Golden State Worriers?

What is ironic is the same unions that we suppose are fighting the

city over cuts and forcing it to take such drastic action are likely to

be entirely beholden to their pension benefits from the very same

CalPERS which is about to take a sizable haircut.Money Down A Rathole: College, Healthcare, Housing

I am sickened by the vast sums I see households squandering on hopelessly marginal "investments" in expensive higher education, healthcare and housing. I too am caught in the crony-capitalist/State cartel web of waste, skimming and fraud: we have paid tens of thousands of dollars on no-frills healthcare insurance (no eyewear, no dental, no meds, $50 co-pay) in the past decade, and received perhaps 3% of this sum in care. But to not have health insurance in America is to invite financial ruin should we suffer some serious illness. The same "must-have" argument supports the conventional wisdom about education: a young person "must have" a college degree if they hope to escape a lifetime of poverty. The issue isn't education per se, it's the ever-rising cost of an education that has arguably lost value in a global job market that faces a vast surplus of educated workers and a scarcity of secure, high-paying jobs. Simply put, minting 10,000 PhD chemists (for example) does not magically create 10,000 jobs for PhD chemists. Yes, education and healthcare are necessary, but cartels have leveraged this necessity into vast skimming operations that yield marginal returns even as their costs balloon without limit. Housing is also a necessity, but it does not follow that it is a high-yield investment. Rather, it has become a sinkhole for hard-earned, scarce cash.

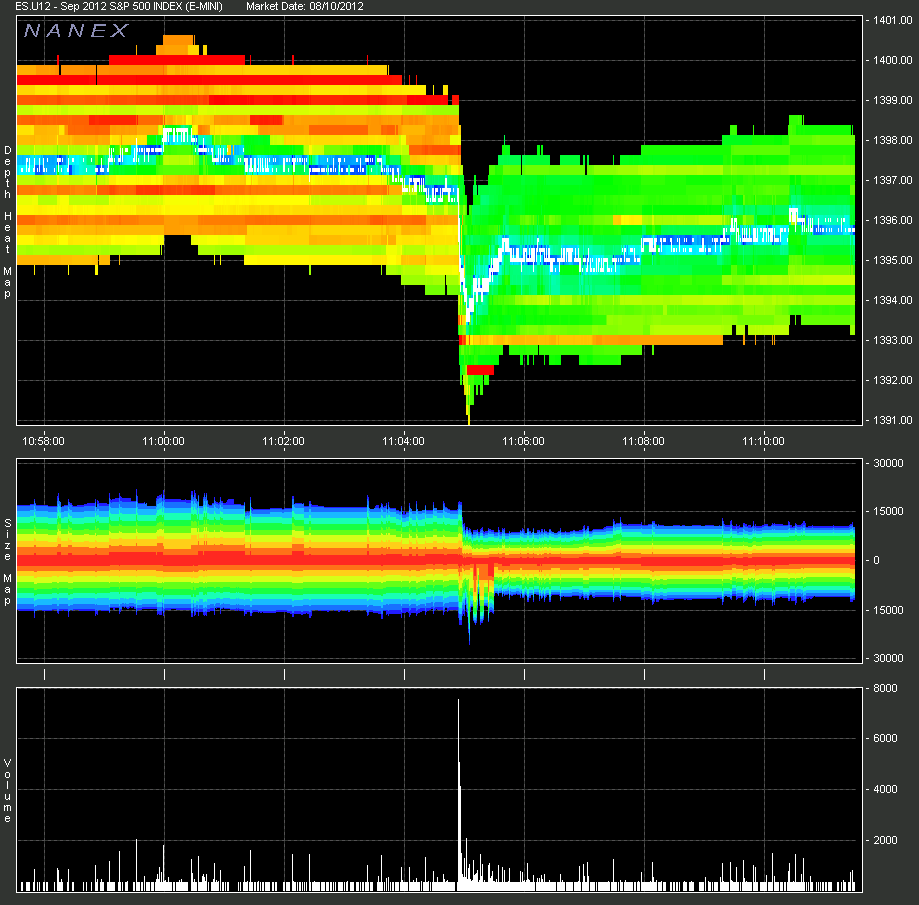

How Two Trades In Half An Hour Make Market Go Boom... And Unboom

What's

the point in commenting any more: when two discrete trades manage a

nearly 1% cumulative roundtrip move in the entire market, all we can

say is "good luck human" - the whale on the other side of "that" trade

is far bigger than Bruno Iksil. And good luck when you need liquidity

once the selling returns. The discount to the bid will be far, far more

than the 5% it cost Knight to unwind its error book to Goldman.

What's

the point in commenting any more: when two discrete trades manage a

nearly 1% cumulative roundtrip move in the entire market, all we can

say is "good luck human" - the whale on the other side of "that" trade

is far bigger than Bruno Iksil. And good luck when you need liquidity

once the selling returns. The discount to the bid will be far, far more

than the 5% it cost Knight to unwind its error book to Goldman.Why Hedge Funds Hate Stocks In A World Where "Tulip Trend" Is Top Performer: Complete July Performance Summary

July was not a bad month for most hedge funds. There is, however, one big problem: virtually all of them underperformed the S&P. As they did in June. As they did in May. Etc. Etc. And that has been the theme this whole year: hedge funds, which account for over $2 trillion in unlevered purchasing power, and between $4-6 trillion levered, are not doing badly, they are simply underperforming the S&P very badly, in many cases by more than 2 standard deviations. And as all those fund managers who wake up and go to bed with two words on their minds: "career risk", underperforming the benchmark, or in this case the broad stock market, which does not demand 2 and 20, is the surest way to extinction. Then again, in a centrally planned market in which a hedge fund called Tulip Trend is the best performer Year To Date (and in which Paulson's Disadvantage Minus continues to be the worst), nothing can really surprise any more.Is This Why Gold Is Outperforming?

Gold is significantly #winning

today - well ahead of stocks and the USD after being closely synced

with them since the lows last Friday pre-ramp. The question is why? We

have an idea. Gold and stocks have been closely correlated on the back

of expectations of Fed/ECN unsterilized printing - as gold has taken on

the appearance of a risk asset - and rightfully so given the nature of

these markets dependence on CBs. However, stocks have outperformed in

their own manipulated manner as whatever magic pressure has held gold

down continues (as they both rise as simple proxies for more money

flooding the system). In a very similar echo of 2009, the last 6-9 months have seen the value of the S&P 500 priced in Gold dip aggressively and then surge back. At current levels we are getting 'rich' in terms of equities priced in real stores of value.

And perhaps, just as in 2009, we are about to see real stores of value

catch up to equity valuations and continue this outperformance...Gold rallied 23% relative to stocks in the preceding three months.

Gold is significantly #winning

today - well ahead of stocks and the USD after being closely synced

with them since the lows last Friday pre-ramp. The question is why? We

have an idea. Gold and stocks have been closely correlated on the back

of expectations of Fed/ECN unsterilized printing - as gold has taken on

the appearance of a risk asset - and rightfully so given the nature of

these markets dependence on CBs. However, stocks have outperformed in

their own manipulated manner as whatever magic pressure has held gold

down continues (as they both rise as simple proxies for more money

flooding the system). In a very similar echo of 2009, the last 6-9 months have seen the value of the S&P 500 priced in Gold dip aggressively and then surge back. At current levels we are getting 'rich' in terms of equities priced in real stores of value.

And perhaps, just as in 2009, we are about to see real stores of value

catch up to equity valuations and continue this outperformance...Gold rallied 23% relative to stocks in the preceding three months.Spanish Bonds Give Up 50% Of Gains In A Week

While

we have pointed out that 10Y Spanish bonds have deteriorated notably

since the Euphoric moves recently, we have oft heard the stoic bulls

arguing thus: but, but, but... 2Y is where the real action is and

that's where the ECB will support them. Umm, sorry, even amid a dismally

quiet and illiquid week which should see yields drifting lower as they

roll gently down the curve, 2Y Spanish bond yields have retraced 50% of their rally from last Friday

and are comfortably back above 4% once again. Perhaps, slowly but

surely, the realization that for it to get better, it has to get much

worse is taking hold - though obviously US equity holders have yet to

get that message.

While

we have pointed out that 10Y Spanish bonds have deteriorated notably

since the Euphoric moves recently, we have oft heard the stoic bulls

arguing thus: but, but, but... 2Y is where the real action is and

that's where the ECB will support them. Umm, sorry, even amid a dismally

quiet and illiquid week which should see yields drifting lower as they

roll gently down the curve, 2Y Spanish bond yields have retraced 50% of their rally from last Friday

and are comfortably back above 4% once again. Perhaps, slowly but

surely, the realization that for it to get better, it has to get much

worse is taking hold - though obviously US equity holders have yet to

get that message.Gold right at the Top of its Recent Trading Range

Trader Dan at Trader Dan's Market Views - 18 minutes ago

Gold has pushed to the very top of its recent trading range as it works

within the confines of its consolidation pattern noted on the chart below.

It either mounts a solid breakout this time around or it will fall back

towards $1600 and slightly below once again.

I have noted that for the last 5 weeks or so, the lows have been slowly

creeping higher hinting at market strength. It simply needs a spark,

something to ignite it and push it past the strong selling pressure

emerging between $1620 - $1630.

Today's strength is predicated on news out of China showing its economy

slowing... more »

Opinions, Not Equity Markets, Need Reality Check

Eric De Groot at Eric De Groot - 1 hour ago

I suggest that opinions, not equity markets, need a reality check. Markets

are reality. Opinions only impede profits. I know that many believe markets

are no longer free, but the setup of leveraged money flows and long-term

secular trends debunk 24/7 manipulation. The invisible hand while very good

at nudging short term trends cannot reserve secular capital flows. For

example, the secular up...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]

by Gary North, Mises.ca:

An inflationist is someone who believes that price inflation is the result of two things: (1) monetary inflation and (2) central bank policy.

A deflationist is someone who believes that deflation is inevitable, despite (1) monetary inflation and (2) central bank policy.

No inflationist says that price inflation is inevitable. Every deflationist says that price deflation is inevitable.

Deflationists have been wrong ever since 1933.

Milton Friedman is most famous for his book, A Monetary History of the United States (1963), which relies on facts collected by Anna Schwartz, who died recently.

It is for one argument: the Federal Reserve caused the Great Depression because it refused to inflate.

This argument, as quoted by mainstream economists, is factually wrong.

Read More @ Mises.ca

from Wealth Cycles:

German TV station ZDF put out a documentary this year called The Greek Lie. Get to the 24 minute mark, and you too can check out the interior of the Athens Ministry of Finance (below).

German TV station ZDF put out a documentary this year called The Greek Lie. Get to the 24 minute mark, and you too can check out the interior of the Athens Ministry of Finance (below).As shocking as the strewn about documents is the abandonment of responsibility for financial decisions on the future of Greeks. Why bother accounting for one’s debts, if there is never the intent to pay off more than the minimum payment due? For as unified as Greece is as a people, a few have broken away from the many to fight their way back to a prosperous future. And what a fight it will be.

After speaking with Artemis, a Spartan now living in Athens, one gets the picture that Greeks are still running on fumes. “Everybody is on credit; families of four have at least five cars. People with two or three loans could go and apply for another, [essentially] refinancing. Even loans of 5,000 euros for holiday seem common,” Artemis said. “Nobody is saving.”

In Spain too we are hearing of banks refinancing loans that are not performing, extending further cash to known poor credit risks. The actions seem to be increasingly desperate for some, as they struggle to maintain their lifestyles, looking for the last hope before the till runs dry.

Read More @ WealthCycles.com

from Testosterone Pit.com:

They only bubble up rarely, these scandals at the Federal Reserve System, but when they do, they’re doozies, involving huge amounts of money, massive conflicts of interest, all-out manipulation, collusion, favoritism, dizzying cronyism…. And yet, over the 100 years that the Fed has existed, it has done an excellent job in one of its other primary functions, maintaining the dollar, which has lost only 96% of its value—instead of 100%.

The latest scandal is the Libor fiasco that is spawning worldwide investigations of the largest banks, going back years. The New York Fed under its President Timothy Geithner knew of the manipulations as early as 2007, and knew it involved banks of which it was one of the regulators. There were some hush-hush contacts with British regulators, and that was it. Nothing changed. Status quo maintained.

Just about then, the financial crisis began to expose the house of cards that financial institutions had become. Bear Stearns was saved. During the ensuing bailout mania of 2007 – 2009, the New York Fed, under the same management, handed trillions of freshly printed dollars to the same banks that it knew were manipulating Libor. It was done in secret, and the public wouldn’t have known who got what, how the decisions were made, why Lehman wasn’t bailed out though Goldman was, had it not been for the audit by the Government Accountability Office (GAO) as authorized by the Dodd-Frank financial reform act [for some gory details, read... The GAO Audit of the Fed Doesn’t Call It ‘Corruption’ but it should].

Read More @ TestosteronePit.com

They only bubble up rarely, these scandals at the Federal Reserve System, but when they do, they’re doozies, involving huge amounts of money, massive conflicts of interest, all-out manipulation, collusion, favoritism, dizzying cronyism…. And yet, over the 100 years that the Fed has existed, it has done an excellent job in one of its other primary functions, maintaining the dollar, which has lost only 96% of its value—instead of 100%.

The latest scandal is the Libor fiasco that is spawning worldwide investigations of the largest banks, going back years. The New York Fed under its President Timothy Geithner knew of the manipulations as early as 2007, and knew it involved banks of which it was one of the regulators. There were some hush-hush contacts with British regulators, and that was it. Nothing changed. Status quo maintained.

Just about then, the financial crisis began to expose the house of cards that financial institutions had become. Bear Stearns was saved. During the ensuing bailout mania of 2007 – 2009, the New York Fed, under the same management, handed trillions of freshly printed dollars to the same banks that it knew were manipulating Libor. It was done in secret, and the public wouldn’t have known who got what, how the decisions were made, why Lehman wasn’t bailed out though Goldman was, had it not been for the audit by the Government Accountability Office (GAO) as authorized by the Dodd-Frank financial reform act [for some gory details, read... The GAO Audit of the Fed Doesn’t Call It ‘Corruption’ but it should].

Read More @ TestosteronePit.com

[Ed. Note:

These folks need to learn about U.N. Agenda 21 and the plans of the

NWO, post haste. This creeping bureaucratic tyranny is beginning to

touch Americans from all walks of life. Time to wake up.]

EconFree

In April, Fauquier County threatened Martha Boneta, owner of a small farm in Paris, VA, with thousands of dollars in fines for a series of alleged violations, including hosting “an event” on her farm without obtaining a special events permit.

There was a time, not too long ago (relatively speaking), that

governments and the groups of elites that controlled them did not find

it necessary to conscript themselves into wars of disinformation.

There was a time, not too long ago (relatively speaking), that

governments and the groups of elites that controlled them did not find

it necessary to conscript themselves into wars of disinformation.

Propaganda was relatively straightforward. The lies were much simpler. The control of information flow was easily directed. Rules were enforced with the threat of property confiscation and execution for anyone who strayed from the rigid socio-political structure. Those who had theological, metaphysical or scientific information outside of the conventional and scripted collective world view were tortured and slaughtered. The elites kept the information to themselves, and removed its remnants from mainstream recognition, sometimes for centuries before it was rediscovered.

With the advent of anti-feudalism, and most importantly the success of the American Revolution, elitists were no longer able to dominate information with the edge of a blade or the barrel of a gun. The establishment of Republics, with their philosophy of open government and rule by the people, compelled Aristocratic minorities to plot more subtle ways of obstructing the truth and thus maintaining their hold over the world without exposing themselves to retribution from the masses. Thus, the complex art of disinformation was born.

Read More @ Activist Post

EconFree

In April, Fauquier County threatened Martha Boneta, owner of a small farm in Paris, VA, with thousands of dollars in fines for a series of alleged violations, including hosting “an event” on her farm without obtaining a special events permit.

from Activist Post

There was a time, not too long ago (relatively speaking), that

governments and the groups of elites that controlled them did not find

it necessary to conscript themselves into wars of disinformation.

There was a time, not too long ago (relatively speaking), that

governments and the groups of elites that controlled them did not find

it necessary to conscript themselves into wars of disinformation.Propaganda was relatively straightforward. The lies were much simpler. The control of information flow was easily directed. Rules were enforced with the threat of property confiscation and execution for anyone who strayed from the rigid socio-political structure. Those who had theological, metaphysical or scientific information outside of the conventional and scripted collective world view were tortured and slaughtered. The elites kept the information to themselves, and removed its remnants from mainstream recognition, sometimes for centuries before it was rediscovered.

With the advent of anti-feudalism, and most importantly the success of the American Revolution, elitists were no longer able to dominate information with the edge of a blade or the barrel of a gun. The establishment of Republics, with their philosophy of open government and rule by the people, compelled Aristocratic minorities to plot more subtle ways of obstructing the truth and thus maintaining their hold over the world without exposing themselves to retribution from the masses. Thus, the complex art of disinformation was born.

Read More @ Activist Post

by Gary North, Lew Rockwell:

Retired parents or grandparents who helped their children get through

college by borrowing money, but who did not repay the money, are now

facing automatic deductions. The lenders go to Social Security. The

Social Security Administration then orders a monthly deduction program.

The money is automatically deducted and sent to the lender.

Retired parents or grandparents who helped their children get through

college by borrowing money, but who did not repay the money, are now

facing automatic deductions. The lenders go to Social Security. The

Social Security Administration then orders a monthly deduction program.

The money is automatically deducted and sent to the lender.

People thought they could beat the system if the could just make it to retirement. No such luck. The banks just get in line. They get paid first.

In 2012 so far, 115,000 retirees have had their monthly payments reduced in this way. This is almost twice the number of people hit in 2011, and the year is not over yet. It was 60,000 in 2007. The number will start rising fast as baby boomers retire.

How much money does the SSA skim off? Up to 15%. For people who are dependent on SS for their income, this is a big hit. They did not budget for paying it back when they still were in the labor force. Now they are retired.

Many of these retirees aren’t even in hock for their own educations. Consumer advocates say that in the majority of the cases they’ve seen, the borrowers went into debt later in life to help defray education costs for their children or other dependents.

Read More @ LewRockwell.com

I'm PayPal Verified

Retired parents or grandparents who helped their children get through

college by borrowing money, but who did not repay the money, are now

facing automatic deductions. The lenders go to Social Security. The

Social Security Administration then orders a monthly deduction program.

The money is automatically deducted and sent to the lender.

Retired parents or grandparents who helped their children get through

college by borrowing money, but who did not repay the money, are now

facing automatic deductions. The lenders go to Social Security. The

Social Security Administration then orders a monthly deduction program.

The money is automatically deducted and sent to the lender.People thought they could beat the system if the could just make it to retirement. No such luck. The banks just get in line. They get paid first.

In 2012 so far, 115,000 retirees have had their monthly payments reduced in this way. This is almost twice the number of people hit in 2011, and the year is not over yet. It was 60,000 in 2007. The number will start rising fast as baby boomers retire.

How much money does the SSA skim off? Up to 15%. For people who are dependent on SS for their income, this is a big hit. They did not budget for paying it back when they still were in the labor force. Now they are retired.

Many of these retirees aren’t even in hock for their own educations. Consumer advocates say that in the majority of the cases they’ve seen, the borrowers went into debt later in life to help defray education costs for their children or other dependents.

Read More @ LewRockwell.com

We The Sheeplez... is intended to reflect

excellence in effort and content. Donations will help maintain this goal

and defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

I'm PayPal Verified

by Greg Hunter, USAWatchdog:

There’s a new U.S. intelligence report that is raising urgency over Iran’s nuclear program. The White House has, once again this week, reaffirmed its commitment to prevent Iran from developing nuclear weapons. Commenting on the new information, Israeli Defense Minister Ehud Barak said, “A nuclear Iran is taking shape right before our eyes.” Barak also said, “There is not much time left for deciding.” It is understood he was referring to an attack on Iran’s nuclear program.

Meanwhile in Syria, the civil war there rages on. The Syrian army is on the offensive in that country’s largest city, Aleppo. Also, the Syrian Prime Minister reportedly defected this week, but there is no end in sight to this bloody conflict. More than 20,000 Syrians have been killed in the last year and a half of fighting. In Europe, the debt/solvency crisis continues.

Mario Monti, the unelected banker who is now Prime Minister of Italy, wants continued bailouts and wants Germany to go along with the money printing. A German Constitutional Court is weighing if all the bailouts are even legal. Mr. Monti doesn’t want to wait for democracy to work, he just wants to continue to bail out the insolvent banks at the expense of the people. What do you expect—he’s a banker.

Read More @ USAWatchdog.com

from BrotherJohnf:

There’s a new U.S. intelligence report that is raising urgency over Iran’s nuclear program. The White House has, once again this week, reaffirmed its commitment to prevent Iran from developing nuclear weapons. Commenting on the new information, Israeli Defense Minister Ehud Barak said, “A nuclear Iran is taking shape right before our eyes.” Barak also said, “There is not much time left for deciding.” It is understood he was referring to an attack on Iran’s nuclear program.

Meanwhile in Syria, the civil war there rages on. The Syrian army is on the offensive in that country’s largest city, Aleppo. Also, the Syrian Prime Minister reportedly defected this week, but there is no end in sight to this bloody conflict. More than 20,000 Syrians have been killed in the last year and a half of fighting. In Europe, the debt/solvency crisis continues.

Mario Monti, the unelected banker who is now Prime Minister of Italy, wants continued bailouts and wants Germany to go along with the money printing. A German Constitutional Court is weighing if all the bailouts are even legal. Mr. Monti doesn’t want to wait for democracy to work, he just wants to continue to bail out the insolvent banks at the expense of the people. What do you expect—he’s a banker.

Read More @ USAWatchdog.com

from BrotherJohnf:

by Byron King, Whiskey and Gunpowder:

Yesterday I gave you a brief history of gold, and why I think the metal

may be higher. Today let’s round out our discussion with the importance

of holding physical metal!

Yesterday I gave you a brief history of gold, and why I think the metal

may be higher. Today let’s round out our discussion with the importance

of holding physical metal!

In fact, over the past few years investors have been flocking to gold and silver.

What’s going on? It’s a worldwide trend. There’s a money migration going on. And I mean BIG money is migrating. It’s like those herds of zebras or wildebeests or gazelles in Africa. When they migrate, the earth shakes and the ground is just a moving kaleidoscope of hides and footprints. The dust clouds blow high into the sky.

Yes, the world economy might be in a recession. People across the world are worried about their job and security for their family. But other people with big bucks are scooping up gold and silver. Those buyers are looking for investment safety, they want to protect and grow their wealth.

Moneyed investors don’t trust the world’s governments or paper currencies (just look what’s happened in the Eurozone in the past few years.) So they are going with gold and silver. The mines and mints are having trouble keeping up with demand.

Read More @ WhiskeyAndGunpowder.com

from TheAlexJonesChannel :

Dear Jim,

WASHINGTON (Reuters) – The U.S. Justice Department said it will not pursue criminal charges against Goldman Sachs Group Inc or its employees related to accusations that the firm bet against the same subprime mortgage securities it was selling to clients.

Brings a tear to one’s eye, doesn’t it?

Not even the ubiquitous “slap on the wrist.”

There are no lines in the sand to cross anymore when it comes to ethics. We now have an open playing field.

Ever wonder why the bankers, who brought the entire world financial system to its knees, were never prosecuted? I know it’s a stretch, but “Accountability has been foresaken and “Pareto Optimality” has been breached on Wall Street.

Marie Antoinette would be proud.

So would Auric Goldfinger, as his assets would benefit greatly in the ensuing chaos.

Yours,

CIGA Wolfgang R

Justice Department drops Goldman financial crisis probe

Thu Aug 9, 2012 9:46pm EDT

By David Ingram and Aruna Viswanatha

WASHINGTON (Reuters) – The U.S. Justice Department said it will not pursue criminal charges against Goldman Sachs Group Inc or its employees related to accusations that the firm bet against the same subprime mortgage securities it was selling to clients.

The decision not to prosecute Goldman, a firm held up by critics as a symbol of Wall Street greed during the 2007-2009 financial crisis, highlights the difficulty in prosecuting crisis-related cases.

Few expected the bank to face criminal charges, but in April 2011, U.S. Senator Carl Levin asked for a criminal investigation after the subcommittee he leads spent more than a year looking into Goldman.

The accusations were aired in a heated 2010 Congressional hearing in which Levin grilled Goldman Chief Executive Lloyd Blankfein for hours about whether it was morally correct for the firm to sell its clients products described internally as “crap”.

“The department and investigative agencies ultimately concluded that the burden of proof to bring a criminal case could not be met based on the law and facts as they exist at this time,” the Justice Department said in a statement late on Thursday.

More…

Hello Mr. Sinclair,

I want to take the time to join with thousands of other individuals who wish to thank you for all of your concern for us. There is obviously no reason for you to devote the time and energy that you do each and every day for “CIGA’s”, other than you tremendous care & compassion for us. I’m certain that you sometimes grow weary of dealing with the worries that many share with you, but I want you to know that your efforts are greatly appreciated!

Anyway, I also decided to write to you today to share a new term with you that my wife, Dawn, just coined. It was so good that I thought it should be shared with you, to in turn share with the world.

So without further ado, here is the term: Government RIG-ulators

Since our country is currently overrun with ‘Government RIG-ulators’, I thought it would be appropriate for anyone who refers to them in print to identify them with their appropriate title!

Thank you again for all you do!

CIGA Ron

I just received my tax return for 2011 back from the IRS. It puzzles me!!! They are questioning how many dependents I claimed. I guess it was because of my response to the question: “List all dependents?”I replied: 12 million illegal immigrants; 3 million crack heads; 42 million unemployed people on food stamps, 2 million people in over 243 prisons; Half of Mexico; and 535 persons in the U.S. House and Senate.” Evidently, this was NOT an acceptable answer. I KEEP ASKING MYSELF, WHOM DID I MISS?

The European Central Bank’s Discreet Help for Greece

The European Central Bank is now taking risky measures to help save Athens from its acute financial emergency. Increasingly, euro-zone leaders are pushing the dirty work on the ECB. In the end, though, they will likely have no choice but to pay Greece the next tranche of its bailout package.

“There is no time to lose,” Jean-Claude Juncker warned just a few days ago. Leaders must use “all means at their disposal” to save the currency union, the head of the Euro Group said. But one thing is becoming clear: Politicians are increasingly pushing the dirty work on to the European Central Bank (ECB).

Take Greece, for example, where liquidity is becoming scarce. The government in Athens needs to repay a maturing bond worth €3 billion ($3.7 billion) to the ECB by Aug. 20. The solution to that problem seems paradoxical: The ECB itself is pumping money into Greece, so that the country can in turn repay the ECB.

It’s a controversial plan, because the central bank is prohibited from financing governments directly. As a result, no one is talking openly about the absurd flows of money. The ECB has only hinted that it will extend a helping hand to Greece.

Now, information has leaked regarding how the ECB plans to keep Greece on its feet until the next tranche of European Union-International Monetary Fund aid is paid out. The ECB has chosen a detour via the Greek central bank. It will allow it to issue additional emergency loans to the country’s banks. These in turn are supposed to use the money to buy up Greek bonds with short maturities. This will scrape together €4 billion, according to the plan.

More…

I'm PayPal Verified

Yesterday I gave you a brief history of gold, and why I think the metal

may be higher. Today let’s round out our discussion with the importance

of holding physical metal!

Yesterday I gave you a brief history of gold, and why I think the metal

may be higher. Today let’s round out our discussion with the importance

of holding physical metal!In fact, over the past few years investors have been flocking to gold and silver.

What’s going on? It’s a worldwide trend. There’s a money migration going on. And I mean BIG money is migrating. It’s like those herds of zebras or wildebeests or gazelles in Africa. When they migrate, the earth shakes and the ground is just a moving kaleidoscope of hides and footprints. The dust clouds blow high into the sky.

Yes, the world economy might be in a recession. People across the world are worried about their job and security for their family. But other people with big bucks are scooping up gold and silver. Those buyers are looking for investment safety, they want to protect and grow their wealth.

Moneyed investors don’t trust the world’s governments or paper currencies (just look what’s happened in the Eurozone in the past few years.) So they are going with gold and silver. The mines and mints are having trouble keeping up with demand.

Read More @ WhiskeyAndGunpowder.com

from TheAlexJonesChannel :

Dear Jim,

WASHINGTON (Reuters) – The U.S. Justice Department said it will not pursue criminal charges against Goldman Sachs Group Inc or its employees related to accusations that the firm bet against the same subprime mortgage securities it was selling to clients.

Brings a tear to one’s eye, doesn’t it?

Not even the ubiquitous “slap on the wrist.”

There are no lines in the sand to cross anymore when it comes to ethics. We now have an open playing field.

Ever wonder why the bankers, who brought the entire world financial system to its knees, were never prosecuted? I know it’s a stretch, but “Accountability has been foresaken and “Pareto Optimality” has been breached on Wall Street.

Marie Antoinette would be proud.

So would Auric Goldfinger, as his assets would benefit greatly in the ensuing chaos.

Yours,

CIGA Wolfgang R

Justice Department drops Goldman financial crisis probe

Thu Aug 9, 2012 9:46pm EDT

By David Ingram and Aruna Viswanatha

WASHINGTON (Reuters) – The U.S. Justice Department said it will not pursue criminal charges against Goldman Sachs Group Inc or its employees related to accusations that the firm bet against the same subprime mortgage securities it was selling to clients.

The decision not to prosecute Goldman, a firm held up by critics as a symbol of Wall Street greed during the 2007-2009 financial crisis, highlights the difficulty in prosecuting crisis-related cases.

Few expected the bank to face criminal charges, but in April 2011, U.S. Senator Carl Levin asked for a criminal investigation after the subcommittee he leads spent more than a year looking into Goldman.

The accusations were aired in a heated 2010 Congressional hearing in which Levin grilled Goldman Chief Executive Lloyd Blankfein for hours about whether it was morally correct for the firm to sell its clients products described internally as “crap”.

“The department and investigative agencies ultimately concluded that the burden of proof to bring a criminal case could not be met based on the law and facts as they exist at this time,” the Justice Department said in a statement late on Thursday.

More…

Hello Mr. Sinclair,

I want to take the time to join with thousands of other individuals who wish to thank you for all of your concern for us. There is obviously no reason for you to devote the time and energy that you do each and every day for “CIGA’s”, other than you tremendous care & compassion for us. I’m certain that you sometimes grow weary of dealing with the worries that many share with you, but I want you to know that your efforts are greatly appreciated!

Anyway, I also decided to write to you today to share a new term with you that my wife, Dawn, just coined. It was so good that I thought it should be shared with you, to in turn share with the world.

So without further ado, here is the term: Government RIG-ulators

Since our country is currently overrun with ‘Government RIG-ulators’, I thought it would be appropriate for anyone who refers to them in print to identify them with their appropriate title!

Thank you again for all you do!

CIGA Ron

I just received my tax return for 2011 back from the IRS. It puzzles me!!! They are questioning how many dependents I claimed. I guess it was because of my response to the question: “List all dependents?”I replied: 12 million illegal immigrants; 3 million crack heads; 42 million unemployed people on food stamps, 2 million people in over 243 prisons; Half of Mexico; and 535 persons in the U.S. House and Senate.” Evidently, this was NOT an acceptable answer. I KEEP ASKING MYSELF, WHOM DID I MISS?

Remember the screams about the US Fed’s utilization of QE from all the Euroecosnobs?

The European Central Bank’s Discreet Help for Greece

The European Central Bank is now taking risky measures to help save Athens from its acute financial emergency. Increasingly, euro-zone leaders are pushing the dirty work on the ECB. In the end, though, they will likely have no choice but to pay Greece the next tranche of its bailout package.

“There is no time to lose,” Jean-Claude Juncker warned just a few days ago. Leaders must use “all means at their disposal” to save the currency union, the head of the Euro Group said. But one thing is becoming clear: Politicians are increasingly pushing the dirty work on to the European Central Bank (ECB).

Take Greece, for example, where liquidity is becoming scarce. The government in Athens needs to repay a maturing bond worth €3 billion ($3.7 billion) to the ECB by Aug. 20. The solution to that problem seems paradoxical: The ECB itself is pumping money into Greece, so that the country can in turn repay the ECB.

It’s a controversial plan, because the central bank is prohibited from financing governments directly. As a result, no one is talking openly about the absurd flows of money. The ECB has only hinted that it will extend a helping hand to Greece.

Now, information has leaked regarding how the ECB plans to keep Greece on its feet until the next tranche of European Union-International Monetary Fund aid is paid out. The ECB has chosen a detour via the Greek central bank. It will allow it to issue additional emergency loans to the country’s banks. These in turn are supposed to use the money to buy up Greek bonds with short maturities. This will scrape together €4 billion, according to the plan.

More…

The global food crisis driven by

demand rising faster than supply has been an ongoing problem for

decades. Recognition of the problem has only attracted media attention

since 2008. The world is unprepared for a resumption of the 2000 up

trends highlighted by the green arrows in the charts below.

Drought, food prices fan fears of new crisis

Drought, food prices fan fears of new crisis

(Reuters) – Global alarm over a potential repeat of the 2008 food crisis escalated after data showed food prices had jumped 6 percent last month and importers were snapping up a shriveled U.S. grain crop, helping drive corn prices to a new record.

Ahead of a critical government report on Friday on the state of the U.S. corn and soybean crops, which have been decimated by the worst drought in over five decades, the United Nation’s food agency warned against the kind of export bans, tariffs and buying binges that worsened the price surge four years ago.

“There is potential for a situation to develop like we had back in 2007/08,” the Food and Agriculture Organisation’s senior economist and grain analyst Abdolreza Abbassian told Reuters.

“There is an expectation that this time around we will not pursue bad policies and intervene in the market by restrictions, and if that doesn’t happen we will not see such a serious situation as 2007/08. But if those policies get repeated, anything is possible.”

Adding a further risk of strain on global food supplies, Japan’s official weather bureau said on Friday its climate monitoring data and models indicated the El Nino phenomenon had already emerged and was likely to last until winter.

More…

(Reuters) – Global alarm over a potential repeat of the 2008 food crisis escalated after data showed food prices had jumped 6 percent last month and importers were snapping up a shriveled U.S. grain crop, helping drive corn prices to a new record.

Ahead of a critical government report on Friday on the state of the U.S. corn and soybean crops, which have been decimated by the worst drought in over five decades, the United Nation’s food agency warned against the kind of export bans, tariffs and buying binges that worsened the price surge four years ago.

“There is potential for a situation to develop like we had back in 2007/08,” the Food and Agriculture Organisation’s senior economist and grain analyst Abdolreza Abbassian told Reuters.

“There is an expectation that this time around we will not pursue bad policies and intervene in the market by restrictions, and if that doesn’t happen we will not see such a serious situation as 2007/08. But if those policies get repeated, anything is possible.”

Adding a further risk of strain on global food supplies, Japan’s official weather bureau said on Friday its climate monitoring data and models indicated the El Nino phenomenon had already emerged and was likely to last until winter.

More…

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment